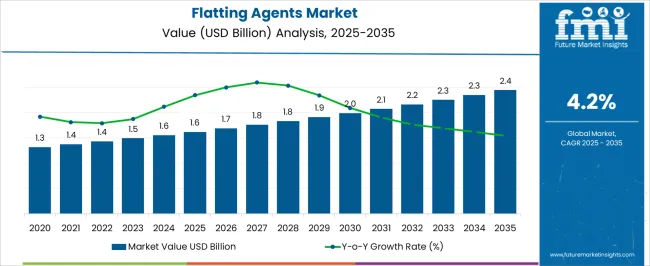

The Flatting Agents Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Flatting Agents Market Estimated Value in (2025 E) | USD 1.6 billion |

| Flatting Agents Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The Flatting Agents market is experiencing steady growth, supported by the increasing demand for surface finishing solutions across multiple industrial applications. The market is primarily being shaped by the adoption of advanced coating technologies, rising awareness of aesthetic and functional surface requirements, and the growing emphasis on durability and scratch resistance. Expansion in industrial activities, including automotive, construction, and general manufacturing sectors, is contributing to higher consumption of flatting agents.

The shift towards water-based and environmentally friendly coatings is further driving market adoption, aligning with regulatory standards on volatile organic compound emissions. Enhanced formulation techniques that improve spreadability, smoothness, and matte finishing are creating opportunities for broader utilization.

As manufacturers seek cost-effective solutions with high performance, flatting agents that provide consistent texture and reduced gloss are gaining preference Future growth is anticipated to be fueled by innovations in low-VOC formulations, increased industrial production, and rising awareness of high-quality coating aesthetics, positioning the market for continued expansion over the coming decade.

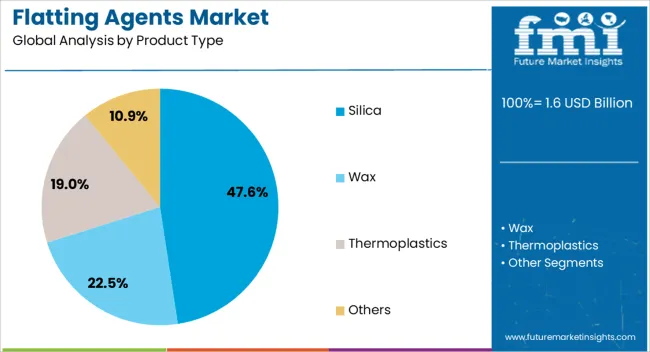

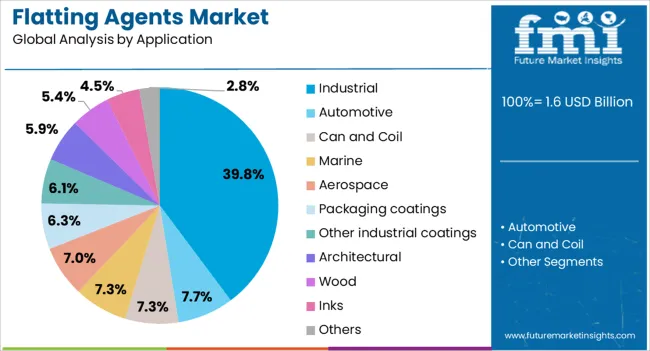

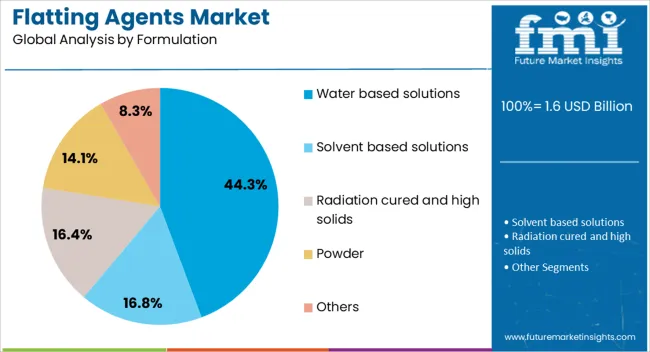

The flatting agents market is segmented by product type, application, formulation, and geographic regions. By product type, flatting agents market is divided into Silica, Wax, Thermoplastics, and Others. In terms of application, flatting agents market is classified into Industrial, Automotive, Can and Coil, Marine, Aerospace, Packaging coatings, Other industrial coatings, Architectural, Wood, Inks, and Others. Based on formulation, flatting agents market is segmented into Water based solutions, Solvent based solutions, Radiation cured and high solids, Powder, and Others. Regionally, the flatting agents industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Silica product type is projected to hold 47.60% of the Flatting Agents market revenue share in 2025, making it the leading product type. This dominance is being driven by silica’s inherent properties, including excellent matting efficiency, thermal stability, and compatibility with a wide range of coating systems. Adoption has been accelerated by industrial demand for coatings that provide uniform surface finish without compromising durability.

Silica particles are widely preferred due to their ability to enhance surface smoothness, reduce gloss, and improve scratch and chemical resistance. The material’s ease of dispersion in water-based and solvent-based systems has further reinforced its utilization.

Manufacturers benefit from the flexibility to modify particle size and distribution to achieve specific matte effects, making silica a reliable choice for high-performance applications The segment growth is expected to continue as industrial coatings increasingly require both functional and aesthetic performance, combined with compliance to environmental and safety standards.

The Industrial application segment is expected to account for 39.80% of the Flatting Agents market revenue in 2025, establishing it as the leading application sector. Growth in this segment is being driven by demand from automotive, construction, and general manufacturing industries that require high-quality, matte-finish coatings. Industrial end-users prioritize consistent gloss control, abrasion resistance, and surface durability, which are effectively delivered by modern flatting agents.

The increase in industrial infrastructure projects and expansion of manufacturing facilities is contributing to higher adoption rates. Furthermore, water-based formulations integrated with flatting agents are being preferred to comply with environmental regulations, reduce VOC emissions, and enhance worker safety.

The segment’s growth has been reinforced by the focus on optimizing coating performance, reducing maintenance requirements, and improving aesthetic appeal in industrial surfaces Ongoing innovation in coating chemistry and formulation techniques is expected to sustain the Industrial segment’s leadership in the flatting agents market.

The Water based solutions formulation segment is projected to capture 44.30% of the Flatting Agents market revenue in 2025, making it the dominant formulation type. This prominence is attributed to the growing preference for environmentally friendly coatings that reduce volatile organic compound emissions and meet regulatory standards.

Water-based formulations provide easier handling, safer application, and better compatibility with silica-based flatting agents, enabling consistent matte finishes across large industrial surfaces. Adoption has been accelerated by the increasing focus on sustainable production practices and the rising demand for high-performance, low-toxicity coatings in automotive, industrial, and commercial applications.

Additionally, water-based systems allow for greater flexibility in adjusting rheology and surface texture without compromising durability, which enhances their attractiveness to end-users The continued shift from solvent-based coatings, combined with the increasing adoption of environmentally compliant products, is expected to drive sustained growth of water-based solution formulations in the flatting agents market.

Flatting agents are used to reduce the glossy effect of the paints, varnishes, lacquers and other finishing paints and coatings in order to meet the tailored specific requirements. The flatting agents are also known as matting agents. Manufacturers are focusing on the development of flatting agents such that the desired matting affect could be obtained whereas maintaining the performance properties of the coatings such as good flow, color, stability, mar resistance and other mechanical and physical properties. The flatting agents are added with paints and coatings to amounts according to the required finish. Flatting agents that not only will reduce gloss but also improves properties such as scratch resistance are being developed.

There has been significant research and development for the development of flatting agents with focus on particle size and pore to improve the efficiency and performance. Flatting agents have specific particle size distribution to diffuse the light in the specific pattern from the paint film and impart a smooth and deep matting effect. The flatting agents are used for a variety of paints and coatings applications ranging from wood, coil and architectural coatings amongst others.

Flatting Agents Market Drivers

The substantial growth in the paints, coatings and inks industry across globe is projected to boost the demand for flatting agents. There has been rise in consumption of decorative paints which is largely being used for the commercial and residential applications. Flatting agents are also being used for inks. Therefore, the steady growth of the end use industry is projected to drive the demand for flatting agents.

Another major benefit of using flatting agents is the significant improvement in properties such as rheology, stability, scratch and mar resistance, finish and smoothness. The increasing concern for aesthetics and appearance and growing use of decorative paints is projected to create positive traction in flatting agents market.

One of the major challenge faced by the global Flatting agents market is the cost associated with the use of advanced flatting agents. Moreover, there are also stringent regulations regarding the emission of harmful volatile organic compounds (VOc's) which is hamper the growth of flatting agents globally. The use of flatting agents in water based paint formulations

With the growing concerns regarding the harmful effect on environment caused by the use of these chemicals, there has been a recent trend for the use of natural flatting agent for paints and coatings applications

In some of the cases, the flatting agents are being added with a hardener additive which allows flexible gloss adjustment, adjust rheology, transparency and stain and scratch resistance has been a major trend in the global flatting agents market. There has been focus on development of advanced grade of flatting agents with could achieve higher matting affect without losing opacity.

Moreover, there has been an increase in consumption of flatting agents to obtain matt effect and superior anti cracking properties in the resin based plasters.

In terms of regional perspective the global flatting agents market is anticipated to be dominated by Asia Pacific region. This is attributed to the significant growth in the paints and coatings industry in the region majorly in China and India with rapid urbanization and industrial and infrastructural developments which is projected to create significant opportunities for growth of flatting agents. North America and Europe are also projected to register noteworthy demand for flatting agents over the forecast period. Latin America and Middle East and Africa are projected to remain low volume high growth regions over the forecast period.

Some of the market participants identified across the value chain of global Flatting Agents market are:

The research report Flatting Agents presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. Flatting Agents also contains projections using a suitable set of assumptions and methodologies. The research report Flatting Agents provides analysis and information according to market segments such as geographies, application, and industry.

The report Flatting Agents is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report Flatting Agents provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report Flatting Agents also maps the qualitative impact of various market factors on Flatting Agents market segments and geographies.

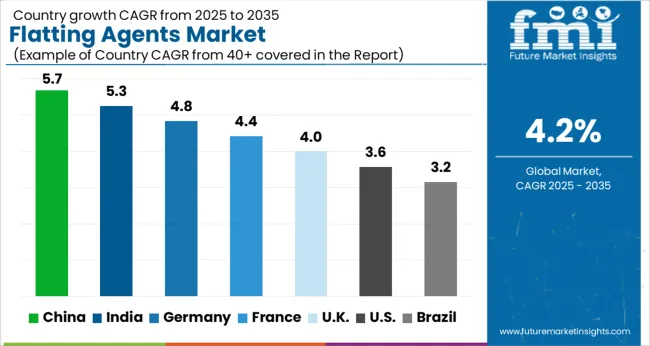

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

The Flatting Agents Market is expected to register a CAGR of 4.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.7%, followed by India at 5.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.2%, yet still underscores a broadly positive trajectory for the global Flatting Agents Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.8%. The USA Flatting Agents Market is estimated to be valued at USD 563.4 million in 2025 and is anticipated to reach a valuation of USD 800.2 million by 2035. Sales are projected to rise at a CAGR of 3.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 73.3 million and USD 47.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Product Type | Silica, Wax, Thermoplastics, and Others |

| Application | Industrial, Automotive, Can and Coil, Marine, Aerospace, Packaging coatings, Other industrial coatings, Architectural, Wood, Inks, and Others |

| Formulation | Water based solutions, Solvent based solutions, Radiation cured and high solids, Powder, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Evonik Industries AG, PPG Industries, Inc., Huntsman Corporation, J.M. Huber Corporation, Dalian Fuchang Chemical Co., Ltd., Imerys S.A., W. R. Grace & Co.-Conn., The Lubrizol Corporation, Michelman, inc., Akzo Nobel N.V., MAPEI, PQ Corporation, Arkema, Allnex, Axalta Coating Systems, and Toyobo Co., Ltd. |

The global flatting agents market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the flatting agents market is projected to reach USD 2.4 billion by 2035.

The flatting agents market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in flatting agents market are silica, wax, thermoplastics and others.

In terms of application, industrial segment to command 39.8% share in the flatting agents market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA