The cosmetic tube industry is growing quickly because more people want packaging that is eco-friendly, strong, and high quality. In beauty, personal care, and pharmaceuticals, creative tube designs are essential for making brands unique, ensuring products are easy to use, and keeping them safe. Companies prioritize using sustainable materials, smart packaging, and automated production to stay competitive. The demand for customizable and biodegradable tubes continues to fuel market growth

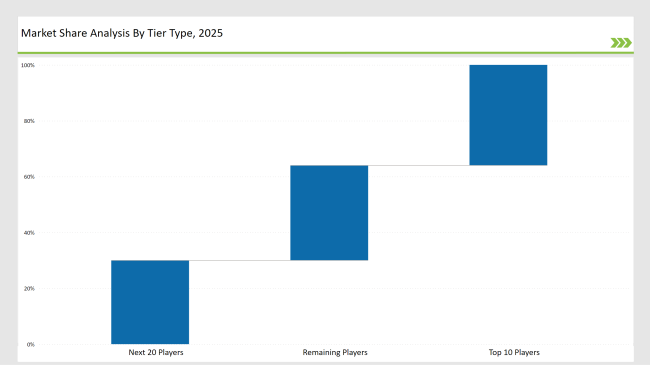

Market leaders like Albéa, Huhtamaki, and Amcor control 36% of the market by using advanced production technologies, strong distribution networks, and continuous product development.

Tier-2 manufacturers, including EPL (formerly Essel Propack), Montebello Packaging, and Berry Global, capture 30% of the market by providing cost-efficient and customizable solutions. Regional and niche players hold the remaining 34%, meeting specialized industry needs with localized production and unique packaging designs.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Albéa, Huhtamaki, Amcor) | 20% |

| Rest of Top 5 (EPL, Montebello Packaging) | 10% |

| Next 5 of Top 10 (Berry Global, Tuboplast, Hoffmann Neopac) | 6% |

The cosmetic tube market offers packaging options for businesses looking for innovative, adaptable, and eco-friendly solutions. Companies are focused on improving materials and designs to match what customers prefer

Manufacturers are focusing on using eco-friendly materials, precise production techniques, and designs that are easy for consumers to use. This helps them meet the constantly changing needs of their customers. They are developing tubes that break down naturally and using AI technology to make production more efficient. They also improve the look of their products with digital printing.

Leading companies dominate the market by prioritizing new ideas, eco-friendliness, and automation. They invest in manufacturing driven by AI, use recyclable materials, and create advanced designs to boost efficiency and competitiveness. Industry trends such as smart packaging, refillable options, and reduced material usage are reshaping the landscape, encouraging environmental progress and more affordable production methods.

Year-on-Year Leaders

To maintain a competitive edge, technology suppliers need to focus on sustainable practices, automation, and the use of new materials. By investing in digital printing, they can improve their ability to offer customized products and strengthen their brand presence.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Albéa, Huhtamaki, Amcor |

| Tier 2 | EPL (Essel Propack), Montebello Packaging |

| Tier 3 | Berry Global, Tuboplast, Hoffmann Neopac |

Leading manufacturers are investing in AI-driven production, bio-based materials, and refillable solutions to meet sustainability goals and enhance product functionality.

| Manufacturer | Latest Developments |

|---|---|

| Albéa | March 2024: Released 100% PCR-based cosmetic tubes. |

| Huhtamaki | June 2024: Launched ultra-lightweight tube packaging. |

| Amcor | January 2024: Developed bio-based, high-barrier tubes. |

| EPL (Essel Propack) | May 2024: Expanded production for premium beauty brands. |

| Montebello Packaging | April 2024: Enhanced laminated tube manufacturing. |

The cosmetic tubes market is undergoing significant changes, emphasizing eco-friendly practices and technological innovation. Manufacturers are turning to AI-driven automation and recyclable materials to satisfy consumer demands for packaging that is both environmentally conscious and cutting-edge

The cosmetic tubes industry is experiencing big changes. Companies are using artificial intelligence (AI) to make production faster and more efficient by automating many parts of the manufacturing process. This helps save time and reduces errors. There's also a major shift toward using environmentally friendly materials. More businesses are creating refillable packaging that breaks down easily, helping to cut down on pollution. With increasing concerns about the environment, stricter regulations worldwide are encouraging manufacturers to adopt a circular economy model. This model emphasizes reusing and recycling materials to reduce waste.

Leading players include Albéa, Huhtamaki, Amcor, EPL (Essel Propack), and Montebello Packaging.

The top 3 players collectively control 20% of the global market.

The market is moderately concentrated, with the top players holding 36%.

Key drivers include sustainability, automation, lightweight materials, and digital printing innovations.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pencil & Pen Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Cosmetic Surgery Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Cosmetic Grade Preservative Market

Cosmetic Oil Market Growth - Size, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA