The dental implant and prosthetic market is exhibiting stable growth, driven by increasing global awareness of oral health, a rise in edentulism cases, and continuous advancements in implantology. Aging populations in developed and emerging economies have led to a higher demand for functional and aesthetic dental restoration.

Press releases from dental device manufacturers and industry publications have emphasized strong adoption of advanced implant systems, CAD/CAM technologies, and biocompatible materials that enhance clinical outcomes. Investments in digital dentistry and 3D printing have further optimized treatment planning, fabrication accuracy, and implant longevity.

Additionally, dental insurance penetration and the expansion of private dental clinics have improved patient access to implants and prosthetic solutions. Innovations in surface coatings and osseointegration technologies have significantly improved success rates for implants across diverse patient groups. Looking forward, market growth is expected to accelerate with the integration of AI in diagnostics, training programs for implant specialists, and the growing demand for minimally invasive procedures. Segmental growth is expected to be led by dental prosthetics, titanium materials, and root-form implants due to their clinical reliability and procedural efficiency.

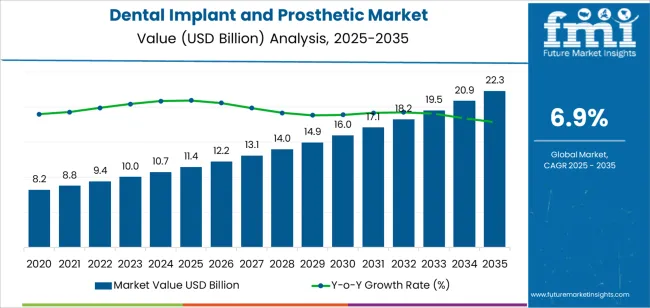

| Metric | Value |

|---|---|

| Dental Implant and Prosthetic Market Estimated Value in (2025 E) | USD 11.4 billion |

| Dental Implant and Prosthetic Market Forecast Value in (2035 F) | USD 22.3 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

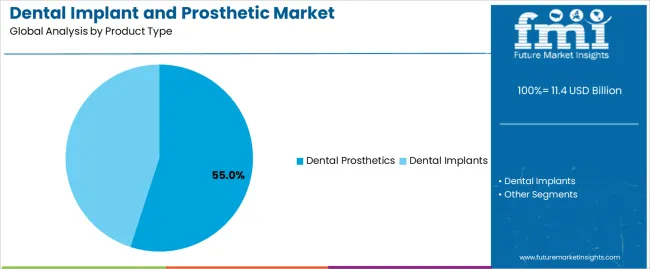

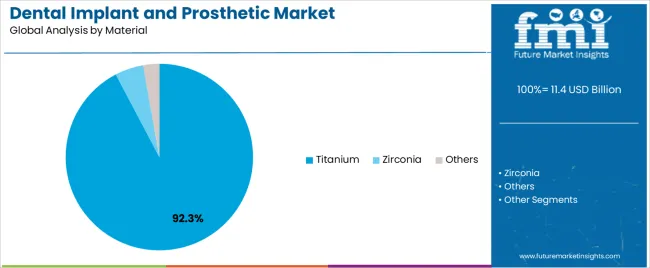

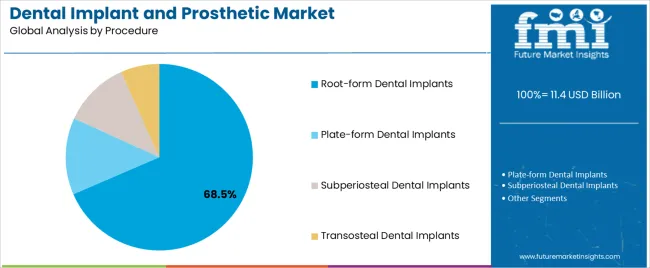

The market is segmented by Product Type, Material, and Procedure and region. By Product Type, the market is divided into Dental Prosthetics and Dental Implants. In terms of Material, the market is classified into Titanium, Zirconia, and Others. Based on Procedure, the market is segmented into Root-form Dental Implants, Plate-form Dental Implants, Subperiosteal Dental Implants, and Transosteal Dental Implants. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Dental Prosthetics segment is projected to hold 55.00% of the dental implant and prosthetic market revenue in 2025, making it the leading product category. This growth has been driven by increasing demand for aesthetic and functional dental restorations following tooth loss.

Dental prosthetics, including crowns, bridges, and dentures, have been preferred for their immediate restorative impact, especially when paired with implant-supported frameworks. Prosthetic components have benefited from digital workflows that streamline design and fabrication, reducing chair time and improving patient comfort.

Furthermore, dental laboratories and clinics have increasingly adopted high-precision milling and additive manufacturing techniques to enhance fit and customization. The prosthetic market’s growth has also been influenced by the growing awareness of oral aesthetics and quality of life improvements, especially among aging and middle-aged populations. With continued advancements in material strength, translucency, and long-term biocompatibility, the Dental Prosthetics segment is expected to sustain its dominant market share.

The Titanium segment is projected to account for 92.3% of the dental implant and prosthetic market revenue in 2025, solidifying its position as the material of choice for dental implants. Growth of this segment has been driven by titanium’s exceptional biocompatibility, mechanical strength, and corrosion resistance, which ensure long-term success in osseointegration.

Clinical literature has consistently supported the use of titanium for its ability to integrate with bone tissue without eliciting immune responses. Dental practitioners have favored titanium implants for their predictability, high survival rates, and flexibility across various bone conditions.

Additionally, titanium’s radiopacity aids in post-operative diagnostics, improving clinical monitoring. Manufacturers have continued to enhance surface modifications and thread designs using titanium to accelerate healing and increase stability. Despite growing interest in ceramic alternatives for aesthetic zones, titanium remains the standard due to its superior performance in load-bearing and posterior applications. These clinical and material advantages are expected to sustain the Titanium segment’s overwhelming market dominance.

The Root-form Dental Implants segment is projected to capture 68.5% of the dental implant and prosthetic market revenue in 2025, securing its status as the leading procedural approach. Growth in this segment has been shaped by its anatomical compatibility with natural tooth roots and strong success rates across various clinical settings.

Root-form implants have been adopted widely due to their minimally invasive placement and ability to achieve high primary stability in most jawbone structures. Dental training programs and implantology curricula have focused predominantly on root-form procedures, reinforcing their global clinical acceptance.

In addition, advancements in guided surgery and CBCT-based treatment planning have enabled more predictable outcomes and reduced post-surgical complications. Patients have increasingly preferred root-form implants for their comfort, quicker healing times, and long-term durability. The widespread availability of implant systems and components designed specifically for root-form applications has further contributed to the segment’s scalability. As implant dentistry continues to evolve toward patient-centric, evidence-based practices, the Root-form Dental Implants segment is expected to maintain its leading role in restorative procedures.

Trends in the dental implant industry suggest that the market is witnessing a shift towards minimally invasive surgeries, which reduces recovery times and complications, thus gaining preference among patients and practitioners alike.

The integration of digital solutions in dental practices is also on the rise, with digital imaging and workflow management systems streamlining procedures and improving patient outcomes. Such advances in dental implant technology will fuel the growth of the sector.

A notable increase in awareness and acceptance of dental implants as a preferred solution for tooth replacement, supported by extensive marketing and education campaigns by manufacturers and dental associations, will elevate the dental implant and prosthetic market size.

The global dental implants and prosthetics market analysis predicts that the rising disposable income levels and increasing healthcare expenditure enable more people to afford advanced dental treatments.

Technological advancements in dental implants, such as biocompatible materials and improved prosthetic designs, are also driving market growth by enhancing the durability and success rates of implants.

The impact of dental technology on patient care is helping dental prosthetics gain more attention from patients, driving the dental implant and prosthetic market growth. The expanding dental tourism industry, particularly in countries offering high-quality yet affordable dental care, is another significant driver.

High costs associated with dental implants and prosthetics, including the cost of materials and the procedures, however, pose a great barrier for many potential patients. This might affect the dental implant and prosthetic market size.

In the United States, the ecosystem is driven by high disposable incomes and a strong emphasis on cosmetic dentistry. The country’s advanced healthcare infrastructure and availability of cutting-edge dental technologies contribute to the high adoption rate of dental implants.

The increasing awareness of oral health and the benefits of dental implants among the population drives the dental implant and prosthetic market size. The presence of leading dental implant manufacturers and extensive research and development activities in the field also play a crucial role.

Favorable reimbursement policies and insurance coverage for dental procedures in the country make such treatments more accessible to a larger segment of the population.

The National Health Service (NHS) provides partial coverage for dental implants, making them more accessible to the general population.

The aging population and increasing prevalence of dental diseases further drive the demand for implants, which spurs the dental implant and prosthetic market growth. The presence of advanced dental clinics and skilled professionals also supports the industry’s advancement.

Continuous advancements in dental technologies and materials enhance the appeal and success rates of dental implants, encouraging more patients to opt for these solutions.

In India, the dental implant and prosthetic market growth is primarily driven by the rising middle-class population with increasing disposable incomes, enabling more people to afford dental implants. The rise in dental tourism, with India becoming a hub for affordable and high-quality dental care, significantly boosts the market.

The presence of a large pool of skilled dental professionals and the adoption of advanced dental technologies further support the sector’s expansion. Government initiatives to improve healthcare infrastructure and access to dental care in the country also drive the ecosystem.

The osseointegration property of titanium allows the material to bond effectively with the jawbone, contributing to a high success rate and longevity of the material.

Apart from this, extensive clinical research and a long history of use have established titanium implants as the gold standard in the dental industry.

Along with such factors, titanium is recognized for exceptional biocompatibility and strength of the material, which makes the element an ideal material for dental implants. Such factors elevate the demand for the material, helping the segment fuel the dental implants and prosthetics market growth.

Modern zirconium implants are engineered to offer high strength and durability. Improvements in material science and manufacturing processes have addressed earlier concerns about the brittleness of zirconium.

Patients and practitioners are increasingly seeking metal-free options that align with holistic health principles. Zirconium implants fit this demand, offering a non-metal alternative that aligns with the holistic approach to dental care.

Above all such factors, Zirconium dental implants offer superior aesthetic benefits compared to traditional titanium implants. The white color of the material resembles natural teeth, elevating the appeal of the material. With such factors, the segment is a crucial factor in the competitive landscape of the dental prosthetics industry.

The competition in the industry governs the dental implants and prosthetics market growth. Key players use technological advancements in dental implants to the fullest, innovating and augmenting product portfolios.

Mergers, acquisitions, strategic collaborations, and partnerships are some vital initiatives of leading organizations that help the competitive landscape of the dental prosthetics industry proliferate.

New entrants can lend strategic resources to gain a larger space in the industry. Innovative marketing can also elevate the position of such firms in the sector.

The following are some key recent developments that have occurred in the sector

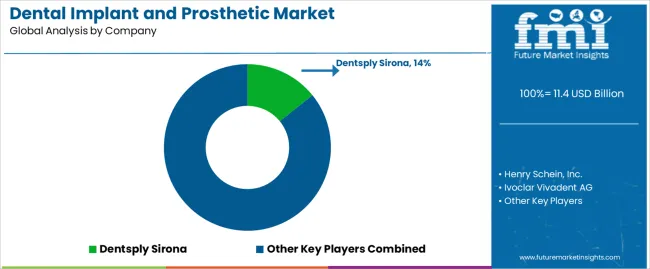

Dentsply Sirona, Henry Schein, Inc., Ivoclar Vivadent AG, Institut Straumann AG, Nobel Biocare Services AG, Danaher, THE AURUM GROUP (AVINENT Implant System), OSSTEM IMPLANT CO., LTD, Southern Implants, SHOFU INC., and Thommen Medical AG are key competitors in the ecosystem.

Dental Implants and Dental Prosthetics are key product categories of the sector.

Based on the material type, Zirconium Dental Implant, Titanium Dental Implants, and others are key categories of the industry.

Root-form Dental Implants, Plate-form Dental Implants, Subperiosteal Dental Implants, and Transosteal Dental Implants are some key procedures followed in the industry.

North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and The Middle East and Africa are the key contributing regions to the industry.

The global dental implant and prosthetic market is estimated to be valued at USD 11.4 billion in 2025.

The market size for the dental implant and prosthetic market is projected to reach USD 22.3 billion by 2035.

The dental implant and prosthetic market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in dental implant and prosthetic market are dental prosthetics and dental implants.

In terms of material, titanium segment to command 92.3% share in the dental implant and prosthetic market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Dental Flap Surgery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA