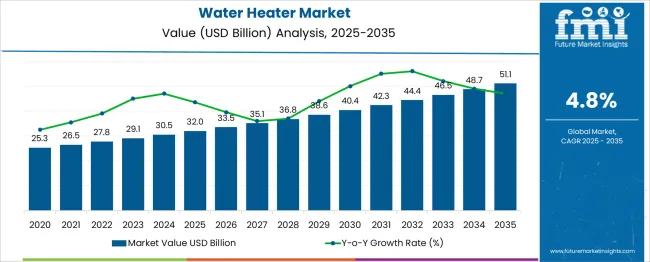

The global water heater market is anticipated to grow from USD 31.9 billion in 2025 to approximately USD 54 billion by 2035, recording an absolute increase of USD 19.1 billion over the forecast period. This translates into a total growth of 59.8%, with the market forecast to expand at a CAGR of 4.8% between 2025 and 2035. The market size is expected to grow by nearly 1.6X during the same period, supported by increasing urbanization, rising disposable income, growing demand for energy-efficient solutions, and expanding residential and commercial construction activities.

Quick Stats for Water Heater Market

Between 2025 and 2030, the water heater market is projected to expand from USD 31.9 billion to USD 42.3 billion, resulting in a value increase of USD 10.4 billion, which represents 51.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising consumer awareness about energy efficiency, increasing demand for smart and connected water heating solutions, and growing penetration of renewable energy-based water heaters in emerging markets. Manufacturers are expanding their product portfolios to address the growing demand for environmentally friendly and cost-effective water heating solutions.

| Metric | Value |

| Estimated Value in (2025E) | USD 31.9 billion |

| Forecast Value in (2035F) | USD 54 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

From 2030 to 2035, the market is forecast to grow from USD 42.3 billion to USD 54.0 billion, adding another USD 8.7 billion, which constitutes 45.5% of the ten-year expansion. This period is expected to be characterized by expansion of smart water heating technologies, integration of IoT and energy management systems, and development of hybrid and heat pump water heater solutions. The growing adoption of green building practices and energy-efficient appliances will drive demand for premium water heaters with enhanced performance and environmental benefits.

Between 2020 and 2025, the water heater market experienced steady expansion, driven by increasing construction activities, urbanization trends, and growing awareness of energy-efficient heating solutions. The market developed as manufacturers recognized the need for innovative water heating technologies to address rising energy costs, environmental regulations, and consumer demand for reliable hot water supply. Government incentives and energy efficiency programs began emphasizing the importance of high-performance water heaters in residential and commercial applications.

Market expansion is being supported by the increasing global population, rapid urbanization, and rising standard of living, which collectively drive demand for reliable hot water supply in residential and commercial buildings. Modern consumers are increasingly focused on energy-efficient appliances that can reduce utility costs while providing consistent performance. The growing emphasis on environmental protection is driving demand for eco-friendly water heating solutions such as solar, heat pump, and hybrid systems.

The expanding construction industry, particularly in emerging economies, is creating substantial demand for water heating equipment in new residential and commercial developments. Consumer preference for smart and connected appliances that offer remote monitoring, scheduling, and energy optimization features is creating opportunities for innovative product offerings. The rising influence of government regulations promoting energy efficiency and the phase-out of inefficient water heating systems is also contributing to increased product adoption and replacement demand across different markets.

The market is segmented by capacity, product, technology, application, and region. By capacity, the market is divided into 30-100 liters, below 30 liters, 100-250 liters, 250-400 liters, and above 400 liters. Based on product, the market is categorized into storage and tankless water heaters. In terms of technology, the market is segmented into electric, solar, gas, and hybrid systems. By application, the market is classified into residential, commercial, and industrial sectors. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

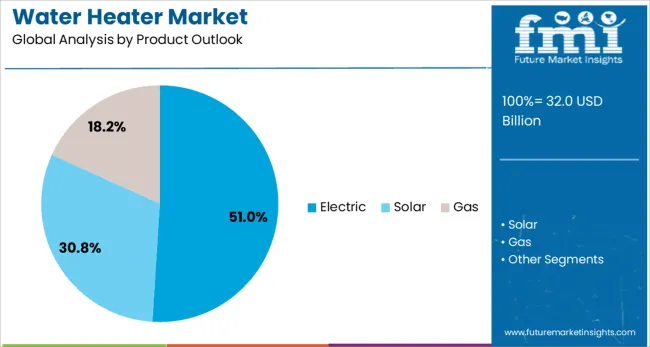

The electric water heater technology is projected to account for 54% of the water heater market in 2025, reaffirming its position as the most widely adopted heating technology. Electric water heaters offer several advantages including easy installation, consistent performance, lower upfront costs, and compatibility with existing electrical infrastructure. The segment benefits from continuous technological improvements in heating elements, insulation materials, and energy efficiency features.

This technology forms the foundation of most residential applications, as it provides reliable hot water supply with minimal maintenance requirements. The growing availability of renewable electricity sources and smart grid integration capabilities continue to strengthen the appeal of electric water heaters. With increasing focus on energy efficiency and smart home integration, electric water heaters equipped with advanced controls and connectivity features align with modern consumer preferences, making them the central growth driver of water heater demand globally.

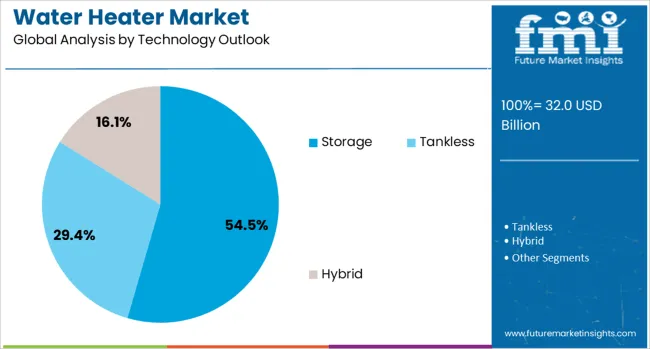

Storage water heaters are projected to represent 51% of water heater demand in 2025, underscoring their role as the preferred solution for consistent hot water supply. Consumers gravitate toward storage systems for their ability to provide large volumes of hot water on demand, cost-effectiveness, and reliability in various climate conditions. Storage water heaters offer the advantage of maintaining hot water reserves, ensuring availability during peak usage periods.

The segment is supported by continuous improvements in tank insulation, heating efficiency, and corrosion resistance technologies. Additionally, manufacturers are increasingly incorporating smart controls, leak detection systems, and energy-saving features that enhance appeal and justify premium pricing. As consumers prioritize reliability and consistent performance, storage water heaters continue to dominate demand, particularly in residential applications where hot water usage patterns vary throughout the day.

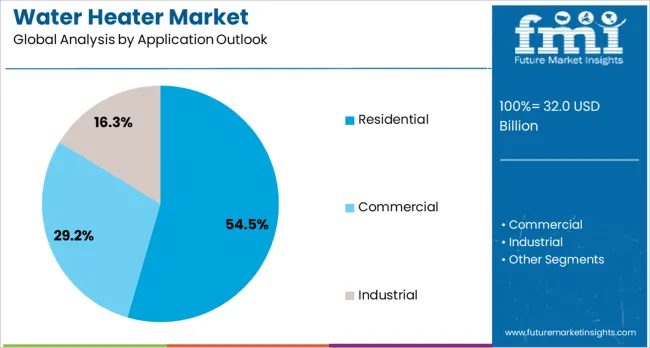

The residential application is forecasted to contribute 54% of the water heater market in 2025, reflecting the fundamental need for hot water in households worldwide. Residential demand is driven by new housing construction, replacement of aging water heaters, and upgrading to more efficient systems. This segment benefits from increasing disposable income, changing lifestyle preferences, and growing awareness of energy-efficient appliances.

The residential segment also benefits from government incentives and rebate programs that encourage homeowners to replace older, less efficient water heaters with modern, energy-saving models. With rising energy costs and environmental consciousness, residential consumers are increasingly willing to invest in premium water heating solutions that offer long-term operational savings and environmental benefits, making residential applications the primary driver of market growth.

The water heater market is advancing steadily due to increasing urbanization, growing construction activities, and rising demand for energy-efficient heating solutions. However, the market faces challenges including high initial costs for advanced systems, installation complexity for certain technologies, and competition from alternative heating solutions. Innovation in smart technologies and renewable energy integration continue to influence product development and market expansion patterns.

The growing adoption of IoT technology and smart home systems is enabling manufacturers to develop intelligent water heaters with remote monitoring, scheduling, and energy optimization capabilities. Smart water heaters offer features such as leak detection, maintenance alerts, and energy usage tracking that provide value to consumers while reducing operational costs. Mobile applications and cloud connectivity allow users to control their water heaters remotely and receive real-time performance data.

Modern water heater manufacturers are incorporating renewable energy sources such as solar thermal collectors and heat pump technology to enhance energy efficiency and reduce operating costs. Hybrid systems that combine multiple heating technologies provide optimal performance across different weather conditions and usage patterns. These technologies improve system efficiency while reducing environmental impact and utility costs for end users.

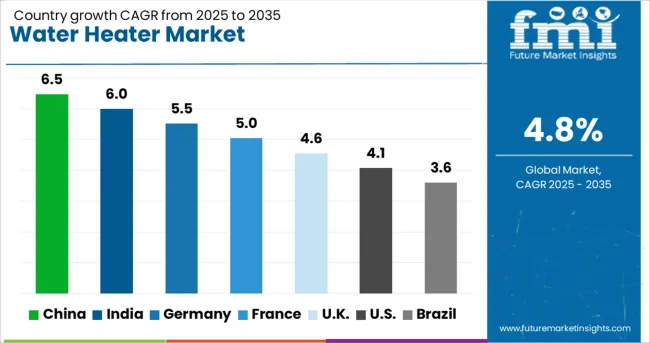

| Country | CAGR (2025-2035) |

| China | 6.4% |

| India | 6 % |

| Germany | 5.5% |

| France | 5 % |

| UK | 4.5% |

| U.S. | 4 % |

The water heater market is experiencing robust growth globally, with China leading at a 6.4% CAGR through 2035, driven by massive urbanization, construction boom, and government support for energy-efficient appliances. India follows closely at 6 %, supported by rising middle-class population, increasing disposable income, and expanding infrastructure development. Germany shows steady growth at 5.5%, emphasizing renewable energy integration and advanced heating technologies. France records 5 %, focusing on energy efficiency regulations and smart home adoption. The UK demonstrates 4.5% growth, prioritizing replacement demand and energy-efficient solutions.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from water heaters in China is projected to exhibit strong growth with a CAGR of 6.4% through 2035, driven by massive urbanization, extensive construction activities, and growing middle-class population demanding modern amenities. The country's rapid infrastructure development and government initiatives promoting energy-efficient appliances are creating significant demand for water heating solutions. Major domestic and international manufacturers are establishing comprehensive production and distribution networks to serve the expanding market.

Revenue from water heaters in India is expanding at a CAGR of 6.0%, supported by rapid urbanization, increasing disposable income, and growing awareness of modern home appliances. The country's young demographic profile and expanding middle class are driving demand for reliable water heating solutions. International manufacturers and domestic companies are establishing production facilities and distribution channels to serve the growing demand for affordable and efficient water heaters.

Opportunities and Trends in Water Heaters in the U.S.

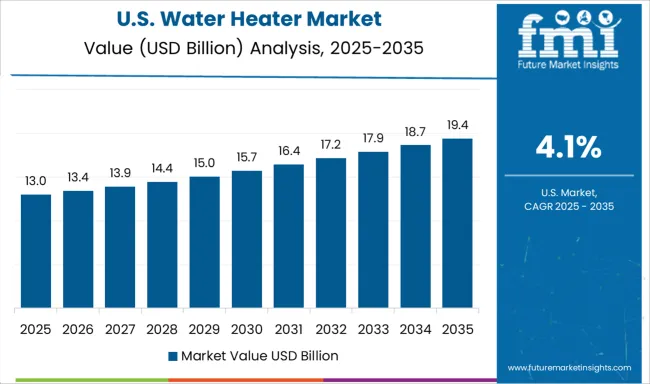

Demand for water heaters in the U.S. is projected to grow at a CAGR of 4.0%, supported by replacement demand for aging infrastructure, consumer preference for energy-efficient appliances, and growing adoption of smart home technologies. American consumers are increasingly focused on reducing utility costs, improving energy efficiency, and integrating connected appliances into their homes. The market is characterized by strong demand for high-performance systems that combine reliability with advanced features.

Revenue from water heaters in Germany is projected to grow at a CAGR of 5.5% through 2035, driven by the country's strong focus on energy efficiency and advanced heating technologies. German consumers consistently demand high-quality, durable products that deliver superior performance while minimizing environmental impact. The market benefits from strict energy efficiency standards and consumer willingness to invest in premium heating solutions.

Revenue from water heaters in the UK is projected to grow at a CAGR of 4.5% through 2035, supported by replacement demand, energy efficiency regulations, and growing consumer awareness of operational cost savings. British consumers value energy efficiency, reliability, and positioning high-efficiency water heaters as essential components of modern homes and buildings.

Revenue from water heaters in France is projected to grow at a CAGR of 5.0% through 2035, supported by energy efficiency regulations, renewable energy integration, and consumer preference for heating solutions. French consumers prioritize energy efficiency and environmental responsibility, making advanced water heating technologies attractive for both new installations and replacement applications.

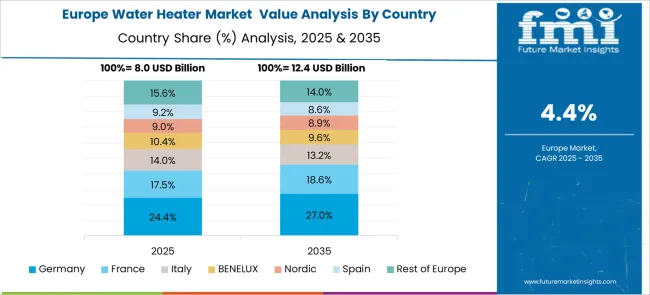

The European water heater market demonstrates sophisticated development across major economies with Germany leading through its precision engineering excellence and advanced heating technology capabilities, supported by companies like Bosch Thermotechnology Corp. pioneering comprehensive water heating solutions with focus on energy efficiency, renewable energy integration, and environmental consciousness while emphasizing superior performance and regulatory compliance. The UK shows strength in energy efficiency regulations and smart home adoption, with companies specializing in high-efficiency water heating systems that meet strict energy standards and provide consistent performance outcomes across residential applications.

France contributes through companies delivering integrated water heating solutions and heating technologies for residential and commercial applications. Italy and Spain demonstrate growth in specialized heating systems for diverse climate conditions. The market benefits from stringent EU energy efficiency regulations, established manufacturing infrastructure, and growing emphasis on renewable energy integration positioning Europe as key center for advanced water heating technologies.

The Japanese water heater market demonstrates steady growth driven by precision manufacturing focus, advanced heating technologies, and consumer preference for high-quality water heating systems ensuring superior energy efficiency and reliability throughout residential and commercial operations. International companies establish presence through cutting-edge heating technologies aligning with Japan's sophisticated appliance industry and stringent quality standards while incorporating smart home integration and automated control capabilities.

The market emphasizes automated control systems, precision heating excellence, and advanced energy efficiency innovations reflecting Japanese manufacturing precision and attention to detail in appliance production processes. Growing investment in smart home technologies supports intelligent water heating systems with real-time monitoring, predictive maintenance, and optimized energy performance. Japanese consumers prioritize product reliability, consistent performance outcomes, and energy efficiency, creating opportunities for premium water heating solutions delivering exceptional performance across residential, commercial, and industrial applications requiring highest quality standards.

The South Korean water heater market shows exceptional growth potential driven by expanding construction industry, increasing adoption of smart home technologies, and growing consumer demand for energy-efficient appliances requiring advanced and reliable heating solutions. The market benefits from South Korea's technological advancement capabilities and increasing focus on energy efficiency competitiveness driving investment in modern water heating technologies meeting international performance standards and regulatory requirements.

Korean manufacturers increasingly adopt smart control systems, advanced heating technologies, and integrated energy management systems improving operational efficiency and user experience while ensuring safety compliance. Growing influence of Korean appliance brands in global markets supports demand for sophisticated water heating solutions ensuring quality performance while maintaining cost-effectiveness. Integration of IoT principles and smart home technologies creates opportunities for intelligent water heating systems with connectivity features, predictive maintenance capabilities, and real-time energy optimization across diverse residential and commercial applications.

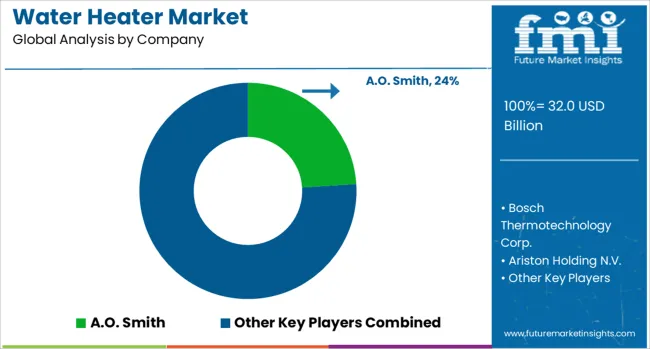

The water heater market is characterized by competition among established appliance manufacturers, specialty heating companies, and emerging technology providers. Companies are investing in advanced heating technologies, energy efficiency improvements, smart connectivity features, and manufacturing practices to deliver reliable, efficient, and appealing water heating solutions. Product innovation, energy performance, and distribution network expansion are central to strengthening market presence and consumer appeal.

A.O. Smith, U.S.-based, leads the market with significant global presence, offering comprehensive water heating solutions with focus on energy efficiency, durability, and advanced features. Bosch Thermotechnology Corp., Germany, provides high-quality heating systems with emphasis on European engineering and environmental consciousness. Ariston Holding N.V., Italy, delivers innovative water heating solutions with focus on design and energy efficiency. Rheem Manufacturing Company, U.S., focuses on residential and commercial water heating systems with advanced technology and reliability.

Rinnai America Corporation, U.S., specializes in tankless and high-efficiency water heating solutions with emphasis on space-saving and energy efficiency. Bradford White Corporation, U.S., offers commercial and residential water heaters with focus on durability and performance. Noritz America Corp, U.S., provides tankless water heating systems with advanced technology and compact design. Whirlpool, U.S., delivers consumer appliances including water heaters with focus on reliability and innovation.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 31.9 billion |

| Capacity | 30-100 Liters, Below 30 Liters, 100-250 Liters, 250-400 Liters, Above 400 Liters |

| Product | Storage, Tankless, Hybrid |

| Technology | Electric, Solar, Gas |

| Application | Residential, Commercial, Industrial |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | A.O. Smith, Bosch Thermotechnology Corp., Ariston Holding N.V., Rheem Manufacturing Company, Rinnai America Corporation, Bradford White Corporation, USA, Noritz America Corp, Whirlpool, Westinghouse Electric Corporation, Bajaj Electricals India, Haier Inc., Havells India Ltd., Lennox International Inc., FERROLI S.p.A, Transform SR Brands LLC. |

| Additional Attributes | Dollar sales by capacity and technology type, regional demand trends, competitive landscape, buyer preferences for energy efficiency versus cost, integration with smart home systems, innovations in heat pump technology, renewable energy integration, and manufacturing practices |

The global water heater market is estimated to be valued at USD 32.0 billion in 2025.

The market size for the water heater market is projected to reach USD 51.1 billion by 2035.

The water heater market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in water heater market are 30 - 100 liters, below 30 liters, 100 - 250 liters, 250 - 400 liters and above 400 liters.

In terms of product outlook, electric segment to command 51.0% share in the water heater market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Bucket Water Heater Market Analysis - Trends, Growth & Forecast 2025 to 2035

Instant Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Electric Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Industrial Solar Water Heaters Market Growth – Trends & Forecast 2025 to 2035

Commercial Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA