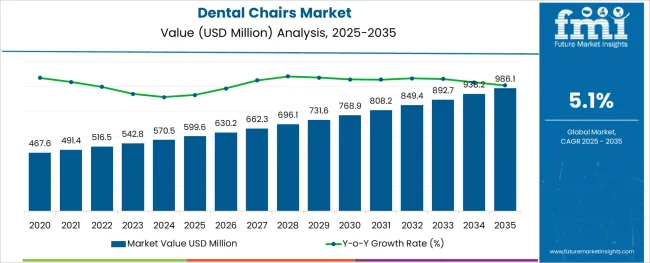

The Dental Chairs Market is estimated to be valued at USD 599.6 million in 2025 and is projected to reach USD 986.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

The dental chairs market is showing steady expansion as healthcare providers continue to modernize dental clinics and improve patient experience. Industry discussions and technology forums have emphasized the role of advanced dental chairs in supporting ergonomic treatment procedures and enhancing workflow efficiency. The growing demand for dental services across cosmetic, restorative, and surgical applications has driven the need for chairs that offer flexibility, comfort, and easy adjustability.

Technological advancements have made it possible to integrate dental chairs with lighting systems, patient positioning controls, and hygiene maintenance features. Additionally, rising dental tourism and growing healthcare infrastructure in emerging regions have contributed to market growth.

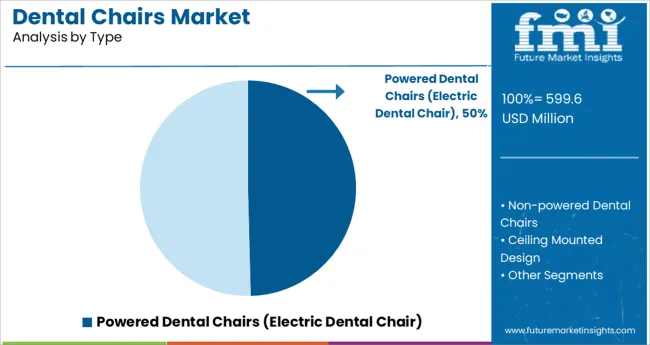

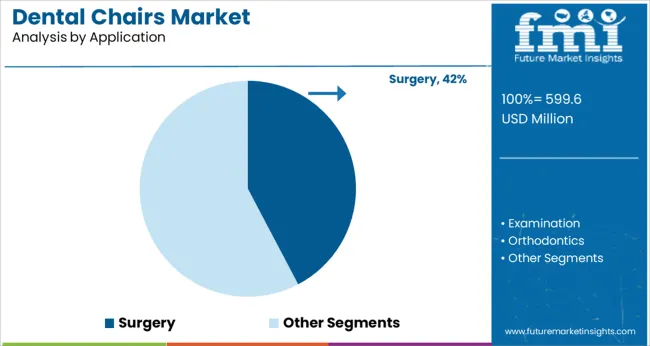

Looking ahead, the adoption of powered chairs and the increasing number of specialized dental procedures are expected to shape market dynamics. Segmental growth is projected to be led by Powered Dental Chairs in the type category and Surgery in the application segment as providers seek to improve treatment outcomes and patient comfort.

The market is segmented by Type and Application and region. By Type, the market is divided into Powered Dental Chairs (Electric Dental Chair), Non-powered Dental Chairs, Ceiling Mounted Design, Mobile Dental Chair, and Dental Chair-Mounted Design. In terms of Application, the market is classified into Surgery, Examination, Orthodontics, and Other Applications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Powered Dental Chairs segment is projected to contribute 49.6% of the dental chairs market revenue in 2025, maintaining its leadership among product types. This segment’s growth has been fueled by the need for greater efficiency and ergonomic support in modern dental clinics. Powered chairs have been widely adopted for their ease of adjustment, allowing dentists to position patients quickly and accurately during procedures.

These chairs are also preferred for their ability to reduce physical strain on practitioners, enhancing productivity during complex treatments. Patient comfort features such as memory foam cushioning and smooth reclining mechanisms have added to their appeal in both general and specialty practices.

As dental clinics increasingly focus on improving operational efficiency and patient satisfaction, the Powered Dental Chairs segment is expected to continue leading market demand.

The Surgery segment is expected to account for 42.3% of the dental chairs market revenue in 2025, reinforcing its status as the primary application area. Growth in this segment has been driven by the increasing number of complex dental surgeries, such as implants, maxillofacial procedures, and advanced periodontal treatments.

Dental practitioners have prioritized the use of chairs with enhanced stability and multi-positioning capabilities to ensure precision during surgical procedures. Additionally, the need for seamless integration with surgical lighting and suction systems has made surgery-grade dental chairs a critical part of clinical setups.

Patient safety and comfort during long surgical sessions have also been important factors supporting this segment’s growth. As dental clinics expand their surgical service offerings, the Surgery segment is expected to sustain strong demand for specialized dental chairs designed for procedural efficiency and comfort.

As per the latest industry analysis by Future Market Insights, a market research and competitive intelligence provider, global Dental Chairs consumption over the past half-decade increased at a CAGR of around 4.9%.

The Dental Chair Market was valued at roughly USD 467.6 Million in 2020, and it is expected to grow at a rate of around 5.1% from 2025 to 2035.

The use of Dentist Chairs has grown in popularity with the advancement in technology. The contemporary dental chairs have unrivaled features that allow both the doctor and the patient to operate and relax comfortably during the procedure.

Dual-position touchpad controls on both sides of the top backrest have recently been added for convenient access. The dual touchpad controllers include the choice of a unit-mounted touchpad, wireless foot control, and a remote wireless touchpad.

As more sophisticated features become available, the dental chairs demand is projected to grow.

Periodontal disease, often known as gum disease, is a prevalent dental issue in the elderly. According to the United Nations, there were 467.6 Million people aged 65 and more in 2020, with the number expected to quadruple to 1.5 Billion by 2050.

The growing senior population is predicted to boost demand for dental chairs for periodontal and gum disease diagnosis and treatment.

The dental equipment market size is expected to expand at a swift pace. Furthermore, expanding healthcare infrastructure is expected to contribute to market development during the projection period. Because of the COVID-19 epidemic, several dental procedures had to be rescheduled, thus lowering the businesses' revenue.

The increased need for patient comfort during treatments is driving the product demand, consequently triggering the growth of the dental chair market. As a consequence, significant developments in dental chairs are being made in order to provide patients with the most comfort possible during operations. Dental Chairs, as well as the placement of the light, may now be customized to match the requirements of both the patient and the surgeon.

The increase in the incidence of oral issues is expected to assist company development in the forthcoming years. Oral health issues are among the most frequent noncommunicable illnesses, impacting a sizable proportion of the global population.

The greater acceptance of poor food habits, poor brushing practices, smoking, and fluoride exposure may all contribute to the rising incidence of these illnesses. Furthermore, many people across the globe, especially in developing nations, have untreated oral health concerns. The epidemiology and usefulness of oral treatment are of national relevance in several nations.

Besides, in the years to come the demand for portable dental chairs is expected to surge. Sales of portable dental chairs is being driven by the surge in requirement for flexibility in work procedures. Alongside, the growing number of elongated dental procedures has led to the surge in demand for dental assistant chairs and dental stools.

COVID-19 patients and emergency services were the only ones who could access healthcare services and staff, influencing elective medical operations. Dentistry was one of the healthcare activities affected due to its elective nature, and certain dental procedures were suspended.

Public organizations such as the American Dental Association (ADA), Centers for Disease Control and Prevention (CDC), and the British Dental Association, among others, developed guidelines.

These guidelines and recommendations are concentrated on only dealing with emergency surgeries and postponing non-emergent medical treatments, which impeded the acceptance of dental Chairs and the growth of the sector in the early phases of the pandemic.

According to research studies, there has been a considerable decrease in patient volume in dental offices throughout the globe.

Due to enforced constraints and limitations, dentistry faced an unprecedented problem in offering elective dental care. In the United States, the majority of states restricted visits to dental clinics by deferring elective operations and only offering access to emergency care.

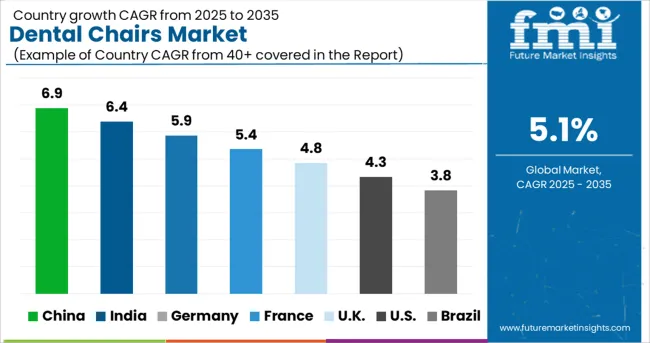

North America dominated the dental chairs market with a revenue share of more than 35.0% in 2024, owing to increased demand for dental chairs due to the strong consumer knowledge about the efficacy of the therapeutic application with dedicated dental chairs.

Furthermore, growth in the number of dental practitioners and clinics is predicted to boost the business in the USA Increased partnerships and collaborations among key market players are further expected to drive industry development.

The market in Asia Pacific is expected to rise at a rapid pace during the projected period, owing to growing awareness of oral health and an increase in the number of cosmetic procedures.

During the projected period, the adoption of technology such as CAD/CAM for dental restoration techniques is likely to promote market development.

The ceiling-mounted design accounted for almost 35% of total dental chair market, in 2024.

It can be attributed to its ability to reduce neck strain caused by prolonged durations of looking down on patients. Its features, such as dental cuspidors, dental handpieces, and a dental chair light, make them an appropriate option. Such advantages and benefits are projected to boost the segment's growth.

Due to the benefits of dental chair-mounted design, such as increased mobility and ease of maintenance, the category is expected to develop significantly throughout the projected period. These chairs are comfortable and make work simpler and more efficient, therefore its popularity is expected to grow. Besides, the demand for powered dental chairs is also on rise.

The demand for dental chairs for examination and treatment is expected to surge in the forthcoming years. Due to the improved oral hygiene awareness, the examination application earned the largest value share of more than 25% in 2024.

According to the Academy of Implant Dentistry, by the year 2025, more than 30 Million Americans will be missing all of their teeth in at least one jaw. Many individuals suffer from poor oral health.

Dental disorders are growing more widespread, needing more diagnosis and treatment, which increases demand for dental Chairs, accelerating the segment's growth.

Besides, dental chair demand through cosmetic procedures is also gaining significant traction. The high need for cosmetic dental surgery, along with increased aesthetic awareness, is likely to drive demand for cosmetic dental procedures, propelling the market ahead.

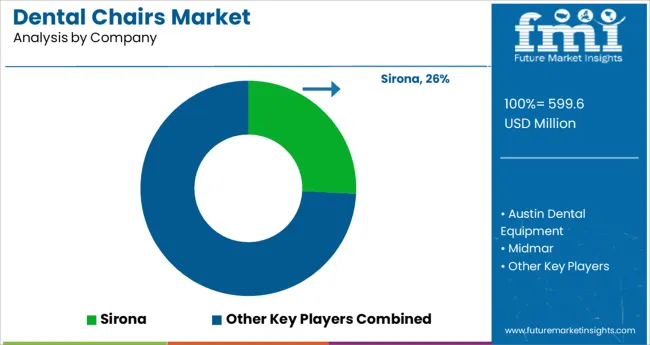

The global dental chairs market is fragmented and tremendously competitive for major competitors. To retain their positions, key market actors are emphasizing the quality of their products while releasing new things more often.

Existing technology advancements, product development and launches, and public awareness campaigns all contribute to a more competitive climate. Some of the most well-known players in the global dental Chairs industry are as follows: Austin Dental Equipment Company (A-Dec, Inc.), Midmark, Craftsmaster Contour Equipment, Inc., XO CARE A/S, and Sirona are among the companies involved.

The global dental chairs market is estimated to be valued at USD 599.6 million in 2025.

It is projected to reach USD 986.1 million by 2035.

The market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types are powered dental chairs (electric dental chair), non-powered dental chairs, ceiling mounted design, mobile dental chair and dental chair-mounted design.

surgery segment is expected to dominate with a 42.3% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Repair Membranes for Implant Procedures Market Size and Share Forecast Outlook 2025 to 2035

Dental Cavity Filling Materials Market Size and Share Forecast Outlook 2025 to 2035

Dental Implant and Prosthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA