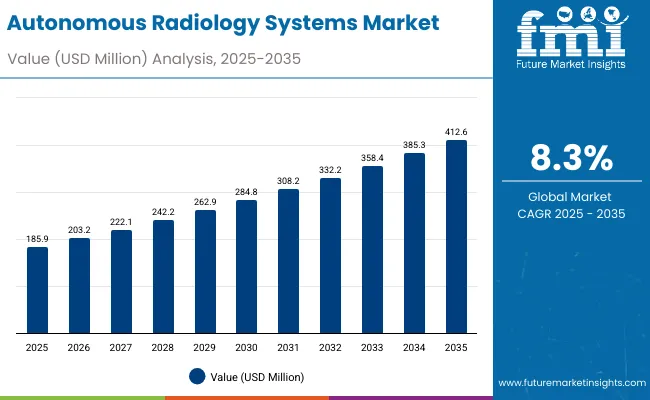

The Global Autonomous Radiology Systems Market has been forecasted to attain a valuation of USD 185.9 million in 2025, rising to USD 412.71 million by 2035, resulting in an incremental gain of USD 226.8 million, which reflects a 45.1% increase over the forecast decade. A compound annual growth rate (CAGR) of 8.3% is expected to be recorded, indicating a rapid expansion trajectory for the global autonomous radiology systems market.

Global Autonomous Radiology Systems Market Key Takeaways

| Metric | Value |

|---|---|

| Global Autonomous Radiology Systems Market Estimated Value in (2025E) | USD 185.9 million |

| Global Autonomous Radiology Systems Market Forecast Value in (2035F) | USD 412.71 million |

| Forecast CAGR (2025 to 2035) | 8.3% |

Between 2025 and 2030, autonomous radiology systems are expected to see broader adoption across hospitals, diagnostic imaging centers, and outpatient clinics, as healthcare providers increasingly rely on AI-assisted imaging to enhance diagnostic accuracy and workflow efficiency. It will grow upto USD 91.1 million in that period from USD 185.9 million in 2025 to USD 277.0 million in 2030.

Advances in deep learning algorithms, cloud-based platforms, and user-friendly software interfaces are making these systems more accessible, prompting adoption even in mid-sized hospitals and telemedicine providers.

Between 2030 and 2035, the market is projected to expand further by USD 135.7 million driven by improvements in multimodal AI integration, real-time image analysis, and hybrid imaging solutions combining MRI, CT, and X-ray data. Rising demand from chronic disease management, cancer diagnostics, and cardiovascular care, along with continuous development in AI algorithms, imaging sensors, and interoperability with electronic health records, will shape the next generation of autonomous radiology systems.

From 2020 to 2024, the global autonomous radiology systems market, expanded from USD 119.5million to USD 172.7 million, transitioning from early AI pilot projects to commercially deployable solutions. During this phase, leading technology providers collaborated with hospitals and research institutions to optimize algorithms, streamline data workflows, and enhance system integration laying the groundwork for widespread adoption across the healthcare ecosystem.

Going forward, the autonomous radiology ecosystem will likely evolve to incorporate AI-powered decision support, predictive analytics, and remote diagnostic capabilities. These innovations aim to reduce diagnostic errors, expand interdisciplinary usability, and improve patient throughput making autonomous radiology systems a standard tool for precision diagnostics and healthcare delivery worldwide.

The growth of the global autonomous radiology systems market is driven by the ability of AI-enabled imaging solutions to enhance diagnostic accuracy, streamline workflows, and reduce human error across multiple imaging modalities, including X-ray, CT, MRI, ultrasound, and mammography. Unlike traditional radiology systems, autonomous solutions integrate deep learning algorithms to provide real-time image analysis, lesion detection, and clinical decision support making them increasingly indispensable in modern healthcare delivery.

Over the past decade, AI in radiology has moved beyond experimental applications. It is now widely adopted in hospitals, diagnostic imaging centers, and telemedicine platforms to support early detection of diseases such as cancer, cardiovascular conditions, and neurological disorders. As healthcare systems face growing patient loads and a shortage of radiologists, autonomous imaging solutions are becoming essential for improving efficiency, standardization, and throughput in clinical workflows.

Another factor fueling market growth is the shift from on-premises deployments to cloud-based and hybrid platforms. Vendors now offer fully integrated systems that combine advanced image processing, secure data storage, and seamless interoperability with electronic health records, enabling healthcare providers to access AI-driven diagnostics anywhere and at any time. This decentralization is expanding adoption, particularly in emerging markets and smaller healthcare facilities.

Moreover, increasing demand for remote diagnostics, telemedicine services, and personalized patient care is fostering innovation in autonomous imaging platforms. Features such as automated triage, predictive analytics, and multi-modal imaging integration allow clinicians to detect complex pathologies more accurately and quickly, improving patient outcomes.

Collectively, these technological and operational drivers are positioning the autonomous radiology systems market for sustained growth, fueled by its essential role in enhancing diagnostic precision, optimizing healthcare workflows, and supporting next-generation digital health initiatives.

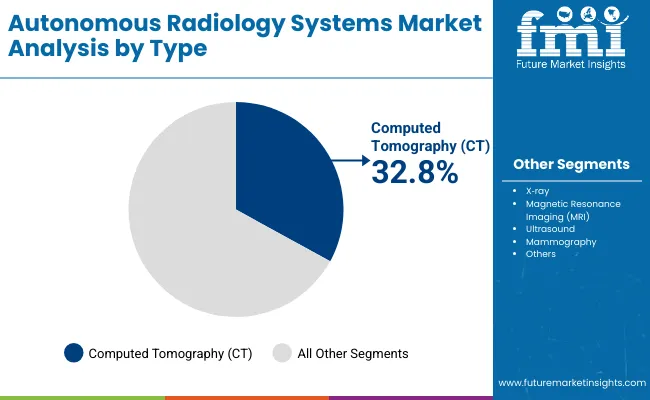

The market is segmented based on type, deployment mode, application, and end user. By type, the market includes Xray, Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, Mammography, and other imaging modalities. In terms of deployment mode, the market is classified into onpremises, multi-modal learning, and hybrid solutions.

Based on application, the market serves cardiology diagnostics, oncology imaging, neuro and cardiovascular interventions, as well as patient positioning and surgical assistance. By end user, the market caters to hospitals, diagnostic centers, ambulatory surgical centers, and research laboratories. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Type | Market Value Share, 2025 |

|---|---|

| X ray | 20.0% |

| Computed Tomography (CT) | 32.8% |

| Magnetic Resonance Imaging (MRI) | 23.1% |

| Ultrasound | 11.6% |

| Mammography | 8.3% |

| Others | 4.2% |

Computed Tomography (CT) Systems are projected to lead the device category with a 32.8% market share in 2025, and are expected to maintain this position due to their ability to deliver high-resolution, volumetric imaging with rapid acquisition times in clinical settings. Unlike conventional CT setups, AI-enhanced systems provide automated lesion detection, segmentation, and quantitative analysis allowing radiologists to identify pathologies with unprecedented speed and accuracy.

Recent advances in photon-counting detectors, iterative reconstruction algorithms, and dual-energy imaging have improved image quality while reducing radiation exposure. Integration with AI-driven workflow platforms and PACS systems enables seamless operation, real-time error detection, and optimized scan protocols making CT indispensable for thoracic, neurological, and cardiovascular diagnostics.

A key factor behind their dominance is their widespread deployment in hospitals, diagnostic imaging centers, and outpatient clinics. With vendors now offering turnkey solutions that minimize operator intervention, AI-powered CT is becoming increasingly accessible to mid-sized healthcare facilities and telemedicine providers. Their relatively fast scan times, high throughput, and versatile clinical applications further position CT as the backbone of modern radiology workflows.

As demand for precision diagnostics and early disease detection grows, the combination of advanced imaging technology and AI integration ensures that CT systems remain a cornerstone of autonomous radiology adoption across healthcare institutions worldwide.

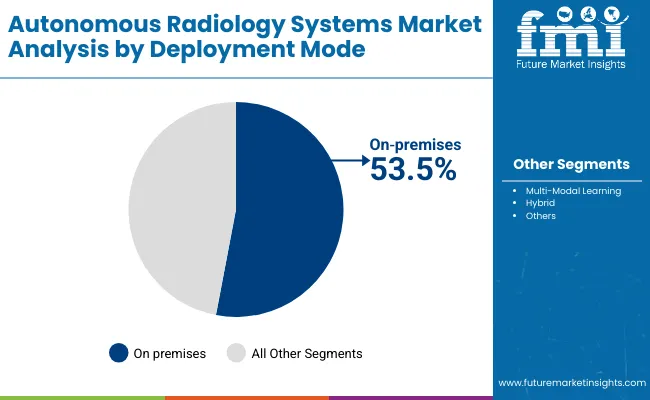

| Deployment Mode | Market Value Share, 2025 |

|---|---|

| On premises | 53.5% |

| Multi-Modal Learning | 33.7% |

| Hybrid | 12.8% |

On-Premises Deployment continues to dominate the technology landscape, accounting for 53.5% of market share in 2025. This model remains the foundation of autonomous radiology adoption due to its proven ability to integrate seamlessly with existing hospital IT infrastructure, maintain patient data security, and deliver real-time image processing with minimal latency. As an essential setup for high-volume imaging centers and large hospitals, on-premises systems offer unmatched control, reliability, and compliance with local data regulations.

What makes on-premises deployment irreplaceable is its stability, standardization, and mature ecosystem of hardware and software. Many healthcare institutions have invested in robustPicture Archiving and Communication System (PACS) servers, dedicated AI modules, and secure network infrastructures, creating a reliable framework for clinical workflows. This deployment type is particularly effective in handling high-throughput modalities such as CT, MRI, and X-ray, where rapid processing and immediate access to results are critical.

Recent improvements in computing power, AI algorithm integration, and automated workflow management have further enhanced the efficiency and usability of on-premises systems. Moreover, training programs and clinical protocols continue to emphasize on-site system management as a core competency, ensuring a sustained pipeline of skilled operators and institutional support.

While multi-modal learning and hybrid deployments are gaining traction in specialized applications, on-premises systems remain the mainstay of the global market, largely due to their versatility, security, and broad compatibility with diverse clinical environments and imaging modalities.

The adoption of autonomous radiology systems is accelerating across hospitals, diagnostic centers, and telemedicine platforms as AI algorithms, cloud computing, and advanced imaging technologies converge to improve diagnostic accuracy and operational efficiency. While growth momentum is strong, the market also faces structural limitations unique to healthcare infrastructure and regulatory requirements.

Rising Demand for Efficient and Accurate Medical Imaging InterpretationThe global autonomous radiology systems market is primarily driven by the increasing need for efficient and accurate medical image analysis. The rising prevalence of chronic diseases, cancers, and neurological disorders has led to a significant surge in imaging studies, creating a burden on radiologists and manual interpretation processes.

Traditional analysis is time-consuming and susceptible to human error, which can delay diagnosis and treatment. Autonomous radiology systems, powered by AI and deep learning, enable automated lesion detection, anomaly recognition, and workflow optimization, improving both speed and diagnostic accuracy.

Research indicates that AI-assisted imaging enhances detection rates across modalities, including X-ray, CT, and MRI, by identifying subtle abnormalities that may be missed by human readers. Integration with electronic health records and cloud platforms allows centralized access and real-time decision support, enabling healthcare providers to manage growing imaging volumes efficiently, reduce errors, and improve patient outcomes, driving adoption in hospitals and diagnostic centers worldwide.

Infrastructure, Expertise, and Regulatory ChallengesThe adoption of autonomous radiology systems faces significant challenges due to the high cost and complexity of deployment. These systems require robust IT infrastructure, high-speed networks, and secure data storage, which can be cost-prohibitive for smaller clinics and healthcare facilities in developing regions.

Moreover, clinical staff must acquire specialized training to effectively interpret AI-generated outputs and manage system operations. The need for regulatory approvals for AI-driven diagnostics further slows adoption, as authorities carefully evaluate the safety, accuracy, and compliance of these technologies.

Patient data privacy concerns add another layer of complexity, requiring stringent cybersecurity measures and adherence to data protection regulations. Without proper institutional support, technical expertise, and ongoing training, even advanced autonomous radiology systems may remain underutilized.

Consequently, these financial, technical, and regulatory barriers limit the market penetration of such systems, restricting their use primarily to well-equipped hospitals and large imaging centers worldwide.

Cloud Adoption, Multi-Modal AI, and Hybrid WorkflowsThe market is evolving toward cloud-based and hybrid solutionsthese solutions provide scalable storage, enable remote diagnostics, and support real-time collaboration among clinicians, making advanced radiology capabilities more accessible to a wider range of healthcare facilities.

Simultaneously, multi-modal AI systems that integrate CT, MRI, X-ray, and ultrasound data are gaining traction, offering comprehensive insights and enabling more personalized diagnostics. Smaller and mid-sized hospitals are increasingly deploying turnkey AI solutions with intuitive interfaces, reducing the need for extensive IT infrastructure or highly specialized staff.

Continuous advancements in algorithm accuracy, processing speed, and system interoperability are further facilitating efficient workflows and reliable diagnostic outputs. Collectively, these developments reflect a shift toward more flexible, integrated, and widely deployable autonomous radiology systems, positioning AI as an essential tool in modern healthcare practice and driving broader market adoption globally.

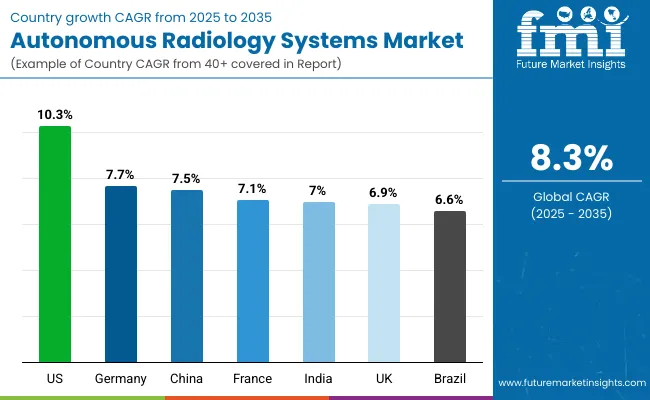

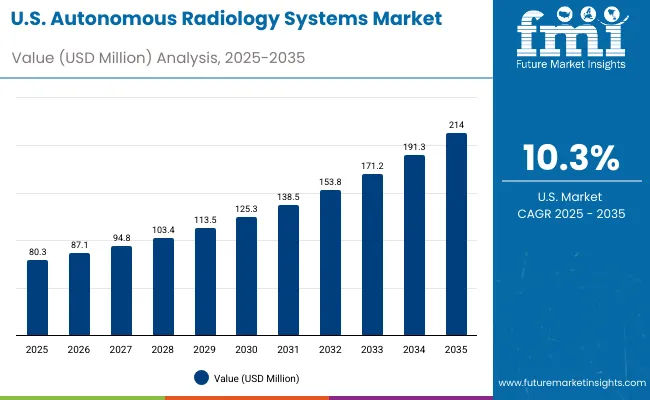

| Country | CAGR |

|---|---|

| USA | 10.3% |

| Brazil | 6.6% |

| China | 7.5% |

| India | 7.0% |

| Europe | 6.9% |

| Germany | 7.7% |

| France | 7.1% |

| UK | 6.9% |

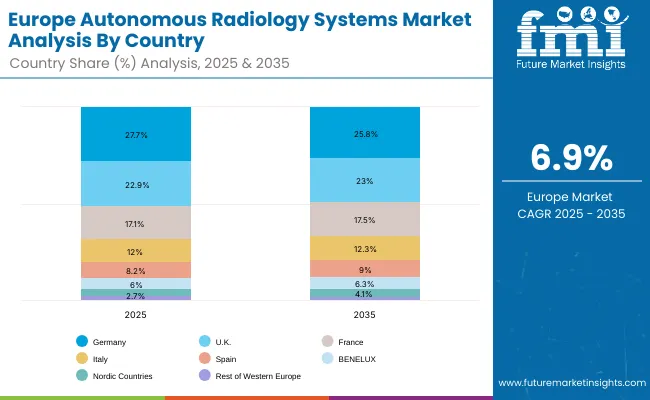

The adoption and growth patterns of autonomous radiology systems exhibit distinct variations across different regions, influenced by the maturity of healthcare infrastructure, government investment in digital health, and specialized diagnostic demand.

In the United States, the market is characterized by strong growth driven by a robust network of hospitals, diagnostic imaging centers, and research institutions, as well as leading technology companies developing AI-enabled imaging solutions.

The availability of advanced imaging infrastructure, including PACS-integrated CT, MRI, and X-ray systems, supports rapid adoption and seamless integration into clinical workflows. Continuous investment in healthcare modernization, telemedicine, and AI research propels demand for autonomous radiology systems, particularly in areas like oncology, cardiovascular care, and neurology. The market here is projected to grow at a CAGR of 10.3%.

In Europe, countries such as Germany, France, and the UK are leading the adoption of autonomous radiology systems, with increasing emphasis on integrating AI-enabled imaging into national healthcare modernization programs and hospital networks. Government-backed digital health initiatives, coupled with investment in advanced diagnostic infrastructure, have facilitated collaboration between hospitals, imaging centers, and technology vendors.

This has enabled the deployment of multi-modal AI systems, cloud-based radiology platforms, and advanced CT, MRI, and X-ray solutions for enhanced clinical outcomes. Regulatory support for AI in healthcare, strategic funding for smart hospitals, and programs aimed at increasing workflow efficiency are fostering sustained market growth, although adoption remains gradual in certain regions due to infrastructure constraints and staff training requirements. The market in Germany is projected to expand at a CAGR of 8.2%, France at 7.6%, and the UK at 6.9%.

Overall, the European autonomous radiology systems market reflects a strategic combination of technological advancement, healthcare policy alignment, and institutional investment, which together govern the pace and scale of adoption in different countries. This interplay underscores the critical role that regional regulations, infrastructure availability, and clinical expertise play in shaping the trajectory of AI-driven diagnostic imaging across Europe.

The global autonomous radiology systems market in the United States has been forecasted to expand at a CAGR of 10.3% between 2025 and 2035. The USA market is advancing steadily, supported by regulatory clearances and strong academic validation of AI imaging tools. The FDA has approved autonomous and semi-autonomous systems for diabetic retinopathy in april 2018 and chest X-ray triage in april 2022, creating a framework for broader adoption.

Companies such as GE HealthCare, in collaboration with NVIDIA, developed autonomous imaging platforms for X-ray and ultrasound, embedding AI directly into acquisition and analysis workflows. Academic leaders including the MIT Jameel Clinic and Massachusetts General Hospital’s Martinos Center have consistently published landmark studies on AI-driven imaging, including the July 2024 Nature Communications study on breast cancer risk prediction (MIRAI), the January 2023 Journal of Clinical Oncology study on lung cancer risk (Sybil). These studies have established global benchmarks for autonomous diagnostics in oncology and neurology.

The global autonomous radiology systems market in India is expected to grow at a CAGR of 7.0%. India’s market is shaped by high disease burden and radiologist shortages. Early adoption is led by centers such as AIIMS and Tata Memorial Centre, where AI-assisted imaging platforms are being piloted in cancer and tuberculosis workflows. In India, multi-site deployments of AI-powered chest X-ray systems capable of near-autonomous abnormality detection are gaining momentum, particularly to address the country’s high tuberculosis burden.

Startups like Qure.ai and DeepTek are implementing these AI solutions across multiple hospitals to detect TB and other chest abnormalities. Large private hospital networks, including Apollo Hospitals, are exploring cloud-based AI radiology platforms to extend diagnostic capacity to underserved regions, reflecting a strong push for scalable and low-resource screening solutions within the country. Large private networks like Apollo Hospitals are exploring cloud-based AI radiology platforms to extend diagnostic capacity to underserved regions.

China’s autonomous radiology systems market is growing at a CAGR of 7.5%. The National Medical Products Administration (NMPA) has approved several AI imaging tools, supporting commercialization. Domestic suppliers are integrating autonomous features into multimodal platforms that include CT, MRI, and ultrasound; these vendors are frequently backed by regional governments.

China is actively expanding the adoption of AI-powered radiology beyond Tier-1 cities such as Beijing and Shanghai. Regional health authorities are co-funding pilot programs to equip county- and municipal-level hospitals with AI-enabled imaging systems.

| Europe Country | 2025 |

|---|---|

| Germany | 27.7% |

| UK | 22.9% |

| France | 17.1% |

| Italy | 12.0% |

| Spain | 8.2% |

| BENELUX | 6.0% |

| Nordic Countries | 3.4% |

| Rest of Western Europe | 2.7% |

| Europe Country | 2035 |

|---|---|

| Germany | 25.8% |

| UK | 23.0% |

| France | 17.5% |

| Italy | 12.3% |

| Spain | 9.0% |

| BENELUX | 6.3% |

| Nordic Countries | 4.1% |

| Rest of Western Europe | 2.0% |

The global autonomous radiology systems market in the United Kingdom is projected to grow at a CAGR of 6.9% between 2025 and 2035, driven by government-backed healthcare innovation programs, supportive regulatory frameworks, and increasing adoption within NHS trusts.

Prominent establishments like King's College London, Imperial College London, and University College London Hospitals (UCLH) are testing AI-assisted imaging platforms for emergency diagnoses, cancer, and chest X-rays. The deployment of AI modules across several hospitals is made possible by the centralized NHS infrastructure, which encourages uniform performance and standardized procedures.

The global autonomous radiology systems market in Germany is anticipated to grow at a CAGR of 8.2% between 2025 and 2035, due to advanced hospital infrastructure, robust industrial AI vendors, and strong regulatory support. Universities such as CharitéUniversitätsmedizin Berlin, University Hospital Heidelberg, and Technical University of Munich Hospitals, are integrating AI-powered modules for automated triage in CT, MRI, and X-ray imaging. German technology providers are pivotal in delivering comprehensive AI imaging solutions, offering support for image acquisition, workflow automation, and initial report generation.

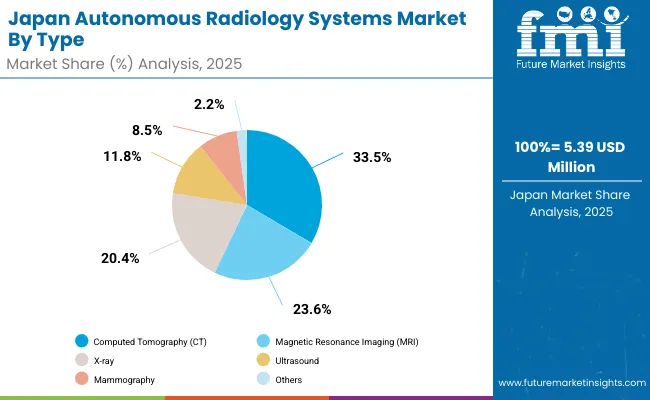

| Type | Market Value Share, 2025 |

|---|---|

| X ray | 20.4% |

| Computed Tomography (CT) | 33.5% |

| Magnetic Resonance Imaging (MRI) | 23.6% |

| Ultrasound | 11.8% |

| Mammography | 8.5% |

| Others | 2.2% |

The global autonomous radiology systems market in Japan has been projected to reach USD 5.39 million by 2025, Computed Tomography (CT) type are expected to lead the product landscape with a 33.5% share, followed by Magnetic Resonance Imaging (MRI) at 23.6%. Japan’s autonomous radiology market is shaped by its advanced healthcare infrastructure and strong tradition in medical technology innovation.

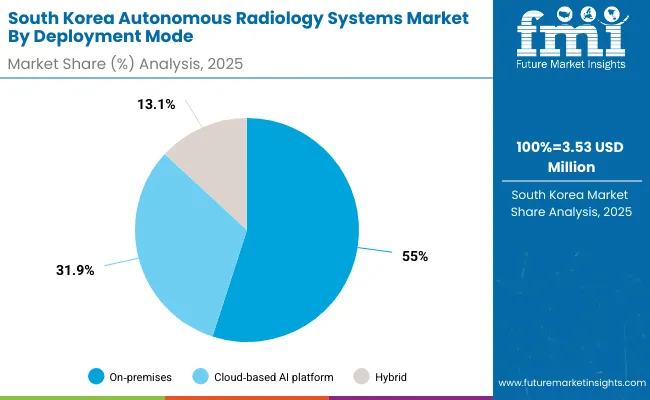

| By Deployment Mode | Market Value Share, 2025 |

|---|---|

| On premises | 55.0% |

| Cloud based AI platform | 31.9% |

| Hybrid | 13.1% |

The global autonomous radiology systems market in South Korea is projected to reach USD 3.53 million by 2025. On-premises deployments are expected to lead with a 55.0% share, followed by cloud-based AI platforms at 31.9%, and hybrid solutions at 13.1%.South Korea’s market is evolving from pilot implementations in research hospitals toward large-scale deployment across healthcare networks, driven by strong digital infrastructure and an emphasis on AI-enabled diagnostic workflows.

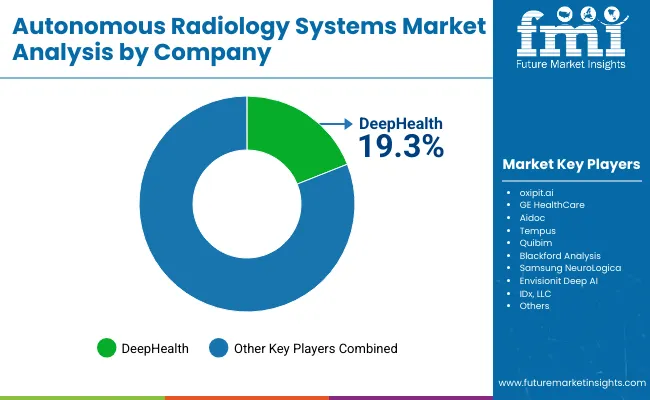

| Company | Global Value Share 2024 |

|---|---|

| DeepHealth | 19.3% |

| Others | 80.7% |

The global autonomous radiology systems market is moderately concentrated, with DeepHealth holding a leading position due to its specialization in AI-powered diagnostic imaging platforms. The company’s dominance is driven by its integrated approach, offering end-to-end autonomous imaging solutions with AI-assisted interpretation, workflow automation, and cloud-based reporting. DeepHealth provides robust support for multi-modality imaging, positioning itself as a preferred vendor for hospitals and imaging networks seeking high-accuracy, scalable AI solutions.

Other key players in the market include oxipit.ai, GE HealthCare, Aidoc, Tempus, Quibim, Blackford Analysis, Samsung NeuroLogica, Envisionit Deep AI, and IDx, LLC, each addressing different segments of the autonomous radiology ecosystem.

Key Developments in Global Autonomous Radiology Systems Market

| Item | Value |

|---|---|

| Quantitative Units | USD 185.9 million |

| By Type | X ray, Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, Mammography, Others |

| By Deployment Mode | On premises, Multi-Modal Learning, Hybrid |

| By Application | Cardiology Diagnostics, Oncology Imaging, Neuro and Cardiovascular Interventions, Patient Positioning and Surgical Assistance |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Europe, Germany, France and UK |

| Key Companies Profiled | DeepHealth, oxipit.ai, GE HealthCare, Aidoc, Tempus, Quibim, Blackford Analysis, Samsung NeuroLogica, Envisionit Deep AI, IDx, LLC |

The global autonomous radiology systems market is estimated to be valued at USD 185.9 million in 2025.

The market size for the global autonomous radiology systems market is projected to reach approximately USD 412.7 million by 2035.

The global autonomous radiology systems market is expected to grow at a CAGR of 8.3% between 2025 and 2035.

The key types in the radiology systems in global autonomous radiology systems market include X ray, Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, Mammography and others.

In terms of deployment mode, on‑premises is projected to command the highest share at 53.3% in the global autonomous radiology systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autonomous Driving Simulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Aerial Robot Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Driving Virtual Simulation Platform Market Forecast and Outlook 2025 to 2035

Autonomous Ultrasound Guidance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Autonomous Imaging Market Size and Share Forecast Outlook 2025 to 2035

Autonomous AI Powered Ophthalmology Screening Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Agents Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Parking Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Trucks Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Drone Platform Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Mobile Robots for Logistics and Warehousing Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Vehicles Market Growth - Trends & Forecast 2025 to 2035

Autonomous Crane Market Growth - Trends & Forecast 2025 to 2035

Autonomous Forklift Market Growth – Trends & Forecast 2024-2034

Autonomous Robot Toys Market

Autonomous Intelligent Vehicle Market

USA Autonomous Crane Market Analysis – Growth, Trends & Forecast 2025-2035

China Autonomous Crane Market Size and Share Forecast Outlook 2025 to 2035

India Autonomous Crane Market Growth – Innovations, Trends & Forecast 2025-2035

Japan Autonomous Crane Market Report – Growth, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA