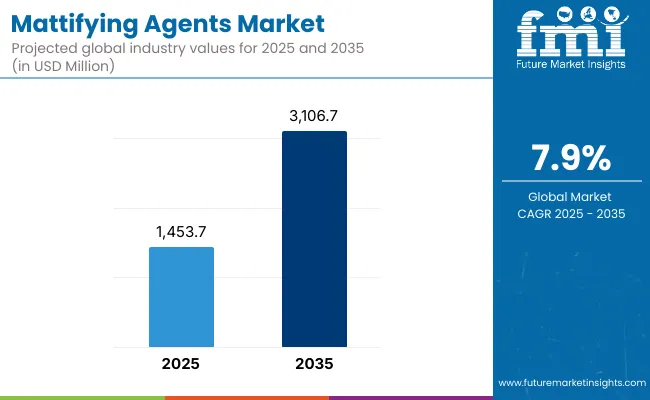

The Global Mattifying Agents Market is expected to record a valuation of USD 1,453.7 million in 2025 and USD 3,106.7 million in 2035, with an increase of USD 1,653.0 million, reflecting a growth of over 113% during the decade. The overall expansion represents a CAGR of 7.9% and signifies a 2X increase in market size.

Global Mattifying Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Global Mattifying Agents Market Estimated Value (2025E) | USD 1,453.7 million |

| Global Mattifying Agents Market Forecast Value (2035F) | USD 3,106.7 million |

| Forecast CAGR (2025-2035) | 7.90% |

During the first five-year period from 2025 to 2030, the market is set to expand from USD 1,453.7 million to USD 2,125.1 million, adding nearly USD 671.4 million, which accounts for 40.6% of total decade growth. This phase marks consistent adoption of mattifying actives in color cosmetics and skincare hybrids, driven by consumer demand for long-lasting makeup wear and oil-free formulations.

Silica & silica blend ingredients dominate this phase as they cater to a wide spectrum of formulations across primers, BB creams, and compact powders where pore-blurring and smooth-finish properties are prioritized.

The second half from 2030 to 2035 contributes approximately USD 981.6 million, equal to 59.4% of total growth, as the market rises from USD 2,125.1 million to USD 3,106.7 million. This acceleration is powered by advanced polymer film formers, PMSQ, and starch-based natural powders being increasingly incorporated in multifunctional skincare-cosmetic blends.

The shift toward dermocosmetic and premium skincare brands further strengthens demand for oil-control and soft-focus effects in hybrid formulations. Asia-Pacific leads this transition with high adoption of sebum-control powders in humid climates, while Western markets witness growth from clean beauty, sustainable ingredient sourcing, and dermatologically tested oil-free products.

Software-like innovations in formulation design and ingredient performance analyticsthough not literal softwareare driving recurring demand for R&D partnerships, boosting the ecosystem of active suppliers such as Evonik, BASF, and Croda. By 2035, polymer film formers and PMSQ-based solutions are projected to capture over 25% share, while dispersion-based mattifiers grow steadily as formulators prefer ready-to-use liquid formats for better texture stability in skin and color formulations.

From 2020 to 2024, the Global Mattifying Agents Market grew from an estimated USD 1,160 million to USD 1,453.7 million, driven by increasing adoption of powder-based silica and starch mattifiers across foundations and primers.

During this period, the competitive landscape was dominated by ingredient manufacturers holding nearly 80% of total revenue, with leading firms such as Evonik, BASF, and Croda focusing on silica-based surface treatments, polymethylsilsesquioxane (PMSQ) microspheres, and polymeric blurring powders designed for advanced sensory effects.

Competitive differentiation centered on particle size optimization, texture consistency, oil-absorption efficiency, and sensory feel, while natural-origin starches began gaining share in sustainable formulations. OEM and brand collaborations remained crucial, as suppliers tailored ingredient performance to regional formulations based on skin type and climatic needs.

By 2025, demand for mattifying actives will reach USD 1,453.7 million, and the market’s value composition will shift as natural powders, PMSQ, and polymer film formers collectively expand beyond 58% share. Traditional silica suppliers face intensifying competition from new entrants offering biodegradable starch-derived microspheres, encapsulated liquid mattifiers, and multifunctional sebum-control dispersions compatible with water-based emulsions. Key players are investing in advanced particle engineering and hybrid crosslinked film systems that enable dual-performance benefits such as oil absorption and soft-focus light diffusion.

The competitive edge is moving from chemical formulation leadership alone to application innovation, clean-label compliance, and sensorial optimization. Suppliers with integrated ingredient portfolios and partnerships with cosmetic manufacturers are expected to maintain long-term advantages through stability testing, regional formulation support, and data-driven ingredient validation.

The market’s expansion is fueled by the rising global preference for oil-control and long-wear beauty formulations, along with growing awareness of sebum regulation and pore-minimizing skincare. Advances in surface-modified silica, PMSQ microbeads, and natural polymeric powders have improved sensory properties, transparency, and texture uniformity, enabling seamless incorporation into both makeup and skincare products. The growing demand for “soft-focus” and “filter-finish” cosmetics reflects shifting consumer expectations toward photo-ready, shine-free skin aesthetics across all demographics.

Innovation in microencapsulation and dispersion technologies has allowed manufacturers to design active ingredients with enhanced compatibility in emulsions and gels. This has opened the door for hybrid foundations, blurring primers, and mattifying serums that deliver smooth application and long-lasting results. In parallel, eco-conscious consumers are accelerating the shift toward starch-based and plant-derived powders as substitutes for traditional synthetic agents.

Major growth is expected from Asia-Pacific, led by China, India, and Japan, where high humidity and pollution levels sustain strong demand for sebum-control and anti-shine products. Western markets, particularly the USA and UK, are witnessing sustained adoption in premium skincare and dermocosmetic formulations that promise both aesthetic and dermatological benefits. Suppliers are differentiating through regulatory alignment (REACH, COSMOS), improved texture feel, and claims such as “non-comedogenic,” “vegan,” and “eco-friendly.”

The market is segmented by chemistry, function, physical form, application, end use, and geography. The chemistry segment covers silica & silica blends, starch & natural powders, polymethylsilsesquioxane (PMSQ), and polymer film formers, reflecting the diversity in particle size and compatibility across formulations.

Functional segmentation includes oil absorption, soft focus/blur effect, and sebum control, addressing the core performance goals of mattifying agents. By physical form, powder, dispersion, and bead/encapsulated types cater to different manufacturing needs across creams, serums, and loose powders.

Application areas span foundations & BB creams, primers & powders, and oil-control skincare, while end-use categories comprise color cosmetics, dermocosmetic, and premium skincare. Geographically, the market covers North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with significant contributions from China, India, Japan, and the USA, reflecting both scale and innovation-driven demand.

| Chemistry | Value Share % 2025 |

|---|---|

| Silica & silica blends | 41.5% |

| Others | 58.5% |

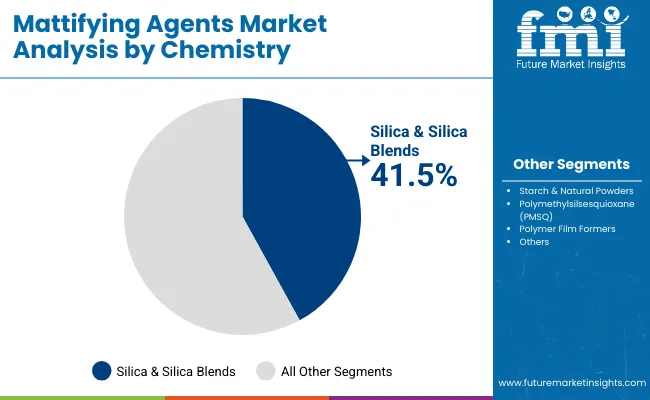

The Silica & Silica Blends segment is projected to contribute 41.5% of the Global Mattifying Agents Market revenue in 2025, maintaining its dominance as the leading chemistry category. This leadership is primarily driven by the wide applicability of silica microbeads and treated silica powders in color cosmetics and oil-control skincare formulations.

Their exceptional oil absorption capacity, transparency, and smooth finish have made them a preferred choice among formulators developing foundations, primers, and compact powders that require a soft-focus aesthetic without altering product shade or texture.

The segment’s strong performance is further supported by continuous innovation in surface modification and particle engineering, which enhances compatibility with diverse emulsions and silicone-based formulations. Silica suppliers are increasingly offering blends with natural or hybrid components, such as silica-starch composites, that deliver enhanced sensory profiles while aligning with the clean beauty movement.

The demand for non-comedogenic, breathable, and lightweight textures is fueling adoption across dermocosmetic and premium skincare brands, ensuring silica remains a cornerstone ingredient. As clean formulation trends advance, silica & silica blends will continue to act as the backbone chemistry of the mattifying agents market, combining performance with sensory appeal.

| Function | Value Share % 2025 |

|---|---|

| Oil absorption | 48.2% |

| Others | 51.8% |

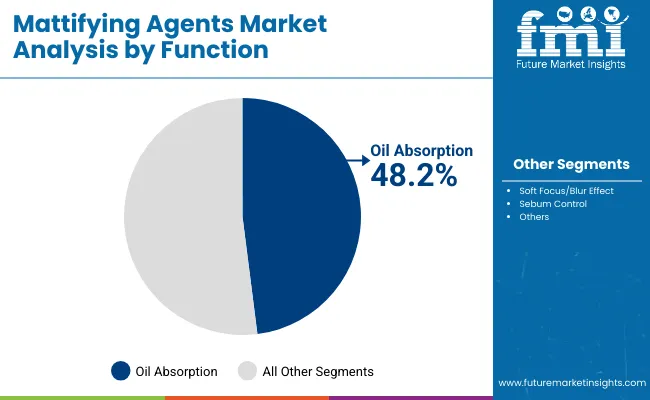

The Oil Absorption segment is forecasted to hold 48.2% of the Global Mattifying Agents Market in 2025, led by its critical role in controlling skin shine and maintaining matte finishes across beauty and skincare applications.

Oil absorption functions are essential for delivering long-lasting wear, balanced sebum regulation, and improved skin texture, making them highly valued in foundations, BB creams, and mattifying serums. The rising demand for products that provide an airbrushed look and anti-shine finish throughout the day continues to drive innovation in this segment.

Manufacturers are engineering microsphere-based powders and encapsulated actives that combine immediate oil control with sustained sebum regulation. Natural-origin ingredients, such as corn starch and tapioca-based absorbents, are also gaining prominence due to their eco-friendly and biodegradable characteristics.

These innovations cater to both high-performance cosmetic brands and dermocosmetic lines focused on skin health and comfort. As global consumers increasingly seek lightweight, breathable, and multifunctional skincare products, the oil absorption segment is expected to remain a central pillar in the formulation of next-generation mattifying solutions.

| Physical Form | Value Share % 2025 |

|---|---|

| Powder | 66.3% |

| Others | 33.7% |

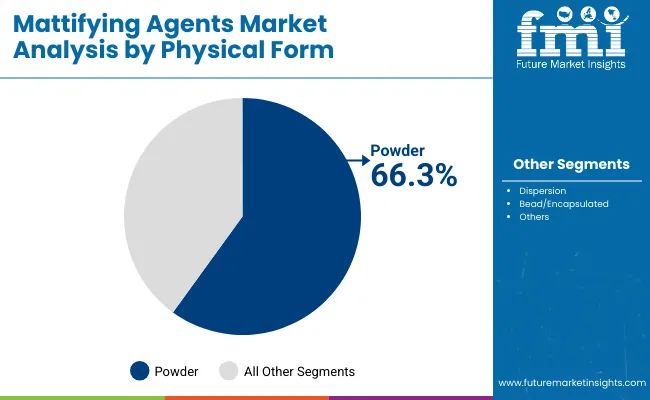

The Powder segment is projected to command 66.3% of the Global Mattifying Agents Market revenue in 2025, reinforcing its dominance as the most widely used physical form in cosmetic and skincare formulations. Powders remain the preferred format due to their high flexibility in blending, superior oil-control capability, and ability to deliver an instant soft-focus finish. Their use spans multiple product typescompact powders, loose finishing powders, liquid foundations, primers, and oil-control skincare creamsmaking them a staple ingredient in both mass and premium markets.

The segment’s growth is further propelled by advances in particle morphology, coating technology, and micronization, which improve dispersibility, sensory texture, and visual uniformity. Cosmetic formulators are increasingly turning toward treated silica, PMSQ microspheres, and starch-based powders to achieve optimized skin adherence and lightweight feel without clogging pores.

While dispersions and encapsulated formats are gaining ground for ease of formulation, the powder segment continues to dominate due to its cost-effectiveness, stability, and established performance record. By 2035, powders are expected to retain their leadership role, underpinning the sensory and functional excellence of mattifying formulations across both color cosmetics and premium skincare segments.

Rising Hybridization Between Makeup and Skincare Formulations

One of the strongest market drivers is the global shift toward hybrid formulations that blur the line between skincare and color cosmetics, particularly within BB creams, primers, and tinted moisturizers. Consumers are no longer seeking products that only offer coveragethey now expect additional oil-control, pore-blurring, and skin health benefits in a single product.

This transition is fueling demand for multifunctional mattifying agents like silica blends, starch derivatives, and polymethylsilsesquioxane (PMSQ) that combine sebum absorption with sensory enhancement and hydration balance.

In major beauty markets such as China, Japan, and South Korea, hybrid “skincare-makeup” innovations have led brands to develop high-performance formulations with invisible matte finishes suitable for humid climates. Western brands are following suit, using mattifying ingredients in “no-makeup makeup” products and daily-use skin tints.

This convergence is redefining the role of mattifyingagentsnot just as oil-control additives but as core multifunctional actives contributing to texture, longevity, and product stability.

Material Innovation in Silica-Starch Blends and PMSQ for Sensory Optimization

Another strong growth driver is formulation innovation focused on sensory performance and texture sophistication. Consumers expect makeup and skincare to deliver not only efficacy but also a refined, smooth, and “blurred” skin feel. To meet this, ingredient manufacturers such as Evonik, BASF, and Croda are developing silica-starch hybrid blends and advanced PMSQ microspheres that create matte finishes while maintaining softness and transparency on skin.

This trend is particularly strong in premium skincare and dermocosmetic brands, where mattifying agents are engineered to provide long-wear comfort without dryness. The evolution of crosslinked polymer film formers that create breathable micro-barriers is driving adoption in next-generation sunscreens, oil-free moisturizers, and matte-finish serums. As texture and sensorial experience become key differentiators in beauty and skincare, demand for scientifically engineered mattifiers with precise particle control and uniform dispersion properties will continue to accelerate.

Formulation Instability and Compatibility Challenges in Multi-Phase Systems

A major restraint lies in the formulation complexity associated with incorporating mattifying agents into multi-phase emulsions, serums, and gel-based skincare systems. Traditional silica powders can sometimes lead to poor dispersion, sedimentation, or uneven distribution, affecting overall product stability and sensory consistency. These challenges increase formulation time, testing cycles, and costs for cosmetic manufacturers.

Moreover, achieving the right balance between oil absorption and hydration without compromising skin feel remains a technical barrier. The incompatibility of certain powders with volatile silicones, surfactant systems, or water-based emulsifiers can limit formulation flexibility. As brands move toward more complex textures like hybrid emulsions or silicone-free clean formulas, the pressure to develop more stable, uniform dispersions of mattifying actives intensifies, restraining growth for some raw material suppliers unable to adapt to this technical demand.

Price Sensitivity and Cost Pressure on Premium Ingredient Blends

While premium formulations using PMSQ and polymer film formers are gaining popularity, their high production cost poses a restraintespecially for brands operating in emerging markets. Advanced mattifying actives require specialized production methods such as surface treatment, crosslinking, and encapsulation, all of which add to per-unit costs.

In cost-sensitive regions like India, Southeast Asia, and Latin America, formulators often opt for starch or talc-based absorbents as cheaper alternatives, limiting the uptake of high-performance synthetic microspheres. Furthermore, as sustainability regulations push brands to transition toward bio-based or biodegradable ingredients, sourcing and certification costs are expected to rise. These cost constraints can slow the pace of premium innovation and limit access to advanced mattifying technologies outside major luxury segments.

Transition Toward Bio-Based, Clean-Label, and Sustainable Mattifiers

A clear trend reshaping the market is the move toward eco-friendly and biodegradable mattifying ingredients, particularly those derived from plant-based starches and natural polymers. With regulatory bodies such as the EU REACH and consumer expectations favoring clean formulations, major ingredient producers are investing in starch-based microspheres and hybrid silica composites that deliver equivalent oil-control performance with lower environmental impact.

The clean beauty movement is also influencing packaging and labeling claims, pushing brands to highlight “plant-derived mattifiers,” “vegan oil-control powders,” and “microplastic-free finishes.” As a result, starch & natural powders, currently accounting for a smaller share than silica, are projected to witness double-digit growth by 2030, especially in Asia and Europe. This sustainability pivot is not merely marketingit’s reshaping R&D pipelines and raw material sourcing strategies across the supply chain.

Regional Specialization and Climate-Based Product Customization

Another emerging trend is the regional customization of mattifying agent formulations based on climate, sebum activity, and cultural preferences. In humid and tropical regions such as India, Indonesia, and Southern China, consumers prioritize strong sebum-control and sweat-resistance, prompting brands to use high-absorbency silica and crosslinked starch particles. Conversely, in Western and temperate regions, the focus is on soft-focus effects and lightweight matte finishes suitable for daily wear or hybrid skincare-makeup routines.

Global suppliers are increasingly segmenting their portfolios geographically, offering custom particle sizes, surface coatings, and dispersion systems optimized for local formulation behavior. This localization trend aligns with the broader movement toward “regional beauty science”, where ingredient technologies are adapted to specific climate and skin-type conditions. It represents a sophisticated evolution of the marketshifting from one-size-fits-all raw materials to targeted, data-driven ingredient strategies tailored to regional performance needs.

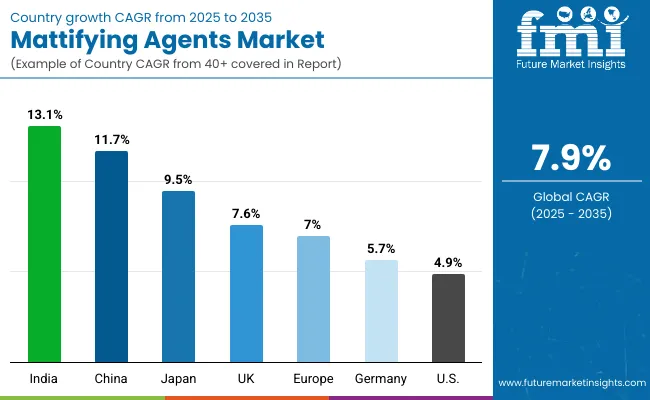

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 11.7% |

| USA | 4.9% |

| India | 13.1% |

| UK | 7.6% |

| Germany | 5.7% |

| Japan | 9.5% |

| Europe | 7.0% |

The Global Mattifying Agents Market demonstrates notable geographic variations in growth between developed and emerging economies. India (13.1% CAGR) and China (11.7% CAGR) lead global expansion, reflecting the surge in oil-control skincare and hybrid cosmetic adoption among young, urban consumers exposed to humid environments and pollution-related skin issues.

Both countries are experiencing a strong movement toward affordable mattifying cosmetics, supported by regional brands emphasizing natural-origin silica-starch blends and talc-free formulations. In China, local ingredient innovation and rapid R&D cycles are accelerating the introduction of sebum-control serums, soft-focus BB creams, and matte-finish sunscreens tailored for Asian skin tones.

India, on the other hand, is witnessing significant penetration in mass-market foundations, compact powders, and daily-use skincare, where anti-shine performance is marketed as a functional necessity rather than a luxury feature. Together, these markets are redefining how global brands approach formulation, texture, and price optimization in emerging Asia.

In contrast, mature markets such as the USA (4.9% CAGR), Germany (5.7% CAGR), and UK (7.6% CAGR) are expanding at a steadier pace, driven primarily by premium skincare and dermocosmetic innovation rather than volume growth. Consumers in these regions are showing increased preference for lightweight, breathable, and “non-greasy” formulations that combine oil control with skin health claims like “microbiome balance” and “hydration retention.”

European brands are also leading in biodegradable and clean-label mattifying agents, supported by regulatory frameworks promoting eco-safe cosmetic ingredients. Japan, with a 9.5% CAGR, remains a pioneer in textural sophistication, emphasizing translucent soft-focus mattifiers that deliver natural finishes without dryness. Overall, Europe maintains a 7.0% CAGR, supported by a strong premium market base and R&D-driven ingredient innovation, while Asia-Pacific continues to outperform in both adoption speed and market value contribution.

| Year | USA Mattifying Agents Market (USD Million) |

|---|---|

| 2025 | 289.92 |

| 2026 | 309.13 |

| 2027 | 329.62 |

| 2028 | 351.46 |

| 2029 | 374.76 |

| 2030 | 399.59 |

| 2031 | 426.07 |

| 2032 | 454.31 |

| 2033 | 484.41 |

| 2034 | 516.52 |

| 2035 | 550.75 |

The Global Mattifying Agents Market in the United States is projected to grow at a CAGR of 4.9%, supported by expanding demand from premium skincare, dermocosmetic, and color cosmetic brands. The USA market reflects a clear shift toward hybrid formulations that merge aesthetic performance with dermatological care.

The foundation and primer categories continue to account for the largest share, supported by consumer preference for lightweight, breathable matte finishes that provide long wear without clogging pores. Brands are also responding to rising consumer awareness about oil-free, non-comedogenic, and anti-shine products, driving sustained investment in silica-based and polymeric mattifying actives.

Growing collaboration between cosmetic ingredient suppliers and skincare brands is fueling innovation in PMSQ and polymer film formers, tailored for dermocosmetic formulations. The segment’s moderate but steady growth also reflects the country’s strong regulatory environment and high R&D spending by multinational corporations such as Evonik, BASF, and Croda.

Consumers are increasingly seeking personalized skincare solutions, leading to the integration of mattifying components in hybrid skincare lines, such as blurring serums, mattifying moisturizers, and tinted SPFs. Furthermore, the rapid expansion of online beauty retail is boosting product accessibility and brand diversification across mass and prestige categories.

The Global Mattifying Agents Market in the United Kingdom is expected to expand at a CAGR of 7.6% through 2035, supported by the country’s strong cosmetic R&D ecosystem and consumer preference for skin-perfected matte aesthetics.

The UK beauty market is emphasizing sustainable and multifunctional formulations, prompting brands to incorporate silica-starch hybrids and natural powders into oil-control products. The integration of mattifying actives in lightweight tinted moisturizers, compact powders, and pore-blurring primers is driving demand across both prestige and drugstore brands.

British formulators are leveraging EU-aligned clean beauty standards to develop products free from microplastics and synthetic talc substitutes, fueling adoption of eco-certified silica and polymer microspheres.

Simultaneously, male grooming and unisex skincare categories are emerging as new frontiers for matte formulations, emphasizing oil-free comfort and subtle texture refinement. With the support of cosmetic innovation clusters, academic partnerships, and government-led sustainability programs, the UK market continues to push performance boundaries in formulation science.

India is witnessing the fastest growth globally, with the Global Mattifying Agents Market expected to expand at a CAGR of 13.1% through 2035. This surge is driven by rising consumer awareness of oil-control skincare and the growing presence of domestic beauty brands catering to tropical climates.

Urbanization and rising disposable incomes are fueling mass adoption of affordable mattifying formulations in compact powders, foundations, and daily-use creams. The high humidity and pollution in Indian cities make anti-shine and sebum-regulating properties a functional necessity, resulting in strong local demand for silica-based and starch-derived absorbents.

Rapid product diversification is occurring across tier-2 and tier-3 cities, supported by cost reductions and greater availability of hybrid cosmetic products through e-commerce. Indian brands are collaborating with ingredient manufacturers to introduce locally sourced, plant-based powders and encapsulated dispersion mattifiers suited for climate-specific skin needs. Training institutions and cosmetic incubators are also integrating advanced formulation education, ensuring long-term innovation capability.

The Global Mattifying Agents Market in China is forecast to grow at a CAGR of 11.7%, the second-highest globally, driven by smart manufacturing, localized innovation, and affordable ingredient production. The Chinese beauty industry is rapidly embracing digital-native brands and AI-driven product formulation platforms, enabling quick market entry for new matte-finish skincare and cosmetic lines. Domestic ingredient suppliers are scaling up production of silica powders, PMSQ microspheres, and polymer dispersions, offering performance comparable to international standards but at lower costs.

The popularity of oil-control cushions, mattifying serums, and hybrid foundations in humid urban areas like Shanghai and Guangzhou is accelerating adoption. Additionally, government support for local R&D centers and cosmetic technology zones is enabling cross-sector innovation between beauty, materials science, and nanotechnology. Affordable mattifying powders are also seeing rapid inclusion in men’s grooming and youth-oriented K-beauty-inspired products.

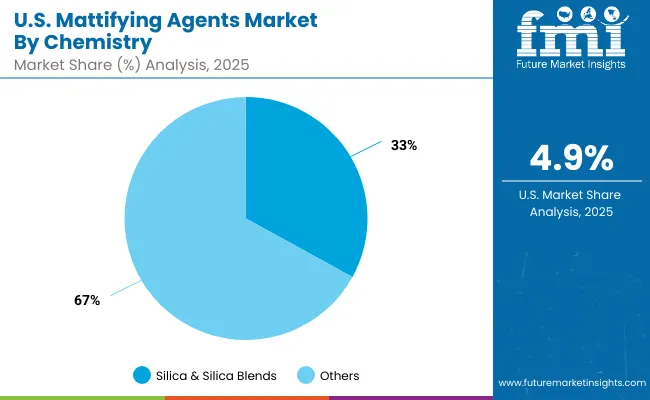

| USA By Chemistry | Value Share % 2025 |

|---|---|

| Silica & silica blends | 32.9% |

| Others | 67.1% |

The Global Mattifying Agents Market in the United States is projected to reach USD 289.9 million in 2025, led by high consumer awareness and established R&D infrastructure in premium skincare and cosmetic innovation. Silica & silica blends contribute 32.9%, while the remaining 67.1% is accounted for by emerging materials including starch derivatives, PMSQ microspheres, and polymer film formerssignifying a strong transition toward advanced and sustainable chemistries. This shift is being accelerated by the popularity of hybrid dermocosmetic formulations, where sebum control, texture refinement, and skin health benefits are integrated into a single product.

The growing adoption of silicone-free, breathable, and clean-label mattifiers reflects USA consumers’ shift toward wellness-oriented beauty. American brands are increasingly focusing on polymer-based microspheres that offer soft-focus effects without dryness, catering to both high-performance makeup and daily-use skincare categories.

Strategic partnerships between ingredient giants (Evonik, BASF, Croda) and emerging indie beauty brands are also stimulating innovation in texture engineering, helping manufacturers create long-wear, anti-shine formulations optimized for varying climates. Additionally, data-driven formulation and sensorial testing platforms are gaining relevance, reinforcing the market’s transition from basic powder actives to smart mattifying systems.

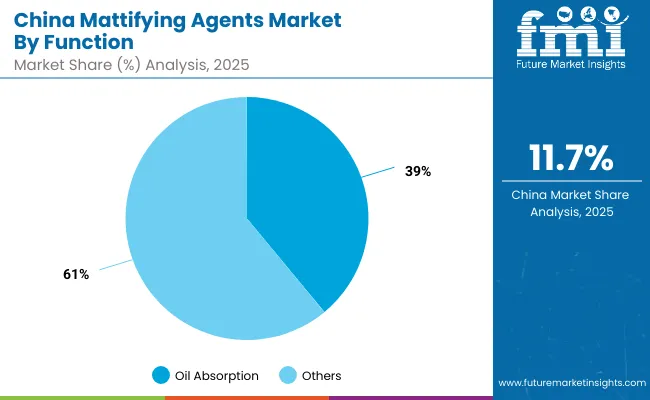

| China By Function | Value Share % 2025 |

|---|---|

| Oil absorption | 39.1% |

| Others | 60.9% |

The Global Mattifying Agents Market in China is projected to reach approximately USD 148.2 million in 2025, expanding at a robust 11.7% CAGR, the second-highest globally. The Oil Absorption segment contributes 39.1%, while soft-focus and sebum-control applications collectively dominate with 60.9%.

Rapid industrial and consumer innovation has positioned China as a dynamic hub for affordable yet high-performance mattifying actives, driven by strong local R&D and government-backed cosmetic innovation clusters. The country’s vast consumer base with oily and combination skin profiles continues to drive demand for oil-regulating agents across both skincare and color cosmetic formulations.

Chinese domestic brands are leveraging hybrid powders combining silica, starch, and PMSQ to achieve translucent, natural-looking matte finishes preferred in humid climates. Simultaneously, the boom in K-beauty and C-beauty-inspired oil-control serums, cushions, and mists is shaping market differentiation.

Cost-effective local production and competitive pricing strategies have made silica-starch blends and polymer dispersions accessible to mid-tier and mass brands. The ecosystem is evolving rapidly toward AI-driven formulation tools and clean, biodegradable ingredient development, supported by local innovation programs and cross-sector collaboration between cosmetic brands, material scientists, and AI startups.

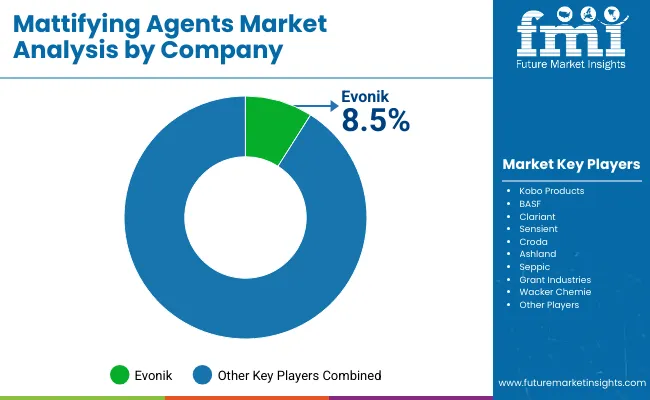

| Company | Global Value Share 2025 |

|---|---|

| Evonik | 8.5% |

| Others | 91.5% |

The Global Mattifying Agents Market is moderately fragmented, with Evonik, BASF, Croda, and Clariant leading global innovation pipelines in surface-modified silica, PMSQ polymers, and hybrid sensory powders. Evonik, with an 8.5% global market share, continues to strengthen its leadership through high-transparency silica and polymeric systems engineered for long-wear matte formulations. BASF and Croda focus on balancing performance with sustainability by developing plant-derived and biodegradable starch-silica composites, addressing increasing regulatory and consumer pressure for cleaner formulations.

Mid-sized specialists such as Kobo Products, Sensient, and Seppic are gaining traction through their tailored solutions for texture differentiation, dispersion stability, and hybrid applications that merge skincare benefits with makeup aesthetics. These players excel in coated silica systems, liquid dispersions, and sensory-enhanced microspheres, often supplying to niche cosmetic and dermocosmetic brands emphasizing soft-focus and blurring effects. Grant Industries and Wacker Chemie maintain their competitive edge through silicone-compatible polymer networks and film formers that ensure uniform matte finishes in high-humidity conditions.

Competitive differentiation is shifting from chemical formulation toward eco-safety, sensory precision, and multi-performance systems. Suppliers are building end-to-end innovation ecosystems, including sensory evaluation labs, AI-based texture profiling, and collaborative product development with beauty brands. As hybrid and clean-label trends dominate, the market is evolving from single-function powders to smart mattifying actives that balance oil absorption, light diffusion, and skincare compatibilitydefining the next decade of competition in the global mattifying agents landscape.

Key Developments in Global Mattifying Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Chemistry | Silica & silica blends, Starch & natural powders, Polymethylsilsesquioxane (PMSQ), Polymer film formers |

| Function | Oil absorption, Soft focus/blur effect, Sebum control |

| Physical Form | Powder, Dispersion, Bead/Encapsulated |

| Application | Foundations & BB creams, Primers & powders, Oil-control skincare |

| End Use | Color cosmetics, Dermocosmetic, Premium skincare |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Evonik, BASF, Clariant, Croda, Sensient, Ashland, Seppic, Kobo Products, Grant Industries, Wacker Chemie |

| Additional Attributes | Dollar sales by chemistry and end use, adoption trends in hybrid skincare-cosmetic products, rising demand for multifunctional oil-control actives, performance innovations in PMSQ and polymer film formers, sector-specific growth in dermocosmetics and premium skincare, increasing role of biodegradable starch-based powders, regional trends shaped by humidity and consumer skin type, and advancements in sensory engineering and encapsulation technology. |

The Global Mattifying Agents Market is estimated to be valued at USD 1,453.7 million in 2025.

The market size for the Global Mattifying Agents Market is projected to reach USD 3,106.7 million by 2035.

The Global Mattifying Agents Market is expected to grow at a CAGR of 7.9% between 2025 and 2035.

The key chemistry types in the Global Mattifying Agents Market are Silica & silica blends, Starch & natural powders, Polymethylsilsesquioxane (PMSQ), and Polymer film formers.

In terms of physical form, the Powder segment is projected to command a 66.3% share in the Global Mattifying Agents Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA