The demand for smart parking systems has been increasing in recent years as a result of growth in the global parking ticket dispenser market due to the rise of urbanization, increasing vehicle ownership, and the need for efficient parking management solutions. As municipalities and private parking facility operators strive to enhance revenue collection, minimize congestion, and optimize vehicle flow, the adoption of automated parking ticket dispensers is becoming increasingly prevalent.

The market is also driven by technological advancements like smart parking systems, contactless payment options, and the integration with mobile applications. Furthermore, the development of smart city projects and digital transformation of transportation infrastructure are driving the growth of demand for advanced parking solutions around the world.

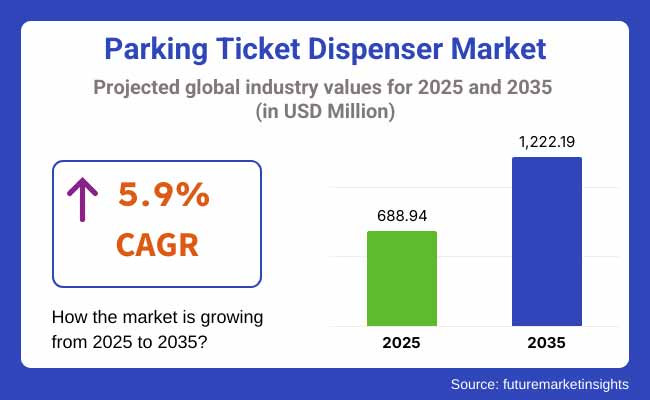

In 2025, the parking ticket dispenser market was valued at approximately USD 688.94 million. By 2035, it is projected to reach USD 1,222.19 million, reflecting a compound annual growth rate (CAGR) of 5.9%. The increasing adoption of smart parking systems in commercial, residential, and government-owned parking facilities is driving market growth.

Factors such as rising concerns about parking space optimization, enhanced security features in automated systems, and the growing trend of digitized transportation networks are also contributing to the expansion. Additionally, partnerships between technology firms and city authorities to implement smart parking infrastructure are expected to create lucrative opportunities for industry players.

The parking ticket dispenser market is continuously witnessing gains in North America, due to high size of vehicle population, urbanization & advanced parking management solutions. The USA and Canadian smart city investments include IoT-based parking solutions, wireless connectivity and real-time monitoring systems.

Other factors include the growing concern for sustainable development and reducing traffic congestion through efficient parking solutions in the region. At the same time, efforts to enforce more stringent control over parking areas and the increased focus on cashless payment with the growing use of mobile wallets are also propelling demand for automated dispensers in commercial and municipal parking facilities.

Strong government initiatives towards traffic management, high adoption of automated parking solutions, and growing intervention towards reducing traffic congestion are few of the factors driving the growth of parking ticket dispenser in Europe. Countries like Germany, the UK, France, and Italy are experiencing increased investment in smart parking infrastructure.

Growth of electric vehicles (EVs) and the rise of EV charging stations in parking facilities is also acting as a positive influence on the market. The region's stringent emission regulations, along with the growing trend toward sustainable urban mobility solutions, further encourage the widespread applicability of technologically advanced and energy-efficient parking ticket dispensers.

Fast urbanization, a burgeoning middle-class population, and burgeoning vehicle ownership are in-line factors responsible for the rise of Asia-pacific as a potential high-growth market for parking ticket dispensers. Evidence the growing trend of countries like China, Japan, South Korea, and India investing in smart parking solutions to reduce traffic congestion and optimize space utilization.

As a result, synchronization of mobile applications with parking systems and rising demand for digital payment solutions is expected to propel the market growth. Moreover, augmenting government initiatives focused on smart city development and the deployment of intelligent transport systems will also contribute to the demand for parking ticket dispensers in the region.

After continuously adopting the parking ticket dispenser across all urban centers, as well as adapting to technological advancement, and the rising need for efficient parking management systems which will create the immense scope of a parking ticket dispenser for the upcoming decade. AI-powered analytics, improved security features and next-generation automated parking solutions will play a significant role in industry trends and future market growth.

Challenges

High Initial Investment and Maintenance Costs

High initial investment to adopt automated parking ticket dispenser systems and their maintenance costs are expected to restrict the growth of the parking ticket dispensers market. Upfront costs also rise when advanced parking ticket dispensers include RFID technology, barcode scanners, and contactless payment systems.

Moreover, the financial burden on parking operators is exacerbated by maintenance costs, which include software and hardware servicing, as well as monitoring of operational efficiency. Companies can tackle this by focusing on modular system designs, predictive maintenance solutions, and cost-effective retrofitting options to deliver affordability and efficiency.

Cybersecurity Threats and Data Privacy Concerns

And as they become increasingly digital, parking ticket dispensers are susceptible to cybersecurity and data privacy threats. Connected systems that process digital transactions and store user data can be targeted by cybercriminals, which include hacking, data breaches, and payment fraud.

Adapting to strict data protection standards - GDPR, PCI DSS and alike - complicates the design of the systems even further. To prevent and calm these threats, organizations should focus on top-tier encryption methods, routine security audits, and practical authentication methods for information integrity and consumer confidence.

Opportunities

Growth of Smart Parking Infrastructure

To boost efficiency, various governments and private sector players are opting for automated parking management systems which uses IoT, AI and cloud based technologies. Smart parking ticket machines are rising to the forefront, with integration with mobile applications in addition to real-time occupancy updates and contactless payment options. All of these features and functionalities will make a difference and companies that innovate user-friendly interfaces, predictive analytics, and a frictionless payment processing system will win a larger market share.

Expansion of Contactless Payment Solutions

Cashless & contact-less solutions are changing the parking industry with growing digital consumers they prefer smart parking transactions in terms of NFC enabled credit cards, mobile wallets, and QR codes. As this trend grows, parking operators and municipalities are investing in technologically advanced ticket dispensers with multi-payment functionality. Organizations that streamline system compatibility with different digital payment gateways and adopt blockchain integrated transaction security will gain early adoption and customer satisfaction.

Between 2020 and 2024 the parking ticket dispenser market saw: Enhancements in automation from 2020 to 2024, greater utilization of contactless payments, and integration with intelligent city frameworks were all topics of discussion.

With increasing traffic congestion and user convenience market demand, AI-based ticketing solutions and cloud parking investment were additionally attractive to by other sectors. Nevertheless, industrial challenges including cybersecurity threats, high implementation costs, and regulatory compliance limit market growth.

2035, a significant increase in artificial intelligence-powered parking technology and blockchain transactional security, as well as fully-integrated smart parking ecosystems, is predicted for the market. The industry will be transformed with advances including autonomous parking solutions, license plate recognition-based ticketing and predictive analytics for space availability. Market leadership and competitive advantage will flow to companies that invest in digitization, sustainability and user-centric innovations;

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with digital transaction and data security laws |

| Technological Advancements | Growth in automation and contactless payments |

| Industry Adoption | Increased investment in smart parking infrastructure |

| Supply Chain and Sourcing | Dependence on traditional hardware-based systems |

| Market Competition | Dominance of established parking technology providers |

| Market Growth Drivers | Demand for digital payment and smart city integration |

| Sustainability and Energy Efficiency | Focus on energy-efficient ticket dispensers |

| Integration of Smart Monitoring | Limited real-time tracking capabilities |

| Advancements in Product Innovation | Development of mobile payment-enabled ticket dispensers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven compliance monitoring and blockchain-based data protection |

| Technological Advancements | Expansion of AI-powered parking solutions and predictive analytics |

| Industry Adoption | Fully integrated smart parking with IoT and real-time monitoring |

| Supply Chain and Sourcing | Shift to cloud-based, software-driven ticketing solutions |

| Market Competition | Rise of AI-driven startups and innovative solution providers |

| Market Growth Drivers | Expansion of autonomous vehicle-compatible parking solutions |

| Sustainability and Energy Efficiency | Large-scale adoption of solar-powered and eco-friendly ticketing systems |

| Integration of Smart Monitoring | AI-powered predictive space availability and automated guidance systems |

| Advancements in Product Innovation | Fully digital, touchless, and license plate recognition-based parking solutions |

The USA market is anticipated to remain a key market for parking ticket dispensers due to the rapid pace of urbanization, rising vehicle ownership, and growing concerns regarding efficient parking management systems. The increasing accessibility of automated parking solutions, such as smart ticket dispensers featuring contactless payment systems, is expected to boost the growth of the market.

Moreover, the emphasis on reducing traffic congestion and improving urban mobility by governments is resulting in growth in investments in high-tech parking infrastructure. Moreover, the growing presence of some major manufacturers and technology partners is also driving the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

With the introduction of smart parking systems in urban regions, the United Kingdom parking ticket dispenser market is growing. Increasing need for ticket dispensers enabled with digital payments and real-time parking management systems.

The drive towards sustainable and cashless solutions for payment and regulatory forces to enable efficient traffic flow is driving adoption. Furthermore, the increasing prevalence of public-private partnerships for smart city initiatives is influencing investments within the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

This is further complemented by the growth of urban infrastructure and strict traffic management regulations. So countries like Germany, France and Italy are utilizing automated parking technologies to make the best use of the space.

Studies have shown that the growing trend is the deployment of IoT-enabled parking meters and cloud-based payment solutions by the best parking management solution providers. Additionally, sustainability-oriented projects are resulting in solar-powered ticket dispensers and eco-friendly payment terminals.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.8% |

The high urban density and increasing development of integrated parking management systems with advanced technologies significantly contribute to the growth of Japan's parking ticket dispenser market. Demand is being driven by the adoption of AI-powered ticket dispensers, facial recognition payment options, and automated license plate recognition.

As space in the car parking of the metropolitan area is limited, the need for an efficient and automated solution is increasing. Additionally, government's initiatives for digital transaction and smart city development can also boost market opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

The South Korea parking ticket dispenser market is expected to grow at a steady rate during the forecast period. There is a growing adoption of QR-code-based and mobile-app-integrated parking systems in the market.

Automated parking infrastructure in some countries is also gaining momentum with the government's smart city initiative. Market players are also adjusting to the consumer trend of contactless and digital payment methods.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

| Detection Technology | Market Share (2025) |

|---|---|

| RFID-Based | 63% |

The market is primarily occupied by RFID-based parking ticket dispensers because they are more efficient, faster and contactless. Employing radio-frequency identification technology, these systems facilitate smooth access and exit by minimizing congestion making for a better user experience. RFID holds advantages in terms of durability, wear, tear, and security features compared to magnetic stripe-based systems.

The increasing focus on minimizing manual interaction and improving operational efficiency in high-traffic areas is also propelling the demand for RFID-based dispensers. Moreover, the smart parking initiatives sponsored by city administrations and private firms are encouraging RFID enabled parking solutions, thereby supporting the long term market growth.

With the developing volume of traffic in urban areas, RFID-centered ticket dispensers become prevalent elements of a smart transportation system. The growing use of cloud-based monitoring and data analytics in RFID-enabled dispensers is also optimizing parking operations and improving revenue management for commercial facilities and municipal authorities.

| End Use | Market Share (2025) |

|---|---|

| Commercial Malls | 52% |

Commercial malls segment is anticipated to have the highest market share of parking ticket dispensers owing to high inflow of vehicles and need for structured parking solution. Shopping centers often network significant passive foot traffic, and effective Parking Management Software can make the shopping process much more convenient for each the client as well as the merchant, help increase sales by improving visitor movements on the company and streamline operations.

While independent parking lots, event venues and parking management systems are often relatively low-tech, commercial malls need sophisticated ticketing systems that enabling automated entry and exit, reducing wait times and securing a better user experience. Mall smart parking ticket dispensers are all about better traffic flow management, cashless digital payment methods, and security features.

The addition of mobile apps, license plate recognition, and real-time parking availability updates are also accelerating the adoption of these systems. The commercial segment is expected to dominate the market growth in the upcoming years owing to increasing investment in automated infrastructure.

Rising levels of urbanization and ownership rates of cars are also pushing mall operators to modernize their parking facilities by transforming them into high-tech lots, including implementing AI-based vehicle tracking and dynamic pricing models to maximize parking efficiency and revenue generation.

The parking ticket dispenser market is witnessing a gradual increase in the demand in this segment owing to the rising urbanization, growing vehicle ownership, and increasing implementation of smart parking solutions. With the need for automated, contactless, and digital payment-integrated parking dispensers, the demand for the solution is accelerating due to commercial and infrastructural space objectives to improve parking management and mitigate congestion within metropolitan regions.

The global Compound Annual Growth Rate (CAGR) is 5.9%, prompting firms to deploy AI-enabled ticketing, cloud connectivity, and sustainable power solutions. Solar header parking ticket dispenser are finding tremendous demand because it integrates with mobile app and can select the real time data.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| SKIDATA GmbH | 20-24% |

| Amano Corporation | 18-22% |

| HUB Parking Technology | 14-18% |

| TIBA Parking Systems | 10-14% |

| Cale Access AB | 8-12% |

| OtherCompanies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| SKIDATA GmbH | In 2025, SKIDATA GmbH introduced AI-powered parking dispensers, featuring real-time analytics and seamless integration with mobile payment apps. |

| Amano Corporation | In 2024, Amano Corporation launched solar-powered ticket dispensers, enhancing sustainability and reducing operational costs. |

| HUB Parking Technology | In 2025, HUB Parking Technology developed cloud-connected parking dispensers, enabling remote monitoring and digital payment processing. |

| TIBA Parking Systems | In 2024, TIBA Parking Systems introduced license plate recognition (LPR)-enabled dispensers, improving security and frictionless entry-exit management. |

| Cale Access AB | In 2025, Cale Access AB launched contactless ticket dispensers, enhancing user convenience and reducing touch-based transactions. |

Key Company Insights

SKIDATA GmbH (20-24%)

SKIDATA offers AI-powered, cloud-linked parking dispensers that focus on mobility solutions (seamless) and data analytics (real time) with innovative solutions that giving SKIDATA a global market lead. The organization also invests in smart city infrastructure and connected mobility services.

Amano Corporation (18-22%)

Amano manufactures innovative sustainable and energy-efficient parking ticket dispensers, incorporating both solar and IoT connectivity. Its emphasis on automated parking solutions keeps it competitive in the market.

HUB Parking Technology (14-18%)

Focused on embracing smart, app-compatible parking systems with digitalized capability, HUB Parking Technology is making the user experience better and more controllable from remote. The company's solutions are cloud-based, driving operational efficiency.

TIBA Parking Systems (10-14%)

TIBA specializes in License Plate Recognition (LPR) and automated ticket dispensers, improving security and vehicle tracking. It is a popular choice in urban areas due to its integration with flexible payments.

Cale Access AB (8-12%)

Cale Access AB is growing in contactless and mobile ticketing, enabling fast, and friction-free parking transactions. Its focus on modernizing parking technology through digital transformation builds its market presence.

Other Key Players (25-35% Combined)

Other key companies that provide sophisticated and tailor-made solutions in the parking ticket dispenser market include:

The overall market size for parking ticket dispenser market was USD 688.94 million in 2025.

The parking ticket dispenser market expected to reach USD 1,222.19 million in 2035.

Rising urbanization, increasing demand for automated parking solutions, growing smart city initiatives, expanding commercial infrastructure, and advancements in contactless payment technologies will drive market demand.

The top 5 countries which drives the development of parking ticket dispenser market are USA, UK, Europe Union, Japan and South Korea.

RFID-based parking ticket dispensers driving market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Detection Technology, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Detection Technology, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Detection Technology, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Detection Technology, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Detection Technology, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Detection Technology, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Detection Technology, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Detection Technology, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Detection Technology, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Detection Technology, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Detection Technology, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Detection Technology, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Detection Technology, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Detection Technology, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Detection Technology, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Detection Technology, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Detection Technology, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Detection Technology, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Detection Technology, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Detection Technology, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Detection Technology, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 16: Global Market Attractiveness by Detection Technology, 2024 to 2034

Figure 17: Global Market Attractiveness by End Use, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Detection Technology, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Detection Technology, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Detection Technology, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Detection Technology, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Detection Technology, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 34: North America Market Attractiveness by Detection Technology, 2024 to 2034

Figure 35: North America Market Attractiveness by End Use, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Detection Technology, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Detection Technology, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Detection Technology, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Detection Technology, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Detection Technology, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Detection Technology, 2024 to 2034

Figure 53: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Detection Technology, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Detection Technology, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Detection Technology, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Detection Technology, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Detection Technology, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Detection Technology, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Detection Technology, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Detection Technology, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Detection Technology, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Detection Technology, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Detection Technology, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Detection Technology, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Detection Technology, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Detection Technology, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Detection Technology, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Detection Technology, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Detection Technology, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Detection Technology, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Detection Technology, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Detection Technology, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Detection Technology, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Detection Technology, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Detection Technology, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Detection Technology, 2024 to 2034

Figure 125: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Detection Technology, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Detection Technology, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Detection Technology, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Detection Technology, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Detection Technology, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Detection Technology, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Parking Management Market Forecast and Outlook 2025 to 2035

Parking Meter Apps Market Size and Share Forecast Outlook 2025 to 2035

Parking Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Parking Finder Apps Market Size and Share Forecast Outlook 2025 to 2035

Oil Dispenser Market

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tray Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Beer Dispensers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soap Dispenser Market Trends - Demand & Forecast 2025 to 2035

Competitive Overview of Tape Dispenser Companies

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Ticketing Market Size and Share Forecast Outlook 2025 to 2035

Water Dispenser Market Trends - Growth & Demand Forecast 2025 to 2035

Strap Dispenser Market

Diesel Parking Heater Market Size and Share Forecast Outlook 2025 to 2035

Powder Dispenser Market Analysis by Product Type, Size, Dispensing Mode, End-use Industry, and Region through 2025 to 2035

Cereal and Dry Food Dispensers Market – Fresh & Convenient Dispensing 2025-2035

Key Players & Market Share in Powder Dispenser Manufacturing

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA