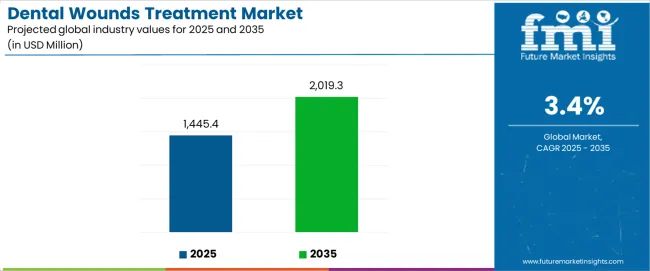

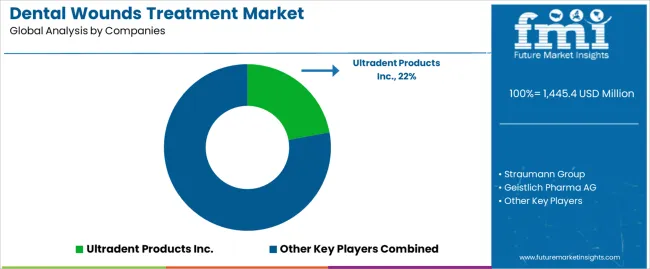

The global dental wounds treatment market, valued at USD 1,445.4 million in 2025, is expected to expand to USD 2,019.3 million by 2035, at a CAGR of 3.4% and reflecting an absolute increase of USD 573.9 million over the forecast period. The progression represents a steady growth trajectory, underpinned by rising incidences of dental surgeries, oral injuries, and periodontal procedures that require effective wound healing interventions. A key dynamic shaping this expansion is the growing patient awareness regarding oral care and the critical role of wound management in reducing complications, improving recovery time, and minimizing risks of infection. The adoption of innovative products such as antimicrobial dressings, bioactive gels, and absorbable wound closure materials is becoming increasingly prominent as both patients and practitioners demand faster healing and improved comfort. Hospitals, dental clinics, and ambulatory care centers are focusing on advanced treatment modalities to support better patient outcomes, which enhances overall product penetration. Cost efficiency and insurance coverage play a central role in driving accessibility, while premium solutions are gaining ground in developed economies due to higher consumer spending power and expectations for minimally invasive, pain-reducing treatment methods.

On the supply side, manufacturers are directing research efforts toward biocompatible and regenerative wound care solutions that integrate with natural tissue recovery processes. This has led to the introduction of collagen-based products, platelet-rich plasma treatments, and medicated gels, which promise better efficacy and shorter healing durations. Pharmaceutical players are strengthening their distribution networks and entering partnerships with dental care providers to ensure stronger market presence across urban and semi-urban regions. However, price sensitivity in emerging economies continues to challenge premium adoption, driving a dual-market structure where cost-effective, conventional wound dressings coexist with advanced treatment technologies. Regulatory compliance and clinical validation also significantly influence product success, as markets require rigorous safety and performance benchmarks before widespread adoption.

From a demand perspective, the increasing prevalence of lifestyle-related oral health issues, such as tooth decay, gum diseases, and implant procedures, creates consistent requirements for wound treatment. Rising dental tourism, especially in regions like Asia and Latin America, contributes to increased procedural volume, indirectly expanding the addressable market for wound care solutions. The emphasis on personalized oral care and the use of digital dentistry techniques, such as guided implantology, has also generated demand for specialized wound treatment products compatible with precision-based procedures. Market dynamics are further influenced by demographic shifts, with aging populations creating higher susceptibility to complex dental interventions and postoperative care needs.

The overall trajectory of the dental wounds treatment market indicates stable, incremental growth with balanced contributions from technological progress, clinical adoption, and patient-driven demand. While growth rates remain moderate compared to high-intensity healthcare segments, the dental wounds treatment market demonstrates resilience by serving as an indispensable component of dental practice. Over the coming decade, product differentiation, integration of regenerative medicine, and affordability will be decisive factors shaping competitiveness and long-term profitability for participants in this sector.

Between 2025 and 2030, the dental wounds treatment market is projected to expand from USD 1,445.4 million to USD 1,732.3 million, resulting in a value increase of USD 286.9 million, which represents approximately 50% of the total forecast growth for the decade. This phase of growth will be shaped by the rising prevalence of dental procedures, increasing awareness about post-operative wound care, and growing adoption of advanced wound healing products. Healthcare providers are expanding their wound care protocols to address the growing complexity of modern dental and surgical procedures.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,445.4 million |

| Forecast Value in (2035F) | USD 2,019.3 million |

| Forecast CAGR (2025 to 2035) | 3.4% |

Between 2025 and 2030, the Dental Wounds Treatment Market is projected to expand from USD 1,445.4 million to USD 1,732.3 million, resulting in a value increase of USD 286.9 million, which represents approximately 50% of the total forecast growth for the decade. This phase of growth will be shaped by rising prevalence of dental procedures, increasing awareness about post-operative wound care, and growing adoption of advanced wound healing products. Healthcare providers are expanding their wound care protocols to address the growing complexity of modern dental surgical procedures.

From 2030 to 2035, the dental wounds treatment market is forecast to grow from USD 1,732.3 million to USD 2,019.3 million, adding another USD 287.0 million, which constitutes the remaining 50% of the ten-year expansion. This period is expected to be characterized by the introduction of advanced wound healing formulations, integration of bioactive materials, and development of specialized products for different types of dental wounds. The growing adoption of minimally invasive dental procedures will drive demand for more sophisticated wound care solutions and specialized therapeutic products.

Between 2020 and 2025, the dental wounds treatment market experienced steady expansion, driven by increasing dental surgery volumes and growing awareness of proper wound management following oral procedures. The dental wounds treatment market developed as dental professionals recognized the need for specialized wound care products to ensure optimal healing outcomes and reduce post-operative complications. Insurance providers and dental institutions began emphasizing proper wound care protocols to maintain treatment success rates and patient satisfaction.

Market expansion is being supported by the rapid increase in dental procedures worldwide and the corresponding need for specialized wound care products following extractions, implants, periodontal surgery, and other oral interventions. Modern dental practice relies on precise wound management to ensure proper healing of surgical sites including extraction sockets, implant placement areas, and periodontal surgical sites. Even minor dental procedures can require comprehensive wound care to maintain optimal healing conditions and prevent complications.

The growing complexity of dental procedures and increasing liability concerns are driving demand for professional-grade wound care products from certified manufacturers with appropriate safety profiles and clinical evidence. Insurance companies are increasingly requiring proper wound care documentation following procedures to maintain coverage and ensure treatment success. Regulatory requirements and professional guidelines are establishing standardized wound care protocols that require specialized products and trained dental personnel.

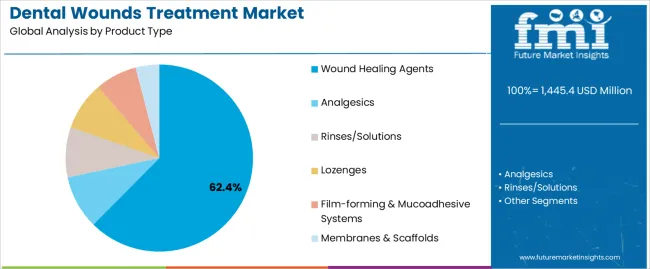

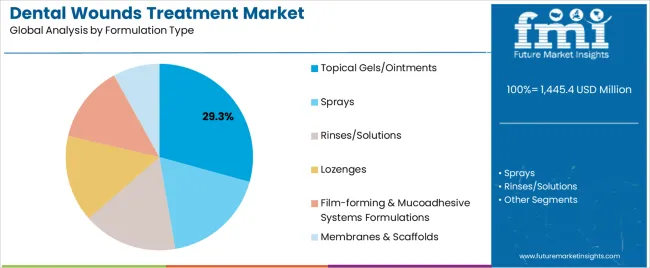

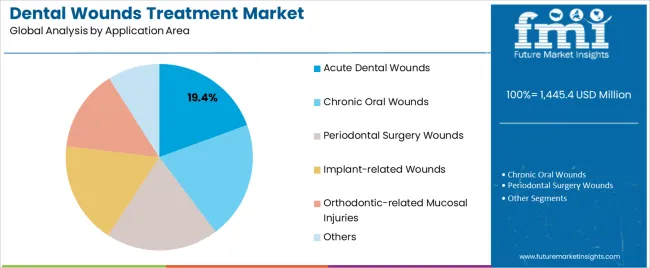

The dental wounds treatment market is segmented by product type, formulation type, application area, sales channel, and region. By product type, the dental wounds treatment market is divided into wound healing agents, analgesics, rinses/solutions, lozenges, film-forming and mucoadhesive systems, and membranes and scaffolds. Based on formulation type, the dental wounds treatment market is categorized into topical gels/ointments, sprays, rinses/solutions, lozenges, film-forming and mucoadhesive systems formulations, and membranes and scaffolds. In terms of application area, the dental wounds treatment market is segmented into acute dental wounds, chronic oral wounds, periodontal surgery wounds, implant-related wounds, orthodontic-related mucosal injuries, and others. By sales channel, the dental wounds treatment market is classified into hospital pharmacies, retail/pharmacy sales, online/e-commerce, clinic pharmacies, and group dental practices. Regionally, the dental wounds treatment market is divided into North America, Europe, East Asia, South Asia and Pacific, Latin America, and the Middle East and Africa.

Wound healing agents are projected to account for 62.4% of the Dental Wounds Treatment Market in 2025. This leading share is supported by the widespread use of these products for accelerating healing in various types of dental wounds, which represent the majority of current oral surgical procedures. Wound healing agents provide active therapeutic intervention using specialized formulations and growth factors, making them the preferred choice for most post-surgical dental care. The segment benefits from established clinical protocols and comprehensive product availability from multiple pharmaceutical suppliers.

Topical gels and ointments are expected to represent 29.3% of dental wound formulation demand in 2025. This significant share reflects the ease of application and sustained contact time that gel-based formulations provide for oral wound sites. Modern topical gels feature multiple active ingredients that provide coordinated therapeutic action following dental procedures or injuries. The segment benefits from growing practitioner preference for controlled-release formulations and increasing patient acceptance of topical wound care protocols.

Acute dental wounds are projected to contribute 19.4% of the dental wounds treatment market in 2025, representing immediate post-procedural wound care needs following dental interventions. These applications include extraction sites, surgical incisions, and traumatic oral injuries requiring immediate therapeutic intervention. Acute wound care typically involves multiple product types and standardized treatment protocols. The segment is supported by growing volume of dental procedures and emphasis on optimal immediate post-operative care.

Hospital pharmacies are estimated to hold 41.9% of the dental wounds treatment market share in 2025. This dominance reflects the institutional nature of many dental procedures and hospital-based oral surgery services. Hospital pharmacies typically maintain comprehensive inventories of specialized dental wound care products and support complex treatment protocols. The channel provides professional oversight and standardized dispensing procedures that ensure appropriate product selection and patient compliance.

The dental wound treatment market is advancing steadily due to increasing dental procedure volumes and growing recognition of the importance of specialized wound care. However, the dental wounds treatment market faces challenges, including varying product costs, the need for continuous training on new therapeutic approaches, and differing treatment protocols across dental specialties. Standardization efforts and evidence-based treatment guidelines continue to influence product adoption and market development patterns.

The growing development of advanced wound healing formulations is enabling more effective treatment of complex dental wound conditions, periodontal surgical sites, and implant placement areas. Advanced formulations incorporating bioactive compounds provide enhanced healing outcomes and reduced recovery time for patients while expanding therapeutic options. These products are particularly valuable for complex oral surgery cases and patients with compromised healing capacity that require specialized therapeutic intervention without extended treatment periods.

Modern dental wound care products are incorporating bioactive materials and regenerative components that improve healing outcomes and reduce treatment time. Integration of growth factors, biocompatible scaffolds, and controlled-release systems enables more precise therapeutic intervention and comprehensive wound management. Advanced materials also support treatment of challenging wound types including extraction sites with compromised bone, periodontal defects, and implant-related complications.

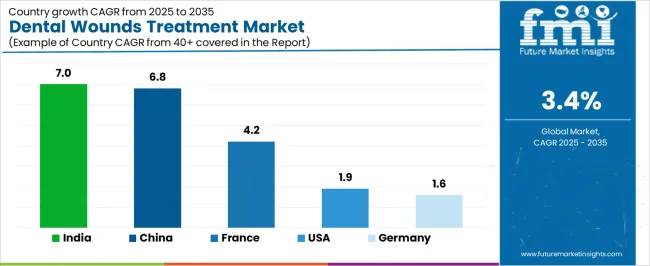

| Country | CAGR (2025–2035) |

|---|---|

| China | 6.8% |

| India | 7.0% |

| France | 4.2% |

| Germany | 1.6% |

| United States | 1.9% |

Revenue from dental wounds treatment in China is projected to exhibit strong growth rate with a CAGR of 6.8% through 2035, driven by rapid expansion of dental healthcare services and increasing consumer awareness of post-procedural wound care. The country's growing dental tourism industry and modernizing oral healthcare infrastructure are creating significant demand for specialized wound care products. Major pharmaceutical companies and dental suppliers are establishing comprehensive distribution networks to support the growing population seeking advanced dental treatments across urban and rural markets.

Government healthcare modernization programs are supporting development of specialized dental care facilities and standardized wound care protocols that enhance treatment outcomes and reduce complications throughout major metropolitan areas. Healthcare industry expansion initiatives are facilitating adoption of international-standard wound care products and training programs that enhance therapeutic capabilities and clinical expertise across dental networks. Advanced wound care protocols are being integrated into dental education curricula, ensuring future practitioners understand optimal wound management approaches and product selection strategies.

Demand for dental wounds treatment in India is expanding at a CAGR of 7.0%, supported by increasing dental healthcare penetration and growing awareness of specialized wound care requirements. The country's expanding middle class and increasing healthcare spending are driving demand for quality dental services and associated wound care products. Dental colleges and specialized treatment centers are gradually establishing capabilities to support modern wound care protocols and therapeutic approaches.

Healthcare infrastructure development and dental education expansion are creating opportunities for specialized wound care product suppliers that can support diverse treatment protocols and practitioner requirements. Professional training and certification programs are developing clinical expertise among dental practitioners, enabling comprehensive wound care services that meet international quality standards and patient expectations nationwide. Modern dental facilities are incorporating advanced wound care protocols that optimize healing outcomes and reduce post-operative complications across diverse patient populations.

Revenue from dental wounds treatment in France is growing at a CAGR of 4.2%, driven by comprehensive healthcare coverage and established dental care infrastructure supporting specialized wound management protocols. The country's advanced dental education system and regulatory framework facilitate adoption of innovative wound care products and evidence-based treatment approaches. Hospital-based oral surgery departments and specialized dental clinics are investing in comprehensive wound care capabilities to serve complex case requirements.

Healthcare system modernization is facilitating integration of advanced wound care technologies that support optimal healing outcomes across diverse dental procedure types and patient demographics. Professional development programs are enhancing clinical capabilities among dental practitioners, enabling specialized wound care services that address evolving patient needs and treatment complexity throughout regional healthcare networks. Advanced therapeutic protocols are being standardized across institutional networks to ensure consistent treatment quality and optimal patient outcomes.

Demand for dental wounds treatment in Germany is projected to grow at a CAGR of 1.6%, supported by the country's emphasis on clinical precision and evidence-based wound care protocols. German dental institutions are implementing comprehensive wound care capabilities that meet rigorous quality standards and regulatory requirements. The dental wounds treatment market is characterized by focus on therapeutic innovation, advanced product integration, and compliance with comprehensive healthcare safety regulations.

Dental care industry investments are prioritizing advanced wound care technologies that demonstrate superior clinical outcomes and reliability while meeting German healthcare quality and safety standards. Professional certification programs are ensuring comprehensive clinical expertise among practitioners, enabling specialized wound care services that support diverse therapeutic protocols and patient requirements throughout the healthcare system. Clinical research initiatives continue advancing wound care science and therapeutic approaches that optimize healing outcomes and reduce treatment complications.

Demand for dental wounds treatment in the USA is expanding at a CAGR of 1.9%, driven by advanced dental care infrastructure and emphasis on evidence-based wound management protocols. Large dental service organizations and specialized oral surgery practices are establishing comprehensive wound care capabilities to serve diverse patient populations. The dental wounds treatment market benefits from insurance coverage requirements for appropriate wound care and regulatory oversight, ensuring treatment quality and safety standards.

Dental care industry consolidation is enabling standardized wound care protocols across multiple practice locations, providing consistent treatment quality and comprehensive coverage throughout regional markets. Professional education and certification programs are developing specialized clinical expertise among practitioners, enabling comprehensive wound care capabilities that support advancing therapeutic requirements and patient expectations across diverse demographic segments.

The dental wounds treatment market in Europe is projected to grow from USD 426.7 million in 2025 to USD 583.4 million by 2035, registering a CAGR of 3.2% over the forecast period. Germany is expected to maintain its leadership with 22.9% market share in both 2025 and 2035, supported by its expansive dental care infrastructure and advanced oral surgery networks.

France is projected to gain ground, expanding its share from 18.1% to 23.2%, attributed to rising dental surgery volumes and expanding wound care protocols in hospital and clinic settings. Italy will maintain steady growth at 21.6% in 2025 to 25.9% in 2035, while Spain shows moderate expansion from 12.2% to 13.3%. BENELUX and Nordic regions demonstrate strong growth potential, with BENELUX expanding from 6.4% to 8.9% and Nordic countries maintaining 3.4% to 3.6% share.

In Europe, wound healing agents dominate the product landscape with approximately 65% market share in 2025, driven by advanced therapeutic protocols and established clinical guidelines across European dental institutions. Analgesics maintain 35% share, supporting comprehensive pain management approaches that complement wound healing strategies in post-operative dental care.

Topical gels and ointments lead formulation preferences with 32% market share, reflecting European practitioner emphasis on controlled-release therapeutic delivery and patient compliance optimization. Spray formulations account for 21% share, particularly popular in Scandinavian and Germanic regions where rapid application methods are preferred for routine wound care protocols.

In the dental wounds treatment market, key players are focused on product innovation and enhancing treatment efficacy for various oral injuries, including soft tissue wounds, oral ulcers, and post-surgical wounds. Ultradent Products Inc. is a leading player, offering a range of solutions such as dental repair gels and wound-healing products, primarily targeting soft tissue management. Straumann Group stands out with its advanced dental biomaterials for wound healing, combining its expertise in dental implants and regenerative dentistry to provide comprehensive treatments for oral injuries.

Geistlich Pharma AG competes with its regenerative tissue products, specializing in bone and soft tissue regeneration in dental applications, particularly in periodontal surgeries. Septodont targets the dental injury treatment market with its range of analgesics, local anesthetics, and regenerative products. Smaller players like Premier Dental Products Company and Access Pharmaceuticals Inc. offer niche solutions, focusing on wound care management and the development of proprietary oral gels and ointments.

Emerging companies such as Synerheal and Regenity introduce innovative wound-healing solutions, leveraging biologics and natural compounds for faster tissue regeneration. Companies like Atlantis Consumer Healthcare Inc., Tricol Biomedical, and Maxigen Biotech Inc. also contribute by offering specialized oral care products that support the healing process in dental surgeries and treatments. The competitive environment is marked by technological advancements and growing demand for minimally invasive, effective wound care solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 2,019.3 Million |

| Product Type | Wound Healing Agents, Analgesics, Rinses/Solutions, Lozenges, Film-forming & Mucoadhesive Systems, Membranes & Scaffolds |

| Formulation Type | Topical Gels/Ointments, Sprays, Rinses/Solutions, Lozenges, Film-forming & Mucoadhesive Systems Formulations, Membranes & Scaffolds |

| Application Area | Acute Dental Wounds, Chronic Oral Wounds, Periodontal Surgery Wounds, Implant-related Wounds, Orthodontic-related Mucosal Injuries, Others |

| Sales Channel | Hospital Pharmacies, Retail/Pharmacy Sales, Online/E-commerce, Clinic Pharmacies, Group Dental Practices |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France, Italy, Spain, South Korea |

| Key Companies Profiled | Ultradent Products Inc.; Straumann Group; Geistlich Pharma AG; Septodont; Premier Dental Products Company; Alliance Pharma plc; Access Pharmaceuticals Inc.; Synerheal; Ricerfarma S.r.l.; Atlantis Consumer Healthcare Inc. |

| Additional Attributes | Dollar sales by product type, formulation type, application area, and sales channel, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging companies, practitioner preferences for therapeutic versus conventional approaches, integration with digital health monitoring and teledentistry platforms, innovations in bioactive materials and controlled-release systems, and adoption of regenerative medicine approaches with growth factors, biocompatible scaffolds, and tissue engineering solutions for enhanced wound healing outcomes. |

The global dental wounds treatment market is estimated to be valued at USD 1,445.4 million in 2025.

The market size for the dental wounds treatment market is projected to reach USD 2,019.3 million by 2035.

The dental wounds treatment market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in dental wounds treatment market are wound healing agents , analgesics, rinses/solutions, lozenges, film-forming & mucoadhesive systems and membranes & scaffolds.

In terms of formulation type, topical gels/ointments segment to command 29.3% share in the dental wounds treatment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Repair Membranes for Implant Procedures Market Size and Share Forecast Outlook 2025 to 2035

Dental Cavity Filling Materials Market Size and Share Forecast Outlook 2025 to 2035

Dental Implant and Prosthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA