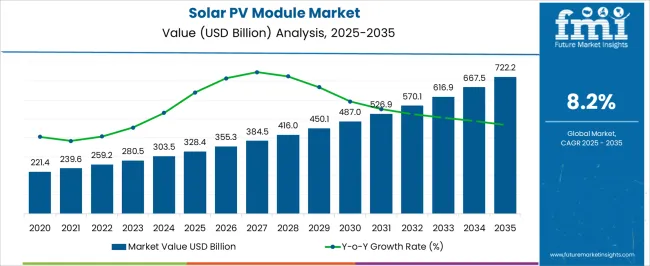

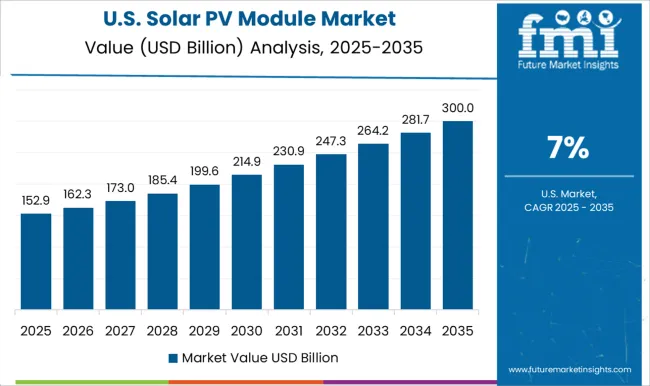

The solar PV module market is set for notable growth, with projections estimating an increase from USD 328.4 billion in 2025 to USD 722.2 billion by 2035, reflecting a strong compound annual growth rate (CAGR) of 8.2%. This expansion signals an ongoing shift toward solar energy as a dominant source of power. The market is expected to benefit from continued global interest in renewable energy, with governments and the private sector driving demand for large-scale solar installations.

With increased awareness around energy independence, coupled with rising electricity costs, solar PV modules are emerging as a reliable solution, propelling substantial market growth over the next decade. As demand for clean energy continues to intensify, the solar PV module market will experience accelerated adoption rates. The market’s 5-year growth block from 2025 to 2030, showing consistent increases, indicates that the industry will see incremental, yet significant, growth in key regions such as Asia-Pacific and Europe. Over the coming years, the market is likely to witness further commercial investments, especially in utility-scale solar farms, as well as residential and commercial adoption. Given the rising economic viability and government incentives, solar PV modules are expected to increasingly replace fossil-fuel-based power generation, which will contribute to the long-term success of the market.

| Metric | Value |

|---|---|

| Solar PV Module Market Estimated Value in (2025 E) | USD 328.4 billion |

| Solar PV Module Market Forecast Value in (2035 F) | USD 722.2 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The solar PV module market holds a prominent share within its parent industries, driven by the demand for renewable energy sources and the push for cleaner electricity generation. Within the renewable energy market, solar PV modules account for approximately 40–45% share, as they are one of the most widely deployed technologies in solar power generation. In the solar power generation market, the segment represents around 55–60%, as PV modules are the core component in converting sunlight into electricity. Within the energy storage systems market, solar PV modules contribute about 12–15%, since storage solutions often complement solar installations, allowing for energy supply even when sunlight is unavailable. In the photovoltaic materials market, the share of solar PV modules is about 30–35%, as they rely heavily on specialized materials like silicon to optimize efficiency and performance. Within the broader electrical equipment market, solar PV modules account for approximately 8–10%, reflecting their growing adoption in residential, commercial, and utility-scale installations. While challenges such as cost, grid integration, and intermittent power generation remain, the solar PV module market continues to benefit from favorable policy support, cost reductions, and growing environmental concerns. From my perspective, solar PV modules have not only reshaped the renewable energy landscape but also set the foundation for long-term growth in decentralized and distributed energy systems, ensuring their pivotal role in the global energy transition.

The solar PV module market is experiencing sustained expansion, driven by accelerating renewable energy adoption, declining module production costs, and supportive government policies for clean power generation. Energy transition reports and solar industry publications have emphasized that technological advancements in efficiency, combined with large-scale manufacturing capabilities, are making solar power increasingly cost-competitive with conventional energy sources.

Global climate commitments and carbon neutrality targets have further spurred investments in utility-scale and distributed solar projects. Financing innovations and improved supply chain resilience have facilitated wider adoption across both developed and emerging markets.

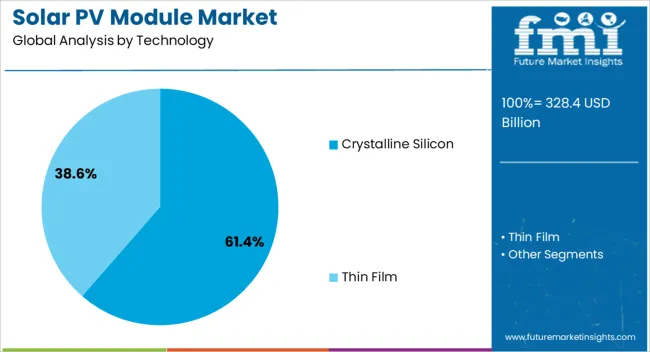

Additionally, continuous improvements in module durability, temperature tolerance, and power output are enhancing long-term performance, strengthening market confidence. The market outlook remains optimistic, supported by rising demand from residential, commercial, and industrial sectors, with crystalline silicon technology, monocrystalline products, and on-grid systems positioned to lead segmental growth due to their efficiency, scalability, and integration potential with modern energy infrastructures.

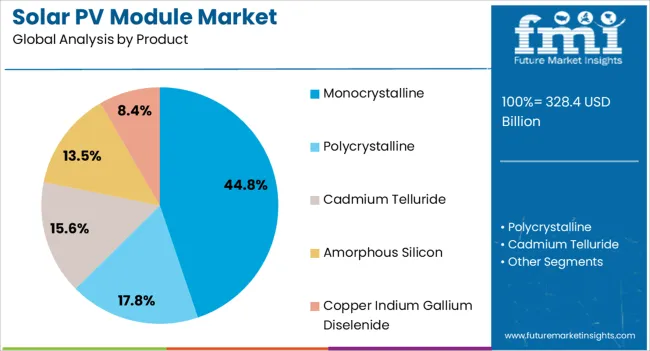

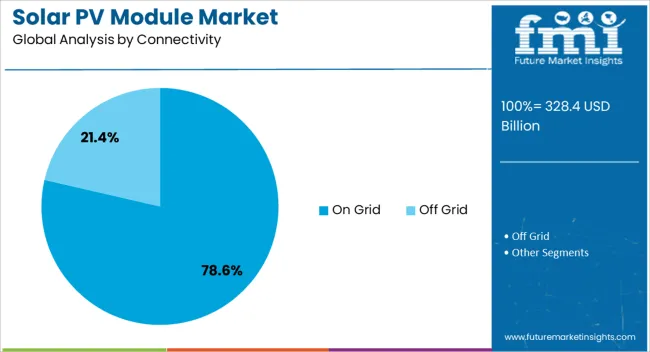

The solar pv module market is segmented by technology, product, connectivity, mounting, end use, and geographic regions. By technology, solar pv module market is divided into Crystalline Silicon and Thin Film. In terms of product, solar pv module market is classified into Monocrystalline, Polycrystalline, Cadmium Telluride, Amorphous Silicon, and Copper Indium Gallium Diselenide. Based on connectivity, solar pv module market is segmented into On Grid and Off Grid. By mounting, solar pv module market is segmented into Ground Mounted and Roof Top. By end use, solar pv module market is segmented into Utility, Residential, and Commercial & Industrial. Regionally, the solar pv module industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The crystalline silicon segment is projected to hold 61.40% of the solar PV module market revenue in 2025, maintaining its dominance owing to its proven efficiency, reliability, and wide-scale manufacturing adoption. Industry assessments have highlighted that crystalline silicon modules offer higher energy conversion rates and long operational lifespans, making them a preferred choice for both rooftop and utility-scale installations.

Established global supply chains and extensive research into silicon cell optimization have driven cost reductions and improved module performance.

Additionally, compatibility with diverse climatic conditions and resistance to environmental degradation have reinforced their market position. As economies of scale in production continue to lower per-watt costs, crystalline silicon technology is expected to remain the benchmark for commercial and residential solar projects, sustaining its leadership in the market.

The monocrystalline segment is projected to account for 44.80% of the solar PV module market revenue in 2025, leading the product category due to its superior efficiency and aesthetic appeal. Monocrystalline modules are manufactured from single-crystal silicon, enabling higher electron mobility and resulting in better energy output per unit area compared to polycrystalline alternatives.

This makes them particularly suitable for space-constrained installations, where maximizing power density is critical. Industry data has shown growing adoption in residential and commercial sectors where efficiency and design integration are key decision factors.

Furthermore, technological advancements in passivated emitter rear cell (PERC) and bifacial monocrystalline modules have enhanced performance under low-light and diffuse conditions. These benefits, combined with longer warranties and proven durability, are expected to support continued market leadership for monocrystalline products.

The on-grid segment is projected to contribute 78.60% of the solar PV module market revenue in 2025, holding the largest share due to its integration with existing electricity distribution networks and favorable policy incentives. On-grid solar systems allow users to offset electricity costs through net metering schemes and feed-in tariffs, making them financially attractive to both residential and commercial customers.

Government-backed renewable energy targets and infrastructure development have expanded grid connectivity, facilitating large-scale deployment. Utility-scale solar farms, a major driver of installed capacity, predominantly use on-grid configurations for centralized power distribution.

The reliability of grid-tied systems, along with reduced need for costly battery storage in many regions, has further boosted adoption. As urban and industrial power demands grow alongside clean energy commitments, on-grid solar PV systems are expected to sustain their market dominance.

The solar PV module market is growing due to increasing demand for renewable energy and energy security. Opportunities are found in off-grid and hybrid energy systems, while trends focus on efficiency and longer lifespans. Challenges include raw material shortages and fierce competition. The market remains poised for continued expansion, driven by the need for reliable, cost-effective solar solutions, along with innovations aimed at improving module efficiency and lifespan.

The solar PV module market is experiencing rapid growth, driven by the increasing adoption of renewable energy sources worldwide. As nations aim to reduce dependence on fossil fuels and enhance energy security, solar energy has emerged as a viable solution. This surge in demand is particularly evident in residential, commercial, and utility-scale solar installations, where PV modules provide reliable, cost-effective energy generation. The global push for energy diversification is expected to continue driving the demand for solar PV modules, especially in markets with high solar potential.

Significant opportunities are emerging in off-grid and hybrid energy systems. As access to reliable electricity remains a challenge in many rural and remote areas, solar PV modules are being increasingly deployed as part of off-grid power solutions. These applications provide an affordable, independent power supply, especially in regions with limited infrastructure. Additionally, hybrid energy systems, combining solar with other sources like wind or batteries, present a growing market for PV modules, offering a versatile energy mix for diverse needs.

A key trend in the solar PV module market is the increasing focus on higher efficiency and extended product lifespans. Manufacturers are investing in new materials, such as bifacial solar cells, that can capture more sunlight and improve overall energy output. Consumers are also seeking longer warranties, ensuring that their investment in solar energy delivers reliable returns. This trend towards higher efficiency is driving the development of next-generation solar modules, meeting the needs of both residential and commercial installations, while offering better long-term value.

The solar PV module market faces challenges such as raw material shortages and intense competition. Key materials like silicon and rare earth metals are subject to supply fluctuations, affecting the overall production costs of PV modules. These supply chain disruptions can lead to price volatility, impacting manufacturers and end-users. Furthermore, the competitive landscape is intensifying, with multiple players vying for market share, which can sometimes lead to price wars and reduced profitability. Manufacturers need to address these issues through efficient resource management and differentiation.

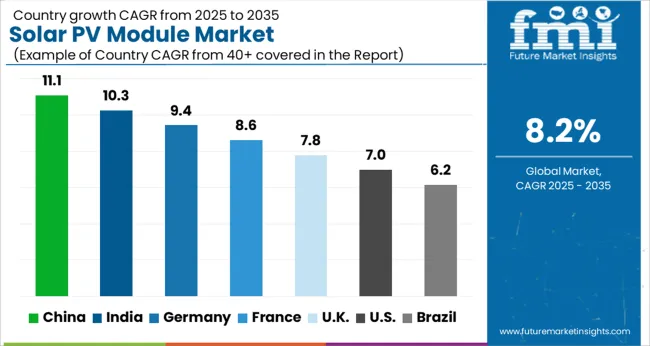

| Countries | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The global solar PV module market is projected to grow at a CAGR of 8.2% from 2025 to 2035. China leads with a growth rate of 11.1%, followed by India at 10.3% and France at 8.6%. The United Kingdom records a growth rate of 7.8%, while the United States shows the slowest growth at 7%. The expansion is supported by government incentives for renewable energy, increasing energy storage capacity, and a global shift towards cleaner energy sources. Emerging markets like China and India benefit from aggressive solar installations, favorable government policies, and rapidly growing energy needs. In contrast, more mature markets such as the USA and UK focus on improving efficiency and integrating solar energy with grid systems. This report includes insights on 40+ countries; the top markets are highlighted for reference.

The solar PV module market in China is projected to grow at a CAGR of 11.1%. China continues to lead the global solar energy market, driven by aggressive renewable energy targets, government subsidies, and large-scale solar installations. The country’s massive energy demand and commitment to reducing carbon emissions are key drivers of the solar PV module market’s expansion. Moreover, China’s extensive solar manufacturing base and investment in research and development are fostering innovation, making the country a significant player in the solar energy sector.

The solar PV module market in India is expected to grow at a CAGR of 10.3%. India’s rapid adoption of solar energy is driven by a rising demand for electricity, government-led initiatives like the National Solar Mission, and the push for cleaner energy sources. The country is investing heavily in solar power infrastructure, with substantial growth in both large-scale solar projects and rooftop installations. India’s commitment to meeting renewable energy targets, along with the decreasing cost of solar technology, is contributing to market expansion.

The solar PV module market in France is projected to grow at a CAGR of 8.6%. France’s increasing focus on renewable energy, particularly solar, is supported by favorable government policies, subsidies, and a strong commitment to achieving carbon neutrality. The country is also investing in smart grid technologies, enabling more efficient integration of solar energy into the national grid. France’s expanding solar capacity, particularly in the residential and commercial sectors, is set to contribute to further growth in the market.

The solar PV module market in the United Kingdom is expected to grow at a CAGR of 7.8%. The UK has been steadily increasing its renewable energy capacity, with solar PV modules playing a significant role in the transition to cleaner energy. Government incentives, green energy policies, and a focus on reducing carbon emissions have led to increased adoption of solar technologies. The shift toward decentralized energy generation and rising consumer interest in energy independence is also contributing to growth in the solar PV module market.

The solar PV module market in the United States is projected to grow at a CAGR of 7%. The USA. solar market is supported by federal and state-level policies promoting renewable energy, as well as continued advancements in solar technology. While growth has slowed in comparison to other markets, the USA remains a leader in solar installations, particularly in the commercial and utility sectors. Increasing demand for residential solar systems, combined with decreasing module costs, is expected to drive further adoption in the coming years.

The solar PV module market is led by global manufacturers competing on efficiency, cost-effectiveness, and technological advancements. Jinko Solar, Canadian Solar, and First Solar lead with brochures that highlight high-efficiency modules, advanced cell technologies, and long-lasting performance. Marketing materials emphasize the integration of renewable energy solutions with smart grid systems, helping customers achieve sustainability goals. Hanwha Group, JA Solar, and LONGi differentiate by showcasing their ability to deliver large-scale projects with optimized energy yield and durability in various environmental conditions. Their brochures often stress cutting-edge technologies like bifacial and monocrystalline solar panels, targeting residential, commercial, and utility-scale projects. Regional players like EMMVEE Solar, Indosolar, Vikram Solar, and Trina Solar focus on providing cost-effective and locally tailored solutions for emerging markets, emphasizing product reliability and quick installation. Brochures highlight various warranty options, efficiency improvements, and rapid payback periods, making them attractive for cost-conscious buyers. Competition in this market is driven by price, performance, and after-sales service. Marketing strategies leverage brochures to communicate product advantages like power output, certification compliance, and durability under harsh weather conditions. These brochures play a key role in positioning suppliers as trusted providers of solar solutions for both residential and commercial solar installations.

| Item | Value |

|---|---|

| Quantitative Units | USD 328.4 Billion |

| Technology | Crystalline Silicon and Thin Film |

| Product | Monocrystalline, Polycrystalline, Cadmium Telluride, Amorphous Silicon, and Copper Indium Gallium Diselenide |

| Connectivity | On Grid and Off Grid |

| Mounting | Ground Mounted and Roof Top |

| End Use | Utility, Residential, and Commercial & Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Jinko Solar, CsunSolarTech, Canadian Solar, EMMVEE SOLAR, First Solar, GCL-SI, Hanwha Group, Indosolar, JA SOLAR Technology Co.Ltd., LONGi, RENESOLA, RISEN ENERGY Co. LTD, REC Solar Holdings AS, Shemzhen Shin Solar Co.Ltd, SOLAR FRONTIER K.K., SunPower Corporation, Su-vastika Systems Private Limited, The Solaria Corporation, Trina Solar, VIKRAM SOLAR LTD, and Yingli Solar |

| Additional Attributes | Dollar sales by module type (monocrystalline, polycrystalline, thin-film) and application (residential, commercial, utility-scale) are key metrics. Trends include rising demand for efficient, high-output solar panels, growth in residential solar installations, and increasing focus on renewable energy adoption. Regional adoption, government incentives, and technological advancements are driving market growth. |

The global solar pv module market is estimated to be valued at USD 328.4 billion in 2025.

The market size for the solar pv module market is projected to reach USD 722.2 billion by 2035.

The solar pv module market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in solar pv module market are crystalline silicon and thin film.

In terms of product, monocrystalline segment to command 44.8% share in the solar pv module market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rooftop Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Ground Mounted Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Panel Recycling Management Market Size and Share Forecast Outlook 2025 to 2035

Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered UAV Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Solar Control Window Films Market Size and Share Forecast Outlook 2025 to 2035

Solar Street Lighting Market Size and Share Forecast Outlook 2025 to 2035

Solar Reflective Glass Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA