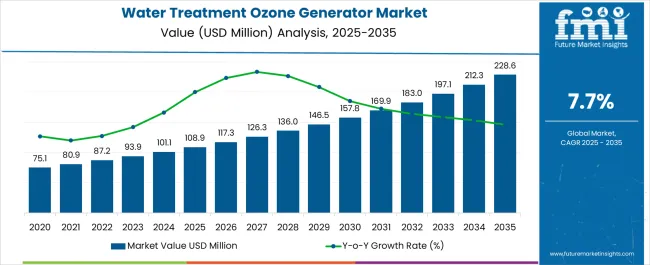

The water treatment ozone generator market is estimated to be valued at USD 108.9 million in 2025 and is projected to reach USD 228.6 million by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

Growth is driven by increasing demand for advanced water purification solutions, rising industrial and municipal wastewater treatment requirements, and stricter environmental regulations. Ozone generators are preferred for their high oxidation efficiency, ability to remove organic and inorganic contaminants, and reduced chemical usage compared with conventional treatment methods. Technological advancements, including energy-efficient systems and automated control features, further support adoption across global regions. Half-decade weighted growth analysis highlights how the market expansion is distributed over the forecast period. From 2025 to 2030, the market captures a higher weighted growth share, as early adoption occurs in North America and Europe, driven by regulatory compliance, infrastructure upgrades, and replacement of aging equipment.

This phase contributes significantly to total revenue due to both volume deployment and higher-value system installations. From 2031 to 2035, growth continues but at a relatively moderated pace, with emerging markets in Asia Pacific, Latin America, and the Middle East driving adoption through urbanization, industrial expansion, and increased investment in water treatment infrastructure. Weighted analysis shows that while the first half-decade sets a strong foundation, the second half ensures sustained growth, reinforcing the market’s long-term stability and cumulative expansion over the decade.

| Metric | Value |

|---|---|

| Water Treatment Ozone Generator Market Estimated Value in (2025 E) | USD 108.9 million |

| Water Treatment Ozone Generator Market Forecast Value in (2035 F) | USD 228.6 million |

| Forecast CAGR (2025 to 2035) | 7.7% |

The water treatment ozone generator market is driven by five primary parent markets with specific shares. Municipal water treatment leads with 40%, using ozone generators for disinfection, odor control, and pollutant removal. Industrial wastewater treatment contributes 25%, applying ozone to chemical, food, and textile effluents. Food and beverage processing represents 15%, employing ozone for water purification, sanitation, and shelf-life extension. Healthcare and pharmaceuticals account for 10%, using ozone-treated water for hygiene and production processes. Aquaculture and swimming pools hold 10%, leveraging ozone for microbial control and water quality maintenance. These segments collectively shape global demand for ozone generators.

Recent developments in the water treatment ozone generator market focus on efficiency, automation, and environmental compliance. Manufacturers are developing high-output, energy-efficient ozone systems with advanced controls for optimized disinfection and reduced chemical usage. Integration with real-time monitoring, IoT connectivity, and automated dosing systems enhances operational reliability and predictive maintenance. Growing adoption in municipal and industrial applications is driven by stricter water quality regulations, sustainability goals, and demand for chemical-free treatment solutions. Advances in compact, modular designs and hybrid systems are enabling wider deployment. These trends are promoting innovation, cost efficiency, and environmentally responsible water treatment solutions globally.

The water treatment ozone generator market is experiencing stable growth, driven by increasing global focus on safe and chemical-free water purification methods. Ozone’s strong oxidizing properties and ability to effectively eliminate bacteria, viruses, and organic contaminants without harmful residues have positioned it as a preferred treatment solution.

Regulatory emphasis on improving water quality standards and reducing reliance on chlorine-based disinfectants has supported adoption across municipal, industrial, and commercial applications. Technological advancements in ozone generation efficiency, durability, and operational control have reduced costs and improved scalability.

The current market is characterized by expanding municipal water treatment infrastructure and growing adoption in food and beverage processing, aquaculture, and swimming pool sanitation. With rising concerns over waterborne diseases and environmental sustainability, demand for ozone-based water treatment is expected to increase further in the forecast period.

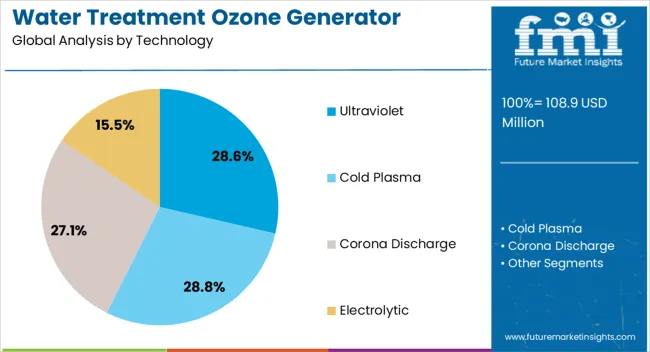

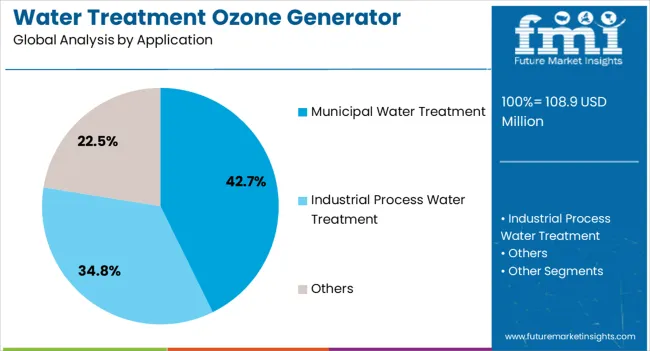

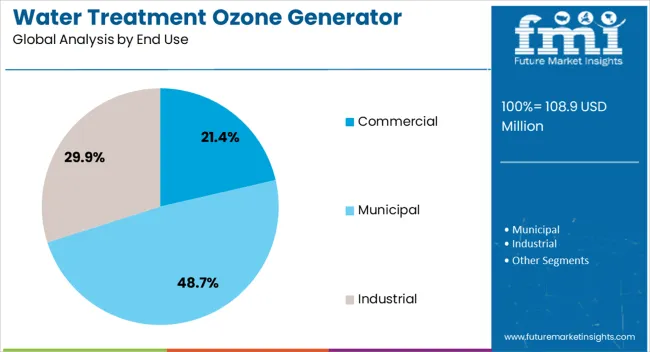

The water treatment ozone generator market is segmented by technology, application, end use, and geographic regions. By technology, water treatment ozone generator market is divided into ultraviolet, cold plasma, corona discharge, and electrolytic. In terms of application, water treatment ozone generator market is classified into municipal water treatment, industrial process water treatment, and others. Based on end use, water treatment ozone generator market is segmented into commercial, municipal, and industrial. Regionally, the water treatment ozone generator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cold plasma segment leads the technology category, holding approximately 28.8% share of the water treatment ozone generator market. Cold plasma technology is gaining traction in water treatment ozone generators because it enables efficient, on-demand ozone production without the need for high temperatures or chemical precursors. Unlike conventional thermal methods, cold plasma operates at ambient conditions, reducing energy consumption and extending equipment lifespan.

Its ability to generate high concentrations of ozone directly from air or oxygen ensures effective disinfection, degradation of organic pollutants, and removal of micropollutants such as pharmaceuticals. Additionally, cold plasma systems are compact, scalable, and safer to operate, making them well-suited for decentralized and industrial water treatment applications where sustainability and cost efficiency are critical.

The municipal water treatment segment dominates the application category with approximately 42.7% share, reflecting the widespread adoption of ozone as a primary or supplementary disinfectant in public water systems. Regulatory compliance with stringent water quality standards and the need to address emerging contaminants have driven municipal adoption.

Ozone’s ability to effectively inactivate pathogens and improve taste and odor without forming harmful disinfection by-products has reinforced its role in municipal systems. Large-scale infrastructure projects, supported by public funding, have accelerated installation rates in both developed and developing regions.

With rising urban populations and increasing demand for safe drinking water, the municipal water treatment segment is expected to maintain its leadership position in the market.

The municipal segment accounts for approximately 48.7% share of the end-use category in the water treatment ozone generator market. Ozone generators are widely used in the municipal sector because ozone is one of the most powerful oxidants for water treatment, capable of effectively disinfecting pathogens, inactivating viruses, and breaking down organic and inorganic contaminants without leaving harmful chemical residues. Unlike chlorine, ozone does not produce significant levels of disinfection byproducts, making it safer for public health and regulatory compliance.

Municipal utilities value ozone systems for their ability to improve water taste, odor, and clarity while meeting stringent drinking water and wastewater standards. Their scalability, reliability, and compatibility with existing infrastructure make them a preferred choice for large-scale operations.

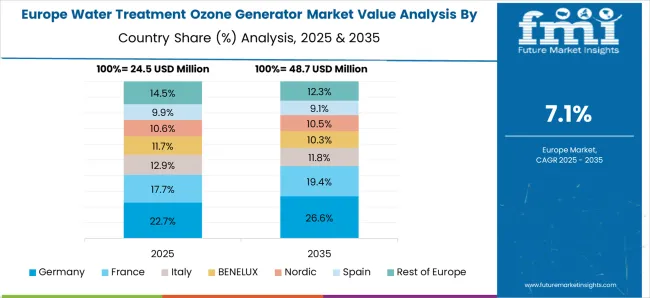

The water treatment ozone generator market is expanding steadily, driven by increasing demand for safe drinking water, municipal wastewater treatment, and industrial effluent management. North America holds around 30% of global demand, led by municipal water treatment plants and large industrial facilities. Europe contributes close to 25%, with strong usage in industrial wastewater, pulp and paper, and food processing sectors. Asia Pacific is witnessing rising adoption due to rapid urbanization and industrial expansion. Stricter environmental regulations and the shift toward chemical-free disinfection methods are accelerating adoption globally.

Regulatory requirements for clean water and the growing need to eliminate pathogens without harmful byproducts are driving adoption of ozone generators in water treatment. Municipalities in North America and Europe are deploying ozone systems to replace chlorine and reduce the formation of trihalomethanes. Industrial applications in pharmaceuticals, textiles, and beverage processing rely on ozone for microbial control and odor reduction. Ozone provides rapid oxidation within seconds, improving treatment outcomes compared with conventional methods. Rising urban water demand and stricter discharge norms across Asia Pacific also support deployment. Manufacturers offering high-capacity, energy-optimized, and automated ozone systems are gaining strong demand across municipal and industrial facilities.

Industrial expansion and bottled water consumption present significant opportunities for ozone generator adoption. Asia Pacific countries such as China, India, and Indonesia are investing heavily in wastewater treatment infrastructure to comply with environmental regulations. Bottled water manufacturers integrate ozone generators to disinfect water, extend shelf life, and ensure microbiological safety. In desalination facilities, ozone is used for pre-treatment and biofouling control, creating an additional growth avenue. Food and beverage industries also incorporate ozone for equipment sterilization and process water treatment. Suppliers that develop modular systems with remote monitoring and energy-efficient operation are positioned to serve both municipal and industrial markets.

The market is witnessing trends toward automated control systems, modular ozone designs, and IoT-enabled monitoring. Automated dosing ensures precise ozone generation based on real-time water quality parameters, reducing energy consumption. Modular generators allow scalable deployment, making them suitable for both small and large treatment plants. IoT-enabled systems provide predictive maintenance, fault detection, and cloud-based performance tracking, reducing downtime by 10–15%. North America emphasizes large-capacity automated systems, while Asia Pacific favors compact modular solutions for decentralized facilities. Adoption of oxygen-fed ozone generators and advanced corona discharge technology is enhancing ozone yield and energy efficiency, shaping the next phase of market development.

Despite strong adoption, the ozone generator market faces challenges from high operating costs and technical expertise requirements. Large-scale generators consume significant energy, raising electricity expenses for municipal and industrial operators. Installation involves complex integration with filtration and pumping systems, requiring skilled technicians. Maintenance of electrodes, power supply units, and ozone destructors adds recurring costs. In developing economies, limited technical expertise and budgetary constraints slow down adoption. Strict safety measures for ozone exposure monitoring also increase compliance costs. Companies focusing on low-energy, user-friendly, and modular designs are working to address these challenges and improve accessibility across global water treatment sectors.

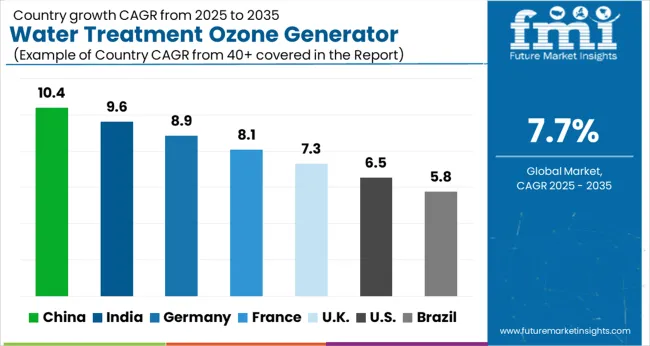

| Country | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| UK | 7.3% |

| USA | 6.5% |

| Brazil | 5.8% |

The water treatment ozone generator market is projected to grow at a global CAGR of 7.7% through 2035, driven by rising demand for advanced water purification, industrial effluent management, and municipal water treatment systems. China leads at 10.4%, a 1.35× multiple of the global benchmark, supported by BRICS-focused infrastructure expansion, urban water treatment projects, and industrial adoption. India follows at 9.6%, a 1.25× multiple, reflecting growing municipal water treatment needs, industrial wastewater management, and government initiatives for clean water. Germany records 8.9%, a 1.15× multiple, shaped by OECD-backed environmental regulations and adoption in industrial and municipal water systems. The United Kingdom posts 7.3%, slightly below the global rate, with adoption concentrated in municipal projects and industrial facilities. The United States stands at 6.5%, 0.85× the benchmark, supported by steady demand in municipal water treatment and industrial applications. BRICS countries drive volume growth, OECD regions emphasize efficiency and compliance, while ASEAN markets contribute through expanding industrial and urban water infrastructure. This report includes insights on 40+ countries; the top markets are shown here for reference.

The water treatment ozone generator market in China is projected to grow at a CAGR of 10.4%, driven by increasing industrial wastewater management, municipal water treatment expansion, and rising awareness of advanced water purification methods. Leading companies such as Xylem, Infilco Degremont, and Degrémont are supplying ozone generators with high efficiency, energy-saving features, and advanced automation. Adoption is concentrated in large industrial facilities, municipal plants, and commercial water treatment installations. Technological innovations such as online monitoring, remote diagnostics, and modular systems enhance reliability and reduce maintenance requirements. Government initiatives to improve water quality, coupled with strict environmental regulations, reinforce market growth. Investments in hybrid ozone-UV systems and high-capacity generators further strengthen deployment across China.

The water treatment ozone generator market in India is expected to expand at a CAGR of 9.6%, supported by the growing need for safe drinking water, industrial effluent management, and municipal water treatment upgrades. Key manufacturers including Degrémont, Xylem, and Aquisense are providing compact and high-efficiency ozone generators suitable for commercial and industrial applications. Adoption is concentrated in urban centers, industrial clusters, and water-intensive sectors such as food processing and pharmaceuticals. Government programs promoting water safety and environmental regulations encourage the deployment of ozone-based systems. Technological advancements including automated control, modular designs, and energy-efficient operation are driving market growth. Awareness about chemical-free water treatment solutions is also boosting adoption.

The water treatment ozone generator market in Germany is projected to grow at a CAGR of 8.9%, driven by stringent water quality regulations, industrial wastewater management, and adoption of advanced treatment technologies. Manufacturers such as Xylem, SUEZ, and Degrémont are supplying ozone generators with energy-efficient designs, precise control, and enhanced safety features. Adoption is concentrated in municipal water plants, industrial facilities, and commercial water treatment systems. Technological trends include integration with UV treatment, smart monitoring, and predictive maintenance to optimize performance. Government incentives and environmental policies encourage the transition from traditional chemical-based treatments to ozone systems. Rising demand for sustainable and chemical-free water purification reinforces market expansion.

The water treatment ozone generator market in the United Kingdom is forecast to expand at a CAGR of 7.3%, driven by increasing municipal water treatment projects, industrial adoption, and the shift toward chemical-free purification. Key suppliers including SUEZ, Xylem, and Degrémont are delivering compact, modular, and high-efficiency ozone systems suitable for water utilities and commercial applications. Adoption is concentrated in urban water treatment plants and large industrial facilities. Trends such as energy-efficient operation, smart monitoring, and hybrid ozone-UV systems enhance reliability and performance. Government mandates for safe water and environmental compliance reinforce market growth. Increasing demand from food processing and beverage sectors also supports adoption.

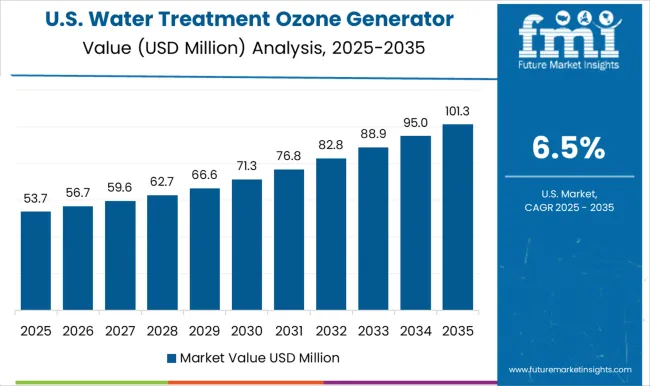

The water treatment ozone generator market in the United States is projected to grow at a CAGR of 6.5%, supported by municipal and industrial water treatment projects, regulatory compliance, and demand for chemical-free purification methods. Companies such as Xylem, Degrémont, and SUEZ are supplying high-performance ozone generators with automation, remote monitoring, and energy-efficient designs. Adoption is concentrated in industrial clusters, municipal plants, and commercial water treatment systems. Technological trends include hybrid ozone-UV systems, predictive maintenance, and smart control systems for optimized operation. Increasing awareness of environmental impact and sustainability drives investment in ozone-based treatment over conventional chemical processes.

Competition in the water treatment ozone generator market is driven by global engineering firms and specialized ozone technology providers, focusing on efficiency, reliability, and compliance with water quality standards. Mitsubishi Electric, EBARA Technologies, and SUEZ lead with industrial-scale generators, emphasizing high output, energy efficiency, and advanced control systems in their brochures. Veolia and Lenntech Water Treatment highlight turnkey solutions and integration with existing water treatment infrastructure, targeting municipal and industrial clients.

Chemtronics, Faraday Ozone, and Ozone Solutions focus on compact and modular systems, suitable for small-scale water treatment or specialized applications. Ozonetek, Primozone, and Toshiba emphasize precision engineering, automated operation, and low maintenance designs. Brochures detail ozone generation capacity, operational parameters, and safety certifications, providing critical information for decision-makers. Marketing materials shape competition, combining schematics, technical data, and application guidance to facilitate selection.

Frequent brochure updates reflect regulatory compliance, efficiency improvements, and technological advancements. Larger manufacturers leverage global presence and brand credibility, while smaller players emphasize agility, specialized solutions, and rapid deployment. Market leadership depends on how effectively brochures communicate performance, reliability, and long-term operational value in water treatment ozone generator solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 108.9 million |

| Technology | Ultraviolet, Cold Plasma, Corona Discharge, and Electrolytic |

| Application | Municipal Water Treatment, Industrial Process Water Treatment, and Others |

| End Use | Commercial, Municipal, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Chemtronics, EBARA Technologies, Faraday Ozone, Lenntech Water Treatment, Mitsubishi Electric, Ozone Solutions, Ozonetek, Primozone, SUEZ, Toshiba, and Veolia |

| Additional Attributes | Dollar sales by generator type and end use, demand dynamics across municipal, industrial, and commercial water treatment, regional trends in water quality regulations, innovation in ozone output, energy efficiency, and automation, environmental impact of ozone use and disposal, and emerging use cases in wastewater treatment, desalination, and cooling water systems. |

The global water treatment ozone generator market is estimated to be valued at USD 108.9 million in 2025.

The market size for the water treatment ozone generator market is projected to reach USD 228.6 million by 2035.

The water treatment ozone generator market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in water treatment ozone generator market are ultraviolet, cold plasma, corona discharge and electrolytic.

In terms of application, municipal water treatment segment to command 42.7% share in the water treatment ozone generator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Water Surface Conditioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water-based Inks Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA