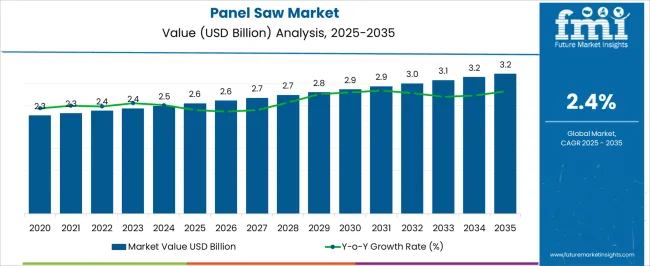

The Panel Saw Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 2.4% over the forecast period.

| Metric | Value |

|---|---|

| Panel Saw Market Estimated Value in (2025 E) | USD 2.6 billion |

| Panel Saw Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 2.4% |

The panel saw market is experiencing robust growth. Rising demand for precision-cut panels, increasing adoption of automated woodworking solutions, and expansion of the furniture and construction sectors are driving market development. Current dynamics are shaped by technological advancements in saw design, digital controls, and safety features, which have enhanced operational efficiency and product reliability.

Market participants are focusing on integrating smart features and automation to meet the evolving requirements of industrial and commercial users. The future outlook is supported by growing urbanization, increasing residential and commercial construction projects, and rising consumer preference for customized and modular furniture solutions.

Growth rationale is founded on the critical role of panel saws in achieving high-precision cuts, reducing material wastage, and optimizing production workflows Continued innovation, operational efficiency, and strategic distribution through established industrial channels are expected to sustain market expansion and support wider adoption across both mature and emerging markets.

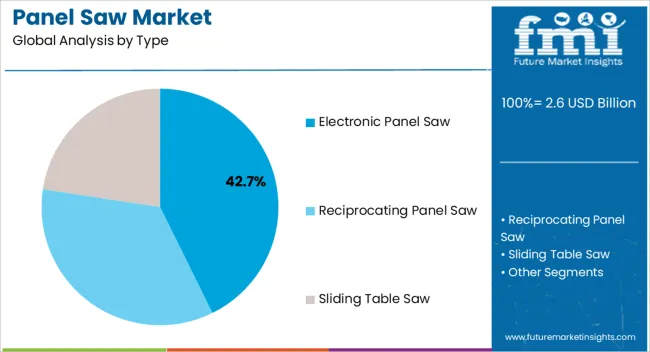

The electronic panel saw segment, holding 42.70% of the type category, has emerged as the leading type due to its precision, automation capabilities, and ease of integration into modern production lines. Its adoption has been supported by growing demand for high-accuracy cutting, reduced labor requirements, and enhanced operational safety.

Reliability and durability in industrial applications have reinforced preference among manufacturers of furniture, cabinetry, and construction panels. Technological improvements, including digital measurement systems, automated cutting programs, and energy-efficient components, have enhanced productivity and reduced operational costs.

Strategic collaborations between manufacturers and suppliers have facilitated timely availability, training, and after-sales support, further driving adoption Continued focus on automation and precision features is expected to maintain the segment’s market share and ensure it remains a key contributor to overall market growth.

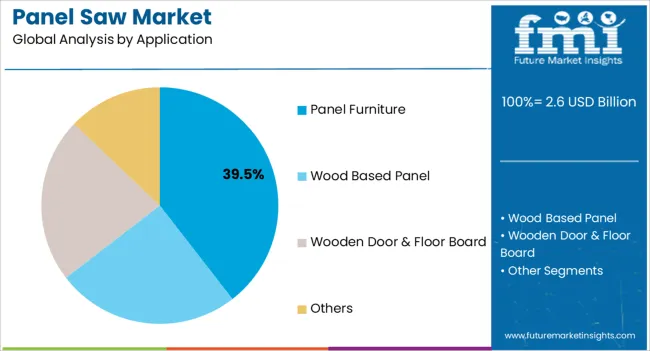

The panel furniture application segment, representing 39.50% of the application category, has been leading due to the rapid growth of the furniture manufacturing industry and rising consumer demand for modular, customized, and aesthetically refined products. Adoption has been driven by the need for high-precision cutting to achieve consistent quality and reduce material wastage.

The segment has benefited from investments in automated production lines, digital design integration, and efficient workflow management. Demand stability has been reinforced by the expansion of commercial and residential construction projects, which have increased the requirement for panel-based furniture solutions.

Continued innovation in cutting techniques and operational efficiency is expected to sustain segment dominance and support incremental growth, ensuring that panel furniture applications remain a significant driver within the overall panel saw market.

Sales of panel saws generated a revenue of around USD 2,180.4 million in 2020. During the period from 2020 to 2025, the global demand for panel saws registered a CAGR of 2.7%. In 2025, the overall market was valued at around USD 2,425.6 million.

| Attributes | Details |

|---|---|

| Panel Saw Market Size (2020) | USD 2,180.4 million |

| Historical Market Size (2025) | USD 2,425.6 million |

| Historical CAGR (2020 to 2025) | 2.7% |

Carpentry industries across all economies are putting more focus on productivity and efficiency in their manufacturing processes to maximize the margin of profit. Moreover, furniture-making companies prefer multi-blade panel saws to optimize industrial processes, shorten production times, and boost overall efficiency.

Demand for industrial panel saws is rising to meet the need for precision and excellent quality, incorporating features like laser-guided cutting and computerized measurement systems. Computerized panel saws have also become necessary for high-end woodworking, such as creating personalized furniture, architectural wood carvings, and other woodcraft works.

The adoption of automated panel saws has also been triggered by the woodworking industry's use of IoT technologies and smart manufacturing solutions to some extent. Woodworking panel saws with remote monitoring capabilities can also provide predictive maintenance and real-time data analytics, which improves their usability and attracts tech-savvy enterprises.

The table below represents the expected growth rates of the panel saw market in the United States, the United Kingdom, China, and India. Asian countries are expected to rally ahead in terms of growth in year-over-year sales, while Western countries are observed to be leading in sales value.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.1% |

| China | 3% |

| United Kingdom | 2.1% |

| India | 3.2% |

The leading position of the United States is mostly attributed to the presence of giant market players. Sale of panel saws are expected to rise at a 2.1% CAGR through 2035.

The panel saw market in the United States has been largely impacted by the growing use of Industry 4.0, or automation using intelligent machines. Also, the presence of software developers in the country is driving the market, leading to the adoption of advanced cutting-edge panel saw software solutions.

The United Kingdom is expected to be a forerunner in Europe for advancements of its panel saw machine manufacturing industries. The market is expected to record a CAGR of 2.1% through 2035.

As the industrial sector is becoming more conscious of sustainability, efficient engineering technologies are being implemented more frequently in most European countries. So, the export of wood and plywood cutting machines all over Europe is anticipated to strengthen the United Kingdom panel saw industry demand.

With an extensive manufacturing base for heavy industrial equipment, China is expected to increase its panel saw production at a CAGR of 3% till 2035.

A growing trend toward ready-to-assemble furniture, driven by urbanization and changing customer lifestyles, has surged the demand for laminated board saws in the country. Also, the rising demand for semi-automatic panel saws from neighboring Asian nations could expand and diversify the regional market further.

The market for panel saws in India is predicted to grow at a CAGR of 3.2% through 2035.

The Indian government is taking several initiatives stressing the use of efficient production methods to boost its small and medium-scale enterprises, including the carpentry industry. In addition, the rapidly expanding heavy equipment manufacturing industries in the country are anticipated to boost the supply of automated CNC panel saws for productivity.

The demand for horizontal panel saws held 27% of the overall market share in 2025, making it the leading segment by product type.

| Attributes | Details |

|---|---|

| Top Product Type | Horizontal Panel Saw |

| Market Share in 2025 | 27% |

Traditionally, carpenters adopt woodworking machines, including panel saws that are designed to hold wood in a horizontal position as it is comfortable during manual work. However, advanced technology that enables vertical panel saws to expedite the wood-cutting processes and cut labor expenses in recent years.

Carpentry finds wide application of panel saws, which contributed to 23% of the total demand in 2025.

| Attributes | Details |

|---|---|

| Top End Use | Carpentry |

| Market Share in 2025 | 23% |

This segment is expected to retain its dominance over the projected years as panel saws in carpentry are essential to produce flat-pack and modular furniture.

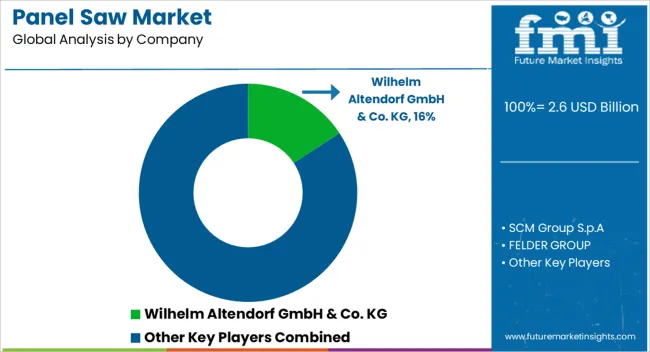

The global panel saw market is relatively consolidated as most of the leading players, with higher investment capacity and extensive distribution channels, hold a significant share of the market. Nowadays, to offer innovative and smart control features and technologies, emerging precision panel cutter companies are spending heavily on research and development activities.

Recent Developments in the Global Panel Saw Market

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 2.6 billion |

| Projected Market Size (2035) | USD 3.2 billion |

| Anticipated Growth Rate (2025 to 2035) | 2.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America, Latin America, Europe, Middle East & Africa (MEA), East Asia, South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Product Type, By Material, By Packaging Format, By End Use, and By Region |

| Key Companies Profiled | Wilhelm Altendorf GmbH & Co. KG; SCM Group S.p.A; FELDER GROUP; Otto Martin Maschinenbau GmbH & Co. KG; Griggio s.r.l.; Casadei Busellato; Robland NV; Baileigh Industrial, Inc; Woodworking Machine-Oliver Machinery Co; SAWSTOP; American Machine Works; Glory Industrial Machinery And Equipment Co., Ltd; OAV Equipment and Tools, Inc.; Joway Machinery Co., Ltd.; Griggio; HOLZMAN; DELTA; BAIEEIGH; Rexon; Yuetong Woodworking Machine; Nanxing |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global panel saw market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the panel saw market is projected to reach USD 3.2 billion by 2035.

The panel saw market is expected to grow at a 2.4% CAGR between 2025 and 2035.

The key product types in panel saw market are electronic panel saw, reciprocating panel saw and sliding table saw.

In terms of application, panel furniture segment to command 39.5% share in the panel saw market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Panel Mount EMI Filter Market Forecast and Outlook 2025 to 2035

SAW Filter Market Size and Share Forecast Outlook 2025 to 2035

Panel Mounted Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Panel Level Packaging Market Analysis by Materials and Technologies Through 2025 to 2035

Saw Blades Market Size, Share, and Forecast 2025 to 2035

Sawing and Cutting Tools Market Growth, Trends and Forecast from 2025 to 2035

Saw Palmetto Market Analysis by Powder, Whole and others Forms Through 2035

TC-SAW Filter Market

Hacksaw Blades Market Size and Share Forecast Outlook 2025 to 2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Tile Saws Market Size and Share Forecast Outlook 2025 to 2035

Flat Panel Antenna Market Size and Share Forecast Outlook 2025 to 2035

Ring Panel Filters Market Size and Share Forecast Outlook 2025 to 2035

Flat Panel Display Market Analysis by Technology, Application, and Region through 2025 to 2035

Flat Panel X-Ray Detectors Market Analysis by Application, Product, and Region Forecast Through 2035

Market Share Distribution Among Ring Panel Filters Providers

Wood Panel Market

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Recycling Management Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA