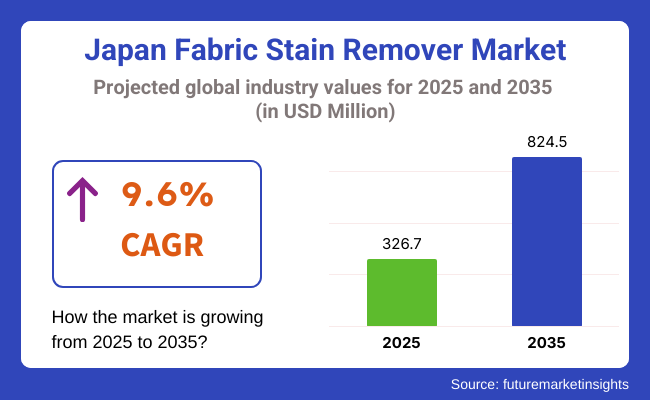

The Japan fabric stain remover market is poised to register a valuation of USD 326.7 million in 2025. The industry is slated to grow at 9.6% CAGR from 2025 to 2035, witnessing USD 824.5 million by 2035. The expansion of Japan's market for fabric stain removers is fueled by the interplay of lifestyle, cultural, and demographic changes that influence consumer behavior.

Japan has a strong cultural priority on cleanliness and appearance, with stain-free clothes being a critical aspect of daily life. Such cultural focus fuels consistent demand for fabric care products, particularly stain removers, which are viewed not only as cleaning products, but as staples in the household.

Urbanization is also a major driver. With more individuals residing in small areas such as apartments, the practicality of owning large washing machines or regularly doing large loads of laundry diminishes. This generates demand for easy, targeted cleaning products-such as fabric stain removers-that enable instant fixes without the inconvenience of full washes.

The aging population in Japan also drives demand, as older adults tend to look for easy-to-use and effective solutions for cleaning their clothes without labor-intensive measures. The rise of dual-income households and busy lifestyles is also driving demand for convenience-oriented products.

Removers that are portable, instant-acting, or even on-the-go (such as pen-type or spray-type removers) are being popularized by young working consumers. Meanwhile, the Japanese consumer base is growing more environmentally conscious.

Buyers are moving toward products that are biodegradable, non-toxic, or contain plant-based ingredients, driving manufacturers to develop in the stain remover category. In addition, Japanese consumers are extremely brand- and quality-focused. Consequently, stain removers that provide evident, consistent outcomes are likely to experience repeat business, which maintains industry growth.

The combination of robust hygiene expectations, aging populations, time pressures, and an increasing desire for environmentally friendly but effective solutions remains to make Japan a rich territory for growth in the fabric stain remover category.

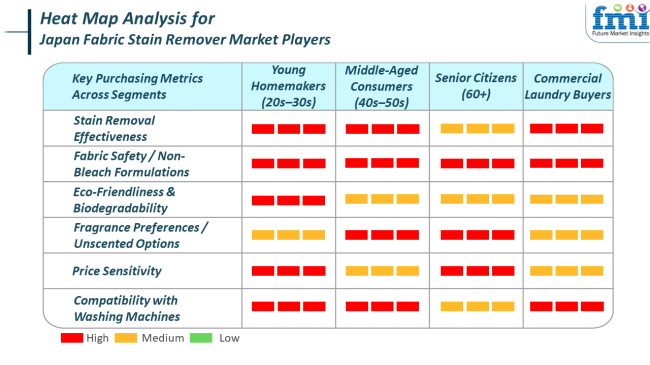

The industry for fabric stain removers is experiencing varied trends across different end-use segments propelled by distinct customer demands. At the household end-use segment, convenience, multifunctionality, and environmental compatibility are major driving forces.

With increasing urbanization and hectic lifestyle, there has been a switch to small and lightweight stain removers such as sprays and pens that promise quick, effective cleaning without compromising on a whole wash. At the same time, the commercial segment, hospitality, and laundry services demand high-performance, value-driven stain removers that can deal with heavy volumes and strong stains.

In specialty segments like baby care and pet care, consumers increasingly demand non-toxic, hypoallergenic products that are safe for the skin while providing continued fabric quality. Such customers prefer gentle ingredients and soft fragrances, especially for sensitive skin.

The buying criteria differ substantially across these segments. Household customers seek products which are effective, convenient to use, and relatively inexpensive, and with a rising demand for natural and multi-tasking products. Commercial customers have efficiency and multipack as primary concerns, requesting products that have professional-level performances at reasonable costs.

In specialty markets, safety is the primary concern, with customers choosing mild, non-toxic stain removers that provide assurance for use on sensitive fabrics, like in baby care or pet care. Altogether, the industry for fabric stain removers is influenced by a combination of convenience, performance, and eco-friendliness for various end-use segments.

Between 2020 and 2024, the industry of fabric stain removers has undergone tremendous changes, primarily due to shifts in consumer behavior, technological innovation, and environmental awareness. Perhaps the most significant change has been increased demand for eco-friendly products as a result of increased environmental consciousness.

Consumers have become increasingly responsible for the ecological footprint of the products they buy, and as a result, there has been an increase in biodegradable, non-toxic, and cruelty-free stain removers. Another change is the growing inclination towards convenience.

Busy lives, especially during lockdown, inclined individuals towards easy, quick-to-use solutions, popularizing portable stain removers in the form of pens, sprays, and wipes. In addition, sales through e-commerce have seen a significant rise with online channels turning into a dominant platform for shopping for fabric care products, given that consumers were compelled to make fewer in-shop visits during the lockdowns.

Looking forward to 2025 to 2035, the industry for fabric stain removers is likely to continue to develop, driven by product formulation innovation and changing consumer attitudes. One of the trends is the development of smart fabric care solutions, where AI and IoT technology can be used to develop more sophisticated, customized cleaning products.

This may involve stain removers that adjust according to the fabric type or the type of stain, providing customized solutions. With sustainability remaining at the forefront, green chemistry and plant-based innovations are set to drive the industry, with an emphasis on lessening the environment impact of the products themselves and their packaging. In addition, as consumers continue to turn towards natural and health-oriented options, demand for chemical-free, mild formulations will increase.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Between 2020 and 2024, the trend was inclined toward environmentally friendly fabric stain removers due to increasing environmental concerns. There was a call for products containing biodegradable, non-toxic, and cruelty-free ingredients. Brands obliged by reformulating products and using more eco-friendly packaging. | Between 2025 and 2035, sustainability will be entrenched further, co ncentrating on green chemistry. Innovations in plant-based ingredients and packaging that promotes a circular economy, including refillable and recyclable packaging are poised to occur . |

| Convenience-based products experienced much increased demand from 2020 to 2024, with portable stain removers in the forms of sprays, pens, and wipes becoming the more popular products. | AI and IoT technologies may enable products to sense specific fabrics and stains and provide a more customized, effective cleaning experience. Convenience will remain a priority but wi th increased technological advancements to further streamline usability. |

| The growth of e-commerce in 2020 to 2024 was spurred on by the pandemic, with consumers increasingly opting to buy online. Platforms and websites offered convenient access to an extensive array of fabric care products, aided by the comfort of customer reviews and comprehensive comparisons, making it convenient to buy the suitable product. | In the future, e-commerce will reign supreme, with even greater personalized shopping experiences fueled by AI. Subscription models for routine deliveries will become increasingly popular, and brands might include features such as augmented reality to enable customers to see the efficacy of products prior to purchase, improving the overall online shopping experience. |

| From 2020 to 2024, manufacturers concentrated on creating quicker-acting, better-performing formulas to respond to consumer demands for effective stain lift. Products became more specialized, catering to different fabric types and stain categories. | In the coming decade, smart stain removers could emerge, with products leveraging AI and IoT to automatically adjust cleaning power based on fabric or stain type. This will result in a more personalized cleaning experience, connecting directly into smart home devices and providing more sophisticated fabric care solutions. |

The industry for Japan fabric stain removers is subject to various risks and challenges that may affect its growth and development over the next few years. One of the key risks is industry saturation. With more brands entering the industry with comparable products, particularly in the convenience and eco-friendly segments, there is a threat of oversupply, resulting in aggressive price competition.

This could erode profit margins for manufacturers and retailers, making it hard for smaller or new players to survive. Furthermore, though brand loyalty is strong in Japan, the tight market could result in difficulties in product differentiation, particularly with identical formulas in mainstream categories such as multi-purpose stain removers.

Supply chain disruption is another critical risk, especially following worldwide disruptions such as the COVID-19 pandemic. Being dependent on imported raw materials like chemicals and packaging, Japan is vulnerable to supply and price volatilities in the market.

Any other worldwide disruptions in the future, including shipping disruptions, trade bans, or natural catastrophes, would cause shortages or rising costs of production, which in turn would influence product pricing and supply.

Liquid fabric stain removers are best-selling and the most popular variety of product available in Japan. The reason they are so much in demand stems from their easiness and multifunctionality. Liquids provide easy application straight to the staining area, as they allow specific control over amounts used. This makes them especially useful for the removal of a wide range of stains, from food and drink to oils and grime, without needing extensive preparation.

The liquid form also means it can be rapidly absorbed into the fabric, resulting in faster and more effective removal of stains, which suits Japan's emphasis on cleanliness and efficiency. In addition, liquid stain removers come in handy, compact bottles, which suit Japan's urban lifestyles, where there is limited space.

Powder stain removers, although still found on the industry, are less sold in Japan than liquid cleaners. Powders also take longer to dissolve when mixed with water, and customers have a perception that they are less effective or less convenient than liquids. On the other hand, Japan prefers products that are convenient to use and store.

With that, the powder form, which has to be mixed with water or applied directly prior to washing, is not as consumer-friendly for instant solutions. Powder stain removers remain popular in some niche uses, such as for certain fabric types or for deep stains in laundry cycles.

The largest end consumers of fabric stain removers in Japan are households. This segment accounts for the lion's share of the industry because of Japan's cultural focus on cleanliness and high premium on keeping clothing well-maintained. There is a strong preference among Japanese households for fabric care products that are effective, convenient, and efficient at making clothes appear clean and spotless.

Household stain removers, especially liquid ones, are very commonly consumed by consumers in their daily cleaning, whether it's to remove food or drink stains on clothes, or to keep school uniform and working attire clean. The constant necessity for these products stems from Japan's meticulousness in regards to personal grooming, especially for work environments where neat and clean clothing is required.

Moreover, with the crowded urban environment and cramped home space in many parts of the country, the convenience of use and minimal size of liquid fabric stain removers render them a convenient alternative for Japanese shoppers who favor goods that are practical and space-conserving.

The Japanese industry for fabric stain removers is competitively driven with major companies marketing a wide assortment of products serving different consumer segments, ranging from eco-friendly and hypoallergenic products to highly efficient stain removal agents.

Leading local players such as Kao Corporation and Lion Corporation remain at the top of the industry with their strong reputations and product development, while multinationals like Procter & Gamble and Unilever continue to be present in the industry with strong market presence via their global penetration and well-known product lines.

Furthermore, organizations such as Kobayashi Pharmaceutical and SANARU COMPANY LIMITED are expanding their presence by accessing niche segments, providing specialized solutions for various types of stains and fabric requirements.

The growing demand for eco-friendly and safe stain removal products has also given rise to a number of green-conscious brands, with organizations such as Amway and S.C. Johnson & Son Inc. benefiting from the industry's movement towards environmentally friendly products.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Kao Corporation | 20-25% |

| Lion Corporation | 15-18% |

| SANARU COMPANY LIMITED | 5-7% |

| Kobayashi Pharmaceutical | 5-7% |

| The Procter & Gamble Company | 7-9% |

| Colgate-Palmolive Company | 4-6% |

| S.C. Johnson & Son Inc. | 3-5% |

| Amway Corporation | 3-4% |

| Church & Dwight Co., Inc. | 2-3% |

| AlEn USA LLC | 1-2% |

| Unilever PLC | 8-10% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kao Corporation | Since its brand name is well-reputed, Kao provides multiple types of stain removers for sensitive skin and delicate cloths. Its focus is great on sustainability through the provision of biodegradable and natural content. |

| Lion Corporation | A leading company in Japan's industry for fabric stain removers, Lion offers top-performing liquid stain removers with a special focus on family safety. Among their products are those for resistant stains , and eco-friendly alternatives for health-oriented consumers. |

| SANARU COMPANY LIMITED | Excels in innovative stain removal products, providing products tailored to specific requirements, including sensitive fabrics and pet stain removal. SANARU is dedicated to offering expert stain care products that meet Japanese consumers' demand for precise and focused cleaning solutions. |

| Kobayashi Pharmaceutical | Provides products like multi-purpose liquid removers that emphasize offering quick-acting solutions. The company emphasizes convenience and efficiency, and the stain removers are specifically designed for a broad variety of common household stains. |

| The Procter & Gamble Company | P&G products like Tide and Ariel enjoy wide acceptability in Japan. These have high-stain-removal performance with formulations to get rid of durable stains on several types of fabric. |

| Colgate-Palmolive Company | Referred to as being liquid stain removers, Colgate-Palmolive offers products that are effective at removing stains without harsh effects on the fabric. They emphasize skin and fabric gentleness, making their products stand as safe for sensitive skin. |

| S.C. Johnson & Son Inc. | Promotes budget-friendly, effective stain removers based on long-lasting performance. It has sprays and wipes that prioritize simplicity and mobility for consumers with hectic lifestyles. |

| Amway Corporation | Is centered on natural, non-toxic stain removers, and positions its brand for consumers that look for environmental-friendly, hypoallergenic, and clean-label alternatives. Amway is positioned for consumers who care for sustainability and make health-conscious lifestyle choices. |

| Church & Dwight Co., Inc. | Known for its Arm & Hammer brand, Church & Dwight offers stain removers with a focus on natural ingredients such as baking soda, making it a go-to brand for consumers interested in chemical-free, eco-conscious cleaning solutions. |

| AlEn USA LLC | Excels at affordable fabric care products with robust stain-fighting capability. The brand is better known for bulk packaging in commercial environments and continues to be a value-conscious choice for homes and businesses. |

| Unilever PLC | Unilever's Omo and Surf brands are highly respected for their multi-purpose stain removers that deliver intense cleaning. The company emphasizes sustainability, with an expanding portfolio of plant-based, biodegradable stain removers that resonate with eco-friendly consumers. |

The Japanese market is shifting towards products that are convenient, sustainable, and high-performing. Kao Corporation and Lion Corporation will remain the dominant players, innovating through environmentally friendly formulations and retaining strong ties with Japanese consumers, who value efficient and safe cleaning products.

Procter & Gamble and Unilever will most likely consolidate their position by diversifying their product lines to incorporate green and natural products, as the market for environmentally friendly products grows. Small players such as SANARU and Kobayashi Pharmaceutical will target niche markets with highly specialized products for particular types of stains or fabrics.

Companies such as Amway and S.C. Johnson will continue to serve health-conscious consumers, focusing on chemical-free, natural solutions that meet Japan's increasing demand for safe and sustainable products. As consumer values shift towards sustainability and ingredient transparency, brands that adopt these values while providing high-performance solutions will be competitive.

In terms of product, the industry is classified into powder, bars/blocks, packs & tablets, liquid, andothers.

With respect to price range, the market is divided into economy/mid-range and premium.

Based on end use, the industry is classified into household and commercial.

With respect to sales channel, the industry is divided into direct sales and indirect sales.

Based on region, the market is classified into Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and the rest of Japan.

The industry is expected to reach USD 326.7 million in 2025.

The industry is projected to witness USD 824.5 million by 2035.

The industry is projected to witness 9.6% CAGR during the study period.

Liquid products are widely sold.

Leading companies include Kao Corporation, Lion Corporation, SANARU COMPANY LIMITED, Kobayashi Pharmaceutical, The Procter & Gamble Company, Colgate-Palmolive Company, S.C. Johnson & Son Inc., Amway Corporation, Church & Dwight Co., Inc., AlEn USA LLC, and Unilever PLC.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Price Range, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Unit Pack) Forecast by End Use, 2019 to 2034

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 10: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 11: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 12: Kanto Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 13: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 14: Kanto Industry Analysis and Outlook Volume (Unit Pack) Forecast by Price Range, 2019 to 2034

Table 15: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 16: Kanto Industry Analysis and Outlook Volume (Unit Pack) Forecast by End Use, 2019 to 2034

Table 17: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 18: Kanto Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 19: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 20: Chubu Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 21: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 22: Chubu Industry Analysis and Outlook Volume (Unit Pack) Forecast by Price Range, 2019 to 2034

Table 23: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 24: Chubu Industry Analysis and Outlook Volume (Unit Pack) Forecast by End Use, 2019 to 2034

Table 25: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 26: Chubu Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 27: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Kinki Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 29: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 30: Kinki Industry Analysis and Outlook Volume (Unit Pack) Forecast by Price Range, 2019 to 2034

Table 31: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 32: Kinki Industry Analysis and Outlook Volume (Unit Pack) Forecast by End Use, 2019 to 2034

Table 33: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 34: Kinki Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 35: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 36: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 37: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 38: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Forecast by Price Range, 2019 to 2034

Table 39: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 40: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Forecast by End Use, 2019 to 2034

Table 41: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 42: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 43: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 45: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 46: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Forecast by Price Range, 2019 to 2034

Table 47: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Forecast by End Use, 2019 to 2034

Table 49: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 50: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Price Range, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 11: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 15: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Price Range, 2019 to 2034

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 19: Industry Analysis and Outlook Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 23: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 26: Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 27: Industry Analysis and Outlook Attractiveness by Price Range, 2024 to 2034

Figure 28: Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 29: Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: Kanto Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 32: Kanto Industry Analysis and Outlook Value (US$ Million) by Price Range, 2024 to 2034

Figure 33: Kanto Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 34: Kanto Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 35: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 36: Kanto Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 37: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 38: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 39: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 40: Kanto Industry Analysis and Outlook Volume (Unit Pack) Analysis by Price Range, 2019 to 2034

Figure 41: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 42: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 43: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 44: Kanto Industry Analysis and Outlook Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 45: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 46: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 47: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 48: Kanto Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 49: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 50: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 51: Kanto Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 52: Kanto Industry Analysis and Outlook Attractiveness by Price Range, 2024 to 2034

Figure 53: Kanto Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 54: Kanto Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 55: Chubu Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 56: Chubu Industry Analysis and Outlook Value (US$ Million) by Price Range, 2024 to 2034

Figure 57: Chubu Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 58: Chubu Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 59: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 60: Chubu Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 61: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 62: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 63: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 64: Chubu Industry Analysis and Outlook Volume (Unit Pack) Analysis by Price Range, 2019 to 2034

Figure 65: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 66: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 67: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 68: Chubu Industry Analysis and Outlook Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 69: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 70: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 71: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 72: Chubu Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 73: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 74: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 75: Chubu Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 76: Chubu Industry Analysis and Outlook Attractiveness by Price Range, 2024 to 2034

Figure 77: Chubu Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 78: Chubu Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 79: Kinki Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 80: Kinki Industry Analysis and Outlook Value (US$ Million) by Price Range, 2024 to 2034

Figure 81: Kinki Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 82: Kinki Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 83: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 84: Kinki Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 85: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 86: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 87: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 88: Kinki Industry Analysis and Outlook Volume (Unit Pack) Analysis by Price Range, 2019 to 2034

Figure 89: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 90: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 91: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 92: Kinki Industry Analysis and Outlook Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 93: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 94: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 95: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 96: Kinki Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 97: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 98: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 99: Kinki Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 100: Kinki Industry Analysis and Outlook Attractiveness by Price Range, 2024 to 2034

Figure 101: Kinki Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 102: Kinki Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 103: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 104: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Price Range, 2024 to 2034

Figure 105: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 106: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 107: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 108: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 109: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 110: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 111: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 112: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Analysis by Price Range, 2019 to 2034

Figure 113: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 114: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 115: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 116: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 117: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 118: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 119: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 120: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 121: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 122: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 123: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 124: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Price Range, 2024 to 2034

Figure 125: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 126: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 127: Tohoku Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 128: Tohoku Industry Analysis and Outlook Value (US$ Million) by Price Range, 2024 to 2034

Figure 129: Tohoku Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 130: Tohoku Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 131: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 132: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 133: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 134: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 135: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 136: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Analysis by Price Range, 2019 to 2034

Figure 137: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 138: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 139: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 140: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 141: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 142: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 143: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 144: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 145: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 146: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 147: Tohoku Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 148: Tohoku Industry Analysis and Outlook Attractiveness by Price Range, 2024 to 2034

Figure 149: Tohoku Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 150: Tohoku Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 151: Rest of Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 152: Rest of Industry Analysis and Outlook Value (US$ Million) by Price Range, 2024 to 2034

Figure 153: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 154: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 155: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 156: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 157: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 158: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 159: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 160: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Price Range, 2019 to 2034

Figure 161: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 162: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 163: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 164: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by End Use, 2019 to 2034

Figure 165: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 166: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 167: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 168: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 169: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 170: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 171: Rest of Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 172: Rest of Industry Analysis and Outlook Attractiveness by Price Range, 2024 to 2034

Figure 173: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 174: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Japan Inkjet Printer Market - Industry Trends & Forecast 2025 to 2035

Japan HVDC Transmission System Market - Industry Trends & Forecast 2025 to 2035

Japan Conference Room Solution Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA