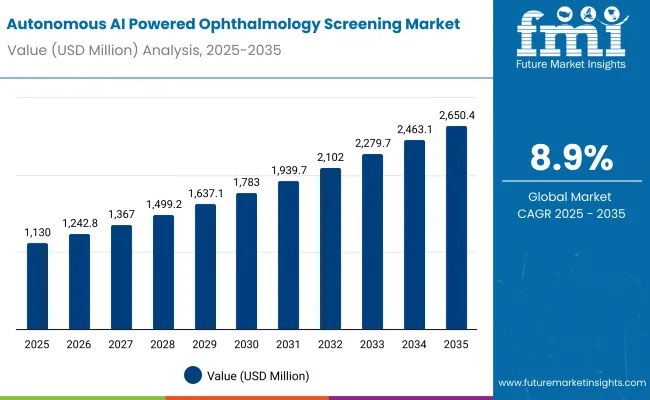

The Global Autonomous AI Powered Ophthalmology Screening Market has been forecasted to attain a valuation of USD 1,130.0 million in 2025, rising to USD 2,650.68 million by 2035, resulting in an incremental gain of USD 1,520.68 million, which reflects a 42.6% increase over the forecast decade. A compound annual growth rate (CAGR) of 8.9% is expected to be recorded, indicating a rapid expansion trajectory for the Global Autonomous AI Powered Ophthalmology Screening Market.

Global Autonomous AI Powered Ophthalmology Screening Market Key Takeaways

| Metric | Value |

|---|---|

| Global Autonomous AI Powered Ophthalmology Screening Market Estimated Value in (2025E) | USD 1,130.0 million |

| Global Autonomous AI Powered Ophthalmology Screening Market Forecast Value in (2035F) | USD 2,650.68 million |

| Forecast CAGR (2025 to 2035) | 8.9 % |

Between 2025 and 2030, autonomous AI-powered ophthalmology screening is expected to see broader adoption across hospitals, diagnostic centers, and telemedicine platforms, as ophthalmologists and healthcare providers increasingly rely on AI-driven retinal imaging to detect diabetic retinopathy, glaucoma, and age-related macular degeneration.

It will grow upto USD 600.7 million in that period from USD 1,130.0 million in 2025 to USD 1,730.7 million in 2030. Advances in cloud-based analytics, user-friendly interfaces, and portable imaging devices are making these systems more accessible, driving adoption even in mid-tier clinics and rural healthcare settings.

Between 2030 and 2035, the market is projected to expand further by USD 920.0million, driven by next-generation AI algorithms capable of multi-disease screening, predictive analytics, and personalized risk assessment. Rising adoption by national health programs and large healthcare networks will further accelerate growth. Continuous innovation in high-resolution imaging sensors, AI interpretability, and real-time patient reporting will define the next generation of ophthalmology screening solutions.

From 2020 to 2024, the Global Autonomous AI Powered Ophthalmology Screening Market, expanded from USD 717.1 million to USD 1,047.5 million, maturing through the increased availability of compact, lab-based, and portable AI screening devices.

During this phase, global medical device manufacturers collaborated with hospitals and research institutions to optimize image acquisition, streamline AI integration, and improve diagnostic accuracy laying the groundwork for broader adoption in both clinical and remote healthcare settings.

The autonomous AI-powered ophthalmology screening ecosystem is likely to evolve with features like cloud-enabled population screening, real-time teleconsultation, and integration with electronic health records (EHR). These advancements aim to reduce clinician workload, improve early detection rates, and expand accessibility, positioning AI-driven ophthalmology screening as a standard tool in preventative eye care worldwide.

The growth of the Global Autonomous AI-Powered Ophthalmology Screening Marketis driven by the ability of these systems to deliver rapid, accurate, and scalable eye disease detection particularly for conditions such as diabetic retinopathy, glaucoma, and age-related macular degeneration. Unlike traditional manual screening conducted by ophthalmologists, AI-powered platforms provide automated, high-throughput analysis of retinal images, enabling earlier diagnosis and reducing the burden on clinical staff.

Over the last few years, the adoption of AI-based ophthalmology screening has expanded beyond specialized clinics and hospitals. Increasing integration into primary care and community health settings allows broad-scale preventive screening, particularly in regions with limited access to eye care specialists. These systems utilize advanced deep learning algorithms capable of detecting subtle pathological features, improving diagnostic accuracy and patient outcomes.

Another factor accelerating market growth is the regulatory approval of autonomous AI systems, such as FDA-cleared platforms, which legitimizes their clinical use and encourages wider adoption. Concurrently, the availability of portable and cloud-connected retinal imaging devices enables deployment in remote and resource-constrained environments, democratizing access to eye care.

Moreover, rising prevalence of diabetes, aging populations, and increased awareness of vision health are driving demand for routine and early ophthalmic screening. This trend, combined with continuous improvements in AI model performance and integration with electronic health record systems, is fostering widespread adoption among healthcare providers.

Collectively, these technological, regulatory, and demographic drivers are positioning the autonomous AI-powered ophthalmology screening market for robust growth, as it becomes an essential tool for scalable, cost-effective, and preventive eye care worldwide.

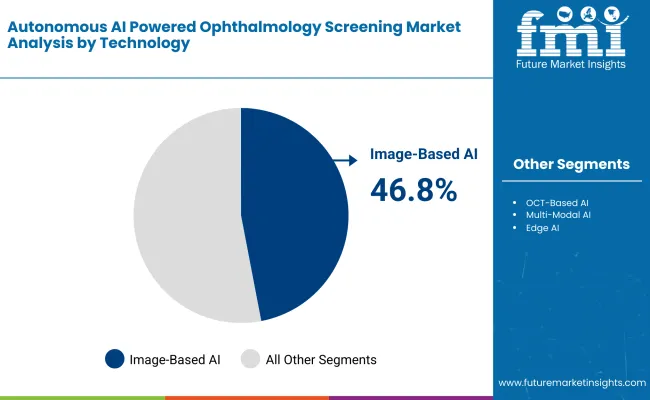

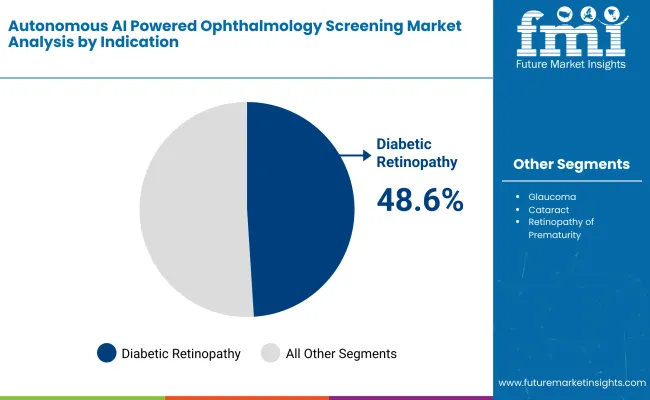

The market is segmented by technology, indication, and end user. Technology includes Image-Based AI (Fundus), OCT-Based AI, Multi-Modal AI, Edge AI, Cloud-Based AI, and Embedded AI in Cameras. By indication, the market covers Diabetic Retinopathy (DR), Age-related Macular Degeneration (AMD), Glaucoma, Cataract, and Retinopathy of Prematurity (ROP).

Based on end user, the segmentation includes Primary Care Clinics, Ophthalmology Clinics, Mobile Clinics / Rural Camps, Hospitals & Tertiary Centers, and Others. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Technology | Market Value Share, 2025 |

|---|---|

| Image-Based AI (Fundus) | 46.8% |

| OCT-Based AI | 12.0% |

| Multi-Modal AI | 6.1% |

| Edge AI | 11.8% |

| Cloud-Based AI | 19.0% |

| Embedded AI in Cameras | 4.3% |

Image-Based AI (Fundus) Systems are projected to lead the technology category with a 46.8% market share in 2025, and are expected to maintain this position due to their ability to deliver high-accuracy retinal imaging and automated disease detection in clinical and screening environments. Unlike OCT-based or multi-modal AI systems, image-based AI leverages large datasets of fundus images to detect subtle pathological changes, enabling early diagnosis of conditions such as diabetic retinopathy, glaucoma, and age-related macular degeneration.

Recent advances in deep learning architectures, combined with high-resolution fundus cameras and optimized preprocessing pipelines, have enhanced the sensitivity and specificity of these systems to near-human expert levels. Integration with cloud platforms and electronic health records allows for real-time analytics, longitudinal patient monitoring, and seamless tele-ophthalmology workflows making these systems indispensable for large-scale vision care programs.

A key factor behind their dominance is the growing adoption in hospitals, diagnostic labs, and community screening programs. With commercial vendors offering turnkey solutions that require minimal technical expertise, image-based AI is becoming accessible to non-specialist clinics and rural healthcare setups. Their relatively low cost of deployment and minimal infrastructure demands further position them as the preferred platform for automated retinal assessment.

As eye care continues to attract cross-disciplinary interest from AI, biomedical, and public health sectors, the combination of accuracy, scalability, and ease of integration ensures that image-based AI (fundus) remains the backbone of modern ophthalmic diagnostics across clinical and research settings.

| Indication | Market Value Share, 2025 |

|---|---|

| Diabetic Retinopathy (DR) | 48.6% |

| Age-related Macular Degeneration (AMD) | 23.9% |

| Glaucoma | 16.0% |

| Cataract | 6.7% |

| Retinopathy of Prematurity (ROP) | 4.8% |

Diabetic Retinopathy (DR) continues to dominate the indication landscape, accounting for nearly half of the total market value in 2025 with a 48.6% share. This condition remains a primary focus for ophthalmic screening and intervention due to its high prevalence among diabetic populations and its potential to cause irreversible vision loss if untreated. DR detection and management rely heavily on advanced imaging and diagnostic modalities, which have become standard practice in both clinical and research settings.

The prominence of DR in the market is driven by widespread adoption of screening programs, increasing awareness among patients and healthcare providers, and strong investment in diagnostic technologies. The condition’s chronic nature and the need for routine monitoring make it a consistent and high-value segment for medical device and imaging companies.

Other indications such as Age-related Macular Degeneration (AMD), Glaucoma, Cataract, and Retinopathy of Prematurity (ROP) represent smaller but growing portions of the market. While these segments benefit from technological advancements in imaging and treatment, they lack the same volume-driven demand seen with DR.

The diabetic retinopathy segment remains irreplaceable in the ophthalmology market due to its combination of high prevalence, frequent monitoring requirements, and integration into standardized clinical workflows. Continued innovation in imaging resolution, AI-based diagnostics, and telemedicine solutions is expected to further strengthen DR’s market position, ensuring sustained investment and adoption across global healthcare systems.

The adoption of autonomous AI-powered ophthalmology screening solutions is accelerating as healthcare providers and technology developers converge to address rising rates of eye disorders and improve diagnostic efficiency. While market momentum is strong, the sector faces structural challenges linked to regulatory compliance, infrastructure, and operator expertise.

Growing Role in Early Detection and Preventive Eye CareAI-powered screening systems are becoming essential in the detection of diabetic retinopathy, glaucoma, and other vision-threatening conditions. These solutions allow clinicians to identify early-stage disease with speed and accuracy that conventional methods cannot match.

Hospitals, primary care clinics, and telemedicine providers are increasingly deploying AI-based workflows to validate diagnoses, monitor patient outcomes, and reduce the burden on ophthalmologists. As telehealth adoption expands, autonomous screening is becoming a standard part of routine eye care.

Shift Toward Compact and Point-of-Care AI Screening DevicesThe market is expanding as manufacturers introduce portable, turnkey systems that fit into a variety of clinical settings. These devices combine high-resolution retinal imaging with AI analysis in real time, enabling even minimally trained staff to conduct screenings effectively.

Integration with cloud-based analytics, automated referral workflows, and user-friendly interfaces allows smaller clinics and community health centers to implement high-quality screening without large-scale infrastructure investment. Countries investing in preventive healthcare programs are equipping clinics and schools with AI screening setups, extending access far beyond traditional hospital environments.

Regulatory, Data, and Training ConstraintsAI ophthalmology screening requires adherence to strict medical device regulations, robust data privacy measures, and clinical validation. Operators still need training to acquire reliable images and interpret AI-generated reports, creating a learning curve for widespread deployment.

These factors limit adoption in routine practice settings, particularly in regions with constrained healthcare infrastructure. Without proper oversight and skilled handling, even advanced systems risk underutilization. Regulatory and operational complexities remain key restraints on market growth, despite strong technological momentum.

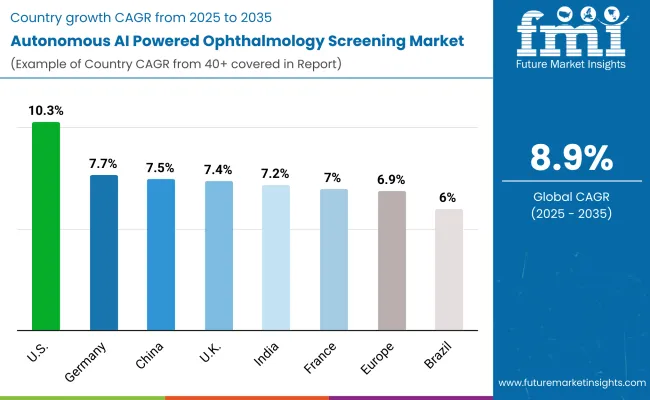

| Country | CAGR |

|---|---|

| USA | 10.3% |

| Brazil | 6.0% |

| China | 7.5% |

| India | 7.2% |

| Europe | 6.9% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 7.4 % |

The adoption and growth patterns of autonomous AI-powered ophthalmology screening systems vary significantly across regions, largely shaped by healthcare infrastructure maturity, government initiatives, and the prevalence of ophthalmic disorders.

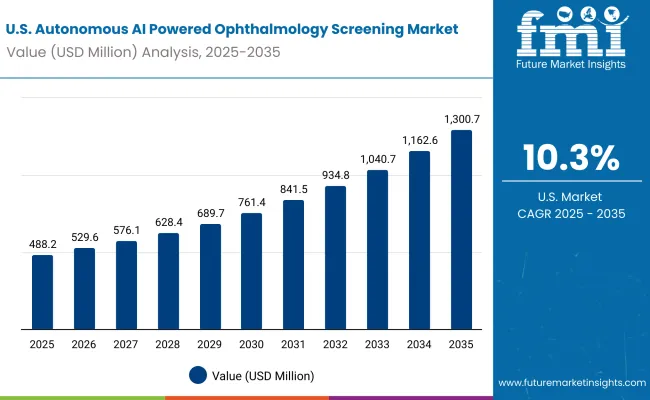

The USA market is witnessing strong growth, fueled by widespread adoption in hospitals, eye care clinics, and diagnostic centers. Significant investment in AI-driven healthcare technologies, coupled with a focus on early detection of vision disorders, accelerates deployment. Supportive regulatory frameworks and collaboration between technology providers and academic medical centers further strengthen adoption. The market in the USA is projected to grow at a CAGR of 10.3%, reflecting robust demand for AI-enabled diagnostic efficiency and improved patient outcomes.

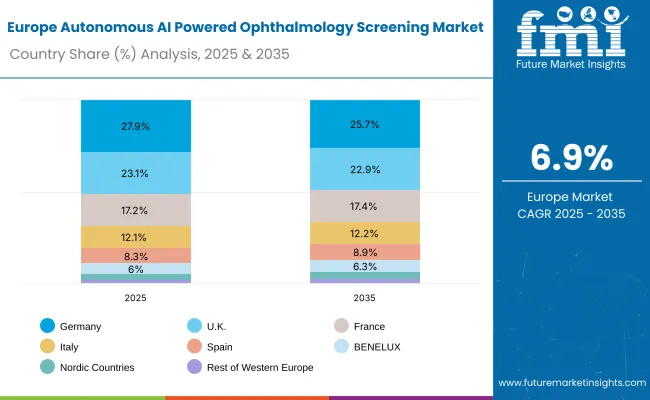

In Europe, countries such as Germany, France, and the UK are at the forefront of adopting autonomous AI-powered ophthalmology screening systems, driven by national healthcare digitization initiatives, investments in AI-enabled diagnostics, and collaboration between hospitals and technology providers.

Government-backed programs promoting telemedicine and AI integration in public health services have facilitated large-scale deployments, enabling use of autonomous screening technologies for early detection of diabetic retinopathy, glaucoma, and other ocular diseases.

Regulatory support for AI healthcare solutions and strategic funding foster sustained market growth, though adoption in some regions remains measured as healthcare providers continue validating clinical efficacy. The market in Germany is expected to grow at a CAGR of 7.7%, France at 7.0%, and the UK at 7.4%.

Overall, the global autonomous AI-powered ophthalmology screening market reflects a strategic blend of technological innovation, healthcare policy alignment, and institutional investment, which collectively govern the pace and scale of adoption across different countries. This dynamic interplay underscores the central role that regional healthcare infrastructure, government initiatives, and clinical expertise play in shaping the trajectory of this rapidly evolving diagnostic technology market.

The market for autonomous AI-powered ophthalmology screening in the United States is projected to grow at a CAGR of 10.3% between 2025 and 2035. The USA remains the largest and most technologically advanced market for AI-driven eye care solutions, driven by high prevalence of diabetic retinopathy, glaucoma, and age-related macular degeneration, alongside robust healthcare infrastructure and insurance coverage. Leading academic medical centers such as Johns Hopkins, Mayo Clinic, and Wills Eye Hospital, as well as specialized ophthalmology networks, are spearheading clinical validation studies and integrating autonomous screening into routine care pathways.

The market for autonomous AI-powered ophthalmology screening in India is projected to grow at a CAGR of 7.2% between 2025 and 2035, driven by rising prevalence of diabetic retinopathy, glaucoma, and age-related eye conditions, alongside increasing smartphone penetration and telemedicine adoption. While urban tertiary hospitals and specialty eye care centers are rapidly adopting AI screening solutions, infrastructure gaps and uneven digital health literacy across rural areas limit nationwide coverage. Premier institutions such as All India Institute of Medical Sciences (AIIMS), SankaraNethralaya, and LV Prasad Eye Institute are leading pilot implementations, clinical validation studies, and AI training programs.

China’s autonomous AI-powered ophthalmology screening market is projected to expand at a CAGR of 7.5% from 2025 to 2035. The market is being driven by strong government initiatives to improve eye health, widespread smartphone and telemedicine adoption, and growing prevalence of diabetic retinopathy and other retinal diseases. Leading hospitals and research centers such as Zhongshan Ophthalmic Center (Sun Yat-sen University), Peking University Third Hospital, and Shanghai Eye Disease Center are actively deploying AI screening solutions and publishing clinical validation studies. Several regional health networks have integrated autonomous AI screening platforms into community clinics, enabling early detection at scale.

| Europe Country | 2025 |

|---|---|

| Germany | 27.9% |

| UK | 23.1% |

| France | 17.2% |

| Italy | 12.1% |

| Spain | 8.3% |

| BENELUX | 6.0% |

| Nordic Countries | 3.4% |

| Rest of Western Europe | 2.1% |

| Europe Country | 2035 |

|---|---|

| Germany | 25.7% |

| UK | 22.9% |

| France | 17.4% |

| Italy | 12.2% |

| Spain | 8.9% |

| BENELUX | 6.3% |

| Nordic Countries | 4.1% |

| Rest of Western Europe | 2.6% |

The autonomous AI-powered ophthalmology screening market in the United Kingdom is projected to grow at a CAGR of 7.4% between 2025 and 2035. Market expansion is supported by a combination of strong public health initiatives, increasing integration of AI into clinical workflows, and early adoption by leading ophthalmic research centers and hospitals. Institutions such as Moorfields Eye Hospital, University College London Hospitals (UCLH), and King’s College London are piloting autonomous AI systems for diabetic retinopathy, glaucoma, and age-related macular degeneration screening.

The United Kingdom benefits from a well-established national healthcare infrastructure, enabling deployment of AI screening solutions in both urban and semi-urban regions. Early-stage integration into the NHS Diabetic Eye Screening Programme and research collaborations with AI startups are accelerating technology adoption and real-world validation.

The autonomous AI-powered ophthalmology screening market in Germany is anticipated to grow at a CAGR of 7.7% between 2025 and 2035, driven by the country’s strong digital health infrastructure, high diabetes prevalence, and emphasis on early detection of retinal diseases. Germany is positioning itself as a key European hub for clinical validation and deployment of AI diagnostic tools, particularly in diabetic retinopathy and macular degeneration. Growth is being fueled by collaborations between university hospitals, device manufacturers, and AI developers, alongside federal initiatives supporting digital health integration. German firms and research centers are also contributing to the development of AI-enabled imaging platforms and workflow integration solutions that are increasingly being exported and adopted across Europe.

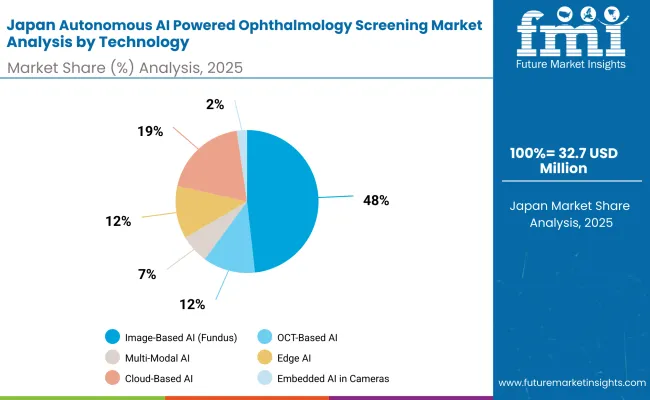

| By Technology | Market Value Share, 2025 |

|---|---|

| Image-Based AI (Fundus) | 48.2% |

| OCT-Based AI | 11.8% |

| Multi-Modal AI | 6.5% |

| Edge AI | 11.9% |

| Cloud-Based AI | 19.2% |

| Embedded AI in Cameras | 2.3% |

The autonomous AI-powered ophthalmology screening market in Japan has been projected to reachUSD 32.77 million by 2025. Image-based AI systems for fundus photography will lead the product landscape with a 48.2% share, followed by cloud-based AI at 19.2% and edge AI at 11.9%. The Japanese market is shaped by a strong national focus on preventive healthcare, universal insurance coverage, and a robust domestic base of optical and imaging device manufacturers.

Leading academic hospitals, such as the University of Tokyo Hospital, Keio University Hospital, and Osaka University Hospital, have made autonomous AI screening central to programs for diabetic retinopathy and age-related macular degeneration. Clinical pilots are combining fundus and OCT-based AI solutions across hospital and community networks, enabling broad experimentation from population-scale diabetes screening to advanced multimodal diagnostics.

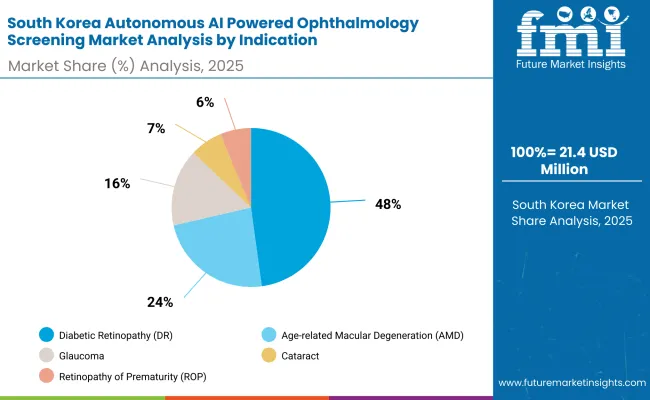

| By Indication | Market Value Share, 2025 |

|---|---|

| Diabetic Retinopathy (DR) | 47.8% |

| Age-related Macular Degeneration (AMD) | 23.5% |

| Glaucoma | 15.7% |

| Cataract | 6.6% |

| Retinopathy of Prematurity (ROP) | 6.3% |

The autonomous AI-powered ophthalmology screening market in South Korea has been projected to reach USD 21.47 million by 2025. By indication, diabetic retinopathy is expected to lead with a 47.8% share, followed by age-related macular degeneration at 23.5% and glaucoma at 15.7%. South Korea’s market is evolving from early academic pilots toward wider deployment in community health and tele-ophthalmology frameworks. National centers such as the Korea Institute of Science and Technology (KIST) and Seoul National University Hospital are leading research and clinical validation of AI-driven retinal imaging. A distinctive driver for South Korea is the integration of AI screening into digital health platforms and nationwide chronic disease management programs, particularly targeting the country’s growing diabetic population.

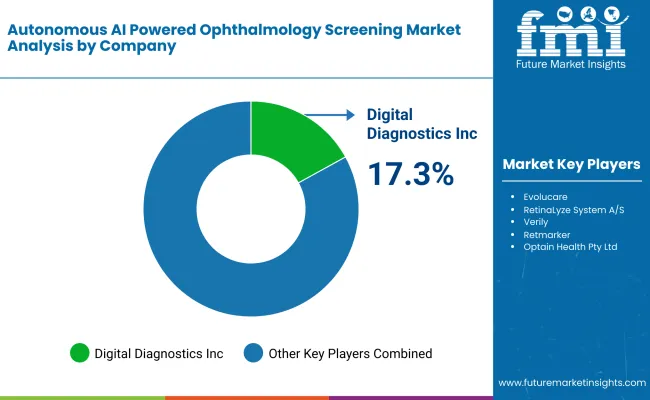

| Company | Global Value Share 2024 |

|---|---|

| Digital Diagnostics Inc. | 17.3% |

| Others | 82.7% |

The autonomous AI-powered ophthalmology screening market is moderately fragmented, with Digital Diagnostics Inc. holding a leading global position due to its FDA-cleared IDx-DR platform for autonomous diabetic retinopathy detection. The company’s strength lies in its regulatory head start, established USA deployments, and expanding payer partnerships, making it the reference point for fully autonomous ophthalmic AI.

Other key players include Eyenuk, AEYE Health, and Remidio Innovative Solutions, each addressing different segments of the ecosystem. Eyenuk is scaling its EyeArt platform across major health systems with FDA clearance, AEYE Health emphasizes ultra-rapid image analysis for point-of-care settings, and Remidio differentiates with portable smartphone-based fundus cameras integrated with AI. Regional and global players such as Beijing Airdoc, Verily, RetinaLyze, Retmarker, and Zebra Medical Vision are embedding AI screening within broader healthcare and chronic disease management frameworks.

Key Developments in Global Autonomous AI Powered Ophthalmology Screening Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,130.0 million |

| Technology | Image-Based AI (Fundus), OCT-Based AI, Multi-Modal AI, Edge AI, Cloud-Based AI, Embedded AI in Cameras |

| Indication | Diabetic Retinopathy (DR), Age-related Macular Degeneration (AMD), Glaucoma, Cataract, Retinopathy of Prematurity (ROP) |

| End User | Primary Care Clinics, Ophthalmology Clinics, Mobile Clinics / Rural Camps, Hospitals & Tertiary Centers, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Europe, Germany, France and UK |

| Key Companies Profiled | Digital Diagnostics Inc., Eyenuk, Inc., AEYE Health, Remidio Innovative Solutions Pvt Ltd., Evolucare, RetinaLyze System A/S, Verily, Retmarker, Intelligent Retinal Imaging Systems, MONA.health, Optain Health Pty Ltd., Beijing Airdoc Technology Co., Ltd., Zebra Medical Vision, Ikerian AG, Altris, Inc., identifeye HEALTH and others |

The global Global Autonomous AI Powered Ophthalmology Screening Market is estimated to be valued at USD 1,130.0 million in 2025.

The market size for the Global Autonomous AI Powered Ophthalmology Screening Market is projected to reach approximately USD 2,650.68 million by 2035.

The Global Autonomous AI Powered Ophthalmology Screening Market is expected to grow at a CAGR of 8.9% between 2025 and 2035.

The key Technology in the Global Autonomous AI Powered Ophthalmology Screening Market include Image-Based AI (Fundus), OCT-Based AI, Multi-Modal AI, Edge AI, Cloud-Based AI, Embedded AI in Cameras.

In terms of Indication, Diabetic Retinopathy (DR) is projected to command the highest share at 48.6% in the Global Autonomous AI Powered Ophthalmology Screening Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autonomous Driving Simulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Aerial Robot Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Driving Virtual Simulation Platform Market Forecast and Outlook 2025 to 2035

Autonomous Ultrasound Guidance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Autonomous Imaging Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Radiology Systems Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Agents Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Parking Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Trucks Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Drone Platform Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Mobile Robots for Logistics and Warehousing Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Vehicles Market Growth - Trends & Forecast 2025 to 2035

Autonomous Crane Market Growth - Trends & Forecast 2025 to 2035

Autonomous Forklift Market Growth – Trends & Forecast 2024-2034

Autonomous Robot Toys Market

Autonomous Intelligent Vehicle Market

USA Autonomous Crane Market Analysis – Growth, Trends & Forecast 2025-2035

China Autonomous Crane Market Size and Share Forecast Outlook 2025 to 2035

India Autonomous Crane Market Growth – Innovations, Trends & Forecast 2025-2035

Japan Autonomous Crane Market Report – Growth, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA