The dental cavity filling materials market is valued at USD 2.4 billion in 2025 and is forecasted to reach USD 3.5 billion by 2035, registering a CAGR of 3.7%. Demand for dental cavity filling materials is influenced by rising global prevalence of dental caries, increasing awareness of oral health, and consistent demand for restorative dentistry procedures. Advancements in biomaterials, improvements in adhesive bonding, and growing availability of chairside restorative solutions are also shaping the development of new cavity-filling options across dental practices and clinics.

Amalgam remains the leading material type due to its durability, strength, and long-established clinical reliability in posterior restorations. Gradual shifts toward resin composites, glass ionomers, and ceramic-based alternatives are evident as patients and dental professionals increasingly favor aesthetic restorations and minimally invasive techniques. Innovation in light-curing composites and bioactive materials continues to improve handling properties, wear resistance, and patient comfort.

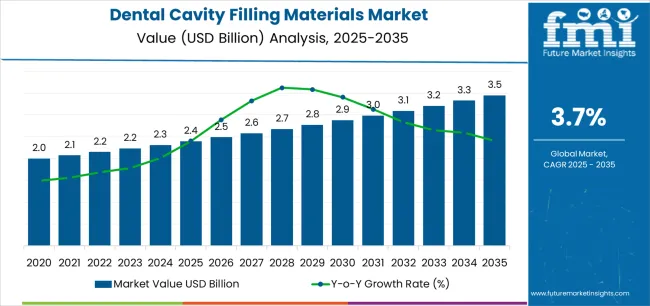

The dental cavity filling materials market shows a steady S-curve growth pattern from 2025 to 2035, reflecting stable expansion supported by rising dental restoration demand and material innovation. The market value is expected to rise from USD 2.4 billion in 2025 to USD 3.5 billion by 2035, indicating gradual but consistent adoption across both developed and emerging economies. The early growth phase (2025–2028) will be marked by increasing replacement of amalgam fillings with composite resins and glass ionomer materials that provide improved biocompatibility and appearance. Expanding dental care access and awareness of restorative procedures will sustain this upward trend.

Between 2028 and 2035, the market is projected to reach its accelerated phase as dental professionals adopt advanced materials such as nanohybrid composites and bioactive fillers designed to enhance tooth remineralization. Growth will then begin to stabilize in mature regions as market penetration levels off, with ongoing demand driven by technological updates and periodic restoration replacements. The curve’s shape indicates a stable and sustainable trajectory, supported by continued advancements in minimally invasive dentistry, global oral health initiatives, and ongoing material research that strengthens the long-term relevance of dental filling solutions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.4 billion |

| Market Forecast Value (2035) | USD 3.5 billion |

| Forecast CAGR (2025-2035) | 3.7% |

The dental cavity filling materials market is expanding thanks to a rising incidence of dental caries and tooth decay globally, which increases demand for restorative treatments. The ageing population and increasing sugar consumption contribute to higher rates of cavities, leading dentists to deploy filling materials more frequently. Technological advances in material science, such as improved adhesive systems, bio-active composites, and glass-ionomer cements, enhance durability, aesthetics and biocompatibility, making these options more attractive in restorative dentistry. The growing preference for tooth-coloured and minimally invasive fillings in cosmetic dental practice also boosts adoption of newer materials over traditional amalgam.

Better access to dental care in emerging markets and enhanced awareness of oral hygiene lead to more restorative visits and material usage. At the same time, regulatory pressure on mercury-based amalgams and healthcare reimbursement improvements support shift toward modern filling solutions. Constraints for the market include cost pressures in low-income regions, variable dental practice infrastructure, and competition from preventive or non-filling therapies that may reduce volumes of traditional cavity restoration.

The dental cavity filling materials market is segmented by classification and application. By classification, the market is divided into amalgam, composite resin, and other restorative materials. Based on application, the market is categorized into hospitals and dental clinics. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

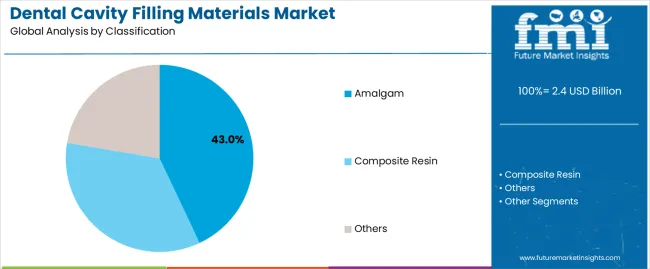

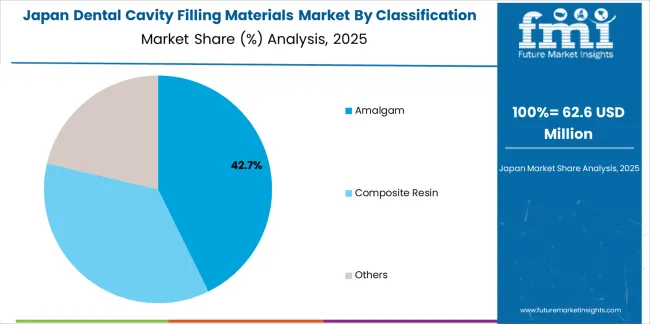

The amalgam segment holds the leading position in the dental cavity filling materials market, representing approximately 43.0% of the total share in 2025. Dental amalgam has been widely used for decades due to its proven strength, durability, and cost efficiency in restorative dental procedures. Its metallic composition, typically a blend of mercury, silver, tin, and copper, provides excellent load-bearing capacity and long-term resistance to wear, making it suitable for posterior teeth restorations where high mechanical performance is required.

Despite the increasing adoption of aesthetic alternatives such as composite resins, amalgam remains prevalent in public health systems and developing markets because of its lower cost, straightforward handling, and reduced sensitivity to moisture during placement. Composite resins, while expanding in use, face limitations related to polymerization shrinkage and long-term wear resistance compared to metallic restoratives. Other filling materials, including glass ionomer and ceramic composites, occupy niche applications requiring specific bonding or fluoride-releasing properties.

Key factors supporting the amalgam segment include:

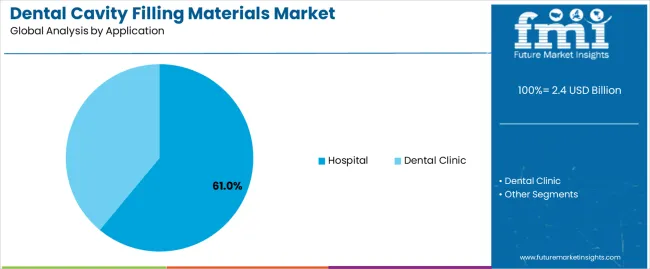

The hospital segment accounts for approximately 61.0% of the dental cavity filling materials market in 2025. Hospitals maintain a significant share due to their role as primary centers for comprehensive dental treatment, emergency care, and specialized restorative procedures. Institutional procurement systems favor standardized materials like amalgam for consistency, quality control, and cost management. Hospital-based dental departments handle complex cases, including multi-surface restorations and full-mouth rehabilitations, requiring high-volume use of filling materials.

Dental clinics represent a growing secondary segment, driven by rising awareness of cosmetic dentistry, aesthetic restorations, and advanced resin-based filling procedures. This category continues to expand with the increasing preference for private practice care and minimally invasive treatment methods.

Primary factors driving hospital-based demand include:

Growing prevalence of dental caries, rising aesthetic dentistry demand, and technological innovation are boosting adoption.

The dental cavity filling materials market is driven by increasing global prevalence of dental caries, linked to dietary habits and aging populations. Growing awareness of oral hygiene and access to dental care are increasing the volume of restorative treatments. Demand for aesthetic, tooth-colored fillings is expanding rapidly, especially among younger demographics seeking natural appearance restorations. Technological innovation in composite resins, glass ionomer cements, and nanohybrid materials enhances bonding strength, durability, and wear resistance. These developments, combined with the adoption of minimally invasive techniques and improved dental adhesives, are fueling constant market expansion in both developed and emerging regions.

Limited reimbursement, stringent regulatory requirements, and competition from preventive care slow market expansion.

High treatment costs and limited reimbursement for restorative dental procedures hinder the widespread adoption of advanced filling materials. Many developing economies lack comprehensive insurance coverage, resulting in patient reluctance to opt for premium restorative options. Regulatory processes for dental materials, including safety, biocompatibility, and long-term performance testing, extend product development timelines and increase manufacturing costs. Furthermore, the growing global focus on preventive dentistry and early intervention strategies, such as fluoride treatments and sealants, reduces the demand for cavity restorations. These economic and structural barriers collectively slow the market’s scalability and limit penetration, particularly in low- and middle-income countries.

Integration of smart biomaterials, growth in emerging regions, and shift toward direct-tooth restorations define market direction.

Emerging trends emphasize the development of smart, bioactive filling materials capable of releasing fluoride and promoting natural enamel remineralization. Advances in nanotechnology and digital dentistry, including CAD/CAM-enabled restorations, enhance treatment precision and longevity. The market is expanding significantly in Asia-Pacific and Latin America, driven by increasing disposable income, dental tourism, and expanding clinical infrastructure. Dental professionals are shifting toward direct, single-visit restorations due to reduced chair time and higher patient satisfaction. Integration of digital workflows, green materials, and minimally invasive restorative methods is shaping the market’s evolution toward efficient, aesthetic, and biologically responsive dental solutions.

| Country | CAGR (%) |

|---|---|

| China | 5.0 |

| India | 4.6 |

| Germany | 4.3 |

| Brazil | 3.9 |

| USA | 3.5 |

| UK | 3.1 |

| Japan | 2.8 |

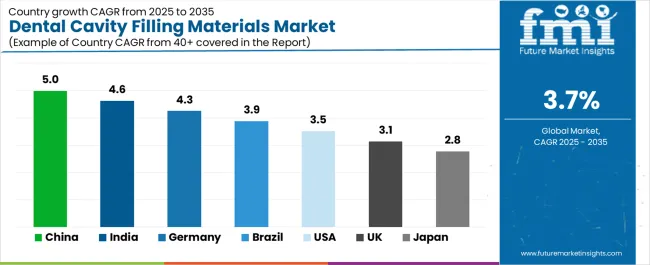

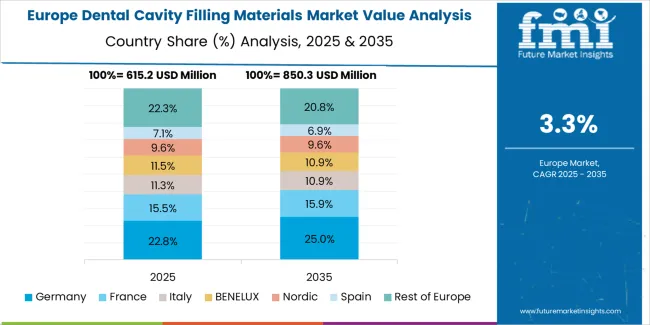

The global dental cavity filling materials market continues to expand through 2035, supported by rising oral healthcare awareness, improved access to dental treatments, and continuous innovation in biocompatible restorative materials. China leads with a 5.0% CAGR, followed by India at 4.6%, reflecting growing healthcare infrastructure and patient demand. Germany grows at 4.3%, driven by advanced dental technologies and material research, while Brazil records 3.9% due to expanding private dental practices. The United States shows steady growth at 3.5%, aligned with innovation in composite materials. The United Kingdom and Japan, at 3.1% and 2.8%, maintain stable expansion through modernization of dental care systems and clinical standards.

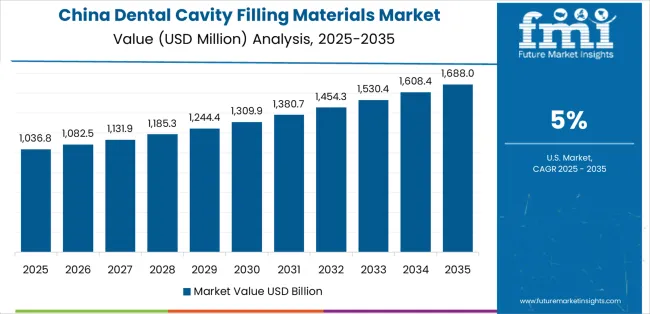

China’s dental cavity filling materials market grows at 5.0% CAGR, supported by expanding healthcare infrastructure and increased focus on preventive dentistry. Government-led oral health programs have boosted public awareness, encouraging demand for restorative procedures. Domestic manufacturers are developing resin-based and glass ionomer materials with enhanced durability and aesthetics. Hospitals and private dental clinics in major cities are integrating advanced filling materials into treatment protocols. Ongoing foreign investments and research collaborations are facilitating knowledge transfer and product innovation. The market benefits from expanding urban dental networks and growing insurance coverage for restorative dental procedures.

Key Market Factors:

India records 4.6% CAGR, driven by rising dental awareness, urbanization, and expansion of private dental care infrastructure. The government’s oral health programs and public hospital initiatives have increased access to restorative dentistry. Domestic manufacturers are introducing affordable glass ionomer cements and light-cured composites suited for diverse patient needs. Growing middle-class expenditure on dental aesthetics has increased demand for tooth-colored filling materials. Academic dental institutions are collaborating with material science firms to improve the strength and biocompatibility of restorative products. The adoption of advanced filling technologies is expanding across metro and semi-urban clinics.

Market Development Factors:

Germany’s market grows at 4.3% CAGR, supported by high dental care standards and strong research activity in material sciences. The country’s regulatory environment promotes the use of biocompatible and mercury-free dental filling materials. German manufacturers are pioneering nanocomposite formulations to enhance durability and optical performance. Integration of CAD/CAM systems in dental laboratories is driving demand for compatible restorative materials. Continuous collaboration between universities, dental research institutes, and private firms supports innovation in resin composites and glass ionomer cements. The country’s established dental insurance coverage ensures stable consumption of restorative materials across clinical practices.

Key Market Characteristics:

Brazil’s dental cavity filling materials market grows at 3.9% CAGR, supported by the country’s extensive dental care infrastructure and global reputation for dental tourism. Increased adoption of resin-based and glass ionomer fillings in private clinics has driven steady demand. Public healthcare programs are expanding coverage for restorative dentistry, especially in urban centers. Domestic manufacturers are focusing on cost-effective materials compatible with international quality standards. Rising education and awareness in oral hygiene have improved patient visits to dental clinics. Ongoing trade partnerships are also strengthening the availability of imported dental restoration products in major markets.

Market Development Factors:

The USA dental cavity filling materials market grows at 3.5% CAGR, supported by strong R&D in bioactive and nanocomposite materials. The market benefits from advanced clinical adoption of tooth-colored resin-based composites replacing traditional amalgam fillings. Dental material manufacturers are focusing on developing products with superior strength and reduced shrinkage. The country’s regulatory alignment with mercury-free restoration standards has accelerated innovation. Growing demand for cosmetic and minimally invasive dentistry supports market stability. Collaboration between universities, research institutes, and dental firms continues to expand applications in high-performance restorative materials.

Key Market Factors:

The UK market grows at 3.1% CAGR, driven by modernization of dental clinics and regulatory focus on patient safety. National Health Service (NHS) policies promote mercury-free restorative materials, encouraging widespread use of glass ionomer and composite fillings. Dental schools and research centers are developing new polymer blends for improved adhesion and longevity. Increased private sector participation and dental insurance expansion are improving accessibility to restorative procedures. Integration of chairside curing technologies and CAD/CAM systems in dental laboratories is enhancing workflow efficiency. Market growth is supported by the country’s consistent oral healthcare reforms and patient-centric dental programs.

Market Characteristics:

Japan’s market grows at 2.8% CAGR, reflecting gradual adoption of advanced restorative materials in a mature dental care system. The country’s focus on minimally invasive dentistry and patient comfort supports use of nanocomposites and hybrid glass ionomer cements. Domestic manufacturers are producing high-strength, fluoride-releasing materials designed for long-term restoration. Universities and material research institutes collaborate to improve biocompatibility and reduce polymerization shrinkage. Aging population demographics maintain demand for restorative procedures. Consistent quality standards and technological innovation ensure Japan’s continued role as a hub for dental material precision manufacturing.

Market Development Factors:

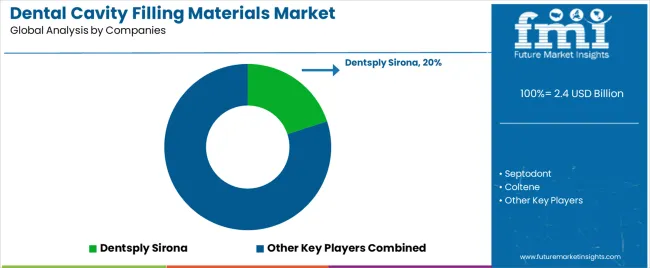

The dental cavity filling materials market is moderately consolidated, with around a dozen established manufacturers active across restorative dentistry segments. Dentsply Sirona leads the market with an estimated 20.0% global share, supported by its extensive range of composite resins, glass ionomer cements, and amalgam alternatives. Its leadership is sustained through consistent innovation in dental material chemistry, clinical performance validation, and strong global distribution channels within professional dentistry.

Septodont, Coltene, and Ivoclar Vivadent follow as major competitors, each focusing on specialized restorative formulations and regionally adapted product portfolios. 3M and Danaher leverage advanced R&D platforms to integrate nanotechnology and biocompatible resin systems, enabling durable, aesthetically consistent restorations. GC Corporation, Heraeus Kulzer, and Shofu maintain balanced global operations, offering clinically proven, high-performance materials tailored for both private practices and institutional dental care.

Mid-tier producers such as VOCO GmbH, Ultradent, and DMG Dental compete through innovation in light-curing composites and simplified handling systems aimed at procedural efficiency. Their competitive position benefits from targeted marketing in high-volume dental markets across Europe and North America.

Competition in this market centers on material durability, aesthetic performance, and regulatory compliance rather than price competition. Continuous product innovation, clinician training, and adherence to international safety standards remain key to maintaining market share as dental professionals increasingly adopt advanced, minimally invasive restorative solutions.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Classification | Amalgam, Composite Resin, Others |

| Application | Hospital, Dental Clinic |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Dentsply Sirona, Septodont, Coltene, Angelus Odontologia, Ivoclar Vivadent, 3M, Danaher, GC Corporation, Heraeus Kulzer, Shofu, VOCO GmbH, Ultradent, DMG Dental |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of dental material manufacturers; advancements in composite resin formulations and mercury-free alternatives; integration with modern restorative dentistry technologies and equipment. |

The global dental cavity filling materials market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the dental cavity filling materials market is projected to reach USD 3.5 billion by 2035.

The dental cavity filling materials market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in dental cavity filling materials market are amalgam, composite resin and others.

In terms of application, hospital segment to command 61.0% share in the dental cavity filling materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Implant and Prosthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA