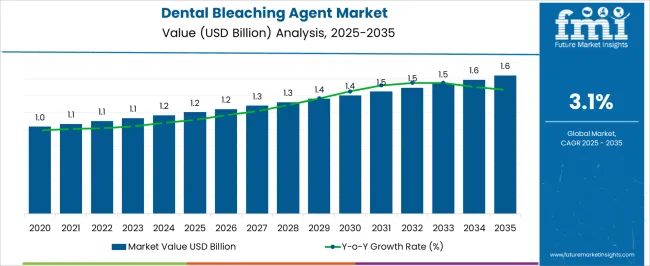

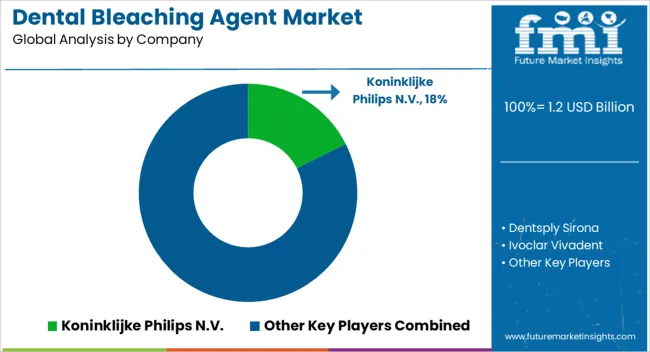

The Dental Bleaching Agent Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 1.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.1% over the forecast period.

| Metric | Value |

|---|---|

| Dental Bleaching Agent Market Estimated Value in (2025 E) | USD 1.2 billion |

| Dental Bleaching Agent Market Forecast Value in (2035 F) | USD 1.6 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

The dental bleaching agent market is experiencing robust growth. Increasing consumer focus on oral aesthetics, rising dental awareness, and growing adoption of at-home and professional teeth whitening solutions are driving market expansion. Current dynamics reflect heightened demand for safe and effective bleaching agents, regulatory compliance regarding active ingredients, and technological advancements in formulation and delivery systems.

Future outlook is influenced by rising disposable incomes, expanding dental service infrastructure, and consumer preference for minimally invasive cosmetic procedures. Growth rationale is supported by ongoing innovation in product efficacy and safety, availability of diverse application formats, and strategic distribution channels that enhance accessibility.

The integration of digital dentistry trends and marketing efforts focused on aesthetic appeal are further contributing to widespread adoption Combined, these factors are expected to sustain demand, enable penetration into emerging markets, and drive consistent revenue growth across professional and consumer segments.

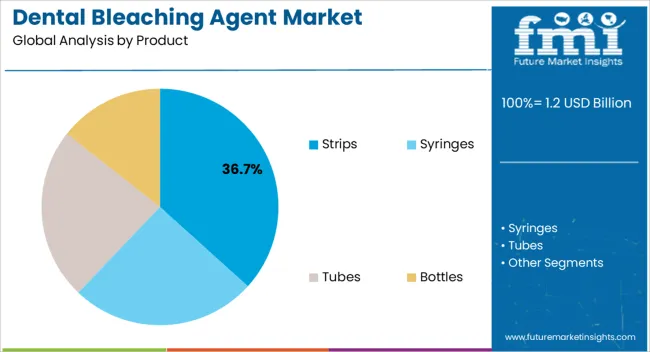

The strips segment, representing 36.7% of the product category, has maintained leadership due to ease of use, convenience, and widespread consumer acceptance. Its dominance has been reinforced by consistent demand in at-home whitening routines and compatibility with multiple formulations.

Product innovation, including flexible and adhesive strip designs, has enhanced user experience and improved compliance. Retail availability and strategic promotion through dental clinics and e-commerce channels have supported broad market adoption.

Safety, efficacy, and regulatory adherence have strengthened consumer confidence Continued focus on improving formulation stability, minimizing sensitivity, and expanding packaging options is expected to sustain the segment’s market share and ensure its continued prominence within the dental bleaching agent market.

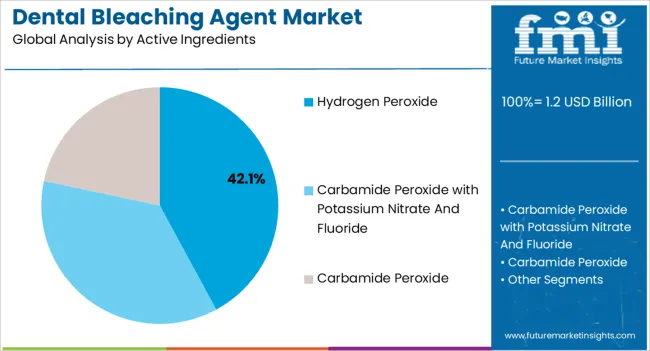

The hydrogen peroxide segment, holding 42.1% of the active ingredients category, has emerged as the leading ingredient due to its proven whitening efficacy, rapid action, and compatibility with multiple delivery formats. Its adoption has been facilitated by clinical validation, regulatory approvals, and consistent performance across consumer and professional applications.

Formulation improvements have enhanced stability, minimized side effects, and ensured long-lasting results. Strategic sourcing and quality control measures have reinforced reliability in supply, while brand recognition and trust have contributed to consumer preference.

Future growth is expected to be driven by enhanced concentration-controlled formulations, integration into novel delivery systems, and continued emphasis on safety and efficacy, sustaining hydrogen peroxide as the dominant active ingredient.

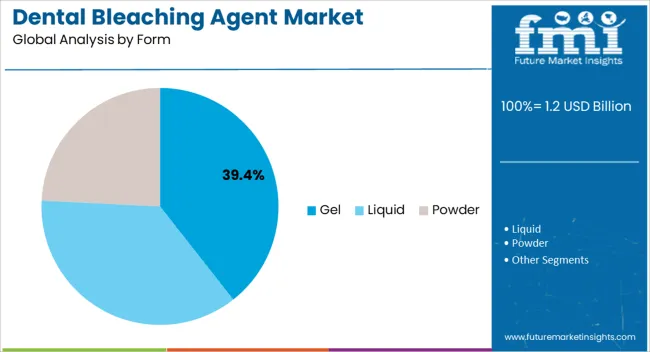

The gel segment, accounting for 39.4% of the form category, has retained market leadership due to ease of application, controlled dosing, and superior adhesion properties that ensure effective whitening. Its adoption has been supported by both at-home and professional usage, where formulation viscosity and stability play critical roles.

Product refinements, including reduced sensitivity and enhanced flavoring, have improved user experience and compliance. Distribution through dental clinics, pharmacies, and online channels has expanded accessibility.

Regulatory compliance, safety standards, and consistent quality have reinforced market confidence Continued innovation in gel formulations, including dual-action and sustained-release properties, is expected to maintain the segment’s market share and support incremental growth within the dental bleaching agent market.

The global dental bleaching agent market recorded a decent CAGR of 2.2% in the last five years, from 2020 to 2025. The market value for dental bleaching agents was around 17.0% of the total USD 6,643.0 million of the global teeth whitening market.

| Historical CAGR (2020 to 2025) | 2.2% |

|---|---|

| Forecast CAGR (2025 to 2035) | 17.0% |

As awareness of aesthetics grows, more and more people want a brighter and whiter smile to improve their appearance. Teeth whitening is a non-invasive and cost-effective way to achieve this. Images of celebrities, influencers, and peers with bright white smiles on social media and in the media are encouraging people to undergo teeth whitening treatment to meet prevailing beauty standards.

Aesthetic issues are also often about self-confidence. A whiter smile can boost self-esteem and self-confidence, which encourages people to undergo teeth whitening. In competitive job markets, a confident and appealing appearance can give job applicants an edge.

A bright smile can make a positive impression during job interviews and motivate people to invest in teeth whitening. For special occasions such as weddings, reunions, or anniversary celebrations, several people value aesthetics. They seek teeth whitening treatments to look good on these occasions.

Certain dietary habits such as coffee, tea, wine, and specific foods can lead to tooth discoloration over time. People with aesthetic concerns are more likely to seek teeth whitening to remove stains and restore their smile.

Over time, more and more emphasis has been placed on creating bleaching agents that are both operative and safe. Several efforts have also been made to reduce tooth sensitivity, a mutual side effect of teeth whitening.

Teeth whitening has become an indispensable part of the cosmetic dentistry procedure. It is repeatedly combined with other treatments such as veneers, bonding, and gum contouring for a complete smile. To meet the growing demand for organic and natural products, manufacturers have begun incorporating these elements into bleaches.

| Attributes | Key Factors |

|---|---|

| Dental Bleaching Agent Market Trends |

|

| Growth Hindrances |

|

| Upcoming Opportunities |

|

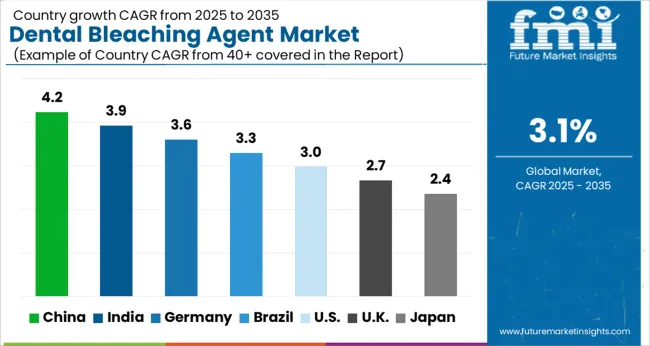

In the table below, the CAGRs of the top 5 countries are given for the review period 2025 to 2035. China and India are expected to remain dominant by exhibiting CAGRs of 6.7% and 6.8%, respectively. Japan and the United Kingdom are expected to follow with CAGRs of 3.0% and 2.0%, respectively.

Market Growth Outlook by Key Countries

| Country | Value CAGR |

|---|---|

| United States | 1.6% |

| Germany | 1.5% |

| United Kingdom | 2.0% |

| Japan | 3.0% |

| China | 6.7% |

| India | 6.8% |

The United States held around 31.6% of the dental bleaching agent market share in 2025. It is projected to continue experiencing high growth throughout the forecast period.

Over the past few years, there has been a steady increase in demand for cosmetic dentistry in the United States. The most popular cosmetic goods include veneers, dental crowns, and bonding agents, even though tooth-whitening procedures have shown a high demand. The American Academy of Cosmetic Dentistry (AACD) estimates that cosmetic dentistry costs the country’s economy over USD 2.75 billion annually.

Celebrities and influencers often promote teeth whitening products, generating awareness and impelling consumer preferences. There is a trend toward natural and safe designs of teeth whitening agents, in line with broader customer preferences for organic and environmentally friendly products.

Dental clinics in the United States often bid personalized treatment plans, including teeth whitening, customized to each patient's needs and preferences. There is a growing market for goods designed to help patients uphold the results of teeth whitening treatments, such as special toothpaste and mouthwashes.

China is projected to continue experiencing high growth throughout the forecast period. The country held a share of around 2.3% in 2025.

The healthcare system in China has continued to include an independent and separate area for dental care. In contrast to other fields of study, hospitals and independent clinics both offer dental care services in China.

Around 20 years ago, when establishing privately or socially supported healthcare organizations became legal, the private dental business in China started to surge. Particularly in locations where the private sector is more supported by the government and tolerated by the populace, the number of private clinics has rapidly expanded.

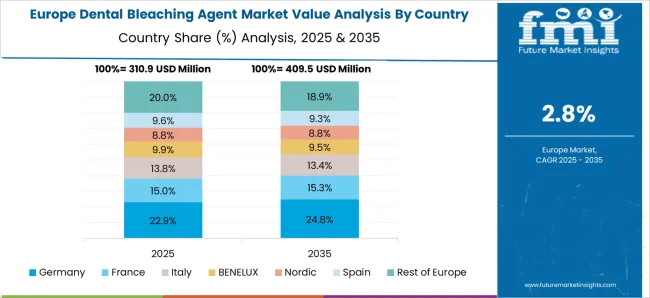

Germany held about 2.2% of the share in the global dental bleaching agent market in 2025. In Germany, dental bleaching is often carried out by dentists in a professional setting or at home with over-the-counter materials. Although OTC treatments are also available, professional teeth whitening is typically regarded as safer and more effective.

One often used active component in tooth whitening products is hydrogen peroxide. The maximum amount of hydrogen peroxide that can be used in such items has been specified by Germany. For over-the-counter products, this restriction is often around 0.1%.

Only dental experts would have access to higher concentrations. Dental bleaching chemicals are being influenced by the inclination toward natural and organic goods in the beauty and cosmetics sector.

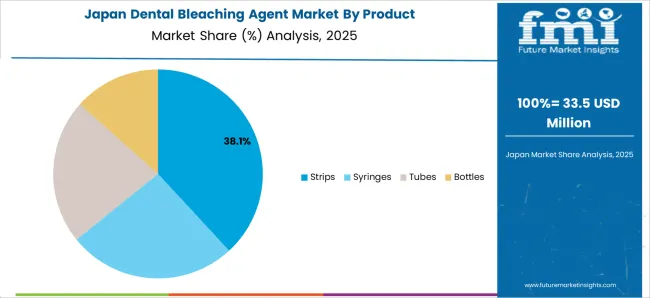

Japan's dental bleaching agent market is projected to expand at a CAGR of 3.0% by 2035. Japan is famous for its beauty and skincare industry. This trend also extends to cosmetic dentistry.

Demand for teeth whitening is increasing among customers who want to improve their smiles. Japan has stable economic development, leading to increased disposable income. This has helped motivate consumers to capitalize on cosmetic procedures, including teeth whitening.

In Japan, professional dental treatment performed in a clinic is preferred. Several consumers also prefer in-office teeth whitening procedures over at-home kits as they find them more effective and safer under professional supervision.

Japan is also known for its technological advancements and innovations. This comprises the dental industry, where current and effective teeth whitening agents and technologies are readily available in clinics.

India’s dental bleaching agent market is estimated to surge at a CAGR of 6.8% by 2035. The dental care market in India is very competitive, with domestic and global companies offering a wide range of tooth whiteners and related goods.

India attaches great importance to compliance with regulations and safety standards for medical products, including teeth-whitening agents. Products must meet robust quality and safety requirements.

Increased customer awareness of oral aesthetics and accessibility of dental treatments, counting teeth whitening, have contributed to growth. Recommendations from dental specialists and influencer marketing also play an important role in inducing customer choices regarding dental products and procedures, including fillers.

There is currently a trend toward natural and safe preparations of tooth whiteners, meeting growing consumer demand for natural and environmentally friendly products. The concentration of dental hospitals in urban areas, combined with better access to healthcare services, has enabled the dental bleaching agent market in India to expand.

The table below signifies leading sub-categories under product, form, and active ingredients categories in the dental bleaching agent market. The syringe is expected to dominate the market for dental bleaching agents by exhibiting a 1.7% CAGR in the evaluation period. Under the form category, the gel segment is projected to lead the dental bleaching agent industry at a 1.6% CAGR.

Market Growth Outlook by Key Segments

| Segment | Value CAGR |

|---|---|

| Syringes (Product) | 1.7% |

| Hydrogen Peroxide (Active Ingredients) | 1.4% |

| Gel (Form) | 1.6% |

| Retail Sales (Distribution Channel) | 2.2% |

The syringe segment under the product category held a share of 40.6% in 2025. Dental whitening procedures frequently involve the use of syringes. Syringes are set to be used to administer dental bleaching agents such as hydrogen peroxide or carbamide peroxide gels.

The ability of syringes to make it possible to apply bleaching agents to the teeth in a precise and controlled manner would drive demand. These are estimated to be used by dentists or other dental experts to apply the bleaching gel directly to the teeth, ensuring equal coverage and reducing contact with delicate gum tissues.

The hydrogen peroxide segment is expected to dominate the global dental bleaching agent market in terms of active ingredients through 2035. It generated a share of about 43.2% in 2025. The ability of hydrogen peroxide to effectively reduce tooth stains brought on by red wine, coffee, tea, smoking, and other sources of discoloration would drive demand.

For dental use, hydrogen peroxide is set to be available in a range of concentrations, from as little as 3% in OTC preparations to greater concentrations in specialist dentistry procedures. Hydrogen peroxide is also considered safe for dental bleaching when used as recommended.

Although hydrogen peroxide is safe for dental use when made as directed, high concentrations or improper use can lead to potential side effects. A handful of them include tooth sensitivity, gum irritation, and soft tissue damage.

The gel segment held a share of around 46.2% in 2025 based on form. Gel-based teeth whitening products usually include a bleaching ingredient, such as carbamide or hydrogen peroxide.

Using over-the-counter kits that come with pre-filled trays or specially manufactured trays, these gels can be administered directly to the teeth. For a predetermined amount of time, the gel is in contact with the teeth, enabling the bleaching agent to remove stains and brighten the teeth. Controlled administration, which reduces contact with delicate gum tissues, and the option to tailor therapies based on patient requirements are two benefits of gel-based dental bleaching solutions.

The retail sales segment based on distribution channels generated a share of around 57.6% in 2025. Drug stores and retail pharmacies are widely located and easily accessible. They are typically present in both rural and urban regions. This facilitates easy access to healthcare items, over-the-counter pharmaceuticals, and prescription drugs.

Retail pharmacies also provide services such as prescription synchronization, blister packaging, and automatic refills. These would help to enhance adherence to prescribed treatments, helping patients manage their drugs.

Retail channels further provide the key distribution platform for over-the-counter teeth whitening products. These also offer easy access to tooth whiteners, making it easy for customers to browse and buy products. This accessibility underwrites the acceptance of at-home teeth whitening.

Retailers often offer a variety of teeth whitening products, comprising strips, toothpaste, gels, pens, and teeth whitening kits. This variety allows customers to choose goods that suit their preferences and requirements.

Manufacturers of teeth whitening products often use strong marketing and branding approaches to promote their goods in retail stores. This can include packaging design, publicity campaigns, and in-store promotions.

Collaboration and geographic expansions are a priority for leading dental bleaching agent companies as they work to create new product lines and expand their global consumer base. Expansion and partnership is the key strategy of leading manufacturers, such as Koninklijke Philips N.V. and Ultradent Products Inc. They aim to enhance their presence in the market and compete with other players during the assessment period.

For instance,

| Attribute | Details |

|---|---|

| Estimated Dental Bleaching Agent Market Size (2025) | USD 1.2 billion |

| Projected Dental Bleaching Agent (2035) | USD 1.6 billion |

| Value-based Industrial Tape Market CAGR (2025 to 2035) | 3.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value (USD million) |

| Key Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Middle East & Africa |

| Key Countries Covered | United States, Canada, Mexico, Brazil, Chile, China, Japan, South Korea, India, Association of Southeast Asian Nations Countries, Australia and New Zealand, Germany, Italy, France, United Kingdom, Spain, BENELUX, Nordic Countries, Russia, Hungary, Poland, Saudi Arabia, Türkiye, South Africa, and Other African Union |

| Key Market Segments Covered | Product, Active Ingredients, Form, Distribution Channel, and Region |

| Key Companies Profiled |

Koninklijke Philips N.V.; Dentsply Sirona; Ivoclar Vivadent; Ultradent Products Inc.; SDI Pola; VOCO GmbH; OraTech; BIOLASE, Inc.; FGM Dental Group; MYEZGOSMILE;Laser Glow Spa; Beyond International Inc. |

| Report Coverage | Market Forecast, Competition Intelligence, Market Dynamics and Challenges, Strategic Growth Initiatives |

The global dental bleaching agent market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the dental bleaching agent market is projected to reach USD 1.6 billion by 2035.

The dental bleaching agent market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in dental bleaching agent market are strips, syringes, tubes and bottles.

In terms of active ingredients, hydrogen peroxide segment to command 42.1% share in the dental bleaching agent market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Dental Flap Surgery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA