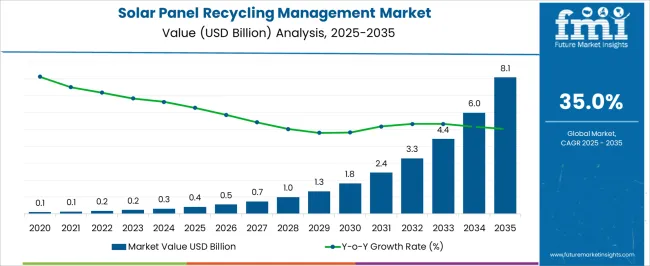

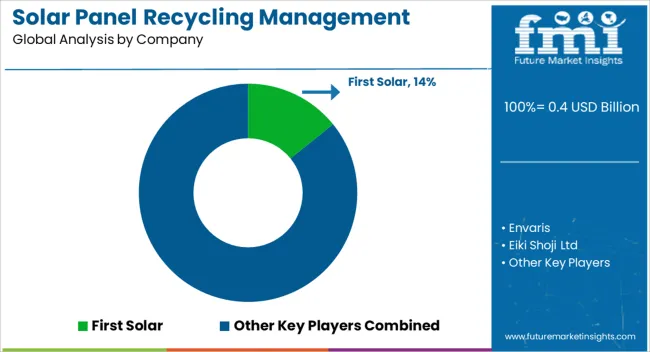

The solar panel recycling management market is estimated to be valued at USD 0.4 billion in 2025 and is projected to reach USD 8.1 billion by 2035, registering a compound annual growth rate (CAGR) of 35.0% over the forecast period.

The market is witnessing high growth rate volatility, reflecting rapid adoption of solar energy globally, combined with evolving regulations for end-of-life solar panel disposal. Increasing installations of photovoltaic modules in residential, commercial, and utility-scale solar projects are driving the volume of waste panels requiring sustainable recycling solutions. Advanced recovery technologies for silicon, glass, and rare metals are being developed to enhance economic viability and reduce environmental impact. Fluctuating raw material prices, government incentives for renewable energy, and extended producer responsibility regulations contribute to annual growth variability.

Companies are exploring partnerships with solar manufacturers, waste management firms, and technology providers to scale operations and optimize cost structures. Emerging regions in Asia-Pacific and Europe demonstrate particularly dynamic market expansion due to regulatory support, increasing solar adoption, and growing awareness of resource recovery. Market participants must navigate volatility by adopting flexible logistics, modular recycling units, and innovative business models to capture value across the full lifecycle of solar panels.

The solar panel recycling management market is strongly shaped by five interconnected parent markets, each driving overall demand and adoption of sustainable end-of-life solutions. The utility-scale solar market holds the largest share at 40%, as massive photovoltaic installations generate significant volumes of decommissioned panels requiring efficient collection, disassembly, and material recovery.

The residential solar segment contributes 25%, with homeowners and small commercial entities increasingly seeking certified recycling channels to responsibly dispose of aging or damaged panels. The commercial and industrial solar market accounts for 15%, driven by rooftop and ground-mounted systems in offices, factories, and shopping complexes where compliance with circular economy and environmental regulations is essential. The solar component and materials supply chain market holds a 12% share, encompassing glass, silicon, and metal suppliers that benefit from recovered materials, closed-loop recycling, and resale of high-value components.

Finally, the government policy and regulatory framework segment represents 8%, incentivizing proper waste management, extended producer responsibility, and adoption of standardized recycling protocols. Collectively, utility, residential, and commercial solar segments account for 80% of overall demand, highlighting that large-scale solar deployment, responsible end-of-life management, and regulatory compliance are the primary growth drivers, while supply chain optimization and policy enforcement provide additional momentum for global market expansion.

| Metric | Value |

|---|---|

| Solar Panel Recycling Management Market Estimated Value in (2025 E) | USD 0.4 billion |

| Solar Panel Recycling Management Market Forecast Value in (2035 F) | USD 8.1 billion |

| Forecast CAGR (2025 to 2035) | 35.0% |

The solar panel recycling management market is gaining momentum as the installed base of solar photovoltaic (PV) systems continues to expand globally and the first generation of panels approaches the end of their operational life. Industry publications and renewable energy association updates have emphasized the importance of structured recycling systems to recover valuable materials such as silicon, glass, aluminum, and silver while minimizing environmental impact.

Regulatory frameworks in major solar markets are mandating proper end-of-life management, driving investment in recycling infrastructure and process innovation. Advances in separation technologies have improved recovery rates, reducing waste and lowering the carbon footprint associated with raw material sourcing.

Partnerships between solar manufacturers, recycling firms, and government agencies are fostering the development of scalable, economically viable recycling models. Looking forward, the market’s growth is expected to be shaped by higher volumes of decommissioned panels, evolving product designs that improve recyclability, and the expansion of specialized processing facilities capable of handling diverse panel types.

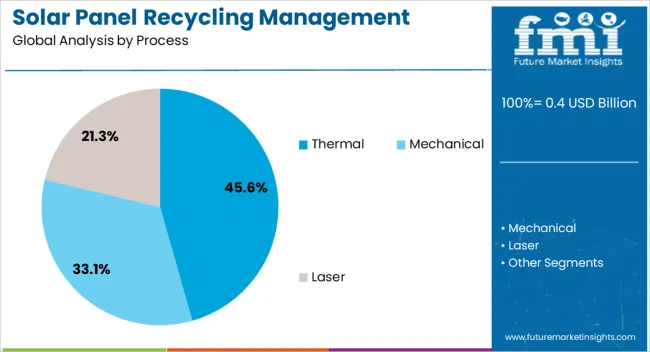

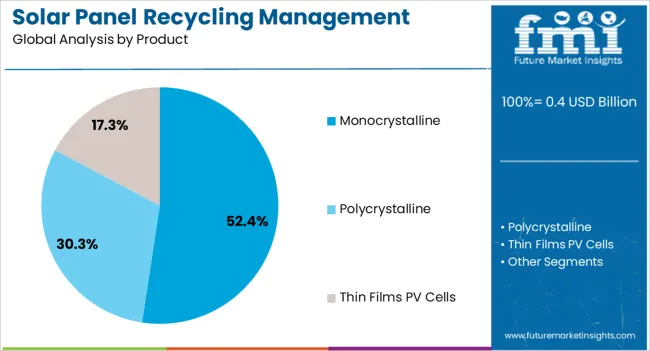

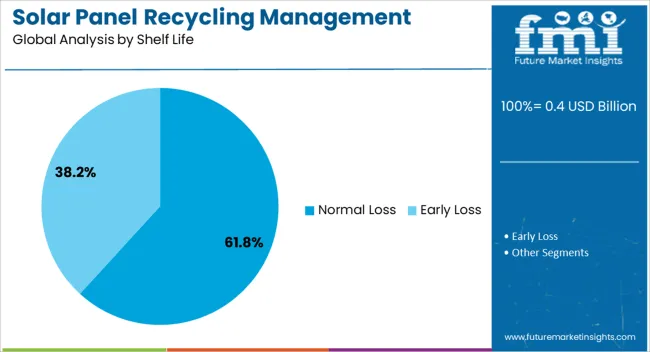

The solar panel recycling management market is segmented by process, product, shelf life, and geographic regions. By process, solar panel recycling management market is divided into thermal, mechanical, and laser. In terms of product, solar panel recycling management market is classified into monocrystalline, polycrystalline, and thin films PV cells. Based on shelf life, solar panel recycling management market is segmented into normal loss and early loss. Regionally, the solar panel recycling management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The thermal process segment is projected to account for 45.6% of the solar panel recycling management market revenue in 2025, maintaining its leadership due to its effectiveness in recovering high-purity materials. Thermal processes involve controlled heating to separate and remove encapsulant layers, enabling the extraction of intact glass and silicon wafers.

Industry reports have noted that this method offers higher recovery efficiency for critical materials compared to purely mechanical processes. Additionally, thermal treatment reduces contamination risks and preserves material quality, which is essential for reintroducing recovered components into manufacturing cycles.

The scalability of thermal systems, along with ongoing improvements in energy efficiency, has supported their adoption by recycling facilities handling large panel volumes. As demand for high-quality secondary raw materials rises in the solar and electronics industries, the thermal segment is expected to remain a preferred processing method in the recycling value chain.

The monocrystalline product segment is projected to hold 52.4% of the solar panel recycling management market revenue in 2025, driven by the high prevalence and material value of these panels in global solar installations. Monocrystalline panels, known for their efficiency and durability, have been widely deployed in both residential and commercial projects over the past two decades.

As these panels reach the end of their operational life, their higher silicon purity and aluminum frame content present strong economic incentives for recycling. Technical analyses from renewable energy research centers have shown that monocrystalline panels yield higher recovery rates for valuable materials compared to polycrystalline alternatives.

Furthermore, the consistent quality of recovered silicon from monocrystalline modules supports its reuse in manufacturing, reducing the need for virgin raw materials. This combination of material value and recovery potential positions the monocrystalline segment as a significant driver of recycling industry revenues.

The normal loss segment is projected to represent 61.8% of the solar panel recycling management market revenue in 2025, reflecting the majority of panels reaching end-of-life under standard degradation patterns rather than premature failure. Industry lifecycle studies have indicated that most solar panels maintain operational performance for 25–30 years before output decline justifies decommissioning. Panels retired under normal loss conditions typically have predictable degradation profiles, allowing recycling facilities to plan processing volumes and optimize recovery operations.

This predictability supports cost-effective logistics, as large batches of panels can be collected and processed together. Additionally, the materials recovered from panels experiencing normal loss are often in better condition compared to those from prematurely failed units, improving recycling yields. As the installed solar base ages and more systems reach their designed lifespan, the normal loss segment will continue to dominate in volume, shaping long-term recycling industry planning and capacity expansion.

The solar panel recycling management market is driven by rising PV installations, stringent regulations, and economic opportunities from material recovery. Integration across the supply chain ensures efficiency and scalability for global adoption.

The increasing deployment of solar PV systems globally is driving demand for recycling management. Large-scale utility installations, residential rooftops, and commercial solar arrays contribute to significant volumes of end-of-life panels over the next decade. Efficient collection, dismantling, and material recovery are becoming critical as decommissioned panels contain valuable silicon, glass, aluminum, and rare metals. Market players are establishing dedicated recycling facilities and partnerships with waste management companies to ensure streamlined operations. Regulatory mandates in Europe, North America, and Asia are further incentivizing proper disposal and recycling practices. The rising awareness among solar project developers, installers, and governments about environmental impact and resource recovery is also boosting adoption of certified recycling solutions.

Regulatory frameworks worldwide are shaping the solar panel recycling management market by mandating environmentally responsible disposal practices. Extended producer responsibility (EPR) policies, subsidies, and recycling targets compel manufacturers and stakeholders to adopt structured recycling processes. Countries like Germany, Japan, and the U.S. are implementing stringent standards for solar PV waste handling, while developing markets are gradually integrating policies for safe disposal. Incentives such as tax benefits, grants, and preferential contracts for recycled materials are motivating manufacturers and recyclers to invest in advanced facilities. Compliance with international standards, reporting obligations, and audit requirements also ensures accountability and traceability of recovered materials. Policies increasingly encourage circular economy practices, emphasizing resource efficiency and reduced landfill dependence.

Recycling solar panels provides significant economic value through recovery of high-purity silicon, aluminum frames, glass, and trace metals like silver and copper. Efficient recycling processes reduce raw material procurement costs for manufacturers, making end-of-life management financially attractive. The resale of reclaimed materials to PV module producers, electronics, and construction sectors generates additional revenue streams. Furthermore, service providers can monetize collection, transportation, and disassembly operations, adding value to the overall supply chain. Investment in automated separation technologies, modular processing plants, and sorting systems enhances operational efficiency and lowers processing costs. This creates a profitable market environment for recycling companies, attracting both new entrants and established PV component manufacturers.

The solar panel recycling management market is increasingly integrated with upstream and downstream supply chains, including manufacturers, installers, waste management firms, and logistics providers. Strategic partnerships enable timely collection, transportation, and processing of decommissioned panels, reducing delays and costs. Digital platforms track inventory, monitor recycling progress, and optimize routes for collection trucks. Some PV manufacturers establish take-back schemes, ensuring traceable disposal and compliance with regulations. Integration with secondary material markets allows for smoother resale of recovered silicon, metals, and glass. Collaboration across stakeholders ensures end-to-end efficiency, scalability, and transparency, strengthening the overall recycling ecosystem. Efficient logistics and supply chain alignment are essential for sustaining growth in a rapidly expanding solar PV market.

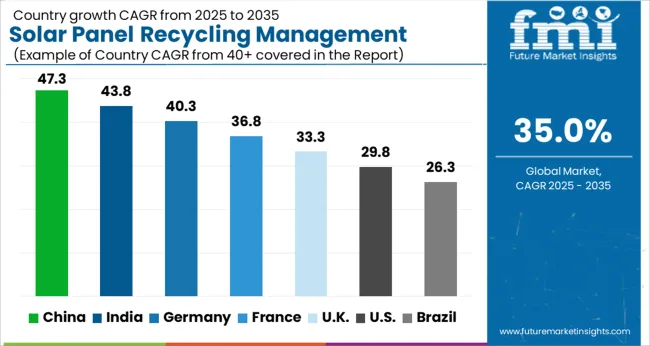

| Countries | CAGR |

|---|---|

| China | 47.3% |

| India | 43.8% |

| Germany | 40.3% |

| France | 36.8% |

| UK | 33.3% |

| USA | 29.8% |

| Brazil | 26.3% |

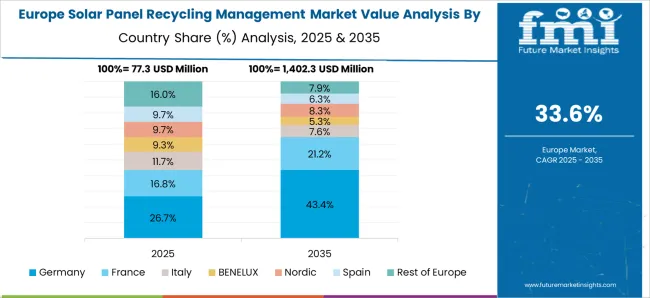

The global solar panel recycling management market is projected to grow at a CAGR of 35.0% from 2025 to 2035. China leads at 47.3%, followed by India at 43.8%, France at 36.8%, the UK at 33.3%, and the USA at 29.8%. Growth is driven by the rapid deployment of solar PV systems, increasing volumes of end-of-life panels, and rising regulatory mandates for responsible disposal and resource recovery. Governments are incentivizing recycling infrastructure, while manufacturers and service providers are investing in collection, dismantling, and material recovery technologies. Asia, particularly China and India, shows accelerated adoption due to large-scale PV installations, whereas Europe and North America emphasize compliance, certified processing, and circular economy practices. The analysis spans over 40+ countries, with the leading markets shown below.

The solar panel recycling management market in China is projected to grow at a CAGR of 47.3% from 2025 to 2035, driven by massive deployment of PV systems and increasing volumes of end-of-life solar panels. National policies promoting circular economy practices, regulatory mandates for e-waste recycling, and incentives for material recovery facilities are fueling adoption. Domestic recyclers are investing in advanced mechanical, thermal, and chemical processes to recover silicon, glass, and metals efficiently. Partnerships between panel manufacturers and recycling companies are enhancing collection networks and end-of-life management. Pilot programs in urban and industrial areas test modular dismantling and automated sorting solutions to optimize material recovery. The country’s strong focus on renewable energy capacity expansion, combined with government-backed recycling initiatives, positions China as the largest contributor to global market growth.

The solar panel recycling management market in India is expected to expand at a CAGR of 43.8% from 2025 to 2035, supported by aggressive renewable energy targets and rising volumes of decommissioned solar panels. Government incentives encourage private and public recyclers to establish state-of-the-art facilities, while policy frameworks mandate environmentally sound disposal. Local manufacturers are integrating recycling plans into their production and supply chains, collaborating with technology providers for automated dismantling and recovery processes. Awareness campaigns on environmental impact and corporate responsibility drive adoption among solar project developers. Urban solar parks, industrial rooftops, and utility-scale installations are key contributors to panel recycling streams, while skill development programs for technicians enhance operational capacity and safety.

France’s solar panel recycling market is projected to grow at a CAGR of 36.8% from 2025 to 2035, driven by stringent EU directives on electronic waste, extended producer responsibility (EPR), and renewable energy mandates. Recycling service providers focus on modular dismantling, high-efficiency material recovery, and environmentally compliant disposal methods. Public-private collaborations promote collection networks, and solar manufacturers are required to implement take-back schemes for panels sold in the domestic market. Investment in chemical and thermal recovery technologies enables extraction of high-purity silicon, aluminum, and rare metals. Growth is supported by large-scale PV installations, urban solar rooftops, and growing participation of municipal waste management services in collection. France is also experimenting with innovative logistics and centralized recycling hubs to streamline panel transportation and processing.

The solar panel recycling market in the UK is expected to grow at a CAGR of 33.3% from 2025 to 2035, driven by national renewable energy targets and government mandates for end-of-life solar management. Recycling operators are focusing on mechanized dismantling, automated sorting, and chemical recovery of silicon, glass, and metals. Collaboration between PV manufacturers, project developers, and local councils facilitates collection programs and compliance with environmental regulations. Utility-scale solar farms and urban rooftop installations provide significant volumes of recyclable panels. Industry associations and technology providers are creating standardized best practices to enhance operational efficiency and reduce carbon footprints. Consumer awareness campaigns promote responsible disposal of panels and encourage adoption of certified recyclers.

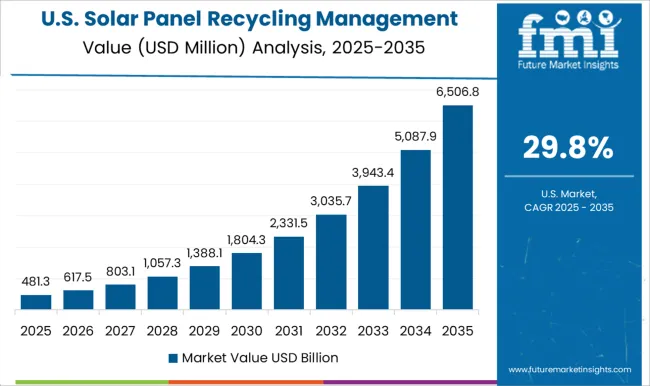

The solar panel recycling management market in the USA is projected to grow at a CAGR of 29.8% from 2025 to 2035, fueled by accelerating PV capacity additions and growing volumes of end-of-life panels. Federal and state-level policies provide incentives for establishing recycling infrastructure and implementing responsible e-waste disposal programs. Private companies are investing in advanced recovery technologies, including chemical leaching and thermal processes, to efficiently extract high-value materials such as silicon, silver, and aluminum. Partnerships between solar manufacturers, project developers, and waste management firms are optimizing collection logistics and processing. Awareness campaigns, combined with extended producer responsibility initiatives, encourage compliance across the industry. Major utility-scale installations, commercial rooftops, and community solar projects contribute significant panel streams for recycling, making the USA a key market for circular PV material management.

Competition in the solar panel recycling management market is defined by recovery efficiency, regulatory compliance, and scalability of operations. First Solar and Envaris lead with end-to-end recycling solutions, including collection, dismantling, and advanced material recovery, emphasizing high silicon, silver, and aluminum yields. Eiki Shoji Ltd and REMA PV Systems compete through chemical and thermal recovery technologies designed for both crystalline and thin-film PV panels.

Darfon Electronics Corporation and Rinovasol differentiate with automated sorting, modular recycling lines, and integration with solar manufacturing supply chains to optimize resource utilization. Regional and mid-tier players such as Chaoqiang Silicon Material, Suzhou Shangyunda Electronics Ltd, PV Recycling LLC, and Silcontel provide niche services like pilot-scale recovery, glass and rare-metal extraction, and localized collection networks. Strategies focus on compliance with global e-waste and environmental regulations, process standardization, energy-efficient recovery, and cost-effective operations.

Canadian Solar, Cellnex Energy Ltd, IG Solar Private Ltd, Reiling Glass Recycling, and ECS Refining LLC leverage partnerships with project developers, manufacturers, and municipal collection services to enhance panel take-back programs and improve material traceability. Product brochure content is detailed and technical. Recyclers highlight recovered material purity, chemical and thermal processing methods, and yield efficiency. Operational parameters including processing capacity, panel type compatibility, energy consumption, and safety protocols are specified. Collection and logistics services, dismantling guides, and process certifications are detailed. Environmental compliance, hazardous material handling, and quality assurance measures are emphasized. Accessories such as modular sorting units, chemical recovery kits, and storage solutions are included. Training programs, maintenance schedules, and regulatory documentation accompany product offerings, reflecting a market focused on sustainability, material circularity, and operational reliability.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.4 billion |

| Process | Thermal, Mechanical, and Laser |

| Product | Monocrystalline, Polycrystalline, and Thin Films PV Cells |

| Shelf Life | Normal Loss and Early Loss |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | First Solar, Envaris, Eiki Shoji Ltd, REMA PV Systems, Darfon Electronics Corporation, Rinovasol, Chaoqiang Silicon Material, Suzhou Shangyunda Electronics Ltd, PV Recycling, LLC, Silcontel, Cellnex Energy Ltd, IG Solar Private Ltd, Reiling Glass Recycling, ECS Refining, LLC, and Canadian Solar |

| Additional Attributes | Dollar sales, market share, growth by PV type (crystalline, thin-film), recovery efficiency, regulatory compliance, collection & logistics trends, technology adoption, competitive landscape, and partnership opportunities, all highlighting revenue potential, share, and operational scalability. |

The global solar panel recycling management market is estimated to be valued at USD 0.4 billion in 2025.

The market size for the solar panel recycling management market is projected to reach USD 8.1 billion by 2035.

The solar panel recycling management market is expected to grow at a 35.0% CAGR between 2025 and 2035.

The key product types in solar panel recycling management market are thermal, mechanical and laser.

In terms of product, monocrystalline segment to command 52.4% share in the solar panel recycling management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Photovoltaic (PV) Market Size and Share Forecast Outlook 2025 to 2035

Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered UAV Market Size and Share Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Solar Control Window Films Market Size and Share Forecast Outlook 2025 to 2035

Solar Street Lighting Market Size and Share Forecast Outlook 2025 to 2035

Solar Reflective Glass Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Desalination Plant Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Solar Silicon Wafer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA