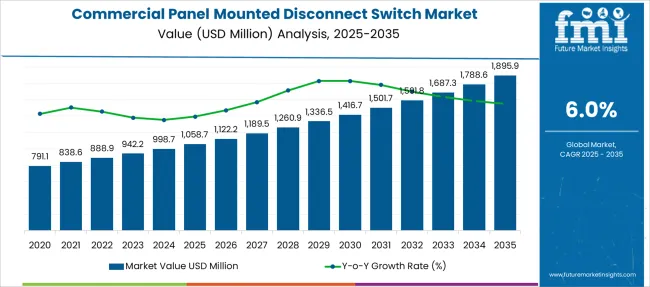

The Commercial Panel Mounted Disconnect Switch Market is estimated to be valued at USD 1058.7 million in 2025 and is projected to reach USD 1895.9 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Panel Mounted Disconnect Switch Market Estimated Value in (2025 E) | USD 1058.7 million |

| Commercial Panel Mounted Disconnect Switch Market Forecast Value in (2035 F) | USD 1895.9 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The commercial panel mounted disconnect switch market is undergoing consistent expansion, driven by the increased need for secure electrical isolation in industrial and commercial power distribution systems. Demand has been supported by growing infrastructure development, modernization of electrical networks, and stricter safety regulations governing workplace electrical installations.

The ability of panel mounted disconnect switches to provide dependable protection and maintenance isolation in compact, panel-integrated formats has made them a critical component in industrial automation, commercial buildings, and energy systems. Growth has also been encouraged by the rise in smart grid deployments and facility retrofits, which require updated switchgear solutions with better space optimization and operational safety.

Technological enhancements in materials, arc suppression mechanisms, and thermal resistance are contributing to product durability and long-term reliability. As electrical loads become increasingly dynamic and distributed, the market is expected to benefit from rising integration of panel mounted disconnect switches in energy-efficient infrastructure and mission-critical systems, reinforcing its long-term relevance..

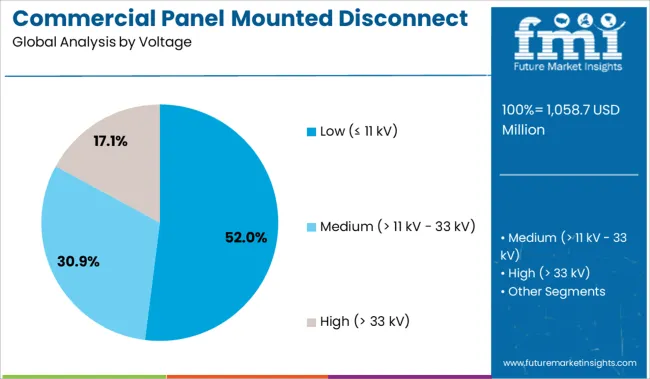

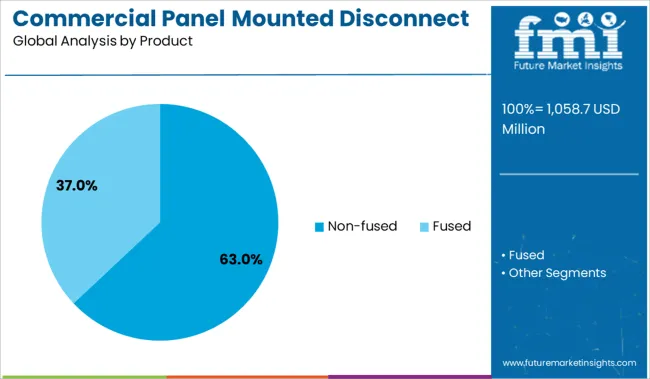

The market is segmented by voltage, product, and region. By Voltage, the market is divided into Low (≤ 11 kV), Medium (> 11 kV - 33 kV), and High (> 33 kV). In terms of Product, the market is classified into Non-fused and Fused. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The low voltage segment, defined as systems operating at or below 11 kV, is projected to account for 52% of the Commercial Panel Mounted Disconnect Switch market revenue share in 2025. This leading position has been supported by widespread application in commercial and light industrial installations where lower voltage levels are standard.

The segment's dominance has been influenced by the ease of installation, cost efficiency, and compatibility with modern low voltage electrical panels used in office buildings, retail complexes, and educational facilities. Increasing energy consumption in urban areas and greater reliance on distributed power systems have necessitated flexible and space-saving switching solutions, which low voltage disconnect switches readily offer.

Their proven reliability in managing safety shutoffs and equipment isolation has been a key factor in their preference for routine maintenance and emergency protection. As building codes and electrical safety standards continue to evolve, the demand for panel mounted low voltage disconnect switches is expected to grow steadily, ensuring sustained segment leadership..

The nonfused product segment is anticipated to represent 63% of the Commercial Panel Mounted Disconnect Switch market revenue share in 2025, marking it as the leading product category. The growth of this segment has been attributed to its widespread adoption in applications where circuit protection is managed separately by breakers or fuses downstream.

Nonfused disconnect switches have been favored for their simplicity, ease of installation, and cost-effectiveness, particularly in settings where overcurrent protection is not required within the switch itself. Their use in HVAC systems, lighting panels, and motor control centers has remained extensive, driven by their ability to provide quick and safe isolation without compromising system integrity.

Enhanced by advancements in switchgear materials and enclosure designs, nonfused options now offer improved durability, thermal performance, and compliance with stringent safety codes. With increasing emphasis on electrical reliability and streamlined maintenance, the segment continues to meet market demands for effective, nonredundant disconnecting solutions across diverse commercial environments..

The commercial panel-mounted disconnect switch market has found strong opportunity through integration with smart building systems. From 2023 to 2025, switches were increasingly embedded into facility management platforms to enable remote diagnostics, automated isolation, and fault prevention.

This shift positions disconnect switches not just as safety components but as intelligent control elements, aligning with the growing emphasis on operational transparency and centralized infrastructure oversight.

The enforcement of stricter electrical safety regulations has been recognized as a primary driver in the growth of the commercial panel-mounted disconnect switch market. In 2023, compliance with new workplace electrical standards was mandated across office complexes and retail facilities, prompting widespread switch upgrades.

By 2024, commercial facilities were being required to install disconnect devices with defined fault-interruption ratings to meet local safety codes. In early 2025, mandatory isolation systems were introduced for emergency shutdown situations, leading property managers to integrate panel-mounted switches into control cabinets as standard.

These shifts indicate that enhanced safety requirements are not optional add-ons-they are regulatory essentials, compelling operators to prioritize compliant disconnection solutions.

In 2023, commercial building managers began integrating panel-mounted disconnect switches into centralized facility control systems, enabling remote shutdown during maintenance or fault events. By 2024, integration with building management software was being adopted, providing real-time status and diagnostic alerts directly to operations teams.

Moving into 2025, switches capable of communicating via digital protocols (such as Modbus or BACnet) were being deployed as part of preventative maintenance regimes, allowing automatic isolation during potential overloads. These integrations have shown that manual switchgear can evolve into intelligent control assets.

Manufacturers offering protocol-ready, network-compatible switches are thus being positioned to capture demand from facility automation and safety alignment strategies.

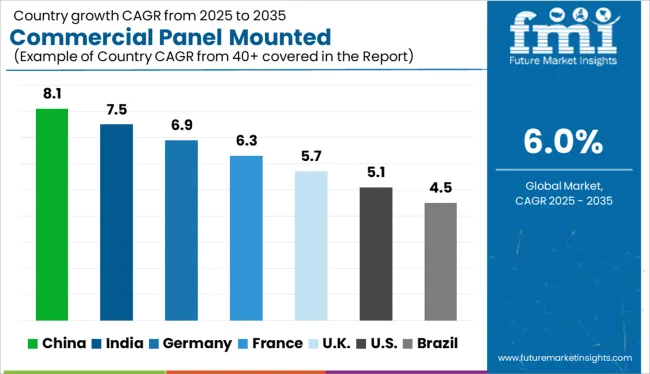

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

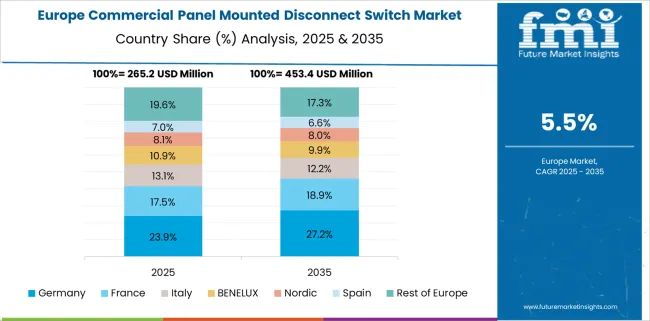

The commercial panel mounted disconnect switch market is projected to grow at a global CAGR of 6% between 2025 and 2035. China leads with an 8.1% CAGR, followed by India at 7.5% and Germany at 6.9%. France posts a moderate 6.3%, while the United Kingdom records the slowest growth among the profiled nations at 5.7%.

China and India benefit from rapid commercial construction, low-voltage equipment retrofits, and code-driven electrical safety enforcement. Germany’s growth is anchored in industrial panel upgrades and EU-compliant switchgear adoption. France supports expansion via HVAC and elevator system integration, while the UK reflects controlled demand in renovation-heavy commercial zones.

China is projected to lead the global commercial panel mounted disconnect switch market at an 8.1% CAGR, driven by aggressive commercial construction and rapid modernization of utility rooms and control panels. The integration of disconnect switches in HVAC, data center infrastructure, and energy metering cabinets is being standardized. Domestic manufacturers are delivering high-spec rotary and non-fusible switches for heavy-load environments. Regulations now mandate disconnects in low-rise commercial power rooms.

India is expected to grow its commercial panel mounted disconnect switch market at a 7.5% CAGR, with high uptake in malls, data centers, and logistics facilities. State-level energy safety audits are prompting widespread adoption in control panels and electrical enclosures. Panel builders and MEP contractors are sourcing thermoplastic and metal-bodied switches with lockout-tagout functionality. Domestic brands are increasing production of IS-compliant switches for Tier-2 city projects.

Germany is forecast to expand its commercial panel mounted disconnect switch market at a 6.9% CAGR, supported by industrial facility upgrades and EU-compliant electrical safety standards. Disconnect switches are widely used in automation cabinets, renewable energy inverters, and factory control rooms. German OEMs are focused on modular, DIN rail-compatible designs with integrated auxiliary contacts. Demand is highest in manufacturing zones and logistics depots transitioning to Industry 4.0 protocols.

France is projected to grow at a 6.3% CAGR, with adoption strongest in hospitality, commercial real estate, and vertical mobility infrastructure. Local electricians and system integrators are equipping service panels with lockable disconnects to comply with CNAM safety norms. Elevator switchboards, HVAC service points, and cold-chain warehouses are key application areas. French OEMs are investing in fire-rated, IP-rated enclosures compatible with indoor commercial setups.

The United Kingdom is expected to grow at a 5.7% CAGR in the commercial panel mounted disconnect switch space, driven by steady infrastructure refurbishment and electrical compliance in public buildings. Educational institutions, supermarkets, and care facilities are adding rotary and lever-action switches to meet BS 7671 guidelines. Distribution boards in legacy retail sites are undergoing panel modernization. However, capital expenditure hesitation among SMEs moderates broader growth.

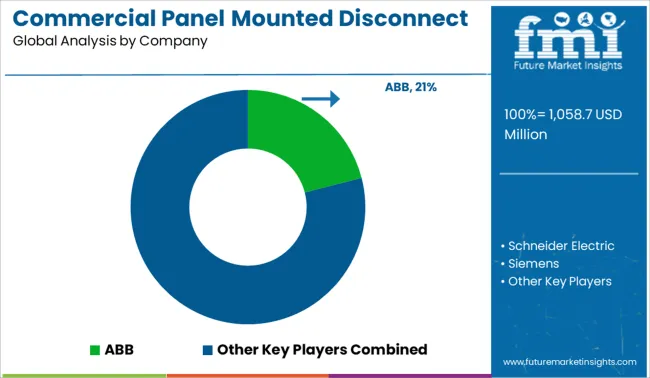

The commercial panel mounted disconnect switch market is moderately consolidated, led by ABB with a significant market share. The company holds a dominant position through its broad portfolio of safety switches, global electrical component distribution, and compliance with international standards across commercial infrastructure.

Dominant player status is held exclusively by ABB. Key players include Schneider Electric, Siemens, Eaton, and Legrand - each offering panel-mounted disconnect solutions with advanced safety features, modular designs, and suitability for power isolation in commercial and industrial facilities.

Emerging players include various regional manufacturers and OEMs focused on low-cost alternatives and niche applications with limited market penetration. Market demand is driven by rising electrical safety compliance requirements, growing complexity in commercial power networks, and retrofitting of outdated distribution panels.

| Item | Value |

|---|---|

| Quantitative Units | USD 1058.7 Million |

| Voltage | Low (≤ 11 kV), Medium (> 11 kV - 33 kV), and High (> 33 kV) |

| Product | Non-fused and Fused |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Schneider Electric, Siemens, Eaton, Legrand, and Others |

| Additional Attributes | Dollar sales by switch type and rating, regional demand trends, competitive landscape, buyer preferences for safety and smart features, integration with IoT, innovations in arc-flash mitigation and remote operation. |

The global commercial panel mounted disconnect switch market is estimated to be valued at USD 1,058.7 million in 2025.

The market size for the commercial panel mounted disconnect switch market is projected to reach USD 1,895.9 million by 2035.

The commercial panel mounted disconnect switch market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in commercial panel mounted disconnect switch market are low (≤ 11 kv), medium (> 11 kv - 33 kv) and high (> 33 kv).

In terms of product, non-fused segment to command 63.0% share in the commercial panel mounted disconnect switch market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA