The global Non-Woven Fabric industry is experiencing significant growth due to increasing demand for lightweight, durable, and cost-effective fabric solutions across healthcare, automotive, construction, and personal care sectors. Advances in material technology, sustainability initiatives, and the adoption of high-performance non-woven textiles are reshaping the competitive landscape.

Market growth is driven by rising demand for eco-friendly, disposable, and reusable fabric applications, regulatory support for sustainable materials, and innovations in biodegradable and smart textiles. As cost-efficiency and quality become priorities, manufacturers are investing in advanced fiber processing, sustainable raw materials, and automation technologies.

Market Leaders & Competitive Landscape

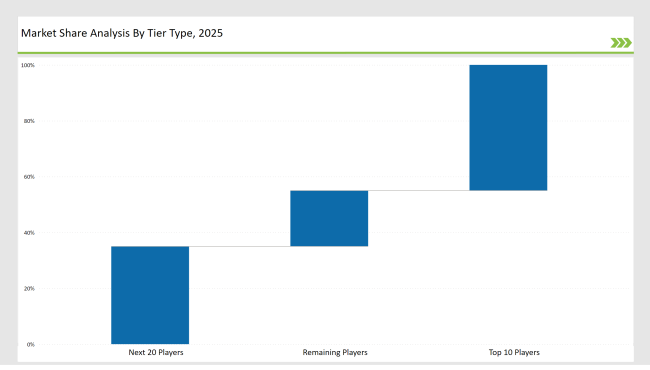

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Berry Global, Freudenberg, Ahlstrom-Munksjö) | 18% |

| Rest of Top 5 (Kimberly-Clark, DuPont) | 15% |

| Next 5 of Top 10 | 12% |

The demand for high-quality non-woven fabrics is increasing across multiple industries:

Manufacturers are focusing on innovative solutions to meet evolving market needs:

Year-on-Year Leaders

To stay competitive in the non-woven fabric industry, suppliers should focus on:

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Berry Global, Freudenberg, Ahlstrom-Munksjö |

| Tier 2 | Kimberly-Clark, DuPont, Glatfelter |

| Tier 3 | TWE Group, Johns Manville, Suominen |

| Manufacturer | Latest Developments |

|---|---|

| Berry Global | Launched high-durability, sustainable non-wovens (March 2024) |

| Freudenberg | Expanded advanced filtration non-wovens (July 2023) |

| Ahlstrom-Munksjö | Developed biodegradable medical fabrics (October 2023) |

| Kimberly-Clark | Innovated in ultra-soft, breathable non-woven textiles (February 2024) |

| DuPont | Introduced high-protection non-woven materials (May 2024) |

The Non-Woven Fabric industry is transitioning toward sustainability, efficiency, and advanced material innovations. Key players are emphasizing:

The industry is expected to advance in:

Rising demand for lightweight, durable, and sustainable fabric solutions.

Berry Global, Freudenberg, Ahlstrom-Munksjö, Kimberly-Clark, and DuPont.

Biodegradable non-wovens, smart textiles, and advanced filtration materials.

Asia-Pacific, North America, and Europe.

Companies are investing in biodegradable fibers, recycled materials, and eco-friendly manufacturing processes.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Woven Fabric Market by Production Process from 2024 to 2034

Fabric Spreading Machine Market Forecast Outlook 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fabric Toys Market Size and Share Forecast Outlook 2025 to 2035

Fabric Softener Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fabric Filter System Market Size & Forecast 2025 to 2035

Fabric Softener Market Analysis by Nature, Product Type, End Use, Sales Channel & Region from 2025 to 2035

Fabric Care Market Analysis - Trends, Growth & Forecast 2025 to 2035

Fabric Odor Eliminator Market – Trends, Growth & Forecast 2025 to 2035

Fabric Stain Remover Market Growth – Trends, Demand & Innovations 2025-2035

Fabric Starch Market

Global Fabric Cutting Machine Market Share Analysis – Trends & Forecast 2025–2035

Prefabricated Composite Sandwich Panels Market Size and Share Forecast Outlook 2025 to 2035

Prefabricated Bathroom Pods Market Size and Share Forecast Outlook 2025 to 2035

Prefabricated Building System Market Growth - Trends & Forecast 2025 to 2035

Mesh Fabric Market Size and Share Forecast Outlook 2025 to 2035

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA