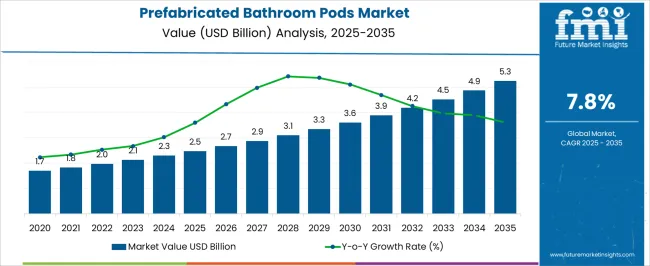

The Prefabricated Bathroom Pods Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period. This trajectory reflects steady year-on-year growth driven by rising demand for modular construction, faster project timelines, and labor cost efficiencies in both residential and commercial sectors. Between 2020 and 2024, the market progressed gradually from USD 1.7 billion to USD 2.3 billion, indicating the early adoption of prefabricated solutions among forward-looking developers and pilot projects emphasizing sustainability and modular efficiency.

By 2025, with a market value of USD 2.5 billion, the sector entered a more accelerated growth phase. From 2025 to 2030, annual increments averaged between USD 0.2–0.3 billion, supported by increasing investments in prefabricated construction, standardization of bathroom pod designs, and expanding acceptance in hospitality, healthcare, and multi-family residential projects. From 2030 to 2035, the market scaled further, rising from USD 3.6 billion to USD 5.3 billion. This period represents a consolidation phase where economies of scale, improved manufacturing technologies, and integration with smart building solutions drive sustained adoption. Overall, the YoY analysis highlights a consistent upward momentum, with no significant stagnation, underscoring the market’s attractiveness and strategic growth opportunities across the decade.

| Metric | Value |

|---|---|

| Prefabricated Bathroom Pods Market Estimated Value in (2025 E) | USD 2.5 billion |

| Prefabricated Bathroom Pods Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The Prefabricated Bathroom Pods Market is experiencing significant momentum, driven by rapid urbanization, the growing demand for modular construction, and rising pressure to reduce on-site labor and construction time. Industry journals and corporate announcements have highlighted that developers are increasingly adopting prefabricated solutions to ensure consistency in quality, reduce waste, and accelerate project delivery timelines.

The current market scenario reflects growing interest across residential, commercial, and hospitality sectors, where standardized design, space efficiency, and compliance with building codes are critical. With governments pushing for sustainable and smart city infrastructure, prefabricated bathroom pods are being recognized as an ideal fit due to their ability to integrate advanced plumbing, electrical, and finishing systems off-site.

Looking ahead, increased investments in green building solutions and digital construction technologies are expected to strengthen the role of prefabricated bathroom pods in modern architectural development These trends are positioning the market for sustained growth and broader adoption across global construction ecosystems.

The prefabricated bathroom pods market is segmented by type, material, application, end use, distribution channel, and geographic regions. By type, the prefabricated bathroom pods market is divided into Steel frame bathroom pods, Concrete bathroom pods, GRP (glass reinforced plastic) bathroom pods, and Hybrid bathroom pods. In terms of material, the prefabricated bathroom pods market is classified into Ceramics, Stainless steel, Glass, Plastic, and Composites. Based on the application, the prefabricated bathroom pods market is segmented into New construction and Renovation/retrofit.

By end use, the prefabricated bathroom pods market is segmented into Residential, Commercial, and Industrial. By distribution channel, the prefabricated bathroom pods market is segmented into Direct and Indirect. Regionally, the prefabricated bathroom pods industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

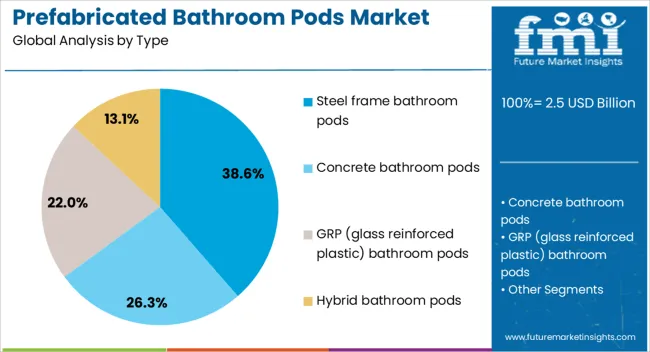

The steel frame bathroom pods segment is projected to account for 38.6% of the Prefabricated Bathroom Pods Market revenue share in 2025, making it the leading type segment. This leadership is being driven by the structural strength, durability, and fire resistance offered by steel frames, which are essential for mid to high-rise buildings.

Industry publications have reported that steel frame pods allow for greater design flexibility and are capable of withstanding transport stress during factory-to-site delivery. Builders and contractors have increasingly favored steel due to its compatibility with both concrete and steel superstructures, especially in urban commercial and residential developments.

Additionally, investor briefings have noted the growing preference for steel pods in healthcare and hospitality sectors where precision, hygiene, and longevity are critical These performance advantages, coupled with efficient fabrication and installation processes, have played a key role in establishing the dominance of steel frame bathroom pods in the overall market.

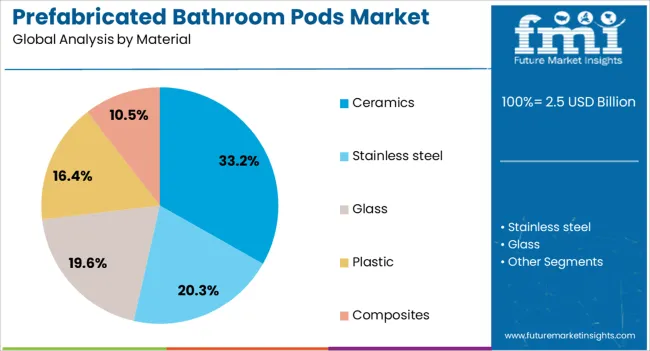

The ceramics material segment is expected to hold 33.2% of the Prefabricated Bathroom Pods Market revenue share in 2025, establishing it as the leading material segment. This dominance has been supported by the widespread use of ceramic fixtures and surfaces due to their durability, ease of cleaning, and moisture resistance. Corporate announcements from pod manufacturers have highlighted ceramics as the preferred choice for maintaining hygiene standards and delivering a premium aesthetic.

Additionally, the non-porous nature of ceramics contributes to the longevity of bathroom interiors and minimizes long-term maintenance. Building journals have reported that the cost-to-performance ratio of ceramic materials aligns well with the objectives of value-driven construction projects.

The consistent availability of ceramic components and their compatibility with factory-assembled systems have further encouraged their use These functional and economic advantages have contributed to ceramics maintaining a leading position in the material selection for prefabricated bathroom pods.

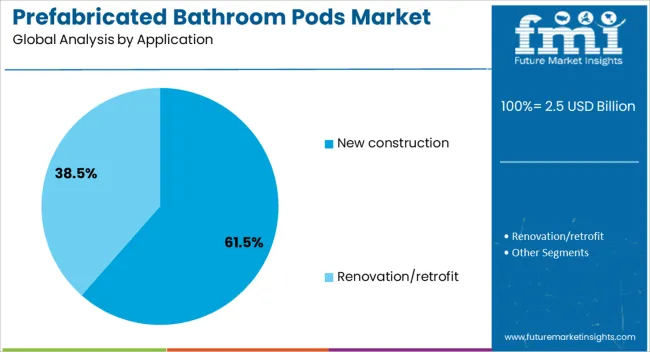

The new construction segment is forecasted to command 61.5% of the Prefabricated Bathroom Pods Market revenue share in 2025, making it the most prominent application segment. This dominance is being attributed to increasing adoption of modular construction techniques in large-scale residential and commercial developments.

Real estate developers and contractors have emphasized the benefits of using prefabricated pods in new builds to meet tight project deadlines, reduce on-site coordination complexity, and ensure consistent quality across multiple units. Press releases from construction firms have underlined the role of pods in reducing labor dependency and achieving faster returns on investment, particularly in cost-sensitive projects.

Furthermore, the rising global trend toward green and sustainable building practices has made factory-built pods attractive due to their controlled manufacturing environment and reduced material waste. These factors collectively have reinforced the preference for prefabricated bathroom pods in new construction projects, positioning this segment as the primary growth contributor in the market.

The prefabricated bathroom pods market is expanding as construction and real estate sectors adopt modular solutions for faster project completion, consistent quality, and reduced on-site labor. These pre-assembled units offer integrated plumbing, electrical fittings, and modern design, making them ideal for hotels, hospitals, residential, and student housing projects. Rising demand for cost-effective and time-efficient construction solutions drives adoption. Manufacturers focus on customization, lightweight materials, and enhanced durability. Europe and Asia-Pacific lead growth due to urban development and large-scale construction initiatives.

Prefabricated bathroom pods enable faster construction by delivering fully assembled units ready for installation. This reduces on-site labor, minimizes delays, and lowers project management complexity. Builders benefit from predictable quality and reduced errors in plumbing, electrical, and finishing work. With rising urban housing demand, hotels, hospitals, and student accommodations increasingly rely on modular bathroom solutions. Manufacturers offering flexible layouts, standardized sizes, and integration with building information modeling (BIM) software enhance client adoption. Faster installation reduces overall project costs and ensures timely completion, making these pods a preferred solution in large-scale construction projects.

High-quality materials, corrosion-resistant fixtures, and robust structural design are critical to prefabricated bathroom pod performance. Manufacturers must adhere to building codes and certification standards to guarantee long-term durability and safety. Precision-controlled factory environments ensure consistent finishes, leak-free plumbing, and accurate electrical installations. Quality assurance includes pressure testing, material inspections, and modular fit verification before shipment. Companies investing in advanced production techniques, superior finishing, and testing facilities gain trust from contractors and developers. Reliability, durability, and uniformity of prefabricated pods are key drivers for adoption in high-volume residential and commercial projects.

The demand for aesthetically pleasing, functional, and space-efficient bathroom pods is increasing. Clients seek modular units that can be tailored to specific project requirements, including size, layout, and integrated accessories. Modular bathroom manufacturers offer a range of finishes, color schemes, and smart features, appealing to premium construction projects. Design flexibility allows developers to maintain consistent branding across hotel chains or institutional buildings. Advanced design tools enable virtual visualization, reducing revisions and errors. Companies capable of providing customizable solutions with efficient installation gain a competitive advantage in the growing modular bathroom segment.

The prefabricated bathroom pod market is competitive with both global and regional players offering varied solutions. Companies differentiate through quality, customization, lead time, and service capabilities. Strategic partnerships with construction firms, architects, and real estate developers facilitate project adoption. Expansion into emerging markets with rapid urban growth and infrastructure development offers significant opportunities. Firms focusing on cost-effective production, lightweight materials, and standardized manufacturing processes can scale operations efficiently. Long-term contracts, after-sales support, and modular innovation help strengthen brand recognition and ensure sustained growth in the global prefabricated bathroom pod market.

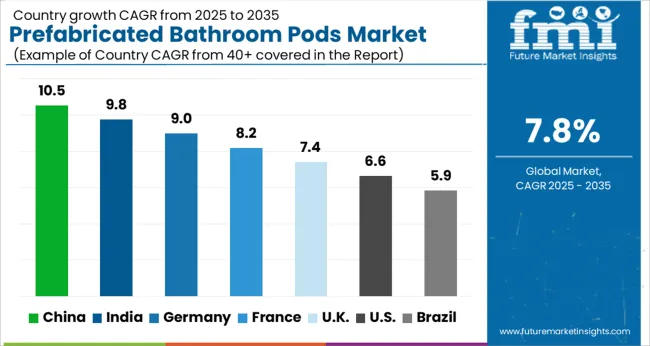

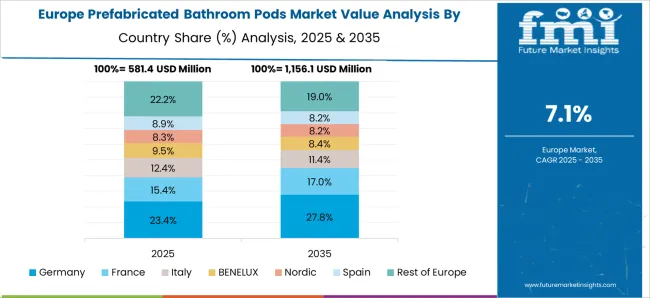

The global prefabricated bathroom pods market is projected to grow at a CAGR of 7.8%, driven by demand in residential, commercial, and hospitality construction projects. China leads with a growth rate of 10.5%, supported by large-scale urban development and modernization initiatives. India follows at 9.8%, fueled by expansion in residential and hospitality construction. Germany shows steady growth at 9.0%, leveraging advanced construction technologies and prefabrication expertise. The UK and USA record moderate growth rates of 7.4% and 6.6%, respectively, reflecting growing adoption in commercial and multi-residential sectors. This report includes insights on 40+ countries; the top countries are shown here for reference.

The prefabricated bathroom pods market in China is growing at 10.5%, driven by rapid urbanization, expansion of the real estate sector, and increasing adoption of modular construction techniques. Prefabricated bathroom pods provide advantages such as reduced construction time, enhanced quality control, and lower labor costs, making them attractive for large-scale residential, hotel, and commercial projects. The government’s push for affordable housing and sustainable building practices further supports market growth. Manufacturers are focusing on innovative designs, water-efficient fixtures, and durable materials to meet the evolving needs of developers and end-users. Additionally, the trend toward off-site construction and industrialized building methods encourages widespread adoption of bathroom pods. With the combination of policy support, technological advancement, and rising demand for faster, high-quality construction solutions, China represents a significant growth opportunity in the prefabricated bathroom pods market.

The prefabricated bathroom pods market in India is projected to grow at 9.8%, fueled by the country’s booming construction and hospitality sectors. Increasing demand for affordable and high-quality housing, coupled with urban infrastructure development, has led to wider adoption of modular and prefabricated solutions. Prefabricated bathroom pods offer benefits such as faster installation, standardized quality, and reduced site labor, making them ideal for large residential complexes, hotels, and commercial buildings. Government initiatives promoting industrialized construction methods and green building practices further stimulate market growth. Key manufacturers are focusing on advanced materials, customizable designs, and water- and energy-efficient fixtures to cater to the growing expectations of developers and end-users. As construction projects increasingly emphasize speed, quality, and sustainability, the market for prefabricated bathroom pods in India is poised for steady expansion in the coming years.

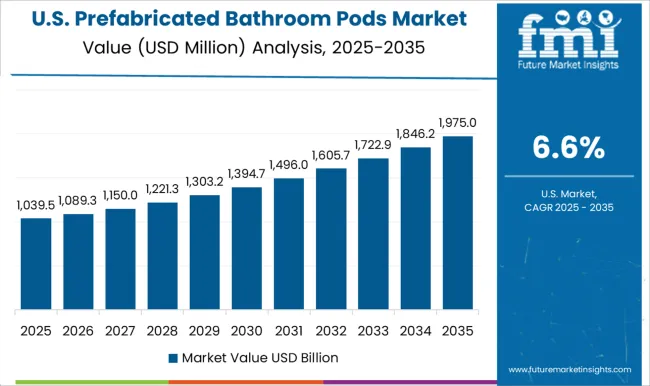

The prefabricated bathroom pods market in the United States is expanding at 6.6%, supported by the growing adoption of modular and off-site construction in residential, commercial, and hospitality projects. Prefabricated bathroom pods offer developers significant advantages, including faster installation, reduced on-site labor costs, and improved quality control. The market is also driven by the increasing demand for sustainable and energy-efficient building solutions. Manufacturers are innovating with durable materials, customizable designs, and water-saving fixtures to meet the diverse requirements of developers and regulatory standards. With urban housing developments, hotels, and multi-family residential projects increasingly embracing industrialized construction methods, the adoption of prefabricated bathroom pods continues to grow. Overall, the USA market is poised for long-term expansion due to the combination of construction efficiency, quality requirements, and sustainability trends.

Prefabricated bathroom pods market is advancing at 9.0%, driven by the country’s focus on modular construction, energy efficiency, and sustainable building practices. Prefabricated solutions are widely adopted in commercial, residential, and hospitality projects for their speed of installation, standardized quality, and ability to minimize site labor requirements. The German construction sector’s emphasis on green building certifications, waste reduction, and industrialized construction techniques supports the use of prefabricated bathroom pods. Manufacturers are investing in high-quality materials, customizable modular designs, and water-saving fixtures to meet the rigorous standards of developers and regulatory authorities. Moreover, the growing trend of off-site construction and urban redevelopment projects provides additional growth opportunities. Overall, Germany’s combination of sustainability priorities, advanced construction methods, and demand for efficient, high-quality solutions positions it as a significant market for prefabricated bathroom pods.

The prefabricated bathroom pods market in the United Kingdom is growing at 7.4%, fueled by urban regeneration, residential construction projects, and the rising popularity of modular building techniques. Prefabricated bathroom pods allow developers to reduce on-site construction time, ensure consistent quality, and cut labor costs. The UK government’s focus on affordable housing, off-site construction, and energy-efficient building practices supports increased adoption of prefabricated solutions. Manufacturers are emphasizing innovative designs, customizable layouts, and water- and energy-efficient fixtures to meet the expectations of developers and end-users. The demand is particularly strong in high-density urban areas where construction timelines and efficiency are critical. With continued investment in housing projects and a shift toward industrialized building methods, the market for prefabricated bathroom pods in the UK is poised for steady growth.

Prefabricated bathroom pods are fully fitted, factory-manufactured units that can be installed rapidly on-site, offering consistency in quality, design flexibility, and improved construction efficiency. The market spans residential, hospitality, healthcare, and student housing sectors, where speed of installation and standardized quality are critical.

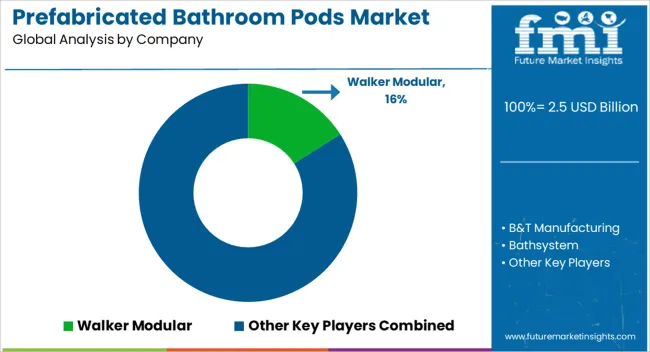

Walker Modular and B&T Manufacturing are leading players, offering innovative pod designs and scalable production capabilities. Companies like Bathsystem, Buildom Prefab Systems, and Elements Europe provide tailored solutions for luxury and commercial developments, integrating plumbing, electrical, and finishing works in compact, preassembled units. Hellweg Badsysteme, Hydrodiseno, and Interpod focus on sustainable and modular bathroom solutions that meet evolving building codes and environmental standards. Modulart, Offsite Solutions, and Oldcastle SurePods enhance market offerings with fully integrated systems optimized for rapid deployment and efficient logistics. Pivotek, Sterchele Group, SurePods, and Taplanes provide innovative designs, catering to both high-rise and low-rise construction projects, emphasizing durability, ease of maintenance, and compliance with international safety and hygiene standards. The market is projected to expand as developers and contractors increasingly prioritize cost-effective, time-saving, and sustainable construction methods. Growing demand for smart bathrooms, integrated water and energy-efficient systems, and high-quality prefabricated solutions are further driving the adoption of bathroom pods, making them an essential component of modern modular construction projects.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Type | Steel frame bathroom pods, Concrete bathroom pods, GRP (glass reinforced plastic) bathroom pods, and Hybrid bathroom pods |

| Material | Ceramics, Stainless steel, Glass, Plastic, and Composites |

| Application | New construction and Renovation/retrofit |

| End use | Residential, Commercial, and Industrial |

| Distribution channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Walker Modular, B&T Manufacturing, Bathsystem, Buildom Prefab Systems, Elements Europe, Hellweg Badsysteme, Hydrodiseno, Interpod, Modulart, Offsite Solutions, Oldcastle SurePods, Pivotek, StercheleGroup, SurePods, and Taplanes |

| Additional Attributes | Dollar sales by type including fully fitted pods, semi-fitted pods, and modular units, application across hotels, residential buildings, and healthcare facilities, and region covering North America, Europe, and Asia-Pacific. Growth is driven by demand for faster construction, labor cost reduction, and increasing adoption of modular building solutions. |

The global prefabricated bathroom pods market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the prefabricated bathroom pods market is projected to reach USD 5.3 billion by 2035.

The prefabricated bathroom pods market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in prefabricated bathroom pods market are steel frame bathroom pods, concrete bathroom pods, grp (glass reinforced plastic) bathroom pods and hybrid bathroom pods.

In terms of material, ceramics segment to command 33.2% share in the prefabricated bathroom pods market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Prefabricated Composite Sandwich Panels Market Size and Share Forecast Outlook 2025 to 2035

Prefabricated Building System Market Growth - Trends & Forecast 2025 to 2035

Modular & Prefabricated Construction Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Furniture Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Remodeling Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Mirror Wiper Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Vanities Market Analysis - Growth, Trends and Forecast from 2025 to 2035

Bathroom Worktops Market Analysis - Trends & Forecast 2025 to 2035

Smart Bathroom Market Insights - Growth & Forecast 2025 to 2035

Targeting Pods Market

Concentrate Pods Market Analysis Size and Share Forecast Outlook 2025 to 2035

Edible Water Pods Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Pods and Capsules Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Pods Packaging Market Analysis by Material Type, Product Type, End Use, Thickness Type, and Region Forecast Through 2035

Airport Sleeping Pods Market Analysis - Trends, Growth & Forecast 2025 to 2035

Patient Monitoring Pods Market

Fragrance Jewellery Pods Market Analysis Size and Share Forecast Outlook 2025 to 2035

Coffee Capsules and Pods Market

Water Soluble Detergent Pods Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA