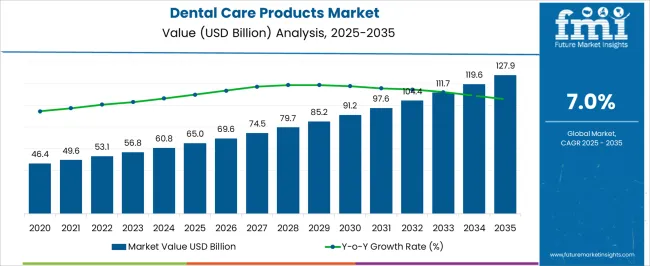

In 2025, the dental care products market is valued at USD 65.0 billion and is expected to reach USD 127.9 billion by 2035, growing at a CAGR of 7.0%. The absolute dollar opportunity over this period is USD 62.9 billion, representing the incremental revenue potential from 2025 to 2035. This growth reflects rising consumer awareness and increasing demand for oral care solutions across diverse demographics. Companies can capitalize on this opportunity by expanding product portfolios, enhancing distribution networks, and targeting emerging markets.

The substantial market expansion provides a clear financial incentive for strategic planning and investment over the decade. From a business perspective, the USD 62.9 billion absolute dollar opportunity demonstrates significant revenue potential for both established players and new entrants.

With the market gradually increasing from USD 65.0 billion in 2025 to USD 127.9 billion in 2035 at a CAGR of 7.0%, firms can plan phased investments, scale production, and optimize supply chains strategically. By focusing on high-demand regions, strengthening marketing efforts, and improving product accessibility, stakeholders can maximize revenue capture. This predictable growth trajectory allows companies to reinforce market positioning and achieve sustained profitability throughout the ten-year period.

| Metric | Value |

|---|---|

| Dental Care Products Market Estimated Value in (2025 E) | USD 65.0 billion |

| Dental Care Products Market Forecast Value in (2035 F) | USD 127.9 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

A breakpoint analysis for the dental care products market highlights key thresholds where growth accelerates or strategic adjustments are needed. With the market valued at USD 65.0 billion in 2025 and projected to reach USD 127.9 billion by 2035 at a CAGR of 7.0%, early breakpoints appear around USD 79.7–85.2 billion. These levels mark the initial phase of significant market expansion, indicating rising consumer demand and increased adoption of oral care products.

Recognizing these breakpoints enables companies to allocate resources efficiently, expand distribution channels, and enhance product availability to capture incremental revenue during periods of accelerated growth. Later-stage breakpoints occur between USD 104.4–119.6 billion as the market approaches maturity and competition intensifies. Surpassing these thresholds may require firms to refine operational efficiency, optimize pricing strategies, and enhance marketing campaigns to maintain growth momentum. Monitoring these breakpoints ensures companies anticipate shifts in demand and adjust production, distribution, and sales strategies accordingly.

The dental care products market is experiencing steady growth driven by rising awareness of oral hygiene and increasing consumer focus on preventive healthcare. The current market scenario reflects strong demand across both developed and emerging economies, supported by advancements in product formulations and growing accessibility of dental care items.

Expansion of retail and e-commerce channels has further facilitated product availability and consumer reach. The increasing prevalence of dental diseases alongside greater emphasis on cosmetic dental care is shaping the future outlook.

Innovations in natural and herbal formulations, along with growing penetration in rural areas, are expected to provide substantial growth opportunities. Furthermore, rising disposable incomes and shifts toward healthier lifestyles are encouraging consumers to invest more in dental care products, sustaining the market’s positive trajectory.

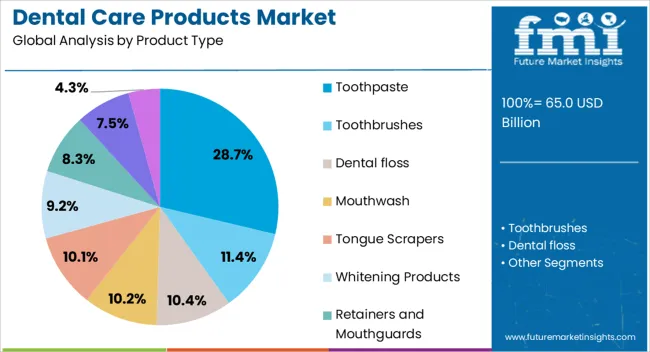

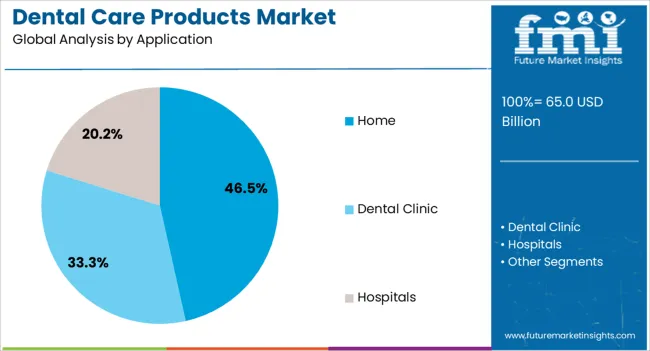

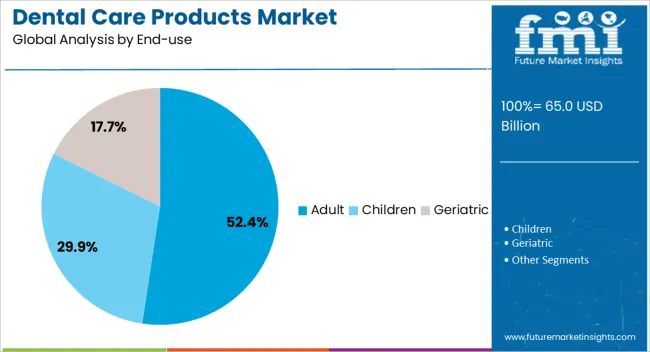

The dental care products market is segmented by product type, application, end-use, distribution channel, and geographic regions. By product type, dental care products market is divided into Toothpaste, Toothbrushes, Dental floss, Mouthwash, Tongue Scrapers, Whitening Products, Retainers and Mouthguards, Dental Kits, and Others.

In terms of application, dental care products market is classified into Home, Dental Clinic, and Hospitals. Based on end-use, dental care products market is segmented into Adult, Children, and Geriatric. By distribution channel, dental care products market is segmented into Online stores, supermarket/hypermarket, Pharmacies, and Others. Regionally, the dental care products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The toothpaste product type is projected to hold 28.7% of the Dental Care Products market revenue share in 2025, making it the leading product category. This position is attributed to toothpaste being the most essential and widely used dental care item globally. The segment’s growth has been propelled by continuous product innovation, including whitening, sensitivity relief, and cavity protection variants.

Increasing consumer preference for multifunctional toothpastes that combine oral health benefits with aesthetic enhancements has also driven demand. Accessibility through multiple retail channels and rising awareness of daily oral hygiene routines have further reinforced toothpaste as the preferred choice.

The segment benefits from well-established manufacturing and distribution networks, enabling penetration into both urban and rural markets. Toothpaste remains the cornerstone of the dental care routine, ensuring its leadership in market share.

The home application segment is expected to capture 46.5% of the overall Dental Care Products market revenue in 2025, dominating the application landscape. This dominance is linked to the widespread adoption of personal oral care routines performed within households.

Growing health consciousness and education regarding preventive dental care have encouraged consumers to regularly use dental care products at home. The rise in disposable incomes has supported greater spending on oral hygiene essentials for family use.

Additionally, the convenience and privacy of home care, especially amid increased health awareness due to global health concerns, have reinforced this segment’s growth. The availability of user-friendly products designed for daily use at home has made this application segment highly accessible, sustaining its leading revenue share.

The adult end-use industry segment is anticipated to hold 52.4% of the Dental Care Products market revenue in 2025, positioning it as the largest consumer group. This dominance results from heightened oral health awareness among adults combined with growing concerns related to aging, such as gum diseases, tooth sensitivity, and cosmetic dental care.

Adults are increasingly investing in specialized dental care products tailored to their specific needs, including anti-cavity, anti-gingivitis, and whitening formulations. The segment’s growth is also supported by the rising prevalence of lifestyle diseases affecting oral health and the expanding focus on preventive care within this demographic.

Marketing efforts and product innovation aimed at adult consumers have further fueled the segment’s expansion. As awareness and health consciousness continue to increase among adults, this end-use group is expected to maintain its market leadership.

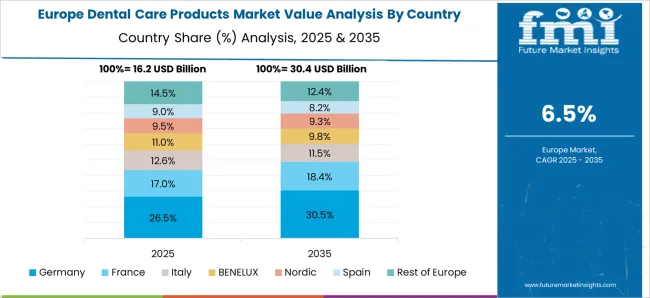

The dental care products market is growing due to rising oral health awareness, increasing disposable income, and expanding dental service accessibility. North America and Europe lead in premium toothpaste, mouthwash, and specialty dental products, emphasizing cavity protection, whitening, and sensitivity care. Asia-Pacific is witnessing rapid growth driven by a growing population, urbanization, and the rising adoption of oral hygiene routines. Manufacturers differentiate through formulation, natural ingredients, packaging, and targeted solutions.

Market expansion is supported by preventive dentistry trends, regulatory approvals, and rising demand for cosmetic dental products, with regional preferences shaping product innovation and marketing strategies.

Dental care products vary in active ingredients, natural formulations, and functional benefits. Europe and North America favor products with fluoride, probiotics, whitening agents, and herbal extracts, targeting sensitivity, enamel strengthening, and cosmetic appeal. Asia-Pacific consumers increasingly adopt cost-effective, multifunctional products that combine cleaning and anti-cavity benefits. Differences in formulation affect oral health outcomes, consumer satisfaction, and repeat purchases. Leading manufacturers invest in R&D for clinically validated ingredients, while regional producers focus on affordability and local ingredient preferences. These contrasts shape adoption rates, brand positioning, and regional market competitiveness in preventive and cosmetic oral care segments.

Packaging design, size, and usability significantly influence consumer adoption. North America and Europe emphasize ergonomic packaging, travel-friendly sizes, and aesthetically appealing designs, supporting premium positioning. Asia-Pacific markets prioritize bulk packs, affordability, and practical packaging for family use. Differences in packaging and convenience affect ease of use, brand loyalty, and purchasing behavior. Suppliers offering attractive, easy-to-use formats capture premium consumers, while regional producers focus on cost-effective bulk solutions. Packaging contrasts directly influence regional adoption, repeat purchases, and marketing strategies across professional, retail, and household segments.

Dental care products are distributed through pharmacies, supermarkets, e-commerce platforms, and professional dental channels. Europe and North America leverage multi-channel strategies including online sales, specialty stores, and dentist recommendations. Asia-Pacific relies heavily on retail chains, mass-market outlets, and online marketplaces targeting a broad consumer base. Differences in distribution affect accessibility, brand visibility, and adoption rates. Leading manufacturers strengthen market penetration through channel diversification, loyalty programs, and promotional campaigns, while regional producers depend on price-sensitive bulk distribution. Distribution contrasts significantly influence regional sales, customer reach, and competitive positioning in both mature and emerging markets.

Regional oral care demand is influenced by awareness, hygiene habits, and cultural practices. Europe and North America emphasize preventive care, cosmetic outcomes, and specialty treatments, supporting premium product adoption. Asia-Pacific growth is fueled by increasing awareness of oral hygiene, rising disposable incomes, and evolving consumer routines, often favoring multifunctional, affordable products. Differences in hygiene practices and cultural expectations affect product development, marketing, and adoption. Suppliers offering products aligned with regional preferences and educational campaigns gain a competitive advantage, while regional producers cater to basic oral care needs. Understanding these contrasts enables tailored strategies for product features, promotions, and regional expansion.

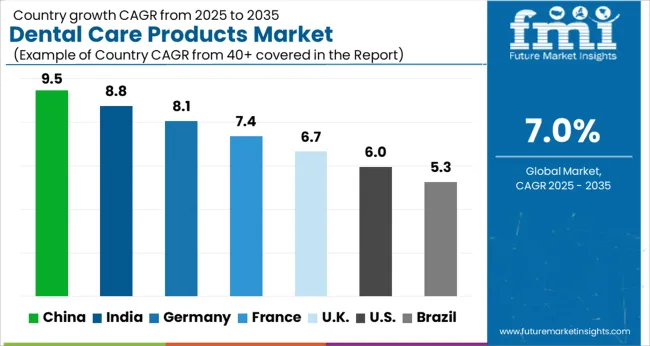

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global dental care products market was projected to grow at a 7.0% CAGR through 2035, driven by demand in oral hygiene, professional dentistry, and consumer healthcare applications. Among BRICS nations, China recorded 9.5% growth as large-scale production facilities were commissioned and compliance with product quality and safety standards was enforced, while India at 8.8% growth saw expansion of manufacturing units to meet rising regional demand. In the OECD region, Germany at 8.1% maintained substantial output under strict health and industrial regulations, while the United Kingdom at 6.7% relied on moderate-scale operations for oral care and professional dental products. The USA, expanding at 6.0%, remained a mature market with steady demand across consumer and professional dental segments, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Dental care products market in China is growing at a CAGR of 9.5%. Between 2020 and 2024, growth was driven by rising oral health awareness, increasing disposable income, and expanding urban population. Consumers adopted toothpaste, mouthwash, floss, and whitening products for preventive and cosmetic purposes. Manufacturers focused on advanced formulations, natural ingredients, and innovative delivery formats such as gels and powders. E-commerce and retail channels expanded accessibility across cities and smaller towns. In the forecast period 2025 to 2035, growth is expected to accelerate with adoption of multifunctional, herbal, and premium oral care products, along with increased professional dental recommendations. China remains a leading market due to large population, growing dental health awareness, and rising middle-class purchasing power.

Dental care products market in India is growing at a CAGR of 8.8%. Historical period 2020 to 2024 saw growth supported by rising oral hygiene awareness, growth of retail and e-commerce channels, and increasing disposable income in urban areas. Consumers preferred toothpaste, mouthwash, floss, and whitening products suitable for local oral health needs. Manufacturers focused on safe, cost-effective, and multifunctional formulations with herbal and fluoride options. In the forecast period 2025 to 2035, market growth is expected to continue with adoption of premium, herbal, and technologically advanced dental care products, along with expansion of professional dental services. Rising government and NGO initiatives promoting oral health awareness will further boost adoption. India is projected to maintain strong growth due to increasing urbanization, health consciousness, and retail penetration.

Dental care products market in Germany is growing at a CAGR of 8.1%. Between 2020 and 2024, growth was supported by high oral health awareness, advanced dental care services, and preference for premium and eco-friendly products. Manufacturers focused on high-quality, natural, and multifunctional formulations including toothpaste, mouthwash, and whitening gels. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of herbal, premium, and technologically advanced products integrated with professional recommendations. Consumer preference for sustainable and safe dental care products, strong retail infrastructure, and rising demand for cosmetic oral care will further support adoption. Germany remains a key European market due to high disposable income, oral health awareness, and demand for premium dental care solutions.

Dental care products market in the United Kingdom is growing at a CAGR of 6.7%. During 2020 to 2024, adoption was driven by home oral care routines, rising awareness of preventive dental health, and growing use of retail and online distribution channels. Manufacturers focused on safe, multifunctional, and easy-to-use products including toothpaste, mouthwash, and floss. In the forecast period 2025 to 2035, market growth is expected to continue moderately with adoption of herbal, multifunctional, and premium dental care solutions. Expansion of professional dental services, awareness campaigns, and sustainable packaging trends will further support market development. The United Kingdom market demonstrates stable growth with emphasis on product safety, convenience, and environmental responsibility.

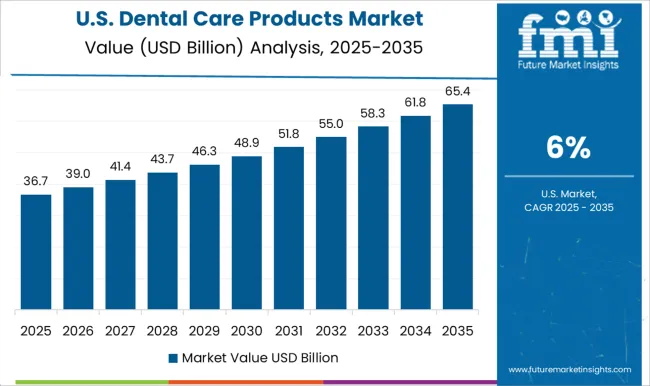

Dental care products market in the United States is growing at a CAGR of 6.0%. Historical period 2020 to 2024 saw growth fueled by rising personal oral hygiene awareness, cosmetic dental trends, and strong retail and e-commerce presence. Consumers preferred multifunctional toothpaste, mouthwash, floss, and whitening products with natural or advanced formulations. Manufacturers focused on premium, safe, and innovative delivery formats. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of herbal, premium, and technologically advanced products, along with integration with professional dental recommendations. Increasing cosmetic dental treatments, health consciousness, and sustainable packaging will further support market expansion. The United States market demonstrates consistent growth with emphasis on innovation, safety, and multifunctionality.

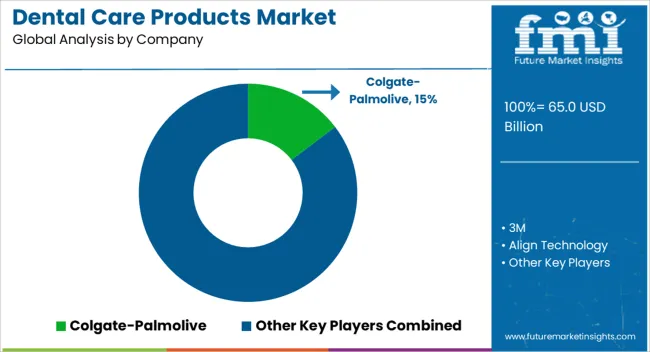

The dental care products market is supplied by Colgate-Palmolive, 3M, Align Technology, Church & Dwight, Danaher, Dentsply Sirona, GC Corporation, GlaxoSmithKline, Henry Schein, Ivoclar Vivadent, Johnson & Johnson, Kao, Patterson Companies, Procter & Gamble, Straumann Holding, Sunstar Suisse, and Unilever. Competition is shaped by product efficacy, formulation, oral health focus, and innovation in tools and devices. Colgate-Palmolive and Procter & Gamble brochures emphasize toothpaste, mouthwash, and whitening solutions with clinically proven benefits. 3M and Dentsply Sirona datasheets highlight professional dental tools, orthodontic aligners, and restorative materials. Align Technology and Straumann detail digital workflow solutions and implant systems for dental professionals.

Observed patterns show increasing interest in preventive care, ease of use, and multifunctional oral hygiene products. Strategies across suppliers focus on portfolio diversification, channel reach, and targeted consumer engagement. Johnson & Johnson and GC Corporation prioritize dental consumables and equipment for clinics and laboratories. Church & Dwight and GlaxoSmithKline emphasize over-the-counter products with broad market appeal. Henry Schein and Patterson Companies invest in supply chain integration, digital services, and professional training. Observed practices include launching specialized products for sensitive teeth, pediatric care, and cosmetic dentistry, while maintaining global regulatory compliance and localized formulations.

| Item | Value |

|---|---|

| Quantitative Units | USD 65.0 Billion |

| Product Type | Toothpaste, Toothbrushes, Dental floss, Mouthwash, Tongue Scrapers, Whitening Products, Retainers and Mouthguards, Dental Kits, and Others |

| Application | Home, Dental Clinic, and Hospitals |

| End-use | Adult, Children, and Geriatric |

| Distribution Channel | Online stores, supermarket/hypermarket, Pharmacies, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Colgate-Palmolive, 3M, Align Technology, Church & Dwight, Danaher, Dentsply Sirona, GC Corporation, GlaxoSmithKline, Henry Schein, Ivoclar Vivadent, Johnson & Johnson, Kao, Patterson Companies, Procter & Gamble, Straumann Holding, Sunstar Suisse, and Unilever |

| Additional Attributes | Dollar sales vary by product type, including toothpaste, toothbrushes, mouthwash, dental floss, and teeth whitening products; by application, such as oral hygiene, preventive care, and cosmetic dentistry; by end-use, spanning individual consumers, dental clinics, and hospitals; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising oral health awareness, cosmetic dentistry trends, and increasing dental care expenditure. |

The global dental care products market is estimated to be valued at USD 65.0 billion in 2025.

The market size for the dental care products market is projected to reach USD 127.9 billion by 2035.

The dental care products market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in dental care products market are toothpaste, toothbrushes, dental floss, mouthwash, tongue scrapers, whitening products, retainers and mouthguards, dental kits and others.

In terms of application, home segment to command 46.5% share in the dental care products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Implant and Prosthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA