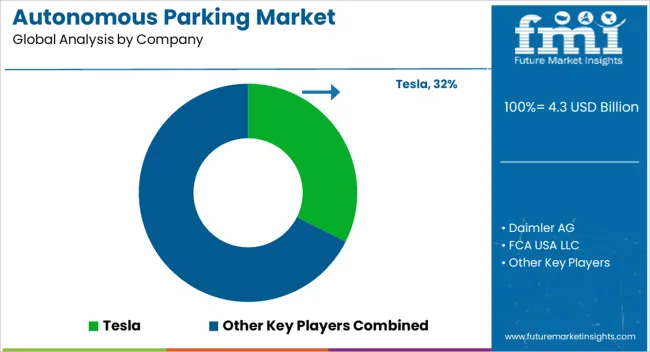

The Autonomous Parking Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 15.7 billion by 2035, registering a compound annual growth rate (CAGR) of 13.9% over the forecast period.

| Metric | Value |

|---|---|

| Autonomous Parking Market Estimated Value in (2025 E) | USD 4.3 billion |

| Autonomous Parking Market Forecast Value in (2035 F) | USD 15.7 billion |

| Forecast CAGR (2025 to 2035) | 13.9% |

The Autonomous Parking market is witnessing accelerated growth as advanced driver assistance systems and smart city infrastructure are being increasingly integrated into urban mobility solutions. The current landscape is being shaped by the rising need to optimize parking efficiency, reduce traffic congestion, and enhance safety in densely populated areas. The adoption of autonomous parking systems is being supported by advancements in sensors, artificial intelligence, and vehicle-to-infrastructure communication.

Additionally, growing investments from automotive manufacturers and technology providers are fueling the development and deployment of such systems across commercial and residential projects. Regulatory frameworks encouraging smart transport solutions are also providing momentum for market expansion. The future outlook for the market remains promising, with increasing demand expected from both metropolitan areas and business hubs.

Furthermore, cost benefits through reduced need for manual parking attendants and optimized space utilization are being recognized as key drivers The deployment of fully automatic systems that can integrate seamlessly with existing infrastructure is being seen as a major opportunity, particularly in environments where efficiency and space management are critical.

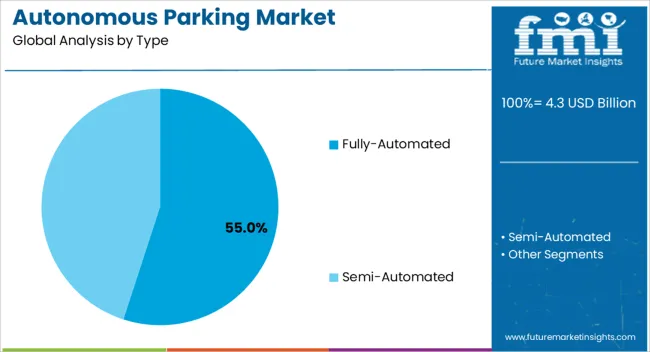

The Fully-Automated type segment is projected to account for 55.00% of the Autonomous Parking market revenue share in 2025, establishing it as the leading segment within the type classification. This position is being attributed to the growing preference for end-to-end automated solutions that eliminate the need for human intervention in parking management. The deployment of fully-automated parking systems is being favored due to their ability to reduce operational costs, optimize parking space usage, and enhance user convenience.

The integration of technologies such as artificial intelligence, machine learning, and sensor networks is enabling efficient and precise vehicle parking, even in complex environments. Urban areas where parking space is limited are witnessing higher adoption as automated systems can maximize available space through better vehicle arrangement.

Additionally, the growing trend of connected vehicles and smart infrastructure has been contributing to the accelerated deployment of fully-automated solutions With the increasing focus on safety, reliability, and ease of access, the fully-automated segment is expected to retain its dominance as more projects incorporate advanced parking management systems.

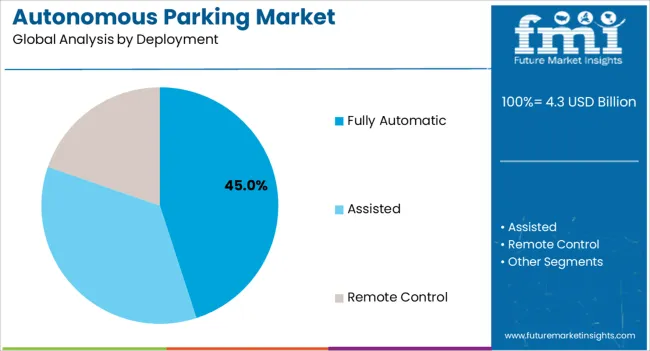

The Fully Automatic deployment segment is expected to hold 45.00% of the Autonomous Parking market’s revenue share in 2025, making it the largest deployment type within the market. The prominence of this segment is being driven by the need for seamless and efficient parking solutions that require minimal human involvement while ensuring high accuracy and safety. Fully automatic deployment systems are being preferred due to their ability to provide consistent parking operations, reduce waiting times, and lower operational costs.

These systems can adapt to a variety of environments and integrate with other vehicle automation technologies, making them suitable for use in high-density urban areas, shopping complexes, and transport hubs. Furthermore, the ongoing development of sensor-based detection systems and automated control algorithms is enhancing the reliability of fully automatic parking solutions.

The trend toward sustainability and optimized resource utilization is also supporting adoption as such systems reduce fuel consumption and emissions associated with searching for parking spaces The fully automatic deployment segment is therefore expected to witness sustained growth as infrastructure modernization and smart mobility initiatives continue to expand.

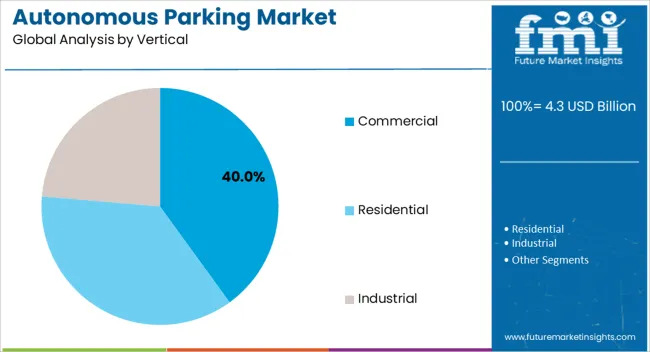

The Commercial vertical segment is anticipated to represent 40.00% of the Autonomous Parking market revenue share in 2025, marking it as the largest application sector within the market. This leadership is being driven by the rising demand for efficient parking solutions in business districts, shopping malls, airports, and corporate campuses where vehicle volume is high and space is constrained. Autonomous parking systems are being widely adopted in commercial settings due to their ability to enhance customer experience, improve space utilization, and reduce operational overheads.

Furthermore, commercial facilities are increasingly investing in automation technologies to optimize their infrastructure, ensure vehicle safety, and meet sustainability goals. The use of fully automated and fully automatic systems in commercial environments is allowing facility operators to offer hassle-free parking services while improving traffic management and reducing carbon footprints.

The growing emphasis on digital transformation within businesses, coupled with the need for seamless service delivery, is accelerating investment in autonomous parking solutions As customer expectations for convenience and efficiency rise, the commercial vertical segment is expected to lead market expansion through continued adoption of smart parking technologies.

Advance & Efficient Functioning

A reduction in human efforts with more efficient and advanced functioning is anticipated to increase the demand for autonomous parking during the forecast period. Its development stage has caught the attention of many companies and researchers are likely to invest more time in bringing new technologies to the market.

Enhanced Lifestyles

Widespread use of cars in urban areas, owing to the growing population, has triggered concerns regarding parking infrastructure. This has necessitated the advancement of the existing infrastructure in these areas.

Moreover, there has been a significant increase in the per capita income, along with an improvement in the lifestyles of consumers from various developing regions. This has accelerated the demand for personal mobility, and increased automobile sales in metropolitan cities. The autonomous parking market, hence, is likely to boost owing to these attributes.

Safe & Convenient

Due to its safety and convenience features the autonomous parking market share is likely to increase during the forecast period. Autonomous parking avoids unwanted accidents and serious injuries such as whiplash and concussions. These are the major factors that are anticipated to propel the autonomous parking market growth in recent years.

A key strategy that has influenced the evolution of urban areas is the creation of smart cities throughout the world. The implementation of IoT-based technology is the consequence of this endeavor, which aims to facilitate the enhancement of characteristics like mobility and transportation.

Thus, the implementation of smart city initiatives by governments across the globe is creating lucrative business opportunities for manufacturers involved in smart parking solutions, therefore assisting the expanded demand for autonomous parking.

The autonomous parking market is segmented into various regions including North America, Europe, Latin America, Asia Pacific & the Middle East, and Africa. North America is likely to dominate the autonomous parking market by acquiring 36.6% of the share during the forecast period. In 2025, North America captured 34.6% of global market shares in 2025.

| Factors | Increasing Demand |

|---|---|

| Details | Rising vehicle numbers and increased traffic in North America are expected to increase the autonomous parking market share due to rising demand in the automotive industry. |

| Factors | Digital Technology |

|---|---|

| Details | Growing innovative mobility and digital technology are likely to increase the adoption of autonomous parking in the region. |

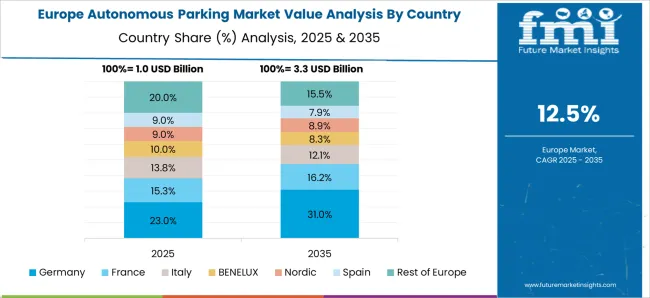

Europe held the second position in the autonomous parking market share by acquiring 23.7% of the global market shares in 2025.

| Attributes | Details |

|---|---|

| Rising Imports and Exports | The autonomous market is rapidly growing in Europe due to the increasing import and export of goods in the region. |

| Attributes | Details |

|---|---|

| Advance Technology | The end-users quick adoption of cutting-edge technology probably increases the market potential for autonomous parking in this region. |

The autonomous parking start-up market is pushing its direction toward innovative ideas to come up with unique products that capture consumers' attention. Start-up companies are focusing on day-to-day research and experiments to achieve their goals in recent years.

Discover Top 2 Start-ups in the Autonomous Parking Market

Wisesight:

Wisesight is an Israeli-based start-up company that manages autonomous parking with smart technology. The company provides parking solutions that include congestion gauge, revenue potential, and vacancies among others. The system has a reminder and it specifies the real-time payment position.

Yazamtec:

Yazamtec is a Dutch-based start-up company that provides autonomous parking optimization. The company developed communicator sensors that give real-time data and determine vehicles in parking areas.

The start-up company uses matrix blockchain techniques to monitor and operate the parking spaces. It also uses AI technology to manage autonomous parking in different areas.

The autonomous parking market is fragmented by the key players and manufacturers present all around the region, during the forecast period. They are developing devices that are easy to use while parking any vehicle. The key players are focusing on using various innovative technologies that fix consumers' needs.

Recent Developments in the Autonomous Parking Market

Major Global Autonomous Parking Players are

Volkswagen AG

With its headquarters in Wolfsburg, Germany- The Volkswagen Group is one of the world's leading manufacturers of automobiles and commercial vehicles.

Toyota Motor Corporation

They are a Japanese multinational automotive manufacturer headquartered in Toyota City, Aichi, Japan, founded by Kiichiro Toyoda and incorporated on August 28, 1937. Toyota is one of the largest automobile manufacturers in the world, producing about 10 million vehicles per year.

Ford Motor Company

They are an American multinational automobile manufacturer headquartered in Dearborn, Michigan, the United States - founded by Henry Ford and incorporated on June 16, 1903. The company sells automobiles and commercial vehicles under the Ford brand and luxury cars under its Lincoln luxury brand.

AB Volvo

They are a Swedish multinational manufacturing corporation headquartered in Gothenburg. While its core activity is the production, distribution, and sale of trucks, buses, and construction equipment, Volvo also supplies marine and industrial drive systems and financial services.

BMW AG

They are a German multinational manufacturer of luxury vehicles and motorcycles headquartered in Munich, Bavaria, Germany. The corporation was founded in 1916 as a manufacturer of aircraft engines, which it produced from 1917 until 1918 and again from 1933 to 1945.

Other Key Players in the Global Market:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Germany, United Kingdom, Nordic, Russia, BENELUX, Poland, France, Spain, Italy, Czech Republic, Hungary, Rest of EMEAI, Brazil, Peru, Argentina, Mexico, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, ASEAN, Thailand, Malaysia, Indonesia, Australia, New Zealand, Others |

| Key Segments Covered | Type, Deployment, Vertical, Region |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Trend Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global autonomous parking market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the autonomous parking market is projected to reach USD 15.7 billion by 2035.

The autonomous parking market is expected to grow at a 13.9% CAGR between 2025 and 2035.

The key product types in autonomous parking market are fully-automated and semi-automated.

In terms of deployment, fully automatic segment to command 45.0% share in the autonomous parking market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autonomous Driving Simulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Aerial Robot Market Size and Share Forecast Outlook 2025 to 2035

Parking Management Market Forecast and Outlook 2025 to 2035

Autonomous Driving Virtual Simulation Platform Market Forecast and Outlook 2025 to 2035

Autonomous Ultrasound Guidance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Autonomous Imaging Market Size and Share Forecast Outlook 2025 to 2035

Autonomous AI Powered Ophthalmology Screening Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Radiology Systems Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Agents Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Trucks Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Drone Platform Market Size and Share Forecast Outlook 2025 to 2035

Parking Meter Apps Market Size and Share Forecast Outlook 2025 to 2035

Parking Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Mobile Robots for Logistics and Warehousing Market Size and Share Forecast Outlook 2025 to 2035

Parking Finder Apps Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Vehicles Market Growth - Trends & Forecast 2025 to 2035

Parking Ticket Dispenser Market Growth, Trends & Forecast 2025 to 2035

Autonomous Crane Market Growth - Trends & Forecast 2025 to 2035

Autonomous Forklift Market Growth – Trends & Forecast 2024-2034

Autonomous Robot Toys Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA