The cosmetic pigment market is expanding steadily due to rising global demand for premium beauty products, technological advancements in color formulation, and increasing consumer preference for long-lasting and safe cosmetic ingredients. The current market landscape is defined by growing use of pigment-based formulations across makeup, skincare, and personal care segments, as manufacturers focus on innovation and compliance with stringent safety standards.

Sustainability initiatives and the shift toward clean beauty have further influenced pigment selection and sourcing. The future outlook remains positive as continued R&D in nanotechnology, surface treatment, and dispersion stability enhances pigment performance and color vibrancy.

Market growth is being driven by increased consumption in emerging economies, evolving fashion trends, and product diversification across both mass and luxury brands The overall expansion is supported by steady raw material availability, regulatory adaptation, and rising consumer awareness of product quality, positioning the cosmetic pigment market for consistent growth and stronger global penetration.

| Metric | Value |

|---|---|

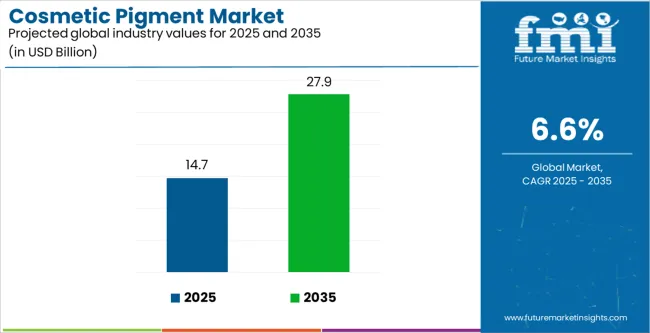

| Cosmetic Pigment Market Estimated Value in (2025 E) | USD 14.7 billion |

| Cosmetic Pigment Market Forecast Value in (2035 F) | USD 27.9 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

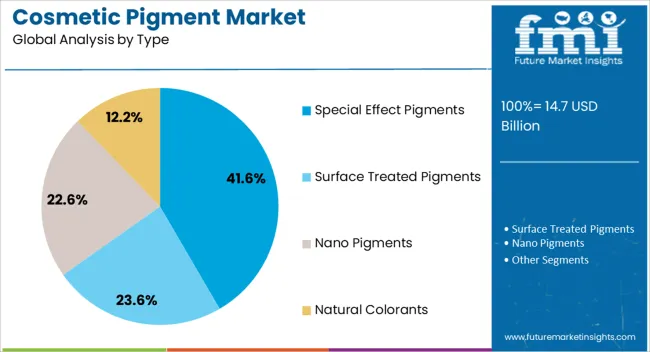

The market is segmented by Elemental Composition, Application, and Type and region. By Elemental Composition, the market is divided into Inorganic Pigments and Organic Pigments. In terms of Application, the market is classified into Facial Makeup, Eye Makeup, Lip Products, Nail Products, Hair Color Products, Special Effect & Special Purpose Products, and Others. Based on Type, the market is segmented into Special Effect Pigments, Surface Treated Pigments, Nano Pigments, and Natural Colorants. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

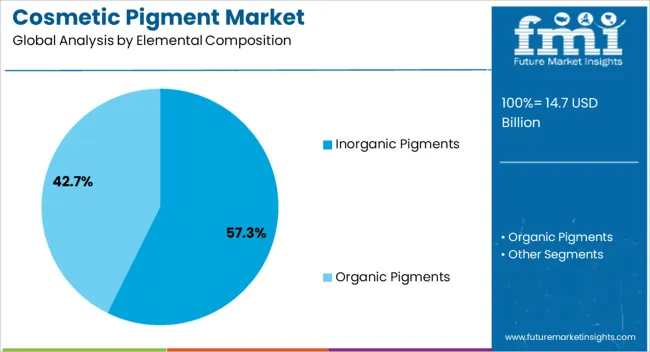

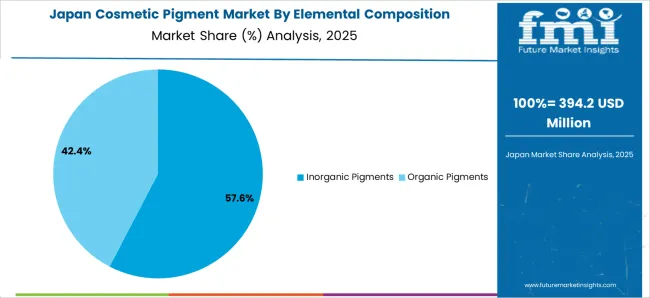

The inorganic pigments segment, accounting for 57.30% of the elemental composition category, has maintained dominance due to its superior color stability, high opacity, and resistance to light and heat. These attributes have made inorganic pigments preferred across a wide range of cosmetic formulations, ensuring reliable performance under varying environmental conditions.

Their compatibility with different bases and emulsions has reinforced usage in multiple product lines, including foundations, lipsticks, and eye shadows. Manufacturers have been focusing on refining particle size and surface treatment to improve dispersibility and enhance aesthetic appeal.

Regulatory compliance related to heavy metal content and purity has also driven quality improvements across production processes The combination of durability, safety, and versatility continues to sustain inorganic pigments as the leading formulation choice within the cosmetic pigment market.

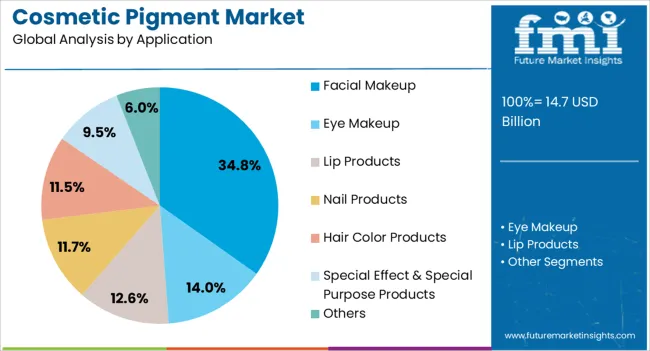

The facial makeup segment, holding 34.80% of the application category, has emerged as the largest application area owing to increasing consumer spending on personal appearance and the continuous introduction of innovative formulations. Demand is supported by growing urbanization, rising disposable income, and the expanding influence of social media and beauty influencers.

Pigment usage in facial products such as foundations, blushes, and highlighters is being optimized for enhanced coverage, smooth texture, and long wear. Advances in microencapsulation and coated pigment technologies have contributed to improved product stability and finish.

Brands are focusing on inclusive shade ranges and natural compositions to align with diverse consumer expectations These combined factors are expected to sustain the segment’s leadership, driving continuous innovation and product differentiation in the facial makeup market.

The special effect pigments segment, representing 41.60% of the type category, has gained prominence due to its ability to deliver visual appeal through shimmer, metallic, pearlescent, and holographic finishes. This category has seen increasing adoption in both color cosmetics and skincare-enhanced makeup products.

The aesthetic versatility of special effect pigments has positioned them as key components in premium and trend-driven product lines. Ongoing technological innovation in coating processes and the development of synthetic mica alternatives have enhanced performance consistency and ethical sourcing.

Market growth is being reinforced by rising demand for visually differentiated products and by the integration of these pigments into multifunctional cosmetics The segment’s expansion is expected to continue as brands leverage optical and sensory effects to elevate consumer experience and strengthen market competitiveness.

Despite the popularity of organic products in cosmetics, the inorganic pigments still rule the roost in the cosmetic pigment market. Facial makeup products are the predominant cosmetics that use cosmetic pigments.

Inorganic pigments are expected to account for 59.8% of the market share by elemental composition in 2025. Factors driving the growth of the inorganic pigments are:

| Attributes | Details |

|---|---|

| Top Elemental Composition | Inorganic Pigments |

| Market Share (2025) | 59.8% |

Facial makeup application of cosmetic pigment is anticipated to account for 25.7% of the market share in 2025. Some of the factors for the growth of facial makeup application of cosmetic pigment are:

| Attributes | Details |

|---|---|

| Top Application | Facial Makeup |

| Market Share (2025) | 25.7% |

The Asia Pacific is set to be an intensely lucrative region for the cosmetic pigment industry. The growing affluence of the region combined with the increasing middle-class and urban population spells out positive potential for the market in the region.

Oceania’s significant outdoor culture helps the market’ purpose in the country. Growing sustainability culture in the region is also seeing the demand for sustainable cosmetic pigments shoot up in Oceania.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

| India | 11.3% |

| China | 9.4% |

| Singapore | 7.6% |

| Australia | 8.7% |

The market is anticipated to register a CAGR of 11.3% in India for the forecast period. Some of the factors driving the growth of the market in the country are:

Japan is set to see the market expand at a CAGR of 7.0% over the forecast period. Prominent factors driving the growth of the market are:

The market is expected to register a CAGR of 9.4% in China. Some of the factors driving the growth of the market in China are:

The market is set to progress at a CAGR of 7.6% in Singapore. Factors influencing the growth of the market in Singapore include:

The market is expected to register a CAGR of 8.7% in Australia. Some of the reasons for the growth of cosmetic pigment in the country are:

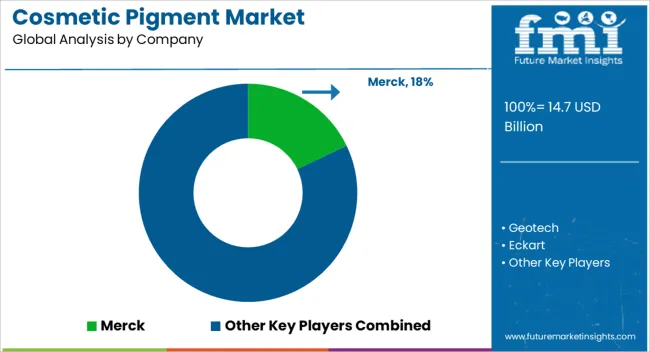

The market for cosmetic pigment is fairly consolidated, with a few companies establishing dominance. However, there is still room enough for small-scale companies.

Players in the cosmetic pigment landscape are looking at celebrity endorsements as well as collaborations with social media influencers to expand their reach. Some of the bigger players are also looking at acquisitions to increase their market share.

Recent Developments in the Cosmetic Pigment Market

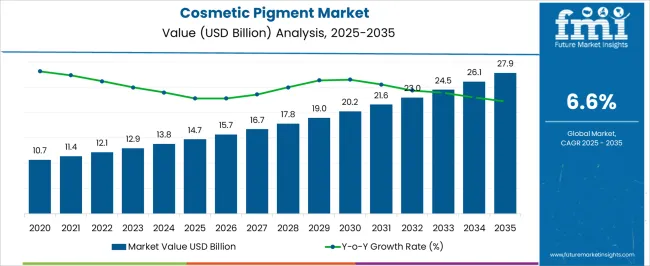

The global cosmetic pigment market is estimated to be valued at USD 14.7 billion in 2025.

The market size for the cosmetic pigment market is projected to reach USD 27.9 billion by 2035.

The cosmetic pigment market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in cosmetic pigment market are inorganic pigments and organic pigments.

In terms of application, facial makeup segment to command 34.8% share in the cosmetic pigment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pencil & Pen Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tubes Market by Material Type & Application from 2025 to 2035

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Cosmetic Surgery Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Cosmetic Grade Preservative Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA