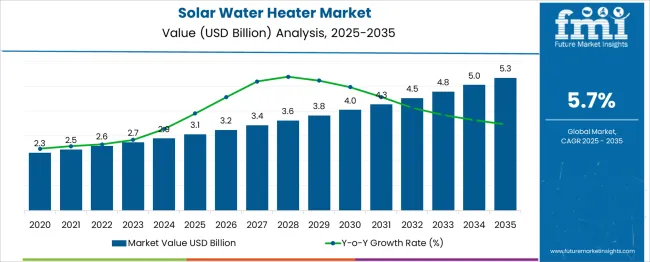

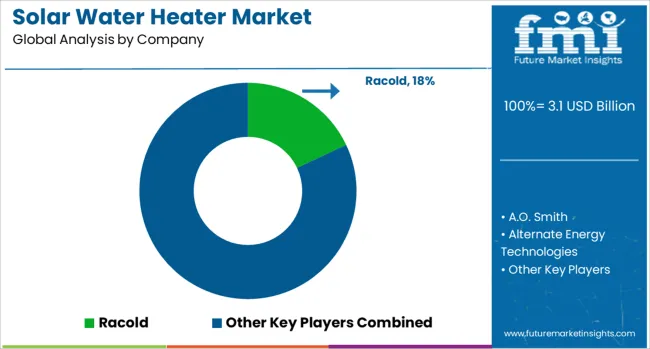

The Solar Water Heater Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. During the early phase from 2020 to 2025, the market value rises moderately from USD 2.3 billion to USD 2.9 billion, contributing about 20% of the total projected growth. This initial expansion is driven by increasing adoption of renewable energy technologies globally, growing government incentives and subsidies promoting solar thermal systems, and rising energy costs that encourage both residential and commercial sectors to seek energy-efficient alternatives.

Improving the efficiency, durability, and affordability of solar water heaters further supports demand in this period. Between 2026 and 2030, the market growth accelerates from USD 3.1 billion to USD 4.3 billion, propelled by heightened environmental awareness, stricter energy regulations, and rapid urbanization that boost demand for solar water heating solutions in emerging and developed economies alike. Enhanced product features such as smart control systems and the use of advanced materials improve performance and user convenience, driving wider adoption. The latter half of the forecast period, from 2031 to 2035, witnesses continued growth from USD 4.5 billion to USD 5.3 billion, supported by expanding industrial and institutional applications, ongoing technological innovation, and increased investments in renewable infrastructure. Market players focusing on cost optimization, innovative designs, and robust customer service are expected to gain a competitive advantage. The solar water heater market is positioned for sustained, long-term growth through 2035, fueled by global emphasis on energy efficiency, environmental, and renewable energy integration across sectors.

| Metric | Value |

|---|---|

| Solar Water Heater Market Estimated Value in (2025 E) | USD 3.1 billion |

| Solar Water Heater Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The solar water heater market is gaining significant momentum, driven by increasing energy costs, rising environmental concerns, and favorable government policies promoting renewable energy solutions. Growing adoption of energy-efficient appliances in both urban and semi-urban areas, coupled with awareness campaigns about solar-based alternatives, is positively influencing market demand.

Technological improvements in solar thermal systems and improved access to financing for rooftop installations are also supporting large-scale deployment. The market is further benefiting from integration into green building codes, carbon reduction mandates, and expanding rural electrification programs.

In emerging economies, the push for decentralized energy sources has made solar water heating a viable and affordable option for mass households.

The solar water heater market is segmented by collector, product application, and geographic regions. The collector of the solar water heater market is divided into Evacuated Tube, Flat Plate, and Unglazed Water. In terms of the product, the solar water heater market is classified into Thermosiphon-Pumped. Based on the application, the solar water heater market is segmented into Residential, Commercial, and Industrial. Regionally, the solar water heater industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

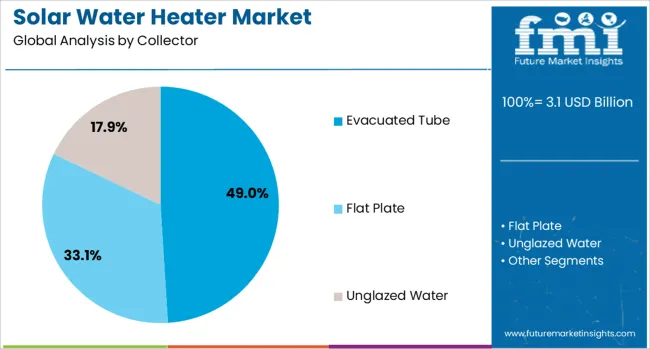

Evacuated tube collectors are projected to account for 49.00% of the total market share in 2025, making them the leading collector type in the solar water heater market. This dominance is driven by their higher thermal efficiency, performance in colder climates, and ability to function under diffused sunlight.

Their modular nature allows easy installation and scalability for both residential and institutional setups. Additionally, evacuated tubes offer better insulation and heat retention, improving energy savings over flat-plate alternatives.

These factors are enhancing their suitability across regions with variable weather and increasing their preference for off-grid applications.

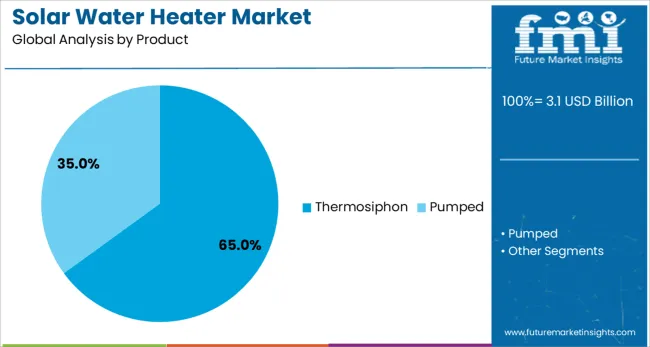

Thermosiphon systems are expected to dominate the product category with a 65.00% market share by 2025. Their popularity stems from simplicity, low maintenance, and absence of pumps or controllers, which makes them especially appealing for residential applications.

These passive systems operate through natural convection, reducing operational complexity and cost. Widely deployed in low-rise buildings, thermosiphon systems are increasingly being adopted in developing economies due to ease of use and reduced dependency on external energy sources.

Their compact design and compatibility with modular rooftops further support large-scale urban deployment.

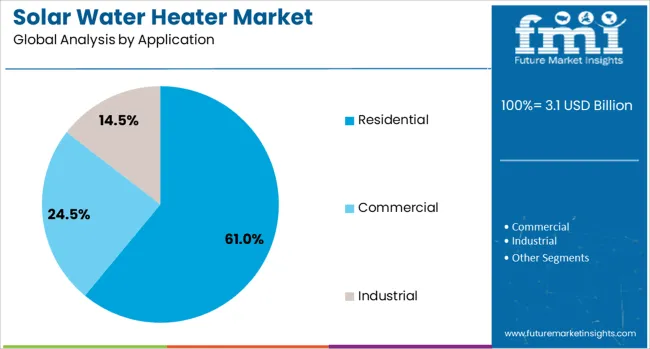

Residential applications are anticipated to capture 61.00% of the solar water heater market share by 2025, emerging as the dominant segment. This growth is being fueled by increasing household-level adoption of sustainable energy solutions, supported by government incentives, rebates, and energy credit programs.

Solar water heaters help reduce utility bills and offer long-term cost advantages, making them attractive for independent homes, housing societies, and multi-unit dwellings.

Rising disposable incomes, environmental awareness, and energy security concerns are accelerating the shift from electric geysers to solar thermal systems in residential spaces across both mature and emerging markets.

The solar water heater market is gaining traction through policy-driven adoption, efficiency improvements, and high-volume applications in residential and industrial sectors. Growing cost benefits and integration flexibility strengthen its future growth outlook.

The solar water heater market is witnessing rapid expansion across residential and commercial sectors due to increasing consumer preference for energy-efficient and cost-saving solutions. Residential installations dominate because of the demand for consistent hot water supply while minimizing electricity consumption. In the commercial space, applications in hotels, hospitals, and educational institutions are gaining traction, driven by the need to reduce operational energy costs. With governments enforcing renewable energy integration in building codes, solar water heating systems have become an attractive option. This trend is supported by easy financing schemes and rebates offered in many regions, which lower the financial burden of initial investments for both individual homeowners and large-scale establishments.

Government regulations and subsidy programs remain significant catalysts for solar water heater adoption globally. Policies mandating renewable energy systems in new constructions have accelerated integration in urban and semi-urban areas. Financial incentives, including tax credits and rebates, have made these systems more affordable for consumers. Public sector investment in awareness campaigns has also played a role in creating demand for solar water heating solutions. Moreover, various regional governments are providing interest-free loans and flexible financing options to make these systems viable for middle-income households. This regulatory push has strengthened market confidence and expanded the overall penetration rate of solar thermal technologies.

Improved design capabilities in flat plate collectors and evacuated tube systems have increased the operational efficiency of solar water heaters under varying weather conditions. These enhancements have made systems more suitable for colder regions and areas with intermittent sunlight, thus broadening the geographic scope of adoption. Advanced insulation techniques and improved heat transfer fluids now enable better heat retention, reducing energy losses significantly. Hybrid configurations, combining solar heating with auxiliary electric or gas heaters, are becoming popular to ensure uninterrupted hot water supply. Such developments cater to modern consumer requirements for reliability, durability, and performance consistency while reducing lifecycle operating costs.

The commercial and industrial sectors are emerging as strong demand drivers in the solar water heater market. Hotels, resorts, hospitals, and educational institutions require large volumes of hot water for daily operations, making solar water heating systems cost-effective over the long term. Similarly, industrial processes involving cleaning, food processing, and chemical treatment are increasingly integrating solar heating to lower dependence on fossil fuels and reduce energy costs. These sectors benefit from economies of scale, enabling quicker returns on investment. Moreover, as energy pricing volatility continues to affect operational budgets, industries are prioritizing renewable heating solutions to ensure long-term energy security and cost stability in production cycles.

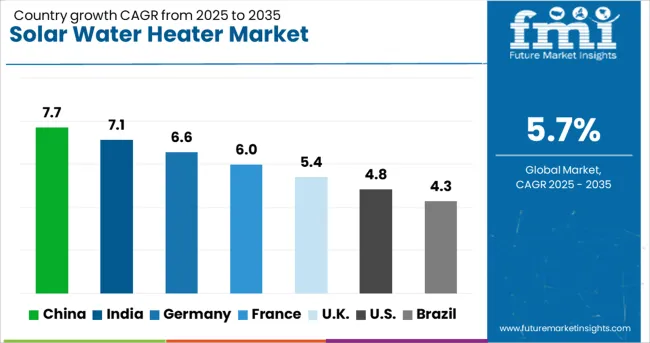

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The solar water heater market is projected to grow globally at a CAGR of 5.7% between 2025 and 2035, driven by policy support, cost-saving benefits, and integration of renewable energy solutions in residential and commercial buildings. China leads with a CAGR of 7.7%, supported by government incentives, large-scale urban housing projects, and strong penetration in rural areas. India follows at 7.1%, fueled by energy-saving programs, high solar irradiance, and financial subsidies for renewable water heating in both urban and semi-urban households. France posts a CAGR of 6.0%, driven by low-carbon transition goals and incentives promoting solar integration in public infrastructure. The United Kingdom grows at 5.4%, reflecting increasing adoption in commercial buildings and hybrid systems combining solar with auxiliary heating. The United States records 4.8%, as demand is influenced by state-level renewable energy mandates and energy efficiency rebate programs for residential and industrial users. The analysis spans over 40 global markets, with these six nations serving as reference points for strategic investments, policy-driven adoption, and technology innovations in the solar water heating sector.

China is expected to post a CAGR of 7.7% during 2025–2035, rising from nearly 6.8% in 2020–2024, reflecting consistent growth supported by policy-driven adoption and large-scale residential integration. The increase in CAGR highlights the impact of aggressive government initiatives, such as solar thermal installation mandates in new housing developments and rural electrification programs that incorporate solar water heating systems. Rapid urban development combined with rising awareness about energy cost savings is accelerating adoption in both residential and commercial sectors. Domestic manufacturers continue to expand production capacity while leveraging advanced evacuated tube technology to enhance system efficiency. This positions China as a leader in global solar water heating deployment.

India is projected to achieve a CAGR of 7.1% for 2025–2035, improving from approximately 6.3% during 2020–2024, driven by renewable energy targets and increasing emphasis on cost-effective heating solutions. The rise is attributed to government-backed programs under the Ministry of New and Renewable Energy, offering capital subsidies for solar water heating systems in households and institutional buildings. Growing demand from urban and semi-urban regions, coupled with favorable climatic conditions, further supports adoption. Industrial sectors using hot water in processes are integrating solar thermal solutions to lower energy bills. Expansion of e-commerce channels and local manufacturing has also contributed to better accessibility and affordability for consumers.

France is estimated to post a CAGR of 6.0% during 2025–2035, up from nearly 5.2% during 2020–2024, supported by strict EU directives promoting renewable energy integration in heating systems. This improvement reflects the growing adoption of solar thermal solutions in new housing and retrofitting projects aligned with national energy transition goals. Financial incentives under programs like MaPrimeRénov’ have accelerated household adoption, while commercial installations in hospitality and institutional facilities remain strong. Technological advances in hybrid solar systems combining auxiliary electric heating ensure reliable performance, enhancing consumer confidence. Rising public awareness of energy efficiency and reduced carbon heating solutions is expected to sustain long-term market penetration.

The United Kingdom is forecasted to grow at a CAGR of 5.4% between 2025–2035, an increase from nearly 4.6% during 2020–2024, marking gradual improvement as energy efficiency norms tighten across residential and commercial infrastructure. The upward shift results from government-led low-carbon heating programs, such as the Boiler Upgrade Scheme, which supports solar water heating adoption alongside other renewable solutions. Growing interest in hybrid configurations integrating solar thermal with heat pumps is improving the appeal of solar technologies in cold climate regions. The commercial sector, particularly healthcare and hospitality, continues to drive demand due to significant energy-saving potential, supported by green building certifications that favor renewable heating integration.

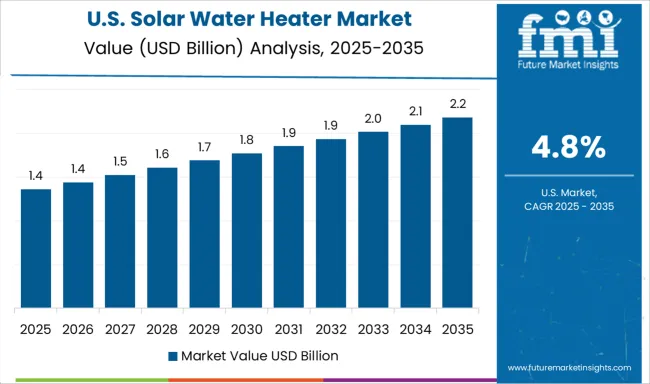

The United States is anticipated to post a CAGR of 4.8% during 2025–2035, up from roughly 4.0% in 2020–2024, demonstrating moderate growth supported by state-level incentives and inclusion of solar thermal in energy efficiency programs. Adoption is particularly strong in regions with high solar exposure such as California, Arizona, and Florida, where rebates and tax credits encourage installation. Commercial installations in hotels, fitness centers, and educational facilities remain steady due to consistent hot water demand. Integration of solar water heating systems with smart energy management platforms is emerging as a trend, enabling improved operational efficiency. These factors collectively strengthen the market outlook despite competition from electric and gas-based water heaters.

The solar water heater market is highly competitive, shaped by established manufacturers and regional specialists such as Racold, A.O. Smith, Alternate Energy Technologies, Bosch Thermotechnology, Bradford White Corporation, Chromagen Australia, EMMVEE SOLAR, GE Appliances, Himin Solar, Rheem Manufacturing Company, SUNPAD, SunTank, Viessmann, and V-Guard Industries. These companies compete by offering diverse product portfolios including flat plate collectors, evacuated tube systems, and integrated solutions tailored for residential, commercial, and industrial applications. Racold and A.O. Smith dominate the domestic water heating segment with premium energy-efficient models backed by strong distribution networks. Bosch Thermotechnology and Viessmann leverage advanced engineering to provide high-efficiency systems suited for both European and emerging markets. Bradford White and Rheem Manufacturing maintain leadership in North America by offering hybrid solar solutions combining auxiliary heating systems.

Himin Solar, a key player in Asia, focuses on large-scale installations and cost-effective designs to cater to high-volume demand. EMMVEE SOLAR and V-Guard Industries strengthen their presence in India through affordable systems designed for tropical climates. SUNPAD and SunTank emphasize innovation in storage tank designs for better thermal performance. Competitive strategies include partnerships with construction firms for integrating solar water heaters into green building projects, after-sales service optimization, and localization of manufacturing to reduce costs. Future success will depend on companies’ ability to align with energy-efficiency regulations, enhance smart integration capabilities, and provide affordable yet high-performance solutions for diverse climatic conditions, ensuring strong market positioning in a rapidly evolving renewable heating landscape.

In July 2024, Bosch Thermotechnology announced the acquisition of the residential and light commercial HVAC business from Johnson Controls and Hitachi. Bosch aims to integrate these into its Home Comfort Group, expanding its water heating and thermal solutions portfolio

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Collector | Evacuated Tube, Flat Plate, and Unglazed Water |

| Product | Thermosiphon and Pumped |

| Application | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Racold, A.O. Smith, Alternate Energy Technologies, Bosch Thermotechnology, Bradford White Corporation, Chromagen Australia, EMMVEE SOLAR, GE Appliances, Himin Solar, Rheem Manufacturing Company, SUNPAD, SunTank, Viessmann, and V-Guard Industries |

| Additional Attributes | Dollar sales, share by product type and region, competitive landscape, pricing trends, regulatory incentives, technology adoption, distribution models, demand forecasts, and growth opportunities across residential and commercial sectors. |

The global solar water heater market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the solar water heater market is projected to reach USD 5.3 billion by 2035.

The solar water heater market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in solar water heater market are evacuated tube, flat plate and unglazed water.

In terms of product, thermosiphon segment to command 65.0% share in the solar water heater market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Solar Water Heaters Market Growth – Trends & Forecast 2025 to 2035

Solar Module Recycling Service Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracking Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Recycling Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Panel Recycling Management Market Size and Share Forecast Outlook 2025 to 2035

Solar Photovoltaic (PV) Market Size and Share Forecast Outlook 2025 to 2035

Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered UAV Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA