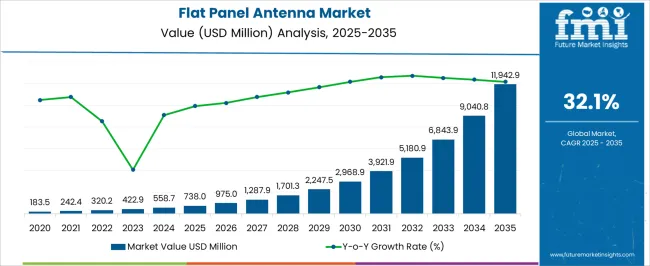

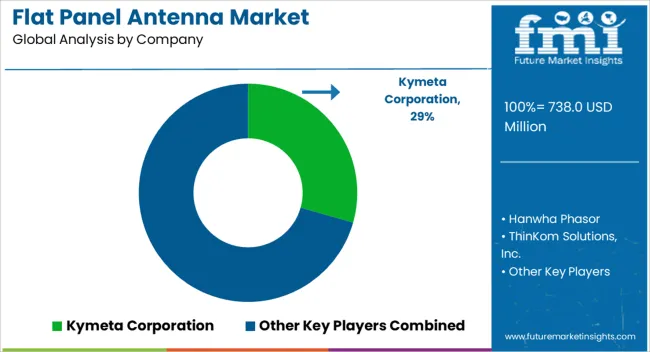

The Flat Panel Antenna Market is estimated to be valued at USD 738.0 million in 2025 and is projected to reach USD 11942.9 million by 2035, registering a compound annual growth rate (CAGR) of 32.1% over the forecast period. A Growth Contribution Index (GCI) analysis reveals significant contributions from both volume and price growth over the forecast period. Between 2025 and 2030, the market grows from USD 738.0 million to USD 2,968.9 million, contributing USD 2,230.9 million in growth, with a CAGR of 32.4%. This early-phase growth is largely driven by the increasing adoption of flat panel antennas in communication technologies, particularly in satellite communications, 5G networks, and defense applications. The demand for compact, lightweight, and high-performance antennas further supports this acceleration.

As industries seek to improve data transmission capabilities and optimize network performance, the market sees a strong surge in volume and technological advancements. From 2030 to 2035, the market continues to expand from USD 2,968.9 million to USD 11,942.9 million, contributing USD 8,974 million in growth, with a slightly lower CAGR of 31.7%. This deceleration reflects market maturation, with more widespread adoption and stronger competition. Despite the slower growth rate, the continued demand for advanced antennas in emerging applications, including IoT, smart cities, and autonomous vehicles, ensures sustained growth. The GCI analysis shows strong early-phase acceleration, followed by steady expansion in the latter years.

| Metric | Value |

|---|---|

| Flat Panel Antenna Market Estimated Value in (2025 E) | USD 738.0 million |

| Flat Panel Antenna Market Forecast Value in (2035 F) | USD 11942.9 million |

| Forecast CAGR (2025 to 2035) | 32.1% |

The rise in low-earth-orbit satellite deployments and growing use of in-motion communication for defense, maritime, and aeronautical applications is propelling the adoption of flat-panel antennas. Technological advances in beamforming, phased array systems, and adaptive signal processing have enhanced performance while reducing form factor and power requirements. Industry participants are focusing on scalable solutions that support seamless switching across networks and frequency bands, aligning with the connectivity demands of modern mobility platforms.

As connectivity infrastructure evolves to support hybrid and multi network environments, the market for flat panel antennas is expected to expand further, especially in mobile platforms, smart transportation systems, and remote communication scenarios.

The flat panel antenna market is segmented by type, operating frequency, network connectivity, orbit type, end use, and geographic regions. By type, the flat panel antenna market is divided into electronically steered and mechanically steered. In terms of operating frequency, the flat panel antenna market is classified into C and X band, and Ku, K, and Ka band. Based on network connectivity of the flat panel antenna market is segmented into Multi-Network Devices and Dedicated Network Devices. By orbit type, the flat panel antenna market is segmented into Geostationary Earth Orbit (GEO) and Non-GEO. By end use, the flat panel antenna market is segmented into Aviation, Telecommunications, Military, Commercial, and Others. Regionally, the flat panel antenna industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

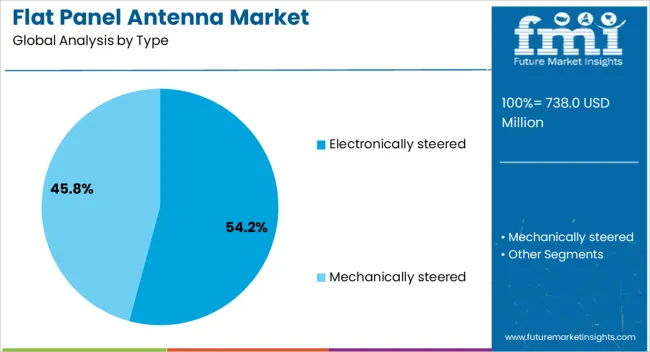

The electronically steered segment is projected to account for 54.20% of the total market revenue by 2025 within the type category, establishing it as the dominant segment. This growth is attributed to its capacity for real time beam steering, reduced mechanical complexity, and superior performance in dynamic environments.

Electronically steered antennas are favored in applications requiring mobility, such as aircraft, military vehicles, and connected transport systems. Their flat, low profile design allows for seamless integration without compromising aerodynamics or structural integrity.

Additionally, the capability to rapidly switch beams enhances connectivity in remote or moving scenarios. These benefits have made electronically steered antennas the preferred option for industries seeking reliability, speed, and multi directional coverage.

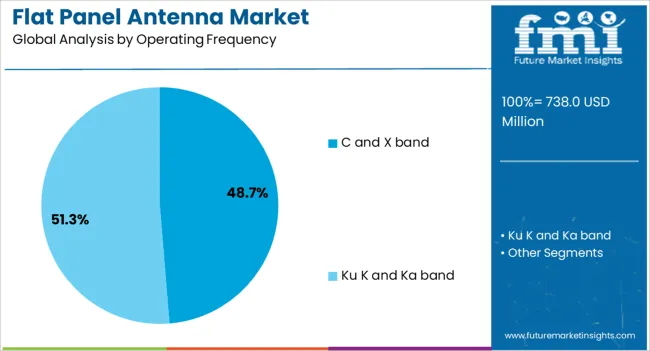

The C and X band segment is expected to hold 48.70% of total market share by 2025 under the operating frequency category, positioning it as the leading frequency range. This dominance is driven by its wide adoption in satellite communications, defense systems, and broadcasting applications.

C and X band frequencies provide reliable signal performance in adverse weather conditions and are suitable for long range communication. These bands are essential in ensuring uninterrupted data flow in mission critical and high bandwidth environments.

Their versatility across commercial and military applications supports broad adoption, contributing to sustained growth within this frequency range.

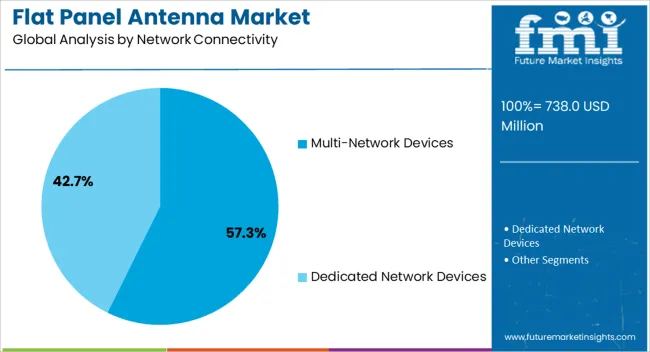

The multi network devices segment is forecasted to contribute 57.30% of the total revenue by 2025 within the network connectivity category, making it the leading subsegment. The growing need for uninterrupted connectivity across multiple platforms and regions has led to the increased deployment of devices that support hybrid networking.

These solutions enable seamless transition between satellite, terrestrial, and cellular networks without loss of signal, which is vital for defense, transport, and logistics sectors. The rising emphasis on redundancy, network diversity, and operational resilience has made multi network devices a strategic priority.

As digital infrastructure expands globally, demand for flexible and interoperable communication solutions continues to elevate the relevance of this segment.

The flat panel antenna market is expanding due to the growing demand for efficient communication systems in telecommunications, aerospace, defense, and satellite industries. These antennas, known for their compact size and high performance, are used in applications such as satellite communication, radar systems, and mobile connectivity. The increasing adoption of high-speed internet, the expansion of satellite networks, and the growth of autonomous vehicle technologies are driving the demand for flat panel antennas. Despite challenges such as high production costs and the need for specialized components, innovations in antenna technology continue to support the market’s growth.

The growth of the flat panel antenna market is primarily driven by the increasing demand for compact, high-performance communication systems. With the rise in satellite-based communication, particularly in remote areas and for global connectivity, flat panel antennas are gaining popularity due to their ability to provide reliable communication while maintaining a small form factor. These antennas are used in a wide range of applications, including satellite internet, mobile communications, and military operations. Their efficient design allows for better bandwidth utilization, improved signal quality, and greater portability. The rapid development of satellite constellations, along with the growing need for seamless connectivity across industries like defense, telecommunications, and transportation, is also fueling demand for flat panel antennas. Furthermore, the growth of autonomous vehicles and the internet of things (IoT) is creating new opportunities for these communication systems.

A significant challenge in the flat panel antenna market is the high production costs associated with advanced antenna designs and materials. While these antennas offer significant advantages in terms of compactness and performance, their manufacturing process requires specialized components and materials, which can drive up costs. The complex design of flat panel antennas, particularly those with multi-beam or phased-array functionalities, presents technical challenges in terms of integration, calibration, and performance optimization. The requirement for precise engineering and testing of these antennas adds to the overall cost of production. The lack of standardization in flat panel antenna technologies and compatibility issues across various communication systems can further complicate adoption. Overcoming these challenges will require significant investment in research and development, as well as advances in manufacturing processes.

The flat panel antenna market presents significant opportunities driven by the growing expansion of satellite networks and mobile connectivity. As demand for global internet access increases, particularly in underserved regions, satellite networks are playing an increasingly important role in providing high-speed communication. Flat panel antennas, with their ability to provide reliable communication at higher frequencies and lower latency, are perfectly suited for satellite communication applications. The growing need for mobile connectivity, particularly in remote areas and for emergency response, is creating opportunities for these antennas to be used in portable communication systems. The increasing adoption of 5G technology is another factor driving the demand for advanced antenna systems, as flat panel antennas are being integrated into mobile infrastructure to support high-speed, low-latency communication. Furthermore, the rise of autonomous vehicles, which require advanced communication systems, provides an opportunity for flat panel antennas to be incorporated into these vehicles for reliable and real-time communication.

A key trend in the flat panel antenna market is the integration of these antennas with 5G networks and emerging satellite constellations. As 5G technology rolls out globally, there is a growing need for advanced antenna systems that can handle the high-speed, low-latency requirements of 5G communication. Flat panel antennas, with their compact size and high-performance capabilities, are becoming a preferred solution for 5G infrastructure, particularly in small cells and remote areas. The rise of large-scale satellite constellations, such as those being developed by SpaceX and OneWeb, is driving demand for flat-panel antennas that can support global broadband services. These constellations require lightweight, durable, and high-performance antennas to provide seamless connectivity across vast geographical areas. The trend towards miniaturization and integration of antennas into various communication devices is also shaping the market, with manufacturers focused on developing more efficient, cost-effective solutions for diverse applications.

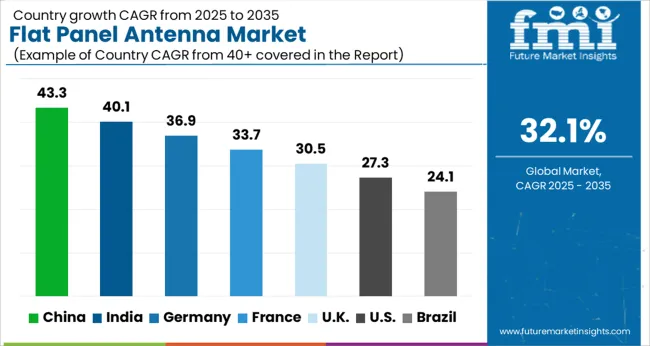

The global flat panel antenna market is projected to grow at a CAGR of 32.1% from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 43.3%, followed by India at 40.1%, and France at 33.7%, while the United Kingdom records 30.5% and the United States posts 27.3%. Divergence reflects local catalysts: increased demand for high-speed internet and satellite communication services in China and India, while more mature markets like the United States and the United Kingdom experience more moderate growth due to infrastructure maturity. The analysis includes over 40+ countries, with the leading markets detailed below.

China is experiencing significant growth in the flat panel antenna market, projected at 43.3% CAGR through 2035. The country’s expanding telecommunications and satellite communication sectors are major contributors to this growth. The rising demand for high-speed, low-latency communication in both urban and rural areas is pushing the adoption of flat panel antennas. As China continues its advancements in 5G, satellite internet, and IoT technologies, the need for high-performance antennas has become crucial. China’s increasing investments in space exploration and satellite infrastructure further drive market demand.

The flat panel antenna market in India is projected to grow at a 40.1% CAGR through 2035. The demand for high-speed internet and satellite services, particularly in remote areas, is driving the market expansion. India’s increasing investments in satellite technology and its drive to expand 5G networks are contributing to the growing adoption of flat panel antennas. The country’s focus on digital connectivity and smart city initiatives further accelerates the need for advanced communication systems, including flat panel antennas. India’s space sector, with its growing satellite launches, is also boosting market demand.

Demand for flat panel antennas in France is growing at a 33.7% CAGR through 2035. France’s robust satellite communication industry, combined with the rise in 5G adoption, is driving the need for high-performance antennas. The country’s focus on expanding its satellite infrastructure and smart city projects is contributing to the growth of this market. France’s commitment to improving digital connectivity and advancing telecommunications technologies further accelerates the adoption of flat panel antennas. The growing interest in space exploration and satellite-based services further supports the market’s expansion.

The UK flat panel antenna market is expected to grow at a 30.5% CAGR through 2035. The demand for high-speed communication solutions, especially for satellite-based services, is increasing as the UK focuses on modernizing its telecommunication infrastructure. The UK’s growing interest in space technologies, including satellite launches and deep space exploration, is driving the adoption of flat panel antennas. The ongoing development of 5G networks and IoT applications also plays a significant role in market growth. The government’s push for smart cities and urban digital infrastructure further accelerates demand for advanced communication solutions.

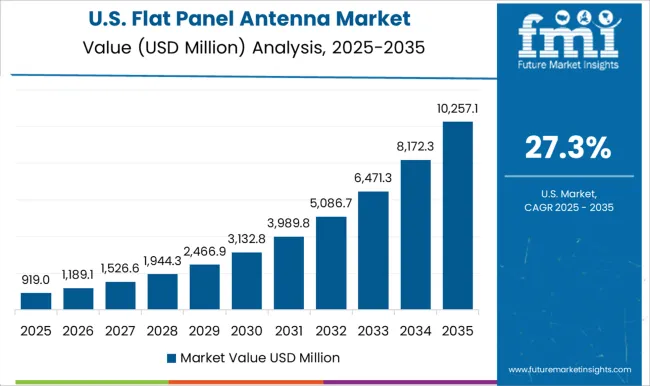

Demand for flat panel antennas in the USA is projected to grow at a 27.3% CAGR through 2035. The USA is a global leader in 5G deployment and satellite communication technologies, which significantly drives the demand for flat panel antennas. The growing need for high-speed data transmission in both commercial and residential sectors is further contributing to market expansion. The increasing focus on space exploration, including satellite-based internet services and IoT applications, is also driving the adoption of advanced antenna technologies. The USA government’s investments in satellite systems and broadband expansion further support market growth.

Kymeta Corporation is a prominent player, renowned for its flat panel antennas designed for satellite communications. These antennas provide cost-effective, scalable solutions, catering to both commercial and military sectors, with a focus on providing reliable connectivity in challenging environments. Hanwha Phasor specializes in phased array antennas, offering high-performance solutions designed for satellite communications and defense applications. Their products are distinguished by enhanced signal reliability, making them ideal for critical and high-performance use cases. ThinKom Solutions, Inc. is another significant player, providing flat panel antennas that are widely used in mobile satellite communication and broadband services. Known for their reliability and ease of use, ThinKom’s antennas focus on ensuring performance consistency, even in mobile and dynamic environments.

TTI Norte manufactures cutting-edge antenna technology used in a wide range of industrial and communication applications, offering flexible and durable solutions that cater to various market needs. L3Harris Technologies, a major player in defense and telecommunications, offers advanced flat panel antenna systems designed for secure, reliable communication in defense, government, and commercial sectors. Their systems are built to provide seamless integration, offering high-performance capabilities that meet the demands of modern communication networks. These companies maintain competitive differentiation through innovation in antenna design, product reliability, and the ability to cater to both commercial and military markets, with growing demand across satellite, defense, and telecommunications industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 738.0 Million |

| Type | Electronically steered and Mechanically steered |

| Operating Frequency | C and X band and Ku K and Ka band |

| Network Connectivity | Multi-Network Devices and Dedicated Network Devices |

| Orbit Type | Geostationary Earth Orbit (GEO) and Non-GEO |

| End use | Aviation, Telecommunications, Military, Commercial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kymeta Corporation, Hanwha Phasor, ThinKom Solutions, Inc., TTI Norte, and L3Harris Technologies |

| Additional Attributes | Dollar sales by product type (satellite communication, defense communication, broadband antennas) and end-use segments (defense, telecommunications, satellite communication). Demand dynamics are driven by the growing need for compact, efficient communication solutions in satellite, defense, and broadband industries. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with innovations in antenna design, improved signal reliability, and expanding applications in mobile broadband and satellite services fueling market expansion. |

The global flat panel antenna market is estimated to be valued at USD 738.0 million in 2025.

The market size for the flat panel antenna market is projected to reach USD 11,942.9 million by 2035.

The flat panel antenna market is expected to grow at a 32.1% CAGR between 2025 and 2035.

The key product types in flat panel antenna market are electronically steered, AESA (active electronically scanned array), PESA (passive electronically scanned array) and mechanically steered.

In terms of operating frequency, c and x band segment to command 48.7% share in the flat panel antenna market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flat Rack Containers Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatbed Die Cutters Market Size and Share Forecast Outlook 2025 to 2035

Flatbed Trucks Market Size and Share Forecast Outlook 2025 to 2035

Flat Valve Caps And Closures Market Size and Share Forecast Outlook 2025 to 2035

Flat Bottom Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flat Bottom Bags Market Size and Share Forecast Outlook 2025 to 2035

Flat Glass Market Growth & Demand 2025 to 2035

Flatware Market Analysis - Growth & Demand Forecast 2025 to 2035

Analyzing Flatback Tape Market Share & Industry Leaders

Leading Providers & Market Share in Flat Bottom Pouch Manufacturing

Market Share Insights of Leading Flat Glass Coating Providers

Flat Steel Market Growth – Trends & Forecast 2024-2034

Flatback Tape Market by Rubber, Silicon & Other Adhesives Forecast 2024 to 2034

Flatware Holders and Organizers Market

Flat Panel Display Market Analysis by Technology, Application, and Region through 2025 to 2035

Flat Panel X-Ray Detectors Market Analysis by Application, Product, and Region Forecast Through 2035

Aflatoxicosis Treatment Market Growth – Trends & Forecast 2025 to 2035

Inflatable Bags Packaging Market Size, Share & Forecast 2025 to 2035

Inflatable Tent Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA