The global leavening agents market is projected to grow from USD 6 billion in 2025 to USD 9.9 billion by 2035, registering a CAGR of 5.1%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6 billion |

| Industry Value (2035F) | USD 9.9 billion |

| CAGR (2025 to 2035) | 5.1% |

Growth in the market is being driven by shifting dietary preferences, an increase in demand for baked goods, and rising health awareness among consumers. The rise in home baking, adoption of clean-label ingredients, and expansion of gluten-free and low-carb diets have increased the use of natural and specialty rising compounds. Product innovations such as ready-to-use mixes, slow-release agents, and fermented sourdough-based solutions are driving adoption across both retail and industrial sectors.

These compounds account for an estimated 23% share of the bakery ingredients category, indicating their foundational role in baking formulations. Within the functional food ingredients space, they hold around 11% share, especially in products targeting health, digestibility, and clean-label positioning. Their contribution to the specialty food additives segment is about 9%, largely through processed foods and dairy-based snacks. In the broader food ingredients industry, they make up just 2%, while their presence across packaged foods remains under 0.5%, due to competition from a wider range of ingredient types.

Regulatory influence stems from food labeling mandates, allergen disclosure requirements, and food safety protocols. In the USA, FDA labeling guidelines and GRAS status monitoring impact the formulation of compounds containing phosphates or aluminum derivatives. In Europe, EFSA frameworks govern the purity and safety of chemical and biological agents. Global reformulation efforts are being shaped by demand for non-GMO yeast, allergen-free blends, and naturally fermented solutions.

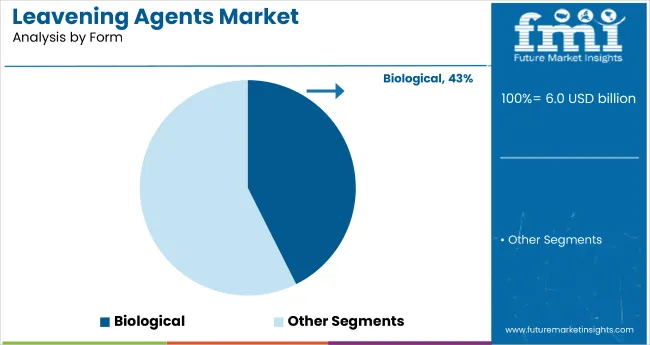

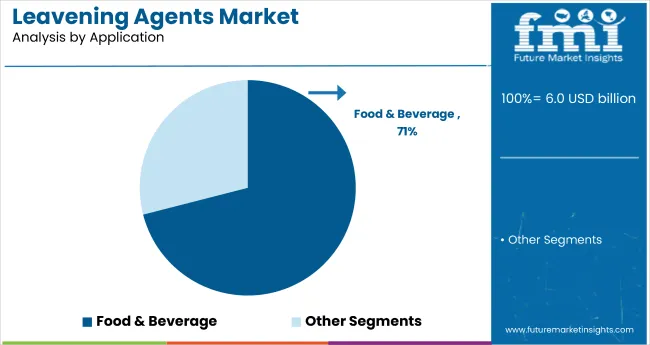

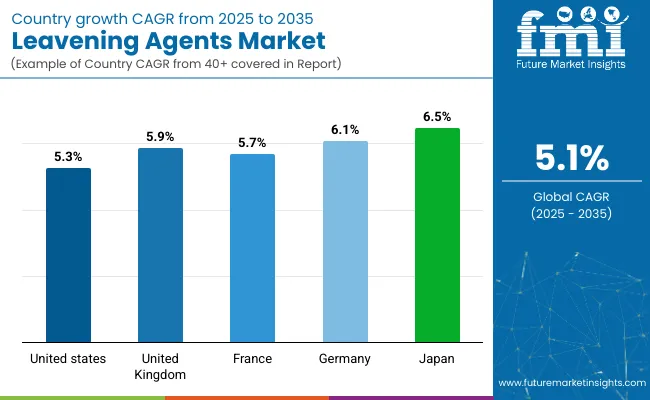

Japan is projected to be the fastest-growing market, expected to expandat a CAGR of 6.5% from 2025 to 2035. Biological will dominate the form segment with a 42.6% share, while food & beverage will lead with 71%. The USA and Germany markets are also expected to grow steadily, with CAGRs of 5.3% and 6.1%, respectively.

The market is segmented by form, application, and region. By form, the market is divided into chemical, biological, and vaporous. In terms of application, the market bifurcated into food & beverage (bakery & confectionery, snack bars, processed foods, baked grain products, dairy products, cheese, spreads & margarines, and carbonated drinks) and personal & health care. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Biological is expected to dominate the form segment, accounting for 42.6% of the global market share by 2025.

Food & beverage is expected to lead the application segment, accounting for 71% of the market share by 2025.

The global leavening agents market is experiencing consistent growth, fueled by rising consumer demand for baked goods, clean-label ingredients, and healthier food options. Leavening agents play a pivotal role in enhancing texture, volume, and shelf life in various food and beverage applications, aligning with evolving dietary preferences and innovation in food processing.

Recent Trends in the Leavening Agents Market

Challenges in the Leavening Agents Market

| Countries | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.5% |

| Germany | 6.1% |

| UK | 5.9% |

| France | 5.7% |

| USA | 5.3% |

Japan's momentum has been shaped by fermented food integration, precision food engineering, and longstanding traditions in artisanal baking. Germany and France sustain demand through artisan bakery expansions and compliance with European Food Safety Authority (EFSA) standards under the EU’s clean label and food safety initiatives. In contrast, developed economies such as the USA (5.3% CAGR), UK (5.9%), and Japan (6.5%) are expected to expand at a steady 1.04 to 1.27 times the global growth rate.

Japan leads in innovation around biological fermentation systems and natural yeast strains, which are integrated into premium baked goods and health-oriented food categories. Germany and France leverage their deep-rooted bakery culture and enforce EU-wide food additive directives that prioritize transparency and sustainability. The USA focuses on clean-label reformulation, growing consumer preference for gluten-free and keto-friendly products, and technological advancement in shelf-life extension. The UK emphasizes traditional and health-conscious bakery trends, especially in the wake of evolving consumer lifestyle preferences.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan leavening agents market is projected to grow at a CAGR of 6.5% from 2025 to 2035. Growth is driven by a strong national preference for fermented foods, natural baking solutions, and low-sodium dietary trends.

The Germany leavening agents revenue is projected to grow at a CAGR of 6.1% during the forecast period, slightly above the global average and driven by strong bakery traditions and EU ingredient disclosure mandates.

The demand for leavening agents in the UK is projected to grow at a CAGR of 5.9% between 2025 and 2035, which is 1.16 times the global growth rate. Growth is supported by a cultural revival of traditional baking and demand for healthier ingredients in baked goods.

The French leavening agents market is forecasted to grow at a CAGR of 5.7% from 2025 to 2035, aligning with European clean-label policies and demand for innovative, texture-enhancing solutions in premium baked goods.

The USA leavening agents revenue is projected to grow at a CAGR of 5.3% from 2025 to 2035, translating to 1.04 times the global rate. Growth is driven by increased home baking trends, clean-label movement, and reformulation in processed foods.

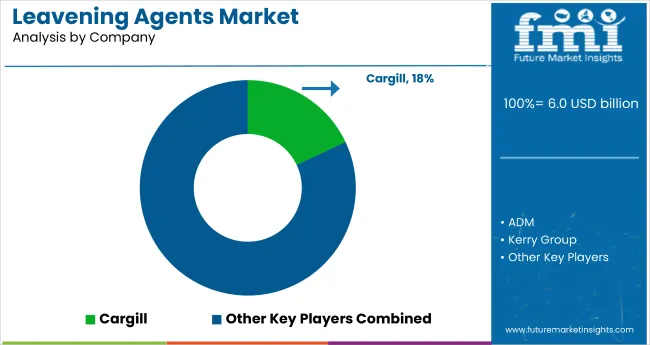

The market is moderately consolidated, with prominent players such as Cargill, ADM, Kerry Group, Corbion, and Lesaffre holding substantial global market shares. These companies offer innovative and diverse solutions across both chemical and biological leavening categories, serving bakery, processed food, dairy, and beverage industries. Cargill emphasizes functional ingredient systems with customizable leavening profiles, while ADM focuses on clean-label solutions compatible with gluten-free and low-carb formulations.

Kerry Group leads in enzyme-based leavening and clean-label innovation, particularly with its Biobake range. Corbion is known for its preservation-enhancing solutions and sustainable sourcing practices, and Lesaffre continues to dominate the biological segment with expertise in natural yeast and fermentation science. Other key players such as Kudos Blends Limited, AB Mauri, Puratos, and Lallemand Inc. are making significant contributions through specialized formulations, regional expertise, and R&D in microencapsulation and shelf-life optimization for various food systems.

Recent Leavening Agents Industry News

In June 2025, MicroBioGen partnered exclusively with Lesaffre to advance yeast innovation across baking, food, and biochemicals by combining proprietary biotechnology with global fermentation expertise and production capabilities.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 6 billion |

| Projected Market Size (2035) | USD 9.9 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value / volume in metric tons |

| Form Analyzed | Chemical, Biological, and Vaporous |

| Application Analyzed | Bakery & Confectionery (Snack Bars, Processed Foods, Baked Grain Products, Dairy Products, Cheese, Spreads & Margarines, and Carbonated Drinks) and Personal & Health Care |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Cargill, ADM, Kerry Group, Corbion, Lesaffre, Kudos Blends Limited, AB Mauri, Puratos, and Lallemand Inc. |

| Additional Attributes | Dollar sales by equipment type, share by power, regional demand growth, policy influence, automation trends, competitive benchmarking |

As per form, the market has been categorized into chemical, biological, and vaporous

This segment is further categorized into Food & Beverage (bakery & confectionery, snack bars, processed foods, baked grain products, dairy products, cheese, spreads & margarines, carbonated drinks), and Personal & Health care

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is valued at USD 6 billion in 2025.

The market is forecasted to reach USD 9.9 billion by 2035, reflecting a CAGR of 5.1%.

Biological will lead the form segment, accounting for 42.6% of the global market share in 2025.

Food & beverage will dominate the application segment with a 71% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 6.5% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA