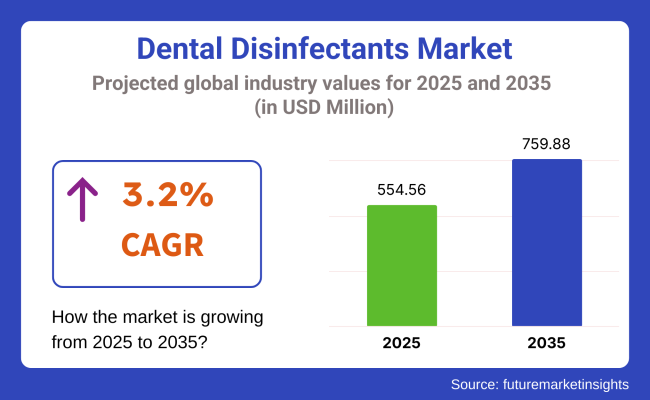

The global dental disinfectants market is projected to grow from USD 554.56 million in 2025 to USD 759.88 million by 2035, registering a CAGR of 3.2% during the forecast period. Growth in this market is being driven by heightened focus on infection control, stricter sterilization protocols, and regulatory enforcement across dental clinics, hospitals, and educational laboratories. Disinfectants are being widely adopted at critical points of care, including operatory surfaces, reusable dental instruments, and dental unit waterlines (DUWLs), in line with hygiene guidelines issued by the Centers for Disease Control and Prevention (CDC) and the American Dental Association.

The rising adoption of alcohol-based, quaternary ammonium compound (QAC)-based, and aldehyde-free disinfectants is being supported by their rapid antimicrobial action, material compatibility, and broad-spectrum efficacy. A major concern in dental settings is the microbial contamination of DUWLs, which can compromise both the safety of practitioners and patients.

“Millions of dollars are spent every year in the dental industry, testing and shocking water lines, which still have an unsatisfactory rate of success,” says Owen Boyd, CEO of Toppen Health. “A key component of the Center Core technology and success is the slow-release of non-toxic molecular iodine, ultimately ensuring we can remove or neutralize any contaminants in any water supply safely, effectively, and affordably, without any guesswork.”

Demand for standardized disinfection protocols is increasing across developing regions, driven by higher dental procedure volumes and expansion of private and franchised dental chains. Leading players such as Dentsply Sirona, 3M, Kerr Corporation, and Crosstex International are focusing on innovation in sustainable packaging, automated cleaning technologies, and regulatory-compliant disinfectant formulations.

As patient safety and clinical hygiene expectations continue to rise, the market is expected to be shaped by advancements in contactless disinfection systems, eco-friendly biocidal agents, and molecular-level pathogen control. These shifts are positioning dental disinfectants as an essential component of modern, tech-enabled oral healthcare delivery worldwide

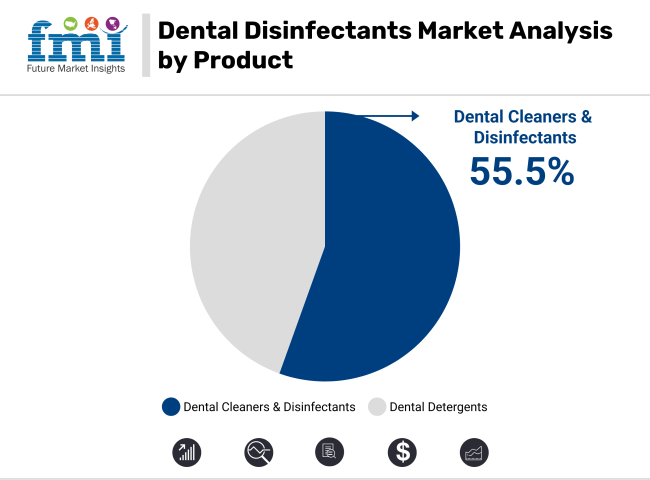

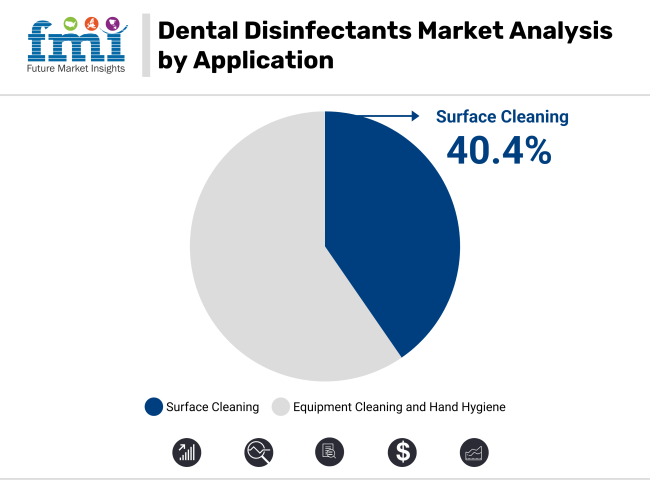

The dental disinfectants market is expanding due to infection control priorities in dental practices. Dental cleaners & disinfectants lead product use, while surface cleaning dominates applications for ensuring hygiene and regulatory compliance.

Dental cleaners and disinfectants are projected to account for 55.5% of the market by 2025, making them the most widely used product type in dental infection control. These products include high-level disinfectants, enzymatic cleaners, and surface sprays that target pathogens on instruments, trays, and hard-to-reach surfaces.

The rise in hospital-acquired infections and global hygiene regulations is boosting demand for fast-acting, broad-spectrum solutions. Companies like Dürr Dental (Orotol® Plus), Crosstex (UltraDose®), and Henry Schein provide a variety of EPA- and CE-compliant formulations, meeting clinical needs across dental offices. Their effectiveness in preventing cross-contamination and maintaining equipment integrity ensures continued product adoption across high-traffic dental environments.

Surface cleaning is expected to lead application areas with 40.4% of market share in 2025, reflecting the growing emphasis on maintaining sterile workspaces in dental clinics. From countertops to dental chairs and light handles, non-porous surfaces are frequently touched and must be disinfected regularly between patient visits.

Disinfectants with rapid action and compatibility with various materials are preferred. Products like CaviCide™ by Kerr TotalCare and Bacillol® 30 Foam by BODE Chemie are widely used for surface disinfection due to their broad antimicrobial activity and material safety. With global health authorities emphasizing stricter infection prevention protocols following COVID-19, surface cleaning remains a top priority investment area.

The dental disinfectants market is gaining momentum due to heightened awareness of infection control and stricter hygiene standards, although cost barriers and concerns about chemical safety are restraining broader adoption.

Increasing infection control protocols are driving demand for dental disinfectants.

Rising global awareness of infection control, particularly following the COVID-19 pandemic, is driving the greater adoption of dental disinfectants in clinics and hospitals. Dental professionals are prioritizing surface sterilization, instrument disinfection, and aerosol control to comply with regulatory hygiene mandates and prevent cross-contamination.

Regulatory bodies and industry guidelines now demand more stringent protocols, boosting demand for high-efficacy disinfectants. Additionally, patient expectations around safety have increased, compelling dental facilities to maintain visibly clean environments. These trends are fueling demand for both chemical-based and environmentally friendly disinfectant products. Continued innovation in fast-acting, non-corrosive, and biocompatible formulations is expected to sustain growth in the years to come.

Chemical exposure risks and cost concerns are limiting wider adoption

Despite strong demand, the dental disinfectants market is facing resistance due to concerns over chemical safety and cost. Many disinfectants contain harsh ingredients like aldehydes and phenols, which may pose health risks to dental staff and patients with prolonged exposure. Ventilation requirements and protective gear increase operational complexity, especially in small and medium-sized clinics.

Moreover, high-quality disinfectants often come at a premium, making them less accessible in cost-sensitive markets. Budget limitations in developing countries further limit investment in advanced disinfection technologies. These challenges are prompting a shift toward safer, eco-friendly alternatives, but adoption remains slow due to limited availability and higher upfront costs.

The dental disinfectants market is expanding due to increasing awareness of infection control, regulatory compliance, and upgrades in clinic hygiene, with India, China, and Japan exhibiting rapid growth, while the USA and Germany are leading innovation.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.0% |

| China | 6.1% |

| Japan | 3.6% |

| India | 6.5% |

| Germany | 1.8% |

The United States dental disinfectants market is projected to grow at a CAGR of 2.0% through 2035, driven by stringent hygiene regulations and a high concentration of dental clinics. Key players like Henry Schein, Envista (Kerr), and ColteneWhaledent offer surface disinfectants, ultrasonic cleaners, and instrument sterilizers.

Infection prevention is tightly integrated with ADA and CDC protocols, increasing demand for high-grade disinfectant sprays and wipes. Widespread dental insurance and preventive care initiatives support the use of disinfectant solutions in routine operations. Clinics emphasize rapid-acting, EPA-compliant products, such as CaviCide or Opti-Cide3, enhancing safety and patient trust in dental settings nationwide.

The German dental disinfectants market is growing steadily at a CAGR of 1.8% through 2035, supported by strict EU regulatory compliance and high hygiene standards across clinics. Manufacturers such as Dürr Dental, Schülke & Mayr, and Dr. Schumacher GmbH lead the market with disinfectant concentrates, instrument immersion solutions, and air disinfectants.

Dental professionals favor aldehyde-free and eco-friendly formulas, aligning with Germany’s sustainability goals. Products such as Orotol Plus and Mikrozid are widely adopted in private and public clinics. Continuing education programs by dental associations encourage safe disinfection protocols, while digital workflow integration further enhances sterilization efficiency and traceability across Germany’s precision-oriented dental care sector.

The dental disinfectants market in China is experiencing rapid expansion, with a projected CAGR of 6.1% through 2035, driven by the growth of dental infrastructure and increasing infection control mandates. Domestic firms like Zhermack China, Runyes, and Zhende Medical are scaling production of surface sprays, instrument soaks, and ultrasonic cleaning solutions.

Urban dental chains are adopting automated disinfection systems to meet the rising expectations of their patients. Foreign brands such as Dentsply Sirona and Kavo Kerr also have a growing presence through local partnerships. With the rise of private clinics and mobile dental services, demand for fast-acting, multi-surface disinfectants is increasing, especially in Tier 1 and Tier 2 cities.

India is the fastest-growing dental disinfectants market, forecasted to grow at a CAGR of 6.5% through 2035, driven by increasing oral care awareness and regulatory focus on sterilization. Companies like PrevestDenPro, Septodont India, and Actizone offer affordable, high-efficacy disinfectant sprays and surface cleaners for small and mid-sized clinics. With over 300 dental colleges, infection control training is improving across the practitioner base.

Demand is especially strong for multipurpose, alcohol-based disinfectants in both urban and semi-urban areas. Importers of Metrex and Coltene products cater to premium clinics. Tele-dentistry and portable equipment setups are further driving the need for compact, quick-acting disinfectant solutions.

The dental disinfectants in the Japanese market are set to grow at a CAGR of 3.6% through 2035, supported by its aging population and exacting clinical hygiene standards. Firms such as GC Corporation, Lion Dental, and Matsuyama Co. provide advanced disinfection systems including surface sprays, enzyme-based cleaners, and automated sterilization aids.

Clinics frequently use alcohol-free formulations to minimize material corrosion. The Japan Dental Association (JDA) enforces disinfection protocols and supports ongoing infection prevention training. Global brands like 3M and Kavo Kerr are also active in the premium segment. Innovation in touch-free and sensor-based disinfection devices is gaining traction in technologically advanced Japanese dental practices.

The dental disinfectants market comprises three tiers of suppliers. Tier 1 includes global hygiene giants like 3M, Ecolab, Procter & Gamble, and Reckitt Benckiser, all recognized for robust R&D, wide product portfolios, and international distribution networks. These firms integrate fast-acting chemistries (e.g., quats, hydrogen peroxide) and smart monitoring systems to maximize efficacy and compliance.

Tier 2 consists of dental-focused brands-such as Dentsply Sirona, Kerr, COLTENE, GC America, and Young Innovations-that specialize in infection-control products like instrument disinfectants and sterilization equipment. Tier 3 encompasses ingredient-level producers supplying core biocides for formulation by other manufacturers. Entry barriers are notable: compliance with regulatory approvals, proof of efficacy, and clinician acceptance.

Metrex Research, MicroCare, and Clorox have introduced upgraded wipe products that emphasize rapid disinfection, material compatibility, and enhanced usability. In 2025, PDI released SaniCloth AF3, a fragrance- and alcohol-free quaternary-based wipe effective against 45 microorganisms within three minutes, making it ideal for sensitive dental surfaces.

Complementing this, PDI’s 2024 Compatibility Reference Guide ensures safe use across various dental materials. Meanwhile, in early 2024, STERIS launched the VPRO™ maX 2 low-temperature sterilizer, offering fast cycles (as quick as 16 minutes), high throughput, and support for 3Dprinted dental instruments. In March 2024, STERIS also introduced Verafit sterilization bags with viewing windows to verify dryness per EU GMP Annex 1 standards.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 554.56 million |

| Projected Market Size (2035) | USD 759.88 million |

| CAGR (2025 to 2035) | 3.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Product Types Analyzed (Segment 1) | Dental cleaners; Disinfectants; Isopropyl alcohol-based products; Hydrogen peroxide-based solutions; Glutaraldehyde-based agents; Isopropyl alcohol combination products; Chlorhexidine-based disinfectants; Ethyl alcohol; Dental detergents; Enzymatic detergents; Neutral detergents |

| Forms Analyzed (Segment 2) | Liquid solutions; Wipes; Gels; Sprays; Foams; Tablets |

| Applications Covered (Segment 3) | Surface disinfection; Equipment cleaning; Hand hygiene |

| End Users Covered (Segment 4) | Hospitals; Independent dental clinics; Group dental practices; Dental laboratories; Academic & research centers; Mobile dental clinics; Ambulatory surgical centers |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; Canada; Germany; United Kingdom; France; China; India; Brazil; Australia |

| Key Players Influencing the Market | Metrex Research, LLC; Getinge AB; Hu- Friedy Mfg. Co., LLC; PDI, Inc.; MicroCare , LLC; STERIS plc; COLTENE Group; Schülke & Mayr GmbH; Palmero Healthcare; The Clorox Company; Young Innovations, Inc.; GC America Inc. |

| Additional Attributes | Regulatory approvals and compliance standards; Innovations in eco-friendly and rapid-action formulations; Impact of COVID-19 hygiene protocols on demand; Adoption of automated disinfection systems in clinics |

The dental disinfectants market is segmented by vaccine types into dental cleaners, disinfectants, isopropyl alcohol-based products, hydrogen peroxide-based solutions, glutaraldehyde-based agents, isopropyl alcohol combination products, chlorhexidine-based disinfectants, ethyl alcohol, dental detergents, enzymatic detergents, and neutral detergents.

By form, the market includes liquid solutions, wipes, gels, sprays, foams, and tablets.

By application, the market is segmented into surface disinfection, equipment cleaning, and hand hygiene.

In terms of end users, the dental disinfectants market is segmented into hospitals dental practices, independent dental clinics, group dental practices, dental laboratories, academic and research centers, mobile dental clinics, and ambulatory surgical centers.

The market is projected to reach USD 759.88 million by 2035, growing from USD 554.56 million in 2025 at a CAGR of 3.2%.

Key players include Metrex Research, Getinge AB, Hu-Friedy Mfg. Co., PDI, Inc., MicroCare, STERIS, COLTENE, Schülke & Mayr, Palmero Healthcare, Clorox, Young Innovations, and GC America.

Growth is driven by increasing dental procedures, heightened infection control awareness, and a growing geriatric population.

Surface disinfectants and sterilization products are the leading categories in the dental disinfectants market.

The market is expected to grow at a CAGR of 3.2% from 2025 to 2035.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA