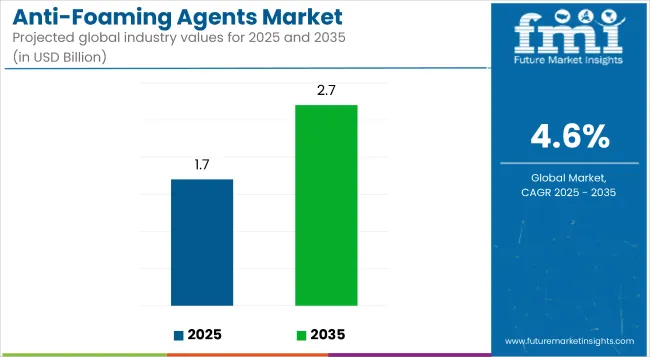

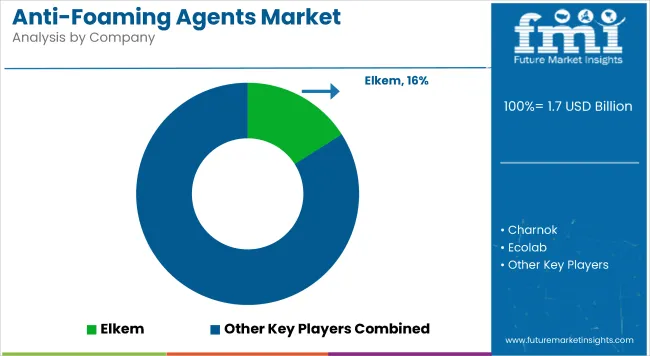

The global anti-foaming agents market is projected to grow from USD 1.7 billion in 2025 to USD 2.7 billion by 2035, registering a CAGR of 4.6%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.7 billion |

| Industry Value (2035F) | USD 2.7 billion |

| CAGR (2025 to 2035) | 4.6% |

The market expansion is being driven by the rising demand for foam control solutions across industrial processes such as food and beverage processing, pharmaceuticals, oil and gas, paints and coatings, and wastewater treatment, which require effective foam prevention and breakdown for process efficiency and product quality.

The market holds an estimated 100% share within the defoaming and anti-foaming chemicals market, around 14% of the global surfactant chemicals market, and 1.2% of the broader specialty chemicals market. Its role is significant in foam management applications in multiple industries, although it forms a small part of the global industrial chemicals segment.

Government regulations impacting the market focus on food safety standards (such as FDA regulations on food-grade anti-foaming agents), environmental safety standards under EPA norms for chemical disposal, and occupational health and safety standards that mandate safe processing environments. These regulatory pressures drive demand for biodegradable, food-grade, and eco-friendly anti-foaming agents with effective foam suppression and compliance assurance in industrial setups.

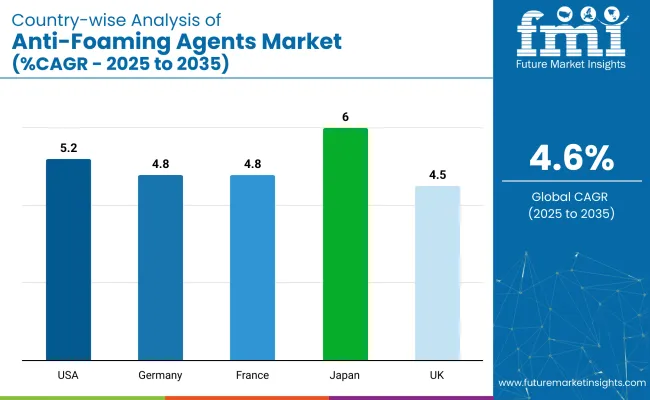

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 6% from 2025 to 2035. Silicone-based will lead the type segment with a 42.6% share, while liquid will dominate the form segment with a 75.5% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 5.2% and 4.5%, respectively.

The market is segmented by type, application, form, and region. By type, the market is divided into silicone-based, oil-based, and water-based. By application, the market is characterized into powder food and beverages (brewing and dairy application), pharmaceuticals (drug formulation and bio-pharmaceutical manufacturing), paints & coating (solvent-based paint and powder coating), oil & gas (production process and refining process), and others (dishwashing, textiles, and metal working).

By form, the market is bifurcated into liquid and powder. Regionally, the market isclassified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

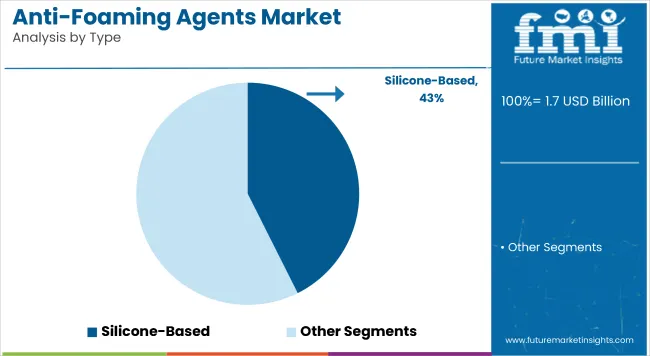

Silicone-based is expected to dominate the type segment, capturing 42.6% of the global market share by 2025. These agents are widely used in food processing, pharmaceuticals, oil and gas, and paints due to their high efficiency, spreadability, and compatibility with diverse formulations, making them an essential input across process industries.

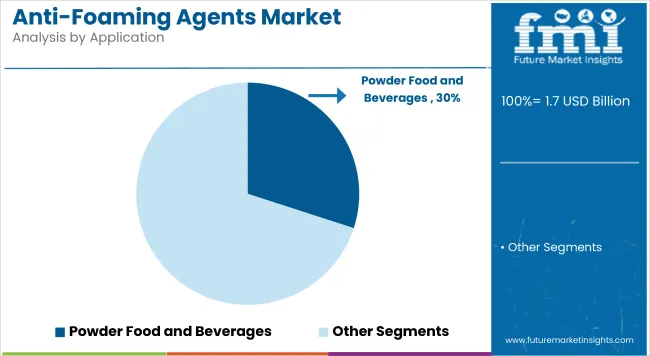

Powder food and beverages are projected to capture 30% of the application segment market share by 2025. This includes brewing and dairy processing, where foam control is essential to ensure processing efficiency, product quality, and compliance with food safety standards.

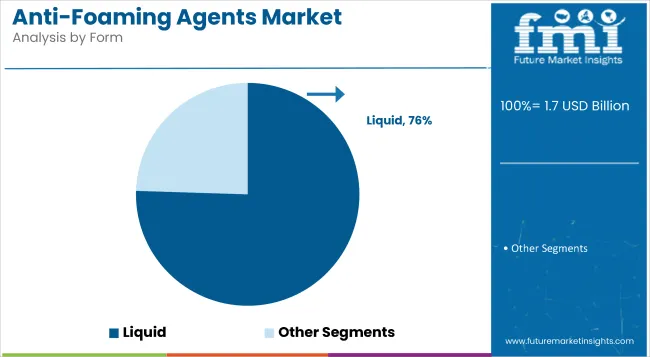

Liquid is projected to lead the form segment, capturing 75.5% of the global market share by 2025. Liquid forms are widely adopted due to their ease of blending, rapid foam suppression, and versatility across food processing, pharmaceuticals, and industrial chemical processes.

The global anti-foaming agents market is experiencing steady growth, driven by increased demand for foam control solutions across food processing, pharmaceuticals, oil and gas, and wastewater treatment industries to maintain operational efficiency and product quality.

Recent Trends in the Anti-Foaming Agents Market

Challenges in the Anti-Foaming Agents Market

Japan is projected to lead growth among OECD countries, registering a 6% CAGR driven by its expanding pharmaceutical manufacturing, bioprocessing, and industrial fermentation sectors. Demand has been supported by stricter quality controls in chemical and life sciences applications.

The USA follows closely, growing at 5.2%, with anti-foaming agents extensively used in oil refining, food processing, and biologics production. In Germany and France, steady expansion at 4.8% each is underpinned by EU food safety standards and increased industrial automation in wastewater treatment and food-grade applications.

The UK is expected to grow at 4.5%, influenced by regulatory divergence post-Brexit, as domestic industries emphasize compliance and cleaner processing. Japan’s advanced formulation capabilities and biopharma strength place it ahead of other OECD nations, while Germany, France, and the UK remain aligned with evolving EU-driven environmental and food-grade compliance frameworks.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan anti-foaming agents revenue is growing at a CAGR of 6% from 2025 to 2035. Growth is driven by high usage in pharmaceuticals, bioprocessing, and food industries. Compared to other OECD nations, Japan focuses on food-grade, low-toxicity formulations compliant with national standards.

The salesof anti-foaming agents in Germany areexpected to expand at 4.8% CAGR, slightly below global average. Demand is driven by food and beverage processing, paints and coatings, and oil and gas refining industries focusing on biodegradable anti-foaming solutions.

The French anti-foaming agents market is projected to grow at a CAGR of 4.8%, driven by food processing and chemical manufacturing sectors requiring foam control. France emphasizes biodegradable and eco-safe formulations in line with EU regulatory frameworks.

The USA anti-foaming agents revenue is projected to grow at 5.2% CAGR. Growth is driven by its large food and beverage, pharmaceutical, oil refining, and wastewater treatment industries demanding efficient foam prevention solutions.

The UK anti-foaming agents market is projected to grow at a CAGR of 4.5%, driven by steady demand in food processing, pharmaceuticals, and chemicals sectors, with regulatory focus on product safety and environmental compliance.

The market is moderately consolidated, with leading players like Elkem, Charnok, Ecolab, Dow Chemicals, and DIC Corporation dominating the industry. These companies provide advanced, efficient anti-foaming solutions catering to industries such as food and beverage processing, pharmaceuticals, paints and coatings, oil and gas, and wastewater treatment. Dow Chemicals focuses on high-performance silicone-based formulations, while Ecolab specializes in food-grade and eco-friendly defoamers.

DIC Corporation offers innovative PFAS-free formulations for automotive and industrial lubricants. Elkem delivers silicone derivatives with wide industrial compatibility, and Charnok is known for its versatile product range serving multiple process industries. Other key players like Münzing Corporation, Crucible Chemical Company, Maxwell Additives Pvt Ltd, OM TexChem Private Limited, and Mohini Organics Pvt Ltd contribute by providing specialized, high-performance anti-foaming agents for a wide range of industrial and food processing applications.

Recent Anti-Foaming Agents Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.7 billion |

| Projected Market Size (2035) | USD 2.7 billion |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2019 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in units |

| Type Analyzed | Silicone-Based, Oil-Based, and Water-Based |

| Application Analyzed | P owder Food & Beverages (Brewing and Dairy), Ph armaceuticals (Drug Formulation and Bio-Pharma Manufacturing), Paints & Coating (Solvent Based Paint and Powder Coating), Oil & Gas (Production Process and Refining Process), Others (Dishwashing, Textiles, and Metal Working) |

| Form Analyzed | Liquid and Powder |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Elkem, Charnok, Ecolab, Dow Chemicals, Vizag Chemicals International, Münzing Corporation, Crucible Chemical Company, Amega Science USA, Momentive, BRB International, ZILIBON DEFOAMER CHEMICAL, Maxwell Addetives Pvt Ltd, Struktol, DIC Corporation, Hangzhou Ruijiang Chemical Co. Ltd, Guangdong Zilibon Chemical Co., OM Tex Chem Private Limited, Mohini Organics Pvt Ltd, Nanhui New Material Co., Ltd., HARMONY ADDITIVES PRIVATE LIMITED |

| Additional Attributes | Dollar sales by type/form/application, market share by segment, regional growth analysis, competitive benchmarking |

As per type, the target industry has been categorized into Silicone-based, Oil-based, Water Based

As per the Application, the target products are sub-segmented into Food and Beverages (Brewing, Dairy Application), Pharmaceuticals (Drug Formulation, Bio-Pharmaceutical manufacturing), Paints and Coating (Solvent Based Paint, Powder Coating), Oil and Gas (Production process, Refining Process), Others (Dishwashing, Textiles, Metal working)

This segment is sub-categorized in Liquid, Powdered

Industry analysis has been carried out in key countries of the regions such as North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is valued at USD 1.7 billion in 2025.

The market is forecasted to reach USD 2.7 billion by 2035, reflecting a CAGR of 4.6%.

Silicone-based will lead the type segment, accounting for 42.6% of the global market share in 2025.

Liquid will dominate the form segment with a 75.5% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 6% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Foaming Agents / Defoamers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA