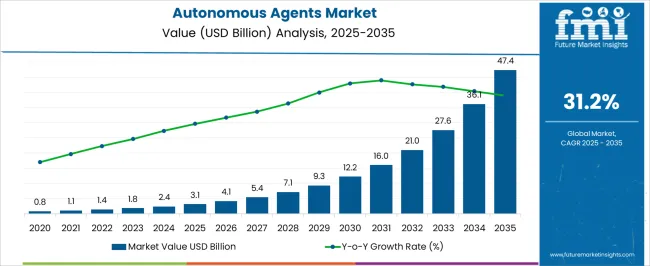

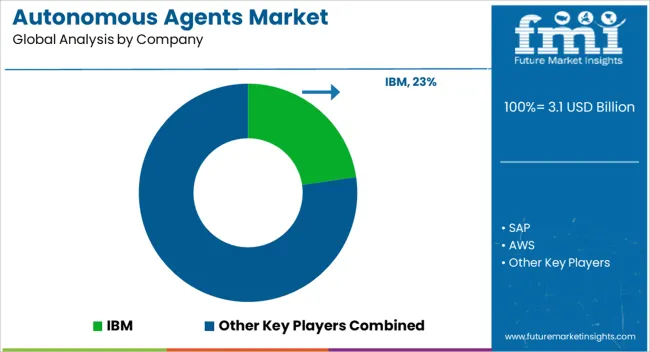

The Autonomous Agents Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 47.4 billion by 2035, registering a compound annual growth rate (CAGR) of 31.2% over the forecast period.

| Metric | Value |

|---|---|

| Autonomous Agents Market Estimated Value in (2025 E) | USD 3.1 billion |

| Autonomous Agents Market Forecast Value in (2035 F) | USD 47.4 billion |

| Forecast CAGR (2025 to 2035) | 31.2% |

The autonomous agents market is gaining strong traction as enterprises adopt AI driven systems to streamline operations, enhance decision making, and deliver improved customer engagement. Rising deployment of natural language processing, machine learning, and predictive analytics is enabling organizations to automate complex tasks across industries.

Regulatory support for AI integration and the growing availability of advanced computing infrastructure are accelerating market adoption. Enterprises are also leveraging autonomous agents to enhance real time insights, improve security frameworks, and optimize customer support functions.

The outlook remains highly positive as companies continue to pursue digital transformation strategies, with autonomous agents serving as a critical enabler for scalability, efficiency, and competitiveness in both established and emerging markets.

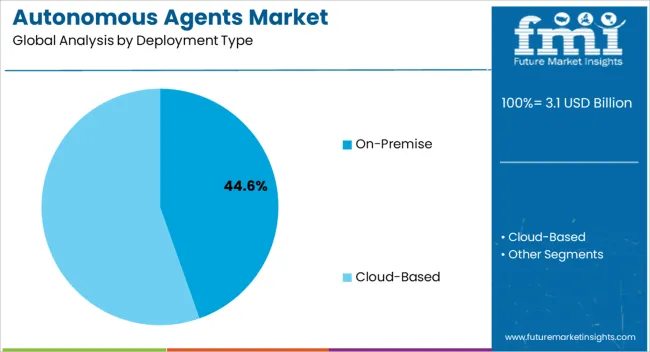

The on premise deployment type is expected to represent 44.60% of the total market revenue by 2025, making it the most significant deployment approach. This dominance is attributed to the need for greater control over data security, compliance requirements, and integration with legacy infrastructure.

Large organizations with critical operations in regulated industries continue to prefer on premise solutions to safeguard sensitive data and maintain internal governance. Additionally, high customization capability and reduced dependency on external cloud vendors have supported its adoption.

As enterprises prioritize control and compliance alongside scalability, the on premise model continues to maintain strong relevance in the autonomous agents market.

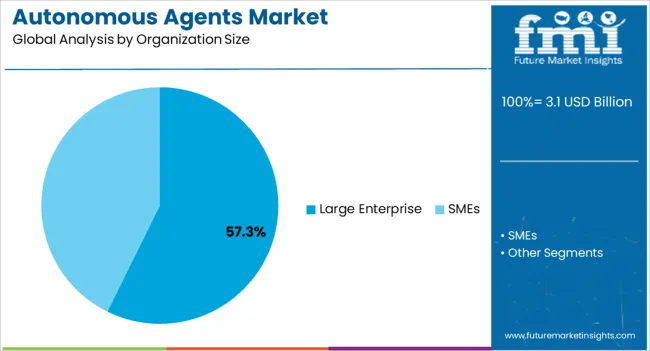

The large enterprise segment is projected to hold 57.30% of market revenue by 2025, positioning it as the leading organization size category. This leadership is driven by their ability to invest in advanced AI infrastructure, integrate autonomous systems at scale, and implement complex automation workflows.

Large enterprises also emphasize digital transformation as part of long term strategic planning, leading to strong demand for autonomous agents to enhance efficiency, reduce costs, and deliver superior customer experiences. Their substantial IT budgets and access to skilled personnel have enabled faster adoption compared to small and medium enterprises.

As a result, large enterprises remain the dominant growth driver for this market.

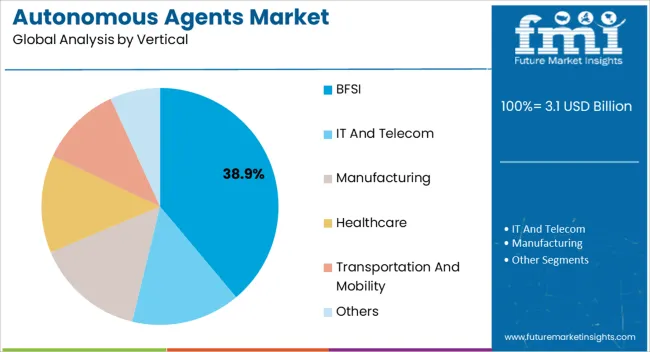

The BFSI vertical is expected to account for 38.90% of total revenue by 2025, making it the largest contributing vertical. This leadership is attributed to the high demand for automation in fraud detection, risk management, compliance monitoring, and personalized financial services.

Banks and financial institutions are increasingly deploying autonomous agents to streamline customer service operations, process automation, and data analysis. The sector’s stringent regulatory requirements and the critical importance of data accuracy have further reinforced the adoption of advanced AI solutions.

As financial institutions expand digital offerings and customer touchpoints, autonomous agents have become integral in ensuring secure, efficient, and responsive service delivery, cementing BFSI’s leading position in the market.

The global autonomous agents industry size developed at a CAGR of 24.0% from 2020 to 2025. In 2020, the global market size stood at USD 3.1 million. In the following years, the market witnessed tremendous growth, accounting for USD 1,366.7 million in 2025.

Use of autonomous agents can assist reduce hazards and improve safety in sectors including transportation, manufacturing, and healthcare. Autonomous cars, for instance, can lower the possibility of human mistake when driving, resulting in few accidents.

Autonomous robots can carry out activities that might be risky for people to conduct in unsafe locations. Autonomous agents become valuable as a result of their capacity to operate in such settings.

According to this report, the huge reason behind the exponential growth of the AI industry can be attributed to the factors such as:

Investments and adoption work as a means of increasing their productivity and efficiency. AI applications from various industries are gaining prominence in the autonomous agent market, and this is an important factor driving the growth of the market.

An increase in the speed and capability of parallel computing is a key factor that promotes market growth. Similarly, a few more key factors that contribute greatly toward fueling market growth include:

There are several business verticals where mobile platforms and decision-making autonomy are becoming increasingly important in the future. Assembling autonomous agents to perform tasks may improve the quality of the user's experience.

In addition, autonomous agents are becoming increasingly popular with end users, due to their constant improvement in performance, a great ability to access information in real time, and scalability.

A rise in the number of autonomous agents being used in intelligent factories, smart homes, robots, and self-driving vehicles has provided significant opportunities for market growth. There are a few more factors that are estimated to offer vital opportunities for the market are:

Autonomous agents are known to be highly capital-intensive, and this is one of the reasons why their market growth has slowed down in the market. Additionally, AA's market share has declined further due to issues related to unsupervised learning, the high investment needed in converting unstructured data into structured data, and other business considerations.

The lack of skilled workers and standard procedures are among the main constraints affecting market growth. In addition, the increasing complexity of networks as well as the security concerns regarding consumer data had a direct impact on the slowdown of the market growth.

Among the deployment types, the on-premises segment is anticipated to contribute hugely to the autonomous agents market growth in the forecast period.

It is due to the growing adoption of artificial intelligence across several enterprise organizations. In 2025, the on-premise deployment segment captured 65.5% share in the global market.

Organizations that deploy autonomous agent solutions on premises require a substantial initial investment by the enterprise, however, they do not incur incremental costs after the first few months of ownership, as they do for cloud deployments. As security prices continue to rise and maintenance costs of on-premises solutions increase, the market for on-premises autonomous agents have seen a steady rise in sales.

Market analysts estimate that the market is likely to reach a CAGR of 32.3% during the forecast period. There is a risk associated with the use of customers' private data which is one of the main reasons why companies prefer to use on-premises deployments over cloud-based deployments. There is a growing trend for large enterprises to deploy these types of deployments in the market.

Based on verticals, autonomous agents have been classified into BFSI, IT, and telecommunications, healthcare, manufacturing, transportation, and mobility. In the global market for autonomous agents, the IT and telecommunications segments are predicted to grow swiftly.

With the advent of coordinated infrastructures, the telecommunications industry has been able to create sophisticated systems, including software-based network architecture and virtualizing web applications. The growth of artificial intelligence and cloud computing, as well as the use of machine learning to automate networks in sales forces, have also been key factors driving the growth of the autonomous agents market.

Intelligent and optimized network operations are key for the vertical as they cater to the needs of communications service providers. The IT and telecommunications market is forecasted to expand at a CAGR of 29.2% during the forecast period.

Nevertheless, most of the AI in these applications is limited to statistical analysis and big data tools, however, the need for autonomous agents is expected to skyrocket in the upcoming years.

A rising number of IT firms in developing nations as well as the development of technology have further boosted the demand for autonomous agents. With efforts in both the private and public sectors, China is offering leadership in AI investment and adoption in EMs. China accounted for 30.4% share in the global market in 2025.

The government of China has launched a comprehensive AI strategy for 2035 and companies such as Baidu and Didi have notably invested in AI research, which may lead to new opportunities for Asia Pacific market.

Over the forecast period, Japan is projected to achieve a CAGR of 30.6% in 2035. South Korea's market is predicted to expand by 29.7% CAGR in the coming years due to the increase in cloud storage and the growth of SMEs in this region. On the other hand, technological companies are turning toward cloud-based deployment models to enable fast deployment, enhanced data security, and great market reliability.

North American region is projected to experience significant growth in the upcoming period. In this region, companies are buying and forming alliances with key companies in the autonomous agent industry to enhance their customer base. Furthermore, Canada and the United States are among the world's advanced countries and are thus increasingly contributing to the implementation of emerging technologies.

By 2035, the United States autonomous agents market is expected to flourish at a CAGR of 32.4%, mainly because cloud-based solutions are being increasingly deployed and many companies are using robots in various verticals of the market. In 2025, the United States captured a 17.3% share of the global market.

Based on the region's early adoption of AI automation and subsequent technological innovations, autonomous agents in the transportation industry market are experiencing notable growth in the United States.

The global autonomous agents market is forecasted to be dominated by Europe over the forecast period. As a result of the in-depth development of economies in the region, there is an expected increase in funding opportunities in the autonomous agent technology sector. During the forecast period, the autonomous agents market in the United Kingdom is predicted to expand at a compound annual growth rate of 31.3%.

In 2025, the United Kingdom captured a 32.9% share in the global market. The growth of companies’ manufacturing robots in the United Kingdom and the high use of automation agents in the e-commerce industry is likely to lead to a growing demand for autonomous agents in the region.

| Countries | CAGR Share in Global Market (2025) |

|---|---|

| The United States | 17.3% |

| The United Kingdom | 32.9% |

| China | 30.4% |

| Japan | 6.5% |

| India | 34.5% |

What is the Level of Competition for Autonomous Agents in the Market?

By partnering with strategic organizations, manufacturers can increase production and meet consumer demands, thereby increasing their revenues as well as market share. End-users can reap the benefits of new technologies through the introduction of new products and technologies. A strategic partnership has the potential to increase the production capacity of a company.

Recent Developments Observed by FMI:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; The Middle East & Africa (MEA) |

| Key Countries Covered | The United States, Canada, Germany, The United Kingdom, Nordic, Russia, BENELUX, Poland, France, Spain, Italy, Czech Republic, Hungary, Rest of EMEAI, Brazil, Peru, Argentina, Mexico, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, ASIAN, Thailand, Malaysia, Indonesia, Australia, New Zealand, Others |

| Key Segments Covered | Deployment Type, Organization Size, Vertical, Region |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Trend Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global autonomous agents market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the autonomous agents market is projected to reach USD 47.4 billion by 2035.

The autonomous agents market is expected to grow at a 31.2% CAGR between 2025 and 2035.

The key product types in autonomous agents market are on-premise and cloud-based.

In terms of organization size, large enterprise segment to command 57.3% share in the autonomous agents market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autonomous Ultrasound Guidance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Autonomous Imaging Market Size and Share Forecast Outlook 2025 to 2035

Autonomous AI Powered Ophthalmology Screening Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Radiology Systems Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Parking Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Trucks Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Drone Platform Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Mobile Robots for Logistics and Warehousing Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Vehicles Market Growth - Trends & Forecast 2025 to 2035

Autonomous Crane Market Growth - Trends & Forecast 2025 to 2035

Autonomous Forklift Market Growth – Trends & Forecast 2024-2034

Autonomous Robot Toys Market

Autonomous Intelligent Vehicle Market

USA Autonomous Crane Market Analysis – Growth, Trends & Forecast 2025-2035

China Autonomous Crane Market: Driving Growth Through Smart Infrastructure and Industrial Automation

India Autonomous Crane Market Growth – Innovations, Trends & Forecast 2025-2035

Japan Autonomous Crane Market Report – Growth, Trends & Forecast 2025-2035

Germany Autonomous Crane Market Insights – Size, Demand & Outlook 2025-2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA