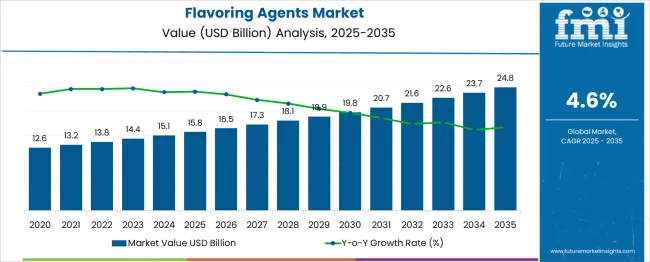

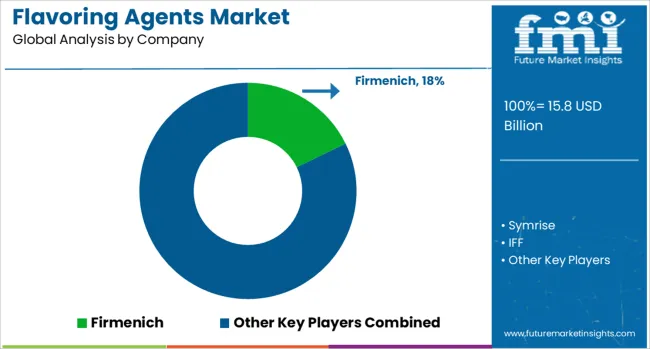

The Flavoring Agents Market is estimated to be valued at USD 15.8 billion in 2025 and is projected to reach USD 24.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The Flavoring Agents Market is projected to grow from an estimated USD 15.8 billion in 2025 to USD 24.8 billion by 2035, with a CAGR of 4.6%. Growth momentum analysis assesses the acceleration or deceleration of market expansion over the forecast period by examining year-on-year increases and overall trend strength. The data indicates a consistent upward trajectory, with incremental increases each year. Early years show modest growth, moving from USD 15.8 billion in 2025 to USD 18.1 billion by 2028. Growth momentum picks up gradually, with values reaching USD 21.6 billion by 2031 and continuing to increase steadily thereafter. The smooth progression with no sharp spikes or declines suggests stable market conditions with steady demand. The moderate CAGR of 4.6% reflects a healthy but not rapid expansion, indicating the market is in a growth phase but not exhibiting rapid acceleration. The steady year-on-year increments illustrate consistent adoption and market penetration, supported by ongoing product innovation and expanding applications in food and beverage industries. The market demonstrates sustained growth momentum with balanced expansion. While growth remains steady, the lack of volatility or sharp changes implies a mature yet growing market where incremental advancements rather than explosive gains drive value increases. Continued innovation and diversification will be critical to maintaining positive momentum in the long term.

| Metric | Value |

|---|---|

| Flavoring Agents Market Estimated Value in (2025 E) | USD 15.8 billion |

| Flavoring Agents Market Forecast Value in (2035 F) | USD 24.8 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The flavoring agents market is experiencing steady growth driven by the ongoing shift toward clean label ingredients, global expansion of functional foods, and continuous product innovation within the food and beverage industry. Regulatory pressure and consumer advocacy are pushing brands to replace synthetic additives with natural alternatives that align with health and transparency goals.

Meanwhile, the rise of plant-based products and reduced-sugar formulations has created opportunities for flavor systems that deliver taste without compromising nutritional value. Food manufacturers are increasingly investing in advanced encapsulation techniques, biotechnology-enabled extraction, and regional flavor adaptation to meet diversified consumer preferences.

The surge in e-commerce and D2C models has accelerated product cycles, prompting flavoring innovations tailored to niche consumer segments. As global diets diversify and regulatory scrutiny heightens, the flavoring agents market is expected to remain central to formulation strategies across food categories, reinforcing long-term demand for both natural and functionally adaptive flavor solutions.

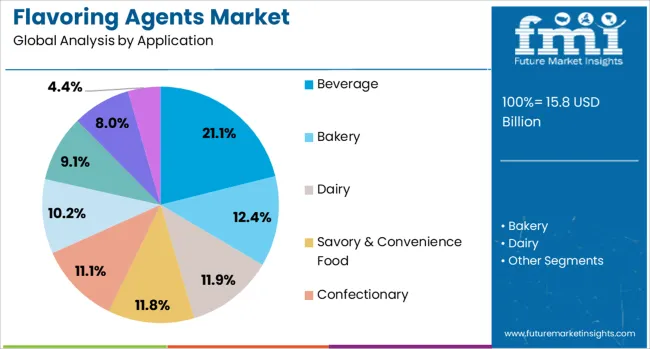

The flavoring agents market is segmented by application type, and geographic regions. By application of the flavoring agents market is divided into Beverage, Bakery, Dairy, Savory & Convenience Food, Confectionary, Meat, Oral Hygiene/pharmaceutical Snacks, Snacks Others (Tobacco, infant food, and animal feed). In terms of type of the flavoring agents market is classified into Natural Flavor, Artificial Flavor. Regionally, the flavoring agents industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

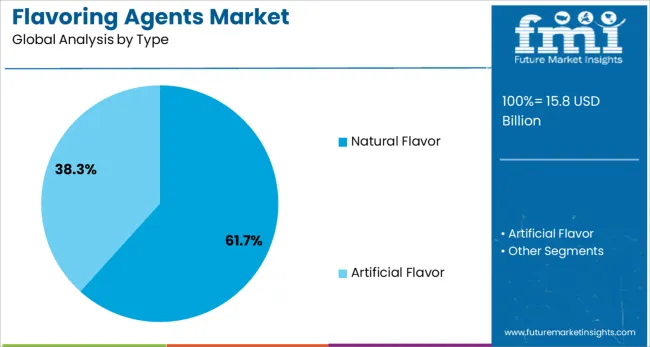

Natural flavoring agents are projected to hold 61.7% of the total market revenue by 2025, making them the dominant type segment. This leadership is being driven by rising health consciousness, increasing regulatory support for clean label standards, and growing consumer demand for transparency in ingredient sourcing.

Food and beverage producers are reformulating legacy products and launching new SKUs using plant-derived or naturally fermented compounds to meet consumer expectations for authenticity and safety. Moreover, natural flavors are being favored across categories including dairy, bakery, snacks, and ready-to-drink products due to their alignment with organic, vegan, and allergen-free labeling claims.

Technological advances in enzymatic synthesis and solvent-free extraction are also improving the stability and intensity of natural flavor profiles, making them competitive with synthetic counterparts in both performance and scalability. These factors collectively reinforce the dominance of natural flavors within the flavoring agents market.

The beverage application segment is expected to contribute 21.1% of total revenue to the flavoring agents market in 2025. This position is attributed to the rapid expansion of functional beverages, flavored waters, carbonated drinks, and plant-based alternatives that rely heavily on advanced flavoring systems for consumer appeal.

Flavoring agents are being increasingly used to enhance mouthfeel, mask bitterness in fortified products, and deliver novel taste profiles that cater to changing lifestyle and demographic preferences. The demand for sugar-free and low-calorie formulations has further driven innovation in beverage flavoring where natural extracts, botanical infusions, and fruit concentrates are playing a critical role.

In parallel, beverage manufacturers are adopting localized and seasonal flavor trends to boost market penetration and brand differentiation. The ability of flavoring agents to influence repeat purchase and brand loyalty in the highly competitive beverage space has positioned this segment for sustained growth through the forecast period.

The market has been witnessing steady growth driven by increasing consumer demand for enhanced taste and aroma in food and beverage products. These agents, comprising natural extracts, synthetic compounds, and essential oils, are extensively used across bakery, confectionery, dairy, and beverages sectors to improve sensory appeal. The market expansion has been supported by growing product innovation focused on clean-label and organic flavor profiles. Rising global disposable incomes and changing dietary preferences have encouraged manufacturers to diversify flavor offerings catering to regional tastes.

The processed and packaged food industry has been a major contributor to the growth of the flavoring agents market, fueled by urbanization and changing lifestyles. The need for convenience foods with appealing taste profiles has led to widespread incorporation of flavoring agents in snacks, ready-to-eat meals, and beverages. Regional and ethnic flavor preferences have encouraged manufacturers to customize formulations, increasing product variety and consumer acceptance. The rise of health-conscious consumers has driven the development of natural and low-calorie flavor options to align with nutritional trends. Furthermore, innovations in flavor delivery systems, such as microencapsulation, have enabled sustained aroma release and improved sensory experience. Food safety regulations governing permissible flavor additives have been shaping formulation practices, ensuring compliance while maintaining quality. These factors collectively have elevated the use of flavoring agents in processed food manufacturing across diverse markets.

Recent advancements in technology have been instrumental in improving the stability and efficacy of flavoring agents in various applications. Microencapsulation, nanoemulsion, and spray drying techniques have been widely adopted to protect volatile flavor compounds from degradation during processing and storage. Controlled release mechanisms have been designed to ensure gradual flavor release, enhancing consumer sensory experience. The use of biopolymer carriers and emulsifiers has optimized flavor retention in complex food matrices. These technological improvements have facilitated the incorporation of delicate natural flavors into products with extended shelf lives without compromising taste. Additionally, novel extraction and purification methods have improved the purity and intensity of natural flavor components. The integration of such innovations has provided manufacturers with versatile tools to meet evolving consumer expectations and regulatory standards, strengthening market competitiveness.

The flavoring agents market has been significantly impacted by stringent regulatory frameworks aimed at ensuring consumer safety and transparency. Food safety authorities across various regions have established guidelines concerning permissible ingredients, labeling requirements, and maximum usage levels for flavor additives. Compliance with standards such as those set by the FDA, EFSA, and Codex Alimentarius has become mandatory for market entry and sustained operations. Regulatory scrutiny has prompted manufacturers to adopt high-quality raw materials and conduct rigorous testing for allergens and contaminants. Labeling regulations mandating clear disclosure of natural versus artificial flavors have influenced marketing and product formulation strategies. Additionally, emerging regulations targeting clean-label and non-GMO product claims have encouraged innovation towards natural flavoring solutions. These regulatory considerations have shaped product development and supply chain practices, ensuring safety without compromising flavor quality.

The versatility of flavoring agents has led to their expanding use beyond food and beverages into pharmaceutical, cosmetic, and personal care industries. In pharmaceuticals, flavoring agents have been incorporated to mask unpleasant tastes in syrups and chewable formulations, enhancing patient compliance. The cosmetic sector utilizes flavors to improve sensory appeal in products like lip balms and lotions. Personal care items such as toothpaste and mouthwash also benefit from flavor additions that provide freshness and consumer satisfaction. Moreover, the pet food industry has adopted flavoring agents to improve palatability. The growing cross-industry demand has encouraged manufacturers to develop multifunctional and safe flavoring solutions adaptable to diverse formulations. This expansion into non-food applications is expected to sustain the overall market growth by creating new revenue streams and broadening product portfolios.

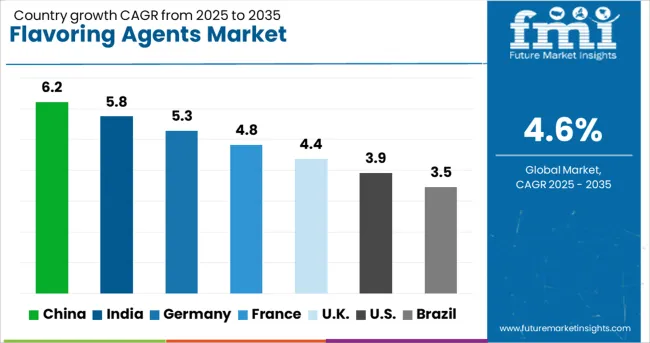

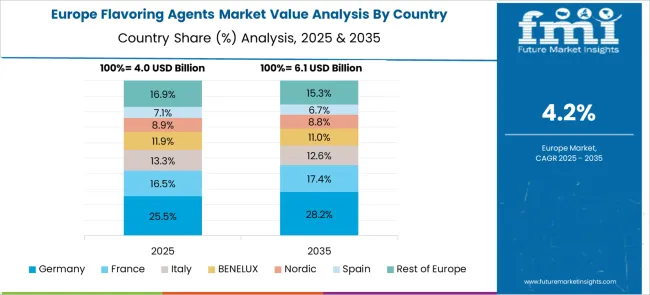

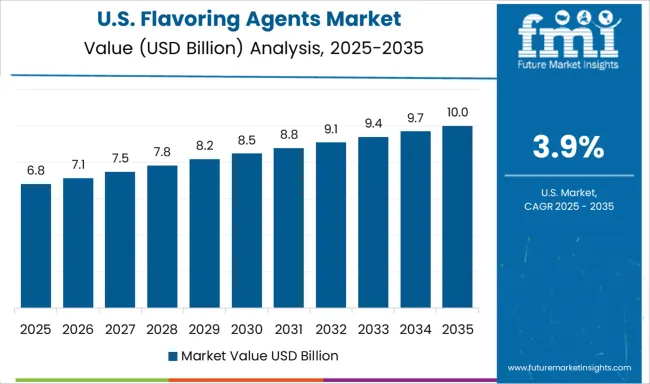

The market is projected to grow at a CAGR of 4.6% between 2025 and 2035, driven by increased demand in food and beverage industries, rising consumer preference for natural flavors, and technological advancements in flavor extraction. China leads with a 6.2% CAGR, supported by a large food processing sector and growing domestic consumption. India follows at 5.8%, fueled by expanding food and beverage production and rising urban population. Germany, at 5.3%, benefits from strong R&D capabilities and innovation in flavor formulations. The UK, growing at 4.4%, is influenced by evolving consumer tastes and premium product launches. The USA, with a 3.9% CAGR, experiences steady growth from rising demand for convenience foods and beverages. This report includes insights on 40+ countries; the top markets are shown here for reference.

China’s industry is projected to grow at a CAGR of 6.2% from 2025 to 2035, fueled by increasing food processing activities and growing consumer interest in diverse taste profiles. Domestic manufacturers are investing in natural and synthetic flavor innovation to meet evolving preferences. Expansion of ready-to-eat and convenience food sectors provides steady demand for flavor additives. Companies such as Givaudan China and Shanghai Frutarom are enhancing R&D to create region-specific flavors catering to local tastes. Regulatory support for food safety and quality further facilitates market growth. The industry also benefits from export opportunities targeting Asia Pacific countries seeking authentic Chinese flavors.

India is expected to grow at a CAGR of 5.8% over the forecast period. Increasing demand from the bakery, beverage, and snack segments drives market expansion. Growing awareness of natural and organic flavors supports product innovation. Companies like Synthite Industries and Mane India are focusing on spice-derived flavors, which appeal to traditional taste preferences. Government regulations on food additives encourage adoption of safer and high-quality ingredients. Market growth is propelled by rising export demand, particularly from Middle Eastern and African countries. Rising disposable spending on packaged foods and rising urban lifestyles further reinforce flavoring agent sales.

Sales of flavoring agents in Germany are forecast to expand at a CAGR of 5.3% between 2025 and 2035. The industry is driven by demand from the bakery and confectionery sectors focusing on authentic and innovative flavor profiles. German consumers prioritize clean label and allergen-free products, pushing manufacturers to develop safer flavor alternatives. Companies such as Symrise and Döhler are investing in biotechnology and natural extraction processes to enhance product quality. Increased consumption of vegan and plant-based foods contributes to evolving flavor requirements. The market benefits from stringent regulatory frameworks that improve product safety and transparency.

The market in the United Kingdom is expected to grow at a CAGR of 4.4% over the coming decade. Demand is fueled by growth in processed and convenience foods, along with rising interest in natural and organic flavor options. Manufacturers focus on developing health-oriented and allergen-free flavor profiles to address consumer concerns. Leading firms emphasize sustainability in sourcing raw materials and supply chain transparency. The beverage industry drives significant flavor demand, especially for alcoholic and non-alcoholic products. Regulatory frameworks support product safety and quality, encouraging innovation. Market players prioritize regional taste adaptation to maintain competitiveness.

The United States flavoring agents industry is projected to grow at a CAGR of 3.9% between 2025 and 2035. Growth is supported by demand in the foodservice, bakery, and beverage segments. Rising consumer preference for clean label and organic flavors encourages product diversification. Leading companies such as International Flavors and Fragrances and dsm-firmenich invest heavily in flavor innovation and customization. The market also benefits from increasing plant-based and ethnic food trends requiring specialized flavor profiles. Regulatory emphasis on ingredient transparency supports consumer confidence. The competitive landscape involves collaborations between flavor houses and food manufacturers to accelerate product development.

The market is shaped by leading global companies offering diverse portfolios of natural and synthetic flavor solutions for the food, beverage, and pharmaceutical industries. dsm-firmenich stands out as a top manufacturer, focusing on creating complex flavor profiles through extensive research and development. Symrise complements this with a broad range of flavor ingredients and fragrance compounds, emphasizing customization to meet client specifications. International Flavors & Fragrances Inc. (IFF) integrates technology and creativity to deliver innovative flavor solutions while expanding its market presence through strategic acquisitions. Takasago focuses on unique flavor compounds with a strong footprint in Asian and global markets. Mane emphasizes natural and organic flavor ingredients, investing in sustainable sourcing and product quality.

Robertet offers expertise in botanical extracts and natural flavors, serving premium food and beverage segments. Kerry Group provides comprehensive taste and nutrition solutions, combining flavor creation with health-focused product development. These manufacturers invest heavily in product launches and R&D to meet evolving consumer tastes and regulatory requirements. Market entry requires significant capital, regulatory approvals, and strong supplier relationships, establishing high barriers for new entrants. Innovation, supply chain management, and adherence to quality standards remain critical factors for sustained competitiveness in the global flavoring agents market.

Recent Development

| Item | Value |

|---|---|

| Quantitative Units | USD 15.8 Billion |

| Application | Beverage, Bakery, Dairy, Savory & Convenience Food, Confectionary, Meat, Oral Hygiene/pharmaceutical Snacks, Snacks, and Others (Tobacco, infant food, and animal feed) |

| Type | Natural Flavor and Artificial Flavor |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | dsm-firmenich, Symrise, IFF, Takasago, Mane, Robertet, and Kerry Group |

| Additional Attributes | Dollar sales by flavor type and application segment, demand dynamics across food and beverage, pharmaceuticals, and personal care products, regional trends in consumer preferences across North America, Europe, and Asia-Pacific, innovation in natural and clean-label flavor extraction, encapsulation technologies, and flavor modulation, environmental impact of raw material sourcing, production waste, and packaging, and emerging use cases in plant-based food products, functional beverages, and alternative protein flavor enhancement. |

The global flavoring agents market is estimated to be valued at USD 15.8 billion in 2025.

The market size for the flavoring agents market is projected to reach USD 24.8 billion by 2035.

The flavoring agents market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in flavoring agents market are beverage, bakery, dairy, savory & convenience food, confectionary, meat, oral hygiene/pharmaceutical snacks, snacks and others (tobacco, infant food, and animal feed).

In terms of type, natural flavor segment to command 61.7% share in the flavoring agents market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flavoring Cosmetic Formulation Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Oils Market Size and Share Forecast Outlook 2025 to 2035

Beverage Flavoring Market Size, Growth, and Forecast for 2025 to 2035

Analysis and Growth Projections for Beverage Flavoring Agent

Chocolate Flavoring Compounds Market Size and Share Forecast Outlook 2025 to 2035

Natural X Flavoring Market Analysis By Form, End-User, Flavors And By Region – Growth, Trends And Forecast From 2025 to 2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA