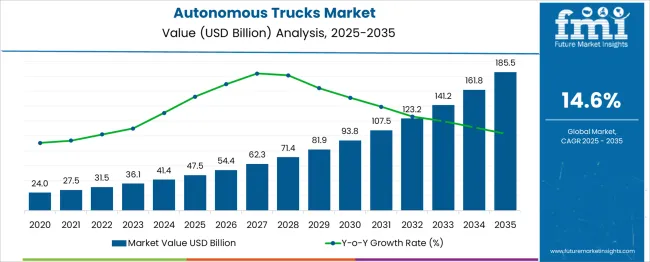

The global autonomous trucks market is likely to expand from USD 47.4 billion in 2025 to approximately USD 185.4 billion by 2035, recording an absolute increase of USD 138.0 billion over the forecast period. This translates into a total growth of 290.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 14.6% between 2025 and 2035. The market size is expected to grow by nearly 3.9X during the same period, supported by the rising adoption of autonomous driving technologies and increasing demand for efficient freight transportation solutions across logistics and supply chain industries.

Between 2025 and 2030, the autonomous trucks market is projected to expand from USD 47.4 billion to USD 93.27 billion, resulting in a value increase of USD 45.8 billion, which represents 33.2% of the total forecast growth for the decade. This phase of growth will be shaped by rising adoption of Level 2 and Level 3 autonomous systems in commercial fleets, increasing investment in autonomous driving infrastructure, and growing demand for freight transportation efficiency. Manufacturers are expanding their autonomous technology capabilities to address the growing complexity of modern logistics requirements across highway and urban environments.

From 2030 to 2035, the market is forecast to grow from USD 93.27 billion to USD 185.4 billion, adding another USD 92.2 billion, which constitutes 66.8% of the ten-year expansion. This period is expected to be characterized by widespread deployment of Level 4 and Level 5 autonomous trucks, integration of advanced sensor fusion systems, and development of comprehensive autonomous fleet management solutions. The growing emphasis on green transportation and driver shortage mitigation will drive demand for more sophisticated autonomous trucking systems with enhanced safety and operational capabilities.

| Metric | Value |

| Estimated Value in (2025E) | USD 47.4 billion |

| Forecast Value in (2035F) | USD 185.4 billion |

| Forecast CAGR (2025 to 2035) | 14.6% |

Market expansion is being supported by the rapid increase in e-commerce activities worldwide and the corresponding need for efficient freight transportation solutions that can operate continuously without driver limitations. Modern logistics operations rely on autonomous trucks to ensure consistent delivery schedules, reduced operational costs, and enhanced safety performance. The growing complexity of supply chain networks and increasing emphasis on transportation efficiency are driving demand for autonomous trucking solutions from certified manufacturers with appropriate technical expertise and safety validation.

The expanding driver shortage crisis and rising labor costs are creating significant demand for autonomous solutions that can maintain freight capacity while reducing operational expenses. Government regulations promoting transportation safety and emissions reduction are establishing new standards for autonomous vehicle technologies that require advanced sensor systems and sophisticated artificial intelligence capabilities.

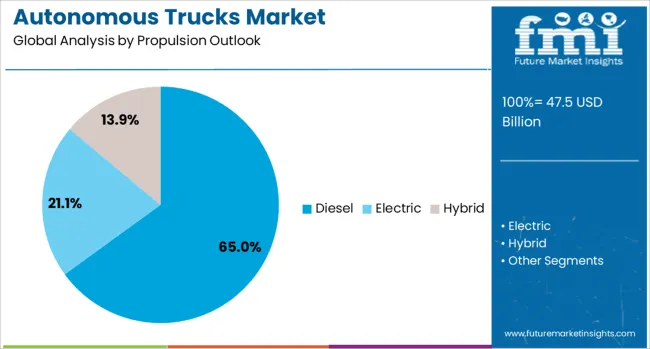

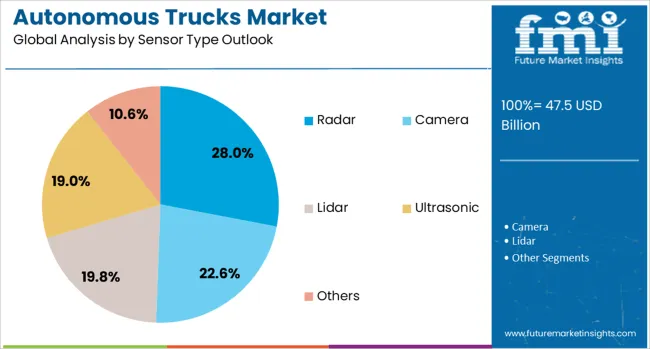

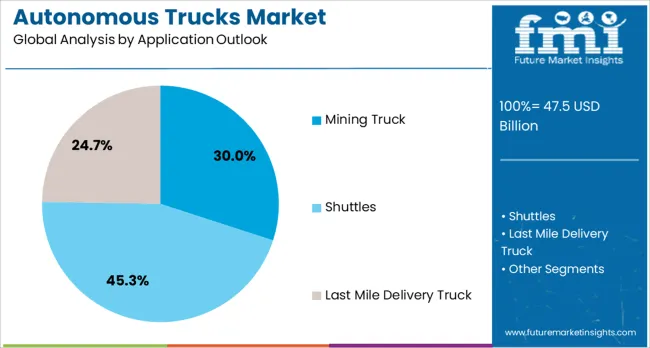

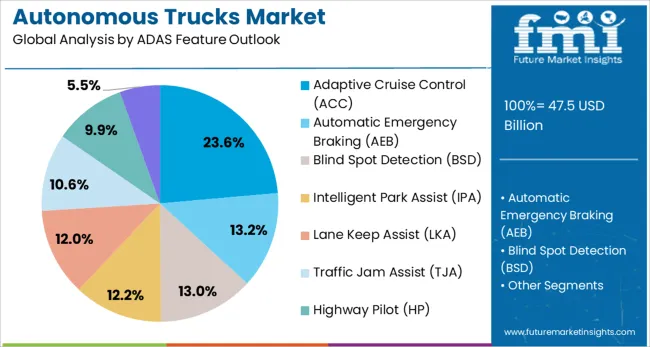

The market is segmented by propulsion, vehicle type, sensor type, application, ADAS features, level of autonomy, and region. By propulsion, the market is divided into diesel, electric, hybrid, and others. Based on vehicle type, the market is categorized into heavy duty trucks, light duty trucks, and medium duty trucks. In terms of sensor type, the market includes radar, camera, lidar, ultrasonic, and others. By application, the market is segmented into mining trucks, shuttles, last mile delivery trucks, and others. ADAS features include adaptive cruise control, automatic emergency braking, blind spot detection, intelligent park assist, lane keep assist, traffic jam assist, highway pilot, and others. Level of autonomy is divided into L2 & L3, L1, L4, and L5. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Diesel propulsion is projected to account for 65% of the autonomous trucks market in 2025. This leading share is supported by the established infrastructure for diesel fuel distribution and the proven reliability of diesel engines in long-haul trucking applications. Diesel-powered autonomous trucks provide superior range and payload capacity, making them the preferred choice for freight transportation operators. The segment benefits from comprehensive fueling networks and established maintenance systems that support commercial trucking operations.

Heavy duty trucks are expected to represent 55% of the vehicle type segment in 2025. This dominant share reflects the primary application of autonomous technology in long-haul freight transportation where heavy duty trucks provide the necessary payload capacity and operational efficiency. Modern heavy duty autonomous trucks feature advanced sensor systems and sophisticated control algorithms designed for highway operation. The segment benefits from significant investment in autonomous technology development and comprehensive testing programs.

Radar sensors are projected to contribute 28% of the sensor type segment in 2025. This significant share reflects the critical importance of radar technology in autonomous vehicle perception systems, providing reliable object detection and distance measurement capabilities in various weather conditions. Radar sensors offer consistent performance across different environmental conditions and provide essential data for autonomous driving algorithms. The segment is supported by continuous technology advancement and cost reduction initiatives.

Mining truck applications are estimated to hold 30% of the application segment share in 2025. This substantial share reflects the early adoption of autonomous technology in mining operations where controlled environments and predictable routes facilitate autonomous vehicle deployment. Mining autonomous trucks operate in dedicated areas with established safety protocols and infrastructure support. The segment benefits from proven operational benefits including improved safety, consistent productivity, and reduced operational costs.

Adaptive cruise control is projected to represent 23.6% of the ADAS features segment in 2025. This leading share reflects the fundamental importance of speed control systems in autonomous trucking applications where maintaining safe following distances and consistent speeds is critical for highway operation. Adaptive cruise control provides the foundation for higher levels of autonomous driving by enabling automated speed management and traffic following capabilities.

Level 2 and Level 3 autonomous systems are expected to account for 34.5% of the autonomy level segment in 2025. This significant share reflects the current state of autonomous technology deployment where partial automation systems provide driver assistance while requiring human oversight. L2 and L3 systems offer practical autonomous capabilities that can be implemented with current technology while maintaining safety through human supervision. The segment represents the transitional phase toward full autonomy in commercial trucking applications.

The autonomous trucks market is advancing rapidly due to increasing transportation efficiency demands and growing recognition of autonomous technology benefits. The market faces challenges including regulatory uncertainty, high technology development costs, and infrastructure requirements for autonomous vehicle operation. Standardization efforts and safety validation programs continue to influence technology development and market adoption patterns.

The growing deployment of comprehensive sensor systems combining radar, lidar, cameras, and ultrasonic sensors is enabling superior environmental perception and decision-making capabilities for autonomous trucks. Multi-sensor fusion provides redundant detection capabilities and comprehensive situational awareness in diverse operating conditions. These advanced systems are particularly valuable for highway operation where high-speed decision-making and precise vehicle control are essential for safety and efficiency.

Modern autonomous truck manufacturers are incorporating advanced AI algorithms and machine learning systems that continuously improve driving performance through real-world experience and data analysis. Integration of cloud-based learning platforms and edge computing enables real-time optimization of autonomous driving behaviors and comprehensive fleet management capabilities. Advanced AI systems also support predictive maintenance and operational efficiency optimization across autonomous truck fleets.

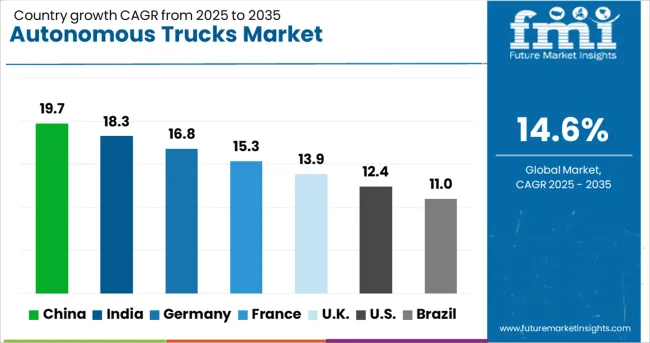

| Country | CAGR (2025-2035) |

| China | 19.7% |

| India | 18.3% |

| Germany | 16.8% |

| France | 15.3% |

| United Kingdom | 13.9% |

| United States | 12.4% |

| Brazil | 11.0% |

The autonomous trucks market demonstrates exceptional growth across major economies, with China leading at a 19.7% CAGR through 2035, driven by massive infrastructure investment and government support for autonomous vehicle development. India follows at 18.3%, supported by growing logistics demand and technology adoption initiatives. Germany records 16.8% growth, emphasizing automotive innovation and regulatory leadership. France shows 15.3% expansion, driven by transportation modernization programs. The United Kingdom demonstrates 13.9% growth, focusing on logistics efficiency and regulatory development. The United States records 12.4% growth, supported by established trucking infrastructure, while Brazil grows at 11.0% with developing autonomous vehicle capabilities. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from autonomous trucks in China is projected to exhibit the highest growth rate with a CAGR of 19.7% through 2035, driven by comprehensive government initiatives supporting autonomous vehicle development and massive infrastructure investment programs. The country's expanding logistics industry and increasing emphasis on transportation efficiency are creating significant demand for autonomous trucking solutions. Major technology companies and automotive manufacturers are establishing comprehensive development programs to support the growing requirements of freight transportation and logistics operations.

Government autonomous vehicle development policies are mandating advancement of self-driving technology and establishing supportive regulatory frameworks, driving investment in autonomous trucking capabilities throughout major industrial corridors. Infrastructure modernization programs are supporting deployment of connected vehicle systems and smart highway technologies that enhance autonomous vehicle operation across transportation networks.

Revenue from autonomous trucks in India is expanding at a CAGR of 18.3%, supported by rapidly growing e-commerce activities and increasing demand for efficient freight transportation solutions. The country's expanding logistics industry and rising transportation volumes are driving interest in autonomous technologies that can address capacity constraints and operational efficiency challenges. Technology companies and logistics providers are gradually establishing capabilities to serve the growing requirements of modern supply chain operations.

Logistics modernization initiatives and infrastructure development programs are creating opportunities for autonomous trucking solutions that can support diverse transportation requirements. Professional development and technology adoption programs are building technical expertise among industry participants, enabling comprehensive autonomous vehicle capabilities that meet evolving logistics and transportation standards.

Demand for autonomous trucks in Germany is projected to grow at a CAGR of 16.8%, supported by the country's leadership in automotive technology development and comprehensive regulatory framework for autonomous vehicles. German automotive manufacturers are implementing advanced autonomous trucking systems that meet stringent safety standards and technical requirements. The market is characterized by focus on engineering excellence, systematic testing protocols, and compliance with comprehensive safety regulations.

Automotive industry investments are prioritizing autonomous vehicle technologies that demonstrate superior performance and reliability while meeting German engineering standards. Professional certification programs are ensuring comprehensive technical expertise among manufacturers, enabling specialized autonomous truck systems that support diverse transportation applications and export requirements.

Demand for autonomous trucks in France is expanding at a CAGR of 15.3%, driven by comprehensive transportation modernization initiatives and established logistics infrastructure. French transportation authorities are supporting autonomous vehicle development through testing programs and regulatory advancement that facilitate technology deployment. The market benefits from integrated approach to transportation innovation and comprehensive support for emerging technologies.

Transportation infrastructure investments are facilitating deployment of autonomous trucking systems that provide enhanced efficiency and safety performance while maintaining operational reliability. Professional development programs are ensuring comprehensive technical capabilities among industry participants, enabling specialized autonomous vehicle solutions that meet evolving transportation requirements and regulatory standards.

Demand for autonomous trucks in the United Kingdom is projected to grow at a CAGR of 13.9%, supported by emphasis on logistics efficiency improvement and progressive regulatory development for autonomous vehicles. British logistics companies are exploring autonomous trucking technologies that can address driver shortage challenges and improve operational efficiency. The market is characterized by focus on practical deployment scenarios and comprehensive safety validation.

Logistics industry investments are enabling evaluation of autonomous trucking applications that provide measurable operational benefits while maintaining safety standards. Professional regulatory development programs are ensuring comprehensive framework development for autonomous vehicle deployment, enabling specialized trucking solutions that support evolving logistics requirements.

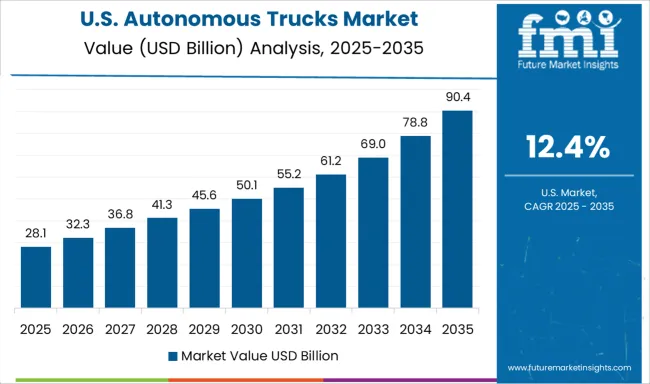

Demand for autonomous trucks in the United States is expanding at a CAGR of 12.4%, driven by established trucking infrastructure and technology leadership in autonomous vehicle development. American companies are implementing comprehensive autonomous trucking programs that leverage existing highway systems and logistics networks. The market benefits from substantial private investment and comprehensive testing programs across diverse operating environments.

Transportation technology investments are enabling large-scale autonomous truck deployment programs that demonstrate practical operational benefits and safety improvements. Professional development initiatives are maintaining technical expertise among industry participants, enabling comprehensive autonomous trucking capabilities that support evolving freight transportation requirements.

Revenue from autonomous trucks in Brazil is growing at a CAGR of 11.0%, driven by developing autonomous vehicle capabilities and increasing interest in transportation efficiency solutions. The country's expanding logistics industry is exploring autonomous technologies that can address operational challenges and improve freight transportation efficiency. Technology companies and logistics providers are investing in capability development to serve evolving transportation requirements.

Transportation development programs are facilitating evaluation of autonomous trucking technologies that support comprehensive logistics applications across diverse operating conditions. Professional capability development initiatives are enhancing technical expertise among industry participants, enabling specialized autonomous vehicle solutions that meet developing transportation and logistics requirements.

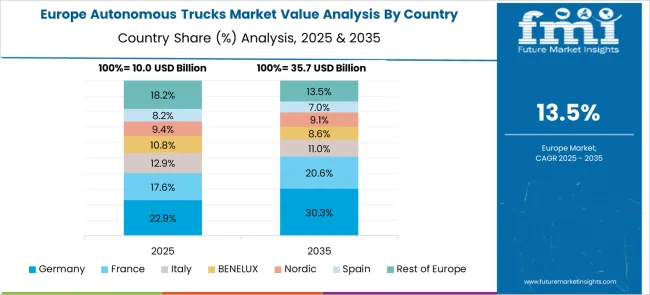

The autonomous trucks market in Europe is projected to grow substantially across major countries, with Germany leading the regional market development. The United Kingdom maintains strong interest in autonomous truck technology, supported by established logistics industries and progressive regulatory frameworks. France demonstrates consistent investment in autonomous vehicle development, driven by transportation innovation programs and infrastructure modernization initiatives.

Germany is expected to maintain its leadership position in European autonomous truck adoption, supported by its advanced automotive manufacturing infrastructure and established trucking industry. The country benefits from comprehensive research and development capabilities and supportive regulatory environment for autonomous vehicle testing and deployment.

The autonomous trucks market is defined by competition among automotive manufacturers, technology companies, and autonomous vehicle developers. Companies are investing in advanced sensor technologies, artificial intelligence systems, comprehensive testing programs, and regulatory compliance to deliver safe, reliable, and cost-effective autonomous trucking solutions. Strategic partnerships, technological innovation, and commercial deployment are central to strengthening product portfolios and market presence.

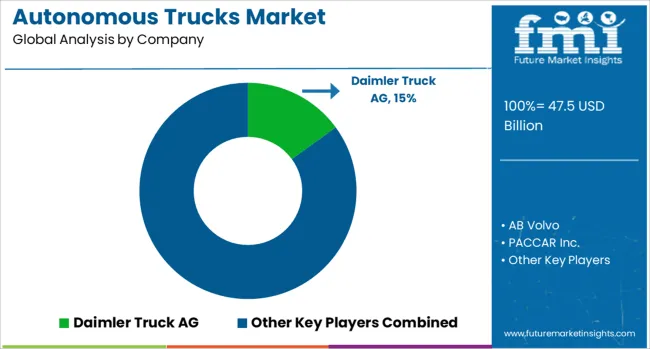

Daimler Truck AG, Germany-based, offers comprehensive autonomous truck systems with focus on commercial vehicle applications and safety validation. AB Volvo (Volvo), Sweden, provides advanced autonomous trucking solutions integrated with established commercial vehicle platforms. PACCAR, United States, delivers autonomous technology integration with proven truck manufacturing capabilities. Tesla, United States, emphasizes electric autonomous trucks with advanced battery technology and charging infrastructure.

Waymo, United States, focuses on autonomous driving technology development and commercial deployment programs. Aurora Innovation Inc., United States, provides comprehensive autonomous vehicle platforms for trucking applications. PlusAI, United States, Applied Intuition Inc., United States, and Nuro, United States, offer specialized autonomous vehicle expertise, advanced software development capabilities, and innovative technology solutions across global autonomous trucking markets.

| Items | Values |

|---|---|

| Quantitative Units | USD 185.4 billion |

| Propulsion | Diesel, electric, hybrid, and others |

| Vehicle Type | Heavy duty truck, light duty truck, medium duty truck |

| Sensor Type | Radar, camera, lidar, ultrasonic, and others |

| Application | Mining truck, shuttles, last mile delivery truck, and others |

| ADAS Features | Adaptive cruise control, automatic emergency braking, blind spot detection, intelligent park assist, lane keep assist, traffic jam assist, highway pilot, and others |

| Level of Autonomy | L2 & L3, L1, L4, L5 |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Daimler Truck AG, AB Volvo (Volvo), PACCAR, Tesla, Waymo, Aurora Innovation, Inc., PlusAI, Applied Intuition, and Nuro. |

| Additional Attributes | Dollar sales by propulsion, vehicle type, sensor type, application, ADAS features, and level of autonomy, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established automotive manufacturers and emerging technology companies, development capabilities for different autonomy levels and applications, integration with advanced sensor technologies and artificial intelligence systems, innovations in autonomous driving algorithms and fleet management solutions, and adoption of comprehensive safety validation systems with regulatory compliance and commercial deployment optimization for enhanced transportation efficiency. |

North America

The global autonomous trucks market is estimated to be valued at USD 47.5 billion in 2025.

The market size for the autonomous trucks market is projected to reach USD 185.5 billion by 2035.

The autonomous trucks market is expected to grow at a 14.6% CAGR between 2025 and 2035.

The key product types in autonomous trucks market are diesel, electric and hybrid.

In terms of vehicle type outlook , heavy duty truck segment to command 55.0% share in the autonomous trucks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autonomous Aerial Robot Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Driving Virtual Simulation Platform Market Forecast and Outlook 2025 to 2035

Autonomous Ultrasound Guidance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Autonomous Imaging Market Size and Share Forecast Outlook 2025 to 2035

Autonomous AI Powered Ophthalmology Screening Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Radiology Systems Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Agents Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Parking Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Drone Platform Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Mobile Robots for Logistics and Warehousing Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Vehicles Market Growth - Trends & Forecast 2025 to 2035

Autonomous Crane Market Growth - Trends & Forecast 2025 to 2035

Autonomous Forklift Market Growth – Trends & Forecast 2024-2034

Autonomous Robot Toys Market

Autonomous Intelligent Vehicle Market

USA Autonomous Crane Market Analysis – Growth, Trends & Forecast 2025-2035

China Autonomous Crane Market Size and Share Forecast Outlook 2025 to 2035

India Autonomous Crane Market Growth – Innovations, Trends & Forecast 2025-2035

Japan Autonomous Crane Market Report – Growth, Trends & Forecast 2025-2035

Germany Autonomous Crane Market Insights – Size, Demand & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA