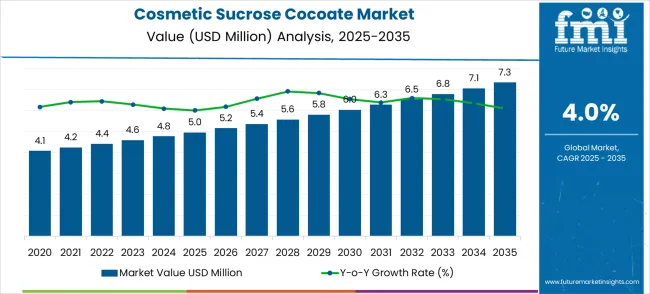

The cosmetic sucrose cocoate market is expected to reach USD 5 million in 2025 and expand to USD 7.3 million by 2035, representing a compound annual growth rate (CAGR) of 4.0%. This growth is supported by increasing demand for natural and plant-derived ingredients in skincare, haircare, and personal hygiene formulations. Sucrose cocoate, derived from sugar and coconut oil, is valued for its mild cleansing, emulsifying, and moisturizing properties, making it a preferred ingredient in clean-label and eco-friendly cosmetic products. As consumer awareness of sustainable beauty trends rises, the market trajectory reflects steady expansion, highlighting its niche but growing importance within the broader cosmetic ingredients landscape.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 5 million |

| Market Forecast Value (2035) | USD 7.3 million |

| Forecast CAGR (2025-2035) | 4.0% |

Year-on-year growth illustrates a consistent climb, with values moving from USD 4.1 million in 2023 to USD 5 million in 2025, and sustaining gradual increases across the forecast horizon. The early phase of market development is characterized by consumer-driven demand for natural formulations and increased product launches by cosmetic manufacturers seeking differentiation. In the later phase, growth is reinforced by brand diversification, entry into emerging markets, and expanded applications in multifunctional skincare products. While incremental, this dual-phase adoption highlights how early-stage niche positioning transitions into wider acceptance, contributing to sustained long-term momentum.

The cosmetic sucrose cocoate market is expected to reach USD 6.0 million by 2030 and USD 7.3 million by 2035, maintaining a CAGR of 4.0%. Early vs late growth curve comparison suggests that the initial half of the forecast period delivers foundational growth as awareness and adoption rise, while the latter half captures deeper market penetration and repeat usage trends. This progression reflects the market’s ability to evolve from a niche, sustainability-driven segment into a more established ingredient category. Overall, the outlook highlights moderate yet reliable expansion, driven by consumer preference for natural formulations, regulatory support for clean beauty, and steady innovation in cosmetic product development.

The cosmetic sucrose cocoate market grows by enabling cosmetic manufacturers to incorporate natural, sustainable ingredients that enhance product performance while meeting consumer demand for clean beauty formulations. Demand drivers include expanding natural and organic cosmetic segments requiring plant-derived emulsifiers, increasing consumer awareness of ingredient safety and environmental sustainability, and growing adoption in premium skincare formulations for enhanced skin compatibility. Priority segments include natural skincare manufacturers and organic beauty brands, with China and India representing key growth geographies due to expanding cosmetic production capabilities and rising consumer demand for natural products. Market growth faces constraints from limited raw material availability and the need for specialized processing capabilities to maintain ingredient purity and quality.

The Cosmetic Sucrose Cocoate market is entering a new phase of growth, driven by demand for natural cosmetic ingredients, expanding clean beauty trends, and evolving sustainability standards across beauty industries. By 2035, these pathways together can unlock USD 12-15 million in incremental revenue opportunities beyond baseline growth.

Pathway A - Skin Care Products Leadership (Premium Natural Formulations) The skin care segment already holds the largest share due to its critical role in natural beauty product development. Expanding multi-functional ingredient capabilities, enhanced purity grades, and sustainable sourcing credentials can consolidate leadership. Opportunity pool: USD 4.2-5.1 million.

Pathway B - 99% Purity Grade Dominance (High-Performance Applications) 99% purity applications account for significant market demand. Growing requirements for premium formulation performance, especially in luxury skincare and sensitive skin products, will drive higher adoption of ultra-pure sucrose cocoate grades. Opportunity pool: USD 3.1-3.8 million.

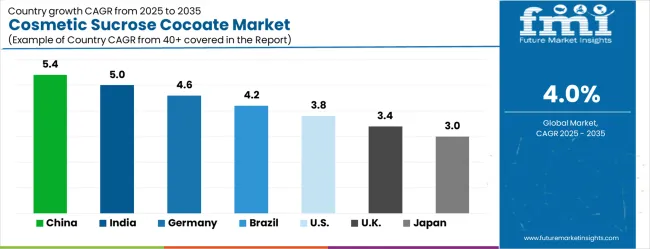

Pathway C - Asia-Pacific Market Expansion (China & India Growth) China and India present the highest growth potential with CAGRs of 5.4% and 5.0% respectively. Targeting expanding cosmetic manufacturing sectors and growing consumer demand for natural beauty products will accelerate adoption. Opportunity pool: USD 2.4-2.9 million.

Pathway D - Hair Care Applications (Natural Hair Product Formulations) Hair care and personal care applications represent significant growth potential with increasing demand for natural hair care ingredients. Products optimized for gentle cleansing and conditioning applications can capture substantial growth. Opportunity pool: USD 1.3-1.6 million.

Pathway E - Clean Beauty Integration With increasing consumer demand for transparent, natural ingredient lists, there is an opportunity to promote sucrose cocoate as a key component of clean beauty formulation strategies. Opportunity pool: USD 0.8-1.0 million.

Pathway F - Organic Certification Expansion Products with organic certification and sustainable sourcing credentials offer premium positioning for environmentally conscious beauty brands and consumers. Opportunity pool: USD 0.6-0.8 million.

Pathway G - Technical Support Revenue Value-added services including formulation support, regulatory assistance, and technical training creates additional revenue streams across global cosmetic markets. Opportunity pool: USD 0.4-0.5 million.

Pathway H - Multi-Functional Applications Enhanced product development targeting multi-functional cosmetic ingredients that provide emulsification, conditioning, and skin-feel benefits in single ingredient solutions. Opportunity pool: USD 0.3-0.4 million.

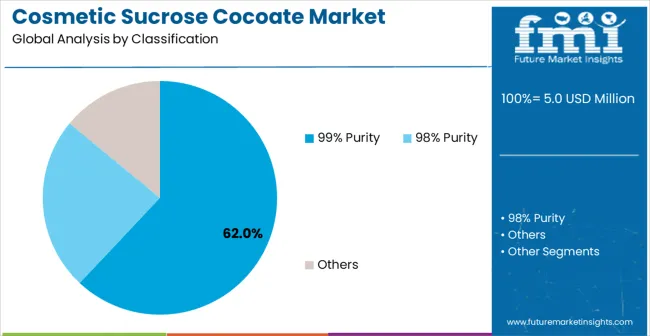

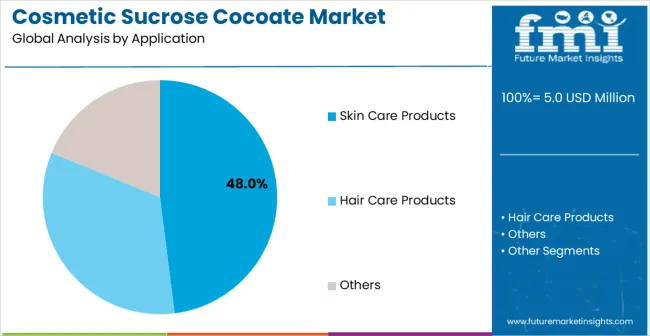

The market is segmented by product type, application, end-user, purity grade, and region. By product type, the market is divided into 98% purity, 99% purity, and others. Based on application, the market is categorized into skin care products, hair care products, and other applications. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

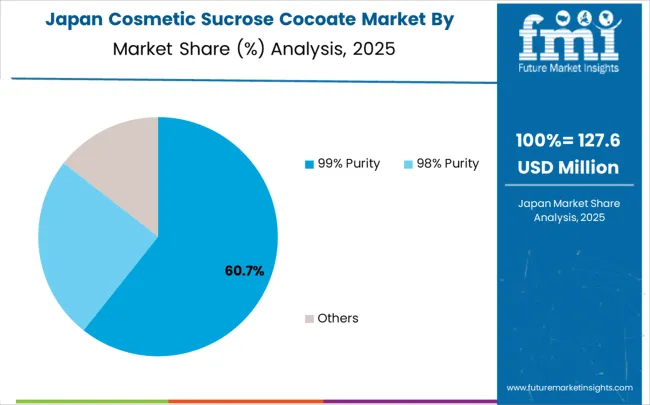

99% purity grade is projected to account for a substantial portion of 62% of the cosmetic sucrose cocoate market in 2025. This share is supported by superior ingredient performance characteristics and enhanced formulation compatibility. 99% purity sucrose cocoate provides optimal emulsification properties that enable cosmetic manufacturers to create stable, high-quality formulations with improved skin feel and application properties. The segment enables stakeholders to benefit from premium ingredient positioning and enhanced product differentiation for advanced cosmetic applications.

Key factors supporting 99% purity grade adoption:

Skin care products applications are expected to represent the largest share of 48% of the cosmetic sucrose cocoate applications in 2025. This dominant share reflects the critical need for gentle, natural emulsifiers in skincare formulations that appeals to premium beauty brands and natural cosmetic manufacturers. The segment provides essential formulation support for moisturizers, cleansers, and anti-aging products in consumer beauty markets. Growing demand for clean beauty products and natural skincare ingredients drives adoption in this application area.

Skin Care Products segment advantages include:

Market drivers include expanding natural cosmetics sector requiring plant-based emulsifiers and surfactants, increasing consumer demand for clean beauty ingredients with sustainable sourcing credentials, and growing adoption in premium skincare formulations where sucrose cocoate supports advanced product development and enhanced skin compatibility. These drivers reflect direct buyer outcomes including improved formulation stability, enhanced consumer appeal through natural positioning, and reduced regulatory compliance risks across multiple cosmetic categories.

Market restraints encompass limited production capacity that constrains ingredient availability for larger cosmetic manufacturers, complex extraction and purification processes requiring specialized technical expertise, and higher costs compared to synthetic alternatives that limit adoption among price-sensitive cosmetic brands. Additional constraints include regulatory variations across different markets and the need for extensive safety testing and documentation that increase time-to-market for new formulations.

Key trends show adoption accelerating in China and India where expanding cosmetic manufacturing capabilities drive demand for natural ingredients, while formulation shifts toward multi-functional ingredients and bio-based alternatives enable broader market penetration. Consumer preference evolution focuses on transparency and sustainability credentials that expand market opportunities for certified natural ingredients. Market thesis faces risk from synthetic alternatives that could provide similar performance characteristics at lower costs or with greater supply chain stability.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.4% |

| India | 5% |

| Germany | 4.6% |

| Brazil | 4.2% |

| USA | 3.8% |

| UK | 3.4% |

| Japan | 3% |

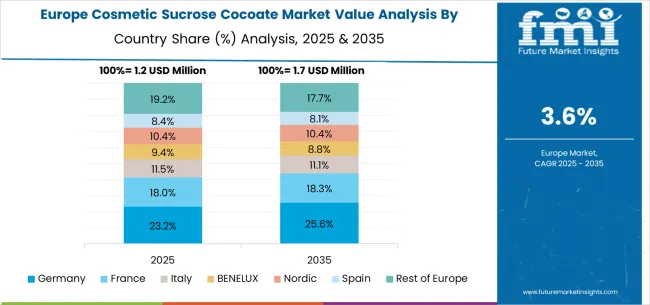

The cosmetic sucrose cocoate market shows varied growth dynamics across key countries from 2025-2035. China leads globally with a CAGR of 5.4%, fueled by rapidly expanding cosmetic manufacturing sector, growing consumer preference for natural ingredients, and increasing adoption in premium skincare and beauty product formulations. India follows closely at 5%, driven by rising disposable income, growing beauty consciousness, and strong domestic cosmetic manufacturing growth supporting natural ingredient adoption. Germany remains Europe's growth engine with 4.6%, leveraging its advanced cosmetic industry, especially in natural and organic beauty product development. Brazil records 4.2%, reflecting opportunities in natural cosmetics and growing consumer awareness despite economic challenges. The United States maintains steady expansion at 3.8%, supported by robust clean beauty market and established natural cosmetic brands. Growth in the United Kingdom (3.4%) and Japan (3%) remains stable, backed by mature cosmetic markets and established beauty industries, though comparatively slower.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the cosmetic sucrose cocoate market with its rapidly expanding cosmetic manufacturing sector and substantial consumer demand for natural beauty products. The market is projected to grow at a CAGR of 5.4% through 2035, driven by increasing natural cosmetic production programs, expanding premium skincare manufacturing activities, and growing consumer adoption across beauty markets in Beijing, Shanghai, and Guangzhou. Chinese cosmetic manufacturers are adopting sucrose cocoate for natural product formulations and clean beauty applications, with particular emphasis on premium positioning and sustainable ingredient sourcing. Government support for cosmetic industry development and consumer safety regulations expand opportunities in natural ingredient applications and organic beauty product sectors.

Cosmetic sucrose cocoate market in India reflects strong potential based on expanding beauty industry and increasing consumer preference for natural cosmetic products. The market is projected to grow at a CAGR of 5% through 2035, with growth accelerating through premium product positioning under quality and natural sourcing constraints, particularly in skincare and personal care applications in Mumbai, Delhi, and Bangalore. Indian cosmetic manufacturers and beauty brands are adopting sucrose cocoate for natural product formulations and Ayurvedic-inspired cosmetic applications, with growing emphasis on traditional ingredient integration. Industry partnerships with international ingredient suppliers expand access to high-quality natural cosmetic ingredients and technical formulation support.

Germany demonstrates established strength in the cosmetic sucrose cocoate market through its advanced cosmetic industry and robust natural beauty sector. The market shows steady growth at a CAGR of 4.6% through 2035, with established cosmetic manufacturers and natural beauty brands driving demand in Berlin, Munich, and Hamburg. German cosmetic companies focus on natural product formulations and clean beauty applications, particularly in premium skincare and organic cosmetic sectors requiring high-quality plant-derived ingredients. The country's strong regulatory framework and established organic beauty market support consistent development across multiple cosmetic categories.

Cosmetic sucrose cocoate market in Brazil shows moderate growth potential at a CAGR of 4.2% through 2035, driven by expanding natural cosmetics sector and growing consumer awareness of clean beauty ingredients. The market benefits from increasing natural product preferences and cosmetic industry development initiatives, with particular strength in skincare and personal care applications. Brazilian cosmetic manufacturers and beauty brands adopt sucrose cocoate for natural product formulations and tropical beauty applications, addressing both consumer preferences and regulatory requirements. Market development faces challenges from economic conditions and import dependencies that affect ingredient procurement and cost competitiveness.

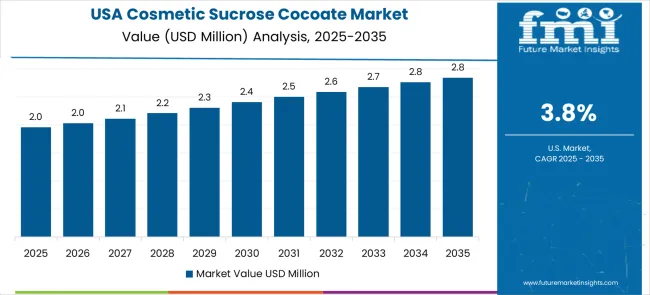

The United States maintains steady growth in the cosmetic sucrose cocoate market through its established clean beauty sector and consumer preference for natural cosmetic ingredients. Market expansion at a CAGR of 3.8% through 2035 reflects consistent demand from natural beauty brands, organic cosmetic manufacturers, and premium skincare companies requiring sustainable ingredient solutions. American cosmetic companies utilize sucrose cocoate across skincare, personal care, and color cosmetic applications, with particular emphasis on transparency and ingredient safety. The country's strong regulatory oversight and established clean beauty market support stable conditions and continued ingredient innovation.

The United Kingdom demonstrates consistent progress in the cosmetic sucrose cocoate market with a CAGR of 3.4% through 2035, supported by established beauty industry and growing natural cosmetic segment. British cosmetic manufacturers and beauty brands adopt sucrose cocoate for natural product formulations and sustainable beauty applications, with particular focus on ingredient transparency and environmental responsibility. The market benefits from strong retail channels for natural cosmetics and established consumer acceptance of premium natural ingredients. Development remains steady across multiple beauty categories despite economic uncertainties affecting discretionary consumer spending.

Cosmetic sucrose cocoate market in Japan shows steady development with a CAGR of 3% through 2035, as established cosmetic companies and beauty brands maintain consistent demand for high-quality natural ingredients. Market growth reflects mature market conditions and established quality standards across skincare and personal care sectors. Japanese cosmetic manufacturers utilize sucrose cocoate for premium product formulations and sensitive skin applications, particularly in skincare and cosmeceutical categories. The market benefits from domestic ingredient expertise and strong technical support infrastructure, though growth remains moderate compared to emerging markets with expanding beauty sectors.

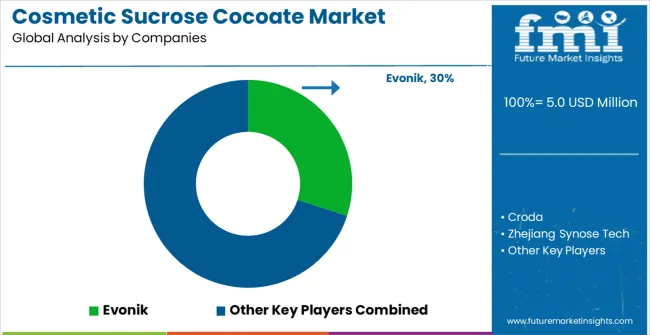

The cosmetic sucrose cocoate market operates with a concentrated structure featuring approximately 8-10 meaningful players, with the top three companies holding 70-75% market share. Competition centers on product quality, technical support, and sustainable sourcing capabilities rather than price competition alone. Market leaders include Evonik, Croda, and Zhejiang Synose Tech, which maintain competitive positions through established customer relationships, comprehensive technical expertise, and strong supply chain capabilities. These companies benefit from scale advantages in production, extensive regulatory compliance knowledge, and established relationships with major cosmetic manufacturers and specialty beauty brands worldwide.

The competitive landscape reflects the specialized nature of sucrose cocoate production, with companies requiring significant technical expertise in sustainable extraction processes, quality control systems, and regulatory compliance across different markets. Market participants differentiate through product purity levels, technical support services, and sustainable sourcing credentials that influence formulator and brand purchasing decisions.

Competition intensifies around innovation in sustainable production methods, with companies investing in green extraction technologies, enhanced purity grades, and technical support programs that improve customer formulation success and product performance. Market dynamics reflect the importance of regulatory expertise, quality assurance capabilities, and long-term supply reliability that influence customer relationships. Strategic partnerships with cosmetic formulators and beauty brands, along with geographic expansion into emerging cosmetic markets, shape competitive positioning across different regional segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 5 million |

| Product Type | 98% Purity, 99% Purity, Others |

| Application | Skin Care Products, Hair Care Products, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ additional countries |

| Key Companies Profiled | Evonik, Croda, Zhejiang Synose Tech, BASF, Clariant, Ashland Global, Lonza, Solvay, Stepan Company, Galaxy Surfactants, Kao Chemicals, Innospec, Lubrizol |

| Additional Attributes | Dollar sales by application categories, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging suppliers, adoption patterns across cosmetic manufacturers and beauty brands, integration with clean beauty trends and sustainable sourcing initiatives, innovations in high-purity grades and sustainable extraction processes, and development of multi-functional cosmetic ingredients with enhanced performance characteristics. |

The global cosmetic sucrose cocoate market is estimated to be valued at USD 5.0 million in 2025.

The market size for the cosmetic sucrose cocoate market is projected to reach USD 7.3 million by 2035.

The cosmetic sucrose cocoate market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in cosmetic sucrose cocoate market are 99% purity, 98% purity and others.

In terms of application, skin care products segment to command 48.0% share in the cosmetic sucrose cocoate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pencil & Pen Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tubes Market by Material Type & Application from 2025 to 2035

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Cosmetic Surgery Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Cosmetic Grade Preservative Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA