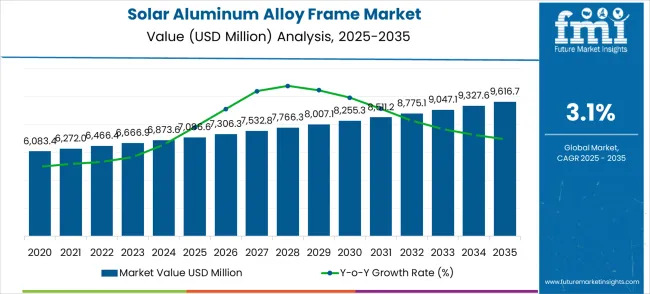

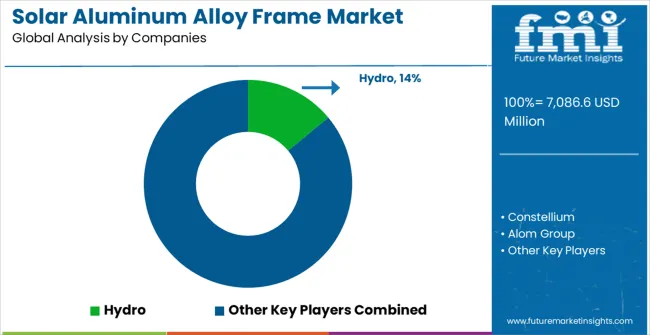

The solar aluminum alloy frame market begins its steady decade journey from a USD 7,086.6 million foundation in 2025, establishing the groundwork for consistent expansion ahead. The first half of the decade witnesses gradual momentum building, with market value climbing from USD 7,306.3 million in 2026 to USD 8,255.3 million by 2030. This initial phase reflects the growing development of solar energy infrastructure, the increasing sophistication of photovoltaic installations, and the expanding requirements for renewable energy projects across global energy transition environments.

The latter half demonstrates sustained growth dynamics, propelling the market from USD 8,511.2 million in 2031 to reach USD 9,616.7 million by 2035. Dollar additions during 2030-2035 maintain steady growth patterns, with annual increments averaging USD 272.3 million compared to USD 233.7 million in the first phase. This progression represents a 35.7% total value increase over the forecast decade.

Market maturation factors include expanding solar power plant construction volumes, residential rooftop solar adoption acceleration, and commercial solar installation precision requirements. The 3.1% compound annual growth rate positions participants to capitalize on USD 2,530.1 million in additional market value creation. This trajectory signals robust opportunities for aluminum frame manufacturers, solar component suppliers, and renewable energy system integrators across the global photovoltaic and solar energy landscape.

Market expansion unfolds through two distinct growth periods with different competitive characteristics for each phase. The 2025-2030 foundation period delivers USD 1,168.7 million in value additions, representing 16.5% growth from the baseline. Market dynamics during this phase center on product standardization, supply chain establishment, and end-user adoption acceleration across residential solar installations, commercial rooftop systems, and utility-scale solar power plant sectors.

The 2030-2035 acceleration period generates USD 1,361.4 million in incremental value, reflecting 16.5% growth from the 2030 position. This phase exhibits mature market characteristics with enhanced competition, product differentiation strategies, and geographic expansion initiatives. Dollar contributions shift from foundational infrastructure development to market share optimization and technological advancement in frame design optimization, corrosion resistance improvements, and structural efficiency enhancements.

Competitive landscape evolution progresses from early market development to established player positioning. The first period focuses on market education and reducing adoption barriers in traditional solar installation applications. The second period witnesses intensified competition for premium market segments and expansion of geographical territories. Market maturation factors include standardized quality requirements, automated manufacturing integration capabilities, and cross-industry application development across residential solar, commercial installations, and utility-scale solar power plant construction sectors.

| Metric | Value |

|---|---|

| Market Value (2025) → | USD 7,086.6 million |

| Market Forecast (2035) ↑ | USD 9,616.7 million |

| Growth Rate ★ | 3.1% CAGR |

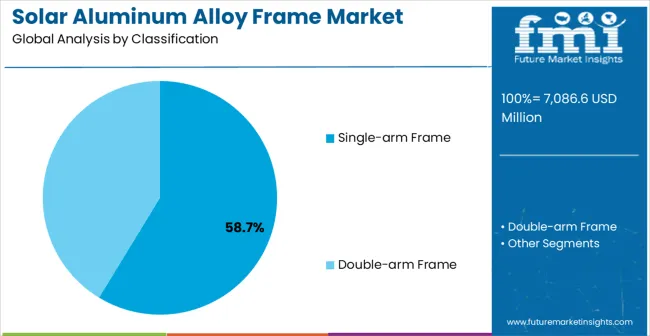

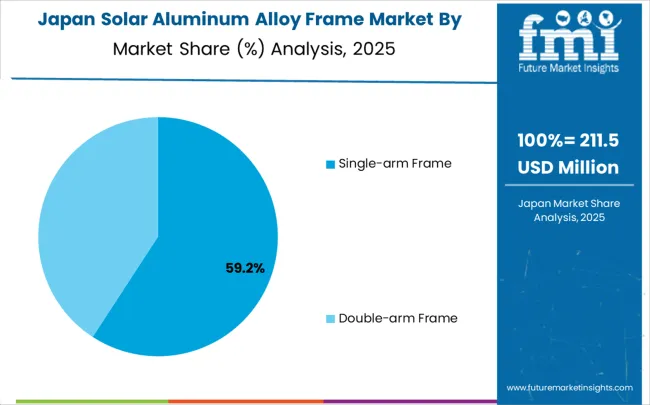

| Segment Leader → | Single-arm Frame (58.7% share) |

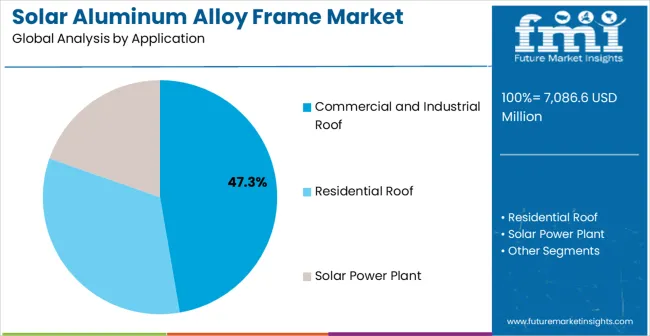

| Application Focus → | Commercial and Industrial Roof (47.3% share) |

Market expansion rests on four fundamental shifts driving solar infrastructure demand acceleration:

However, growth faces headwinds from steel frame alternatives and generic mounting solutions competition. Traditional mounting systems maintain cost advantages for basic applications. Market maturation creates pricing pressure from established manufacturers with extensive global supply chains and economies of scale capabilities.

Primary Classification: Frame Type Distribution

Secondary Breakdown: Application Categories

Geographic Segmentation: Regional Market Distribution

Market Position: Single-arm frame systems establish clear market leadership through superior structural efficiency and cost-effective manufacturing advantages across diverse solar installation applications. Simplified design architecture provides reliable panel support while maintaining compatibility with existing mounting infrastructure and installation procedures. Consistent performance capabilities enable effective load distribution where complex dual-arm systems may not justify additional complexity for standard applications.

Value Drivers: Single-arm frame technology offers excellent structural performance and wind load resistance while providing cost-effective solutions for large-scale solar installations. Streamlined manufacturing processes provide production efficiency and competitive pricing advantages across global markets. Proven installation systems accommodate multiple panel configurations within single project operations for operational efficiency and labor cost optimization.

Competitive Advantages: Single-arm frame systems offer simplified installation procedures compared to complex dual-arm alternatives requiring extensive structural analysis and specialized mounting hardware. Superior cost positioning increases adoption rates through total project cost advantages and procurement budget compatibility for solar installations. Market acceptance occurs through decades of proven reliability and established installation procedures across diverse solar project environments.

Market Challenges: Structural limitations compared to dual-arm systems may affect adoption in extreme weather conditions and high wind load applications. Performance constraints for specialized installations requiring enhanced structural support and seismic resistance capabilities. Market positioning challenges occur when competing against engineered dual-arm solutions offering superior load distribution and structural redundancy.

Strategic Market Importance: Commercial and industrial roof installations represent the primary demand driver for solar aluminum alloy frame applications across global commercial facilities. Corporate solar projects, manufacturing facility installations, and industrial energy systems require robust mounting solutions for operational efficiency. Professional installation standards mandate consistent structural capabilities for system reliability, operational continuity, and regulatory compliance.

Market Dynamics Q&A:

Business Logic: Commercial facilities prioritize structural reliability and operational efficiency, making professional-grade frames essential for meeting energy targets and sustainability standards. Cost justification occurs through reduced energy costs and enhanced operational performance. Corporate requirements demand consistent mounting solutions for operational continuity and environmental compliance.

Forward-looking Implications: Corporate net-zero commitments create new mounting requirements for large-scale rooftop systems with enhanced structural capabilities for maximum energy generation. Industrial automation development demands precision mounting solutions for solar integration with manufacturing operations and energy management systems. Global commercial solar expansion sustains market demand across emerging regions with expanding industrial infrastructure and corporate sustainability initiatives.

Drivers of the Solar Aluminum Alloy Frame Market The solar aluminum alloy frame market is primarily driven by increasing demand from renewable energy infrastructure and solar installation operations requiring robust mounting systems and structural support capabilities. Applications in utility-scale solar plants, commercial rooftop installations, and residential solar systems necessitate frames that provide reliable panel support and long-term durability, making specialized aluminum frames attractive solutions. The integration of advanced alloy technologies and corrosion-resistant treatments into frame systems further emphasizes the need for improved structural performance and extended service life, ensuring consistent operational standards. Additionally, stringent renewable energy regulations across commercial and utility sectors encourage the use of professional-grade frames that reduce installation risks and improve system reliability. Frame compliance with international solar installation standards also makes them preferred choices for critical applications, where documented performance and reliability are essential for operational efficiency, creating a stable demand pipeline globally.

Restraints Affecting Market Growth Despite advantages, the solar aluminum alloy frame market faces several growth inhibitors. Competition from steel mounting systems creates alternative structural options with potentially lower material costs, reducing demand for aluminum frames in price-sensitive project segments. Moreover, the cost differential between basic frames and high-performance alloy systems may discourage adoption in budget-conscious installations and small-scale projects. Limited customization capabilities compared to more versatile steel fabrication methods further constrain market expansion opportunities. Additionally, the raw material price volatility for aluminum and supply chain dependencies add to manufacturing costs and pricing complexity. These challenges collectively slow market penetration, particularly in basic solar installations or simple mounting requirements, restraining overall market growth despite rising demand for professional solar mounting solutions.

Key Trends and Market Evolution Patterns The solar aluminum alloy frame market is evolving steadily, driven by technological improvements and structural enhancements. Advanced alloy integration represents a major trend, enabling better corrosion resistance, extended service life, and improved structural performance for demanding applications. Lightweight design optimization is gaining traction, promoting installation efficiency, reduced structural loads, and enhanced handling characteristics during project construction. Modular frame initiatives focus on developing standardized systems suitable for diverse panel technologies and installation configurations. Furthermore, there is increasing demand for pre-engineered solutions tailored to specific project requirements, offering optimized structural properties while maintaining installation simplicity standards. These trends collectively indicate a market that is gradually advancing while responding to solar industry needs, ensuring sustained growth and innovation in specialized mounting system development.

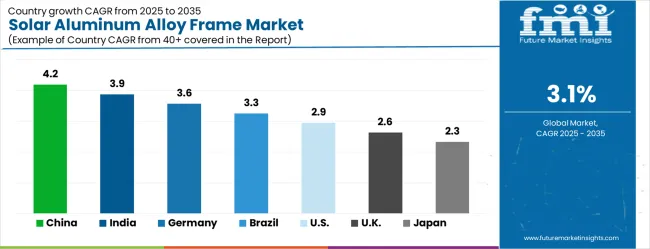

Global market dynamics reveal distinct performance tiers reflecting regional solar energy capabilities and renewable infrastructure development levels. Growth Leaders including China (4.2% market share) and India (3.9% share) demonstrate expanding solar manufacturing ecosystems with professional mounting system adoption, while Germany (3.6% share) represents European renewable energy excellence in solar installation applications. Steady Performers such as Brazil (3.3% share) and the United States (2.9% share) show consistent demand growth aligned with renewable energy modernization and solar installation expansion requirements. Mature Markets including the United Kingdom (2.6% share) and Japan (2.3% share) display established market participation reflecting advanced solar integration and renewable energy standardization.

Regional synthesis indicates Asia Pacific leadership through solar manufacturing expansion and renewable energy growth. European markets emphasize quality standards and advanced solar applications. North American demand reflects renewable energy modernization and solar installation infrastructure advancement initiatives.

| Country | Market Share (%) |

|---|---|

| China | 4.2 |

| India | 3.9 |

| Germany | 3.6 |

| Brazil | 3.3 |

| USA | 2.9 |

| UK | 2.6 |

| Japan | 2.3 |

China establishes market leadership with a commanding 4.2% market share through solar manufacturing sector dominance across photovoltaic production facilities, renewable energy infrastructure development, and solar installation operations. The nation's extensive solar manufacturing capacity and growing renewable energy sophistication drive consistent demand for aluminum frame solutions, supported by comprehensive clean energy modernization and government solar development initiatives. Market dynamics center on utility-scale solar development creating new mounting requirements for large-scale photovoltaic installations and grid-connected renewable energy systems.

Manufacturing sector leadership promotes widespread adoption of solar mounting systems for industrial facility energy independence and operational cost reduction across diverse production environments. Solar installation concentration in major renewable energy zones creates significant demand density for professional mounting solutions, while clean energy policies specifically include structural component requirements for comprehensive solar project development initiatives. Export manufacturing excellence necessitates strict quality control standard adherence through documented mounting procedures and professional system certification processes.

India demonstrates robust growth potential with a 3.9% market share through rapidly expanding solar energy capabilities and comprehensive government promotion of renewable energy initiatives under various clean energy development programs. The market reflects increasing solar installation sophistication and widespread mounting system adoption across project facilities, with renewable energy sector growth creating consistent demand for structural solutions across both utility-scale installations and distributed solar providers.

Commercial solar expansion drives significant secondary demand through stringent mounting requirements for rooftop installations and industrial solar systems. Government clean energy mandates actively promote professional structural standards for enhanced operational efficiency and international renewable energy quality compliance, while major infrastructure development projects increase solar installation volumes requiring professional mounting applications. Market activity centers on comprehensive technology transfer agreements bringing international solar standards to domestic installation facilities. Foreign renewable energy investment introduces advanced mounting requirements for improved operational efficiency and competitive energy delivery.

Germany maintains a 3.6% market share through exceptional engineering excellence and established renewable energy technology traditions across diverse solar and industrial sectors. The nation's sustained market demand is supported by an established solar installation base with advanced photovoltaic capabilities and precision renewable energy equipment expertise, where solar quality requirements create consistent demand for professional mounting solutions across utility installations and specialized rooftop system applications.

Advanced solar manufacturing requires extensively certified mounting systems for strict export compliance and international quality standards adherence, while renewable energy engineering services utilize precision frame solutions for advanced project development and comprehensive testing applications. Quality standard development significantly influences global solar practices requiring advanced mounting adoption and professional renewable energy innovation programs. Advanced solar research initiatives continuously develop innovative applications for mounting systems across emerging photovoltaic technologies, with export leadership necessitating comprehensive quality documentation supporting international solar standards and regulatory compliance requirements.

Brazil represents a significant emerging market with 3.3% market share through comprehensive renewable energy development initiatives and solar sector expansion across domestic and regional markets. The market reflects increasing solar sophistication and professional mounting system adoption driven by government policies promoting domestic clean energy capabilities and solar infrastructure development, while renewable energy growth creates consistent demand for mounting solutions across installation facilities and operations.

Utility-scale solar expansion drives primary market demand through domestic energy diversification and regional renewable energy requirements for Latin American markets, with solar sector development creating substantial opportunities for mounting applications and professional structural solutions. Infrastructure development significantly increases solar installation facility construction requiring professional mounting systems and equipment modernization. Market development benefits from government renewable energy promotion supporting domestic solar capabilities and strategic regional positioning for clean energy market access, while infrastructure projects support solar sector growth requiring professional mounting capabilities and facility modernization. Regional renewable energy agreements facilitate improved market access for professional mounting systems and solar equipment.

The United States demonstrates steady growth with a 2.9% market share through comprehensive renewable energy leadership and strategic solar technology initiatives supporting domestic clean energy capabilities. The market reflects an established solar installation base with significant utility-scale project strength and advanced photovoltaic mounting capabilities, where commercial solar operations create substantial demand for professional mounting systems and comprehensive structural support systems meeting stringent operational requirements.

Solar industry leadership requires precision mounting systems for critical installation procedures and specialized project applications, while professional technology manufacturing maintains consistent demand for high-quality frame solutions supporting solar training programs and installer certification applications. Professional innovation adoption creates integration requirements for mounting systems with sophisticated solar equipment and energy management systems. Solar competitiveness initiatives encourage substantial investment in mounting technologies and installation enhancement capabilities, with solar training programs requiring extensively documented mounting procedures supporting comprehensive certification applications and industry standards compliance.

The United Kingdom demonstrates market stability with a 2.6% market share through comprehensive renewable energy modernization and strategic professional solar sector initiatives across key residential and commercial applications. The established solar installation base emphasizes quality standards and precision project applications, where renewable energy sector strength creates substantial demand for professional mounting systems in critical rooftop installations and high-performance solar system applications. Professional solar sector requires precision mounting instruments for advanced installation procedures and technical training hardware meeting stringent professional standards and certification requirements, while solar research initiatives continuously develop innovative applications for professional mounting systems and renewable energy equipment.

Solar modernization maintains strict quality standard requirements for international competitiveness and operational excellence. Net-zero considerations create significant opportunities for domestic professional solar adoption requiring precision installation capabilities and professional equipment solutions, with government renewable energy strategy initiatives actively supporting professional solar technology adoption and excellence development. Strategic solar sector policies emphasize domestic capability development and professional technology investment for renewable energy and installation sectors.

Japan maintains technological leadership with a 2.3% market share through exceptional precision manufacturing excellence and comprehensive quality standard development across diverse solar and renewable energy sectors. The mature market features established professional mounting system adoption across industries and sophisticated solar installation capabilities, where renewable energy leadership creates consistent demand for precision mounting technologies and professional structural systems meeting strict quality and operational requirements. Solar technology manufacturing requires precision mounting systems for component assembly and comprehensive testing applications ensuring reliable performance and installation excellence, while photovoltaic electronics industry utilizes specialized frame solutions for advanced solar system production and precision manufacturing applications.

Quality management system development significantly influences global solar practices and professional mounting adoption worldwide. Solar technology exports include precision mounting system requirements for international installation facilities and technology transfer programs, with research initiatives continuously advancing mounting system processing and solar application technologies. Solar development creates substantial opportunities for precision mounting system integration and advanced structural equipment applications.

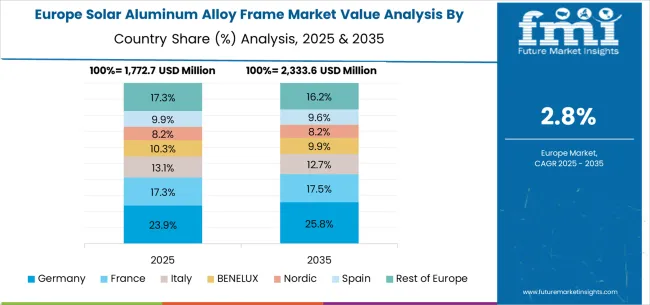

The solar aluminum alloy frame market in Europe is projected to grow steadily, supported by strong renewable energy demand and solar installation modernization initiatives. The European market value is estimated at USD 1,558.5 million in 2025, representing 22.0% of the global market. Germany leads the region with USD 255.1 million (16.4% European share), driven by its robust renewable energy infrastructure, precision solar installation excellence, and advanced mounting system standards across diverse applications. The United Kingdom follows with USD 184.3 million (11.8% European share), benefiting from renewable energy modernization initiatives, stringent solar installation quality standards, and comprehensive technology quality requirements.

France holds USD 146.3 million (9.4% European share), supported by solar expansion, renewable energy investments, and professional mounting system adoption across multiple sectors. Italy contributes USD 112.4 million (7.2% European share), spurred by solar facility development and growing adoption of professional mounting systems in renewable energy operations. Spain represents USD 89.2 million (5.7% European share), driven by solar modernization and renewable energy facility upgrades. The Rest of Europe, including Nordic countries (Sweden, Denmark, Norway), BENELUX region (Netherlands, Belgium, Luxembourg), and Eastern European nations, accounts for USD 771.2 million (49.5% European share), backed by specialized solar applications, expanding professional mounting adoption, and increasing renewable energy installation requirements.

Market structure reflects moderate concentration with established aluminum manufacturing companies maintaining significant market positions while specialized solar component manufacturers serve niche segments. Competition style emphasizes product performance, structural reliability, and application-specific design optimization. Industry dynamics favor companies combining manufacturing expertise with comprehensive distribution networks and professional technical support capabilities.

Tier 1 - Global Market Leaders: Hydro, Constellium, and Alom Group dominate through comprehensive product portfolios, extensive global distribution networks, and established aluminum manufacturing capabilities spanning multiple applications. Competitive advantages include substantial research and development resources, established customer relationships across solar and renewable energy sectors, and significant manufacturing scale economies enabling cost optimization and rapid product development cycles. Market positions reflect exceptional quality reputation and deep technical expertise across diverse solar installation and renewable energy mounting applications, with strong brand recognition supporting premium pricing strategies and professional market positioning. These companies leverage comprehensive distribution networks, extensive technical documentation, and robust customer support systems to maintain market leadership positions through consistent product availability, standardized technical support, and coordinated customer service delivery across international solar markets.

Tier 2 - Specialized Technology Providers: Companies like Nippon Light Metal, Hulamin, and Indal Aluminium Industry focus strategically on specific application segments and professional solar markets through highly specialized product offerings and targeted professional solutions. Competitive advantages include deep application expertise, specialized technical service capabilities, and concentrated innovation focus enabling rapid response to evolving solar requirements and customer-specific needs across installation and renewable energy sectors. Market positioning emphasizes technical specialization, advanced alloy development, and comprehensive customer relationship development across professional solar environments requiring precision mounting solutions. These companies excel in specialized market segments through superior product knowledge, customized application support, and flexible design configurations meeting specific professional requirements. Their competitive strategies center on technological differentiation, specialized training programs, and comprehensive technical consultation services, enabling premium market positioning and professional customer loyalty development through expertise-based value propositions.

Tier 3 - Regional and Niche Competitors: Companies including Do Thanh Aluminum, Yonz Technology, Anhui Xinbo Aluminum, CITIC Bohai Aluminum Industries, and Chuzhou Ruida serve local markets and specialized applications through focused regional strategies and customized product offerings addressing specific solar mounting needs. Competitive advantages include cost competitiveness, responsive regional service capabilities, and exceptional customization flexibility enabling rapid adaptation to local solar requirements and customer preferences across installation and renewable energy applications. Market participation focuses strategically on price-sensitive segments and specialized mounting requirements across diverse solar environments where global players may lack focused attention or cost optimization capabilities. These companies leverage regional market knowledge, local technical support advantages, and flexible manufacturing capabilities to compete effectively against larger competitors through personalized customer service, rapid response times, competitive pricing structures, and specialized application expertise, enabling market penetration in segments requiring localized support, cost optimization, and customized professional solar solutions.

The solar aluminum alloy frame market is central to renewable energy excellence, solar installation efficiency, photovoltaic operations, and professional mounting applications. With increasing demands for structural reliability, operational durability, and system performance, the sector faces pressure to balance frame affordability, performance levels, and comprehensive professional support services. Coordinated action from governments, industry bodies, OEMs/manufacturers, suppliers, and investors is essential to transition toward technologically advanced, environmentally optimized, and globally accessible solar mounting systems.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Manufacturers Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 7,086.6 million |

| Frame Type | Single-arm Frame, Double-arm Frame |

| Application | Residential Roof, Commercial and Industrial Roof, Solar Power Plant |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, China, Japan, South Korea, India, ASEAN, Australia, New Zealand, Brazil, Chile, Kingdom of Saudi Arabia, GCC Countries, Turkey, South Africa |

| Key Companies Profiled | Hydro, Constellium, Alom Group, Nippon Light Metal, Hulamin, Indal Aluminium Industry, Do Thanh Aluminum, Yonz Technology |

The global solar aluminum alloy frame market is estimated to be valued at USD 7,086.6 million in 2025.

The market size for the solar aluminum alloy frame market is projected to reach USD 9,616.7 million by 2035.

The solar aluminum alloy frame market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in solar aluminum alloy frame market are single-arm frame and double-arm frame.

In terms of application, commercial and industrial roof segment to command 47.3% share in the solar aluminum alloy frame market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solar Module Recycling Service Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracking Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Recycling Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Panel Recycling Management Market Size and Share Forecast Outlook 2025 to 2035

Solar Photovoltaic (PV) Market Size and Share Forecast Outlook 2025 to 2035

Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered UAV Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Solar Control Window Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA