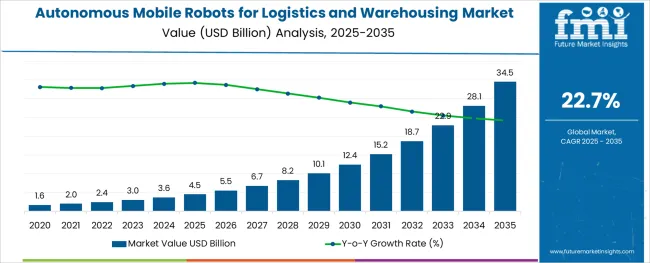

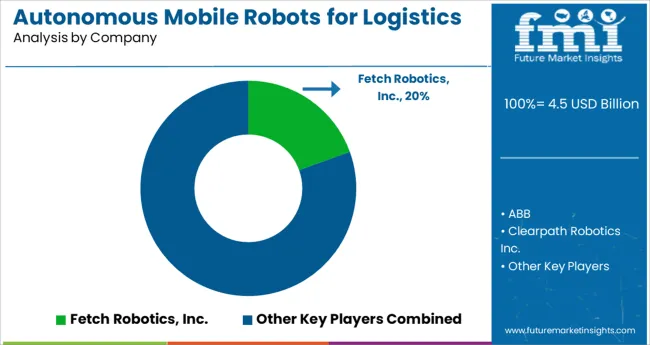

The Autonomous Mobile Robots for Logistics and Warehousing Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 34.5 billion by 2035, registering a compound annual growth rate (CAGR) of 22.7% over the forecast period.

The autonomous mobile robots market for logistics and warehousing is expanding rapidly as companies seek to enhance operational efficiency and reduce labor costs. Industry insights highlight a shift towards automation to address labor shortages and meet growing e-commerce demands. The adoption of advanced robotics solutions enables faster, more accurate material handling and inventory management.

Continuous innovations in robot navigation, sensor technologies, and AI integration have improved robot performance in complex warehouse environments. Increasing investments in smart warehouses and supply chain digitization are further fueling market growth.

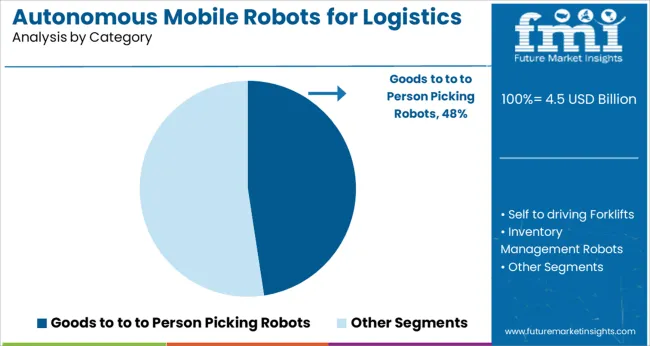

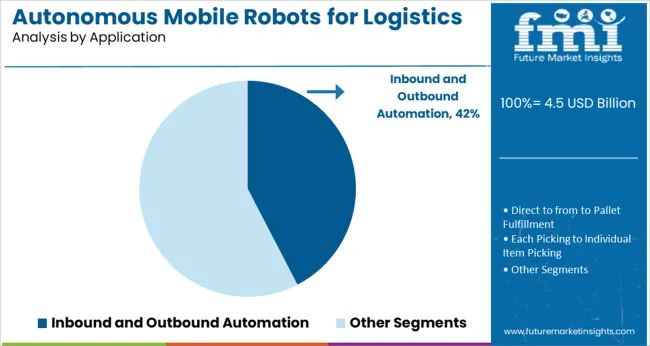

The trend towards flexible, scalable automation solutions is also encouraging adoption across various logistics operations. Segment growth is expected to be led by hardware solutions, goods-to-person picking robot categories, and applications focused on inbound and outbound automation, reflecting the priorities of modern warehousing operations.

The market is segmented by Solution, Category, Application, and End Use and region. By Solution, the market is divided into Hardware, Software, and Services. In terms of Category, the market is classified into Goods to to to Person Picking Robots, Self to driving Forklifts, Inventory Management Robots, Unmanned Aerial Vehicles, and Data Collection Robots. Based on Application, the market is segmented into Inbound and Outbound Automation, Direct to from to Pallet Fulfillment, Each Picking to Individual Item Picking, Sortation, Center Handling, Induction of Palletized Goods, Built to Order Pallet, Order Fulfillment, Robotic Truck Loading, and Reverse Logistics Handling. By End Use, the market is divided into Warehouses, Fulfillment Centers, Distribution Centers, and Fleet Management. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Hardware segment is projected to account for 51.3% of the autonomous mobile robots market revenue in 2025, maintaining its position as the leading solution type. Growth in this segment is driven by demand for robust physical robot platforms that can perform a wide range of logistics tasks.

Warehouse operators prioritize hardware reliability, payload capacity, and operational endurance to ensure continuous workflow. Hardware investments have increased as businesses replace manual processes with automated systems that require durable and flexible robots.

The segment benefits from ongoing advancements in battery technology, mobility systems, and onboard processing power, all contributing to enhanced robot capabilities. With hardware being the foundation of autonomous operations, this segment is expected to remain dominant.

The Goods-to-Person Picking Robots segment is expected to hold 47.6% of the market revenue in 2025, leading the category segment. This growth is driven by the efficiency gains these robots bring by transporting items directly to human pickers, reducing travel time and increasing picking accuracy.

Adoption is strong in e-commerce and retail warehouses where speed and order accuracy are critical. The robots are valued for improving ergonomics and reducing labor fatigue, which in turn lowers operational errors and injuries.

Their ability to seamlessly integrate with warehouse management systems has further accelerated adoption. As demand for faster fulfillment grows, goods-to-person picking robots are expected to maintain their leading role.

The Inbound and Outbound Automation segment is projected to contribute 42.4% of the market revenue in 2025, establishing it as the primary application area. Growth in this segment is fueled by the need to streamline goods receipt and dispatch processes in warehouses and distribution centers.

Automation in inbound operations speeds up unloading, sorting, and storage, while outbound automation enhances packing and shipping efficiency. The demand for just-in-time delivery and high order volumes has intensified the need for automated solutions in these workflows.

Companies are investing in technologies that minimize manual handling, reduce errors, and increase throughput. This application segment is expected to remain central as logistics networks evolve to meet modern supply chain challenges.

Increasing Demand for Logistics & Warehouse Automation

A few years ago, the logistics and warehouse operations and processes were carried out manually, employing thousands of workers for material handling and carrying out in-house logistics operations.

As the supply-chain industry flourished globally in the past few years, there has been a huge demand for autonomous mobile robots for logistics and warehousing and sales of autonomous mobile robots for logistics and warehousing operations to improve order fulfilment and in-house distribution of goods with the ultimate goal to reduce the labour costs.

The adoption of autonomous mobile robots for logistics and warehousing has solved many problems posed by the booming supply-chain demands.

Autonomous mobile robots for logistics and warehousing manufacturers are collaborating with warehouse operations for automated inventory handling and movement, tracking and locating materials within the warehouse facilities, freeing the human workforce from such time-consuming processes and thus improving the material handling efficiency within the warehouses.

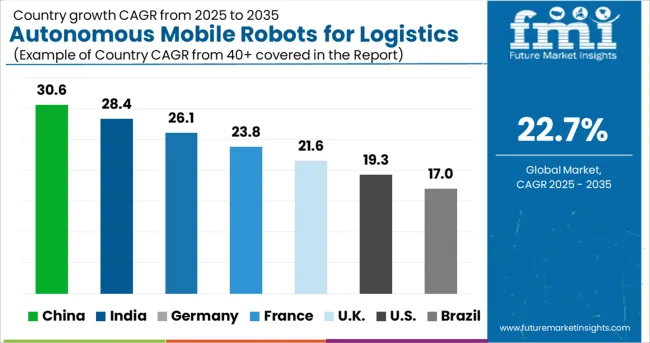

The Asia Pacific is estimated to be a highly lucrative region in autonomous mobile robots for logistics and warehousing market share. The autonomous mobile robots for logistics and warehousing market share and eCommerce are growing at a lightning pace within the Asia Pacific countries such as China, India, and South-East Asia.

The significant growth demand for autonomous mobile robots for logistics and warehousing’s massive investment into warehouse automation via the deployment of autonomous mobile robots fulfils the demand for the labour shortage and improves material handling operations to drive scalability, reliability, and efficiency.

In growing economies like India, the autonomous mobile robots for the logistics and warehousing market and the sales of autonomous mobile robots for logistics and warehousing are booming at an unprecedented rate and are estimated to attract nearly USD10 billion in investments in the next 5 years.

To address this huge investment and supply chain demand for autonomous mobile robots for logistics and warehousing, the logistics and warehouse operations are shifting from manual to automated operations through the deployment of sales of autonomous mobile robots for logistics and warehousing for effective material handling.

Rapid growth in the e-commerce Industry globally.

The e-commerce industry worldwide is growing at a breakneck pace. The global e-commerce sales of autonomous mobile robots for logistics and warehousing were valued at USD 2.4 trillion in 2020 and are estimated to be nearly USD 3.0 trillion by 2020, with US and China dominating the global e-commerce segment of autonomous mobile robots for the logistics and warehousing market.

Due to this ever-growing e-commerce trend, retailers are facing challenges such as a shortage of labour for warehouse management, complicated order fulfilment processes, and more. Logistics and warehouse automation technologies such as autonomous mobile robots have made tremendous developments in recent years to overcome these supply-demand challenges.

Key players in the autonomous mobile robots for logistics and warehousing market share are focusing on strategic collaboration and partnerships with major retailers as well as product innovations and developments for sustained business growth.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 22.7% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Product, application, region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Kuka AG; Teradyne, Inc.; Clearpath Robotics, Inc.; Grey Orange Pte. Ltd.; Swisslog Holding AG; K. Hartwall Oy AB; Boston Dynamics, Inc.; Harvest Automation, Inc.; inVia Robotics, Inc.; and Omron Adept Technology; Inc. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global autonomous mobile robots for logistics and warehousing market is estimated to be valued at USD 4.5 billion in 2025.

It is projected to reach USD 34.5 billion by 2035.

The market is expected to grow at a 22.7% CAGR between 2025 and 2035.

The key product types are hardware, software and services.

goods to to to person picking robots segment is expected to dominate with a 47.6% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autonomous Aerial Robot Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Ultrasound Guidance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Autonomous Imaging Market Size and Share Forecast Outlook 2025 to 2035

Autonomous AI Powered Ophthalmology Screening Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Radiology Systems Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Agents Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Parking Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Trucks Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Vehicles Market Growth - Trends & Forecast 2025 to 2035

Autonomous Crane Market Growth - Trends & Forecast 2025 to 2035

Autonomous Robot Toys Market

Autonomous Intelligent Vehicle Market

Autonomous Forklift Market Growth – Trends & Forecast 2024-2034

Autonomous Drone Platform Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Driving Virtual Simulation Platform Market Forecast and Outlook 2025 to 2035

USA Autonomous Crane Market Analysis – Growth, Trends & Forecast 2025-2035

China Autonomous Crane Market Size and Share Forecast Outlook 2025 to 2035

India Autonomous Crane Market Growth – Innovations, Trends & Forecast 2025-2035

Japan Autonomous Crane Market Report – Growth, Trends & Forecast 2025-2035

Germany Autonomous Crane Market Insights – Size, Demand & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA