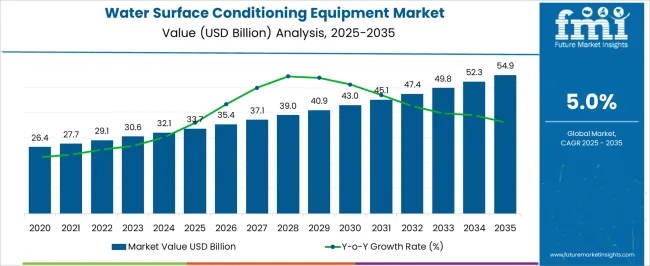

The water surface conditioning equipment market is projected to grow from USD 33.7 billion in 2025 to USD 54.9 billion in 2035, reflecting a CAGR of 5.0%. During the early adoption phase (2020–2024), the market was gradually expanded from USD 26.4 billion to USD 33.7 billion as equipment was introduced and tested in various water bodies. Pilot installations were deployed to evaluate performance, maintenance efficiency, and water quality improvements.

Municipal and private stakeholders supported initial investments. From 2025 to 2035, the market was observed to transition through scaling (2025–2030) and consolidation (2030–2035). By 2030, the market was expected to surpass USD 40.9 billion, driven by expanded deployment across lakes, reservoirs, and industrial water bodies. During the consolidation phase, growth was moderated toward USD 54.9 billion by 2035 as leading suppliers strengthened market presence and smaller players were aligned or exited. The 5.0% CAGR indicated steady expansion, and the market was established as a standard solution for water quality management, surface treatment, and ecosystem support across multiple sectors and regions.

| Metric | Value |

|---|---|

| Water Surface Conditioning Equipment Market Estimated Value in (2025 E) | USD 33.7 billion |

| Water Surface Conditioning Equipment Market Forecast Value in (2035 F) | USD 54.9 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The water surface conditioning equipment market is influenced by several parent markets, each contributing to its growth. The municipal water treatment sector is estimated to drive approximately 30%, as equipment is deployed for maintenance of urban lakes, reservoirs, and ponds. Industrial water management is considered responsible for 20%, as cooling towers, treatment ponds, and effluent systems are conditioned using specialized equipment. Aquaculture and fisheries are estimated to account for 15%, as surface conditioning is applied to improve oxygenation and water quality. Environmental management services are assessed to influence 10%, as programs are implemented to maintain water ecosystems and reduce pollutants. Recreational water bodies contribute around 8%, as lakes, resorts, and parks are maintained for aesthetic and safety purposes. Equipment manufacturing and supply are evaluated at 7%, as machinery and components are produced and distributed. Research and consulting services account for 5%, as operational assessments and performance evaluations are conducted. Lastly, automation and monitoring solutions are estimated at 5%, as systems are integrated for efficiency and remote management.

The Water Surface Conditioning Equipment market is experiencing consistent growth driven by increasing demand for high-purity water in industrial and semiconductor processes. The market is being influenced by the rising adoption of advanced water treatment solutions to meet stringent environmental and operational standards. Investments in semiconductor manufacturing, electronics fabrication, and other precision industries are expanding the need for efficient water conditioning systems that ensure optimal surface quality and contamination control.

Technological advancements in filtration, reverse osmosis, and cleaning automation are enabling higher throughput and reduced water wastage. Additionally, operational efficiency and cost reduction strategies are favoring equipment that combines reliability with low maintenance requirements.

The market outlook remains positive as regulatory compliance and the global emphasis on sustainable water management continue to drive adoption Opportunities for growth are particularly strong in emerging regions where industrialization and electronics manufacturing are expanding rapidly, requiring scalable and upgradeable water surface conditioning solutions that can be integrated into existing process lines without significant downtime.

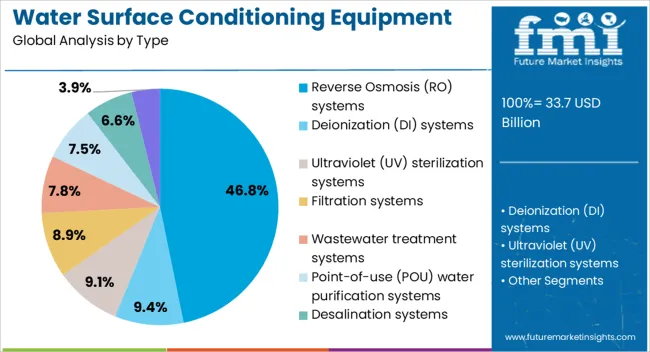

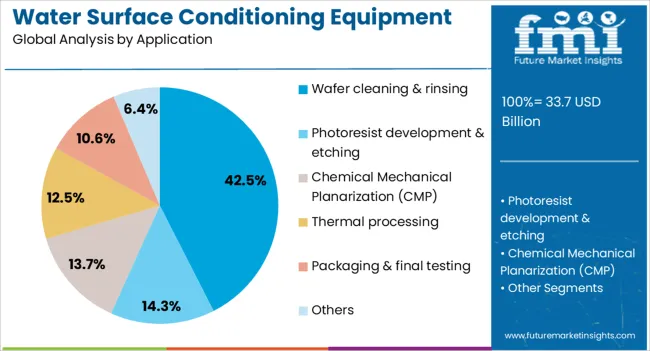

The water surface conditioning equipment market is segmented by type, application, and geographic regions. By type, water surface conditioning equipment market is divided into Reverse Osmosis (RO) systems, Deionization (DI) systems, Ultraviolet (UV) sterilization systems, Filtration systems, Wastewater treatment systems, Point-of-use (POU) water purification systems, Desalination systems, and Others. In terms of application, water surface conditioning equipment market is classified into Wafer cleaning & rinsing, Photoresist development & etching, Chemical Mechanical Planarization (CMP), Thermal processing, Packaging & final testing, and Others. Regionally, the water surface conditioning equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Reverse Osmosis systems segment is projected to hold 46.8% of the Water Surface Conditioning Equipment market revenue share in 2025, making it the leading type. This dominance is being driven by the high efficiency of RO systems in removing dissolved solids, ions, and organic contaminants, which ensures the delivery of ultra-pure water critical for industrial and wafer manufacturing processes.

Adoption has been accelerated by the growing focus on sustainable water usage, as RO systems enable significant water recycling and reduce the dependence on freshwater sources. The modular design of modern RO systems allows scalability and integration with existing water treatment lines, providing operational flexibility and reduced installation costs.

Furthermore, the reliability of these systems in delivering consistent water quality under varying process demands has reinforced their position as the preferred type in the market The continued emphasis on process optimization, regulatory compliance, and precision cleaning in manufacturing environments is expected to sustain the growth of this segment over the coming years.

The Wafer Cleaning and Rinsing application segment is anticipated to account for 42.5% of the Water Surface Conditioning Equipment market revenue share in 2025, establishing it as the leading application. This prominence is being supported by the critical role of high-purity water in removing contaminants, particles, and residues from semiconductor wafers during fabrication. The demand for advanced water surface conditioning solutions has increased due to shrinking feature sizes in semiconductors, which require meticulous cleaning processes to avoid defects and yield losses.

Adoption has been further driven by rising investments in semiconductor fabs, electronics assembly, and precision manufacturing, where water conditioning systems are essential for maintaining high-quality production standards. Systems capable of delivering stable water quality while minimizing chemical usage and waste generation are being increasingly preferred, supporting sustainability goals.

The ability to integrate these systems with automated cleaning lines and real-time monitoring technologies has reinforced their relevance As semiconductor and electronics industries continue to expand, wafer cleaning and rinsing applications are expected to remain a significant driver of market growth.

The water surface conditioning equipment market is expanding due to increasing demand for water quality management in aquaculture, wastewater treatment, and industrial applications. North America and Europe lead with advanced aerators, skimmers, and surface agitators for commercial aquaculture, ponds, and treatment facilities. Asia-Pacific shows rapid growth driven by aquaculture expansion, industrial water treatment needs, and rising environmental awareness. Manufacturers differentiate through energy efficiency, durability, automation, and maintenance simplicity. Regional variations in water treatment regulations, operational requirements, and environmental standards influence adoption, deployment strategies, and competitive positioning globally.

Adoption of water surface conditioning equipment heavily depends on energy efficiency and aeration performance. North America and Europe emphasize high-performance aerators and agitators designed to maintain dissolved oxygen, prevent algae growth, and enhance water circulation for aquaculture and treatment facilities. Asia-Pacific markets increasingly adopt cost-effective, reliable equipment for ponds, tanks, and industrial water management. Differences in aeration efficiency and energy consumption impact operational costs, water quality, and overall system performance. Leading suppliers invest in energy-efficient designs, advanced motor technologies, and precise control systems for premium applications, while regional manufacturers provide durable, low-cost alternatives. Equipment efficiency contrasts shape adoption, operational performance, and market competitiveness across global water surface conditioning sectors.

Automation and monitoring capabilities enhance equipment performance and operational convenience. North America and Europe focus on intelligent surface conditioning systems with real-time sensors, remote control, and automated scheduling to optimize oxygen levels and water quality. Asia-Pacific adoption includes semi-automated systems with manual adjustments, balancing cost and functionality for aquaculture and small-scale industrial applications. Differences in automation and monitoring affect labor requirements, water quality consistency, and maintenance efficiency. Suppliers offering smart, integrated systems gain premium adoption, while regional players provide functional, cost-efficient equipment. Automation and monitoring contrasts shape adoption, operational efficiency, and competitive differentiation across water surface conditioning markets globally.

Environmental regulations and water quality standards significantly influence equipment adoption. North America and Europe enforce strict standards for aquaculture, wastewater discharge, and industrial effluents, driving the use of certified, high-performance surface conditioning equipment. Asia-Pacific regulations vary; advanced markets follow global standards, while emerging regions emphasize practical compliance with local environmental requirements. Differences in regulatory stringency affect product selection, operational protocols, and installation timelines. Suppliers providing certified, regulation-compliant equipment gain higher adoption, while regional manufacturers focus on affordable, locally compliant solutions. Regulatory contrasts shape market penetration, operational safety, and competitiveness across global water surface conditioning equipment markets.

Equipment longevity, durability, and maintenance requirements influence adoption decisions. North America and Europe prefer corrosion-resistant, high-durability equipment with minimal maintenance, enabling consistent performance in industrial, municipal, and aquaculture applications. Asia-Pacific markets often adopt robust, cost-effective systems that may require more frequent servicing but offer reliable water conditioning in varied environments. Differences in maintenance complexity and durability affect operational costs, equipment downtime, and water quality consistency. Leading suppliers provide advanced materials, modular designs, and extended warranties for premium applications, while regional manufacturers focus on affordability and basic functionality. Durability and maintenance contrasts shape adoption, operational continuity, and market competitiveness across global water surface conditioning equipment segments.

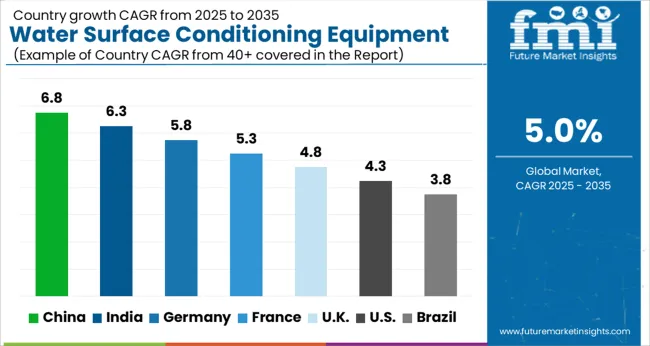

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

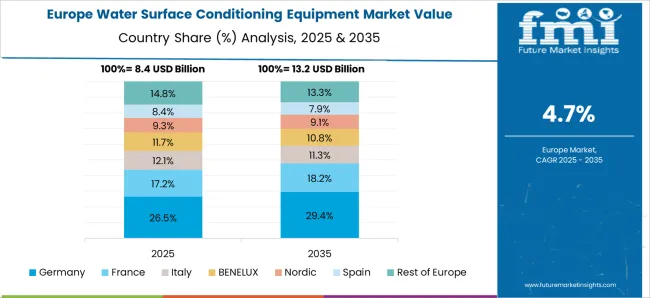

The global water surface conditioning equipment market was projected to grow at a 5.0% CAGR through 2035, driven by demand in water treatment, aquaculture, and recreational water management applications. Among BRICS nations, China recorded 6.8% growth as large-scale manufacturing and deployment facilities were commissioned and compliance with industrial and safety standards was enforced, while India at 6.3% growth saw expansion of production units to meet rising regional demand. In the OECD region, Germany at 5.8% maintained substantial output under strict industrial and operational regulations, while the United Kingdom at 4.8% relied on moderate-scale operations for commercial and recreational water applications. The USA, expanding at 4.3%, remained a mature market with steady demand across industrial, aquaculture, and recreational segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The water surface conditioning equipment market in China is being driven at a CAGR of 6.8% due to rising demand for pond, lake, and industrial water quality management. Aerators, mixers, and circulation systems are being adopted to improve water oxygenation, reduce algae growth, and maintain ecological balance. Manufacturers are being encouraged to provide durable, energy efficient, and easy-to-install equipment. Distribution through water management companies, industrial suppliers, and online platforms is being maintained. Government regulations on water quality and environmental standards are being followed. Research and development in energy efficient, automated, and low-maintenance equipment is being conducted to enhance performance. Growing interest in aquaculture, industrial water treatment, and recreational water facilities is being considered a key factor driving market growth in China.

In India, the water surface conditioning equipment market is being expanded at a CAGR of 6.3% as demand for clean water in ponds, lakes, and reservoirs grows. Aeration systems, mixers, and circulation devices are being adopted to improve water quality and reduce algae. Manufacturers are being focused on producing cost-effective, durable, and efficient equipment. Distribution through industrial suppliers, water management agencies, and online platforms is being maintained. Government initiatives for water quality management and environmental protection are being followed. Awareness programs for aquaculture and water conservation are being conducted to encourage adoption. Increasing aquaculture activity, urban water treatment projects, and recreational water management are being considered key drivers of market growth in India.

The water surface conditioning equipment market in Germany is being driven at a CAGR of 5.8% due to growing demand for industrial, recreational, and aquaculture water quality management. Aerators, circulation systems, and mixers are being adopted to maintain dissolved oxygen levels, reduce algae, and improve water quality. Manufacturers are being encouraged to produce energy efficient, low-maintenance, and reliable equipment. Distribution through industrial suppliers, environmental agencies, and water management companies is being maintained. Research and development in advanced aeration, automated control, and monitoring systems is being undertaken to enhance performance. Compliance with environmental and water safety regulations is being ensured. Germany’s focus on sustainable water management practices and aquaculture growth is being considered a key factor supporting adoption of water surface conditioning equipment.

The United Kingdom water surface conditioning equipment market is being expanded at a CAGR of 4.8% as demand for clean water in recreational lakes, ponds, and aquaculture systems rises. Aerators, mixers, and circulation equipment are being used to maintain oxygen levels and reduce algae growth. Manufacturers are being focused on providing high quality, energy efficient, and low-maintenance systems. Distribution through water management companies, industrial suppliers, and online platforms is being ensured. Awareness campaigns and training programs are being conducted to educate operators on proper usage and maintenance. Growing interest in aquaculture, recreational water management, and industrial water treatment is being considered a key driver for market adoption.

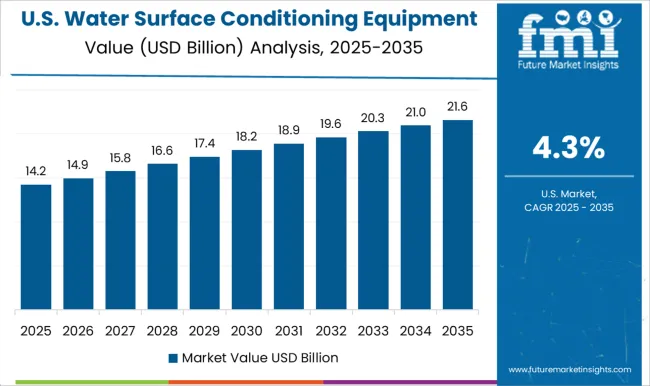

The United States water surface conditioning equipment market is being driven at a CAGR of 4.3% by increasing demand for industrial, recreational, and aquaculture water management. Aerators, circulation devices, and mixers are being adopted to improve water quality, reduce algae growth, and maintain oxygen levels. Manufacturers are being encouraged to produce energy efficient, reliable, and easy-to-maintain equipment. Distribution through industrial suppliers, water management companies, and online platforms is being maintained. Compliance with environmental and water safety standards is being ensured. Research and development in advanced automated systems and energy efficient technologies is being conducted. Growing aquaculture, recreational water management, and municipal water treatment initiatives are being considered key growth drivers in the United States.

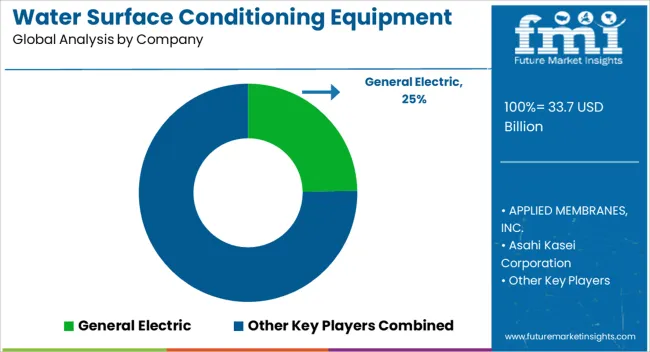

The water surface conditioning equipment market is driven by the increasing need for efficient water treatment and management solutions across industrial, municipal, and commercial applications. Key suppliers in this market are General Electric, APPLIED MEMBRANES, INC., Asahi Kasei Corporation, DuPont de Nemours, Inc., Entegris, Inc., Evoqua Water Technologies, and Marlo, Inc. Advanced equipment is developed and supplied to improve water quality, remove contaminants, and optimize the performance of water systems, including filtration, aeration, and surface treatment technologies. Specialized surface conditioning systems and membrane-based solutions are produced by General Electric and APPLIED MEMBRANES, INC., where emphasis is placed on enhancing operational efficiency and extending equipment life. Innovations in chemical-free treatment, energy-efficient designs, and automated monitoring are implemented by Asahi Kasei Corporation and DuPont de Nemours, Inc. to meet strict environmental standards and reduce operational costs. These solutions are designed to address challenges such as algae growth, sedimentation, and chemical imbalance in water bodies, ensuring safe and sustainable water management. Further, Entegris, Inc., Evoqua Water Technologies, and Marlo, Inc. provide systems and equipment for industrial water conditioning, cooling tower optimization, and wastewater management. Research and development activities are continuously conducted to improve scalability, reliability, and eco-friendly characteristics of water surface conditioning technologies. The global adoption of these solutions is supported by regulatory compliance, technological advancements, and the increasing focus on water conservation and treatment efficiency. Market growth is facilitated by the widespread need for clean water, resource management, and sustainable industrial operations, with these leading suppliers driving innovation and setting industry standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 33.7 Billion |

| Type | Reverse Osmosis (RO) systems, Deionization (DI) systems, Ultraviolet (UV) sterilization systems, Filtration systems, Wastewater treatment systems, Point-of-use (POU) water purification systems, Desalination systems, and Others |

| Application | Wafer cleaning & rinsing, Photoresist development & etching, Chemical Mechanical Planarization (CMP), Thermal processing, Packaging & final testing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | General Electric, APPLIED MEMBRANES, INC., Asahi Kasei Corporation, DuPont de Nemours, Inc., Entegris, Inc., Evoqua Water Technologies, and Marlo, Inc. |

| Additional Attributes | Dollar sales vary by equipment type, including aerators, diffusers, mixers, and surface skimmers; by application, such as wastewater treatment, industrial water treatment, aquaculture, and lakes & ponds; by end-use industry, spanning municipal utilities, industrial facilities, and agriculture; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising water quality regulations, industrial water management needs, and environmental conservation initiatives. |

The global water surface conditioning equipment market is estimated to be valued at USD 33.7 billion in 2025.

The market size for the water surface conditioning equipment market is projected to reach USD 54.9 billion by 2035.

The water surface conditioning equipment market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in water surface conditioning equipment market are reverse osmosis (ro) systems, deionization (di) systems, ultraviolet (uv) sterilization systems, filtration systems, wastewater treatment systems, point-of-use (pou) water purification systems, desalination systems and others.

In terms of application, wafer cleaning & rinsing segment to command 42.5% share in the water surface conditioning equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA