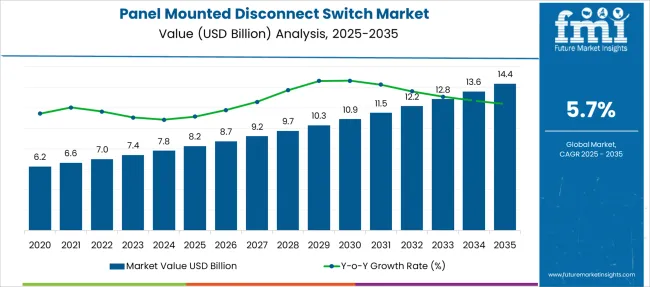

The Panel Mounted Disconnect Switch Market is estimated to be valued at USD 8.2 billion in 2025 and is projected to reach USD 14.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| Panel Mounted Disconnect Switch Market Estimated Value in (2025 E) | USD 8.2 billion |

| Panel Mounted Disconnect Switch Market Forecast Value in (2035 F) | USD 14.4 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The panel mounted disconnect switch market is experiencing steady growth, driven by the increasing demand for reliable electrical safety devices in industrial settings. Industry requirements for secure isolation of electrical circuits to perform maintenance and ensure operator safety have highlighted the importance of disconnect switches.

The shift toward automation and upgraded power distribution systems has contributed to higher adoption rates. Improvements in switch design, focusing on durability and ease of installation, have enhanced their appeal to electrical engineers and facility managers.

Additionally, strict safety regulations and standards in electrical installations continue to drive the replacement of outdated equipment. The market outlook remains positive with growing industrial infrastructure development and the need for efficient power control solutions. Segment growth is expected to be dominated by non-fused switches, low voltage ratings of 11 kV or below, and applications focused on the industrial sector.

The panel-mounted disconnect switch market is segmented by product, voltage, and application and geographic regions. The product of the panel-mounted disconnect switch market is divided into Non-Fused and Fused. In terms of voltage, the panel-mounted disconnect switch market is classified into Low (≤ 11 kV), Medium (> 11 kV - 33 kV), and High (> 33 kV). Based on the application of the panel-mounted disconnect switch, the market is segmented into Industrial, Commercial, and Utility. Regionally, the panel-mounted disconnect switch industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

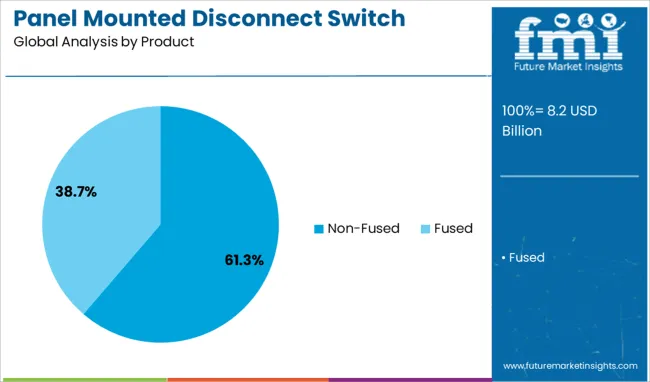

The non-fused product segment is expected to hold 61.3% of the panel mounted disconnect switch market revenue in 2025, maintaining its leadership position. This segment has grown due to its suitability for use in circuits where upstream protection devices handle fault interruption. Non-fused switches are preferred for their simpler design, ease of maintenance, and cost-effectiveness.

Industrial users have increasingly favored non-fused switches for applications requiring circuit isolation without the need for built-in overcurrent protection. The segment benefits from widespread acceptance in electrical panels for motor control centers and distribution boards.

As operational safety and efficiency remain critical, non-fused disconnect switches are anticipated to continue leading product demand.

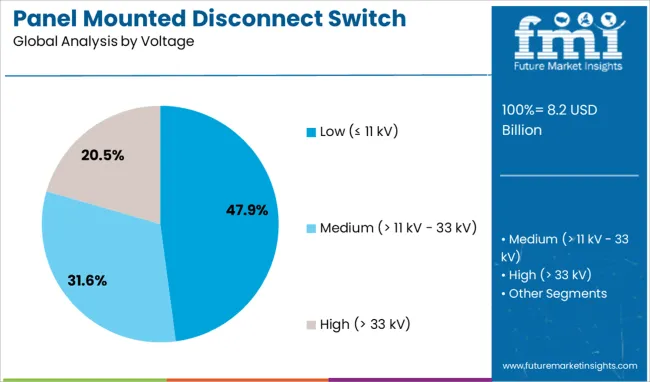

The low voltage segment, defined as 11 kV or below, is projected to contribute 47.9% of the market revenue in 2025, establishing itself as the dominant voltage rating category. This is primarily due to the extensive use of low voltage electrical systems in industrial facilities for power distribution and equipment control.

Low voltage disconnect switches provide reliable isolation and safe maintenance access while meeting industry safety standards. The segment has expanded alongside industrial growth, where low voltage applications are common in motors, transformers, and control circuits.

Its broad applicability and compliance with electrical safety regulations ensure sustained demand. As industrial power systems modernize and expand, low voltage disconnect switches are expected to retain their market prominence.

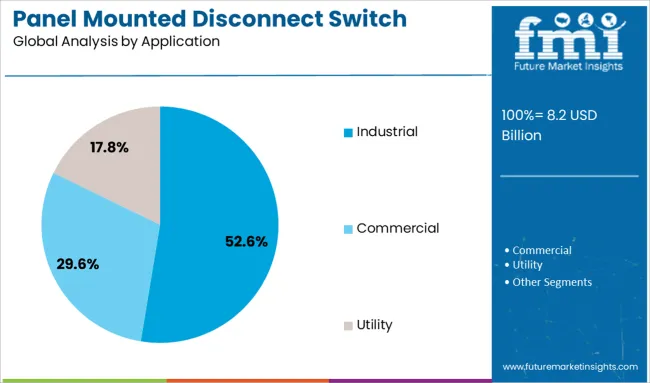

The industrial segment is projected to represent 52.6% of the panel mounted disconnect switch market revenue in 2025, making it the largest application segment. Industrial facilities demand robust and reliable electrical components to ensure uninterrupted operations and worker safety. Disconnect switches are critical for isolating equipment during maintenance and emergencies.

The rise in industrial automation, increased factory expansions, and modernization of electrical infrastructure have all contributed to the growing need for panel mounted disconnect switches.

Stringent occupational health and safety regulations also mandate the use of proper disconnecting devices to reduce electrical hazards. With continued industrial development worldwide, the industrial application segment is expected to maintain its leadership in market revenue.

The panel mounted disconnect switch market is expanding owing to stringent electrical safety regulations, growing automation adoption, and expansion of power infrastructure worldwide. Investors are focused on smart and IoT-enabled switch designs integrated into control panels for predictive maintenance in utilities and industrial sectors. Compact and modular designs are becoming mainstream for space-limited installations. High installation and retrofit complexity, competition from dry-type alternatives, and reliance on oil-filled construction restrict market expansion. Manufacturers prioritizing safety standards compliance and ease of installation are viewed as best positioned for growth through 2025 and beyond.

Market growth is being driven by enforcement of electrical isolation standards and increased automation across manufacturing and energy sectors. In 2024, utilities in Asia-Pacific and North America accelerated upgrading of distribution panels, driving procurement of panel mounted disconnect switches for high-voltage safety applications. Growing investment in grid modernization and EV charging infrastructure prompted greater deployment of safe disconnect solutions rated above 11 kV. It is widely believed that emphasis on compliance with IEC and UL standards is ensuring steady adoption among industrial buyers globally.

Opportunities are emerging in disconnect devices featuring built‑in condition monitoring and remote status reporting for predictive maintenance. By 2025, switch-makers rolled out units with digital sensors tracking temperature and switching cycles, facilitating integration into smart substation schemes. Modular designs and plug-and-play cartridges are gaining traction in commercial installations to simplify servicing. It is considered that suppliers offering connected and scalable switch platforms will attract utilities and large industrial clients looking to reduce downtime and TOTAL cost of ownership.

A key trend in 2024–2025 has been transition toward compact switch models designed for space-constrained panels, especially in data centres and offshore applications. IoT-enabled diagnostic feedback and ruggedized insulation systems are being adopted to enable real-time fault detection. Non-fused switch variants continue to dominate due to lower maintenance and simpler operation. Hybrid versions combining fused and non-fused modules are also gaining interest. It is strongly believed that product designs delivering reliability and form-factor flexibility will dictate procurement preferences across new installations.

The market is constrained by high equipment and installation costs, limited retrofit compatibility, and long certification cycles. In 2024 developers encountered delays in commissioning due to stringent compliance checks and oil-related safety procedures. Furthermore, dry-type alternatives and fuse-free switch tech are increasingly preferred for lower-voltage indoor panels, limiting use of panel-mounted types in certain segments. It is strongly believed that smaller players unable to offer simplified installation and cost-effective designs will be challenged in competing with emerging alternatives.

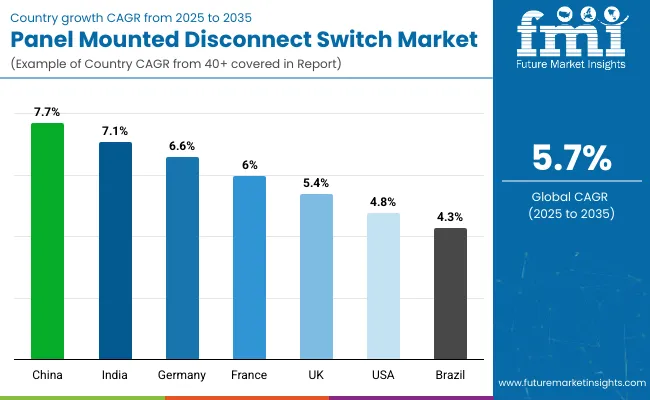

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The global panel mounted disconnect switch market is projected to grow at a CAGR of 5.7% from 2025 to 2035. China leads with 7.7%, followed by India at 7.1% and Germany at 6.6%. France records 6.0%, while the United Kingdom posts 5.4%. Growth is driven by rising adoption in industrial control systems, enhanced electrical safety standards, and expansion of renewable energy projects. China and India dominate demand through rapid industrialization, while Germany focuses on compact high-performance designs. France and the UK prioritize compliance-driven retrofits and integration with smart monitoring features for advanced electrical systems.

The panel mounted disconnect switch market in China is projected to grow at 7.7%, supported by large-scale automation projects and increased focus on safety in power distribution systems. Rotary disconnect switches dominate usage in industrial control panels. Manufacturers integrate arc-flash mitigation technologies for improved protection. Growth in renewable power installations accelerates adoption across substations and distributed generation units.

The panel mounted disconnect switch market in India is expected to grow at 7.1%, driven by expanding manufacturing infrastructure and energy sector modernization. Compact switch designs dominate installation in HVAC and motor control systems. Manufacturers develop cost-effective solutions with quick-install features for SMEs. Rising demand for reliable circuit isolation in commercial buildings boosts deployment.

The panel mounted disconnect switch market in Germany is forecast to grow at 6.6%, driven by Industry 4.0 adoption and strong emphasis on operational safety. Fused disconnect switches dominate heavy-duty industrial environments. Manufacturers innovate with IP65-rated enclosures for harsh conditions. Increasing deployment in automated assembly lines accelerates demand for advanced switchgear solutions.

The panel mounted disconnect switch market in France is expected to grow at 6.0%, supported by modernization of aging electrical networks and renewable energy integration. Non-fused disconnect switches dominate retrofitting projects for commercial setups. Manufacturers introduce modular configurations to improve installation flexibility. Increased focus on compliance with EU electrical safety norms boosts demand for premium switchgear.

The panel mounted disconnect switch market in the UK is projected to grow at 5.4%, driven by expansion of smart grid projects and rising energy efficiency mandates. Multi-pole disconnect switches dominate installations in renewable energy systems. Manufacturers invest in integrating remote monitoring capabilities with IoT platforms. Increasing adoption in data centers reinforces market demand for high-reliability disconnect switches.

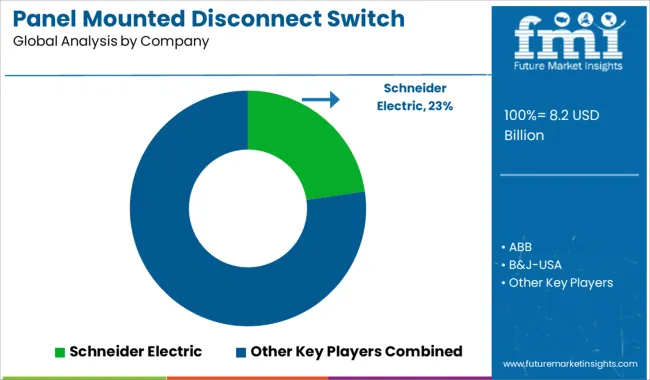

The panel mounted disconnect switch market is moderately consolidated, with Schneider Electric recognized as a leading player due to its comprehensive range of high-performance disconnect switches designed for industrial, commercial, and residential applications. The company’s focus on safety, reliability, and integration with smart energy management systems strengthens its leadership in the global market.

Key players include ABB, B&J-USA, c3controls, Changan Group, Eaton, Emerson Electric, EMSPEC, General Electric, Havells India, Honeywell International, Littelfuse, LOVATO ELECTRIC, MERSEN EP, Richards Manufacturing, Rockwell Automation, Salzer, Siemens, SOCOMEC, and WEG. These companies provide disconnect switches engineered to ensure safe power isolation during maintenance and emergency shutdowns, with designs suitable for harsh environments and compliance with international safety standards such as IEC and UL.

Market growth is driven by increasing demand for electrical safety solutions, modernization of power distribution infrastructure, and growing adoption of renewable energy systems requiring secure isolation mechanisms.

Leading manufacturers are focusing on innovations such as compact modular designs, enhanced arc-flash protection, and integration of digital monitoring for predictive maintenance. North America and Europe dominate the market due to stringent electrical safety regulations, while Asia-Pacific is experiencing rapid growth fueled by industrial expansion and smart grid deployments.

In March 2025, ABB committed USD 120 million to expand its electrification manufacturing capacity in the USA-doubling its Mississippi facility and adding production in Selmer, Tennessee. This investment also created approximately 250 new jobs, reinforcing ABB’s leadership in panel-mounted disconnect switch production across North America.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.2 Billion |

| Product | Non-Fused and Fused |

| Voltage | Low (≤ 11 kV), Medium (> 11 kV - 33 kV), and High (> 33 kV) |

| Application | Industrial, Commercial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, ABB, B&J-USA, c3controls, Changan Group, Eaton, Emerson Electric, EMSPEC, General Electric, Havells India, Honeywell International, Littelfuse, LOVATO ELECTRIC, MERSEN EP, Richards Manufacturing, Rockwell Automation, Salzer, Siemens, SOCOMEC, and WEG |

| Additional Attributes | Dollar sales segmented by product type (fused vs non-fused), voltage class (low, medium, high), and application (industrial, commercial, utility). Regional demand strong in North America and Europe, with Asia-Pacific showing fastest growth. Innovations include IoT-enabled monitoring, compact safety-focused designs, smart grid integration, and AI-driven diagnostics for predictive maintenance and operational reliability. |

The global panel mounted disconnect switch market is estimated to be valued at USD 8.2 billion in 2025.

The market size for the panel mounted disconnect switch market is projected to reach USD 14.4 billion by 2035.

The panel mounted disconnect switch market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in panel mounted disconnect switch market are non-fused and fused.

In terms of voltage, low (≤ 11 kv) segment to command 47.9% share in the panel mounted disconnect switch market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Panel Mounted Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Panel Mount EMI Filter Market Forecast and Outlook 2025 to 2035

Panel Saw Market Size and Share Forecast Outlook 2025 to 2035

Panel Level Packaging Market Analysis by Materials and Technologies Through 2025 to 2035

Flat Panel Antenna Market Size and Share Forecast Outlook 2025 to 2035

Ring Panel Filters Market Size and Share Forecast Outlook 2025 to 2035

Flat Panel Display Market Analysis by Technology, Application, and Region through 2025 to 2035

Flat Panel X-Ray Detectors Market Analysis by Application, Product, and Region Forecast Through 2035

Market Share Distribution Among Ring Panel Filters Providers

Wood Panel Market

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Recycling Management Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Touch Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Mounting Structures Market Growth - Trends & Forecast 2025 to 2035

Solar Panel Tracking Mounts Market

Display Panel Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Bed Head Panel Market Size and Share Forecast Outlook 2025 to 2035

Livestock Panel Gates Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA