The Matting Agents Market is estimated to be valued at USD 461.5 million in 2025 and is projected to reach USD 737.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Matting Agents Market Estimated Value in (2025 E) | USD 461.5 million |

| Matting Agents Market Forecast Value in (2035 F) | USD 737.6 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

The Matting Agents market is gaining notable traction as industries increasingly demand coatings and finishes with reduced gloss and enhanced aesthetic appeal. These agents are widely adopted in sectors such as automotive, industrial, architectural, and packaging, where surface properties significantly influence product performance and customer perception. Market growth is being fueled by the rising preference for eco-friendly and low-VOC formulations, particularly in regions with stringent environmental regulations.

Advancements in nano-technology and particle size control are enabling manufacturers to produce high-performance matting agents with improved dispersion, transparency, and durability. The expansion of end-use industries such as automotive refinishing, industrial manufacturing, and decorative paints is further supporting adoption. Additionally, increasing use of waterborne formulations driven by regulatory compliance and sustainability trends is reinforcing market expansion.

Continuous R&D investments are leading to the development of multi-functional matting agents that combine scratch resistance, anti-settling properties, and chemical durability With industries demanding cost-effective and performance-driven solutions, the Matting Agents market is poised to witness robust growth over the forecast period, driven by innovation and regulatory alignment.

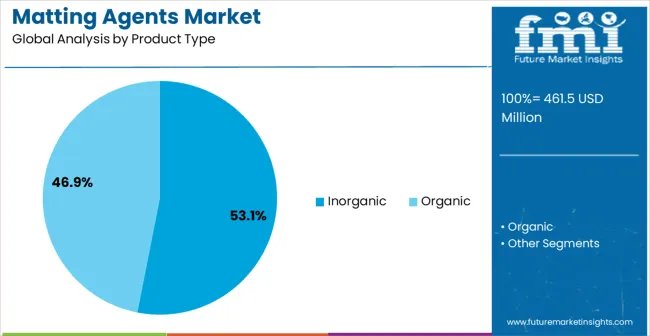

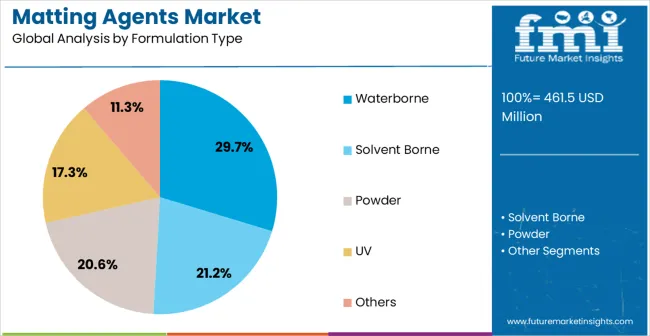

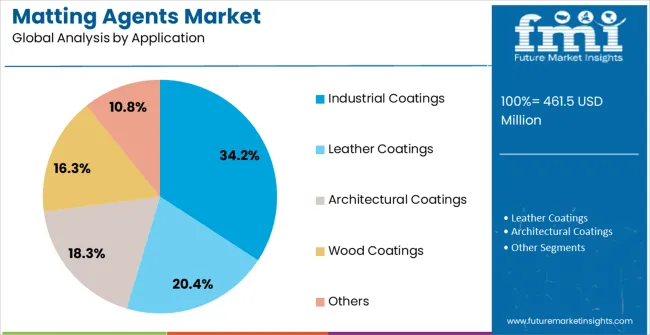

The matting agents market is segmented by product type, formulation type, application, and geographic regions. By product type, matting agents market is divided into Inorganic and Organic. In terms of formulation type, matting agents market is classified into Waterborne, Solvent Borne, Powder, UV, and Others. Based on application, matting agents market is segmented into Industrial Coatings, Leather Coatings, Architectural Coatings, Wood Coatings, and Others. Regionally, the matting agents industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The inorganic product type segment is projected to account for 53.1% of the market revenue in 2025, positioning it as the dominant product category. Growth in this segment is attributed to the superior mechanical strength, chemical resistance, and thermal stability that inorganic matting agents deliver compared to organic alternatives. These properties make them highly suitable for demanding applications such as automotive, industrial, and heavy-duty coatings, where durability and resistance are critical.

Inorganic agents, such as silica-based formulations, also provide excellent matting efficiency with minimal impact on other coating properties, ensuring consistent performance. The ability to offer uniform surface finishes, scratch resistance, and long-lasting appearance is reinforcing their preference among manufacturers and end users.

Cost-effectiveness and compatibility with both solvent-borne and waterborne systems further enhance their adoption across diverse industries As advancements in particle engineering improve transparency and dispersibility, the inorganic segment is expected to maintain its leadership, supported by increasing demand for durable and sustainable coating solutions across industrial and architectural sectors.

The waterborne formulation type segment is anticipated to hold 29.7% of the market revenue in 2025, reflecting its growing importance in sustainable coating solutions. This growth is primarily driven by the rising adoption of eco-friendly technologies aimed at reducing volatile organic compound emissions, in line with regulatory mandates across major regions. Waterborne systems offer significant advantages such as lower toxicity, safer handling, and reduced environmental impact, which are aligning with industry-wide sustainability objectives.

Matting agents designed for waterborne coatings are increasingly being developed with enhanced dispersibility and performance consistency, ensuring high-quality finishes while meeting stringent environmental standards. The compatibility of waterborne formulations with inorganic matting agents is further boosting their market penetration, especially in automotive refinishing, wood coatings, and architectural paints.

Growing acceptance in emerging economies, where environmental regulations are rapidly evolving, is also contributing to expansion As industries continue to prioritize environmentally responsible practices without compromising performance, the waterborne formulation type segment is expected to achieve steady and sustained growth in the forecast period.

The industrial coatings application segment is forecasted to hold 34.2% of the market revenue in 2025, making it the leading application area. This dominance is driven by the extensive use of matting agents in protective and decorative coatings applied across machinery, equipment, and manufacturing infrastructure. Industrial coatings demand high-performance finishes that combine durability, corrosion resistance, and controlled gloss levels to meet operational and aesthetic requirements.

Matting agents play a critical role in enhancing surface uniformity, providing scratch resistance, and improving overall coating performance. The growing expansion of the manufacturing sector, coupled with rising infrastructure investment, is directly fueling demand in this segment. Additionally, industrial users are increasingly adopting waterborne and low-VOC formulations to comply with environmental standards, which has created greater reliance on high-performing matting agents.

Continuous innovation aimed at improving dispersion and transparency in industrial coatings is further supporting growth With industrial processes demanding long-lasting and resilient finishes, the industrial coatings application segment is expected to maintain its leading position in the matting agents market.

Matting effect is a property that depends upon the intensity of light reflexion and a subjective impression identified by our senses. With several coating applications, the preference for matte finishes in the market is enormous, due to which different matting agents and methods exist for indoor as well as outdoor durable powder coatings.

Matting effect relies on the shape of the matting agent & particle size and most efficient formulators, such as waxes and silica depend on the desired effect and paint application. Matte finishes are produced to achieve an application of a low-gloss coating and are more cost-effective. The matte aspect of paint similarly depends on the formulation of its Pigment Volume Concentration (PVC), which is raised to lower the glossiness.

Matting agents used in coatings increase antiglare properties in end products and offer temperature and corrosion resistance. Matting agent manufacturers are more focused towards reducing the organic solvent content from paint and coating formulations, owing to rising environmental concerns and to match the particle with dry film thickness.

Growing awareness and popularity of matte finishing in developed and emerging nations, coupled with the growing construction industry, are projected to drive the global matting agents market during the forecast period.

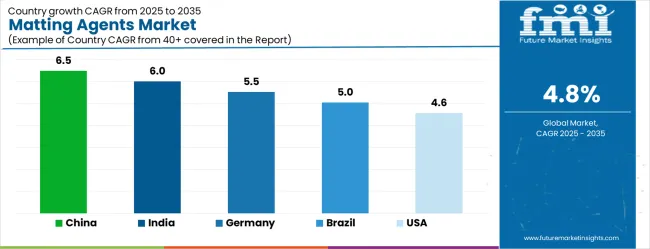

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| Brazil | 5.0% |

| USA | 4.6% |

| UK | 4.1% |

| Japan | 3.6% |

The Matting Agents Market is expected to register a CAGR of 4.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.5%, followed by India at 6.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.6%, yet still underscores a broadly positive trajectory for the global Matting Agents Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.5%. The USA Matting Agents Market is estimated to be valued at USD 172.2 million in 2025 and is anticipated to reach a valuation of USD 172.2 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 21.1 million and USD 15.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 461.5 Million |

| Product Type | Inorganic and Organic |

| Formulation Type | Waterborne, Solvent Borne, Powder, UV, and Others |

| Application | Industrial Coatings, Leather Coatings, Architectural Coatings, Wood Coatings, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

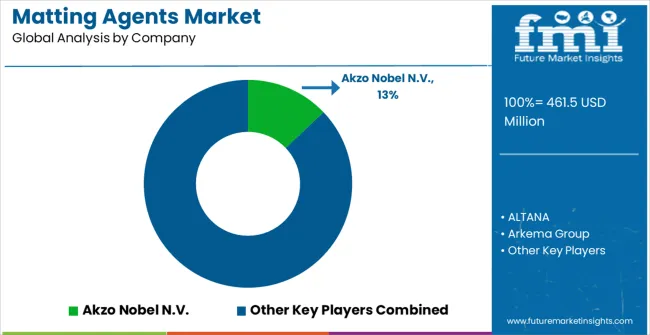

| Key Companies Profiled | Akzo Nobel N.V., ALTANA, Arkema Group, BASF SE, Deuteron GmbH, Eastman Chemical Company, Evonik Industries AG, Huntsman International LLC, Imerys S.A., J.M. Huber Corporation, Lubrizol Corporation, PPG Industries, Inc., Solvay S.A., and W. R. Grace & Co.-Conn |

The global matting agents market is estimated to be valued at USD 461.5 million in 2025.

The market size for the matting agents market is projected to reach USD 737.6 million by 2035.

The matting agents market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in matting agents market are inorganic, _silica, _others, organic, _thermoplastics and _waxes.

In terms of formulation type, waterborne segment to command 29.7% share in the matting agents market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

ESD Safe Matting Market Size and Share Forecast Outlook 2025 to 2035

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Entrance Matting Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA