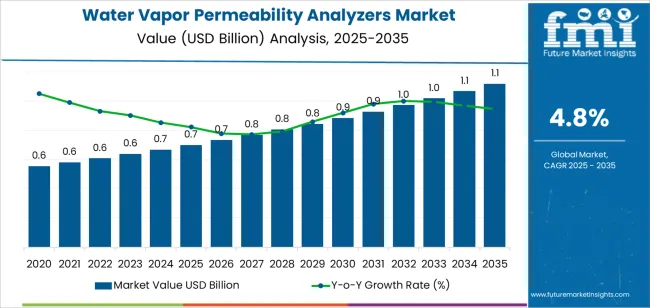

The global water vapor permeability analyzers market is expected to grow from USD 0.7 billion in 2025 to approximately USD 1.1 billion by 2035, recording an absolute increase of USD 0.4 billion over the forecast period. This translates into a total growth of 59.8%, with the market forecast to expand at a CAGR of 4.8% between 2025 and 2035.

The market size is expected to grow by nearly 1.60 times during the same period, supported by increasing global demand for barrier property testing equipment in pharmaceutical packaging operations, growing adoption of moisture transmission measurement technologies in food packaging quality control, and rising material performance standards driving specialized testing instrument procurement across various industrial barrier testing applications.

The market expansion reflects fundamental shifts in packaging material qualification requirements and product protection protocols. Food and beverage manufacturers are implementing comprehensive barrier testing programs to ensure consistent packaging performance across shelf-stable product operations, particularly for sensitive food items and premium beverage packaging serving retail distribution networks. Pharmaceutical companies require precise moisture permeability measurement systems to optimize blister packaging selection in drug product development and stability program validation. Textile manufacturers are investing in permeability testing technologies to support technical fabric characterization programs and performance textile development.

| Metric | Value |

|---|---|

| Water Vapor Permeability Analyzers Market Value (2025) | USD 0.7 billion |

| Water Vapor Permeability Analyzers Market Forecast Value (2035) | USD 1.1 billion |

| Water Vapor Permeability Analyzers Market CAGR | 4.8% |

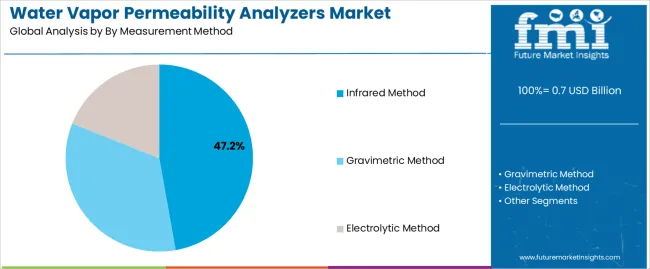

| Leading Segment by Measurement Method (2025) | Infrared Method (47.2%) |

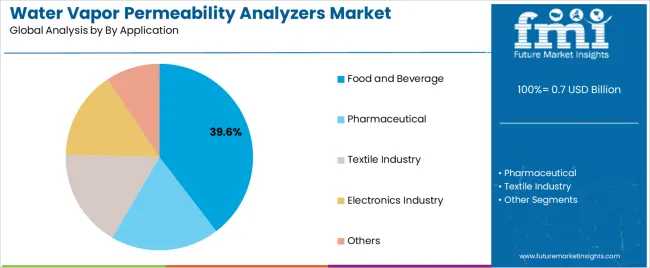

| Leading Segment by Application (2025) | Food and Beverage (39.6%) |

| Key Growth Regions | Asia Pacific, Europe, and North America |

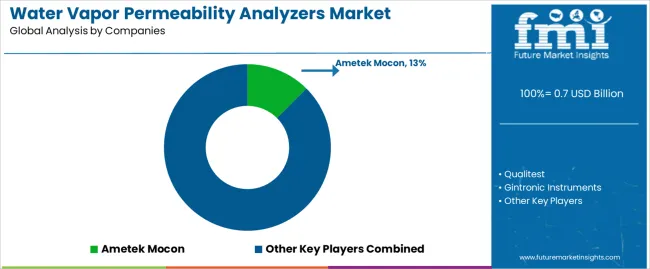

| Top Companies by Market Share | Ametek Mocon, Qualitest, Gintronic Instruments |

Regional dynamics demonstrate concentrated growth in established manufacturing economies with mature packaging infrastructure and expanding pharmaceutical production sectors. Asian markets, led by China and India, are experiencing accelerated adoption driven by packaging material manufacturing expansion and pharmaceutical quality control enhancement programs. European markets maintain steady growth supported by stringent packaging performance standards and continuous testing methodology improvement initiatives in regulated industries. North American operations focus on pharmaceutical packaging validation and testing procedure standardization across quality control workflows.

Technology adoption patterns reflect the transition from manual cup method procedures to automated permeability analyzers capable of rapid testing cycles and enhanced measurement precision. Testing equipment manufacturers are developing integrated platforms that combine multiple measurement methodologies with digital data management systems, addressing manufacturer requirements for operational efficiency and regulatory compliance documentation. The market faces ongoing challenges related to measurement standardization across testing methods, equipment calibration maintenance requirements, and cost justification for small-scale packaging operations with limited testing volumes.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.7 billion |

| Market Forecast Value (2035) | USD 1.1 billion |

| Forecast CAGR (2025-2035) | 4.8% |

| PACKAGING QUALITY STANDARDS | REGULATORY COMPLIANCE | TECHNOLOGICAL ADVANCEMENT |

|---|---|---|

| Product Shelf Life Requirements Expanding packaging performance specifications and moisture barrier requirements driving demand for precise permeability testing equipment across food packaging and pharmaceutical container qualification programs. Material Development Testing Growing focus on advanced packaging material characterization and barrier property optimization creating demand for analytical instruments supporting research and quality control operations. Quality Assurance Integration Manufacturing quality systems and incoming material inspection protocols requiring validated testing equipment with comprehensive documentation capabilities. |

Pharmaceutical Packaging Standards Stringent regulatory requirements for pharmaceutical container closure systems favoring validated testing methodologies with proven measurement accuracy and traceability. Food Safety Regulations Food contact material standards and packaging performance verification mandates necessitating barrier property testing with documented measurement procedures. International Standard Compliance ISO and ASTM testing method specifications driving investment in standardized testing equipment with certified performance capabilities. |

Automated Testing Systems Development of automated measurement platforms reducing manual intervention and enabling high-throughput testing with enhanced reproducibility and operational efficiency. Multi-Methodology Platforms Integration of multiple testing methods in unified instruments supporting diverse material testing requirements and comparative measurement capabilities. Digital Data Management Laboratory information system connectivity and automated result documentation enabling enhanced compliance tracking and real-time quality monitoring. |

| Category | Segments Covered |

|---|---|

| By Measurement Method | Infrared Method, Gravimetric Method, Electrolytic Method |

| By Application | Food and Beverage, Pharmaceutical, Textile Industry, Electronics Industry, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Infrared Method | Leader in 2025 with 47.2% market share projected to maintain dominance through 2035. Established measurement protocol with rapid testing cycles and minimal sample preparation requirements. Non-destructive testing capability providing real-time moisture transmission monitoring across diverse packaging materials. Momentum: steady growth driven by pharmaceutical packaging testing expansion and food industry quality control applications requiring fast turnaround results. Watchouts: higher equipment costs compared to traditional methods and calibration maintenance requirements affecting long-term operational expenses. |

| Gravimetric Method | Traditional segment with 31.4% market share maintaining relevance through standardized testing protocols and regulatory acceptance. Proven measurement methodology with established correlation to product stability and extensive historical performance data. Adoption concentrated in pharmaceutical laboratories and material research facilities requiring validated reference methods. Momentum: moderate growth through regulatory compliance applications and research institution utilization. Watchouts: extended testing duration limiting throughput capacity and manual procedure complexity affecting operational efficiency in high-volume testing environments. |

| Electrolytic Method | Specialized segment with 21.4% market share benefiting from ultra-low permeability measurement requirements and precision testing applications. Superior sensitivity for high-barrier materials and controlled atmosphere packaging requiring detection of minimal moisture transmission rates. Growing adoption in pharmaceutical packaging qualification and advanced barrier film development. Momentum: rising through pharmaceutical container testing and specialty packaging material characterization. Watchouts: limited material compatibility and specialized maintenance requirements affecting operational flexibility across diverse testing programs. |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Food and Beverage | Dominant segment at 39.6% market share in 2025 with established packaging quality control infrastructure and comprehensive barrier testing operations. Critical for flexible packaging qualification and shelf-stable product development requiring consistent moisture protection. Mature testing protocols with standardized procedures and material specification requirements. Momentum: steady growth driven by packaged food expansion and premium beverage packaging development. Watchouts: cost sensitivity in commodity food packaging and testing throughput requirements in high-volume manufacturing operations affecting equipment utilization patterns. |

| Pharmaceutical | Expanding segment with 28.7% market share driven by blister packaging qualification and stability program validation requirements. Essential for primary packaging material selection and regulatory submission documentation requiring validated testing methodologies. Adoption concentrated in pharmaceutical companies and contract packaging organizations. Momentum: strong growth through pharmaceutical manufacturing expansion and regulatory compliance enhancement. Watchouts: stringent equipment qualification requirements and method validation complexity affecting procurement timelines and operational implementation in GMP environments. |

| Textile Industry | Established segment at 16.3% share focused on technical fabric characterization and performance textile development requiring breathability assessment. Diverse applications across protective clothing, sportswear, and functional textiles requiring moisture vapor transmission measurement. Investment driven by technical textile innovation and performance standard development. Momentum: moderate growth through technical textile market expansion and athletic apparel development. Watchouts: testing procedure variation across textile categories and material thickness challenges affecting measurement standardization across diverse fabric constructions. |

| Electronics Industry | Specialized segment with 9.8% market share serving electronic component packaging and display barrier film qualification. Premium applications requiring ultra-low permeability measurement and accelerated testing capabilities. High-precision requirements supporting investment in advanced testing technologies. Momentum: steady growth through flexible electronics development and OLED display production. Watchouts: extremely low permeability detection requirements and environmental control complexity necessitating specialized testing conditions and equipment capabilities. |

| Others | Residual segment with 5.6% market share encompassing diverse applications including medical device packaging, agricultural film testing, and building material characterization. Small volume with specialized testing requirements and limited standardized procedures. Adoption concentrated in niche material applications and research facilities. Momentum: flat to modest growth with application-specific requirements. Watchouts: limited equipment optimization for specialized applications and small market size constraining manufacturer development investment. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Pharmaceutical Regulatory Requirements Expanding pharmaceutical packaging validation and container closure system testing requirements driving investment in validated permeability measurement equipment for regulatory compliance. Packaging Material Innovation Growing development of advanced barrier materials and multilayer packaging structures creating demand for precise characterization equipment supporting material qualification programs. Quality Control Standardization Manufacturing quality system enhancement and incoming material testing protocols requiring standardized measurement equipment with documented performance capabilities. |

High Equipment Costs Significant capital investment requirements and maintenance expenses limiting adoption in small-scale packaging operations and research facilities with limited budgets. Testing Duration Limitations Extended measurement times for traditional methods affecting throughput capacity in high-volume quality control operations requiring rapid material qualification. Method Standardization Challenges Variations across different testing methodologies and correlation complexity affecting measurement comparability and material specification development. |

Automated Sample Handling Integration of robotic sample loading and automated testing sequences reducing manual intervention and enabling high-throughput laboratory operations. Multi-Chamber Systems Development of parallel testing configurations enabling simultaneous measurement of multiple samples improving laboratory productivity and operational efficiency. Environmental Control Integration Advanced temperature and humidity regulation systems ensuring precise testing conditions and enabling accelerated aging simulation in permeability assessment. |

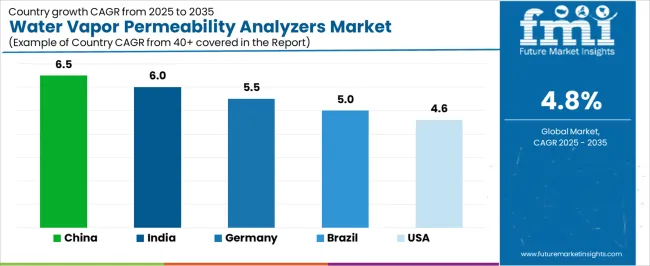

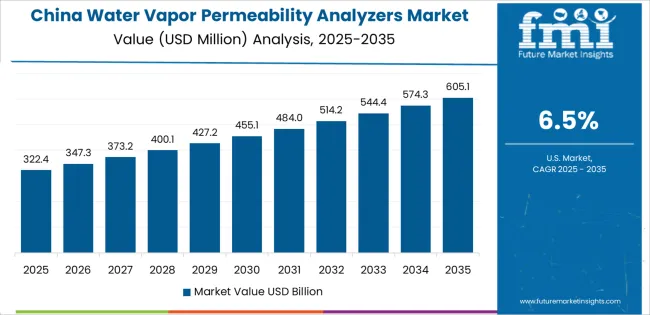

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| Brazil | 5.0% |

| United States | 4.6% |

China is projected to exhibit strong growth with a market value of USD 231.1 million by 2035, driven by expanding pharmaceutical packaging manufacturing and comprehensive food packaging material production creating substantial opportunities for testing equipment suppliers across quality control operations, material research facilities, and packaging converter operations. The country's massive packaging industry infrastructure and expanding quality testing capabilities are creating significant demand for permeability testing systems supporting operational efficiency and product quality standards. Major pharmaceutical companies and packaging material manufacturers are establishing comprehensive testing laboratories to support large-scale production operations and meet growing domestic regulatory requirements.

India is expanding to reach USD 223.3 million by 2035, supported by extensive pharmaceutical manufacturing capacity expansion and comprehensive packaging material production development creating steady demand for testing technologies across diverse industrial operations and quality control segments. The country's growing pharmaceutical contract manufacturing infrastructure and expanding packaging industry awareness are driving demand for permeability analyzers that provide consistent measurement performance while supporting cost-effective operational requirements. Equipment suppliers and manufacturers are investing in local service infrastructure to support growing testing requirements and technology adoption.

Germany is projected to reach USD 35.6 million by 2035, supported by the country's leadership in pharmaceutical quality control and advanced packaging material development requiring sophisticated testing systems for barrier property characterization and material qualification applications. German manufacturers implement high-quality testing programs that support advanced measurement specifications, operational reliability, and comprehensive quality documentation. The market is characterized by focus on measurement precision, method validation standards, and compliance with stringent pharmaceutical and packaging industry regulations.

Brazil is growing to reach USD 34.5 million by 2035, driven by pharmaceutical manufacturing expansion and food packaging development creating constant opportunities for testing equipment suppliers serving both multinational pharmaceutical operations and domestic packaging material producers. The country's expanding pharmaceutical contract manufacturing sector and growing food processing capabilities are creating demand for testing technologies that support diverse barrier measurement requirements while maintaining performance standards. Manufacturers and quality control organizations are developing procurement strategies to support testing capability enhancement and regulatory compliance program implementation.

The United States is projected to reach USD 60.2 million by 2035, expanding at a CAGR of 4.6%, driven by pharmaceutical packaging validation and food packaging quality control supporting comprehensive testing programs and advanced measurement capabilities. The country's extensive pharmaceutical manufacturing infrastructure and established packaging industry capabilities are creating demand for permeability analyzers that support operational efficiency and regulatory compliance standards. Testing equipment manufacturers and suppliers are maintaining comprehensive validation support capabilities to serve diverse quality control requirements.

What is the market split by country in Europe?

The water vapor permeability analyzers market in Europe is projected to grow from USD 162.2 million in 2025 to USD 259.4 million by 2035, registering a CAGR of 4.8% over the forecast period. Germany is expected to maintain its leadership position with a 34.2% market share in 2025, declining slightly to 33.6% by 2035, supported by its advanced pharmaceutical manufacturing infrastructure and comprehensive packaging material testing facilities concentrated in North Rhine-Westphalia and Bavaria regions.

The United Kingdom follows with a 23.8% share in 2025, projected to reach 24.3% by 2035, driven by comprehensive pharmaceutical quality control operations and packaging material research facilities. France holds a 18.6% share in 2025, expected to maintain 18.4% by 2035 with food packaging and pharmaceutical testing applications. Italy commands a 13.9% share, while Spain accounts for 6.7% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 2.8% to 3.4% by 2035, attributed to increasing permeability testing adoption in Nordic countries and emerging Eastern European pharmaceutical manufacturing operations implementing quality control standardization programs.

Japanese water vapor permeability analyzers operations reflect the country's exacting pharmaceutical quality standards and comprehensive packaging material testing protocols. Major pharmaceutical companies including Takeda and Daiichi Sankyo require rigorous equipment qualification procedures that exceed international standards, driving demand for permeability testing systems with validated measurement specifications. Organizations maintain comprehensive testing protocols and equipment calibration procedures supporting consistent quality control across pharmaceutical manufacturing operations.

The packaging material development sector demonstrates particular strength in applying advanced permeability testing to barrier film innovation, with companies implementing sophisticated measurement operations for high-barrier material characterization. Regulatory oversight through the Pharmaceuticals and Medical Devices Agency emphasizes comprehensive method validation and testing documentation that favors established equipment manufacturers with proven permeability measurement technologies.

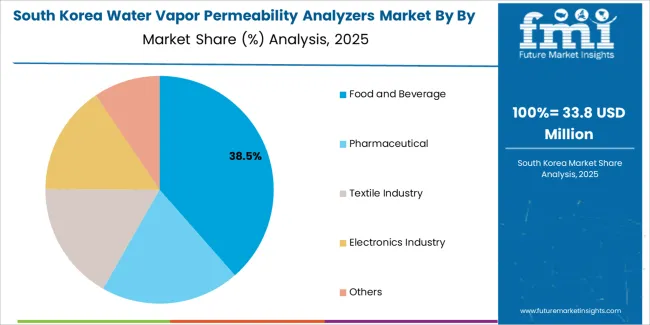

South Korean water vapor permeability analyzers operations reflect the country's pharmaceutical manufacturing development and comprehensive packaging material production capabilities. Major pharmaceutical companies including Celltrion and Samsung Biologics implement sophisticated testing procurement strategies supporting both drug product packaging qualification and quality control operations targeting international regulatory standards. Organizations are investing in advanced permeability analyzer systems to enhance operational efficiency while meeting global pharmaceutical and packaging specifications.

The electronics packaging sector drives demand for ultra-low permeability testing systems capable of supporting OLED display barrier film qualification and flexible electronics packaging development. Korean manufacturers prioritize equipment suppliers with comprehensive technical support capabilities and established calibration service systems supporting consistent measurement performance across high-precision quality control operations.

Market dynamics favor established testing equipment manufacturers with proven permeability measurement expertise and comprehensive pharmaceutical industry relationships supporting packaging qualification and quality control operations. Value concentration occurs around validated testing systems capable of delivering precise measurement accuracy with regulatory acceptance, creating barriers for new entrants lacking pharmaceutical certification credentials and method validation documentation. Several competitive archetypes dominate market positioning: global analytical instrument companies leveraging broad testing equipment portfolios and established pharmaceutical relationships across packaging and material testing segments; specialized permeability analyzer manufacturers offering focused measurement solutions with advanced performance characteristics in barrier property testing; regional testing equipment suppliers providing localized technical support and cost-competitive solutions for emerging market quality control operations; and innovative measurement technology developers creating next-generation testing platforms with enhanced automation capabilities.

Switching costs remain elevated due to equipment qualification requirements, method validation procedures, and established testing protocols that favor incumbent suppliers in conservative pharmaceutical industries. Technology transitions toward automated testing systems and multi-methodology platforms create opportunities for suppliers offering operational efficiency advantages and testing throughput benefits, while pharmaceutical regulatory requirements and method validation complexity slow adoption in risk-averse quality control environments. Consolidation pressure increases as larger analytical instrument companies acquire specialized permeability testing manufacturers to expand material characterization capabilities and strengthen pharmaceutical industry market positions.

Strategic positioning requires comprehensive method validation support and proven measurement accuracy across diverse packaging materials, particularly for pharmaceutical container closure testing and high-barrier material qualification programs. Technical support capabilities and application expertise services become critical differentiation factors as laboratories prioritize measurement reliability and regulatory compliance in critical quality control operations. Market share stability depends on maintaining pharmaceutical industry acceptance and regulatory method recognition while adapting permeability testing technologies to emerging automation requirements and high-throughput testing demands without disrupting established quality control workflows or requiring extensive revalidation investments.

| Items | Values |

|---|---|

| Quantitative Units | USD 0.7 billion |

| Measurement Method | Infrared Method, Gravimetric Method, Electrolytic Method |

| Application | Food and Beverage, Pharmaceutical, Textile Industry, Electronics Industry, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, and other 40+ countries |

| Key Companies Profiled | Ametek Mocon, Qualitest, Gintronic Instruments, TESTEX, TOYOSEIKI, Techlab Systems, Testron Group, Industrial Physics (Systech), Poretech, Hexa Plast, IDM Instruments, Jinan Labthink Instruments, Paratronix Instruments, Jinan Saicheng Electronic Technology, Shandong Drick Instruments, Hefei Fanyuan Instrument, Guangzhou Biaoji Packaging Equipment, GESTER International, Guangzhou Labstone, Jinan Pubtester Instruments, Guangzhou Shounuo Scientific Instrument, Shandong Qktester, Jinan SYSTESTER Instruments, Suzhou Atomic Instruments |

| Additional Attributes | Dollar sales by measurement method and application, regional demand across NA, EU, APAC, competitive landscape, pharmaceutical quality control adoption patterns, packaging material testing integration, and measurement methodology optimization initiatives driving barrier property characterization, operational efficiency, and regulatory compliance standards |

By Measurement Method

The global water vapor permeability analyzers market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the water vapor permeability analyzers market is projected to reach USD 1.1 billion by 2035.

The water vapor permeability analyzers market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in water vapor permeability analyzers market are infrared method, gravimetric method and electrolytic method.

In terms of by application, food and beverage segment to command 39.6% share in the water vapor permeability analyzers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA