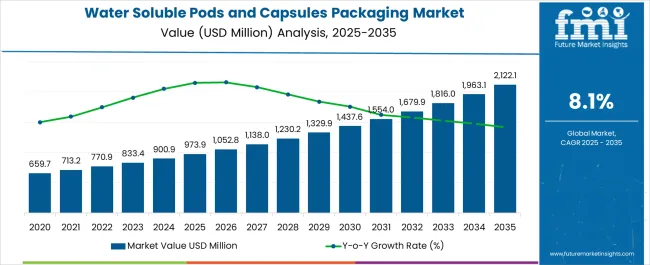

The water soluble pods and capsules packaging market is estimated to be valued at USD 973.9 million in 2025 and is projected to reach USD 2122.1 million by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

The market maturity curve shows early adoption during 2020–2024, with growth from USD 659.7 million in 2020 to USD 900.9 million in 2024, driven by pilot programs in household cleaning, personal care, and food products. By 2025, adoption enters the scaling phase as production capacity expands and procurement from mainstream manufacturers increases. Between 2025–2030, the market grows from USD 973.9 million to USD 1,437.6 million, supported by wider deployment and standardized processes. During the 2030–2035 consolidation phase, the market expands from USD 1,554.0 million in 2030 to USD 2,122.1 million by 2035, reflecting stabilization and strong penetration across multiple product categories.

Growth moderates as major suppliers capture the majority of demand, optimizing supply chains and operational workflows. The adoption lifecycle shows a progression from early adoption (2020–2024), through rapid scaling (2025–2030), to consolidation (2030–2035), where procurement patterns become predictable, distribution channels mature, and leading suppliers establish dominant market positions, creating a structured and stable market environment.

| Metric | Value |

|---|---|

| Water Soluble Pods and Capsules Packaging Market Estimated Value in (2025 E) | USD 973.9 million |

| Water Soluble Pods and Capsules Packaging Market Forecast Value in (2035 F) | USD 2122.1 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

Seasonality in the water soluble pods and capsules packaging market is influenced by production cycles, consumer demand peaks, and promotional campaigns. Data shows that Q3 and Q4 account for 35–40% of annual procurement, coinciding with peak household cleaning and personal care product usage, as well as year-end retail promotions. Conversely, Q1 typically records 10–15% lower activity, as manufacturers adjust inventory and plan production for the new year. Seasonal product launches, limited-edition offerings, and marketing campaigns can create temporary demand spikes of 10–15% above baseline. Suppliers align production, inventory, and distribution to meet these seasonal surges efficiently.

Cyclicality reflects broader investment and replacement trends in packaging operations. Water soluble pod and capsule facilities typically undergo capacity expansions or process upgrades every 5–7 years, generating periodic surges in demand that can increase annual market size by USD 100–150 million. Shifts in regulatory approvals, material availability, or product innovations can temporarily accelerate procurement, producing short-term spikes of 5–10% above projected growth. These cyclical patterns overlay the underlying CAGR of 8.1%, creating alternating periods of rapid expansion and moderate stabilization, allowing suppliers to optimize production, inventory, and supply chain management.

The market is experiencing accelerated growth, supported by increasing demand for sustainable and convenient packaging solutions across home care, personal care, and food applications. The market expansion is being driven by the rising consumer shift toward eco-friendly products and the need for precise, single-use dosing formats that reduce product wastage. Manufacturers are focusing on biodegradable and water-soluble materials that align with environmental regulations and corporate sustainability goals, further boosting adoption.

Technological advancements in film-forming materials and encapsulation techniques have enhanced product performance, ensuring faster dissolution and better product protection. Market growth is also supported by the increasing penetration of water-soluble pods in emerging economies, where convenience and environmental awareness are gaining momentum.

As industries prioritize reducing plastic waste and improving operational efficiency, water-soluble packaging formats are expected to remain at the forefront of innovation The ability to cater to diverse applications while meeting stringent safety and environmental standards positions the market for long-term, sustainable expansion.

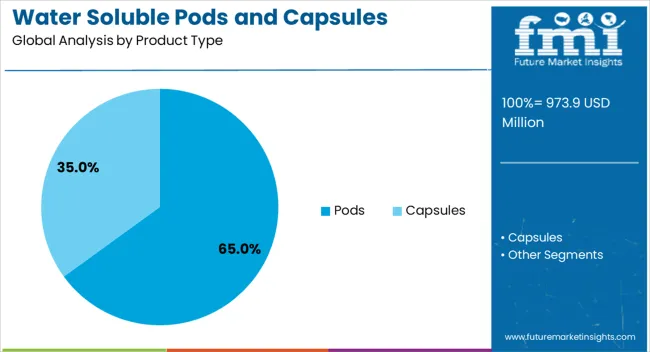

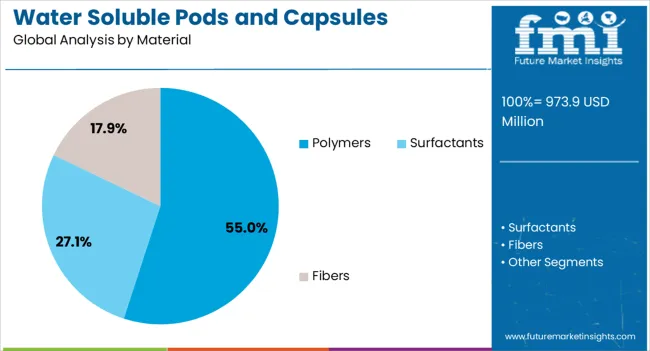

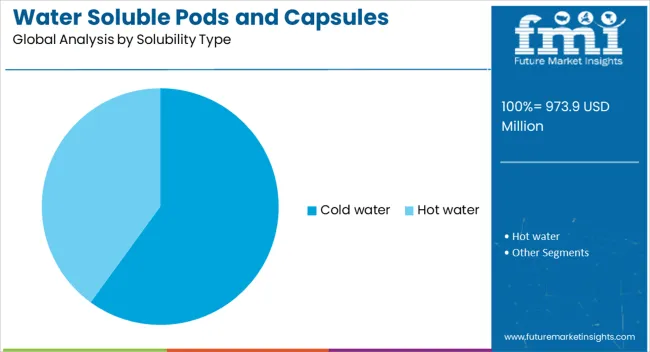

The water soluble pods and capsules packaging market is segmented by product type, material, solubility type, application, and geographic regions. By product type, water soluble pods and capsules packaging market is divided into pods and capsules. In terms of material, water soluble pods and capsules packaging market is classified into polymers, surfactants, and fibers. Based on solubility type, water soluble pods and capsules packaging market is segmented into cold water and hot water. By application, water soluble pods and capsules packaging market is segmented into homecare products, personal care & cosmetics, agrochemicals, food & beverage, pharmaceuticals, and others. Regionally, the water soluble pods and capsules packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pods segment is projected to hold 65% of the water soluble pods and capsules packaging market revenue share in 2025, making it the leading product type. This dominance has been driven by the convenience and precision offered by pre-measured pods, which ensure consistent dosing and reduce spillage or overuse. Their strong adoption in home care and laundry applications is supported by the ability to deliver active ingredients in a compact, dissolvable format that eliminates the need for additional packaging. The growing preference for single-use, water-soluble formats aligns with consumer demand for ease of use and environmental responsibility. Technological improvements in pod design and sealing methods have enhanced product integrity and shelf life, further strengthening their market position. Pods also offer versatility in accommodating various formulations, from liquids to powders, without compromising solubility performance These advantages, combined with increasing retail and e-commerce availability, have reinforced the segment's leadership in the overall market.

The polymers segment is estimated to account for 55% of the market revenue share in 2025, making it the most prominent material type. Growth in this segment has been supported by the development of advanced, biodegradable polymers that offer both strength and rapid solubility in water. These materials have been adopted for their ability to encapsulate diverse product types while maintaining stability during storage and transportation. The use of polymers enables customization of film thickness, dissolution rate, and barrier properties, meeting the specific requirements of various end-use industries. Increasing regulatory pressure to minimize plastic waste has accelerated investment in eco-friendly polymer innovations, further enhancing adoption. The compatibility of these polymers with mass production techniques has also supported scalability, ensuring consistent supply to global markets Their proven performance in maintaining product quality and safety has made them the preferred choice for manufacturers, securing their dominant position in the market.

The cold water solubility type segment is expected to hold 60% of the market revenue share in 2025, emerging as the leading solubility type. This growth is attributed to the rising demand for formulations that dissolve efficiently at lower temperatures, which improves energy efficiency and supports eco-friendly practices. Cold water-soluble packaging is particularly valued in applications where preserving active ingredient stability is crucial, as it minimizes heat exposure during use. The segment has benefited from advancements in polymer chemistry that enable rapid dissolution without compromising film strength or product protection. Consumer demand for convenient, ready-to-use products that do not require heated water has further boosted adoption, especially in regions prioritizing water and energy conservation The appeal of cold water solubility is also reinforced by its compatibility with a wide range of product categories, from cleaning agents to food items, cementing its leadership in the market.

The water soluble pods and capsules packaging market is growing due to demand for convenience, precise dosing, and environmentally friendly solutions across laundry, dishwashing, personal care, and food products. Key companies such as Procter & Gamble, Henkel, SC Johnson, Reckitt Benckiser, and Novamont drive growth through innovative, biodegradable films and performance-focused designs. Adoption is highest in North America and Europe, with Asia-Pacific emerging. Regulatory compliance and dissolution performance are critical. Until cost-effective, fully biodegradable materials scale, water soluble packaging will remain a premium and essential solution.

Water soluble pods and capsules are increasingly used in laundry detergents, dishwasher tablets, and multi-purpose cleaning agents due to precise dosing, mess-free handling, and convenience. Companies like Procter & Gamble and Henkel provide pods that dissolve completely in water, reducing waste and avoiding overdosing while improving cleaning efficiency. North America and Europe show strong adoption due to consumer awareness and demand for high-performance cleaning solutions, whereas Asia-Pacific is gradually increasing uptake with urban households and modern retail growth. Pods also improve storage safety and portability, especially in households with children or shared facilities. Formulation compatibility is critical; pods must maintain chemical stability while ensuring rapid dissolution in various water temperatures. Until alternative packaging offers the same convenience and controlled dosing, water soluble pods will continue to grow in laundry, dishwashing, and personal care segments.

Beyond cleaning products, water soluble capsules are being adopted in food and beverage segments, including instant drink mixes, vitamins, and powdered supplements. Capsules dissolve in water, providing single-serve convenience while reducing packaging waste. Companies like SC Johnson and Novamont are developing biodegradable films compatible with food-grade products, ensuring safety and solubility. Adoption is highest in regions with busy urban lifestyles, such as North America, Europe, and East Asia, where on-the-go consumption is rising. Packaging design must balance solubility, storage stability, and product compatibility. Consumer preferences for sustainable and convenient single-serve options continue to drive innovation in this segment. Until alternative materials or dosing systems can match water solubility and biodegradability, single-use capsules will remain a key format for convenient food and beverage consumption.

Water soluble pods and capsules must comply with strict environmental, food-contact, and chemical safety regulations. In Europe, REACH and Biodegradability standards require verification of film dissolution and environmental impact. North America mandates EPA and FDA approvals for household chemicals and food-contact materials. Key players like Reckitt Benckiser and Henkel ensure compliance through rigorous testing, traceability, and certification of polymer films. Biodegradability, compostability, and safe chemical interactions are increasingly prioritized due to consumer and governmental pressures. Emerging markets are adopting these standards gradually, but regulatory clarity is often limited. Until global harmonization of testing and certification standards improves, manufacturers must invest in validated materials and processes to ensure market acceptance, product safety, and environmental compliance across regions.

Major players differentiate through material innovation, dissolution efficiency, and product safety. Procter & Gamble and Henkel focus on laundry and dishwashing pods with advanced water solubility, SC Johnson targets personal care applications, while Novamont emphasizes biodegradable films. Companies use partnerships with chemical formulators, retailers, and logistics providers to secure adoption and optimize packaging performance. Regional manufacturers compete on cost, but often cannot match the R&D capabilities or scale of multinationals. Competitive strategies include product diversification, branded solutions for retail, and sustainable packaging claims. Until alternative formats match water solubility, stability, and ease-of-use, established players maintain strong positions through technological expertise, global distribution networks, and compliance with evolving environmental standards.

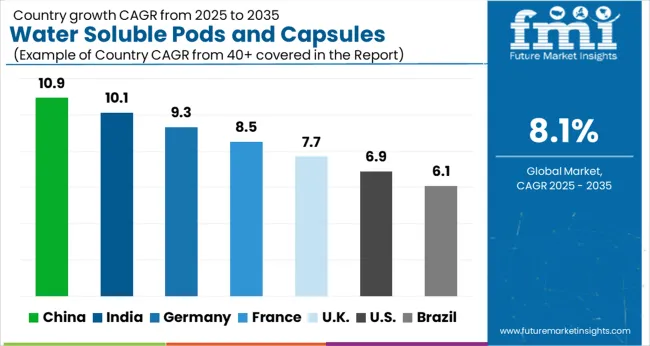

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

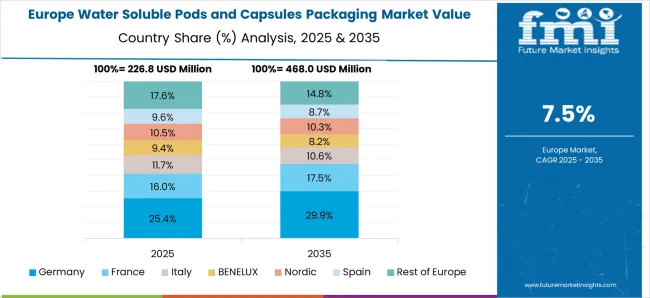

The global water soluble pods and capsules packaging market is projected to grow at a CAGR of 8.1% through 2035, supported by increasing demand across detergent, personal care, and pharmaceutical applications. Among BRICS nations, China has been recorded with 10.9% growth, driven by large-scale production and deployment in laundry, cleaning, and personal care products, while India has been observed at 10.1%, supported by rising utilization in household and industrial detergent solutions. In the OECD region, Germany has been measured at 9.3%, where production and adoption for pharmaceutical and household packaging applications have been steadily maintained. The United Kingdom has been noted at 7.7%, reflecting consistent use in personal care and detergent packaging, while the USA has been recorded at 6.9%, with production and utilization across household, pharmaceutical, and personal care sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The water soluble pods and capsules packaging market in China is growing at a CAGR of 10.9%, driven by increasing demand from detergent, cleaning, and personal care sectors. Manufacturers are adopting pods and capsules to improve convenience, reduce dosing errors, and enhance product safety. The packaging solutions are designed for single-use applications, ensuring precise chemical or product delivery. Growth in retail and e-commerce channels boosts demand for these ready-to-use formats. Companies are expanding production capacities and offering specialized packaging solutions to meet consumer expectations. The market benefits from increasing awareness about ease of use, safe handling, and space-saving packaging. Rising adoption in commercial and household cleaning applications supports sustained growth for water soluble pods and capsules packaging across China.

The water soluble pods and capsules packaging market in India is expanding at a CAGR of 10.1%, supported by growing use in detergents, cleaning agents, and personal care products. These packaging formats improve convenience, reduce dosing errors, and ensure safe handling of concentrated products. Manufacturers are offering customized solutions for single-use applications to cater to both household and commercial users. Retail growth, including online sales channels, drives higher adoption of pre-measured pods and capsules. Production facilities are scaling up to meet rising demand from urban and semi-urban markets. The market also benefits from consumer preference for easy-to-use packaging that minimizes wastage. With increasing awareness of safety, precision, and convenience, the water soluble pods and capsules packaging market in India is positioned for steady growth.

The water soluble pods and capsules packaging market in Germany is growing at a CAGR of 9.3%, driven by demand from household and commercial cleaning products. These packaging solutions allow precise dosing, safe handling, and easy application of concentrated detergents and cleaning agents. Manufacturers are focusing on single-use pods and capsules to improve convenience for consumers. The market is supported by retail and online distribution channels, ensuring wider availability. Companies offer customized formats for different product types, enhancing consumer satisfaction. Growing adoption in hospitality, institutional cleaning, and domestic households further boosts market demand. Rising preference for pre-measured, easy-to-use packaging materials ensures steady growth of water soluble pods and capsules packaging in Germany.

The water soluble pods and capsules packaging market in the United Kingdom is expanding at a CAGR of 7.7%, driven by rising demand from detergents, cleaners, and personal care products. Single-use packaging ensures precise dosing and safer handling, enhancing consumer convenience. Manufacturers are offering innovative pod and capsule designs to meet household and commercial requirements. Retailers, including e-commerce platforms, are increasing distribution, improving availability. The market benefits from adoption in commercial cleaning services and domestic households alike. Companies focus on producing pre-measured pods and capsules that reduce wastage and provide a user-friendly experience. The trend toward convenient, ready-to-use packaging continues to support steady growth for water soluble pods and capsules packaging in the UK.

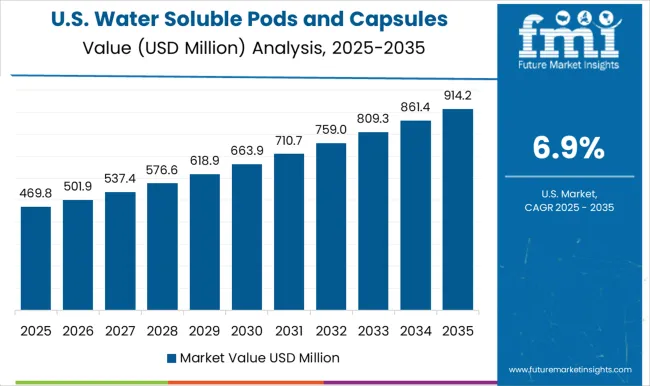

The water soluble pods and capsules packaging market in the United States is growing at a CAGR of 6.9%, fueled by demand from detergents, cleaning agents, and personal care products. Single-use pods and capsules provide precise dosing, safe handling, and convenience for both households and commercial users. Retail and online distribution channels drive higher accessibility across the country. Manufacturers offer customized pod sizes and capsule formats to cater to specific product needs and application types. Commercial cleaning services, institutional users, and households are primary adopters of these packaging solutions. The preference for pre-measured, easy-to-use, and mess-free packaging ensures consistent growth of the water soluble pods and capsules packaging market in the United States.

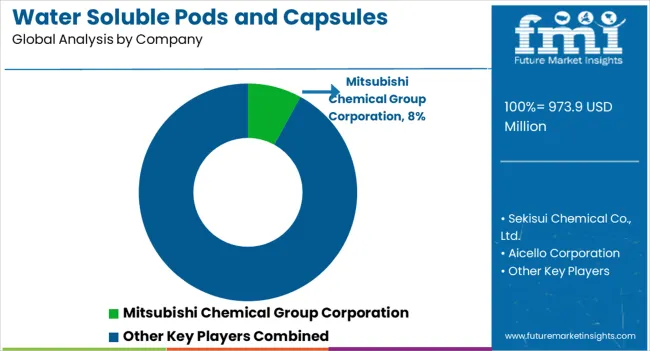

The water soluble pods and capsules packaging market is expanding rapidly due to the growing demand for single-dose, convenient, and eco-friendly packaging solutions across industries such as laundry, household cleaning, personal care, and pharmaceuticals. These packaging formats offer precise dosing, reduce product wastage, and enhance user convenience, while also aligning with sustainability trends as many are biodegradable or water-soluble. Companies in this market are focusing on innovation in polymer technology, barrier properties, and film solubility to improve product performance and consumer appeal. Mitsubishi Chemical Group Corporation is a leading supplier, providing advanced water-soluble films and pod materials for various applications. Sekisui Chemical Co., Ltd. and Aicello Corporation specialize in high-quality soluble films and environmentally friendly formulations.

Kuraray Co., Ltd. focuses on water-soluble polymer technologies for industrial and consumer applications. Packaging companies such as Constantia Flexibles and Cortec Corporation offer tailored pod and capsule solutions, while Arrow Greentech Ltd., and Ecopol S.p.A. provide regionally optimized products and sustainable alternatives. The market continues to benefit from rising consumer preference for convenience and eco-conscious products, with innovations in multi-layer films, enhanced solubility, and barrier performance driving growth. As manufacturers aim to reduce plastic waste and meet environmental regulations, water-soluble pods and capsules packaging is positioned as a key solution for sustainable product delivery worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 973.9 million |

| Product Type | Pods and Capsules |

| Material | Polymers, Surfactants, and Fibers |

| Solubility Type | Cold water and Hot water |

| Application | Homecare products, Personal care & cosmetics, Agrochemicals, Food & beverage, Pharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mitsubishi Chemical Group Corporation, Sekisui Chemical Co., Ltd., Aicello Corporation, KURARAY Co., Ltd., Constantia Flexibles, Cortec Corporation, Arrow Greentech Ltd., Ecopol S.p.A., and [Other regional / local players] |

| Additional Attributes | Dollar sales by type including single-dose pods, multi-dose capsules, and film packs, application across laundry detergents, dishwashing, and personal care products, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for convenient and eco-friendly packaging, increasing adoption of single-use products, and focus on sustainability. |

The global water soluble pods and capsules packaging market is estimated to be valued at USD 973.9 million in 2025.

The market size for the water soluble pods and capsules packaging market is projected to reach USD 2,122.1 million by 2035.

The water soluble pods and capsules packaging market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in water soluble pods and capsules packaging market are pods and capsules.

In terms of material, polymers segment to command 55.0% share in the water soluble pods and capsules packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Water Surface Conditioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water-based Inks Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Coatings Market Size and Share Forecast Outlook 2025 to 2035

Waterway Transportation Software Market Size and Share Forecast Outlook 2025 to 2035

Waterless Cosmetics Powders Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA