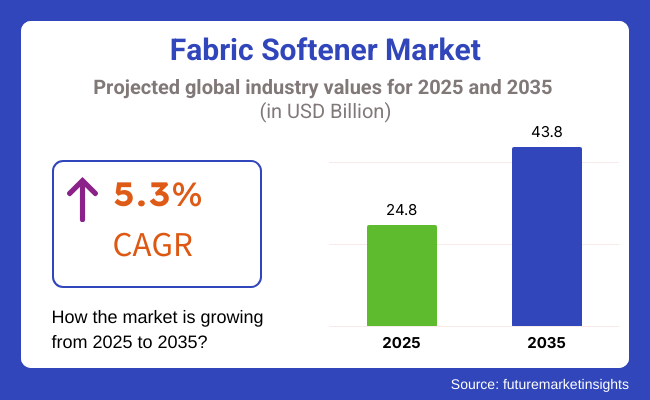

The fabric softener market is expected to experience steady growth between 2025 and 2035, driven by the rising demand for laundry care products, increasing awareness of fabric care, and advancements in eco-friendly formulations. The industry is projected to grow from USD 24.8 billion in 2025 to USD 43.8 billion by 2035, reflecting a CAGR of 5.3% over the forecast period.

The industry is witnessing a consistent growth trend, as a result of the increased consumer interest in laundry care items that contribute to fabric softness, freshness, and longevity. They also help to avoid static cling, create a fluffier finish, and in some cases, they can be a source of a long-lasting smell thus, these items are essential in household and industrial laundry.

Also, the prevalent trend toward the use of high-quality and environmentally friendly products is an additional factor that is expanding the industry even more. The mainspring of the industry growth is mainly spurred by the rapid rate of urbanization, increased amounts of disposable income, and the altered way of living of consumers.

The customers prefer products that incorporate extra useful properties like maximum bacterial, odor-free, and no skin irritants. The search for hypoallergenic and dermatologically tested softeners has surged, particularly among the consumers with sensitive skin and families with toddlers.

The transition to a sustainable and plant-based product is the main factor that forms current industry trends. Absolutely, the focus of enterprises is on biodegradable content, recyclable packaging, and eco-friendly formulations in order to attract environmentally-driven consumers.

The introduction of the concepts like concentrated and dryer sheet fabric softeners that are user-friendly and efficient, while at the same time, reduce water usage and packaging waste, is also another point of interest. The novel technological advancements in encapsulated fragrance and slow-release scent technology are other factors driving innovation in the industry.

The heat of the moment aromatherapy-inspired scents and natural essential oil-based products is facilitating the expansion of the product range, thereby enriching the overall shopping experience. Conversely, the industry is confronting difficulties like the skyrocketing control of regulation on the chemical-based products and the fretting on synthetic fragrances, and preservatives.

Consumer tendencies for fragrance-free and allergen-free laundry items make tough competition for traditional products which is a critical issue to consider. Moreover, the emergence of other fabric conditioning solutions like dryer balls and fabric sprays may take their toll on the industry expansion.

In spite of the worries, there are great chances for the industry to go beyond the limits. According to predictions, the growth of smart washing machines, which come with built-in product features, will be a core driver of product innovation.

Additionally, the rise of e-commerce and the growing presence of direct-to-consumer sales is improving product accessibility and broaden brand visibility. The continuous shift in consumers' choices involving fabric care and sustainability will assure the industry growth in the future.

The industry is seeing dynamic changes being motivated by consumer change, concerns towards sustainability, and innovation in formulating the products. The biggest segment still holds the position in the household consumers, who now demand lasting scents, hypoallergenic products, and sustainable versions.

Plants-derived softeners with no artificial contents, phthalates, or parabens are increasingly trendy among ecologically conscious consumers. Functional interest is of higher priority compared to fragrance in commercial laundries, with users seeking concentrated formulation applied in a high-efficient measure to save product volume and preserve the fabric condition.

In hospital and hotel laundries, industrial uses emphasize antimicrobial and hypoallergenic formulations to satisfy regulatory demands. With the development of smart washing machines and detergent pods, innovation in sheet-form and capsule-based softeners has been imminent.

Moreover, biodegradable and water-efficient products are becoming increasingly sought after as sustainability is still a priority while making a purchase. Companies are emphasizing refillable packaging and natural scents to attract sustainable-conscious consumers.

Between 2020 and 2024, the industry developed steadily with individuals prioritizing comfort and care in fabrics. The awareness of benefits of laundry care, urban life, and growing disposable incomes triggered demand for enhanced fragrance, softness, and anti-static benefits in fabric softeners.

Liquid softeners remained the most popular type due to their convenience and improved performance. Businesses responded to shifting consumer interests by introducing eco-friendly, plant-based, and hypoallergenic types to address issues concerning skin sensitivities and the environment.

Also, growth in online retailing channels gave consumers easier access to more varieties of products, contributing further to the growth of the industry. Forward to 2025 to 2035, the industry will undergo revolutionary change with technology and sustainability.

Natural and biodegradable ingredients will become the standard as consumers look for ecological products. Automatic detergent and softener dispensing in smart washing machines will lead to maximum product utilization and minimum wastage.

The next decade will witness the rise in application of microencapsulation technology innovations to provide fragrance for longer, allergen-free, dermatologist-tested, and natural products for sensitive skin. Low-plastic or refillable packaging formats will gain momentum as producers make an attempt to leave a smaller footprint. Sustainability with innovation will be the defining characteristic of the next ten years' competitive industry.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Plant-based and hypoallergenic softener expansion. Ultra-concentrated and concentrated product growth to fight packaging waste. IoT-integrated smart dispensing systems in washing machines. | AI-powered fabric care solutions that adaptively adjust the softener concentration according to the fabric type and wash cycle. Biodegradable, microplastic-free solutions prevail. Self-cleaning softeners enabled with nanotech that remove detergent residues from clothes. |

| Transition to eco-friendly, phosphate-free, and cruelty-free softeners. Reuse and recycling package steps were initiated by companies to reduce plastic litter. | Zero waste, water-free softeners. AI-driven purchasing of ingredients means sustainable manufacturing. Blockchain-based transparent green certificates are the new normal. |

| Big Data-enabled washing machines automatically flush the amount of softener based on the sensitivity level of clothes. Home care smartphone apps with IoT connectivity tracked use and re-order needs. | Real-time AI-based fabric care avoids overuse for ultimate softness. Auto-refill subscription business models offer personalized products. Metaverse-based product testing enables customers to virtually experience softness. |

| Growing demand for hypoallergenic, baby-friendly, and gentle products. DTC and e-commerce brands increased industry share. | More markets embrace low-cost, environmentally friendly softeners. AI-driven customized fabric care products adjust products according to skin sensitivity and washing behavior. |

The industry is expanding with the rising consumer demand for laundry care products that enhance the quality and lifespan of fabrics. However, the stringent environmental regulations relating to the chemical composition, biodegradability, and waste in packaging are the primary barriers to compliance. Companies have to embrace eco-friendly ingredients and sustainable packaging to keep up with the regulations and consumer demand.

Challenges in the supply chain, like the changes in the costs of raw materials, transportation delays, and the shortage of plant-based softening agents, threaten the production stability. The dependence on petroleum chemicals that much is also a factor exposing the industry to price fluctuations. The businesses will have to consider diversifying suppliers, look for the renewable sources and improve efficiency in production for dealing with these issues.

The increased competition of detergent brands that come with-in built softening properties and the extension to the use of natural alternatives like vinegar and wool dryer balls presented a significant threat to the growth of the industry. The consumers prefer multifunctional, hypoallergenic, and fragrance-free options. The focus on the innovation, dermal-friendly, and long-lasting products that are in tune with the customers' preferences is the way for brands to remain competitive.

Consumer fears related to aromatic fragrances, possible allergens, and chemical remnants are bleak the impact on the industry trust. A high level of ingredient transparency and the use of common procedures for third-party certifications, as well as dermatological testing, will be necessary to ensure that the brand maintains the level of credibility and earns customer loyalty in an industry that is ever-health more conscious.

By 2025, liquid fabric softeners are expected to retain a lucrative industry segment, which is anticipated to account for a share of around 57.2% of the industry. Such strong leadership is due to their superior fabric conditioning, lasting fragrance, and ease of use. Liquid variants repel static build-up, limit the formation of wrinkles, and broaden the lifespan of clothes, which is the reason households all over the world prefer them.

Major brands - Swachh (Procter & Gamble), Comfort (Unilever), and Snuggle (Henkel), to name a few - offer sophisticated formulations with features like scent boosters, hypo-allergenic, concentrate formats, and wide-ranging appeal to both developed and developing markets and consumers.

By 2025, fabric softener sheets are expected to contribute 24% of the industry share. [Weight importance] Sheets are easy, cheap, and small, making them ideal for small living conditions or trips. Brands like Bounce (P&G) and Gain still dominate this segment with a host of different (not to mention anti-static) scents. Although very popular, sheets represent less fabric conditioning than liquids, reducing their desirability among certain consumer segments, such as those seeking premium care.

In short, a shift in consumer behaviour is what propels the industry with an increasing focus on sustainable and versatile products. At the same time, liquid softeners represent the largest segment, and sheets are the most economical or lazy users. How major industry players innovate and industry their products will be critical in determining consumer preferences for the future.

Conventional fabric softeners are projected to maintain approximately 58.5% of the overall industry share in 2025. Traditional ones are most common, as they are inexpensive, readily available, and have long been used successfully for fabric conditioning. Conventional softeners often included fragrance-enhancing agents, anti-static agents, and wrinkle-reducing components, which all attracted a broad spectrum of consumers.

The category is being invigorated by major brands like Downy (Procter & Gamble), Snuggle (Henkel), and Comfort (Unilever), with innovations like long-lasting scents and concentrated formulas that welcome them back to mainstream households. In price-sensitive markets, particularly in Asia and Latin America, the affordability of conventional softeners has also led to their widespread use.

In contrast, the industry share of organic products is anticipated to be 41.5% in 2025, with consumers seeking eco-friendly, health-conscious alternatives. As awareness increases around allergens, skin sensitivities, and their effects on the natural world, consumers are beginning to demand plant-based options and biodegradable, non-toxic formulations.

Brands like Seventh Generation, Ecover, and Method have become popular, offering chemical-free softeners, certified USDA Organic, and ECOCERT, targeting eco-conscious consumers, primarily in North America and Europe.

Category-wise, conventional products continue to dominate the overall industry. Still, the organic category is experiencing significant growth, which is attributed to sustainable trends, supportive regulations, and increased retail shelf space.

Overall, the industry is thus placed at an intersection of demand for performance-based traditional solutions and eco-friendly organic products, with consumer awareness and brand transparency expected to play a significant role in shaping future growth dynamics.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

| UK | 5.5% |

| France | 5.4% |

| Germany | 5.7% |

| Italy | 5.2% |

| South Korea | 6% |

| Japan | 4.9% |

| China | 6.5% |

| Australia | 5.1% |

| New Zealand | 4.8% |

The USA industry will grow at 5.8% CAGR from 2025 to 2035. Consumers are progressively looking for ecologically friendly, hypoallergenic products as concerns over skin sensitivities and concern for the planet rise.

The number one trend influencing purchasing trends is fragrance retention solutions, which are made possible by microencapsulated scent technology. Industry leaders like Procter & Gamble and Unilever dominate the industry by introducing new, plant-based products that are attractive to sustainability-conscious customers.

Online shopping and subscription models are propelling industry growth. E-commerce gives businesses the ability to offer personalized experiences and bulk purchases. Additionally, multi-action softeners, such as anti-wrinkle and anti-static softeners, continue to grow among convenience-driven consumers. Exposure to high-end and specialist players with dermatologist-tested products also facilitates industry growth.

The UK industry is projected to grow at a CAGR of 5.5% during the forecast period. There is increasing demand for cruelty-free and biodegradable products, which is aligned with the UK's strong culture of sustainability. Industry leaders like Comfort and Lenor are focusing on the concentrated and refill models in a bid to reduce plastic usage and decrease costs.

Supermarket private labels are increasing, posing a threat to branded products by offering low-cost but quality products. Consumers also require water-saving and quick-dissolve softeners, particularly in urban centers where water conservation is encouraged. The growth in the number of small-scale, ethical businesses offering vegan softeners is contributing to industry diversification.

The French industry is expected to gain a CAGR of 5.4% during 2025 to 2035. French preferences for luxury and natural home care boost the demand for high-end softeners with botanicals and subtle scents. Established names such as L'Arbre Vert emphasize the use of eco-label certifications and allergen-free products.

The country's shift towards sustainability compels the use of refill points for fabric softeners in grocery stores. A trend is also observed where fabric softeners are increasingly moving towards the level of premium detergents with enhanced protection for clothes and fragrance longevity. Handcrafted scented softeners offered by niche brands are gaining attention as evidence of the leading position of French perfume in-home care.

The German industry is projected to achieve a CAGR of 5.7% over the next decade. Customers prefer biodegradable, vegan, and fragrance-free products and thus demand such products, and brands like Frosch and Sonett are compelled to produce plant-based products. Dermatologist-tested and hypoallergenic softeners are sought after by sensitive skin customers.

The German industry also sees expansion in the likes of capsule and concentrated forms that reduce packaging waste and enhance convenience. Sales of wrinkle-fighting and anti-static advantages via fabric softeners are on the growth curve, targeting working professionals who need convenience-based cleaning.

The Italian industry will grow by 5.2% between 2025 and 2035. The rich heritage in Italian fashion and textiles gives the country's buying trend a direction of maintaining the feel of the fabric and the color streak with the assistance of a softener. Industry leader companies Chanteclair and Felce Azzurra have oils of vital significance along with heritage-type scents in the product to differentiate the brands.

The industry also is experiencing increasing sales of luxury and craft softeners, largely with natural content like olive oil or lavender. Beyond this, increased penetration among Italian consumers for smart washing machines is driving sales for low-foam specialty softeners for use with automatic detergent dispensers.

South Korea's industry will increase at a 6% CAGR. South Korea's beauty and skincare segment contributes significantly to the laundry care segment, and hypoallergenic and skin-friendly softeners are on a roll. Softeners with high-quality skincare ingredients endorsed by companies such as LG Household & Health Care are industry leaders.

Long-lasting fragrance technology has a trend going on, and K-beauty-perfumed fragrances are being included in softeners. Direct-to-consumer sales are also spurred by South Korea's established e-commerce culture, where many brands introduced special online-only products.

The Japan industry is set to grow at a CAGR of 4.9%. With limited household space and preferences for less packaging, there is a growing demand for small-form, concentrated softeners. Such companies as Lion and Kao emphasize rapid-dissolving and low-waste products.

Chinese customers demand antibacterial and deodorizing functions in softeners as a result of the cultural preference for cleanliness within the nation. Cold wash softener innovation is also part of the industry activity to cater to energy-saving washing behavior.

China's industry will grow at a CAGR of 6.5%. Higher disposable incomes and the need for antibacterial and fragrant softeners drive the industry. Blue Moon and Liby are the leaders with AI-based smart dosing technologies.

Direct-to-consumer and internet platforms are growing rapidly, making entry into the industry easier. Softeners with a combination of multi-functionality along with fabric protectors, wrinkle-resistance, and odor control appeal also meet with favor with consumers since they address greater convenience and hygiene demands.

The industry in Australia will expand at a 5.1% CAGR. Growing demand for greywater and eco-friendly composition drives innovation with brands like Bosisto's and Earth Choice. Consumers are using natural softeners due to increasing concern for the environment.

The industry is also shifting towards bulk buying and refill packaging to reduce the use of plastic. As online shopping continues to grow in popularity, digital channels are adding to increased accessibility and tailored product availability.

The industry for New Zealand's will increase at a CAGR of 4.8%. Sustainability leads the way, with a high demand for cruelty-free and biodegradable softeners. Domestic players like Ecostore highlight natural, toxin-free components to resonate with eco-friendly consumers.

The need for softeners that are outdoor and sportswear-friendly while keeping the fabric breathable is increasing, making New Zealand special. In addition, increasing demand for septic-safe softeners comes after the usage of off-grid wastewater treatment systems throughout the country.

The industry reportedly continues to grow steadily on the demand of consumers for long-lasting fragrances, fabric care benefits, and eco-friendly formulations. Plants, hypoallergenic, and concentrated softeners are merely changes shaping product innovations that brands style for sustainability-conscious buyers.

Leading players in the industry with these scent technologies, biodegradable ingredients, and their formulations being specialized for sensitive skin include Procter & Gamble (Downy), Unilever (Comfort), Henkel, Colgate-Palmolive, and SC Johnson. Also emerging in the industry are small brands and private labels that stress organic ingredients and refillable packaging, as well as allergen-free alternatives.

Key innovations include micro-encapsulated fragrance technology for prolonged freshness, low-water formulations, and dermatologically tested products. Such factors have pushed firms to invest money into their smart packaging and digital marketing strategies as a way of engaging consumers loyal to the brand.

Strategic factors affecting competition include e-commerce expansion, the implementation of sustainable sourcing of raw materials, and legal compliance with green certifications. As demand for premium multifunction increases, brands are keen on personalized scent, eco-packaging, and partnerships with appliance manufacturers to push their presence into the industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Procter & Gamble (Downy, Lenor) | 25-30% |

| Unilever (Comfort, Snuggle) | 18-22% |

| Henkel (Vernel, Suavitel) | 12-16% |

| Colgate-Palmolive (Soupline) | 6-10% |

| SC Johnson (Ecover, Method) | 4-8% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Procter & Gamble | Industry leader with Downy and Lenor, focusing on premium fragrance technology and fabric protection. Strong global presence and investment in eco-friendly innovations. |

| Unilever | Expanding its Comfort and Snuggle brands with concentrated formulas and plant-based variants. Enhancing digital marketing and brand partnerships. |

| Henkel | Strengthens its Vernel and Suavitel brands with long-lasting freshness and dermatologically tested formulas. Increasing industry penetration in Latin America and Europe. |

| Colgate-Palmolive | Focused on Soupline, a gentle, family-friendly product with growing traction in European markets. |

| SC Johnson | Expanding its Ecover and Method brands, catering to the sustainable and eco-conscious consumer segment. |

Key Company Insights

P&G (25-30%)

Procter & Gamble, a pioneer in the industry, capitalizes on strong brand loyalty and high-end products, as is evident from focus areas such as smart scent technology, ultra-concentrated softeners, and sustainable packaging, all of which further enhance the consumer experience while reducing their environmental impact.

Unilever (18-22%)

Unilever enhances the eco-efficiency and affordability of its products, including extending Comfort with biodegradable and plant-based products. The company places emphasis on increasing its sustainability offerings by introducing formulations enhanced with renewable ingredients and plastic-free packaging.

Henkel (12-16%)

Henkel is also investing in a bouquet of fragrance innovations and fabric care technologies while catering to the skin-sensitive segment with its formulations, which has attracted a diverse number of consumer segments. These microencapsulated fragrances, deep-fiber conditioning agents, and hypoallergenic formulations will further increase the already broad range of products that the company offers.

Colgate-Palmolive (6-10%)

Colgate-Palmolive fortifies Soupline's formulations, which are dermatologically safe and family-oriented, with an expanded range of use in Europe. It prides itself on mild, skin-friendly formulations for family-style caring and skin-sensitive consumers.

SC Johnson (4-8%)

SC Johnson derives financial gains from the budding industry for eco-friendly fabric conditioners made for chemical-free, cruelty-free, and biodegradable products. It has recognized millennial consumers and those from Generation Z by focusing campaigns on ethical sourcing, reduced plastics use, and claims of nontoxic formulations.

Other Key Players (25-35% Combined)

By nature, the industry is segmented into organic and conventional.

By product type, the industry is segmented into liquid, sheets, sprays, tablets, and dryer bars.

By end use, the industry is segmented into laundry services, textile industry, household, hospitality industry, and others.

By sales channel, the industry is segmented into independent retailers, hypermarkets, multi brand stores, supermarkets, specialty retail stores, online sales, company website, and 3rd party online sales.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is expected to generate USD 24.8 billion in revenue by 2025.

The industry is projected to reach USD 43.8 billion by 2035, growing at a CAGR of 5.3%.

Key players include Procter & Gamble, Unilever, Henkel, Colgate-Palmolive, SC Johnson, Church & Dwight (Arm & Hammer), Seventh Generation, Fabrizio Yuhan-Kimberly, and The Laundress.

North America and Asia-Pacific, driven by rising household consumption, increasing awareness of sustainable laundry products, and innovations in biodegradable products.

Liquid fabric softeners dominate due to their convenience, deep fiber penetration, and ability to provide long-lasting fragrance and softness to clothes.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 4: Global Market Volume (Unit Pack) Forecast by Nature, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 6: Global Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 8: Global Market Volume (Unit Pack) Forecast by End Use, 2019 to 2034

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 10: Global Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: North America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 14: North America Market Volume (Unit Pack) Forecast by Nature, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: North America Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 17: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: North America Market Volume (Unit Pack) Forecast by End Use, 2019 to 2034

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 20: North America Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Latin America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 24: Latin America Market Volume (Unit Pack) Forecast by Nature, 2019 to 2034

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 26: Latin America Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 27: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 28: Latin America Market Volume (Unit Pack) Forecast by End Use, 2019 to 2034

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 30: Latin America Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: Western Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 33: Western Europe Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 34: Western Europe Market Volume (Unit Pack) Forecast by Nature, 2019 to 2034

Table 35: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 36: Western Europe Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 37: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 38: Western Europe Market Volume (Unit Pack) Forecast by End Use, 2019 to 2034

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 40: Western Europe Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 44: Eastern Europe Market Volume (Unit Pack) Forecast by Nature, 2019 to 2034

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Eastern Europe Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 47: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: Eastern Europe Market Volume (Unit Pack) Forecast by End Use, 2019 to 2034

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 50: Eastern Europe Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 52: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 54: South Asia and Pacific Market Volume (Unit Pack) Forecast by Nature, 2019 to 2034

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 56: South Asia and Pacific Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 58: South Asia and Pacific Market Volume (Unit Pack) Forecast by End Use, 2019 to 2034

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 60: South Asia and Pacific Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: East Asia Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 63: East Asia Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 64: East Asia Market Volume (Unit Pack) Forecast by Nature, 2019 to 2034

Table 65: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 66: East Asia Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 67: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 68: East Asia Market Volume (Unit Pack) Forecast by End Use, 2019 to 2034

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 70: East Asia Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 72: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 74: Middle East and Africa Market Volume (Unit Pack) Forecast by Nature, 2019 to 2034

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 76: Middle East and Africa Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 78: Middle East and Africa Market Volume (Unit Pack) Forecast by End Use, 2019 to 2034

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 80: Middle East and Africa Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Nature, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 11: Global Market Volume (Unit Pack) Analysis by Nature, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 15: Global Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 19: Global Market Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 20: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 21: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 23: Global Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 26: Global Market Attractiveness by Nature, 2024 to 2034

Figure 27: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 28: Global Market Attractiveness by End Use, 2024 to 2034

Figure 29: Global Market Attractiveness by Sales Channel, 2024 to 2034

Figure 30: Global Market Attractiveness by Region, 2024 to 2034

Figure 31: North America Market Value (US$ Million) by Nature, 2024 to 2034

Figure 32: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 33: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 35: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 37: North America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 41: North America Market Volume (Unit Pack) Analysis by Nature, 2019 to 2034

Figure 42: North America Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 43: North America Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 45: North America Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 49: North America Market Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 53: North America Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 56: North America Market Attractiveness by Nature, 2024 to 2034

Figure 57: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 58: North America Market Attractiveness by End Use, 2024 to 2034

Figure 59: North America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 60: North America Market Attractiveness by Country, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) by Nature, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 63: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 67: Latin America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 70: Latin America Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 71: Latin America Market Volume (Unit Pack) Analysis by Nature, 2019 to 2034

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 75: Latin America Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 79: Latin America Market Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 83: Latin America Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 86: Latin America Market Attractiveness by Nature, 2024 to 2034

Figure 87: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 88: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 89: Latin America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 90: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 91: Western Europe Market Value (US$ Million) by Nature, 2024 to 2034

Figure 92: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 95: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 97: Western Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 100: Western Europe Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 101: Western Europe Market Volume (Unit Pack) Analysis by Nature, 2019 to 2034

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 104: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 105: Western Europe Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 108: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 109: Western Europe Market Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 113: Western Europe Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 116: Western Europe Market Attractiveness by Nature, 2024 to 2034

Figure 117: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 118: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 120: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: Eastern Europe Market Value (US$ Million) by Nature, 2024 to 2034

Figure 122: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 123: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 127: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 131: Eastern Europe Market Volume (Unit Pack) Analysis by Nature, 2019 to 2034

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 135: Eastern Europe Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 139: Eastern Europe Market Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 143: Eastern Europe Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 146: Eastern Europe Market Attractiveness by Nature, 2024 to 2034

Figure 147: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 148: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 150: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 151: South Asia and Pacific Market Value (US$ Million) by Nature, 2024 to 2034

Figure 152: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 153: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 161: South Asia and Pacific Market Volume (Unit Pack) Analysis by Nature, 2019 to 2034

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 165: South Asia and Pacific Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 169: South Asia and Pacific Market Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 173: South Asia and Pacific Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 176: South Asia and Pacific Market Attractiveness by Nature, 2024 to 2034

Figure 177: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 178: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2024 to 2034

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 181: East Asia Market Value (US$ Million) by Nature, 2024 to 2034

Figure 182: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 183: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 185: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 187: East Asia Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 190: East Asia Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 191: East Asia Market Volume (Unit Pack) Analysis by Nature, 2019 to 2034

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 194: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 195: East Asia Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 198: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 199: East Asia Market Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 203: East Asia Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 206: East Asia Market Attractiveness by Nature, 2024 to 2034

Figure 207: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 208: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 209: East Asia Market Attractiveness by Sales Channel, 2024 to 2034

Figure 210: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 211: Middle East and Africa Market Value (US$ Million) by Nature, 2024 to 2034

Figure 212: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 213: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 217: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 221: Middle East and Africa Market Volume (Unit Pack) Analysis by Nature, 2019 to 2034

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 225: Middle East and Africa Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 229: Middle East and Africa Market Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 233: Middle East and Africa Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 236: Middle East and Africa Market Attractiveness by Nature, 2024 to 2034

Figure 237: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 238: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2024 to 2034

Figure 240: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fabric Softener Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fabric Toys Market Size and Share Forecast Outlook 2025 to 2035

Fabric Filter System Market Size & Forecast 2025 to 2035

Fabric Care Market Analysis - Trends, Growth & Forecast 2025 to 2035

Fabric Odor Eliminator Market – Trends, Growth & Forecast 2025 to 2035

Fabric Stain Remover Market Growth – Trends, Demand & Innovations 2025-2035

Global Fabric Cutting Machine Market Share Analysis – Trends & Forecast 2025–2035

Fabric Spreading Machine Market Growth – Trends & Forecast 2024-2034

Fabric Starch Market

Prefabricated Composite Sandwich Panels Market Size and Share Forecast Outlook 2025 to 2035

Prefabricated Bathroom Pods Market Size and Share Forecast Outlook 2025 to 2035

Prefabricated Building System Market Growth - Trends & Forecast 2025 to 2035

Mesh Fabric Market Size and Share Forecast Outlook 2025 to 2035

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Metal Fabrication Fluid Market Size and Share Forecast Outlook 2025 to 2035

Smart Fabric Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA