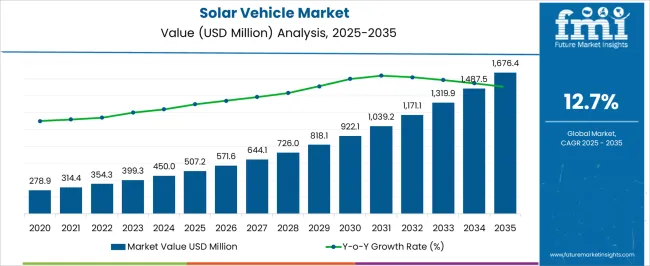

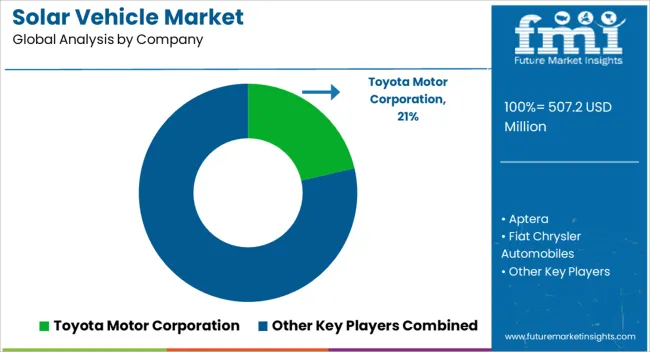

The solar vehicle market is projected to grow from USD 507.2 million in 2025 to USD 1,676.4 million in 2035, reflecting a CAGR of 12.7%. During the early adoption phase (2020–2024), the market expanded from USD 278.9 million to USD 507.2 million as solar-powered prototypes and pilot vehicles were introduced and tested by manufacturers and fleet operators. Pilot programs were conducted to evaluate energy efficiency, range, and operational reliability.

By 2025, the market is expected to reach USD 507.2 million, with broader adoption observed as interest grows among commercial fleets and niche consumer segments for trial deployments and small-scale production runs. From 2025 to 2035, the market is projected to transition through scaling (2025–2030) and consolidation (2030–2035). By 2030, the market is forecast to surpass USD 818.1 million, driven by expanded deployment across commercial, public, and private transport sectors and an increase in manufacturing capacity. During the consolidation phase, growth is expected to moderate toward USD 1,676.4 million by 2035 as leading manufacturers strengthen market presence and smaller players consolidate or exit. The 12.7% CAGR indicates strong expansion, establishing the market as a viable solution for niche and specialized vehicle applications with broader adoption across multiple transport segments.

| Metric | Value |

|---|---|

| Solar Vehicle Market Estimated Value in (2025 E) | USD 507.2 million |

| Solar Vehicle Market Forecast Value in (2035 F) | USD 1676.4 million |

| Forecast CAGR (2025 to 2035) | 12.7% |

The solar vehicle market is influenced by several parent markets, each contributing to overall growth. The electric vehicle industry is estimated to drive approximately 30%, as solar integration is applied to hybrid and fully electric platforms. Automotive manufacturing and assembly are considered responsible for 20%, as vehicles are produced, assembled, and integrated with solar components.

Solar panel and photovoltaic material production is assessed to account for 15%, as cells, modules, and coatings are supplied for energy capture. Battery and energy storage systems are estimated to contribute 10%, as power management and storage solutions are provided for vehicle operation. Fleet management and commercial transport services influence around 8%, as solar vehicles are deployed for specialized routes and operations. Research and development services are evaluated at 7%, as vehicle designs, energy efficiency, and integration methods are tested. Charging infrastructure and maintenance services account for 5%, as systems are installed and operational reliability is maintained. Finally, regulatory and certification services are estimated at 5%, as compliance, safety, and standards are ensured for solar vehicle deployment. These parent markets form an ecosystem in which the solar vehicle market is expanded. When the relative contributions of each sector are considered, strategic planning, operational alignment, and supply chain optimization are enabled, allowing steady market growth and broader adoption across niche and commercial transport segments.

The Solar Vehicle market is experiencing robust growth driven by increasing environmental awareness, government incentives for clean transportation, and the rapid evolution of energy storage and solar integration technologies. Current market adoption reflects a strong preference for renewable-powered mobility solutions that reduce carbon emissions while improving energy efficiency.

The convergence of electric propulsion with solar charging capabilities has expanded the functional versatility of vehicles, enabling longer range and reduced dependence on conventional charging infrastructure. Rising investments in sustainable transportation, coupled with advances in lightweight materials and photovoltaic efficiency, are shaping the future outlook of the market.

Expanding infrastructure for renewable energy integration and ongoing innovations in energy management systems are expected to further accelerate the adoption of solar vehicles With global efforts focused on achieving net zero emissions and energy-efficient mobility, the market is positioned for significant growth across passenger and commercial segments, supported by both technological advancements and evolving consumer preferences.

The solar vehicle market is segmented by vehicle, electric vehicle, battery, solar panel, and geographic regions. By vehicle, solar vehicle market is divided into Passenger vehicle and Commercial vehicle. In terms of electric vehicle, solar vehicle market is classified into Battery electric vehicle and Hybrid electric vehicle. Based on battery, solar vehicle market is segmented into Lithium-ion, Lead-acid, and Lead carbon. By solar panel, solar vehicle market is segmented into Monocrystalline and Polycrystalline. Regionally, the solar vehicle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

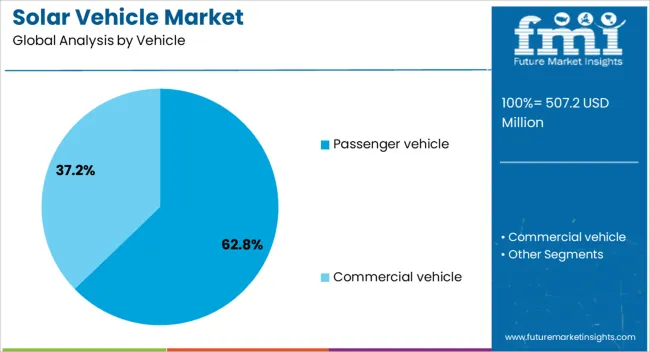

The passenger vehicle segment is projected to hold 62.8% of the Solar Vehicle market revenue in 2025, establishing it as the leading vehicle category. This prominence is being attributed to the rising adoption of private solar-enabled mobility solutions that combine environmental sustainability with operational cost savings. The growth of this segment has been reinforced by increasing consumer preference for clean transportation, ease of vehicle ownership, and improvements in solar energy harvesting efficiency.

Enhanced vehicle designs that integrate solar panels without compromising aesthetics or aerodynamics have further supported adoption. Passenger vehicles are increasingly being equipped with energy management systems that optimize solar energy utilization, improving driving range and reducing dependency on conventional electricity.

Additionally, the availability of government incentives for eco-friendly vehicles and rising fuel costs have strengthened the commercial viability of solar passenger vehicles The segment’s leadership is expected to continue as renewable energy integration and consumer awareness expand in both developed and emerging markets.

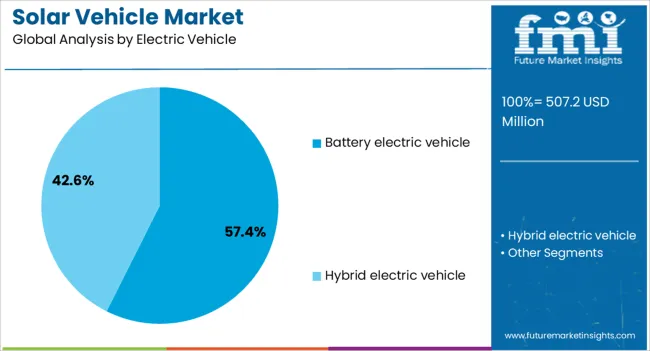

Battery electric vehicles are estimated to capture 57.4% of the market revenue in 2025, positioning them as the leading propulsion type within the Solar Vehicle market. This growth is being driven by the ability to combine solar charging with electric drivetrain efficiency, delivering cost-effective, zero-emission transportation. Widespread adoption is supported by advances in electric vehicle technology, including longer battery life, faster charging capabilities, and intelligent energy management systems.

Solar integration provides a supplementary energy source that enhances range and reduces operational costs, making battery electric vehicles particularly attractive for private and fleet applications. Rising government mandates for emission reduction and increasing availability of charging infrastructure have further catalyzed adoption.

The segment benefits from strong consumer confidence in electric mobility and growing corporate investment in renewable transportation solutions As battery technologies continue to improve and solar panel efficiency increases, battery electric vehicles are expected to remain the dominant propulsion choice within the solar vehicle sector.

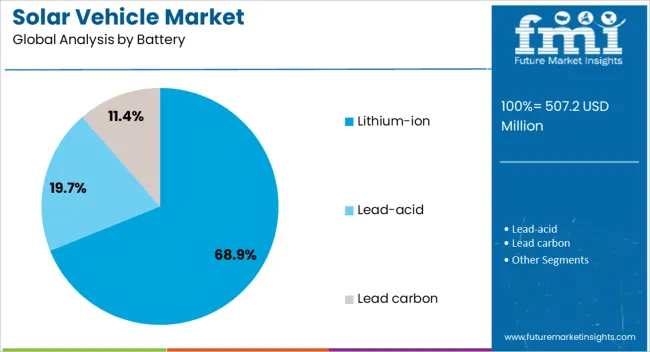

The lithium-ion battery segment is projected to hold 68.9% of the Solar Vehicle market revenue in 2025, emerging as the leading energy storage solution. This dominance is being attributed to the high energy density, long cycle life, and lightweight properties of lithium-ion technology, which make it particularly suitable for solar-powered vehicles. Adoption has been accelerated by the need for efficient energy storage that complements solar charging and optimizes driving range.

Lithium-ion batteries offer fast charging and improved thermal management, enabling integration with intelligent energy systems that monitor and balance power use. As demand grows for higher performance and longer range solar vehicles, lithium-ion technology provides a scalable and cost-effective solution.

Additionally, decreasing battery costs and increasing production capacity have facilitated widespread deployment across passenger and commercial solar vehicles The segment’s continued growth is expected to be reinforced by ongoing research in next-generation lithium-ion chemistries and increased adoption of renewable-powered mobility solutions.

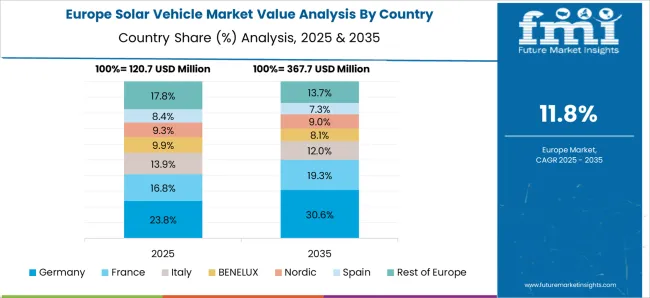

The solar vehicle market is growing due to increasing demand for sustainable mobility, rising fuel costs, and advancements in solar energy integration. North America and Europe lead with high-performance solar-electric vehicles for passenger transport, research, and demonstration fleets. Asia-Pacific is witnessing rapid adoption driven by government incentives, urban mobility solutions, and electric vehicle infrastructure expansion. Manufacturers differentiate through solar panel efficiency, energy storage, lightweight materials, and aerodynamic design. Regional variations in regulations, solar irradiance, and charging infrastructure influence adoption, deployment strategies, and competitive positioning globally.

Adoption of solar vehicles depends on solar panel efficiency and battery storage capacity. North America and Europe prioritize high-efficiency photovoltaic cells integrated with lithium-ion or advanced battery packs to maximize energy utilization and driving range. Asia-Pacific markets increasingly adopt cost-effective solar panels and medium-capacity storage solutions for urban mobility and public transport fleets. Differences in solar efficiency and storage technology affect range, vehicle performance, and operational feasibility. Leading suppliers focus on lightweight, high-output solar modules and energy-dense batteries for premium applications, while regional manufacturers provide practical, affordable alternatives. Energy capture and storage contrasts shape adoption, vehicle usability, and competitive positioning in global solar vehicle markets.

Vehicle weight and aerodynamic efficiency significantly influence solar vehicle adoption. North America and Europe emphasize advanced composites, aluminum alloys, and optimized aerodynamics to reduce drag and energy consumption for longer trips and research-grade vehicles. Asia-Pacific adoption focuses on cost-efficient lightweight materials and simple aerodynamic designs suitable for urban transport and fleet applications. Differences in material selection and design efficiency impact energy utilization, driving range, and manufacturing costs. Leading suppliers invest in advanced materials, precision engineering, and aerodynamic modeling, while regional manufacturers prioritize durability and affordability. Material and design contrasts drive adoption, operational efficiency, and market differentiation across solar vehicle applications globally.

Integration with charging infrastructure, solar charging stations, and grid support affects solar vehicle adoption. North America and Europe focus on hybrid solar-electric systems compatible with conventional charging stations and solar-assisted infrastructure to optimize energy use. Asia-Pacific markets are expanding solar vehicle adoption alongside urban EV networks and solar-assisted charging solutions. Differences in infrastructure readiness and energy management affect operational continuity, vehicle uptime, and fleet scalability. Suppliers providing integrated charging solutions and energy management systems gain higher adoption, while regional manufacturers focus on self-sufficient solar-powered vehicles. Infrastructure and integration contrasts shape adoption, usability, and strategic positioning in global solar vehicle markets.

Government policies, subsidies, and regulatory support strongly influence solar vehicle adoption. North America and Europe provide grants, tax incentives, and research funding to promote sustainable mobility, supporting premium solar vehicle adoption. Asia-Pacific governments implement incentives for fleet electrification, public transportation, and renewable energy integration, emphasizing cost-effectiveness. Differences in policy support affect production scale, pricing, and market penetration. Suppliers offering compliant, incentive-eligible vehicles gain competitive advantage, while regional manufacturers leverage local subsidies for affordability. Policy and incentive contrasts shape adoption, investment strategies, and growth potential across global solar vehicle markets.

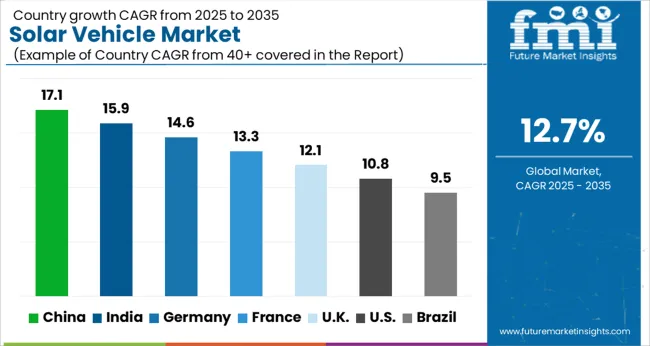

| Country | CAGR |

|---|---|

| China | 17.1% |

| India | 15.9% |

| Germany | 14.6% |

| France | 13.3% |

| UK | 12.1% |

| USA | 10.8% |

| Brazil | 9.5% |

The global solar vehicle market was projected to grow at a 12.7% CAGR through 2035, driven by demand in personal, commercial, and public transportation applications. Among BRICS nations, China recorded 17.1% growth as large-scale manufacturing and assembly facilities were commissioned and compliance with automotive and safety standards was enforced, while India at 15.9% growth saw expansion of production units to meet rising regional demand. In the OECD region, Germany at 14.6% maintained substantial output under strict industrial and regulatory frameworks, while the United Kingdom at 12.1% relied on moderate-scale operations for personal and commercial solar-powered vehicles. The USA, expanding at 10.8%, remained a mature market with steady demand across transportation and commercial segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The solar vehicle market in China is being driven at a CAGR of 17.1% due to increasing adoption of renewable energy vehicles and government support for green transportation. Electric and hybrid vehicles equipped with solar panels are being adopted to reduce fuel consumption and carbon emissions. Manufacturers are being encouraged to provide high efficiency, durable, and cost-effective solar vehicles. Distribution through dealerships, e-commerce platforms, and authorized suppliers is being maintained. Policies promoting clean energy, tax incentives, and infrastructure development for charging and solar integration are being followed. Research and development in battery efficiency, solar panel integration, and lightweight materials is being conducted. Growing awareness of environmental impact, urban traffic solutions, and consumer interest in energy efficient vehicles are being considered key factors supporting market growth in China.

Solar vehicle market in India is being expanded at a CAGR of 15.9% due to rising demand for electric vehicles and solar-powered mobility solutions. Vehicles integrated with solar panels are being adopted to enhance energy efficiency and reduce dependency on conventional fuels. Manufacturers are being focused on producing cost-effective, reliable, and energy efficient vehicles. Distribution through dealerships, online sales, and authorized suppliers is being ensured. Government incentives, subsidies, and initiatives promoting solar mobility are being followed. Training programs and awareness campaigns on solar vehicle benefits are being conducted. Increasing urbanization, rising fuel prices, and growing interest in sustainable transport are being considered primary drivers of market growth in India.

Solar vehicle market in Germany is being driven at a CAGR of 14.6% due to growing adoption of solar-powered and hybrid electric vehicles. Vehicles integrated with solar panels are being adopted to improve energy efficiency and reduce environmental impact. Manufacturers are being encouraged to provide high quality, technologically advanced, and reliable vehicles. Distribution through dealerships, OEMs, and authorized suppliers is being maintained. Research and development in battery technology, solar panel efficiency, and vehicle aerodynamics is being conducted to enhance performance. Germany’s strong focus on clean energy, environmental regulations, and consumer awareness are being considered major factors supporting adoption of solar vehicles.

The United Kingdom solar vehicle market is being expanded at a CAGR of 12.1% as demand for solar-powered vehicles and energy efficient mobility grows. Solar-integrated electric and hybrid vehicles are being adopted to reduce fuel consumption and emissions. Manufacturers are being focused on producing reliable, efficient, and environmentally friendly vehicles. Distribution through dealerships, e-commerce platforms, and authorized suppliers is being ensured. Awareness campaigns and government programs promoting green mobility are being conducted. Rising interest in clean transportation, urban mobility solutions, and environmental responsibility is being considered a key factor supporting market growth in the United Kingdom.

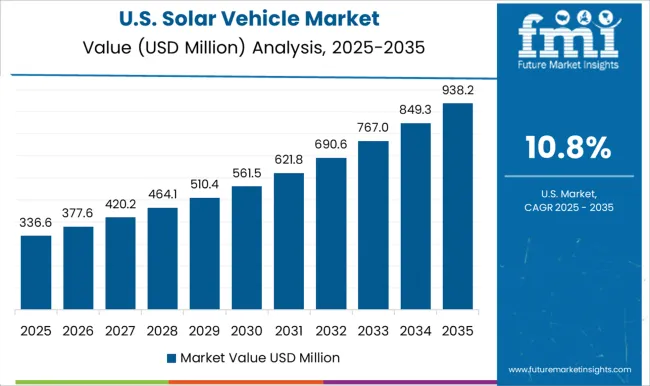

The United States solar vehicle market is being driven at a CAGR of 10.8% due to increasing adoption of solar-powered and hybrid electric vehicles. Vehicles equipped with solar panels are being adopted to improve energy efficiency and reduce dependency on fossil fuels. Manufacturers are being encouraged to supply high quality, energy efficient, and technologically advanced vehicles. Distribution through dealerships, e-commerce, and authorized suppliers is being maintained. Research and development in battery performance, solar integration, and lightweight materials is being conducted. Government incentives, clean energy policies, and rising consumer awareness of sustainability are being considered key drivers of solar vehicle adoption in the United States.

The solar vehicle market is being shaped by growing demand for sustainable and energy-efficient transportation solutions, driven by environmental concerns and rising fuel costs. Prominent suppliers in this market include Toyota Motor Corporation, Aptera, Fiat Chrysler Automobiles, Fisker, Ford Motor Company, Lightyear, Rivian Automotive, Sono Motors, Venturi Automobiles, and Volkswagen. These companies are actively involved in designing and manufacturing solar-powered vehicles, integrating photovoltaic cells into vehicle surfaces to harness solar energy and extend driving range while reducing dependence on conventional fuels. Innovation and technology play a central role in the market, with suppliers like Lightyear, Aptera, and Sono Motors leading the development of lightweight solar panels, advanced battery systems, and energy-efficient drivetrain designs. Traditional automotive giants, including Toyota, Ford, and Volkswagen, are investing in hybrid models that combine solar energy with electric powertrains to enhance vehicle efficiency and performance. These companies are also focusing on improving vehicle aerodynamics, lightweight materials, and smart energy management systems to optimize solar energy utilization under various driving conditions. Market leaders are further emphasizing sustainability through the adoption of eco-friendly manufacturing processes, recyclable materials, and reduced carbon emissions across their operations. Collaborations and partnerships are being leveraged to accelerate research and development, enhance solar integration technology, and expand commercial availability of solar vehicles. With rising consumer awareness, supportive government incentives, and the global push toward renewable energy solutions, these suppliers continue to drive the solar vehicle market by delivering innovative, practical, and environmentally responsible mobility solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 507.2 Million |

| Vehicle | Passenger vehicle and Commercial vehicle |

| Electric Vehicle | Battery electric vehicle and Hybrid electric vehicle |

| Battery | Lithium-ion, Lead-acid, and Lead carbon |

| Solar Panel | Monocrystalline and Polycrystalline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toyota Motor Corporation, Aptera, Fiat Chrysler Automobiles, Fisker, Ford Motor Company, Lightyear, Rivian Automotive, Sono Motors, Venturi Automobiles, and Volkswagen |

| Additional Attributes | Dollar sales vary by vehicle type, including passenger cars, buses, trucks, and two-wheelers; by propulsion type, spanning hybrid solar-electric and fully solar-powered vehicles; by application, such as personal transport, commercial fleets, and public transit; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for renewable energy, government incentives, and sustainable transportation solutions. |

The global solar vehicle market is estimated to be valued at USD 507.2 million in 2025.

The market size for the solar vehicle market is projected to reach USD 1,676.4 million by 2035.

The solar vehicle market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in solar vehicle market are passenger vehicle and commercial vehicle.

In terms of electric vehicle, battery electric vehicle segment to command 57.4% share in the solar vehicle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vehicle Integrated Solar Panels Market Size and Share Forecast Outlook 2025 to 2035

Solar Module Recycling Service Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracking Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Recycling Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Panel Recycling Management Market Size and Share Forecast Outlook 2025 to 2035

Solar Photovoltaic (PV) Market Size and Share Forecast Outlook 2025 to 2035

Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered UAV Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA