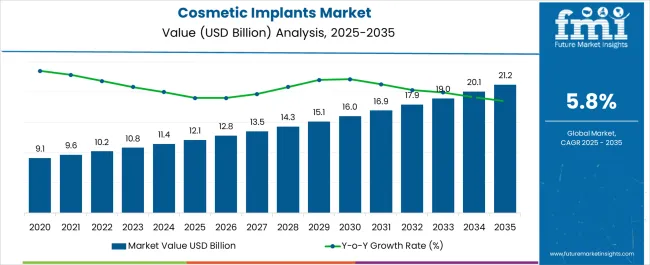

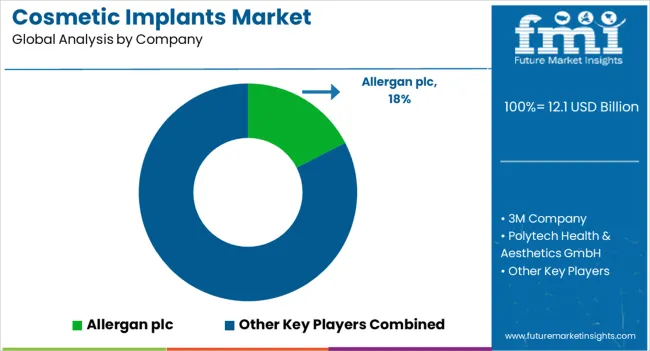

The Cosmetic Implants Market is estimated to be valued at USD 12.1 billion in 2025 and is projected to reach USD 21.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Cosmetic Implants Market Estimated Value in (2025 E) | USD 12.1 billion |

| Cosmetic Implants Market Forecast Value in (2035 F) | USD 21.2 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The cosmetic implants market is evolving steadily, driven by rising demand for aesthetic enhancements, advancements in biocompatible materials, and increased accessibility to minimally invasive surgical options. Improved social acceptance of cosmetic procedures, along with growing influence from digital media, has expanded the candidate base across demographics.

Technological advancements in 3D imaging and implant modeling have improved surgical outcomes and patient confidence, while safer, long-lasting materials are reducing revision rates. Additionally, procedural affordability and regulatory clearances across emerging markets are contributing to higher procedure volumes.

With healthcare infrastructure improving and cosmetic tourism on the rise, the industry is expected to benefit from cross-border demand. Increased collaboration between device manufacturers and dermatological clinics is also accelerating innovation cycles and expanding product portfolios tailored to specific anatomical and cultural preferences.

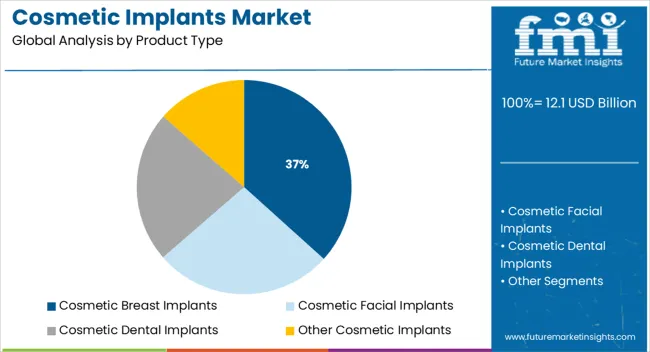

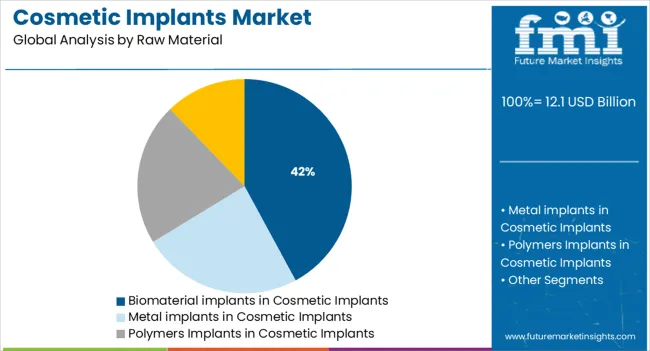

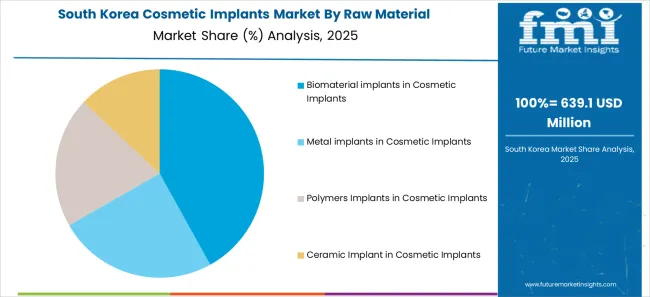

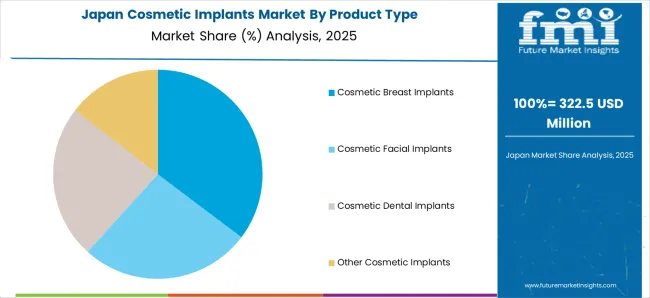

The market is segmented by Product Type and Raw Material and region. By Product Type, the market is divided into Cosmetic Breast Implants, Cosmetic Facial Implants, Cosmetic Dental Implants, and Other Cosmetic Implants. In terms of Raw Material, the market is classified into Biomaterial implants in Cosmetic Implants, Metal implants in Cosmetic Implants, Polymers Implants in Cosmetic Implants, and Ceramic Implant in Cosmetic Implants. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Cosmetic breast implants are projected to contribute 36.7% of the total revenue in the cosmetic implants market by 2025, making them the leading product type segment. This prominence is being reinforced by rising aesthetic consciousness, reconstructive needs post-mastectomy, and high procedural availability across private clinics and specialty hospitals.

Breast augmentation remains one of the most performed cosmetic surgeries globally, supported by continuous design innovations such as anatomical shaping, cohesive gel implants, and surface texturing that minimize capsular contracture risk. Advancements in pre-surgical imaging and simulation have enhanced procedural planning, reducing post-operative dissatisfaction and contributing to higher adoption.

Additionally, expanding acceptance across emerging markets and broader age groups is driving sustained demand within this segment.

Biomaterial implants are anticipated to account for 42.1% of total revenue in the cosmetic implants market by 2025, positioning this raw material segment as the most dominant. The growth of this segment is attributed to rising preference for materials that combine durability, compatibility, and minimal immune response.

Advanced biomaterials such as silicone, polylactic acid (PLA), and polyethylene offer customizable textures and flexible shapes, improving both functional and aesthetic outcomes. Innovations in bioactive materials and surface coatings have enhanced tissue integration and healing timelines.

Furthermore, regulatory bodies have shown greater support for materials with documented safety and efficacy, encouraging market adoption. As patient expectations shift toward long-lasting, natural-feeling implants, biomaterials remain central to next-generation product development.

North America accounts for a significant share of the global Cosmetic Implants Market due to expansions witnessed in its major countries along with increasing awareness and greater spending on cosmetics treatments and procedures. Increasing awareness regarding cosmetic implants among the population drives the demand for the cosmetic implants market in the region.

Also, the changing lifestyles and increasing focus on dental aesthetics are increasing the adoption of cosmetic dentistry, which is expected to propel the cosmetic implants market in the upcoming year.

For instance, in August 2025- Allergan Aesthetics, an AbbVie company announced the USA FDA approval of JUVÉDERM® VOLUX™ XC for the improvement of jawline definition in adults over the age of 21 with moderate to a severe loss of jawline definition.

Improving Healthcare Infrastructure and Economic Development to Boost Market Expansion

Easy availability to quality healthcare, favorable reimbursement policies, a strong clinical pipeline, and approval of novel drugs are the major factors that drive the growth of the global Cosmetic Implants Market.

Increasing consumer inclination towards modifying their facial features, growing popularity of minimally invasive cosmetic procedures, innovation in facial implant materials, dental implants, and expansion of healthcare infrastructure are some of the major factors driving the global cosmetic implants market.

Also, technological advancements like hyaluronic acid facial, and silicone gel breast implants create favorable growth opportunities for the market. The market is also driven by several government initiatives to promote awareness regarding cosmetic implants.

For instance, the American Society of Plastic Surgeons (ASPS) and The Plastic Surgery Foundation (The PSF) are running the Breast Reconstructive Awareness Campaign to educate women about the post-breast cancer diagnosis

Despite the growing popularity of cosmetic implants, various factors are likely to pose a threat to the growth of the cosmetic implants market during the forecast period. The high cost of cosmetic implants and the threat of malfunctioning are some of the prominent factors anticipated to hinder the market's growth during the forecast period.

Also, high chances of surgical complications, increasing cost of cosmetic surgeries, adverse effects of the cosmetic surgery, and lack of proper healthcare facilities across some developing economies are projected to harm the growth of the Cosmetic Implants Market over the forecast period.

Lack of awareness of the operational effectiveness and other benefits of the technologically advanced implant systems restrain the growth of the market.

In addition to this, rising expenditure on healthcare, growing awareness about cosmetic procedures, and an increasing number of specialty clinics and ambulatory centers will further expand the size of cosmetics implants market in the future.

The growing influence of social media and the rising awareness among individuals about physical appearance drive the growth of the market in the forecasting period.

Furthermore, the population drifting towards aesthetic appearance and increasing disposable income are also driving the growth of the global cosmetic implants market.

For instance, According to the American Society of Plastic Surgeons (ASPS), almost 9.1 million people underwent surgical and minimally invasive cosmetic procedures in the United States in 209.1.

In addition, the rising incidence of accidents, the rising prevalence of acquired or congenital deformities of the face along with technological advancements in plastic surgery procedures are the key driving factors for the cosmetic implant market.

However, the high cost related to cosmetic implantation surgeries and the lack of skilled personnel are the major factors hampering the growth of the global cosmetic implants market.

As per the analysis, the dental implants segment is anticipated to hold remunerative opportunities for the global cosmetics implants market. Various developing countries are making significant developments in their budgets, thereby, offering lucrative opportunities to players in the market.

Based on the product type, the dental implants segment is expected to dominate the market in the forecast period. The segment is projected to exhibit a CAGR of 5.8% during the forecast period. The segment is expected to have experienced a CAGR of 6.3% during the timeframe of 2020 to 2024.

Dental implants are among the major application of cosmetic implants as they are more advanced and designed with utmost care and efficiency. Due to the rising geriatric population along with the burden of dental diseases, increasing demand for cosmetic implants. Moreover, rising research studies proving the efficacies of dental implants will also boost the segment.

As per the analysis, by raw material, the polymer implants segment is expected to lead the market during the forecast period. The segment is anticipated to have witnessed a 6.5% CAGR from 2020 to 2024. Whereas, during the forecast period, the segment is estimated at a 5.9% CAGR.

The increasing use of polymer and synthetic products in the manufacturing of breast, facial, and body contouring implants is the major factor contributing to the growth of the segment in the forecasting period.

On the other hand, the metal implants segment accounts for significant growth in the forecasting period due to the increasing number of cosmetic dentistry practices and the high cost of dental implant devices.

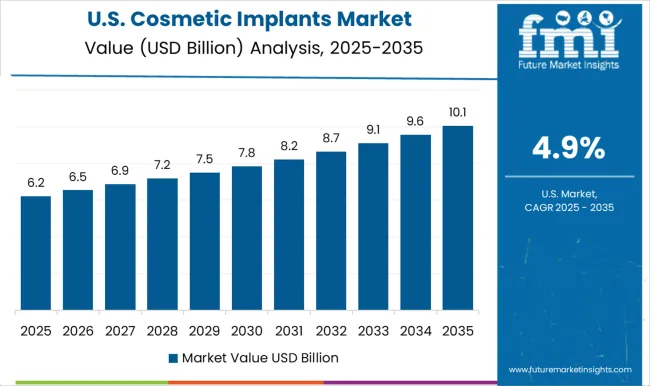

North America region dominates the global cosmetic implants market by acquiring the maximum share during the forecast period. The US is the leading contributor in the region due to increasing awareness and greater spending on cosmetic treatments and procedures in recent years.

In addition, increasing awareness regarding cosmetic implants among the population drives the demand for cosmetic implants in the USA

Moreover, the changing lifestyles and increasing focus on dental aesthetics are increasing the adoption of cosmetic implant dentistry. These factors are expected to propel the cosmetic implants market share in the upcoming year.

For instance, in August 2025- Allergan Aesthetics, an AbbVie company, announced the USA FDA approval of JUVÉDERM® VOLUX™ XC for the improvement of jawline definition in adults over the age of 21 with moderate to a severe loss of jawline definition. These factors are growing the USA cosmetic implants market size in the coming years.

The UK is followed by the USA market by rising global cosmetic treatment and rising awareness regarding cosmetic surgery and advanced technology during the forecast period.

The number of key manufacturers in the healthcare sector and rising demand for cosmetic dental implants are flourishing in the UK cosmetic implants market size.

Moreover, rising medical tourism, high patient awareness and rising accidents are increasing the cosmetic implant dentistry centre that rising demand for cosmetic implants in recent years. The growing popularity of minimally invasive surgeries is flourishing the global cosmetic implants market share during the forecast period.

Asia Pacific is the fastest-growing region globally due to the rising generic population during the forecast period. The Korean market is upliftingly acquiring a relevant share in the global cosmetic implants market during the forecast period.

With such acceleration in the dental industry, manufacturers of dental implants and prosthetics are focusing on leading the market footprint globally during the forecast period.

Moreover, the development of the Korean market can be credited to the rapid

development in the concerned field. The essential key players are contributing to their goals in the market by focusing on the end-users demand in recent years. Moreover, rising awareness about aesthetic appearance and looks increases the Korean cosmetic implants Market achieving the maximum output during the forecast period.

The Japanese market is growing in the cosmetic implants industry by capturing a high share during the forecast period. The innovation of cosmetic implants, such as facial implants and government initiatives are accelerating the demand for cosmetic implants in the market.

Moreover, rising ambulatory centres and growing speciality clinics are anticipated to boost the Japanese cosmetic implants market size during the forecast period.

The growing number of dental diseases and the rising awareness for the same is surging the Japanese cosmetic implants market growth in recent years. The key market players are playing a vital role in the market by focusing on the patient's requirements during the forecast period.

North America is anticipated to lead in the global cosmetic implants market during the forecast period. The market is likely to garner USD 12.1 Billion while exhibiting a CAGR of 5.5% from 2025 to 2035.

North America is expected to hold a large share in the global Cosmetic Implants Market due to the increasing number of cosmetic surgeries and the presence of leading technological advancements in the healthcare sector.

The Cosmetic Implants Market is growing at a significant rate due to its high adoption in the region. The demand for cosmetic implants in Latin America is expected to rise at a moderate pace during the forecast period due to rising medical tourism, high patient awareness levels, an increasing number of accidents, and the growing popularity of minimally invasive surgeries.

Europe accounts for a significant share of the global Cosmetic Implants Market due to expansions witnessed in its major countries along with the increasing awareness and greater spending on cosmetics treatments and procedures.

With such acceleration in the dental industry, manufacturers of dental implants and prosthetics are focusing on leading economies to strengthen their market footprint globally. Increasing awareness regarding cosmetic implants among the population drives the demand for the cosmetic implants market in Europe.

APAC is anticipated to be the fastest-growing region during the forecast period. China is likely to make the most significant contribution to developing the market.

China is estimated at USD 1.3 Billion, expanding at a 5.1% CAGR during the forecast period. The growth of the market can be attributed to the presence of evolving countries such as; India, China, Japan, and others.

In addition, Japan has been recognized as another potent player in the region. According to the analysis, the country is anticipated at USD 1.0 Billion while recording a CAGR of 4.2% in the forecast period. The development of the regional market can be credited to the rapid development in the concerned field.

The UK and South Korea are estimated at USD 7.3 Billion and USD 6.5 Billion respectively. The growth rate of the UK is anticipated to be 4.5% while for South Korea it is estimated at 3.7% from 2025 to 2035.

| Countries | Estimated CAGR |

|---|---|

| USA | 5.5% |

| UK | 4.5% |

| China | 5.1% |

| Japan | 4.2% |

| South Korea | 3.7% |

Eminent players of the global cosmetic implants market include Allergan plc, 3M Company, Polytech Health & Aesthetics GmbH, Sientra Inc., and GC Aesthetics plc among others. Recent key developments among players include:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.8% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD Million for Value and Units for Volume |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Product Type, Raw Material, Region |

| Regions Covered | North America; Europe; APAC; Latin America; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Mexico, Brazil, Germany, France, Italy, BENELUX, UK, Nordic, China, Japan, South Korea, GCC, South Africa, Turkey |

| Key Companies Profiled | 3M Company; Polytech Health & Aesthetics GmbH; Sientra Inc.; GC Aesthetics Plc.; Danaher Corporation; Dentsply Sirona Inc.; Straumann; Johnson & Johnson; Zimmer Biomet Holdings Inc.; AbbVie Inc.; Cochlear Ltd.; Henry Schein Inc. |

| Report Customization & Pricing | Available upon Request |

The global cosmetic implants market is estimated to be valued at USD 12.1 billion in 2025.

The market size for the cosmetic implants market is projected to reach USD 21.2 billion by 2035.

The cosmetic implants market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in cosmetic implants market are cosmetic breast implants, cosmetic facial implants, cosmetic dental implants and other cosmetic implants.

In terms of raw material, biomaterial implants in cosmetic implants segment to command 42.1% share in the cosmetic implants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pencil & Pen Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tubes Market by Material Type & Application from 2025 to 2035

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Cosmetic Surgery Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Cosmetic Grade Preservative Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA