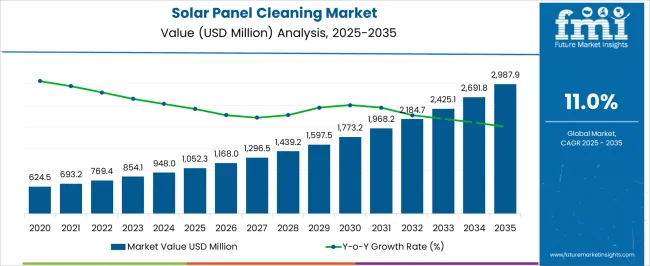

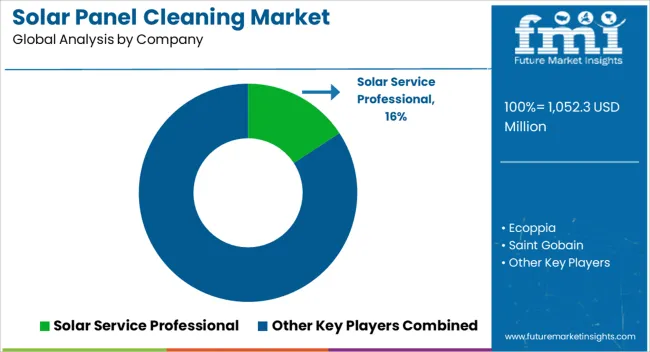

The solar panel cleaning market is estimated to be valued at USD 1052.3 million in 2025 and is projected to reach USD 2987.9 million by 2035, registering a compound annual growth rate (CAGR) of 11.0% over the forecast period.

The year-on-year (YoY) growth analysis of the solar panel cleaning market indicates a significant upward trajectory, with values projected to rise from USD 1,052.3 million in 2025 to USD 2,987.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 11%. Over the first few years, the market is expected to grow steadily, increasing from USD 1,052.3 million in 2025 to USD 1,168 million in 2026, reaching USD 1,296.5 million by 2027. This increase is likely to be driven by the rapid expansion of the solar energy sector and the rising need for maintaining optimal efficiency in solar panel systems. As solar installations continue to grow globally, the demand for cleaning and maintenance services is set to increase.

By 2035, the solar panel cleaning market is projected to have grown significantly, reaching USD 2,987.9 million, driven by the expanding global solar power capacity and the increased recognition of the importance of regular panel maintenance. The YoY growth pattern suggests that companies involved in solar panel cleaning services and technologies will see a steady rise in demand for their offerings. As the need for cost-effective and efficient cleaning solutions intensifies, the market is expected to see continued investment and innovation, making solar panel cleaning an essential component of the solar energy ecosystem.

Utility-scale solar installations drive substantial demand for automated cleaning systems including robotic platforms, water recovery systems, and centralized control equipment that can service thousands of panels across expansive solar farms. Desert installations face particular challenges from sand accumulation, mineral deposits, and water scarcity that influence cleaning frequency and methodology selection.

Operations and maintenance teams evaluate cleaning system performance through energy output monitoring, cost per megawatt hour calculations, and equipment reliability metrics that determine optimal cleaning intervals and technology selection. Water treatment systems address local water quality issues including mineral content, pH levels, and filtration requirements that prevent spot formation and panel damage during cleaning operations.

Commercial rooftop markets involve cleaning equipment designed for building-mounted arrays where access limitations, safety requirements, and structural considerations affect equipment selection and operational procedures. Building owners and facility managers coordinate cleaning activities with rooftop maintenance schedules, HVAC service requirements, and tenant operations to minimize disruption while maintaining system performance.

Mobile cleaning equipment accommodates diverse installation configurations, panel angles, and roof access constraints that vary significantly across different building types and architectural designs. Insurance considerations influence safety equipment requirements, personnel training protocols, and liability coverage that affect service pricing and contractor selection.

| Metric | Value |

|---|---|

| Solar Panel Cleaning Market Estimated Value in (2025 E) | USD 1052.3 million |

| Solar Panel Cleaning Market Forecast Value in (2035 F) | USD 2987.9 million |

| Forecast CAGR (2025 to 2035) | 11.0% |

The solar panel cleaning market is experiencing strong growth as the efficiency and long-term performance of photovoltaic systems increasingly depend on proper maintenance practices. Rising global solar power capacity installations, supported by government incentives and corporate sustainability commitments, are driving demand for effective cleaning solutions that maximize energy output. The accumulation of dust, dirt, and pollutants on panels can significantly reduce energy generation, making professional and automated cleaning technologies essential.

Advancements in specialized cleaning equipment, water-efficient systems, and non-abrasive materials are improving operational outcomes and lowering maintenance costs. Growing awareness of return-on-investment benefits from regular cleaning, combined with the expansion of large-scale solar farms, is further supporting market adoption.

Environmental regulations encouraging the use of eco-friendly cleaning processes are shaping innovation trends, with manufacturers developing solutions that minimize water usage and chemical impact As solar infrastructure expands across arid and industrial regions where soiling rates are high, the demand for efficient, scalable, and sustainable cleaning solutions is expected to grow steadily over the coming years.

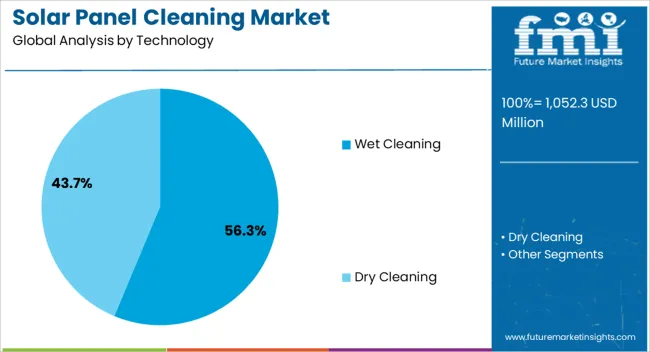

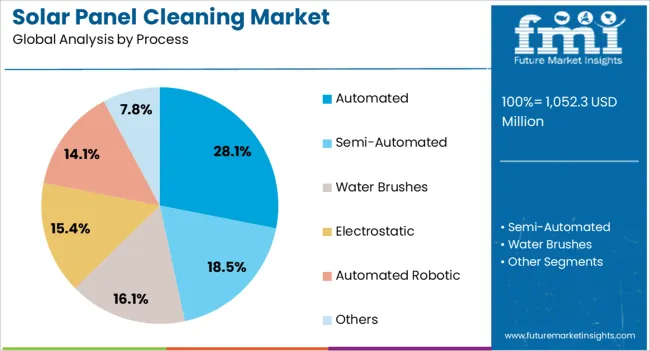

The solar panel cleaning market is segmented by technology, process, and geographic regions. By technology, solar panel cleaning market is divided into Wet Cleaning and Dry Cleaning. In terms of process, solar panel cleaning market is classified into Automated, Semi-Automated, Water Brushes, Electrostatic, Automated Robotic, and Others. Regionally, the solar panel cleaning industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wet cleaning technology segment is projected to account for 56.3% of the solar panel cleaning market revenue share in 2025, making it the leading technology type. This dominance is being driven by its high effectiveness in removing stubborn dirt, bird droppings, and environmental residues that can significantly reduce panel efficiency. Wet cleaning techniques, which often use purified or demineralized water, help prevent residue build-up and avoid damage to the glass surface, thereby extending the operational lifespan of panels.

The segment is also benefiting from its suitability across a wide range of solar installations, including utility-scale farms, rooftop systems, and industrial facilities. Growing demand in regions with high dust accumulation, such as arid and semi-arid zones, is reinforcing its market position.

Technological advancements in water-efficient systems, coupled with the integration of soft-bristle brushes and controlled pressure mechanisms, are improving cleaning precision while reducing water consumption The continued emphasis on maintaining peak energy generation rates is expected to sustain the strong adoption of wet cleaning solutions in the global market.

The automated process segment is anticipated to represent 28.1% of the solar panel cleaning market revenue share in 2025, positioning it as the leading process type. Its growth is being supported by the increasing need for cost-effective, labor-efficient, and scalable cleaning methods, particularly for large solar farms. Automated systems minimize downtime and reduce reliance on manual labor, allowing for consistent and timely cleaning schedules that preserve panel efficiency throughout the year.

These systems are designed to operate with minimal water usage and can be programmed to adapt to site-specific conditions, making them suitable for diverse environments. The integration of robotics, AI-driven control systems, and sensor-based navigation is enhancing operational precision and reducing maintenance requirements.

Adoption is further reinforced by the rising cost of manual labor and the push for operational efficiency in renewable energy projects As solar power installations continue to expand in size and complexity, automated cleaning processes are expected to play a critical role in sustaining long-term performance and maximizing return on investment.

The solar panel cleaning market is expanding due to the increasing demand for maintaining solar panel efficiency in a growing renewable energy landscape. Opportunities are emerging with automated and eco-friendly cleaning solutions, including robotic and waterless technologies. However, high cleaning equipment costs and maintenance requirements remain challenges, particularly for smaller users. Despite these barriers, the market outlook remains positive, driven by technological innovations and sustainability trends that enhance the efficiency and affordability of solar panel cleaning systems.

The solar panel cleaning market is growing as the global shift towards renewable energy increases the need for maintaining solar panel efficiency. Dust, dirt, and other environmental factors can significantly reduce the energy output of solar panels. As the adoption of solar power systems expands, particularly in regions with high dust and pollution levels, the demand for effective solar panel cleaning solutions is rising. Regular cleaning helps maximize energy efficiency, making it an essential service for solar plant operators and homeowners alike.

One of the major opportunities in the solar panel cleaning market lies in the development and adoption of automated and robotic cleaning systems. These advanced cleaning technologies not only reduce labor costs but also offer precision and effectiveness in removing dirt and debris. As automation continues to evolve, solar power operators are increasingly adopting robotic solutions to reduce maintenance costs, increase operational uptime, and enhance safety. This trend is expected to accelerate with advancements in AI, robotics, and IoT integration in solar panel maintenance.

There is a growing trend toward eco-friendly and waterless solar panel cleaning solutions. As water scarcity becomes a critical issue in many regions, especially in areas with large solar farms, cleaning methods that conserve water are gaining traction. Technologies such as dry cleaning brushes, air-based systems, and electrostatic cleaning are becoming popular alternatives to traditional water-based methods. These sustainable cleaning solutions are not only environmentally friendly but also reduce operational costs, further driving the adoption of waterless technologies in the market.

A significant challenge facing the solar panel cleaning market is the high cost of cleaning equipment and maintenance. While automated and robotic systems offer efficiency, the initial investment in these technologies can be high, making them inaccessible for small-scale solar panel users. Additionally, the need for frequent maintenance and servicing of cleaning equipment adds to the overall cost. As the market matures, cost-effective cleaning solutions and improved equipment longevity will be key to overcoming these challenges and expanding adoption in residential and commercial solar sectors.

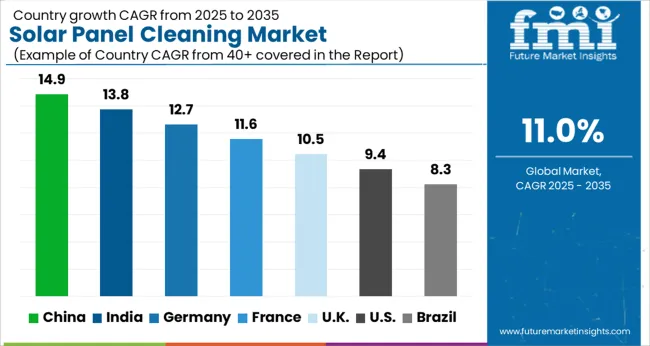

| Country | CAGR |

|---|---|

| China | 14.9% |

| India | 13.8% |

| Germany | 12.7% |

| France | 11.6% |

| UK | 10.5% |

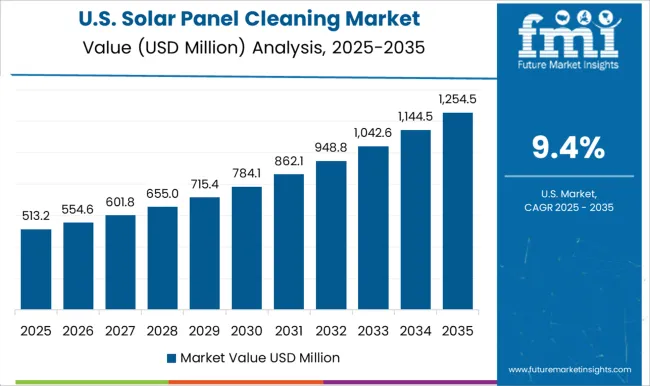

| USA | 9.4% |

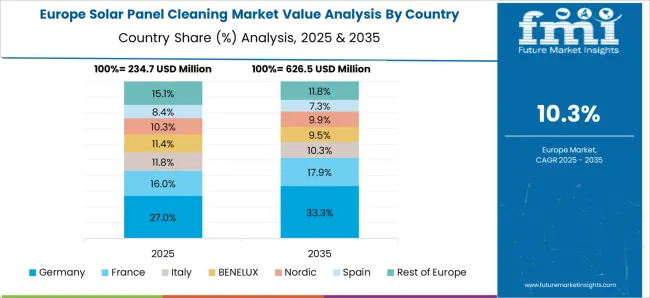

| Brazil | 8.3% |

The global solar panel cleaning market is projected to grow at an 11% CAGR from 2025 to 2035. China leads with a growth rate of 14.9%, followed by India at 13.8% and France at 11.6%. The United Kingdom records a growth rate of 10.5%, while the United States shows the slowest growth at 9.4%. The varying growth rates across these markets are driven by expanding solar power capacities and increasing demand for efficient maintenance solutions. Emerging markets like China and India are experiencing faster growth due to rapid solar energy adoption and geographical factors like dust accumulation, while more mature markets like the USA and the UK see steady growth driven by renewable energy policies, technological adoption, and efficiency requirements. This report includes insights on 40+ countries; the top markets are shown here for reference.

The solar panel cleaning market in China is projected to grow at a CAGR of 14.9%. China is the world leader in solar power generation, and the rapidly expanding solar infrastructure is driving the need for efficient and cost-effective cleaning solutions. As solar power capacity continues to increase, particularly in remote, arid, and industrial regions, the demand for specialized cleaning technologies is intensifying. China’s commitment to sustainable energy and renewable sources is further pushing the adoption of solar panel cleaning systems. Moreover, the government’s focus on reducing maintenance costs and improving the efficiency of solar power systems contributes to the growing demand for cleaning services and equipment.

The solar panel cleaning market in India is projected to grow at a CAGR of 13.8%. India is rapidly increasing its solar energy production, with solar installations growing across rural and urban landscapes. The country’s geographical features, such as high dust accumulation in desert and semi-desert regions, are contributing to the need for specialized solar panel cleaning services. As India continues to invest in clean energy, the demand for cost-effective cleaning systems that ensure optimal panel performance is growing. Government incentives for solar energy expansion, along with a focus on maximizing efficiency, are further driving the adoption of solar panel cleaning technologies in India.

The solar panel cleaning market in France is projected to grow at a CAGR of 11.6%. France’s commitment to renewable energy, along with the growing number of solar installations, is fueling the demand for solar panel cleaning solutions. The market is particularly driven by the country’s expanding solar farms in both urban and rural areas, where maintaining optimal panel efficiency is crucial for maximizing energy production. Furthermore, the French government’s focus on reducing energy costs and improving the efficiency of solar systems through proper maintenance is expected to support the growth of the solar panel cleaning market. Increased awareness about the importance of panel upkeep is further contributing to market expansion.

The solar panel cleaning market in the United Kingdom is projected to grow at a CAGR of 10.5%. As the UK continues to expand its renewable energy portfolio, solar power is playing an increasingly important role in the energy mix. The growing demand for solar energy, coupled with the need to maintain panel efficiency, is driving the need for solar panel cleaning technologies. With increased installations in both residential and commercial sectors, there is a rising awareness about the importance of panel upkeep to ensure consistent energy generation. The UK government’s ongoing support for green energy solutions continues to support the growth of solar panel cleaning systems across the country.

The solar panel cleaning market in the United States is projected to grow at a CAGR of 9.4%. The USA continues to experience significant growth in solar energy capacity, especially in states with high solar potential such as California, Nevada, and Arizona. The increasing number of solar farms, coupled with a need for efficiency in maintaining these systems, is driving the demand for solar panel cleaning. As the focus on renewable energy strengthens, the need to maintain the panels to avoid efficiency loss due to dust, dirt, and debris is becoming more critical. The USA government’s green energy policies and state-level support are expected to further push the adoption of solar panel cleaning technologies in the coming years.

The solar panel cleaning market is led by companies offering advanced, efficient, and sustainable cleaning solutions that help maximize solar energy output and system longevity. Ecoppia dominates with fully automated robotic cleaning systems that eliminate water usage, reduce maintenance costs, and improve efficiency in large-scale solar farms. Saint-Gobain contributes through high-performance cleaning materials and surface treatment technologies that prevent dust accumulation and enhance solar transmittance.

Miraikikai, Premier Solar Cleaning, and Pacific Panel Cleaners provide both automated and manual cleaning systems, serving utility-scale and residential installations with flexible, on-site maintenance solutions. Clean Solar Solutions and Solar Cleaning Machinery specialize in scalable, commercial-grade cleaning equipment and services designed to minimize panel downtime and labor dependency.

Sharp Corporation, Indisolar Products, and Solbright strengthen regional markets by offering customized, cost-effective cleaning technologies suited to diverse climatic and environmental conditions. Solar Service Professionals focuses on integrated maintenance packages that combine cleaning, inspection, and performance monitoring for solar installations.

| Item | Value |

|---|---|

| Quantitative Units | USD 1052.3 Million |

| Technology | Wet Cleaning and Dry Cleaning |

| Process | Automated, Semi-Automated, Water Brushes, Electrostatic, Automated Robotic, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ecoppia, Saint-Gobain, Miraikikai, Premier Solar Cleaning, Pacific Panel Cleaners, Clean Solar Solutions, Sharp Corporation, Indisolar Products, Solar Cleaning Machinery, Solbright, and Solar Service Professionals. |

| Additional Attributes | Dollar sales by cleaning method (manual, robotic, chemical) and panel type (flat, curved, bifacial) are key metrics. Trends include increasing demand for efficient, waterless cleaning solutions and automation in large-scale solar installations. Regional adoption, technological advancements in cleaning equipment, and sustainability concerns are driving market growth. |

The global solar panel cleaning market is estimated to be valued at USD 1,052.3 million in 2025.

The market size for the solar panel cleaning market is projected to reach USD 2,987.9 million by 2035.

The solar panel cleaning market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in solar panel cleaning market are wet cleaning, _semi-automated, _automated, _water brushes, _others, dry cleaning, _electrostatic, _automated robotic and _others.

In terms of process, automated segment to command 28.1% share in the solar panel cleaning market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Recycling Management Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Mounting Structures Market Growth - Trends & Forecast 2025 to 2035

Solar Panel Tracking Mounts Market

Solar Component Cleaning Chemicals Market

India Solar Panel Mounting Structure Market Analysis and Forecast for 2025 to 2035

Vehicle Integrated Solar Panels Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Profiles for Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar Module Recycling Service Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracking Module Market Size and Share Forecast Outlook 2025 to 2035

Panel Mount EMI Filter Market Forecast and Outlook 2025 to 2035

Cleaning Robot Market Size and Share Forecast Outlook 2025 to 2035

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Panel Saw Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA