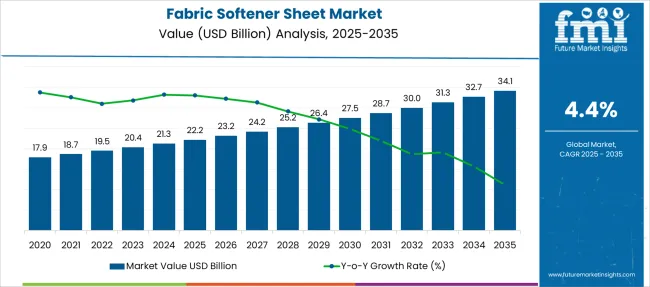

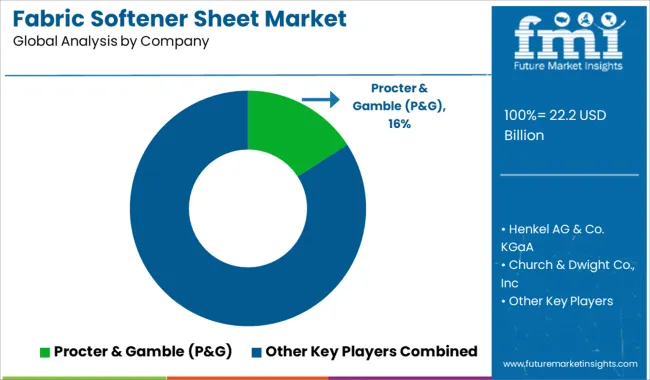

The Fabric Softener Sheet Market is estimated to be valued at USD 22.2 billion in 2025 and is projected to reach USD 34.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Fabric Softener Sheet Market Estimated Value in (2025 E) | USD 22.2 billion |

| Fabric Softener Sheet Market Forecast Value in (2035 F) | USD 34.1 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The fabric softener sheet market is expanding steadily due to increasing consumer preference for convenient, on-the-go laundry solutions that enhance fabric freshness and softness. Demand is being driven by the growing importance of fragrance retention, static reduction, and wrinkle control in laundry care routines.

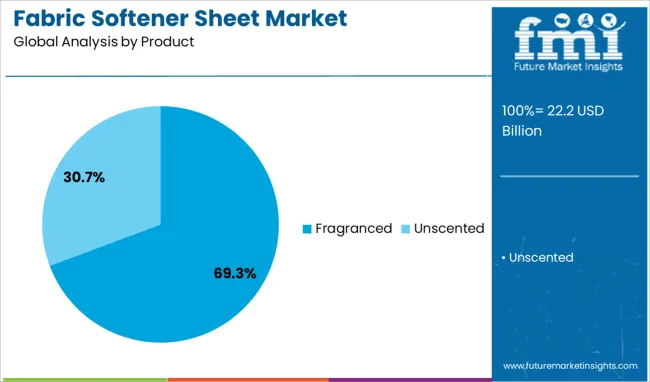

In particular, fragranced variants are gaining strong traction as consumers seek long-lasting and pleasant scents in their garments, which complements the shift toward premium home care experiences. The market outlook remains favorable with heightened brand competition, innovation in eco-friendly formulations, and the emergence of multifunctional sheets that combine softening, scenting, and anti-static benefits.

As urban populations grow and disposable incomes rise, particularly in developing regions, the adoption of softener sheets is expected to increase further. In addition, rising awareness of energy and water conservation supports the use of sheets as a dry alternative to traditional softeners, enhancing their appeal among environmentally conscious consumers.

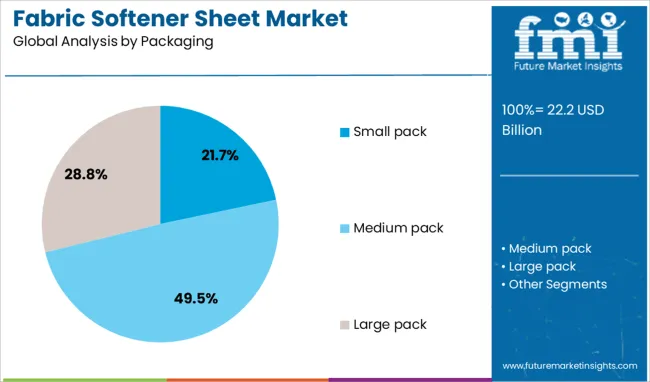

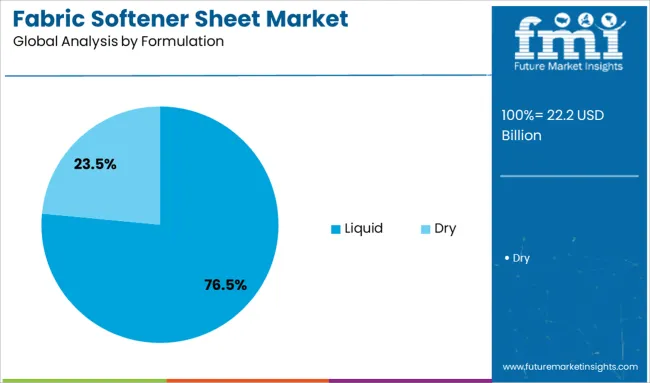

The fabric softener sheet market is segmented by product, packaging, formulation, application, distribution channel, and geographic regions. The fabric softener sheet market is divided into Fragranced and Unscented. The fabric softener sheet market is classified into Small pack, Medium pack, and Large pack. Based on the formulation of the fabric softener sheet, the market is segmented into Liquid and Dry. By application of the fabric softener sheet, the market is segmented into Household use, Hotels, Restaurants, Hospitals, Laundromats, and Others. The distribution channel of the fabric softener sheet market is segmented into Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Department Stores, Direct Sales, and Others. Regionally, the fabric softener sheet industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fragranced product segment commands a significant 69.3% share of the fabric softener sheet market, driven by growing consumer demand for long-lasting scent enhancement in laundry care routines. Fragrance has become a key differentiator in household products, with shoppers favoring sheets that provide a refreshing aroma throughout the day.

Manufacturers are continuously developing new scent profiles and investing in encapsulation technologies to improve fragrance longevity and intensity. The sensory experience offered by fragranced sheets not only adds perceived value but also encourages brand loyalty among users.

With an increasing number of consumers associating pleasant scents with cleanliness and comfort, this segment has gained mass appeal across both residential and institutional settings. Continued emphasis on aromatherapeutic and nature-inspired fragrance blends is expected to drive growth, as consumers seek emotional and sensory benefits from their laundry products.

The small pack segment holds a 21.7% market share in the packaging category, reflecting its popularity among cost-conscious and convenience-seeking consumers. Small packs are preferred for their portability, trial appeal, and suitability for small households or on-the-go usage. This packaging format has seen particular uptake in urban regions where storage space is limited and frequent shopping patterns dominate.

Additionally, small pack sizes are strategically used by brands to attract new customers and encourage sampling of new fragrance lines. Retailers also benefit from easier shelf placement and faster inventory turnover with these compact units.

The rise of e-commerce and subscription-based delivery models has further enhanced the viability of small pack formats. Moving forward, the small pack segment is expected to grow as consumers prioritize flexibility and value-for-money in their home care purchases.

The liquid formulation segment represents a dominant 76.5% share of the fabric softener sheet market, indicating its strong influence on product characteristics and performance. Though fabric softener sheets are traditionally perceived as dry products, many are infused with concentrated liquid formulations that enhance fragrance release, static control, and fabric feel.

This segment’s strength lies in its ability to deliver multifunctional performance in a compact format, appealing to users who value effectiveness alongside convenience. Liquid-infused sheets offer better dispersion of active ingredients during the drying cycle and are often perceived as more premium due to their enhanced sensory benefits.

Manufacturers are investing in advanced liquid technologies to deliver biodegradable, allergen-free, and long-lasting benefits while maintaining product stability. As innovation continues, the liquid segment is likely to retain its lead by offering greater efficacy and customizable features aligned with evolving consumer expectations.

The fabric softener sheet market is driven by convenience, premiumization, and rising demand for eco-friendly, hypoallergenic formulations. Growth is further fueled by regional expansion, online retail penetration, and evolving consumer preferences for performance-focused, sustainable laundry solutions.

The fabric softener sheet market benefits from increasing consumer inclination toward convenience-driven laundry products. These sheets eliminate the need for measuring liquid softeners, making them an attractive alternative for time-pressed households. Their easy-to-use nature ensures compatibility with modern dryers, offering quick application while reducing wrinkles and static in garments. Growing adoption among consumers who prioritize hassle-free solutions for everyday laundry has fueled demand across developed markets. The trend toward multi-functional household products further supports the penetration of fabric softener sheets in both residential and commercial laundry applications, strengthening their position in the broader fabric care segment globally.

Premium variants of fabric softener sheets dominate retail shelves, with manufacturers focusing on fragrance intensity, wrinkle control, and added freshness. Multi-scent packs and hypoallergenic formulas are gaining traction among consumers seeking personalized laundry care. These premium offerings are marketed as value-added products, enabling brands to maintain stronger price positions in competitive retail environments. Partnerships with retailers for exclusive variants and expansion of fragrance profiles enhance consumer loyalty. Such differentiation has become critical for brands to remain competitive against alternative fabric care formats like liquid softeners and dryer balls, thereby sustaining the relevance of softener sheets in evolving markets.

Although traditional softener sheets have relied on synthetic chemicals, there is rising demand for safer and cleaner alternatives. Consumers are increasingly conscious of chemical exposure in laundry products, prompting the development of formulations free from irritants and dyes. Hypoallergenic and dermatologist-tested variants are finding favor among families and sensitive-skin users. Manufacturers are actively promoting plant-derived ingredients, signaling a shift toward natural-based solutions within the category. These trends reflect an ongoing change in purchase decisions, with health and wellness influencing product selection. This dynamic has spurred research and development efforts focused on combining safety with performance in fabric care.

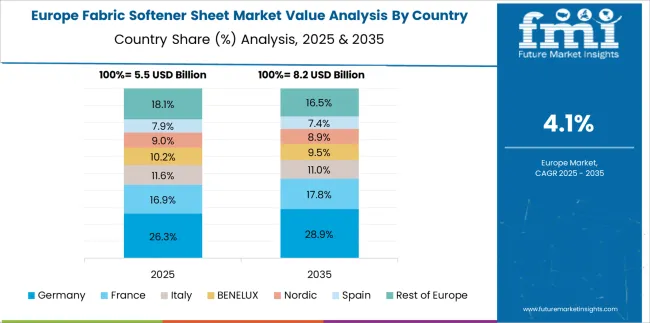

North America and Europe continue to dominate the market due to high appliance penetration and established laundry care practices. However, Asia-Pacific markets are emerging as growth hotspots, driven by increasing access to modern laundry appliances and evolving household routines. Expanding retail distribution through supermarkets, specialty stores, and e-commerce platforms is accelerating adoption globally. Online sales have become a critical channel for premium and niche variants, offering brands opportunities to target consumers directly with subscription models and bundled product offerings. This strategic approach supports revenue growth and enhances customer retention in competitive markets with shifting consumer preferences.

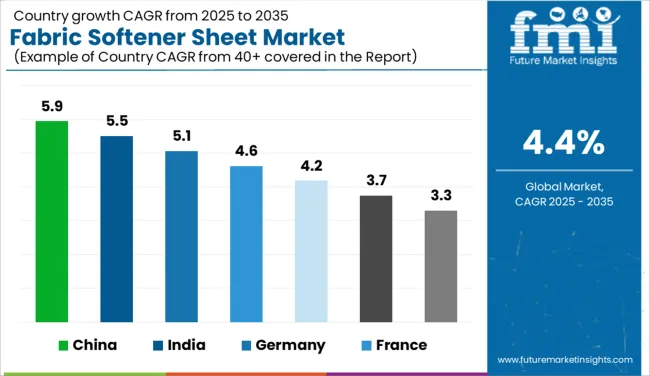

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The fabric softener sheet market, forecast to grow at a global CAGR of 4.4% from 2025 to 2035, exhibits varying growth across major economies. China leads with a CAGR of 5.9%, driven by rising appliance penetration and growing preference for convenience-oriented laundry solutions. India follows at 5.5%, supported by premium product adoption among urban consumers and increasing online retail penetration. Germany records 5.1% CAGR, benefiting from strong household care brands and eco-friendly product innovation targeting sustainability-conscious buyers. Growth in France stands at 4.6%, backed by demand for premium scented laundry products and eco-certified formulations. The United Kingdom posts a CAGR of 4.2%, reflecting gradual adoption of premium variants amid competitive pricing from private labels. The United States grows at 3.7%, with stable demand dominated by established brands but facing slower momentum due to liquid softener competition and sustainability concerns. Overall, Asia-Pacific markets present higher growth potential compared to mature Western regions, indicating strategic focus areas for manufacturers. The report covers in-depth data for over 40 countries, with the top five profiled as key growth benchmarks for global market players.

The CAGR for the United Kingdom increased from around 3.3% in 2020-2024 to approximately 4.2% during 2025-2035, reflecting stronger consumer inclination toward premium laundry products. Rising demand for fabric care items that deliver fragrance and wrinkle control supported this acceleration. E-commerce platforms and retail partnerships expanded category visibility, while innovations in multi-scent and hypoallergenic sheets improved adoption among households with high laundry frequency. Growth was further encouraged by private-label penetration in supermarkets, coupled with rising interest in eco-friendly sheets made from plant-based fibers. Despite competition from liquid softeners, convenience-driven buyers and time-saving features maintain relevance for dryer sheets in the UK market.

China’s CAGR advanced from approximately 4.4% during 2020-2024 to 5.9% for 2025-2035, driven by higher adoption of modern laundry appliances and preference for time-efficient household products. Urban middle-class households increasingly opted for scented dryer sheets, enhancing garment softness and freshness. Premium international brands strengthened their foothold through cross-border e-commerce channels, while domestic companies invested in fragrance innovation and biodegradable solutions. China’s expanding online retail infrastructure and consumer inclination toward convenience-oriented formats played a key role in growth momentum. Additionally, sustainable product launches resonated with younger consumers prioritizing environmental safety in household care.

India’s CAGR climbed from nearly 4.1% in 2020-2024 to about 5.5% for 2025-2035, reflecting changing consumer behavior and growing laundry appliance ownership. Rising disposable income and urbanization have accelerated preference for value-added fabric care solutions. Market growth has been supported by retail shelf expansions in Tier 2 and Tier 3 cities and the introduction of low-cost yet premium-positioned scented sheets. Brands focused on affordability and eco-friendly innovations to capture budget-conscious consumers. Increased adoption among nuclear households and working professionals has made convenience-oriented fabric care products a necessity rather than a luxury in the Indian context.

The CAGR in Germany rose from 4.3% during 2020-2024 to nearly 5.1% for 2025-2035, supported by eco-certification trends and premiumization in household care categories. Consumers increasingly adopted fabric softener sheets for convenience and compatibility with energy-efficient dryers. Premium brands launched fragrance-rich and wrinkle-control sheets marketed for luxury laundry experiences. German retailers leveraged sustainable packaging and plant-based ingredient campaigns, resonating with environmentally responsible consumers. Despite market maturity, innovative formulations and bundled offerings in online channels kept demand stable. Strategic partnerships with leading e-commerce platforms further enhanced product visibility, strengthening the category’s long-term prospects.

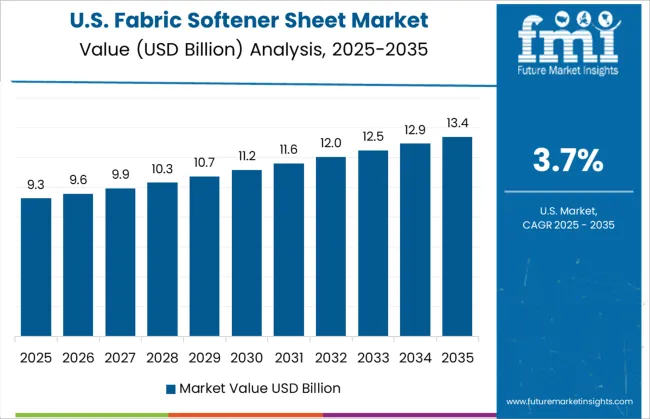

The USA CAGR improved from around 3.1% during 2020-2024 to approximately 3.7% during 2025-2035, supported by brand-led innovation and rising consumer preference for multi-scent packs. Despite early market saturation and competition from liquid conditioners and dryer balls, fabric softener sheets retained relevance due to ease of use and cost efficiency. Growth was further stimulated by retailer-specific premium variants featuring anti-static and wrinkle-free functionalities. Sustainability concerns pushed manufacturers to introduce compostable sheets and recyclable packaging. The USA market, dominated by established players, witnessed growth opportunities through private-label expansion and subscription-based online models offering value-driven solutions for frequent buyers.

The global fabric softener sheet market is shaped by innovation and strategic product expansion led by major consumer goods companies. Procter & Gamble (P&G) dominates with brands such as Bounce and Downy, emphasizing fragrance innovation and anti-static properties to meet evolving consumer needs. Henkel AG & Co. KGaA offers premium softening solutions under brands like Snuggle, focusing on fragrance variety and fabric care performance. Church & Dwight Co., Inc. strengthens its presence through Arm & Hammer-based softener sheets, leveraging its brand equity in household care. Colgate-Palmolive Company and Reckitt Benckiser Group plc target multi-functional fabric care solutions, integrating long-lasting freshness with eco-friendly messaging. Seventh Generation Inc., a Unilever-owned brand, highlights plant-based and biodegradable sheet options, catering to environmentally conscious consumers. Unilever also expands its influence through Comfort and associated fabric care innovations across global markets. Suavitel, widely popular in Latin America, focuses on affordability and fragrance diversity. Kimberly-Clark Corporation and The Clorox Company are tapping into premium segments, emphasizing allergen-free and sensitive-skin solutions. S. C. Johnson & Son, Inc. continues to strengthen its footprint in household care through innovative sheet-based offerings. Sustainability-focused brands such as Ecover Belgium NV, GreenShield Organic, LLC, Attitude Living Inc., and Mrs. Meyer’s Clean Day are accelerating the adoption of natural, compostable, and non-toxic fabric softener sheets, addressing the growing demand for eco-certified laundry solutions. These companies are competing through fragrance innovation, sustainable packaging, and direct-to-consumer strategies, ensuring consistent market growth and consumer engagement globally.

Key strategies and drivers for 2024 and 2025 in the fabric softener sheet market include product premiumization through multi-scent and hypoallergenic variants, expansion of biodegradable and plant-based sheets to meet eco-conscious demand, and leveraging e-commerce for direct-to-consumer sales. Partnerships with retailers for exclusive SKUs and sustainability-driven packaging innovations are accelerating adoption. Rising demand from emerging markets, driven by growing appliance penetration and lifestyle upgrades, further supports growth. Brands are focusing on fragrance enhancement, fabric care performance, and subscription models to strengthen customer loyalty, while innovation in recyclable materials is becoming a core strategy for competitive advantage.

| Item | Value |

|---|---|

| Quantitative Units | USD 22.2 Billion |

| Product | Fragranced and Unscented |

| Packaging | Small pack, Medium pack, and Large pack |

| Formulation | Liquid and Dry |

| Application | Household use, Hotels, Restaurants, Hospitals, Laundromats, and Others |

| Distribution Channel | Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Department Stores, Direct Sales, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Procter & Gamble (P&G), Henkel AG & Co. KGaA, Church & Dwight Co., Inc, Colgate-Palmolive Company, Reckitt Benckiser Group plc, Seventh Generation Inc., Unilever, Suavitel, Kimberly-Clark Corporation, The Clorox Company, S. C. Johnson & Son, Inc., Ecover Belgium NV, GreenShield Organic, LLC, Attitude Living Inc., and Mrs. Meyer's Clean Day |

| Additional Attributes | Dollar sales, share, regional demand patterns, competitive landscape, pricing benchmarks, premium vs value segment performance, distribution channel trends, consumer preferences for eco-friendly sheets, innovation pipeline, and forecasted CAGR for key markets. |

The global fabric softener sheet market is estimated to be valued at USD 22.2 billion in 2025.

The market size for the fabric softener sheet market is projected to reach USD 34.1 billion by 2035.

The fabric softener sheet market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in fabric softener sheet market are fragranced and unscented.

In terms of packaging, small pack segment to command 21.7% share in the fabric softener sheet market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fabric Spreading Machine Market Forecast Outlook 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fabric Toys Market Size and Share Forecast Outlook 2025 to 2035

Fabric Filter System Market Size & Forecast 2025 to 2035

Fabric Care Market Analysis - Trends, Growth & Forecast 2025 to 2035

Fabric Odor Eliminator Market – Trends, Growth & Forecast 2025 to 2035

Fabric Stain Remover Market Growth – Trends, Demand & Innovations 2025-2035

Global Fabric Cutting Machine Market Share Analysis – Trends & Forecast 2025–2035

Fabric Starch Market

Fabric Softener Market Analysis by Nature, Product Type, End Use, Sales Channel & Region from 2025 to 2035

Prefabricated Composite Sandwich Panels Market Size and Share Forecast Outlook 2025 to 2035

Prefabricated Bathroom Pods Market Size and Share Forecast Outlook 2025 to 2035

Prefabricated Building System Market Growth - Trends & Forecast 2025 to 2035

Mesh Fabric Market Size and Share Forecast Outlook 2025 to 2035

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Metal Fabrication Fluid Market Size and Share Forecast Outlook 2025 to 2035

Smart Fabric Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA