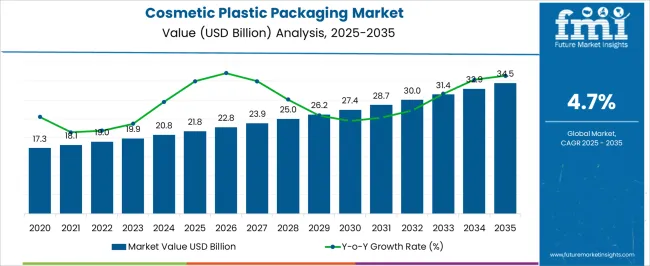

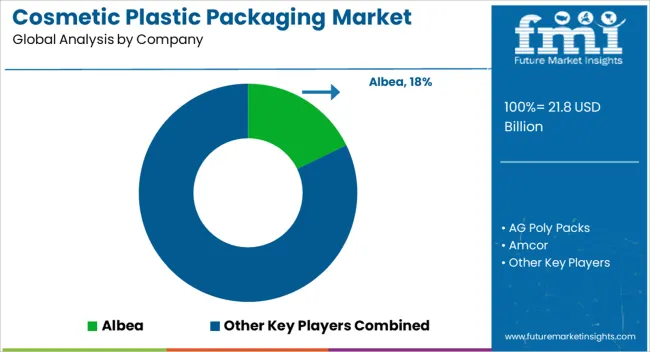

The cosmetic plastic packaging market is estimated to be valued at USD 21.8 billion in 2025 and is projected to reach USD 34.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. The growth curve of the cosmetic plastic packaging market is expected to follow a steady upward trajectory.

Year-on-year growth indicates a gradual increase, with the market moving from USD 21.8 billion in 2025 to USD 22.8 billion in 2026 and reaching USD 25 billion by 2028. This trend reflects the rising demand for innovative and durable packaging solutions in the cosmetics sector, where visual appeal, protection, and product integrity are critical factors in consumer decision-making and brand differentiation. By 2035, the cosmetic plastic packaging market is projected to reach USD 34.5 billion, highlighting the importance of high-quality packaging in supporting product value and market competitiveness. The growth pattern underscores the reliance of cosmetic manufacturers on versatile and resilient packaging options to ensure product safety, enhance shelf presence, and maintain consumer trust.

Increasing consumer preference for visually appealing and functional packaging is expected to drive continuous adoption, positioning the market as a crucial component of the cosmetics industry. Suppliers who provide durable, design-focused, and reliable packaging solutions are likely to benefit from this steady growth trend over the decade.

| Metric | Value |

|---|---|

| Cosmetic Plastic Packaging Market Estimated Value in (2025 E) | USD 21.8 billion |

| Cosmetic Plastic Packaging Market Forecast Value in (2035 F) | USD 34.5 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The cosmetic plastic packaging market is a specialized segment within the broader cosmetics and personal care market, where it holds approximately 6-7% share, driven by the growing demand for convenient, lightweight, and durable packaging solutions for makeup, skincare, and haircare products. Within the overall plastic packaging market, cosmetic packaging represents about 4-5% share, reflecting its niche yet high-value contribution, with a focus on aesthetic appeal, functionality, and brand differentiation. In the beauty and skincare products market, the share of plastic packaging is higher, around 7-8%, as these products require innovative, protective, and visually appealing containers that enhance shelf presence and consumer engagement.

The household and consumer goods packaging market accounts for roughly 3-4% share, where cosmetic packaging forms a smaller but influential part, especially in multi-use containers and travel-friendly formats. In the luxury goods packaging market, cosmetic plastic packaging holds around 5-6% share, driven by premium designs, high-quality finishes, and customization to align with brand image and consumer expectations.

The cosmetic plastic packaging market is witnessing robust expansion driven by rising global demand for personal care and beauty products, especially in emerging markets. Lightweight, cost-effective, and easily moldable plastic materials have become the preferred choice for brands aiming to balance visual appeal with performance.

Increased focus on portability, hygiene, and convenience especially in skincare and haircare routines has led to widespread adoption of innovative packaging formats. Additionally, evolving consumer preferences for eco-friendly and recyclable solutions are prompting manufacturers to invest in advanced plastic blends and post-consumer resin technologies.

The sector is also benefiting from the growing influence of e-commerce and social media, which have amplified the importance of visually distinct and functional packaging designs.

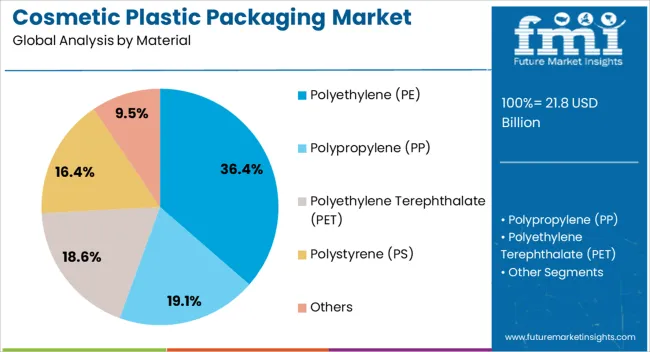

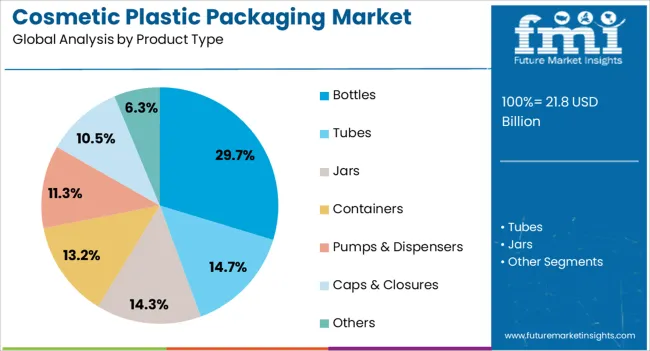

The cosmetic plastic packaging market is segmented by material, product type, application, and geographic regions. By material, cosmetic plastic packaging market is divided into Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polystyrene (PS), and Others. In terms of product type, cosmetic plastic packaging market is classified into Bottles, Tubes, Jars, Containers, Pumps & Dispensers, Caps & Closures, and Others.

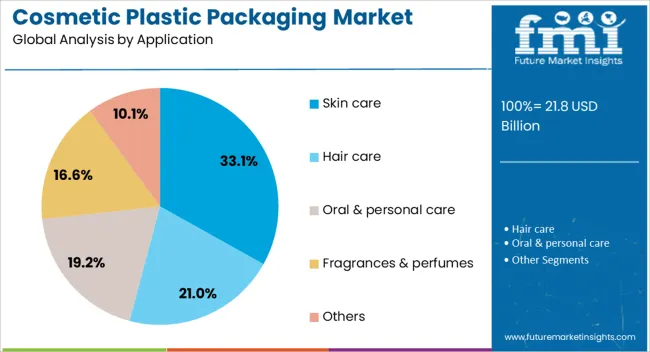

Based on application, cosmetic plastic packaging market is segmented into Skin care, Hair care, Oral & personal care, Fragrances & perfumes, and Others. Regionally, the cosmetic plastic packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyethylene (PE) is projected to hold 36.40% of the cosmetic plastic packaging market by 2025, making it the leading material segment. Its dominance stems from its flexibility, durability, and compatibility with a variety of cosmetic formulations.

PE's resistance to moisture and chemicals ensures product integrity, particularly in skincare and haircare packaging. The material’s ease of molding into complex shapes supports branding needs across both mass-market and premium lines.

Moreover, the increasing use of recycled PE in packaging formats aligns with sustainability targets and regulatory shifts aimed at circular economy integration, further solidifying its appeal to environmentally conscious brands.

Bottles are anticipated to account for 29.70% of the market share in 2025, leading the product type category. Their popularity is driven by their functionality, ease of use, and broad applicability across creams, lotions, serums, and liquid cosmetics.

Bottles provide superior product protection and are compatible with pumps, droppers, and spray tops, enhancing user convenience and product dosing accuracy. Manufacturers are leveraging advanced molding techniques and multilayer structures to improve aesthetics and shelf life.

The rise of travel-sized packaging and e-commerce-friendly formats is also pushing brands to innovate in bottle design, further reinforcing their leading position.

Skin care is expected to command 33.10% of the cosmetic plastic packaging market in 2025, emerging as the top application area. This dominance is supported by growing global awareness of daily skincare routines and increasing product diversification within the segment.

From cleansers and moisturizers to serums and sunscreens, skin care demands diverse packaging that ensures hygiene, precision, and product preservation. Plastic packaging offers flexibility in form, size, and barrier properties, catering to the needs of both premium and budget-friendly lines.

Additionally, the rise of active ingredient-based formulations has heightened the need for packaging materials that preserve potency, further boosting demand in the skin care category.

The cosmetic plastic packaging market is expanding with rising beauty and personal care consumption. Opportunities lie in sustainable, refillable solutions, while trends highlight personalization and premium packaging experiences. Challenges include high raw material costs and regulatory compliance complexities. Overall, market growth is supported by demand for functional, visually appealing, and consumer-centric packaging solutions that enhance brand differentiation and align with evolving consumer preferences globally.

The cosmetic plastic packaging market is witnessing growth due to increasing demand from the beauty and personal care sector. Rising consumption of skincare, haircare, and color cosmetics, especially in emerging economies, is driving the need for innovative and attractive packaging solutions. Brands prioritize lightweight, durable, and visually appealing plastic packaging to enhance product shelf presence and customer experience. The shift toward online retail and premium product lines is also encouraging adoption of aesthetically designed, functional packaging that aligns with brand identity and consumer expectations.

Significant opportunities are emerging in sustainable and refillable cosmetic packaging. Companies are investing in recyclable plastics, reusable containers, and eco-friendly materials to meet consumer demand for environmentally responsible products. Refillable and modular designs are gaining traction in luxury and mass-market segments, offering both cost-effectiveness and brand loyalty benefits. Innovation in dispensing mechanisms, airtight containers, and multi-functional packaging further enhances market potential. Growing awareness among consumers and regulatory support for reducing single-use plastics provide additional growth opportunities for manufacturers focusing on green packaging solutions.

A prominent trend is the adoption of personalized and premium packaging to differentiate cosmetic products in a competitive market. Custom printing, color variations, and unique shapes allow brands to cater to niche consumer preferences. Limited edition packaging and luxury finishes, including metallic coatings, embossing, and tactile surfaces, are increasingly used to elevate perceived value. Additionally, smart packaging with QR codes or NFC technology for authentication and engagement is gaining popularity. These trends reflect the market’s shift toward experiential, consumer-focused packaging that enhances brand recognition and customer loyalty.

The cosmetic plastic packaging market faces challenges due to rising raw material costs, especially for specialty polymers and high-quality plastics. Price-sensitive brands may be reluctant to adopt premium or sustainable solutions, limiting widespread adoption. Regulatory compliance related to safety, recyclability, and chemical migration is complex and varies across regions, adding to operational burdens. Manufacturing consistency and quality control for intricate designs or multi-component packaging also present challenges. Addressing these barriers requires investment in advanced production processes, cost-efficient materials, and adherence to international regulatory standards.

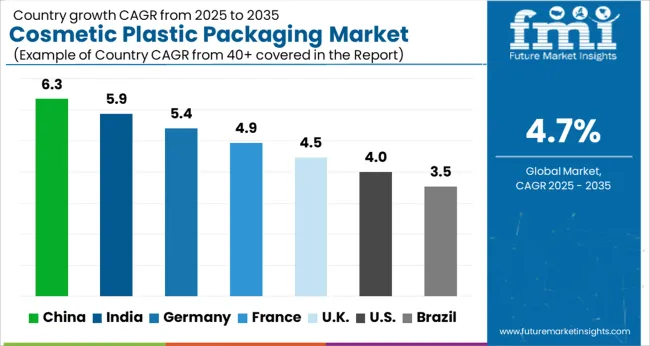

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The global cosmetic plastic packaging market is projected to grow at a CAGR of 4.7% from 2025 to 2035. China leads with a growth rate of 6.3%, followed by India at 5.9% and France at 4.9%. The United Kingdom records a growth rate of 4.5%, while the United States shows the slowest growth at 4%. Expansion is supported by rising demand for premium and convenient packaging solutions, growth of the beauty and personal care industry, and increasing e-commerce penetration. Emerging markets such as China and India benefit from rising disposable incomes and urban retail expansion, while developed countries like the USA, UK, and France focus on innovative designs, sustainability regulations, and luxury cosmetic packaging. This report includes insights on 40+ countries; the top markets are shown here for reference.

The cosmetic plastic packaging market in China is growing at 6.3% CAGR, the highest among leading countries. Growth is fueled by expanding beauty and personal care sectors, rising disposable incomes, and increasing online retail penetration. Manufacturers are introducing innovative, lightweight, and functional packaging solutions for creams, lotions, and makeup products. Premium cosmetic brands are driving demand for customized and attractive packaging designs. The growing popularity of skincare and luxury cosmetics reinforces steady market expansion.

The cosmetic plastic packaging market in India is advancing at 5.9% CAGR, supported by growing beauty, personal care, and wellness industries. The rise of urban retail outlets and e-commerce platforms enhances demand for innovative and convenient packaging. Manufacturers are focusing on lightweight, durable, and visually appealing solutions for creams, serums, and cosmetics. The growing adoption of international beauty brands and premium products further fuels market growth. Consumer awareness regarding product aesthetics and hygiene is increasing packaging sophistication.

The cosmetic plastic packaging market in France is growing at 4.9% CAGR, driven by the strong luxury cosmetics sector and premium skincare products. Manufacturers emphasize innovative, high-quality packaging with superior aesthetics and functionality. Regulations regarding packaging safety and material compliance influence design choices. The adoption of refillable and reusable solutions is gradually rising to meet consumer expectations. Cosmetic brands continue to focus on packaging differentiation to strengthen brand identity and appeal.

The cosmetic plastic packaging market in the United Kingdom is expanding at 4.5% CAGR, influenced by premium personal care products and online retail growth. Brands increasingly adopt high-quality, functional, and visually appealing packaging solutions for creams, lotions, and makeup products. Consumers prefer eco-conscious designs and durable solutions, prompting manufacturers to innovate. The rise in skincare and beauty routines among urban populations contributes to steady demand. Packaging for travel-size and portable products is also gaining traction.

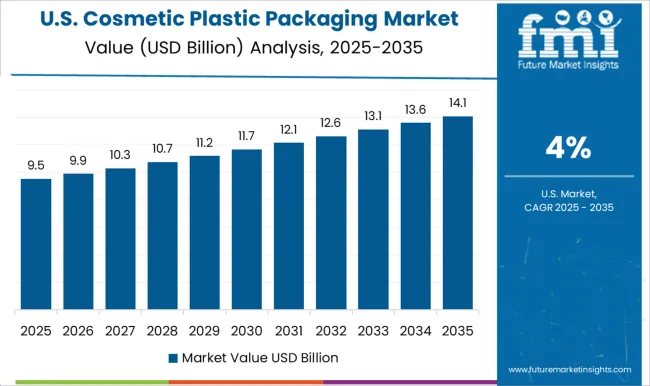

The cosmetic plastic packaging market in the United States is growing at 4% CAGR, the slowest among leading nations. Demand is driven by personal care, luxury cosmetics, and expanding e-commerce sales. Manufacturers focus on functional, safe, and visually attractive packaging for creams, serums, and makeup. Innovation in pump dispensers, airless containers, and refillable solutions is increasing. Consumer demand for premium and eco-friendly packaging supports steady market growth.

Leading companies in the cosmetic plastic packaging market, such as Albea, Amcor, and Aptar Group, are competing by offering innovative, durable, and visually appealing packaging solutions for skincare, makeup, and personal care products. Albea emphasizes modular and customizable designs, with brochures highlighting lightweight, refillable, and premium-feel packaging. Amcor focuses on sustainable performance, presenting product lines that combine protection, barrier properties, and aesthetics for global brands. Aptar Group promotes functional dispensing systems, including pumps, sprays, and closures, designed for ease of use and product preservation. AG Poly Packs, Berry Global, and Blakelin Plastics highlight high-quality injection-molded and thermoformed solutions that cater to mid- and premium-tier cosmetic brands.

Other key players, including Cosmopacks, Gerresheimer, and Green Earth Packaging, differentiate through specialty packaging, emphasizing airtight seals, tamper-evident designs, and color customization. Regional suppliers such as Guangzhou Keyuan Plasticware, Jarsking, and Vimal Plastics focus on scalable manufacturing and cost-efficient solutions. Silgan Holdings, Smurfit Kappa, and Plastoworld India highlight turnkey packaging solutions for global distribution, while Prempac, Libocosmetics, and Weltrade showcase innovative closures and jar systems. Product brochures consistently frame packaging as a combination of brand identity, functional reliability, and visual appeal. Competition in this market is driven by the ability to provide differentiated, durable, and aesthetically superior solutions that meet the evolving demands of cosmetic brands worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.8 Billion |

| Material | Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polystyrene (PS), and Others |

| Product Type | Bottles, Tubes, Jars, Containers, Pumps & Dispensers, Caps & Closures, and Others |

| Application | Skin care, Hair care, Oral & personal care, Fragrances & perfumes, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Albea, AG Poly Packs, Amcor, APackaging Group, Aptar Group, Berry Global, Blakelin Plastics, Cosmopacks, Gerresheimer, Green Earth Packaging, Guangzhou Keyuan Plasticware, Harman Packaging, Jarsking, Libocosmetics, Plastoworld India, Prempac, Silgan Holdings, Smurfit Kappa, Vimal Plastics, Visonpack, and Weltrade |

| Additional Attributes | Dollar sales by packaging type (bottles, jars, tubes, pumps) and material (PET, PP, acrylic, glass) are key metrics. Trends include rising demand for sustainable and premium packaging, customization for brand differentiation, and growth in skincare and color cosmetics. Regional adoption, technological innovations, and consumer preferences are driving market growth. |

The global cosmetic plastic packaging market is estimated to be valued at USD 21.8 billion in 2025.

The market size for the cosmetic plastic packaging market is projected to reach USD 34.5 billion by 2035.

The cosmetic plastic packaging market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in cosmetic plastic packaging market are polyethylene (pe), polypropylene (pp), polyethylene terephthalate (pet), polystyrene (ps) and others.

In terms of product type, bottles segment to command 29.7% share in the cosmetic plastic packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pencil & Pen Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tubes Market by Material Type & Application from 2025 to 2035

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Cosmetic Surgery Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Cosmetic Grade Preservative Market

Cosmetic Oil Market Growth - Size, Demand & Forecast 2025 to 2035

Cosmetic Vials Market Trends - Size & Growth 2025 to 2035

Market Share Insights of Cosmetic Tubes Product Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA