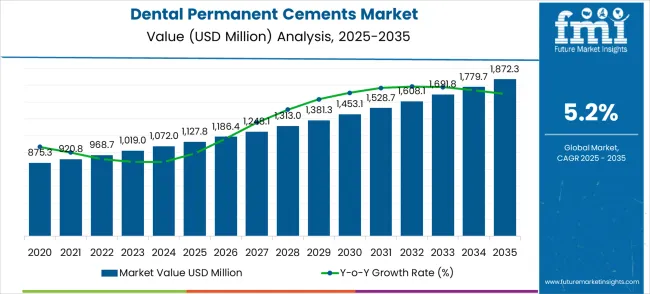

The dental permanent cements market, valued at USD 1,127.8 million in 2025 and forecasted to reach USD 1,872.3 million by 2035, demonstrates a consistent CAGR of 5.2%. The initial phase between 2025 and 2027 shows gradual acceleration, with the market expanding from USD 1,127.8 million to USD 1,248.1 million. Early growth is primarily driven by increasing adoption of advanced dental restoration procedures and rising demand for long-lasting cement solutions in restorative dentistry. Innovations in resin-modified cements and improved biocompatibility contribute to steady market uptake, while emerging regions witness gradual penetration due to growing dental healthcare infrastructure and patient awareness.

Between 2027 and 2030, the market exhibits moderate acceleration, with values moving from USD 1,313.0 million to USD 1,453.1 million. During this period, technological enhancements such as faster setting times, superior adhesion, and reduced post-procedural sensitivity stimulate adoption among dental professionals. The acceleration trend reflects both product innovation and rising procedure volumes, while the deceleration in growth intensity is mitigated by market maturation in developed regions. Dental clinics increasingly prioritize efficiency and clinical outcomes, which reinforces the adoption of high-performance permanent cements, sustaining positive market momentum.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,127.8 million |

| Market Forecast Value (2035) | USD 1,872.3 million |

| Forecast CAGR (2025–2035) | 5.2% |

The period from 2030 to 2033 marks a deceleration phase as the market approaches intermediate saturation, with values rising from USD 1,528.7 million to USD 1,691.8 million. Incremental growth is supported by repeat purchases and replacement cycles rather than entirely new adoption. Competitive pricing and diversification of cement formulations across applications, including crowns, bridges, and inlays, influence market expansion. While technological innovation continues, the rate of acceleration slows due to the relative stability of demand in mature dental markets, reflecting a transition toward consistent but moderate growth rates.

From 2033 to 2035, the market resumes moderate acceleration to reach USD 1,872.3 million. Growth is reinforced by ongoing dental awareness campaigns, expansion in restorative dentistry procedures in emerging regions, and incremental product refinements. This phase illustrates that the acceleration and deceleration pattern is cyclic, governed by early-stage adoption, mid-term technology-driven growth, and late-stage market stabilization. Understanding these fluctuations allows manufacturers and stakeholders to optimize production, distribution, and marketing strategies in alignment with evolving dental cement demand.

Market expansion is being supported by the increasing global dental care accessibility and the corresponding need for durable, biocompatible dental restoration materials that provide long-term clinical success in diverse dental procedures. Modern dental practice requires advanced cement systems that deliver superior bond strength, aesthetic properties, and biocompatibility while supporting various restorative and prosthetic applications. The excellent mechanical properties and clinical versatility of dental permanent cements make them essential components in contemporary dental treatment where restoration longevity and patient satisfaction are paramount.

The growing focus on aesthetic dentistry and patient-centered care is driving demand for advanced dental materials from certified manufacturers with proven track records of clinical performance and biocompatibility. Dental practitioners are increasingly investing in premium cement systems that offer improved handling characteristics, enhanced aesthetic properties, and superior long-term clinical outcomes compared to conventional dental cements. Clinical standards and patient expectations are establishing performance benchmarks that favor scientifically validated dental cement solutions with demonstrated clinical efficacy and biocompatibility profiles.

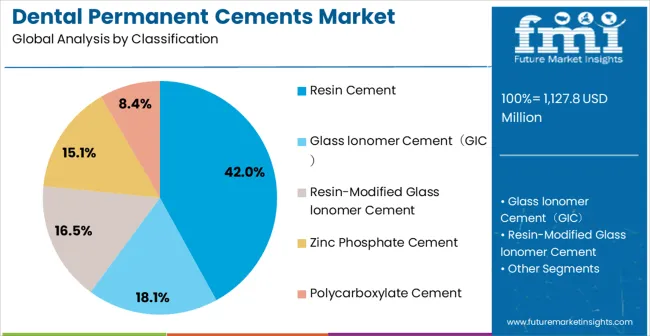

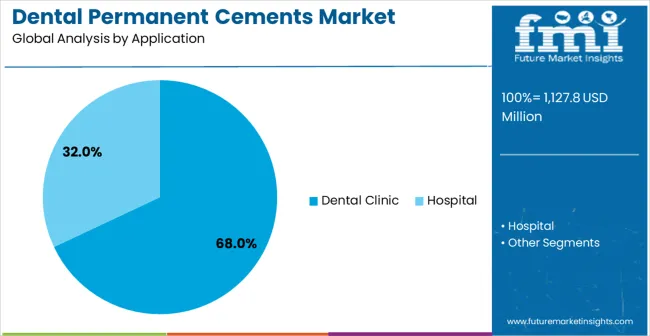

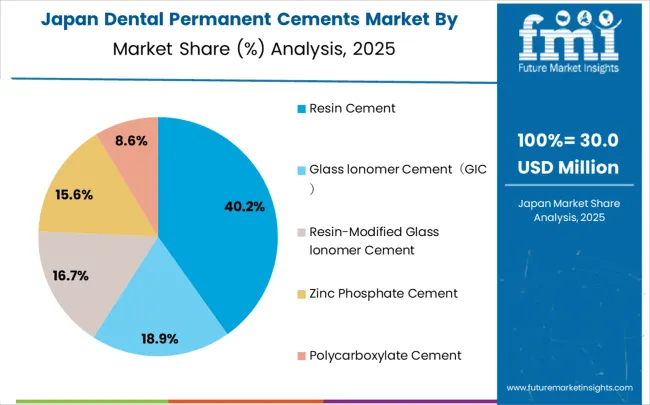

The market is segmented by cement type, application, and region. By material composition, the market is divided into resin cement, glass ionomer cement (GIC), resin-modified glass ionomer cement, zinc phosphate cement, and polycarboxylate cement. Based on application, the market is categorized into hospital dental departments and dental clinic practices. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Resin cement systems are projected to account for 42% of the dental permanent cements market in 2025. This leading share is supported by the superior mechanical properties and aesthetic capabilities that resin cements provide in demanding dental restoration applications. Resin cements offer excellent bond strength, superior aesthetics, and versatile application possibilities, making them the preferred choice for crown and bridge cementation, veneer bonding, and high-stress dental restoration procedures. The segment benefits from continuous technological advancement that has improved handling characteristics, curing properties, and long-term clinical performance while expanding application possibilities across diverse dental specialties.

Modern resin cement formulations incorporate advanced bonding technologies, optimized filler systems, and sophisticated polymerization chemistry that ensure superior clinical performance while providing excellent aesthetic integration with natural tooth structure. These innovations have significantly improved clinical outcomes and patient satisfaction while reducing post-operative sensitivity and restoration failure rates. The restorative dentistry and prosthodontic communities particularly drive demand for resin cement solutions, as these materials enable predictable outcomes in complex aesthetic and functional restoration procedures.

The growing demand for aesthetic dentistry and minimally invasive procedures creates expanding opportunities for resin cements in veneer bonding, aesthetic crown cementation, and adhesive restoration applications. The integration of simplified application protocols and improved handling characteristics enables broader clinical adoption while maintaining superior performance characteristics, further accelerating market growth as dental practitioners seek reliable yet user-friendly cement solutions.

Dental clinic applications are expected to represent 68% of dental permanent cements demand in 2025. This dominant share reflects the primary setting for routine dental restorative procedures and the comprehensive range of dental treatments provided in private practice and group clinic environments. Dental clinics require versatile cement systems for diverse procedures including crown and bridge cementation, filling placement, and various restorative treatments across different patient populations. The segment benefits from the large volume of routine dental procedures performed in clinic settings and the increasing accessibility of dental care in both developed and emerging markets.

Dental clinic applications demand reliable cement systems that provide consistent clinical performance across diverse patient cases and treatment scenarios while supporting efficient practice workflow and patient satisfaction. These applications require cement materials capable of handling varied clinical conditions, providing predictable outcomes, and supporting diverse restoration types and materials commonly used in general dental practice. The growing focus on comprehensive dental care and aesthetic treatment options drives consistent demand for versatile cement systems that enable high-quality clinical outcomes. Private dental practices and clinic chains contribute significantly to market growth as practitioners invest in proven cement systems to support growing patient volumes and expanding treatment offerings.

The trend toward digital dentistry and CAD/CAM restorations in clinic settings creates opportunities for specialized cement systems designed for digital workflow integration and diverse restoration materials. The segment also benefits from increasing patient expectations for aesthetic and durable dental treatments that require advanced cement systems for optimal clinical success.

The dental permanent cements market is advancing steadily due to increasing global dental care demand and growing recognition of advanced dental materials importance in achieving optimal clinical outcomes. The market faces challenges including varying regulatory requirements across different regions, technique sensitivity affecting clinical success rates, and cost considerations in different healthcare systems. Continued clinical education and product innovation programs remain essential for optimizing clinical performance and expanding market adoption.

The growing adoption of digital dentistry workflows and CAD/CAM restoration technologies is driving development of specialized cement systems optimized for digital restorations and automated cementation procedures. Advanced cement formulations provide enhanced compatibility with digital materials while supporting simplified application protocols and predictable clinical outcomes. These technologies are particularly valuable for practices implementing digital workflows that require cement systems specifically designed for contemporary restoration materials and techniques.

Modern cement manufacturers are incorporating bioactive components and multifunctional capabilities that provide therapeutic benefits beyond mechanical retention, including remineralization support, antibacterial properties, and enhanced biocompatibility. Integration of bioactive glass, fluoride release, and antimicrobial agents enables superior clinical performance and significant therapeutic advantages compared to conventional cement formulations. Advanced material science and biocompatibility research also support development of next-generation cement systems that actively contribute to oral health maintenance and restoration longevity.

| Country | CAGR (2025–2035) |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| Brazil | 5.5% |

| United States | 4.9% |

| United Kingdom | 4.4% |

| Japan | 3.9% |

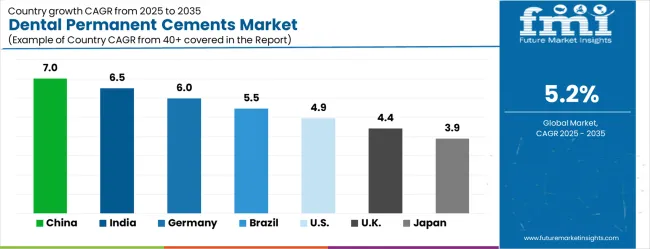

The market is growing rapidly, with China leading at a 7.0% CAGR through 2035, driven by expanding dental care infrastructure, increasing dental awareness, and growing demand for advanced dental materials in restorative and aesthetic procedures. India follows at 6.5%, supported by rising dental care accessibility and growing investments in modern dental practice equipment and materials. Germany records strong growth at 6.0%, focusing dental technology innovation, clinical excellence, and advanced dental material development. Brazil grows steadily at 5.5%, integrating modern dental materials into expanding dental healthcare services and aesthetic dentistry practices. The United States shows moderate growth at 4.9%, focusing on advanced dental materials innovation and premium dental care services. The United Kingdom maintains steady expansion at 4.4%, supported by NHS dental services and private dental practice development. Japan demonstrates stable growth at 3.9%, focusing precision dental materials and advanced clinical applications.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is projected to grow at a CAGR of 7.0% between 2025 and 2035, driven by increasing dental healthcare investments and rising awareness of oral care. Adoption of advanced dental restorative procedures has led to higher demand for permanent cements in clinics and hospitals. Leading manufacturers such as GC Corporation and 3M have expanded local production and introduced high-strength, bioactive cements tailored to dental practitioners. Rising number of private dental chains and hospital expansions have further contributed to growth. Continuous product innovation in esthetic and adhesive properties has positioned Chinese clinics to adopt durable cement solutions. Demand is also supported by government programs promoting oral health awareness and preventive care initiatives.

India is forecasted to grow at a CAGR of 6.5% from 2025 to 2035, influenced by increasing dental clinic networks and rising awareness of cosmetic dentistry. Adoption of permanent cements is supported by demand for crowns, bridges, and implant procedures. Companies like Ivoclar Vivadent and Septodont have introduced cost-effective and bioactive cement solutions for Indian dental professionals. Dental education programs and training workshops have enhanced professional adoption. Urban and semi-urban clinics are increasingly upgrading restorative capabilities. Rising insurance coverage for dental treatments and government health campaigns further facilitate market growth. Continuous introduction of adhesive and esthetic cements has reinforced the preference for durable and reliable solutions.

Germany is expected to grow at a CAGR of 6.0% during 2025–2035, supported by a high standard of dental care and strong adoption of technologically advanced restorative procedures. German clinics and hospitals favor cements with superior bonding, esthetic, and biocompatible properties. Leading companies such as Ivoclar Vivadent and Heraeus Kulzer have developed high-performance adhesive and bioactive cements. Aging population and increasing demand for long-lasting restorations have strengthened market penetration. Dental practitioners focuses precision and quality, influencing product selection. Ongoing research collaborations and material innovation further contribute to market expansion. Germany’s strong dental education and professional associations have reinforced adoption of modern permanent cement solutions.

Brazil is projected to grow at a CAGR of 5.5% between 2025 and 2035, driven by increasing dental clinic infrastructure and rising interest in restorative dentistry. Adoption of permanent cements is concentrated in urban dental practices offering crowns, bridges, and implant procedures. Local distributors have partnered with global suppliers like 3M and Dentsply Sirona to provide advanced cement formulations. Awareness campaigns on oral hygiene and preventive dentistry have reinforced market expansion. Cost-effective bioactive and adhesive cements are preferred for mid-range clinics, while premium products target specialized practices. Government support for public oral health initiatives also contributes to increasing adoption.

The United States is forecasted to grow at a CAGR of 4.9% from 2025 to 2035, influenced by a high adoption of cosmetic and restorative dentistry. Dental practitioners emphasize long-lasting, esthetic, and bioactive cement solutions for crowns, inlays, and implants. Companies such as 3M, GC Corporation, and Ivoclar Vivadent have expanded advanced product lines with superior bonding and fluoride release capabilities. Market expansion is further supported by rising insurance coverage for dental procedures and continuing professional education programs. Demand is concentrated in urban and suburban areas where high-quality dental services are widely available. Technological innovation and preference for durable solutions remain key drivers of adoption.

The United Kingdom is expected to grow at a CAGR of 4.4% between 2025 and 2035, supported by increasing awareness of restorative and cosmetic dental procedures. Permanent cements are widely used in crowns, bridges, veneers, and implant applications. Manufacturers such as Dentsply Sirona and GC Corporation have introduced bioactive and adhesive cements tailored for UK dental practices. Adoption is supported by professional training programs, dental associations, and accreditation standards focusing product quality. Public and private clinics are investing in durable restorative solutions. Consumer awareness campaigns promoting oral health and aesthetics have reinforced the demand for reliable and esthetic cement solutions across the country.

Japan is projected to grow at a CAGR of 3.9% during 2025–2035, influenced by high standards of dental care and rising focus on preventive and restorative dentistry. Adoption of permanent cements is concentrated in urban dental clinics offering crowns, bridges, and implant-based procedures. Japanese manufacturers such as Shofu and GC Corporation have introduced high-quality adhesive, bioactive, and fluoride-releasing cements to meet professional requirements. Clinics prioritize esthetic outcomes, durability, and biocompatibility in cement selection. Continuing education programs, product demonstrations, and technology-driven materials have further reinforced adoption. Urban consumer preference for high-quality dental services ensures steady market growth throughout the forecast period.

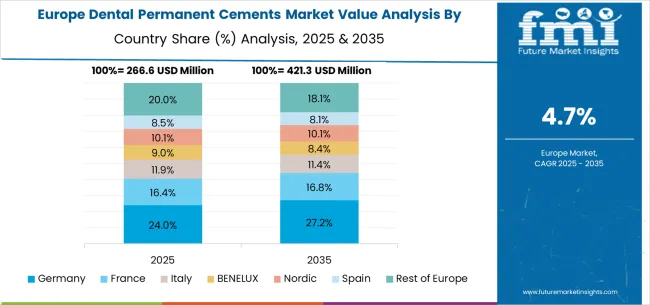

The dental permanent cements market in Europe is projected to grow from USD 266.6 million in 2025 to USD 421.3 million by 2035, registering a CAGR of 4.7% over the forecast period. Germany is expected to remain the largest national market with 24.0% share in 2025, rising to 27.2% by 2035, supported by its strong dental technology sector, advanced dental care infrastructure, and clinical innovation programs. The United Kingdom follows with 16.4% in 2025, inching up to 16.8% by 2035 as comprehensive dental services and professional training programs strengthen adoption. France accounts for 9.8% in 2025, easing slightly to 8.4% by 2035, reflecting consolidation in dental modernization initiatives.

Italy holds 10.1% in 2025, moderating to 8.8% by 2035, while Spain represents 10.1% in 2025, easing to 11.4% by 2035, supported by clinical adoption in restorative and cosmetic dentistry. BENELUX countries contribute 8.5% in 2025, softening to 8.1% by 2035, while the Nordic region accounts for 20.0% in 2025, easing to 18.1% by 2035, reflecting maturity in advanced dental technology hubs. The rest of Europe (Eastern Europe and other emerging markets) collectively accounts for 20.0% in 2025, moderating to 18.1% by 2035, supported by growing clinical infrastructure and adoption of advanced restorative dental solutions in emerging European regions.

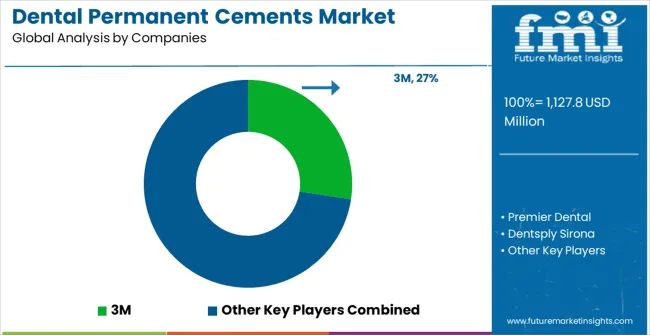

The market is defined by competition among established dental material manufacturers, specialized dental product companies, and regional dental supply providers. Companies are investing in advanced material technologies, clinical research programs, educational support services, and comprehensive product portfolios to deliver reliable, biocompatible, and clinically superior dental cement solutions. Strategic partnerships, clinical validation, and geographic expansion are central to strengthening market presence and professional relationships.

3M, operating globally, offers comprehensive dental material solutions with focus on innovation, clinical performance, and professional support services. Premier Dental provides specialized dental cement systems with focus on clinical reliability and practitioner education. Dentsply Sirona, multinational dental technology leader, delivers comprehensive dental material portfolios with focus on clinical excellence and digital integration. Cosmedent offers aesthetic dental materials with specialized cement formulations for cosmetic applications.

Kulzer GmbH provides advanced dental material systems with focus on German engineering excellence and clinical validation. Ivoclar Vivadent delivers comprehensive dental material solutions with focus on aesthetic applications and clinical research. Shofu Inc. offers precision dental materials with specialized cement technologies. Kuraray provides innovative dental material systems with advanced bonding technologies.

GC International AG, Huge Dental, and DMG offer specialized dental material expertise, regional market knowledge, and comprehensive product support across global and regional dental professional communities.

The dental permanent cements market underpins dental treatment excellence, patient care quality, restorative dentistry advancement, and oral healthcare improvement. With clinical performance requirements, biocompatibility standards, and demand for superior treatment outcomes, the sector must balance innovation leadership, clinical safety, and accessibility. Coordinated contributions from governments, professional organizations, manufacturers, dental practitioners, and investors will accelerate the transition toward evidence-based, biocompatible, and clinically optimized dental cement technologies.

| Items | Values |

|---|---|

| Quantitative Units | USD 1,127.8 million |

| Classification Type | Resin Cement, Glass Ionomer Cement (GIC), Resin-Modified Glass Ionomer Cement, Zinc Phosphate Cement, Polycarboxylate Cement |

| Application | Hospital, Dental Clinic |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | 3M, Premier Dental, Dentsply Sirona, Cosmedent, Kulzer GmbH, Ivoclar Vivadent, Shofu Inc., Kuraray, GC International AG, Huge Dental, DMG |

| Additional Attributes | Dollar sales by cement type and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established dental material manufacturers and specialized suppliers, clinical preference analysis for different cement formulations and applications, integration with digital dentistry workflows and CAD/CAM restoration systems, innovations in bioactive materials and multifunctional cement properties for enhanced clinical outcomes, and adoption of advanced cement technologies with improved handling characteristics and superior long-term clinical performance for diverse restorative and prosthetic applications. |

The global dental permanent cements market is estimated to be valued at USD 1,127.8 million in 2025.

The market size for the dental permanent cements market is projected to reach USD 1,872.3 million by 2035.

The dental permanent cements market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in dental permanent cements market are resin cement, glass lonomer cement(gic), resin-modified glass lonomer cement, zinc phosphate cement and polycarboxylate cement.

In terms of application, dental clinic segment to command 68.0% share in the dental permanent cements market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Implant and Prosthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA