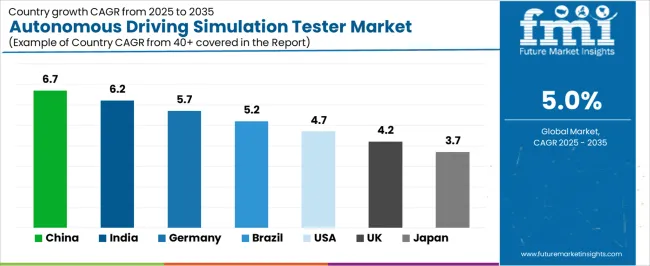

The autonomous driving simulation tester market is forecast to grow from USD 1.8 billion in 2025 to USD 2.9 billion by 2035, at a CAGR of 5%, with regional momentum driven by autonomous mobility programs, regulatory developments, and investment in ADAS and AV systems. Asia Pacific remains the dominant growth engine, led by China at 6.7% as national AV testing zones, large-scale smart-city pilots and extensive OEM–tech partnerships accelerate simulation-based validation. China’s high-density urban environments demand advanced virtual-scenario libraries, reinforcing the adoption of high-fidelity car simulators. India follows at 6.2%, supported by rising automotive R&D, domestic simulation developers, and urban-mobility initiatives that drive demand for scalable, cloud-enabled test environments suited for early-stage AV programs.

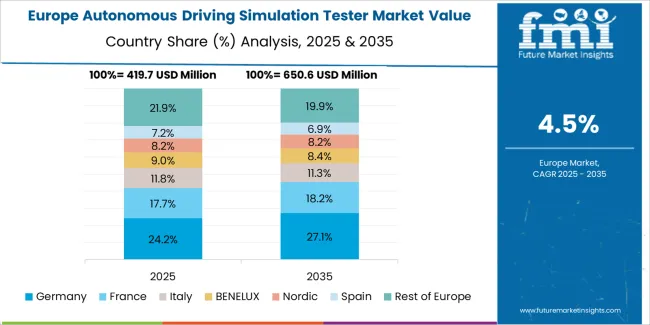

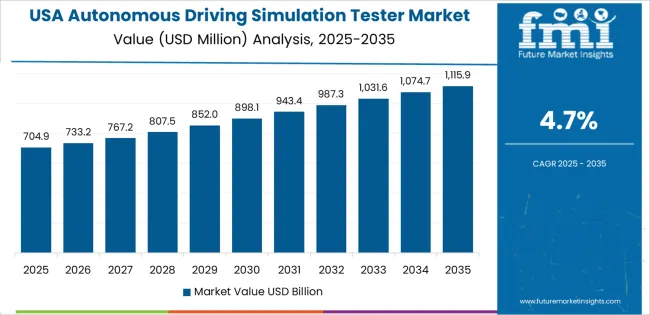

Europe sees strong expansion driven by Germany at 5.7%, supported by premium OEMs, Tier-1 suppliers and strict safety-certification frameworks requiring repeatable simulation cycles for Level 2+ and Level 3 autonomy. The region relies heavily on digital twins, scenario-based testing and hardware-in-the-loop integration. The United Kingdom grows at 4.2% through government-backed AV corridors and academic–industry simulation research hubs that prioritise validation for connected and autonomous mobility. North America continues as a core market, with the United States growing at 4.7% on the back of mature AV pilots, software-defined vehicle platforms and high adoption of AI-driven simulation frameworks by tech companies, robotaxi developers and automotive OEMs. Brazil anchors Latin America at 5.2% as smart-mobility programs expand and global automakers test ADAS performance in mixed-traffic local conditions. Across all regions, demand is reinforced by software-defined vehicles, increasing AV-model complexity and the shift to continuous virtual validation across full vehicle lifecycles.

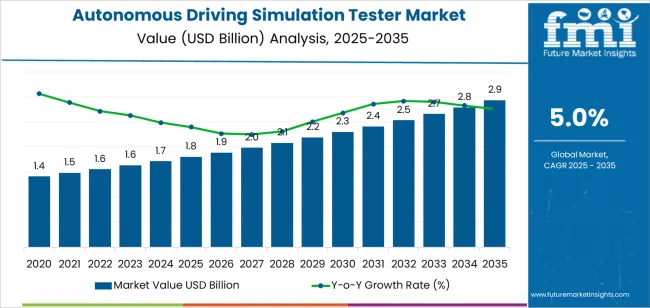

The inflection point mapping for the autonomous driving simulation tester market identifies key points where growth either accelerates or decelerates over the forecast period. Between 2025 and 2030, the market will grow from USD 1.8 billion to USD 2.3 billion, with an inflection point likely occurring around 2027-2028. During this phase, the market will experience steady growth as autonomous vehicle technologies and their testing requirements continue to mature. The inflection point in this period is driven by the increasing number of autonomous driving trials and expanding regulatory frameworks that will require more extensive and reliable simulation tests. As the technology advances, this will trigger an acceleration in the adoption of high-fidelity simulation tools capable of modeling complex driving environments.

Between 2030 and 2035, the market will continue to grow from USD 2.3 billion to USD 2.9 billion, with another potential inflection point around 2032-2033. This period will see the adoption of next-generation autonomous vehicles and the integration of more sophisticated AI algorithms and machine learning models into the testing simulators. As the market moves closer to the widespread deployment of autonomous vehicles, the demand for advanced simulation testers will spike, driving accelerated growth towards the latter part of the forecast period. The second inflection point is likely to occur as autonomous vehicle deployment becomes more common, and the need for continuous testing and refinement of these systems becomes critical. This will lead to a faster adoption of simulation technology, marking the peak growth of the market.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.8 billion |

| Market Forecast Value (2035) | USD 2.9 billion |

| Forecast CAGR (2025-2035) | 5% |

The autonomous driving simulation tester market is expanding rapidly as automotive manufacturers and technology firms increasingly adopt virtual testing platforms to validate advanced driver assistance systems (ADAS) and fully autonomous driving solutions. These simulation testers enable safe, repeatable and scalable evaluation of vehicle behavior in a wide range of scenarios such as urban traffic, highway driving and adverse weather conditions without the logistical cost of physical prototypes. As the complexity of autonomous systems grows, simulation testing has become essential to reduce development time and meet evolving regulatory and safety standards.

Technological advances further support the market growth. Innovations in sensor modelling, artificial intelligence, virtual environment realism and cloud based simulation platforms improve the fidelity of tests and enable faster iteration. The rise in global investment in autonomous mobility, coupled with shifts towards electric and connected vehicles, drives demand for comprehensive simulation testers. However, challenges remain: the high cost of high fidelity simulation systems, complexity of replicating all real world edge cases and data security concerns when using shared cloud platforms may slow adoption in some regions. Despite these barriers, the increasing need for robust and efficient testing infrastructure positions the autonomous driving simulation tester market for continued strong growth.

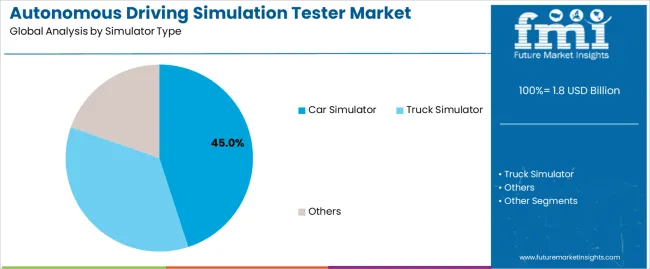

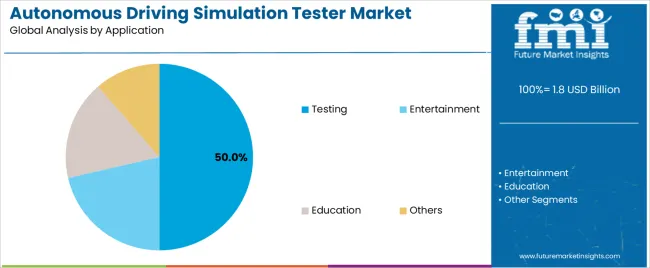

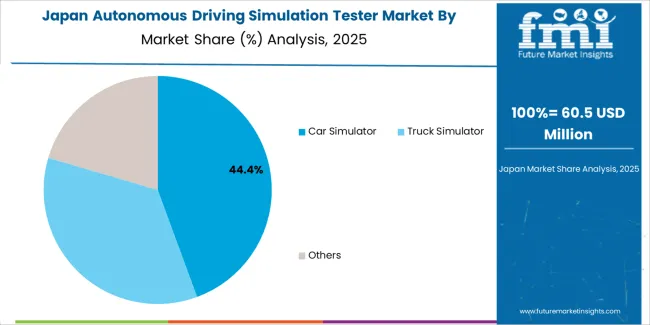

The autonomous driving simulation tester market is segmented by simulator type and application. The leading simulator type is car simulator, holding 45% of the market share, while the dominant application segment is testing, accounting for 50% of the market. These segments are central to the growth of the market, driven by the increasing focus on autonomous vehicle development, safety testing, and the demand for realistic simulation environments.

The car simulator segment leads the autonomous driving simulation tester market, capturing 45% of the market share. Car simulators are essential tools for testing the performance, safety, and behavior of autonomous vehicles in various driving scenarios. They offer a realistic and controlled environment for testing vehicle responses to different road conditions, traffic patterns, and driver interactions, which is critical for the development of safe and reliable autonomous driving systems.

Car simulators are widely used by automotive manufacturers, tech companies, and research institutions to simulate real-world driving conditions without the need for physical road tests. With advancements in simulation technology, car simulators provide increasingly accurate models of real driving experiences, which enhances their value in autonomous vehicle testing. As autonomous vehicle development accelerates, the demand for car simulators is expected to grow, maintaining their leadership in the market.

>

>

The testing application segment is the largest in the autonomous driving simulation tester market, accounting for 50% of the market share. Testing is a critical aspect of the autonomous vehicle development process, where simulators play a key role in evaluating the behavior, safety, and performance of autonomous systems in various driving conditions. Simulators allow developers to test the vehicles' responses to a wide range of real-world scenarios without the risks associated with on-road testing.

The rise in regulatory standards for autonomous vehicles and the need for extensive safety validation have increased the demand for simulation-based testing. Testing using simulators enables manufacturers to accelerate the development process while ensuring that their autonomous vehicles meet safety and performance standards. As autonomous vehicles continue to evolve and undergo rigorous testing, the testing segment is expected to remain the dominant application in the market.

The autonomous driving simulation tester market is growing rapidly as the development and deployment of autonomous vehicles (AVs) advance. Simulation testers provide safe, controlled virtual environments to mimic complex real world driving conditions and test automated driving algorithms before physical trials. This growth is driven by stricter safety and regulatory requirements, increasing investment in AV and advanced driver assistance systems (ADAS), and the need to replicate rare or hazardous scenarios that are impractical or dangerous in real life. Simultaneously, the market is shaped by computing power needs, data set complexity, and integration with real world vehicle hardware and software.

Several factors drive this market’s expansion. First, OEMs and Tier 1 suppliers face stringent safety and validation requirements for autonomous driving levels, making simulation testers essential for verifying system behaviour across thousands of virtual miles. Second, advances in AI, sensor fusion, and digital twin technologies increase the complexity of testing and thus the value of simulation solutions that can replicate these conditions. Third, the shift toward software defined vehicles and OTA (over the air) updates means lifecycle testing must continue virtually, boosting demand for simulation testers. Fourth, the emergence of new use cases such as robotaxi fleets, automated shuttles and commercial vehicles extends simulation needs beyond passenger cars into broader mobility segments.

Despite strong drivers, the market faces some constraints. High computational and data storage requirements for high fidelity simulation environments drive up system cost and infrastructure investment, which may limit uptake among smaller players. The challenge of replicating real world edge cases and ensuring virtual-to real world correlation remains significant, potentially reducing confidence in purely simulated testing. Regulatory fragmentation across regions and uncertainty about standardised validation criteria for AVs may delay or complicate deployment of simulation solutions. Additionally, as hardware in the loop and real world testing continue to be required, the simulation tester market must integrate with physical testing flows, adding complexity and cost.

Emerging trends include the increasing adoption of cloud based simulation platforms that allow scalability, global collaboration and virtual fleets to run millions of driving scenarios in parallel. Another trend is the incorporation of machine learning tools that automatically generate scenario libraries, adapt simulation difficulty, and identify edge cases without manual programming. There is also a shift toward multi domain simulation testers covering vehicle dynamics, sensors, environment, and connectivity to reflect the full AV stack. Furthermore, partnerships between vehicle OEMs, software providers and simulation specialists are becoming common to build custom validation suites aligned with specific autonomy levels. Finally, regions like Asia Pacific are seeing faster growth in simulation tester adoption as mobility innovation accelerates and local OEMs seek tools to compete globally.

The autonomous driving simulation tester market is growing rapidly as the automotive industry increasingly invests in autonomous vehicle technologies. Autonomous driving simulation testers are used to create realistic virtual environments that allow for the testing and validation of self-driving systems, helping manufacturers improve the safety, reliability, and functionality of autonomous vehicles. The growing adoption of autonomous driving technology, combined with the increasing need for safety and regulatory compliance, is driving demand for simulation tools that can replicate real-world driving conditions. As countries like China and Germany continue to push forward with the development and deployment of autonomous driving technologies, the need for advanced simulation systems is expected to rise. This analysis explores the key drivers of the autonomous driving simulation tester market across different countries.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.7% |

| India | 6.2% |

| Germany | 5.7% |

| Brazil | 5.2% |

| USA | 4.7% |

| United Kingdom | 4.2% |

| Japan | 3.7% |

China leads the autonomous driving simulation tester market with a CAGR of 6.7%. The country has made significant investments in autonomous vehicle technologies and has set ambitious goals for the development and deployment of self-driving cars. With major automakers and tech companies investing heavily in autonomous driving research, the demand for simulation testers to validate and improve autonomous driving systems is growing rapidly.

China’s government is also playing a pivotal role in promoting autonomous vehicles, providing regulatory support and incentives for research and development. The country's large automotive manufacturing base, combined with the rapid development of smart cities and the expansion of electric vehicle (EV) infrastructure, further fuels the demand for autonomous driving simulation testers. As China leads the charge in autonomous driving technology, the market for simulation testers is expected to continue expanding at a strong pace.

India’s autonomous driving simulation tester market is growing at a CAGR of 6.2%. The country is witnessing rapid advancements in autonomous vehicle technology, particularly with an increasing number of domestic and international players exploring the development of self-driving cars. As India’s automotive industry moves toward innovation, the demand for testing and simulation systems to ensure the safety and performance of autonomous vehicles is rising.

India’s burgeoning tech sector and its focus on smart transportation solutions, particularly in urban areas, are contributing to the market’s growth. Additionally, the country’s increasing investments in electric vehicles (EVs) and mobility solutions further drive the adoption of autonomous technologies. As the demand for safer and more efficient transportation solutions increases, the market for autonomous driving simulation testers in India will continue to expand.

Germany’s autonomous driving simulation tester market is projected to grow at a CAGR of 5.7%. As one of the leading countries in automotive manufacturing, Germany is heavily invested in the development and deployment of autonomous driving technologies. Major automakers and suppliers in Germany are at the forefront of autonomous driving research, and there is a growing need for advanced simulation tools to test and validate these technologies.

Germany’s strong focus on automotive innovation, coupled with its leadership in electric vehicle and mobility solutions, creates a robust demand for autonomous driving simulation testers. The country’s commitment to stringent safety standards and regulatory requirements for autonomous vehicles ensures that simulation systems will continue to play a crucial role in the development process. As the country’s automotive industry continues to evolve, the demand for simulation testing tools will remain strong.

Brazil’s autonomous driving simulation tester market is expected to grow at a CAGR of 5.2%. Brazil is witnessing a steady rise in the adoption of autonomous driving technology, particularly as local automakers and international companies explore the development of self-driving vehicles. With Brazil’s expanding automotive sector and its focus on developing smart city infrastructure, there is an increasing need for testing solutions that ensure the safety and reliability of autonomous vehicles.

The country’s growing interest in electric vehicles (EVs), combined with efforts to improve urban mobility, is further driving the demand for autonomous vehicle technologies. As Brazil moves toward adopting self-driving cars, the need for efficient and accurate simulation systems to test autonomous driving systems will continue to grow, supporting steady market expansion.

The United States has a projected CAGR of 4.7% for the autonomous driving simulation tester market. The USA is one of the largest markets for autonomous vehicle development, with significant investments from both established automakers and tech companies. The growing push for autonomous driving technology, particularly in urban and suburban areas, is driving the need for advanced simulation testers to ensure the performance and safety of self-driving systems.

The USA government’s support for autonomous vehicle research, along with the increasing adoption of electric and autonomous vehicles, further fuels the market for simulation systems. The country’s leadership in technological innovation, particularly in AI, machine learning, and automation, supports the continued growth of the autonomous driving simulation tester market. As autonomous driving technologies become more mainstream, demand for simulation tools will remain strong.

The United Kingdom’s autonomous driving simulation tester market is projected to grow at a CAGR of 4.2%. The UK is making significant progress in the development of autonomous vehicle technologies, with a growing number of startups and automotive manufacturers focusing on self-driving solutions. As the demand for autonomous vehicles increases, the need for advanced testing and simulation systems is also growing.

The UK government has implemented regulatory frameworks to support autonomous vehicle trials and research, which further stimulates the market for autonomous driving simulation testers. Additionally, the country’s push for greener transportation solutions and its growing focus on electric vehicles and smart mobility are contributing to the adoption of autonomous driving technologies. As the UK continues to invest in autonomous vehicle research, the demand for simulation testers will continue to rise.

Japan’s autonomous driving simulation tester market is expected to grow at a rate of 3.7%. Japan has been a leader in automotive innovation and is increasingly investing in autonomous vehicle technologies. With major automakers in Japan leading the charge for autonomous driving systems, the demand for testing and simulation tools is on the rise.

Japan’s government has been supportive of autonomous vehicle research and development, with regulations designed to ensure safety and compliance in self-driving technologies. The country’s focus on advanced technology and its well-established automotive industry create a strong market for autonomous driving simulation testers. As Japan continues to develop autonomous driving systems and integrate them into the transportation infrastructure, the need for accurate and reliable simulation tools will continue to grow.

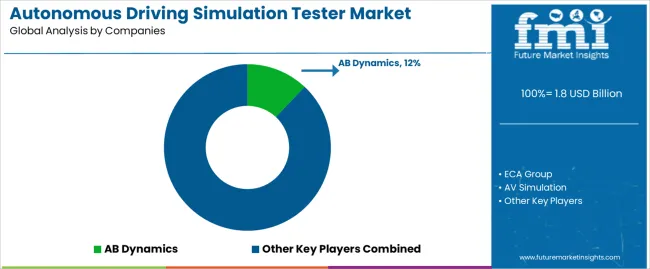

In the autonomous driving simulation tester market, firms such as AB Dynamics (holding around 12% share), ECA Group, AV Simulation, VI-Grade, L3Harris Technologies, Cruden, Zen Technologies, Ansible Motion, XPI Simulation, Virage Simulation, IPG Automotive, AutoSim, Tecknotrove System, Tianjin Zhonggong Intelligent, Beijing Ziguang Legacy Science & Education, Beijing KingFar, Fujian Couder Technology and Shenzhen Zhongzhi Simulation are active. The global autonomous vehicle simulation solutions market was valued at about USD 1 billion in 2024 and is expected to grow at a compound annual growth rate of approximately 10.6%.

Competition in this market hinges on several strategic priorities. One focus is system fidelity and scenario coverage: vendors emphasise high-fidelity simulation platforms capable of replicating sensor behaviour (lidar, radar, camera), vehicle dynamics and rare edge-case scenarios for autonomous-driving validation. A second priority is integration with testing workflows and hardware-in-the-loop (HIL): platforms that support real-time interaction with vehicle systems, scalability to thousands of virtual miles and automated test-case generation carry strong appeal. Third, regional and vertical coverage matter: companies that offer global support, localised scenario libraries (city, highway, rural, mixed traffic), and regulatory-validation capabilities gain advantage

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Simulator Type | Car Simulator, Truck Simulator, Others |

| Application | Testing, Entertainment, Education, Others |

| Key Companies Profiled | AB Dynamics, ECA Group, AV Simulation, VI-Grade, L3Harris Technologies, Cruden, Zen Technologies, Ansible Motion, XPI Simulation, Virage Simulation, IPG Automotive, AutoSim, Tecknotrove System, Tianjin Zhonggong Intelligent, Beijing Ziguang Legacy Science and Education, Beijing KingFar, Fujian Couder Technology, Shenzhen Zhongzhi Simulation |

| Additional Attributes | The market analysis includes dollar sales by simulator type and application categories. It also covers regional adoption trends across major markets. The competitive landscape highlights key manufacturers in the autonomous driving simulation tester market, with innovations in car and truck simulation technologies. Trends in the growing demand for simulation-based testing in autonomous driving systems, entertainment, and education are explored, along with advancements in simulation realism, software, and hardware integration. |

The global autonomous driving simulation tester market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the autonomous driving simulation tester market is projected to reach USD 2.9 billion by 2035.

The autonomous driving simulation tester market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in autonomous driving simulation tester market are car simulator, truck simulator and others.

In terms of application, testing segment to command 50.0% share in the autonomous driving simulation tester market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autonomous Aerial Robot Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Ultrasound Guidance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Autonomous Imaging Market Size and Share Forecast Outlook 2025 to 2035

Autonomous AI Powered Ophthalmology Screening Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Radiology Systems Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Agents Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Parking Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Trucks Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Drone Platform Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Mobile Robots for Logistics and Warehousing Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Vehicles Market Growth - Trends & Forecast 2025 to 2035

Autonomous Crane Market Growth - Trends & Forecast 2025 to 2035

Autonomous Forklift Market Growth – Trends & Forecast 2024-2034

Autonomous Robot Toys Market

Autonomous Intelligent Vehicle Market

Autonomous Driving Virtual Simulation Platform Market Forecast and Outlook 2025 to 2035

USA Autonomous Crane Market Analysis – Growth, Trends & Forecast 2025-2035

China Autonomous Crane Market Size and Share Forecast Outlook 2025 to 2035

India Autonomous Crane Market Growth – Innovations, Trends & Forecast 2025-2035

Japan Autonomous Crane Market Report – Growth, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA