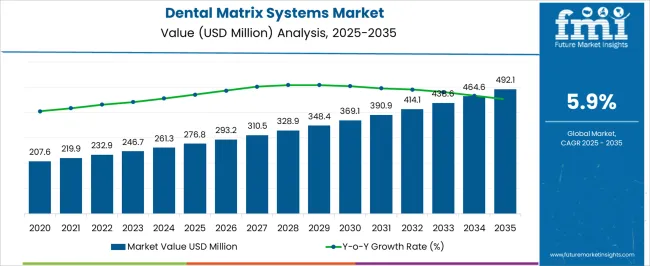

The Dental Matrix Systems Market is estimated to be valued at USD 276.8 million in 2025 and is projected to reach USD 492.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Dental Matrix Systems Market Estimated Value in (2025 E) | USD 276.8 million |

| Dental Matrix Systems Market Forecast Value in (2035 F) | USD 492.1 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

The dental matrix systems market is witnessing steady expansion, fueled by the rising prevalence of dental caries and restorative procedures worldwide. Increasing emphasis on minimally invasive dentistry, along with growing patient demand for high-quality aesthetic outcomes, has driven adoption of advanced matrix systems.

Clinical journals and industry updates have underscored the importance of matrix systems in ensuring proper contact points and contour during restorative procedures, thereby improving long-term treatment outcomes. Investments by dental product manufacturers in precision-engineered systems have enhanced ease of use and procedural efficiency for dental practitioners.

Additionally, the global rise in preventive dental care awareness and increasing access to modern dental services in emerging economies have created strong growth opportunities. Favorable reimbursement policies in several regions and continuous product innovation in materials and designs are expected to further accelerate adoption. Future market growth will likely be supported by digital dentistry advancements, expanding dental clinics, and heightened focus on patient comfort and procedural success.

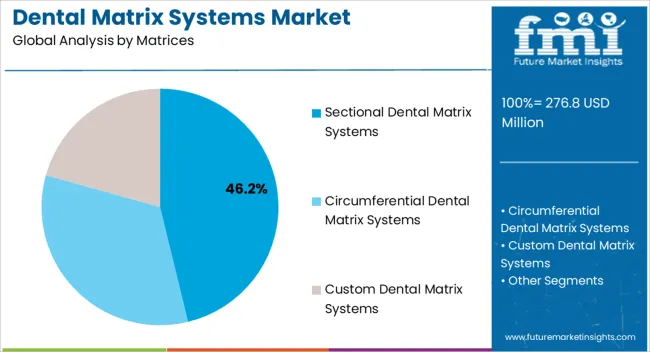

The Sectional Dental Matrix Systems segment is projected to contribute 46.20% of the dental matrix systems market revenue in 2025, positioning it as the leading matrices type. Growth in this segment has been driven by its superior ability to recreate natural tooth anatomy and provide tight interproximal contacts during restorative procedures.

Clinical evaluations have consistently shown higher success rates with sectional systems compared to traditional options, owing to improved adaptation and reduced risk of overhangs. Dentists have increasingly preferred these systems for their predictable clinical outcomes and shorter chair time.

Manufacturers have also enhanced sectional systems with advanced ring designs and pre-contoured matrices, improving stability and ease of placement. As demand for high-quality restorative outcomes continues to rise, the Sectional Dental Matrix Systems segment is expected to retain its dominant role in clinical practice.

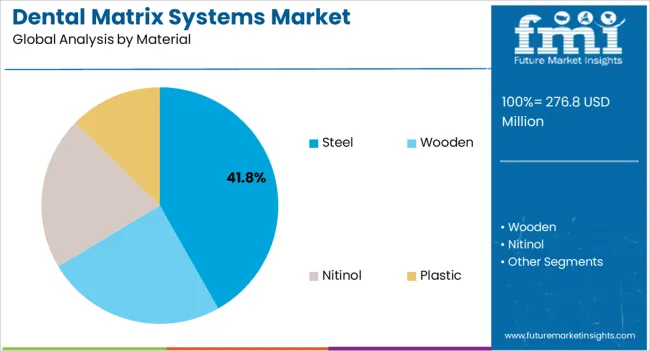

The Steel segment is projected to hold 41.80% of the dental matrix systems market revenue in 2025, maintaining its leading position among material types. This growth has been supported by the strength, durability, and reliability of stainless steel in maintaining matrix form during restorative procedures.

Steel matrices have been widely adopted due to their ability to provide consistent contouring and withstand repeated use without distortion. Dental practitioners have valued steel for its cost-effectiveness and compatibility with a wide range of restorative materials, including composites and amalgams.

Advances in manufacturing processes have resulted in smoother surface finishes and pre-contoured shapes, enhancing clinical precision and reducing patient discomfort. Although alternative materials such as transparent and disposable matrices are gaining attention, steel continues to dominate due to its proven clinical reliability and economic viability. This entrenched position ensures the Steel segment’s continued leadership in the market.

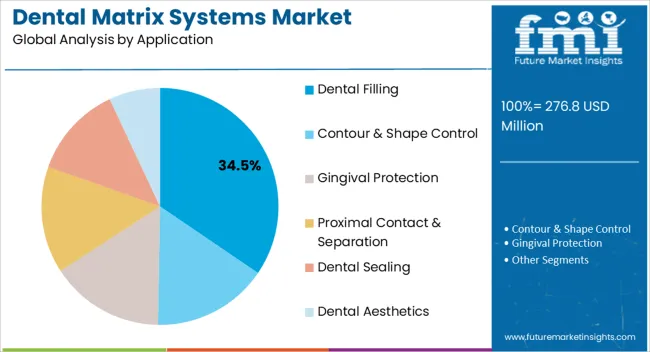

The Dental Filling segment is projected to account for 34.50% of the dental matrix systems market revenue in 2025, solidifying its position as the largest application segment. Growth in this segment has been driven by the global rise in dental caries, which remains one of the most prevalent oral health issues across all age groups.

Dental fillings represent a fundamental restorative procedure, where matrix systems play a critical role in shaping and stabilizing restorative material. The increasing preference for aesthetic composite fillings has further strengthened demand for precision matrix systems that ensure proper marginal integrity and contact.

Clinical guidelines and practitioner surveys have highlighted the importance of reliable matrices in improving treatment efficiency and reducing postoperative complications. With rising dental care access in emerging economies and continuous advancements in restorative materials, the Dental Filling segment is expected to sustain its leadership in driving demand for dental matrix systems.

The global market for dental matrix systems was around 10.1% of the overall USD 276.8 Billion of the global restorative materials market in 2025.

Advances in dental matrix systems have improved their accuracy and ease of use. Sectional matrix systems have gained popularity due to their ability to provide excellent anatomical shaping and tight interproximal contacts in Class II composite restorations, contributing to market growth.

Patients who are pleased with their aesthetically acceptable restorations are more likely to refer others to the same dental clinic. This word-of-mouth promotion generates demand for dental matrices among dental professionals who want to match the aesthetic demands of their patients.

Dental matrix systems play a crucial role in enabling minimally invasive dentistry by allowing surgeons to minimize the removal of healthy tooth structure, reduce patient discomfort, and improve the long-term prognosis of dental treatments suture internally without the need for large incisions.

The growing preference for these procedures has boosted the demand for dental matrix systems.

Owed to the above factors, the global dental matrix systems market is projected to grow at CAGR of 6.2% in forecasted period.

The rural population in some countries is often deprived of advanced medical techniques. There is an opportunity to educate this population pool and help them understand the necessity of oral hygiene and dental care.

Such approaches will create a chance for the market to grow even in those areas where the impact is low. This could be achieved by several approaches, one of which is communication through telehealth.

It would help support patients as well as address their needs and provide a chance to promote advanced products such as smart dental devices that are currently holding a better market position.

Cost-effective dental matrix products allow dental professionals to offer aesthetic restorations at a more affordable price. This accessibility attracts more patients seeking improved dental aesthetics, leading to an increased demand for dental matrix products.

The development of cost-effective and innovative dental matrices can be integrated into digital dentistry workflows, allowing for precise digital impressions and CAD/CAM fabrication.

This integration enhances the accuracy and efficiency of restorations, promoting superior aesthetic results. As healthcare infrastructure improves and economic conditions develop, the market for dental matrix systems in these regions is likely to expand.

Acquiring CAD/CAM equipment, such as intraoral scanners, design software, milling machines, and 3D printers, can be expensive. Smaller dental clinics or those on tight budgets may find it difficult to make such a large investment.

While digital dentistry has the potential to reduce material waste, the cost of CAD/CAM materials like blocks and milling discs can be higher than traditional restorative materials used with traditional dental matrices.

Dentists may select restorative materials and treatments based on dental matrix reimbursement rates.

Dentists may choose other materials if reimbursement for dental matrices is lower or does not match their actual costs, which affects demand for dental matrices. Uncertain reimbursement policies can create challenges for market growth.

Compliance with regulatory standards comes at a high cost to manufacturers. These costs can include clinical investigations, product testing, maintaining the quality management system, and ongoing compliance monitoring, potentially impacting market growth.

The USA occupies 26.9% of market share in 2025 globally. In the United States, there is a high demand for minimally invasive dentistry. Increasing tendency toward minimally invasive dentistry, and dental matrix systems are critical instruments in this strategy.

Further, dentists are increasingly using treatments that retain better tooth structure during restorative procedures.

The United States boasts one of the world's major dentistry industries. There is a high demand for dental matrix systems to support restorative operations because to the large number of dental practices, clinics, and dental professionals. As a result, the United States has emerged as the leading market for dental matrix systems in North America.

Japan is the second leading country within East Asia. The dental matrix systems market in Japan is set to grow at a high CAGR of 7.2% over the forecast period.

Japan is at the forefront of healthcare technological developments. The country places a high priority on research and development, which has resulted in the development of new dental matrix systems with sophisticated features. Japan is on the cutting edge of incorporating digital technologies into dentistry.

This involves the use of CAD/CAM systems, intraoral scanners, and 3D printing technologies, which are frequently combined with dental matrix systems to provide exact restorations.

In 2025, the China held a significant share in the East Asia dental matrix systems market and contributed around USD 15.8 Million.

The Chinese government has taken steps to improve healthcare services, particularly dental treatment. Subsidies or incentives for dental clinics to invest in new dental technologies, such as dental matrix systems, may be included in these efforts.

China has established dental product regulatory guidelines, including dental matrix systems. Dental producers must adhere to these quality standards in order to ensure the safety and efficacy of their products, providing dentists and patients confidence in their use.

By matrices, sectional dental matrix systems held 57.7% market share in world in 2025.

Sectional matrix systems are extremely adaptable and can be employed in a variety of restorative treatments, particularly Class II composite restorations.

They are appropriate for a wide range of tooth sizes and shapes, making them useful in a variety of therapeutic circumstances. Sectional matrices are simple to use and manipulate. Dentists save chairside time by quickly placing and adjusting the matrices for efficient restorations.

By material, steel held 46.5% market share in world in 2025. Steel dental matrices are flexible enough to adapt to different tooth shapes and sizes, allowing for versatility in their application. They can be shaped and adjusted to fit various clinical scenarios.

Steel dental matrices can be sterilized and reused multiple times, which adds to their cost-effectiveness. Proper sterilization procedures ensure that the dental matrix systems remains safe for use on different patients.

The market value of dental filling is USD 276.8 Million, representing a sizable 26.8% market share in 2025. Achieving proper marginal adaptation (fit) of the filling material to the tooth is crucial for preventing micro leakage and recurrent decay. The dental matrix systems ensures that the filling material is confined within the prepared cavity and does not extend beyond the tooth's margins.

The matrix system helps in controlling the flow and placement of the filling material, ensuring it is properly condensed and compacted to achieve maximum strength and longevity of the restoration.

The dental clinics have a considerable presence in the dental matrix systems market, accounting for 34.8% value share in 2025, and exhibiting a high CAGR of 5.2% over the forecast period. Dental clinics are prominent users of dental matrix systems.

These devices are commonly used in various surgical procedures performed within clinic settings, including dental fillings, gingival protection, dental sealing and dental aesthetic. As dental clinics strive to provide advanced medical care and meet patient needs, the demand for dental matrix systems is growing.

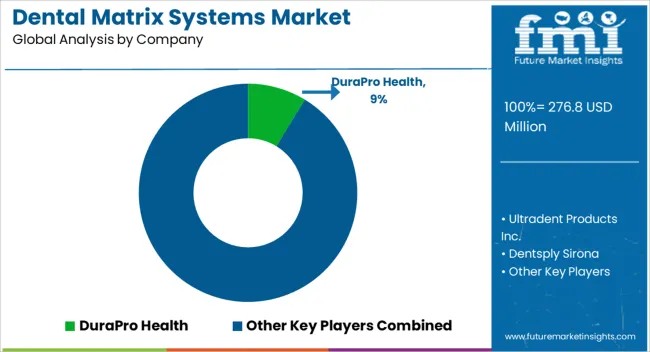

With several players manufacturing dental matrix systems, market has become highly competitive. To gain market share and edge over others, players are undertaking initiatives like acquisition of competitor firms and collaboration with healthcare institutes to develop innovative product lines

Similarly, recent developments related to the companies manufacturing the dental matrix systems have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value, Units for Volume |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Central Asia; Russia & Belarus; Balkan & Baltic Countries and Middle East and Africa (MEA) |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Peru, Chile, Columbia, China, Japan, South Korea, India, Indonesia, Philippines, Thailand, Malaysia, Vietnam, Australia & New Zealand, Germany, France, Spain, Italy, BENELUX, Nordic Countries, UK, Poland, Hungary, Romania, Czech Republic, GCC Countries, Türkiye, Northern Africa, South Africa, Israel and Kingdom of Saudi Arabia |

| Key Market Segments Covered | Matrices, Material, Application, Distribution Channel and Region |

| Key Companies Profiled | DuraPro Health; Ultradent Products Inc.; Dentsply Sirona; Safco Dental Supply LLC; Garrison Dental Solutions, LLC.; Premier Dental Co.; Young Innovations, Inc.; Medicom; Zest Dental Solutions; Pac-Dent, Inc.; Henry Schein Inc.; Clinician's Choice Dental Products Inc. |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Pricing | Available upon Request |

The global dental matrix systems market is estimated to be valued at USD 276.8 million in 2025.

The market size for the dental matrix systems market is projected to reach USD 492.1 million by 2035.

The dental matrix systems market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in dental matrix systems market are sectional dental matrix systems, _universal rings, _matrix bands, _anatomical wedges, circumferential dental matrix systems, _wide circumferential dental matrix, _narrow circumferential dental matrix and custom dental matrix systems.

In terms of material, steel segment to command 41.8% share in the dental matrix systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Dental Flap Surgery Market Size and Share Forecast Outlook 2025 to 2035

Dental Chairs Market Size and Share Forecast Outlook 2025 to 2035

Dental Units Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA