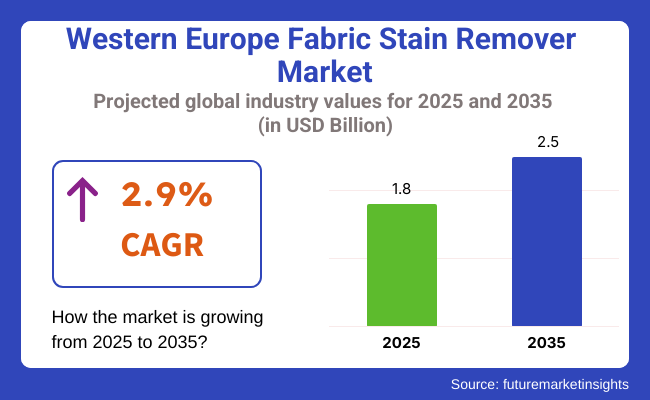

The Western Europe fabric stain remover market is poised to register a valuation of USD 1.8 billion in 2025. The industry is slated to grow at 2.9% CAGR from 2025 to 2035, witnessing USD 2.5 billion by 2035. The market is witnessing rapid growth owing to a number of major factors attributed to shifting consumer habits, lifestyle trends, and rising awareness regarding hygiene and sustainability.

One of the major driving factors is the rising need for convenient and time-efficient cleaning solutions. With busier lifestyles, consumers are giving importance to products that simplify home chores. Clothing stain removers, which provide easy and convenient stain removal, have become a household necessity, particularly as people want to cut down on cleaning time. This is especially so in families with children and pets, where stain incidents are more common, again fueling demand.

The increasing emphasis on cleanliness and hygiene, especially post-pandemic, is another important driver of the market's growth. As people have become more health- and hygiene-aware, fabric care has also become more important. Stain removers not only treat visible stains but also assist in maintaining the hygiene of fabrics by removing bacteria, odor, and germs.

Increased health and cleanliness awareness goes beyond surface stains to an overall need for sanitized, fresh-smelling fabrics, especially in clothing and bedding.In addition, the need for sustainable and eco-friendly cleaning products is increasing.

Western European consumers are becoming more inclined to search for eco-friendly fabric stain removers using biodegradable materials and recyclable packaging. The move towards sustainability in household daily products has challenged manufacturers to be creative and provide solutions for environmentally conscious consumers, thereby broadening the market.

These items tend to capitalize on natural, plant-derived ingredients that are viewed as safer for the consumer as well as the environment. As sustainability continues to influence buying habits, low-impact fabric stain removers are becoming increasingly popular in the marketplace.

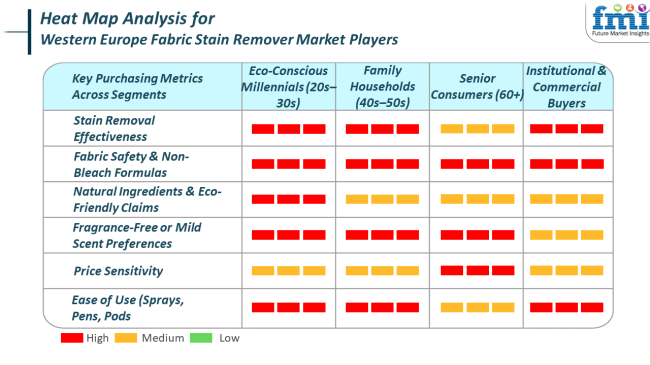

Trends and buying behavior vary across end-use segments in the Western European market. Under the household segment, convenience, effectiveness, and environmental friendliness are the major concerns of the consumers. Fast and effective removal of stains, particularly food, mud, and grease stains, is highly desired.

Environmentally friendly consumers want stain removers with biodegradable ingredients, non-toxic composition, and recyclable packages. Moreover, usability and scent have been significant attributes, with people preferring products having easy applicability, including sprays and gels.

In both industrial and business markets, cost efficiency, big packaging, and performance-based staining take over from purchase criteria. For hospitality businesses, laundry services, and bulk garment care, products have to manage aggressive, high-load stains and still be price-effective.

Environmental formulations are also more highly regarded, particularly among industries that are committed to sustainability. Products must deliver effective stain removal without creating significant environmental costs, and numerous industries prefer to use stain removers produced from renewable, sustainable materials.

Between 2020 and 2024, the Western European market for fabric stain removers witnessed profound transformations inspired by evolving consumer habits, technological innovation, and increased environmental consciousness. The COVID-19 pandemic was a key driver of these transformations, as greater home confinement contributed to more emphasis on cleaning and hygiene.

Consumers increasingly became more careful in their choice of products, opting for sustainable and environmentally friendly fabric care products. This was followed by a rising demand for plant-based components and biodegradable packaging.

Furthermore, new formulation and pack technologies led to more effective, convenient-to-use products, i.e., sprays, gels, wipes that provide efficient stain removal with little effort. Companies that could deliver high performance and sustainability developed a strong competitive advantage during these years, attractive to a newer, more health- and ecologically conscious clientele.

Ahead to 2025 to 2035, the market for fabric stain removers will develop further with drives from developments in sustainability, convenience, and customization. One of the main trends in the future will be further growth in green chemistry and biodegradable formulas, driven by increasing consumer pressure for sustainable products.

The circular economy focus will push businesses towards innovation in packaging, striving towards zero-waste solutions, such as refill containers and recyclable materials. When the consumers are becoming increasingly concerned about environmental impact, the industry will witness the emergence of brands that are providing complete transparency in ingredients sourcing and manufacturing processes.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The COVID-19 pandemic significantly boosted demand for hygiene and cleaning products, such as fabric stain removers. Consumers were more concerned about hygiene, cleanliness, and having a sanitized space at home. | With rising concerns over the environment, sustainability will be at the center of industry transformation. Firms will focus on biodegradable ingredients, eco-friendly packaging, and renewable materials to cater to consumer demand for green products. |

| Consumers also became more aware of the environmental footprint of the products they consume, and as such, demand increased for natural, green, and sustainable fabric stain removers. The shift towards plant-based ingredients and non-toxicity gained momentum. | The future market will transition to circular economy practices, whereby brands will focus on refill packaging, recyclability, and zero-waste production processes. This trend will define the product offering of the future. |

| Formulation and packaging innovations enhanced product performance and ease of use, with rapid and convenient formats such as sprays, gels, and wipes gaining traction. | The sector will adopt intelligent cleaning technologies, including AI-formulations, that can identify particular stains or type of fabric and customize the clean for consumers. |

| Online shopping convenience became a stronger force in the fabric stain remover market with customers preferring online purchases because of lockdowns and health issues. Online shopping accelerated with digital stores providing convenience, ease of access, and variety. | The future will be more digital with online experiences tailored to individual needs through personalized product suggestions using AI, improved customer feedback, and supply chain efficiencies. Online shopping convenience will remain at the forefront. |

The Western Europe market for fabric stain removers is exposed to a number of risks that may affect its stability and growth. Economic instability is one of the major risks, as it may influence consumer expenditure patterns. Economic recessions, inflation, or changes in disposable income may result in lower demand for premium or environmentally friendly stain removers, as consumers may opt for cheaper alternatives. During difficult economic periods, consumers become more price-sensitive, and they will turn to lower-cost, mass-market products rather than specialty or green products. This trend can damage premium, eco-friendly brands.

A second threat is changes in regulations for the use of chemicals in domestic products. The European Union regulates chemicals in consumer products very strongly, and alteration of these rules could necessitate companies reformulating their products at a high cost and time burden. The market is also put under growing pressure to implement environmentally friendly manufacturing and minimize the footprint of production activities.

Brands that do not deliver on these expectations could be subjected to consumer backlash, resulting in reputational risk and market share loss. Firms could also be subject to regulatory fines if they do not adhere to changing environmental standards, further contributing to cost of doing business.

In Western Europe, liquid form stain removers for fabric are the best-selling and most preferred format among customers. Their appeal is fueled by a mix of convenience, versatility, and efficiency. Liquid versions can be easily applied directly on stains, washed in washing machines, or diluted for use on different types of fabrics, and are thus well-suited for removing a variety of stains-from grease and oil to wine and grass.

Their speed in penetrating fabric fibers makes it possible to break down stains more rapidly, and liquids are typically seen by consumers as newer and easier to use, particularly for pre-treatment. Numerous liquid stain removers now come in environmentally friendly, biodegradable forms, a trend that caters well to the region's high focus on sustainability.

Powder stain removers also account for a significant market share, particularly among budget-conscious consumers or those who use conventional cleaning products. Powders are generally perceived as very effective for heavy-duty cleaning and are commonly used alongside normal laundry detergents. They are commonly used in machine-washing households where the powder can be placed directly into the drum or detergent drawer.

In Western Europe, economy and mid-range stain removers of fabric are market leaders. This mass popularity stems mainly from their affordability, accessibility, and usability for daily purposes. The majority of households seek dependable cleaning agents that fit their monthly budgets, and economy/mid-range products provide a useful compromise between price and performance.

These stain removers are readily found in supermarkets, discount stores, and online websites, which makes them easily accessible to frequent shoppers. Additionally, mid-range products usually contain well-established brands that consumers have confidence in, with tried-and-tested formulas for typical household stains, which further enhances their popularity among a wide demographic range.

With that, however, the premium market has been consistently expanding, especially among consumers who are health-conscious and environmentally aware and are willing to spend a little extra for products that are in line with their values.

Premium fabric stain removers tend to advertise plant-based, non-toxic ingredients, cruelty-free testing, and eco-friendly packaging, appealing to consumers who value environmental and ethical concerns. They also come with more complex or concentrated formulations, providing specialized solutions for sensitive fabrics, resistant stains, or allergen elimination.

The Western European fabric stain remover industry is highly competitive, with the presence of major global players as well as innovative sustainable brands. The industry is significantly driven by consumer needs for performance, value, and growing eco-friendly formulation. Top firms like Procter & Gamble, Henkel, and Unilever dominate the market share, with proven household names of products addressing varying fabric care requirements.

These industry players use proven distribution channels, brand loyalty, and ongoing innovation to hold key positions. Concurrently, the market is experiencing greener and multi-functional formats, frequently launched by newer companies and sustainability-focused divisions of well-established brands.

Company Name Estimated Industry Share (%)

| Company Name | Estimated Industry Share (%) |

|---|---|

| The Procter & Gamble Company | 15-18% |

| Henkel Corporation | 12-14% |

| Unilever PLC | 10-12% |

| Reckitt Benckiser Group plc | 8-10% |

| Colgate-Palmolive Company | 5-7% |

| S.C. Johnson & Son Inc. | 4-6% |

| Church & Dwight Co., Inc. | 3-5% |

| Amway Corporation | 3-4% |

| AlEn USA LLC | 2-3% |

| Kao Corporation | 2-4% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| The Procter & Gamble Company | Leaders in the stain remover market with household names such as Ariel and Tide, both liquid and powder options. P&G emphasizes performance, innovation, and growth of sustainable product lines. |

| Henkel Corporation | Famous for Persil and Sil , Henkel provides strong stain-removing products with an increasing number of eco-friendly variants. They spend a lot on sustainable packs and biodegradable ingredients. |

| Unilever PLC | The core of Unilever's fabric care offering is OMO and Comfort brands. Unilever combines stain removal with fragrances and softness, which appeals to a wide demographic. |

| Reckitt Benckiser Group plc | RB's premium stain remover is Vanish, which has powders, gels, and sprays available. The brand is well-known throughout Western Europe and continues to invest in sustainable formats. |

| Colgate-Palmolive Company | Sells fabric care solutions through niche and localized brands, focusing on price and everyday use in stain removal. |

| S.C. Johnson & Son Inc. | Although recognized for basic household cleaning, S.C. Johnson has entered the stain remover market with multi-purpose, environmentally friendly sprays that are convenient to use. |

| Church & Dwight Co., Inc. | Sells fabric care through the OxiClean brand, which specializes in oxygen-based stain removal. They focus on penetrating cleaning, multipurpose application, and increasingly natural bases. |

| Amway Corporation | Amway's SA8 product line features biodegradable, phosphate-free stain removers that appeal to the company's direct-to-consumer, eco-friendly philosophy. |

| AlEn USA LLC | Sells low-cost, plant-based cleaning products under Ensueño and other brands to price-sensitive and environmentally conscious consumers. |

| Kao Corporation | Conducts business primarily through niche fabric care brands emphasizing innovative, gentle stain removers and eco-friendly solutions for sensitive fabrics. |

The Western European market for fabric stain removers remains dominated by multinationals such as Procter & Gamble, Henkel, and Unilever, which excel in product coverage, innovation, and loyalty. The market will become increasingly dynamic as environmental standards tighten and consumer sensitivity to sustainability rises.

Those brands that can provide effective performance together with green credentials-like biodegradable composition, refill systems, and clear sourcing-will reap competitive gain. Furthermore, direct-to-consumer and niche brands like Amway's and AlEn's are creating new spaces by winning over more discerning and value-led consumers. The future of this industry will be shaped by a synthesis of efficacy, convenience, and moral accountability.

In terms of product, the industry is classified into powder, bars/blocks, packs & tablets, liquid, and others.

With respect to price range, the market is divided into economy/mid-range and premium.

Based on end use, the market is classified into household and commercial.

In terms of sales channel, the industry is divided into direct sales and indirect sales.

By country, the industry is segregated into the U.K., Germany, Italy, France, Spain, and the rest of Europe.

The industry is expected to reach USD 1.8 billion in 2025.

The market is projected to witness USD 2.5 billion by 2035.

The industry is slated to capture 2.9% CAGR during the study period.

Liquid products are widely used.

Leading companies include The Procter & Gamble Company, Colgate-Palmolive Company, S.C. Johnson & Son Inc., Amway Corporation, Church & Dwight Co., Inc., AlEn USA LLC, Unilever PLC, Henkel Corporation, Reckitt Benckiser Group plc, and Kao Corporation.

Table 1: industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2019 to 2034

Table 2: industry Analysis and Outlook Volume (Units Pack) Forecast by Country, 2019 to 2034

Table 3: industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 5: industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 6: industry Analysis and Outlook Volume (Units Pack) Forecast by Price Range, 2019 to 2034

Table 7: industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 8: industry Analysis and Outlook Volume (Units Pack) Forecast by End Use, 2019 to 2034

Table 9: industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 10: industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 11: UK industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 12: UK industry Analysis and Outlook Volume (Units Pack) Forecast By Region, 2019 to 2034

Table 13: UK industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 14: UK industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 15: UK industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 16: UK industry Analysis and Outlook Volume (Units Pack) Forecast by Price Range, 2019 to 2034

Table 17: UK industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: UK industry Analysis and Outlook Volume (Units Pack) Forecast by End Use, 2019 to 2034

Table 19: UK industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 20: UK industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 21: Germany industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 22: Germany industry Analysis and Outlook Volume (Units Pack) Forecast By Region, 2019 to 2034

Table 23: Germany industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 24: Germany industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 25: Germany industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 26: Germany industry Analysis and Outlook Volume (Units Pack) Forecast by Price Range, 2019 to 2034

Table 27: Germany industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 28: Germany industry Analysis and Outlook Volume (Units Pack) Forecast by End Use, 2019 to 2034

Table 29: Germany industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 30: Germany industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 31: Italy industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 32: Italy industry Analysis and Outlook Volume (Units Pack) Forecast By Region, 2019 to 2034

Table 33: Italy industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 34: Italy industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 35: Italy industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 36: Italy industry Analysis and Outlook Volume (Units Pack) Forecast by Price Range, 2019 to 2034

Table 37: Italy industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 38: Italy industry Analysis and Outlook Volume (Units Pack) Forecast by End Use, 2019 to 2034

Table 39: Italy industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 40: Italy industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 41: France industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 42: France industry Analysis and Outlook Volume (Units Pack) Forecast By Region, 2019 to 2034

Table 43: France industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: France industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 45: France industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 46: France industry Analysis and Outlook Volume (Units Pack) Forecast by Price Range, 2019 to 2034

Table 47: France industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: France industry Analysis and Outlook Volume (Units Pack) Forecast by End Use, 2019 to 2034

Table 49: France industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 50: France industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 51: Spain industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 52: Spain industry Analysis and Outlook Volume (Units Pack) Forecast By Region, 2019 to 2034

Table 53: Spain industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 54: Spain industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 55: Spain industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 56: Spain industry Analysis and Outlook Volume (Units Pack) Forecast by Price Range, 2019 to 2034

Table 57: Spain industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 58: Spain industry Analysis and Outlook Volume (Units Pack) Forecast by End Use, 2019 to 2034

Table 59: Spain industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 60: Spain industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 61: Rest of industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 62: Rest of industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 63: Rest of industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 64: Rest of industry Analysis and Outlook Volume (Units Pack) Forecast by Price Range, 2019 to 2034

Table 65: Rest of industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 66: Rest of industry Analysis and Outlook Volume (Units Pack) Forecast by End Use, 2019 to 2034

Table 67: Rest of industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 68: Rest of industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Figure 1: industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 2: industry Analysis and Outlook Value (US$ Million) by Price Range, 2024 to 2034

Figure 3: industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 4: industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 5: industry Analysis and Outlook Value (US$ Million) by Country, 2024 to 2034

Figure 6: industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 7: industry Analysis and Outlook Volume (Units Pack) Analysis by Country, 2019 to 2034

Figure 8: industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 9: industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 10: industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 11: industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 12: industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 13: industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 14: industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 15: industry Analysis and Outlook Volume (Units Pack) Analysis by Price Range, 2019 to 2034

Figure 16: industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 17: industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 18: industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 19: industry Analysis and Outlook Volume (Units Pack) Analysis by End Use, 2019 to 2034

Figure 20: industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 21: industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 22: industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 23: industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 24: industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 25: industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 26: industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 27: industry Analysis and Outlook Attractiveness by Price Range, 2024 to 2034

Figure 28: industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 29: industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 30: industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: UK industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 32: UK industry Analysis and Outlook Value (US$ Million) by Price Range, 2024 to 2034

Figure 33: UK industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 34: UK industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 35: UK industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 36: UK industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 37: UK industry Analysis and Outlook Volume (Units Pack) Analysis By Region, 2019 to 2034

Figure 38: UK industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 39: UK industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 40: UK industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 41: UK industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 42: UK industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 43: UK industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 44: UK industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 45: UK industry Analysis and Outlook Volume (Units Pack) Analysis by Price Range, 2019 to 2034

Figure 46: UK industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 47: UK industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 48: UK industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 49: UK industry Analysis and Outlook Volume (Units Pack) Analysis by End Use, 2019 to 2034

Figure 50: UK industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 51: UK industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 52: UK industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 53: UK industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 54: UK industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 55: UK industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 56: UK industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 57: UK industry Analysis and Outlook Attractiveness by Price Range, 2024 to 2034

Figure 58: UK industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 59: UK industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 60: UK industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 61: Germany industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 62: Germany industry Analysis and Outlook Value (US$ Million) by Price Range, 2024 to 2034

Figure 63: Germany industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 64: Germany industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 65: Germany industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 66: Germany industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 67: Germany industry Analysis and Outlook Volume (Units Pack) Analysis By Region, 2019 to 2034

Figure 68: Germany industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 69: Germany industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 70: Germany industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 71: Germany industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 72: Germany industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 73: Germany industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 74: Germany industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 75: Germany industry Analysis and Outlook Volume (Units Pack) Analysis by Price Range, 2019 to 2034

Figure 76: Germany industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 77: Germany industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 78: Germany industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 79: Germany industry Analysis and Outlook Volume (Units Pack) Analysis by End Use, 2019 to 2034

Figure 80: Germany industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 81: Germany industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 82: Germany industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 83: Germany industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 84: Germany industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 85: Germany industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 86: Germany industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 87: Germany industry Analysis and Outlook Attractiveness by Price Range, 2024 to 2034

Figure 88: Germany industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 89: Germany industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 90: Germany industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 91: Italy industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 92: Italy industry Analysis and Outlook Value (US$ Million) by Price Range, 2024 to 2034

Figure 93: Italy industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 94: Italy industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 95: Italy industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 96: Italy industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 97: Italy industry Analysis and Outlook Volume (Units Pack) Analysis By Region, 2019 to 2034

Figure 98: Italy industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 99: Italy industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 100: Italy industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 101: Italy industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 102: Italy industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 103: Italy industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 104: Italy industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 105: Italy industry Analysis and Outlook Volume (Units Pack) Analysis by Price Range, 2019 to 2034

Figure 106: Italy industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 107: Italy industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 108: Italy industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 109: Italy industry Analysis and Outlook Volume (Units Pack) Analysis by End Use, 2019 to 2034

Figure 110: Italy industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 111: Italy industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 112: Italy industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 113: Italy industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 114: Italy industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 115: Italy industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 116: Italy industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 117: Italy industry Analysis and Outlook Attractiveness by Price Range, 2024 to 2034

Figure 118: Italy industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 119: Italy industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 120: Italy industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 121: France industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 122: France industry Analysis and Outlook Value (US$ Million) by Price Range, 2024 to 2034

Figure 123: France industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 124: France industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 125: France industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 126: France industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 127: France industry Analysis and Outlook Volume (Units Pack) Analysis By Region, 2019 to 2034

Figure 128: France industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 129: France industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 130: France industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 131: France industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 132: France industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 133: France industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 134: France industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 135: France industry Analysis and Outlook Volume (Units Pack) Analysis by Price Range, 2019 to 2034

Figure 136: France industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 137: France industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 138: France industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 139: France industry Analysis and Outlook Volume (Units Pack) Analysis by End Use, 2019 to 2034

Figure 140: France industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 141: France industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 142: France industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 143: France industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 144: France industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 145: France industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 146: France industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 147: France industry Analysis and Outlook Attractiveness by Price Range, 2024 to 2034

Figure 148: France industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 149: France industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 150: France industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 151: Spain industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 152: Spain industry Analysis and Outlook Value (US$ Million) by Price Range, 2024 to 2034

Figure 153: Spain industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 154: Spain industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 155: Spain industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 156: Spain industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 157: Spain industry Analysis and Outlook Volume (Units Pack) Analysis By Region, 2019 to 2034

Figure 158: Spain industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 159: Spain industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 160: Spain industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 161: Spain industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 162: Spain industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 163: Spain industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 164: Spain industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 165: Spain industry Analysis and Outlook Volume (Units Pack) Analysis by Price Range, 2019 to 2034

Figure 166: Spain industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 167: Spain industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 168: Spain industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 169: Spain industry Analysis and Outlook Volume (Units Pack) Analysis by End Use, 2019 to 2034

Figure 170: Spain industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 171: Spain industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 172: Spain industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 173: Spain industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 174: Spain industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 175: Spain industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 176: Spain industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 177: Spain industry Analysis and Outlook Attractiveness by Price Range, 2024 to 2034

Figure 178: Spain industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 179: Spain industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 180: Spain industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 181: Rest of industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 182: Rest of industry Analysis and Outlook Value (US$ Million) by Price Range, 2024 to 2034

Figure 183: Rest of industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 184: Rest of industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 185: Rest of industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 186: Rest of industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 187: Rest of industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 188: Rest of industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 189: Rest of industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 190: Rest of industry Analysis and Outlook Volume (Units Pack) Analysis by Price Range, 2019 to 2034

Figure 191: Rest of industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 192: Rest of industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 193: Rest of industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 194: Rest of industry Analysis and Outlook Volume (Units Pack) Analysis by End Use, 2019 to 2034

Figure 195: Rest of industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 196: Rest of industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 197: Rest of industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 198: Rest of industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 199: Rest of industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 200: Rest of industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 201: Rest of industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 202: Rest of industry Analysis and Outlook Attractiveness by Price Range, 2024 to 2034

Figure 203: Rest of industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 204: Rest of industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fabric Stain Remover Market Growth – Trends, Demand & Innovations 2025-2035

Japan Fabric Stain Remover Market Analysis - Size, Share & Trends 2025 to 2035

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA