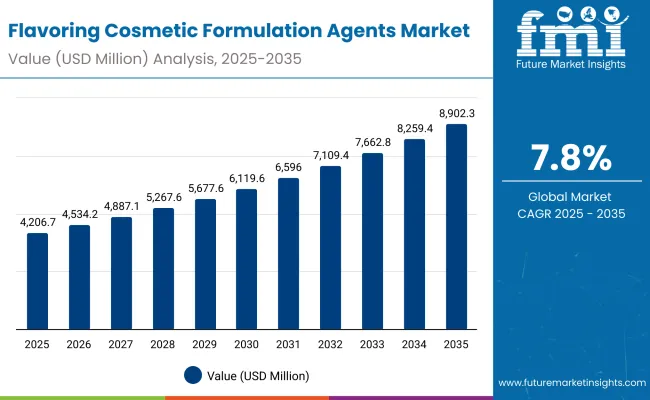

A valuation of USD 4,206.7 million is projected for the Flavoring Cosmetic Formulation Agents Market in 2025, which is expected to advance to USD 8,902.3 million by 2035. This represents an absolute increase of USD 4,695.6 million, nearly doubling the market size over the decade. Growth across this period translates into a CAGR of 7.8%, underscoring the sustained demand for functional and clean-label formulations.

Flavoring Cosmetic Formulation Agents MarketKey Takeaways

| Metric | Value |

|---|---|

| Flavoring Cosmetic Formulation Agents Market Estimated Value in (2025E) | USD 4,206.7 Million |

| Flavoring Cosmetic Formulation Agents Market Forecast Value in (2035F) | USD 8,902.3 Million |

| Forecast CAGR (2025 to 2035) | 7.80% |

Between 2025 and 2030, the market is expected to expand from USD 4,206.7 million to USD 6,119.6 million, reflecting an addition of USD 1,912.9 million that accounts for more than 40% of total growth. This phase will be characterized by rising consumption in oral care and medicated balm categories, where flavor innovation is increasingly used to strengthen compliance and product appeal.

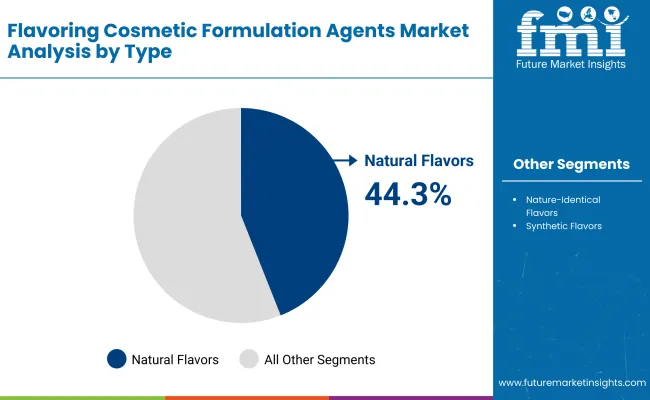

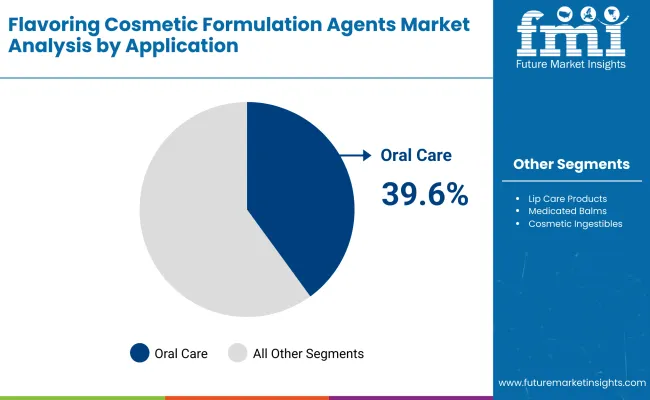

Natural flavors are forecast to dominate with 44.3% of market share in 2025, while oral care applications are anticipated to lead with 39.6%, reaffirming the role of flavor as a driver of consumer loyalty.

From 2030 to 2035, an additional USD 2,782.7 million is expected to be generated, equating to nearly 60% of total growth. This acceleration will be powered by nutracosmetic expansion and enhanced adoption of flavored delivery systems such as beauty gummies.

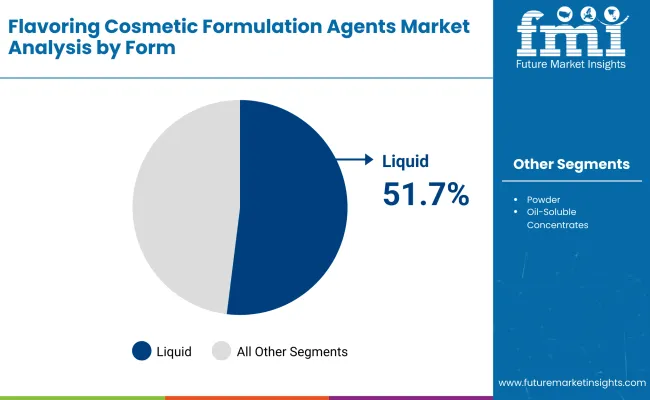

Liquid formats are projected to remain the leading form with 51.7% share in 2025, sustained by their compatibility with diverse applications. With Asia-Pacific markets such as China and India demonstrating double-digit CAGRs, regional contributions are expected to intensify, reinforcing global market momentum through 2035.

From 2020 to 2024, steady adoption of flavoring solutions was observed across oral care and personal care categories, driven by the rising demand for natural and nature-identical formulations. During this phase, leading players captured strong positions through innovation pipelines and regional expansion, with Europe and North America providing mature demand while Asia-Pacific markets accelerated uptake. Competitive advantages were established through diversified product portfolios and consistent investments in natural ingredient sourcing.

By 2025, the market is expected to reach USD 4,206.7 million, supported by the growth of oral care applications that account for 39.6% share. Looking ahead to 2035, the market is forecast to double to USD 8,902.3 million, with expansion anchored by nutracosmetic adoption and the rising role of liquid formats that already dominate with 51.7% share.

Competitive strategies will increasingly shift toward localized innovation, AI-driven formulation support, and partnerships with nutracosmetic and personal care brands. The focus is expected to transition from ingredient supply alone to ecosystem-based solutions that deliver enhanced consumer experiences.

The growth of the Flavoring Cosmetic Formulation Agents Market is being driven by evolving consumer preferences and increasing demand for functional formulations. Rising interest in natural and nature-identical ingredients has been observed, as clean-label positioning and regulatory scrutiny encourage a shift away from synthetic options. In oral care, flavoring agents are being adopted to improve product compliance and enhance user experience, while lip care and medicated balms are benefitting from flavor-led differentiation.

Nutracosmetic products such as beauty gummies are also gaining traction, as flavor is leveraged to elevate consumer acceptance of ingestible formats. Technological advancements in flavor extraction and formulation have enabled higher stability, extended shelf life, and improved versatility, further supporting widespread adoption.

Regional growth is being powered by Asia-Pacific markets, where double-digit CAGRs are expected due to expanding middle-class consumption and localized innovation. Overall, market expansion is anticipated to be reinforced by cross-category application, innovation pipelines, and evolving health-and-wellness trends.

The Flavoring Cosmetic Formulation Agents Market has been structured across type, application, and form, each presenting unique growth dynamics. By type, natural flavors are projected to hold the leading position with a 44.3% share in 2025, reflecting the strong shift toward clean-label and health-oriented products.

Within applications, the “Others” category, which includes lip care, medicated balms, and nutracosmetics, is expected to dominate with 60.4% share, underscoring the broadening use of flavoring agents in wellness-driven and lifestyle formulations.

In terms of form, liquid solutions are anticipated to account for the largest share of 51.7% in 2025, highlighting their adaptability, stability, and ease of integration in both oral care and nutracosmetic products. These dominant categories will continue to shape innovation strategies, anchoring the market’s forward trajectory through 2035.

| Type | Market Value Share, 2025 |

|---|---|

| Natural flavors | 44.3% |

| Others | 55.7% |

Natural flavors are projected to dominate the type segment with 44.3% share in 2025, equating to USD 1,863.57 million. Growth in this category is being reinforced by the global shift toward clean-label and health-conscious formulations, where natural ingredients are prioritized for consumer trust and regulatory compliance. Oral care, lip care, and nutracosmetic applications are increasingly relying on natural flavors to differentiate products and enhance user experience.

Regulatory favorability in key markets such as North America and Europe is expected to further strengthen adoption. While the “Others” category remains larger in absolute value, natural flavors will represent the most strategic growth avenue as brands align with transparency, sustainability, and consumer-driven demand for authenticity in taste solutions.

| Application | Market Value Share, 2025 |

|---|---|

| Oral care | 39.6% |

| Others | 60.4% |

The “Others” category in applications is anticipated to dominate with 60.4% share in 2025, worth USD 2,540.85 million, while oral care contributes 39.6% or USD 1,665.85 million. Lip care, medicated balms, and nutracosmetics are fueling this leadership, with flavoring agents being adopted to enhance consumer compliance and product differentiation.

Nutracosmetic innovations such as beauty gummies are expanding rapidly as flavor becomes integral to consumer acceptance and repeat purchases. Medicated and therapeutic lip care products are also increasingly flavor-driven, reinforcing adoption.

While oral care retains importance, the broader “Others” category showcases higher adaptability to emerging wellness and lifestyle preferences. This leadership reflects the evolving role of flavoring agents in extending far beyond traditional oral hygiene categories.

| Form | Market Value Share, 2025 |

|---|---|

| Liquid | 51.7% |

| Others | 48.3% |

Liquid formulations are anticipated to dominate the form segment, holding 51.7% share in 2025 with USD 2,174.86 million in sales. Liquids are widely favored due to their high solubility, stability, and ease of incorporation into oral care and nutracosmetic applications. Their compatibility with diverse flavor delivery systems allows for consistent performance in toothpaste, mouthwash, and functional beauty products.

Manufacturers are prioritizing liquid flavor solutions for their efficiency in scaling production and ensuring uniform distribution in formulations. While other formats such as powders and oil-soluble concentrates account for 48.3%, liquid formulations will remain the backbone of the market. The continued preference for liquid solutions reflects their versatility and alignment with innovation pipelines focused on wellness and consumer convenience.

Despite significant opportunities, the Flavoring Cosmetic Formulation Agents Market is shaped by complex dynamics where cost pressures, regulatory frameworks, and consumer health priorities converge. While innovation accelerates adoption in oral and nutracosmetic applications, challenges persist around compliance, sourcing, and evolving sensory expectations.

Integration of Flavor Science with Functional Wellness

The convergence of flavoring agents with functional wellness solutions is being emphasized as a critical growth driver. Flavor compounds are no longer positioned solely as sensory enhancers but as enablers of adherence in therapeutic oral care and nutracosmetic categories.

The incorporation of scientifically validated, bioactive-compatible flavor systems is allowing manufacturers to expand into health-linked applications where palatability defines product acceptance. By aligning flavor development with clinical research and wellness positioning, long-term partnerships between ingredient suppliers and consumer brands are being fostered. This integration is expected to elevate market credibility, differentiating premium formulations while sustaining consumer trust in wellness-oriented products.

Volatility in Natural Ingredient Supply Chains

A persistent restraint is being observed in the volatility of natural ingredient supply chains, particularly for botanical and plant-derived sources. Seasonal disruptions, regional agricultural dependencies, and sustainability concerns create pricing instability and limit scalability for natural flavors.

Compliance-driven reliance on authenticated sourcing further intensifies exposure to fluctuations in crop yields, transportation constraints, and environmental regulations. As consumer preference shifts toward clean-label formulations, reliance on natural flavors amplifies vulnerability to these challenges.

Strategic investment in resilient supply models, controlled cultivation, and biotech-driven alternatives will be required to overcome these constraints. Without such measures, inconsistent availability of natural raw materials may hinder growth momentum in the decade ahead.

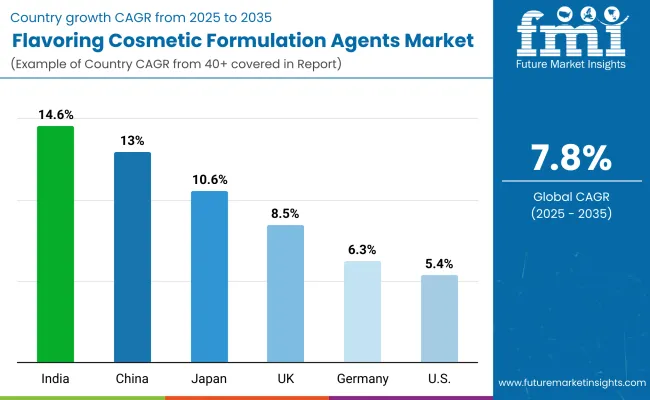

| Country | CAGR |

|---|---|

| China | 13.0% |

| USA | 5.4% |

| India | 14.6% |

| UK | 8.5% |

| Germany | 6.3% |

| Japan | 10.6% |

The global Flavoring Cosmetic Formulation Agents Market is projected to expand at varying growth trajectories across key countries, influenced by consumer health priorities, regulatory frameworks, and regional innovation ecosystems.

Asia-Pacific is expected to emerge as the fastest-growing hub, anchored by India at a remarkable 14.6% CAGR and China at 13.0% CAGR through 2035. India’s momentum will be shaped by its expanding nutracosmetic sector, rising disposable incomes, and cost-competitive manufacturing that accelerates flavored product penetration across oral care and wellness brands. China is expected to strengthen its position through large-scale production capabilities and a growing middle-class preference for premium flavored personal care products.

Japan is forecast to grow at 10.6% CAGR, supported by advanced R&D integration and a strong heritage in functional beauty formulations. In Europe, moderate but steady growth is anticipated, led by the UK at 8.5% CAGR and Germany at 6.3%, where regulatory compliance and consumer preference for natural flavors reinforce market stability.

Europe overall is projected at 7.9% CAGR, highlighting resilience in a mature but innovation-driven market. By contrast, the USA is expected to record a slower 5.4% CAGR due to market maturity, though opportunities will be fostered by demand for sustainable and natural ingredient portfolios.

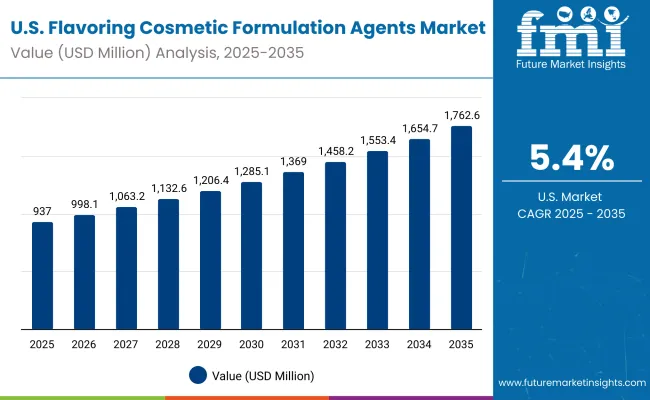

| Year | USA Flavoring Cosmetic Formulation Agents Market (USD Million) |

|---|---|

| 2025 | 937.04 |

| 2026 | 998.16 |

| 2027 | 1063.26 |

| 2028 | 1132.61 |

| 2029 | 1206.49 |

| 2030 | 1285.18 |

| 2031 | 1369.00 |

| 2032 | 1458.29 |

| 2033 | 1553.41 |

| 2034 | 1654.73 |

| 2035 | 1762.66 |

The Flavoring Cosmetic Formulation Agents Market in the United States is projected to expand at a CAGR of 6.6% between 2025 and 2035. Growth will be shaped by the integration of natural and functional flavor systems into oral care, lip care, and nutracosmetic products.

Regulatory-driven preference for clean-label solutions is expected to amplify adoption, while innovation pipelines will continue to favor liquid and natural formulations. Industry leaders are anticipated to strengthen partnerships with nutracosmetic and personal care manufacturers to accelerate flavor-driven differentiation.

The Flavoring Cosmetic Formulation Agents Market in the United Kingdom is projected to grow at a CAGR of 8.5% between 2025 and 2035. Expansion will be reinforced by increasing alignment with sustainability targets and consumer preference for natural formulations. Regulatory frameworks encouraging transparency in ingredient sourcing are anticipated to accelerate the shift toward clean-label flavor systems. Premiumization trends in oral care and nutracosmetic products will also shape innovation strategies in the region.

The Flavoring Cosmetic Formulation Agents Market in India is projected to grow at a CAGR of 14.6% between 2025 and 2035. Growth will be fueled by rapid expansion in nutracosmetics, functional personal care, and cost-efficient manufacturing. Rising disposable incomes and a growing middle class are expected to boost consumption of flavored health and beauty products. India’s positioning as a key manufacturing hub is anticipated to support export opportunities for regional players.

The Flavoring Cosmetic Formulation Agents Market in China is projected to grow at a CAGR of 13.0% between 2025 and 2035. Expansion will be propelled by a rapidly expanding middle class, premiumization in personal care, and increasing demand for functional wellness products. Government initiatives to strengthen domestic ingredient supply chains are also anticipated to reduce dependency on imports.

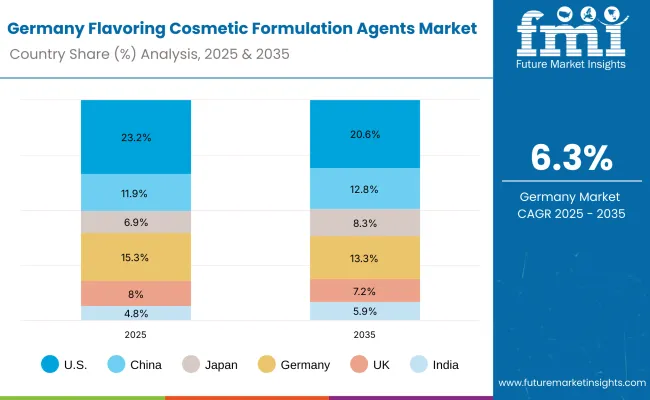

| Country | 2025 |

|---|---|

| USA | 23.2% |

| China | 11.9% |

| Japan | 6.9% |

| Germany | 15.3% |

| UK | 8.0% |

| India | 4.8% |

| Country | 2035 |

|---|---|

| USA | 20.6% |

| China | 12.8% |

| Japan | 8.3% |

| Germany | 13.3% |

| UK | 7.2% |

| India | 5.9% |

The Flavoring Cosmetic Formulation Agents Market in Germany is projected to grow at a CAGR of 6.3% between 2025 and 2035. Market expansion will be shaped by strong regulatory frameworks, consumer preference for sustainability, and the dominance of clean-label trends. Manufacturers are expected to prioritize high-quality, traceable flavor systems aligned with EU standards.

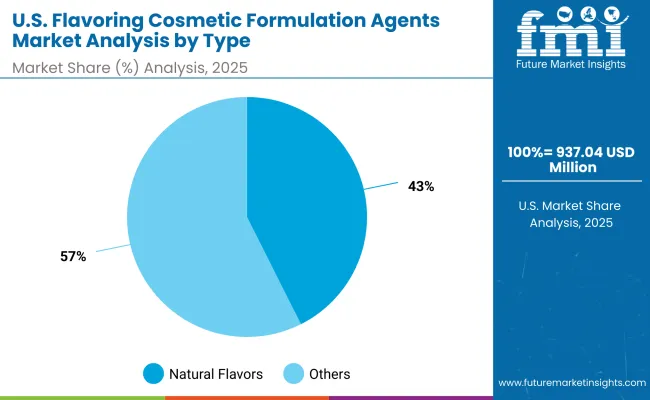

| USA By Type | Market Value Share, 2025 |

|---|---|

| Natural flavors | 42.6% |

| Others | 57.4% |

The Flavoring Cosmetic Formulation Agents Market in the United States is projected at USD 937.04 million in 2025. “Others” contribute 57.4%, while natural flavors account for 42.6%, highlighting the dominant role of broader categories including nature-identical and synthetic flavors. This structural lead reflects the entrenched use of cost-efficient formulations across oral care, lip care, and functional wellness products, where stability and scalability are prioritized.

However, the notable share of natural flavors signals a decisive consumer shift toward clean-label and transparent sourcing. As compliance frameworks strengthen and sustainability gains prominence, natural flavors are expected to steadily increase their contribution.

Strategic emphasis will likely shift toward balancing affordability with authenticity, supported by localized innovation hubs and biotech-enabled ingredient development. The interplay between value-driven “Others” and consumer-trusted natural flavors will define the USA growth trajectory.

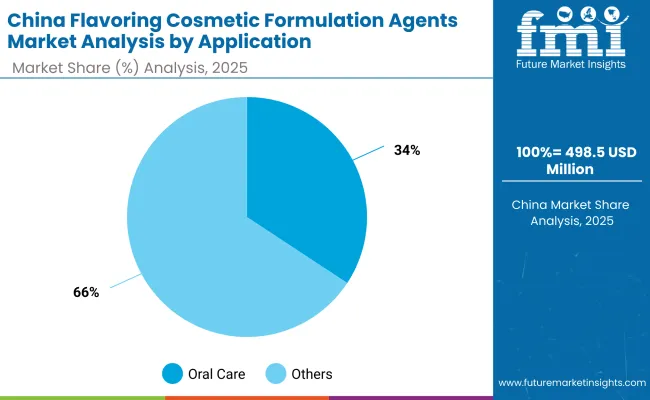

| China By Application | Market Value Share, 2025 |

|---|---|

| Oral care | 34.3% |

| Others | 65.7% |

The Flavoring Cosmetic Formulation Agents Market in China is projected at USD 498.58 million in 2025. “Others” dominate with 65.7%, while oral care applications contribute 34.3%, reflecting the country’s diversified adoption across lip care, medicated balms, and nutracosmetic categories. This leadership underscores how lifestyle-driven consumption and the popularity of beauty-from-within products are shaping the market.

Oral care remains a significant contributor, with flavoring agents being integrated into toothpaste and mouthwash to improve user compliance and sensory appeal. However, the broader “Others” category reflects stronger momentum as functional wellness, beauty innovation, and therapeutic applications expand rapidly. The interplay between these segments will define China’s growth path, where domestic innovation and global partnerships are expected to accelerate scaling opportunities.

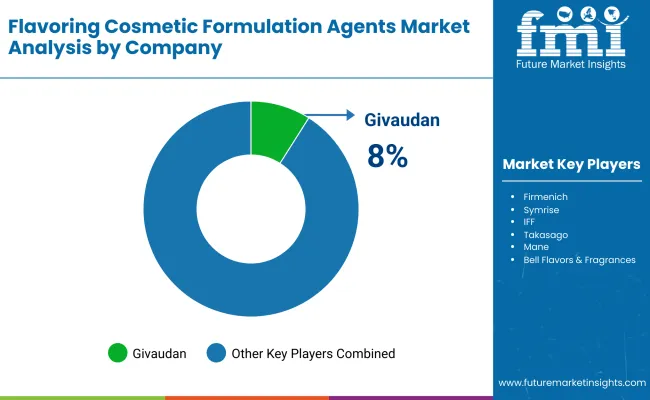

| Company | Global Value Share 2025 |

|---|---|

| Givaudan | 8.0% |

| Others | 92.0% |

The Flavoring Cosmetic Formulation Agents Market is moderately fragmented, with global leaders, regional innovators, and niche-focused players competing across oral care, lip care, and nutracosmetic applications. Global ingredient leaders such as Givaudan, Firmenich (DSM-Firmenich), Symrise, IFF, Takasago, Mane, Sensient, Robertet, Kerry, and Bell Flavors & Fragrances hold strong positions due to broad product portfolios, advanced R&D, and global reach.

Among these, Givaudan is the clear leader, capturing 8.0% of global value share in 2025, while the remaining 92.0% is distributed across other players. This leadership is reinforced by Givaudan’s investments in natural and nature-identical flavor systems, which are aligned with clean-label and wellness-driven demand.

Mid-sized companies such as Takasago, Mane, and Sensient are increasingly emphasizing specialization in regional markets, supported by agile innovation and localized production capacities. These players are expected to strengthen their positions by focusing on niche segments such as nutracosmetics and functional lip care.

Smaller, specialized firms including Robertet and Bell Flavors & Fragrances are prioritizing customized flavor solutions, highlighting adaptability to regional consumer trends. Competitive differentiation is shifting from pure flavor portfolios to integrated solutions that combine natural sourcing, biotech-driven innovation, and sustainability-focused supply chains. Strategic collaborations and acquisitions are anticipated to accelerate, as players seek stronger footholds in fast-growing regions such as Asia-Pacific.

Key Developments in Flavoring Cosmetic Formulation Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD 4,206.7 Million (2025E); USD 8,902.3 Million (2035F) |

| Type | Natural Flavors, Nature-identical Flavors, Synthetic Flavors |

| Application | Oral Care, Lip Care Products, Medicated Balms, Cosmetic Ingestibles (Beauty Gummies) |

| Form | Liquid, Powder, Oil-soluble Concentrates |

| End-use Industry | Oral Care Brands, Lip Care Manufacturers, Nutracosmetic Producers |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Givaudan, Firmenich (DSM-Firmenich), Symrise, IFF, Takasago, Mane, Sensient, Robertet, Kerry, Bell Flavors & Fragrances |

| Additional Attributes | Market share by type, application, and form; adoption trends in nutracosmetics and oral care; increasing demand for natural and clean-label flavors; technological advances in liquid formulations; regional growth led by Asia-Pacific; competitive focus on sustainability and biotech-enabled flavor solutions |

The global Flavoring Cosmetic Formulation Agents Market is estimated to be valued at USD 4,206.7 million in 2025.

The market size for the Flavoring Cosmetic Formulation Agents Market is projected to reach USD 8,902.3 million by 2035.

The Flavoring Cosmetic Formulation Agents Market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in the Flavoring Cosmetic Formulation Agents Market are natural flavors, nature-identical flavors, and synthetic flavors.

In terms of application, the “Others” category, which includes lip care, medicated balms, and nutracosmetics, is expected to command 60.4% share in the Flavoring Cosmetic Formulation Agents Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flavoring Oils Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Beverage Flavoring Market Size, Growth, and Forecast for 2025 to 2035

Analysis and Growth Projections for Beverage Flavoring Agent

Chocolate Flavoring Compounds Market Size and Share Forecast Outlook 2025 to 2035

Natural X Flavoring Market Analysis By Form, End-User, Flavors And By Region – Growth, Trends And Forecast From 2025 to 2035

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA